RELIABLE PLATINUM FORECAST

Daily Accurate Platinum Trading Signals

1 Hour, 4 Hour, Daily & Weekly Elliott Wave Counts

Live analysis sessions and trading rooms

Daily technical videos, sequence reports & more…

Platinum Trading Signals

Trade with confidence with exclusive Elliott Wave Forecasts

What Influences the Value of Platinum? Both on the production and consumption sides of this argument, platinum exhibits unique peculiarities. Traditionally, both merchants' and industries' desire has come by making it comparable to silver and gold yet distinct from virtually every other commodity. The following five factors have a significant impact on platinum prices: The Economy of South Africa The State of the Global Auto Sector Electric Car Advancement Catalytic Converter Modifications Desire for Technology Investment.

Keeping a keen eye on these factors can help traders identify the overall future movement of the market; however, technical trading strategies promulgate much more influence on the metal than the fundamental driving forces. Thus, it is crucial to formulate a technical trading strategy before placing a trade on platinum!

We at Elliott Wave Forecast understand that not everyone can be a financial expert but that shouldn’t prevent you from taking advantage of such rewarding opportunity.

Why use Elliott Wave Forecast for Platinum?

Let our expert analysts help you trade the right side and blue boxes with timely and reliable Platinum forecasts.

- Daily & Weekly Technical Videos

- Live Chat Rooms

- Live Analysis Sessions

- Sequence Reports

- Free Education and Learning

- Live Trading Room Sessions

Don't take our word for it. See what our customers say

We take great pride in delivering what we promise. With EWF family growing every single day here's what some of our members have to say.

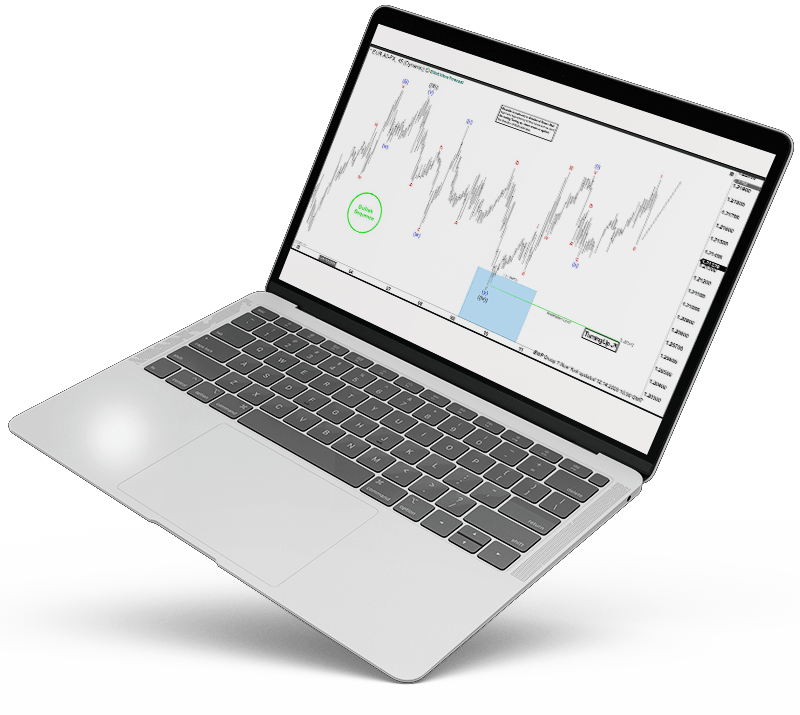

Platinum Forecast using the Blue Box Approach

Blue boxes are one of the few ideas and technical methods we use while analyzing charts. It is one of the most frequently used boxes by Elliot Wave Forecast analysts because it assigns high-frequency inflection areas of interest, allowing traders and investors to buy or sell a financial asset, cryptocurrency, commodity, asset, or stock at the right time and on the right side of the trend. Our best traders arrange blue boxes in chart regions with a more severe danger and probability of trend continuation or trend reversal against our intended objectives. The blue boxes also include and represent the 3, 7, or 11 swings to the end. Our analysts additionally utilize blue boxes for a variety of reasons, including the usage of Fibonacci extensions in its orchestration. It is also used to meet business goals. For illustration, if we have a running trade on the blue box developing with high-frequency inflection regions and areas of interest, we would exit our present trade and possibly join a new trade that the blue box has to provide. Thus, it is one of our primary trading techniques and has a high chance of success.

Learn to trade the right side with blue boxes.

Platinum Forecast & Signals

If you really are fresh to platinum investing, the below suggestions can help you trade better profitably.

Set a Plan

If you have a smaller resource, a plan that enables you to purchase and store may work better than seeking frequent trades and investment thesis, implying a high number of management fees. On the other hand, if you’ve got a higher budget, you would be able to experiment with additional platinum trading techniques.

Always do market research.

If you’d rather be effective in platinum trading, you must always do a thorough market analysis before placing a trade. For example, what is the primary trend of platinum today?

Select the Technique that is Most Effective for You.

We must emphasize that there is no one-size-fits-all approach for trading platinum, just as there is no one-size-fits-all strategy for trading currency. A technique that succeeds well for someone else may not function in your circumstance. This is why you must choose a method that you are familiar with and adhere to all of it. Then, continue to evaluate your performance and development with the selected approach frequently.

If you’d like to trade platinum, you must first grasp your choices and devise a sound plan. Create a strong strategy, stay up to date on the newest developments in the global platinum trading, and concentrate on polishing your abilities to become the best trader every day

Make a list of your trading objectives.

Establishing your investing objectives may assist you in avoiding being influenced by sentiments. Your goals may also help you develop your chosen business plan, such as a technique for turning a scalp trade or position/swing trade.

Establish Risk Profile

Whatever trading technique you use, it is critical to thoroughly assess your risk tolerance. This may help you decide whether to choose the safest path or attempt more bold actions.

Technical Analysis for Platinum

Because of the fundamental nature of platinum, it is critical to trade platinum with numerous confluences and higher probability setups. Below are the technical trading techniques used by Elliot Wave Forecast’s traders and analysts daily!

Elliott Wave Analysis

Because platinum is susceptible to a wide variety of fundamental variables, it is prone to a high level of volatility and volume. As a result, the commodity’s fashionable character. Elliott Wave Analysis is a valuable tool for trading commodities and precious metals that are trending. It helps in the study of past market waves as well as the forecast of more significant future market movements with exceptional precision and exact entry locations. The technique of Elliot Wave Analysis includes wave structures, cycles, sequences, and linked sequences. It is a widely used technical technique in financial markets. It applies to many industries, including cryptocurrencies! However, as many investment banks suggest, the trading plan should include a variety of confluences and not rely only on one technical signal. As a consequence, depending only on Elliot wave research to make trading choices may be disastrous. Elliot Wave Forecast employs various analytical techniques to better evaluate the market and place special and timely entry orders. Our technical and analytical techniques include Elliot wave models, market correlations, Fibonacci, trendlines, market dynamics, and sequences. Such technological tools enable us to monitor demand with extraordinary accuracy and stay on the right side of the trend. At Elliot Wave Forecast, the term “right hand” refers to the overall trend’s trajectory as well as our language about the market’s direction. For example, when we refer to a trend on the right side, we are referring to the trend’s specific location (bullish or bearish).

Fibonacci

Many people are familiar with Fibonacci, although it is seldom utilized to its full potential. It offers high likelihood figures for potential trend retracements and extensions. As a consequence, it is pretty popular and essential among traders and investors. Elliot Wave Forecast incorporates Fibonacci into our pre-existing trading methodology. For example, to get a more comprehensive and accurate picture of the market, we use Elliot wave analysis and sequencing combined with Fibonacci extensions and retracements.

Trendlines

Trendines are considered as simple technical tools. Due to their simplicity, trendlines can be among the most powerful trend trading tools. Futhermore, trendlines, regardless of their design, are highly useful and precise scientific tools. The vast majority of traders utilize it as a secondary confluence for their entry or exit orders. Elliot wave prediction uses it for a variety of applications. One of the most critical aspects in determining the nature and intensity of the trend. We also combine other indicators with trendlines, such as RSI and the distribution mechanism, to create a very viable and accurate trendline trading method.

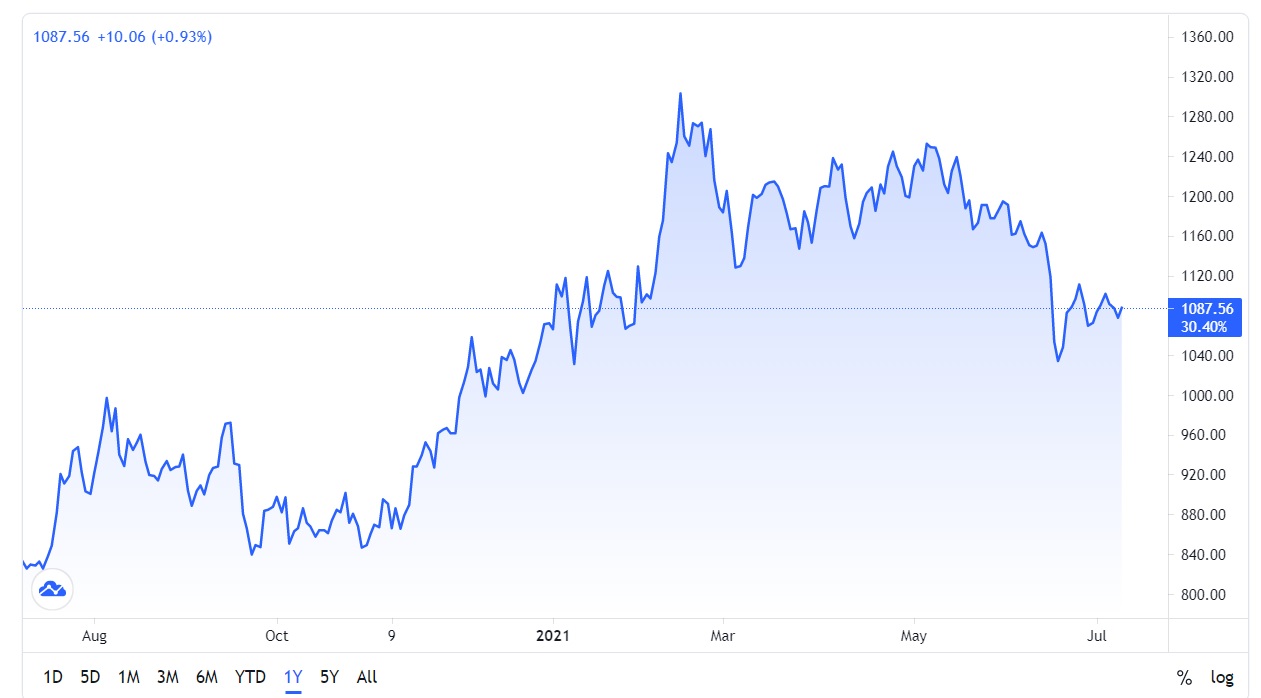

Correlations in the Market

Because platinum is a valuable metal, it has a positive correlation with gold. In every manner, it tracks the price of gold. For example, if the price of gold rises, so will the price of platinum, and vice versa. As a result, before trading platinum, it is essential to assess the entire environment of the yellow metal! Our analysts use the first-and second-dimension correlation method to achieve a more exact and accurate correlation of a particular pair across various asset classes. Allocating a correlation strategy in every trade we take, helps us to make more informed decisions and improve our overall trading style.

Platinum: An Overview

What Makes Platinum So Expensive? Platinum is an organic compound and element that is present under the Earth’s surface. Since its customer base transcends easy classification, the silvery metallic component is among the most fascinating commodities. Platinum is in a growing market in economic sectors, including the automobile sector, to be used in emissions controls and catalytic aspects of automobiles. In contrast, speculators/investors and traders prize the silvery element as an investment property and repository of wealth. Platinum is popular among jewelry purchasers due to its magnificent gleaming look and immunity to corrosion.

Crypto & more. Covering up to 78 instruments globally.