Every investor nowadays is asking himself/herself the same question repeatedly, “What’s going to happen in 2024”. For investors, this is a vital query as lots of money is involved. Before making investment decisions, investors like me seek valuable insight on which sectors and/or which stocks will be giving high returns. Let’s have a broad look at what happened in 2021 and what’s expected of 2024:

2021 Performance and 2024 Outlook

In the past year, FAANG stocks, Facebook, Amazon, Apple, Netflix, and Alphabet (formerly known as Google) were major drivers of the indices. Also, these stocks benefitted hugely from the pandemic. The demand for vaccines stocks is continuously rising. Going forward in 2024, the tech industry will be moving ahead with good growth rates. The tech stocks are increasing by the moment.

Environmental and Social Governance has become increasingly popular in 2021. Investors have been actively investing in ESG and this sector is expected to attract investors in 2024

In this post-pandemic period, 2024 will also see a bounce in consumer stocks. Airlines, hotels, and restaurants will see increased earnings as compared to the previous two years. Go though a list of the best airline stocks which can give your investment portfolio a huge push upwards. Also, pharmaceutical stocks have been in demand since the COVID, but government policies revolving around controlling the prices might dampen the robust growth.

The energy prices and the energy stocks has bounced back extraordinarily. With demand back to normal, the production of oil and gas has increased. Therefore, this sector might be under pressure to outperform.

Top Buzzing Stocks 2024

So what are the top buzzing stocks for 2024? We have compiled a list below:

| Sr. No. | Name | Symbol | Market Capitalization | Price (As on 4th January 2022) |

| 1 | ASML Holdings | ASML | $ 297.8 Billion | $ 779.19 |

| 2 | Delta Air Lines | DAL | $ 25.91 Billion | $ 40.46 |

| 3 | Southwest Airlines | LUV | $ 26.015 Billion | $ 44.66 |

| 4 | UnitedHealth Group | UNH | $ 466.5 Billion | $ 490.9 |

| 5 | Harmony Biosciences Holdings, Inc. | HRMY | $ 2.462 Billion | $ 43.29 |

| 6 | The Boeing Company | BA | $ 123.7 Billion | $ 213.63 |

| 7 | General Motors | GM | $ 90.934 Billion | $ 65.74 |

| 8 | IBM | IBM | $ 126.516 Billion | $ 138.02 |

| 9 | Nordstrom | JWN | $ 3.765 Billion | $ 24.22 |

| 10 | Royal Dutch Shell | RDS | $ 179.208 Billion | $ 45.9 |

ASML Holdings

ASML is the world’s only producer of extreme ultraviolet, or EUV, lithography machines, which are needed by semiconductor foundries and large chipmakers to produce the most powerful chips in the world. The semiconductor stocks are growing at a very fast pace.

In the recent quarterly report, the company reported:

- Net Sales of 5 billion euros (approx. $ 5.67 billion)

- Net Income of 1.8 billion euros (approx. $ 2.04)

- Earnings per share of 4.39 Euros (approx. $ 4.98)

The company’s market valuation is at $ 297.8 billion. Its share is trading at $ 712.3. the company’s stock is on an upward streak for the past two years. The stock was trading at a price of $ 487.72 on the first trading day of 2021. And the share concluded the year at a price of $ 796.14. this represents an increase of roughly 63% during the year.

The company expects higher demand for its products. Moreover in order to provide for its customers, the company is providing them with high-productivity upgrade solutions for their installed base. This cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention

The company expects higher demand for its products. Moreover in order to provide for its customers, the company is providing them with high-productivity upgrade solutions for their installed base. This cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention

Also read:

Delta Air Lines

Delta Air Lines, Inc. provides scheduled air transportation for passengers and cargo in the United States and internationally. The company operates through two segments, Airline and Refinery. Get to know the best EV stocks to invest in today.

In its recent quarterly report, the company reported:

- Pre-tax income of $1.5 billion

- $15.8 billion in liquidity

The company announced an incremental acquisition of two more used Airbus A350-900 aircraft after discarding some old aircraft. Moreover, international passenger revenue recovered to 42% of third-quarter 2019 levels.

The market value of Delta Airlines is $25.91 billion. Its share is trading around $40.35. The stock took a huge dip due to COVID-19. Since then, it has been recovering slow and steadily. The stock kicked off the year 2021 at a price of $40.21 and closed the year at a price of $39.08.

The airline has been showing amazing recovery and is generating profits for the past two quarters. Will travel back on track, Delta is en route towards growth and higher profits. 5G stocks is a huge opportunity for investors to jump in right now to enjoy good profits in the future.

The airline has been showing amazing recovery and is generating profits for the past two quarters. Will travel back on track, Delta is en route towards growth and higher profits. 5G stocks is a huge opportunity for investors to jump in right now to enjoy good profits in the future.

Check our updated for Dow Jones Forecast.

Southwest Airlines

Southwest is one of the major airlines of the United States and the world’s largest low-cost carrier. It has been delivering excellence through its outstanding service for the past 51 years. The airline has been ranked #1 for Newsweek’s America’s Best Customer Service in the Low-Cost Airlines category. Southwest has a long history of returning value to its shareholders. Moreover, it is a preferred choice of investors due to the regular dividend payments. Get to know the best monthly dividend stocks for 2024.

According to the airline’s ESG goals, Southwest plans to reduce carbon emissions intensity by at least 20 percent by 2030 and maintain carbon-neutral growth every year by the end of the decade

In its recent quarterly report, the company reported:

- Net income of $446 million

- Liquidity of $17.0 billion, which is in excess of debt outstanding of $11.2 billion

- Operating revenues of $4.7 billion,

The demand and revenue performance was quite strong and dramatic, as reported in the recent quarter. Overall performance has undergone huge improvement as compared to a year ago.

The company has a market capitalization of over $26 billion. Its share is trading at $43.99. Like all other airlines, Southwest stock received a huge blow when COVID-19 hit. After the initial dive, the company’s stock recovered fully and peaked at $63.42 in April-2021. The stock kicked off the year 2021 at a price of $46.61 and closed off at $42.84.

Also check out our list of best cryptocurrencies.

Also check out our list of best cryptocurrencies.

UnitedHealth Group

UnitedHealth Group, Inc. provides health care coverage, software, and data consultancy services. It is the most diversified health care company in the United States. The company operates through four business segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

In its recent quarterly report, the healthcare company reported:

Revenues Increased 11% to $72.3 Billion, with Strong and Diversified Growth across Optum and UnitedHealthcare

- Revenue of $ $72.3 Billion, driven by strong and diversified growth across Optum and UnitedHealthcare

- Earnings from Operations were $5.7 Billion

- Net Earnings $4.28 Per Share and Adjusted Earnings $4.52 Per Share

UnitedHealth Group has a market valuation of $461 billion. Its share is trading at $489.69. Like other airline companies, UnitedHealth stock price took a huge dive. But the post-pandemic performance of the stock is amazing. The stock kicked off the year 2021 at a price of $350.68. The closing price on the last day of trading in 2021 was $502.14. The stock has appreciated by 45% during the year and more than doubled since the pandemic-driven market crash. The demand for crypto mining stocks is continuously rising.

Get to know everything about high frequency trading.

Harmony Biosciences Holdings Inc.

Harmony Biosciences is dedicated to developing & commercializing innovative therapies and novel medications for patients living with rare neurological diseases. The bioscience company is a fairly new company that was founded in 2017. It went public in 2020, selling its share at an initial price of $24. By using the stock signals, you can avoid hours of technical analysis to understand the market.

In its recent quarterly report, the company reported:

- Net product revenues were $80.7 million, compared to $45.6 million for the same period in 2020

- Net loss was $9.6 million

- Cash and cash equivalents were $189.7 million.

Harmony Biosciences has a market capitalization of over $2.36 billion. Its share is trading at $40.3. After the IPO the stock of the Bioscience company went on an upward run. The stock peaked at $47.75. The stock kicked off the year 2021 at a price of $36.15 and it closed at $42.64.

Get to know the best quantum computing stocks.

Get to know the best quantum computing stocks.

The Boing Company

The Boeing Company designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through four segments:

- Commercial Airplanes

- Defense, Space & Security

- Global Services

- Boeing Capital

The airline’s portfolio across commercial, defense, space, and services is well-positioned. Moreover, the company is focused on improving its overall performance. The airline company plans to introduce advancing technologies and digital manufacturing capabilities to drive the next generation of products and a sustainable future. Blue-chip stocks are an excellent form of investing.

In its recent quarterly report, the airline company reported:

- Revenue of $15.3 billion

- Net loss per share at $ 0.6

The stock of the Boeing Company is currently trading at $ 209.93. the company has a market valuation of around $ 123.54. The stock kicked off the year 2021 at a price of $ 214.06 and concluded the year at $ 201.32. the price remained stagnant.

If you are seeking a steady stream of income, you should invest in REIT stocks.

If you are seeking a steady stream of income, you should invest in REIT stocks.

General Motors

General Motors is a global company that makes and sells cars, trucks, crossovers, and automobile parts around the world. It was the world’s largest motor vehicle manufacturer for much of the 20th and early 21st centuries. It operates on six different continents and works in 22 different time zones. Its automotive business is divided into four business segments: GM North America (GMNA), GM Europe (GME), GM International Operations (GMIO), and GM South America (GMSA). Investors are now looking for the finest solar energy stocks to invest in.

The company’s business strategy is in line with ESG. GM plans to be carbon neutral in its global products and operations by 2040.

In its recent quarterly report, GM reported:

- Total sales and revenue were $26.8 billion

- Net income was $2.4 billion

General Motors has a market capitalization of over $91 billion. Its share is trading at $62.74. The stock of the motor company is on a bullish run since the year 2020. The stock kicked off the year 2021 at a price of $41.64 and concluded the year at a price of $58.63.

Get to know about RSI trading strategies.

Get to know about RSI trading strategies.

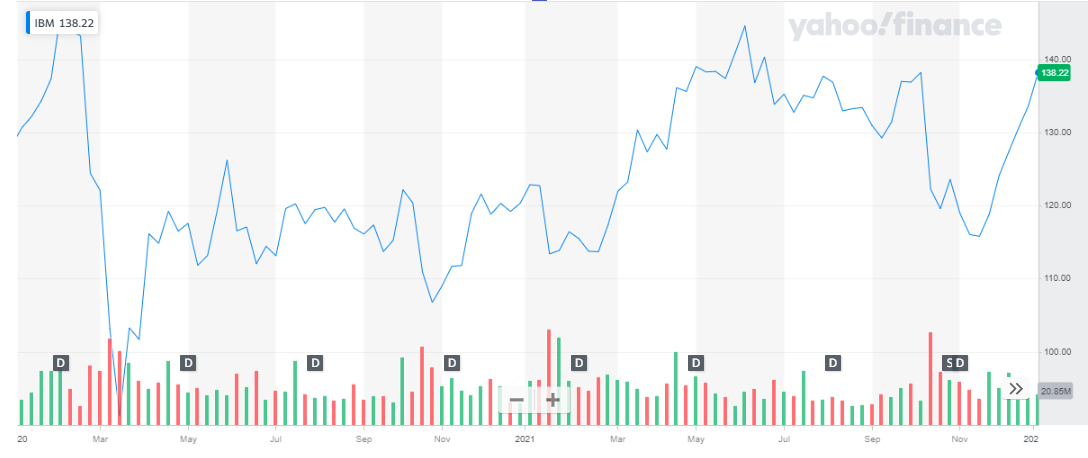

IBM

IBM is a multinational computer hardware company that ranks among the world’s largest information technology companies, providing a wide spectrum of hardware, software, and services offerings. The company is shifting its focus toward cloud computing and artificial intelligence. The computer company has a very solid cloud strategy and is a dependable dividend stock that is regularly paying dividends for many decades now. The breakthrough of technology has led to an increase in automated processes in every organization. Robotic stocks have gained popularity now.

In the recent quarterly report, IBM reported:

- Revenue of $17.6 billion

- Debt reduced by $7.0 billion since year-end 2020

The company has reported excellent cash generation for the recent quarter. Also, throughout the year the company has maintained a strong balance sheet and liquidity to support its hybrid cloud and AI strategy. With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

IBM is a $124 billion company whose share is trading at a price of $138.22. the stock kicked off the year 2021 at a price of $120.34 and ended the year at a price of $133.

Trade with confidence with exclusive Nasdaq Elliott Wave Forecasts.

Trade with confidence with exclusive Nasdaq Elliott Wave Forecasts.

Read more:

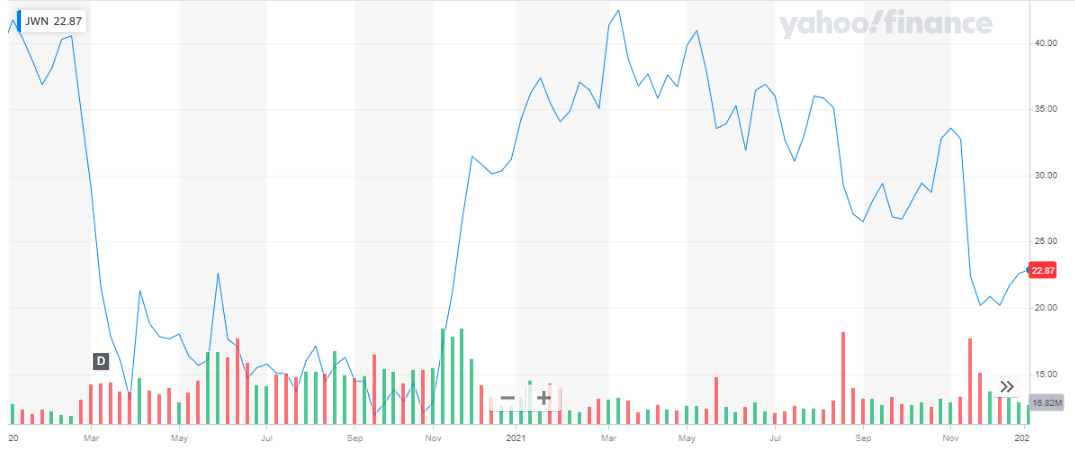

Nordstrom

Nordstrom is a luxury department store that sells clothing, footwear, handbags, jewelry, cosmetics, and related personal products.

In its recent quarterly report, the department store reported:

- Total Sales and Revenue was $3.64

- Net sales increased by 18% as compared to the same period last year

- Net Earning were reported at $64 million

Nordstrom has a market capitalization of over $3.64 billion. Its share is currently trading at $22.87. 2020 was not a good year for Nordstrom stock. After the huge dip due to COVID-19, the company’s stock struggled throughout the year. During the last quarter, the company’s stock showed improvement and entered 2021 at a price of $31.21. Nordstrom stock was trading at $22.62 on the last trading day of 2021.

Get to know some of best gaming stocks to invest in now.

Get to know some of best gaming stocks to invest in now.

Royal Dutch Shell

Royal Dutch Shell is an Anglo-Dutch multinational oil and gas company. It is the second-largest private sector energy corporation in the world. The company’s main business is the exploration for and the production, processing, transportation, and marketing of hydrocarbons (oil and gas). Investing in oil stocks offers great rewards in terms of high returns.

In its recent quarterly report, Shell reported:

- Net loss of $448 million

Royal Dutch Shell has a market capitalization of $179 billion. Its share is trading at $46. The company stock received a huge blow due to the pandemic led market crash. The stock is on the path to recovery. 2021 was a good year for the company’s stock. The stock kicked off the year 2021 at $33.61. Royal Dutch Shell concluded the year 2021 at a price of $43.35.

Get to know the best oil and gas ETFs to buy in 2024.

Get to know the best oil and gas ETFs to buy in 2024.

CONCLUSION

The current year brings new hopes for all investors. Looking at the recent trends, we have compiled a list of the top 10 buzzing stocks which are expected to grow in 2024.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Lithium Stocks to Buy in 2024

- Best Robinhood Stocks to Buy in 2024

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest