Natural Gas (NG) has lost over 63% in value since the peak in August 2022. It has been a rather sharp decline with a sizeable recovery in the middle before the decline resumed again. Today, we will take a look at Elliott Wave structure of the decline from August 2022 peak, show some charts from […]

-

Natural Gas Bouncing From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of Natural Gas charts. In which, the $NG_F is bounce from Elliott wave blue box area.

-

Elliott Wave View in Silver (XAGUSD) Favors the Metal Going Higher

Read MoreSilver (XAGUSD) shows 5 waves up from 11.28.2024 low favoring more upside. This article and video look at the Elliott Wave path.

-

Gold-to-Silver Ratio (AUG) Can be in Triangle Consolidation

Read MoreGold-to-Silver Ratio (AUG) is a ratio of the underlying metals (i.e. Gold and Silver). The ratio is simply calculated by dividing Gold price and Silver price, thus the name Gold to Silver ratio. Since the 1970s, after the gold standard was abandoned, the long-run average gold-to-silver ratio is around 65:1. Over the past 50 years, […]

-

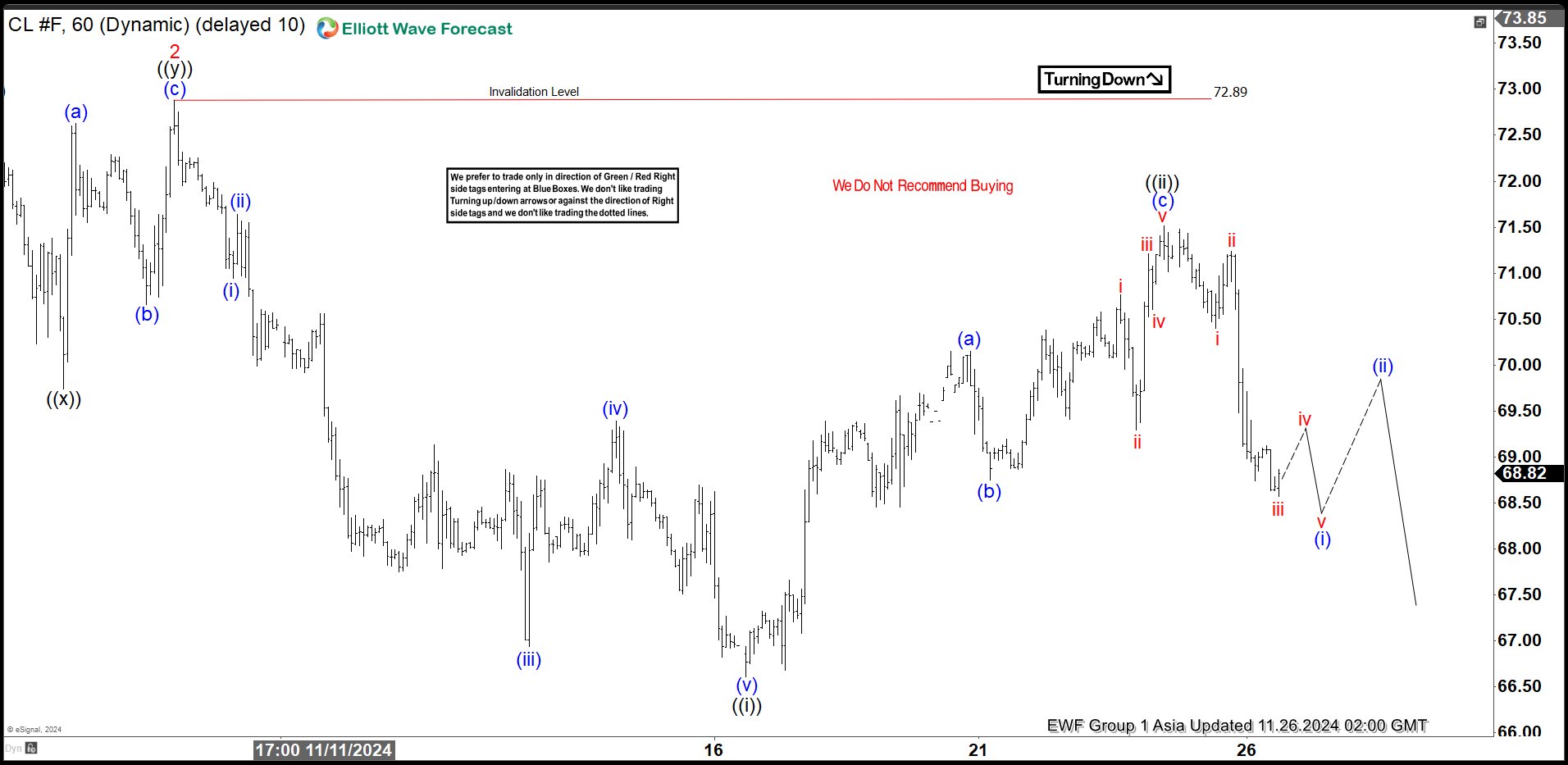

Elliott Wave View: Oil (CL) Short Term May See More Downside

Read MoreOil (CL) is Looking to resume lower in impulsive structure.. This article and video look at the short term Elliott Wave path of Oil

-

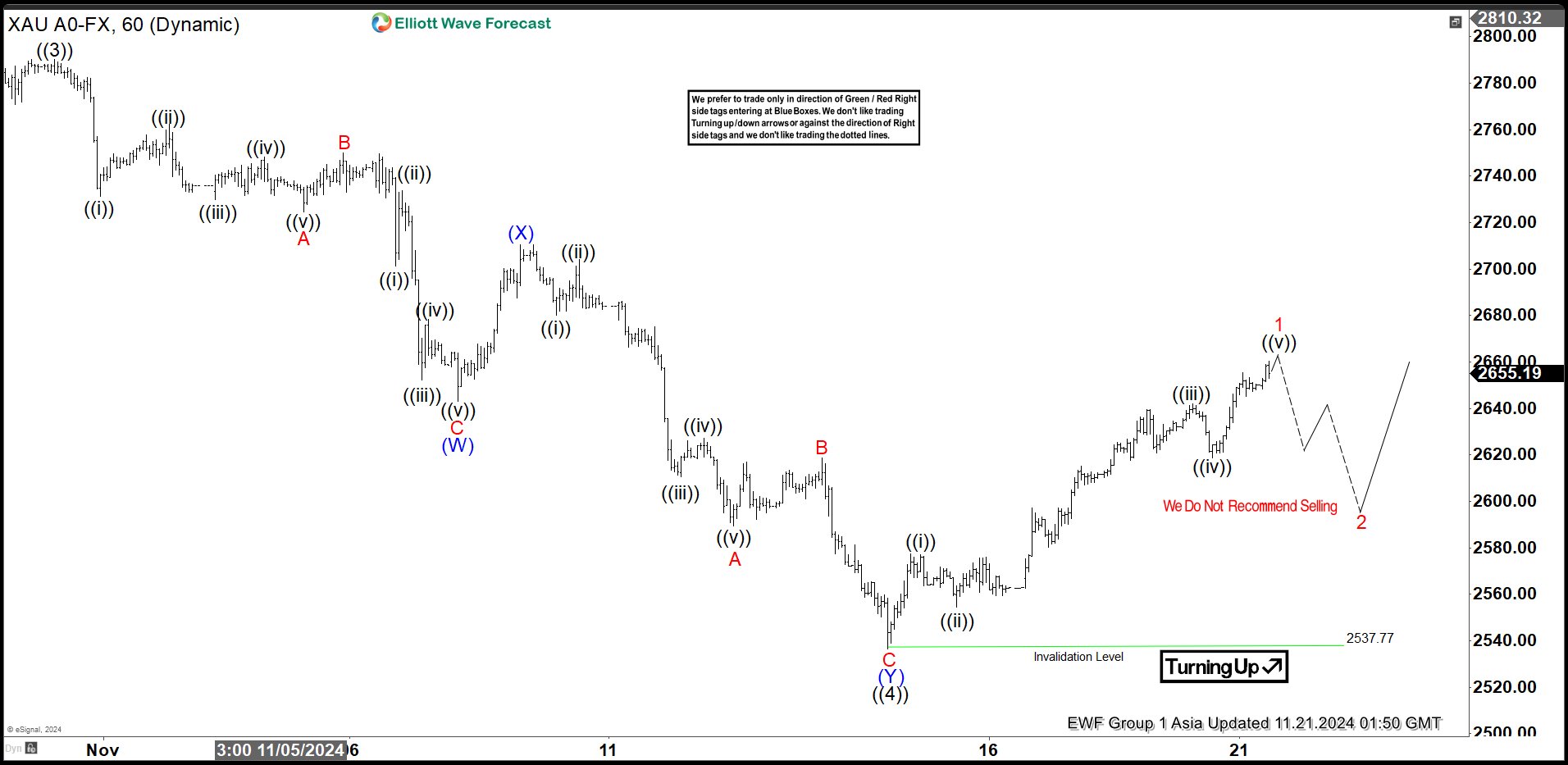

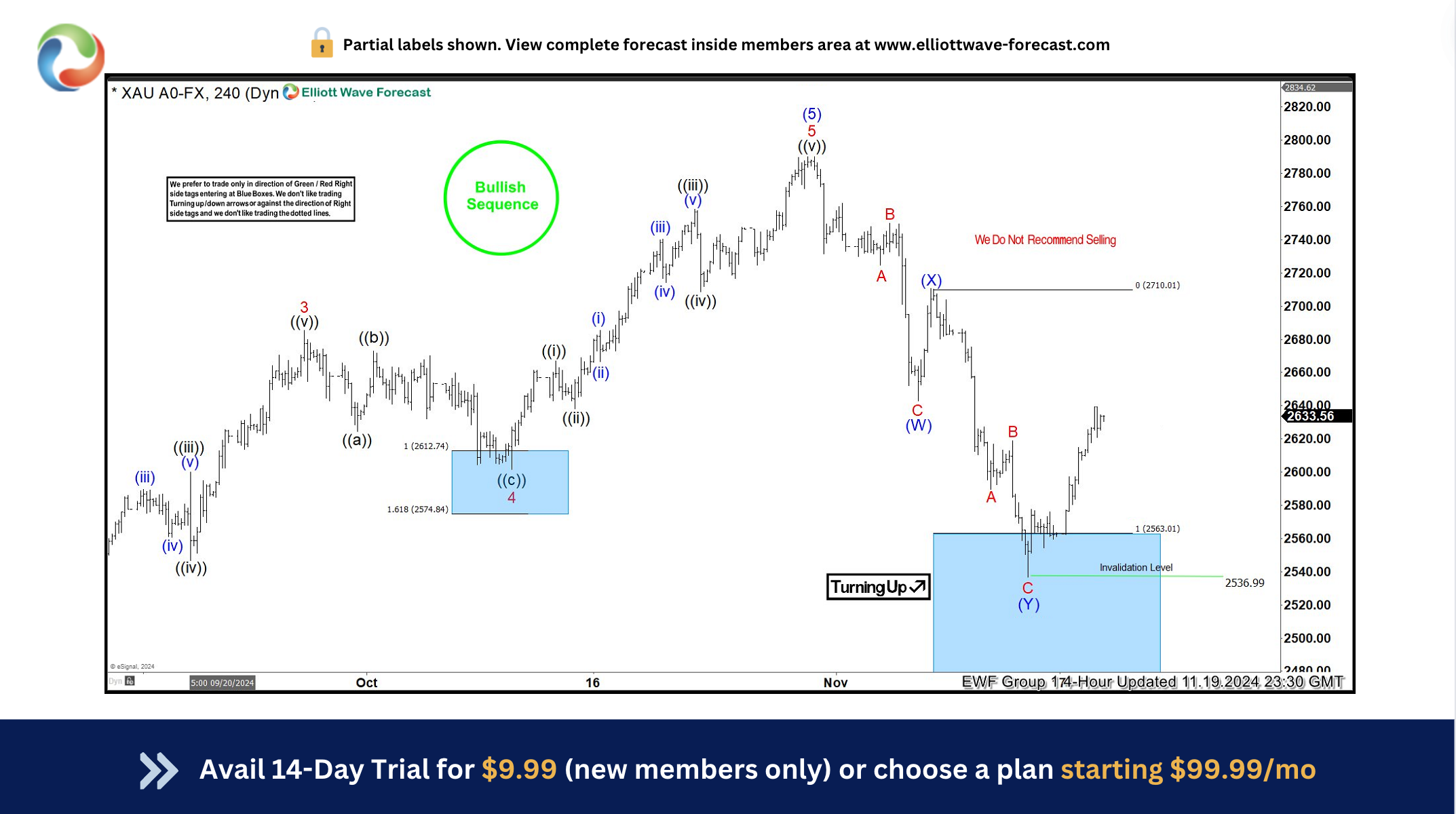

Elliott Wave View: Gold (XAUUSD) Starts Next Leg Higher

Read MoreGold (XAUUSD) Has Resumed Higher and Dips likely will find support. This article and video look at the Elliott Wave path of the metal.

-

Gold (XAUUSD) puts buyers in profit from the blue box

Read MoreHello traders. Welcome to new blog post where we discuss trade setups across the major asset classes. In this post, we will discuss a recent setup on Gold (XAUUSD) for educational purposes. Gold is in an all-time bullish sequence. The commodity continues to hit fresh record highs. It did that multiple times this year after […]