The boom of bitcoin and other cryptocurrencies has developed an increased interest in crypto trading. In fact, crypto day trading has become an increasingly popular form of trading. One of the key benefits of crypto trading over other trading is that crypto traders can execute their trades at any time of the day.

Day trading is one of the most commonly used trading strategies. It involves entering and exiting trading positions on the same day. Since the trading happens within the same day, this strategy may also be referred to as intraday trading. The stock trading advisory websites help investors make the right financial decisions.

Cryptocurrency trading strategies are critical for traders to make the most out of their investments. A trader can use many techniques for day trading to gain from short-term fluctuations. But he/she should be careful while devising a day trading strategy that should be based on research. There are multiple technical analysis courses available that teach technical analysis.

Pay Attention To The Following Things While Day Trading Cryptocurrency

- Manage your Risk – the first and foremost rule of trading is do not to risk more than you can afford. Since crypto trading is still considered a fairly new form of trading, it has its set of high-risk outcomes. It is very important to research and not follow the herd behavior of the crypto market. It is very easy to be driven by the flow of the market but it is not advisable to blindly follow the market. There are trading blogs designed for individual investors who are interested in choosing individual buzzing stocks.

- Choose your purpose for crypto trading – before entering the crypto market, it is very important to choose your motive for entering the market. Whether your purpose is to day trade or the scalp or you want to carry out copy trading, you need to define this for yourself. Be mindful of the fact that trading digital currencies are a zero-sum game: Someone wins and someone else loses.

- Don’t buy because the price of low – While trading stocks and forex, this strategy often is advised but for crypto, this is a complete no. The decision to invest in a crypt coin should not be based on the current price but its market cap. There are multiple forex trading platforms in the market.

If you are confused between investing in stocks or forex, go through investing in forex or stocks – which is more profitable?

How To Make Money Day Trading Cryptocurrency

Day trading is not easy. Neither is everyone’s cup of cake. If it was easy that every trader would be rich and there would have been no losers in the market. While there is no hard and fast rule for succeeding in the crypto market, as an investor you can follow some guidelines which can help avoid the pitfalls:

- Set your goals for every trade: As a day trader, you have to enter and exit the market every day. Therefore, you have to set a time limit for yourself for trading. When the time expires, you just exit and take whatever profit or loss you have. Don’t let the greed or fear of losing prolong your trade. Often chasing maximum profit or avoiding losses leads to huge money loss. There is a vast array of trading courses available online which you can join, each with its own merits and every course suitable for different types of traders.

- Make use of Stop Loss orders: Make a habit of setting a stop loss whenever you open a position. This will ensure that you do not lose more than you can afford. And it will also keep your emotions separate from the trade. Setting a stop loss will automatically carry out the trade, eliminating the risk of emotional decisions.

- Make use of Profit/Limit orders: Setting take profit order to sell, as soon as the price reaches your target return will take the emotions out of the trade. Often the trend reversals happen In a blink of an eye. And while you prolong your trades in hope of bigger gains, you not only lose the profit but also can lead to losses.

Check out our list of the best day trading stocks in 2023.

Best Crypto Day Trading Strategies

Let’s discuss some of the best crypto day trading strategies which we have selected below. These strategies have helped traders earn profits in the crypto market.

- Blue Box Strategy

- Steady Incremental Profit Accumulation Strategy (SIPAS)

- Scalping

- Copy Trading

- Arbitrage

- Range Trading

- High-Frequency Trading

- Channel Trading

- News and Sentimental Analysis

Blue Box Strategy

The blue box is one of the most effective technical strategies used by investors. The blue box on the charts represents the area where traders can enter the market. An example of a blue box chart is shown below:

In the above chart, Right Side Higher” stamp with invalidation level of 24956 is marked. This indicates that traders should not try to sell, even if the price drops lower. Traders need to buy the dips instead. The blue box is the area in which the trend of the price can change.

The blue box is simply the area that traders can execute the trade.

Checkout some of the best oil and gas ETFs to buy now. Investing in oil stocks offers great rewards in terms of high returns.

Steady Incremental Profit Accumulation Strategy (SIPAS)

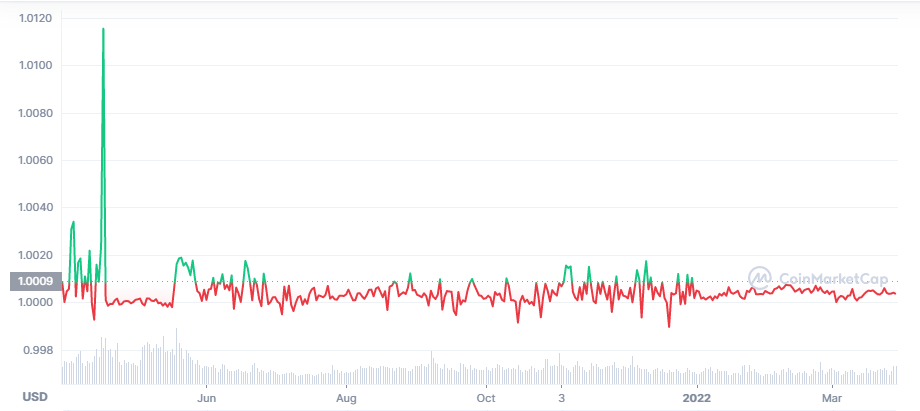

This is one of the best and safest crypto day trading strategies for beginners. As a beginner, the best way to tread ahead in crypto trading is to avoid any wild fluctuations within the crypto market. And to do that investing in stable crypto coins is the answer. An example of a stable coin is USDT.

The below chart shows how stable the coin has been over the past year.

Get to know the best quantum computing stocks.

Scalping

Scalping

Scalping is one of the most common and widely used trading strategies in the crypto market. It takes advantage of the small movements in asset prices.

Since the crypto market is highly volatile which means sharp price fluctuations, crypto traders need to make quick decisions while implementing this. Also, this strategy requires multiple trades within a day to make a good profit as profit per trade is very low. The aim of this strategy is not big gain from one trade but gains from a large number of transactions. There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

Scalping time intervals range from as short as 1 minute to 1 hour. A crypto trader can make use of trade bots for this as manual trading becomes hard. Using a trader bot can help analyze market statistics in shorter periods and make trading faster. The best way to benefit from this strategy is to carefully select and specify your timeframe. Once you have done that, all you have to do is to execute your trades or set your trading bot according to it.

Check our updates for NASDAQ Forecast.

Copy Trading

Copy-trading in real is about copying other people’s trades. Cryptocurrency traders copy the trading positions of other investors within a social trading network. To do this, the crypto trader links his/her account to the original investor’s account and positions are mirrored. The original investor typically earns a monthly fee as compensation for allowing to copy his/her trades.

One of the benefits this trading strategy allows to the trader is that he/she can stop the trade and manage them on their own. Copy-trading also gives the option of stop-loss on the whole trade. This allows the traders to control any potential risk.

Copy trading is used by beginners and seasoned traders both. With this trading strategy, a trader can save all the time spent on research and can start generating money with little time and effort. Traders can also decide how much they want to invest in the trader who they are copying.

Get to know the list of crypto mining companies that are leading the industry.

Crypto copy trading is an officially recognized trading strategy. It is hassle-free and also excellent for diversification in your portfolio. But even then, there are still some downsides to this trading strategy. Firstly, the cost of copy trading which you have to pay in form of commission and fees. Secondly, you are allowing a total stranger to handling the lead of your investment portfolio. And even the best traders cannot win every time, hence the risk of losing money is always there.

Get to know some of best blue-chip stocks to invest in now.

Arbitrage

Cryptocurrency arbitrage is a strategy in which investors buy a cryptocurrency on one exchange and then quickly sell it on another exchange for a higher price. The trader takes advantage of the difference in the price of cryptocurrencies on multiple trading platforms. While the price difference might be small and even short-lived, the returns can be huge when large volumes are traded.

To make use of this crypto trading strategy traders need to have /her accounts on multiple crypto trading platforms. But finding an arbitrage opportunity is a daunting task as there are so many cryptocurrencies being traded on multiple crypto trade platforms. That is why many traders make use of software applications to track best cryptocurrencies in real-time.

Amongst the less popular and less traded cryptocurrencies, there are opportunities of finding bigger price spreads of the same cryptocurrency on different platforms. Since these currencies are not commonly traded, they can experience rapid price fluctuations. But these fluctuations can earn high profits or it can even be bad news.

Despite being a profitable opportunity, this crypto trading strategy comes with its set of risks. The most commonly faced risk by traders is the thin price spread. Since the price difference is low, a trader needs to act fast to seize the opportunity and he/she needs to be careful to not increase the purchase price or decrease the selling price. Also, in order to benefit from the arbitrage day trading strategy, having enormous trading volumes is very important. not only it is important to earn a sizeable profit but it is also important to maintain the price of the cryptocurrency at the desired level.

Get to know head and shoulders pattern trading guide.

Range Trading

Range trading takes advantage of non-trending markets by identifying consistent high and low prices, known as resistance and support bands. The concept behind this crypto trading strategy is to enable the trader to identify when an asset is oversold or overbought. This strategy assumes that the price of crypto assets moves within a specific range. Traders make use of candlestick charts and support and resistance levels. The trader buys when the price reaches support levels and sells when a price reaches a resistance level.

Range trading helps traders focus on earning profits while other traders are trading the breakout or breakdown. Having a range of prices enables the trader to clearly define the support and resistance levels. But one thing to be careful about is that while adopting range trading, traders need to strictly remain in the defined range and not act during an uptrend or downtrend. Forex indicators are constructive in making disciplined and informed decisions.

Another limitation of range trading is that the crypto assets will fall out of the range at some point in time. Therefore, identifying pivot points is also very important. These pivot points enable the traders to identify the change in trend and/or shift towards a new trading session.

High-Frequency Trading

High-Frequency Trading uses various algorithms to analyze the smallest price fluctuations of the same cryptocurrencies on different trading platforms. Usually, High-Frequency trading platforms automatically detect price discrepancies and open and close trade positions accordingly. This trading strategy aims for short-term goals that would otherwise go unnoticed by the naked eye.

High-Frequency Trading has gained popularity due to its ability to multiple trades per second. The computers which are used to execute the high-frequency traders are programmed to host sophisticated algorithms. These systems, are continuously analyzing and monitoring the cryptocurrencies across multiple exchanges by millisecond. These systems are designed to detect trends and other trading triggers that human traders cannot observe no matter how professional they are.

The highlighting factors of High-Frequency Trading

- It makes use of high-speed and complex programs in order to generate and execute orders

- It utilizes the short periods of opening trade positions and selling them

- It’s a day trading strategy hence no overnight risk

High-Frequency Trading largely depends on the algorithm and equipment used. Hence, the institutional investors are majorly equipped to handle these large trades.

The major advantage of High-Frequency Trades is speed and automation. The system which carries out the trades can spot opportunities and open and sell hundreds of positions in minutes. Moreover, these system-generated trades also eliminate any potential error that might occur due to manual handling.

High-Frequency Trading is an excellent crypto trading strategy but it should be executed carefully.

Also read:

Channel Trading

Similar to the range trading strategy, the Chanel Trading strategy is executed used when the price moves inside an ascending or descending channel. It is a chart pattern trading method used in the continuation of an established trend, as part of a trend following strategy. Chanel trading method gives near to exact entry and exit points. A channel is formed when the price action within two parallel trendlines, on a chart, tests each of these lines twice. The best currency pair to trade is the one you are most familiar with.

Four common methods of trading using the Chanel strategy are:

- Ascending Channel Trading Strategy – An ascending channel is where the price is moving higher. With this channel, price is making higher highs and higher lows.

- Descending Channel Strategy – A descending channel is when the price is moving lower. With this type of channel, price is making a series of lower highs and lower lows that you will be able to connect with your trendlines.

- Channel Breakout Strategy- This is a very popular channel trading strategy. With this strategy, you are looking for the channel to break and take advantage of the possible explosive momentum.

- False Breakout Channel Strategy- Channel levels will regularly false break. You will often see price pop above or below the channel support or resistance before snapping back in the opposite direction right back into the channel.

A trader opens a long-positions at the lower border of the channel and closes at the upper one. Short positions, in turn, are opened at the upper border of the channel and closed at the lower one. Since one of the best trades for this strategy is those that correspond to the trend, it is always safe better to open long positions at the lower border of the ascending channel and short ones at the upper border of the descending channel. The Stop-Loss is set outside the channel boundaries and follows their direction. And when the channel boundaries are broken, the trader waits for a new channel to form and starts trading within it.

Get to know about best penny stocks to invest in.

News and Sentimental Analysis

The crypto market is highly responsive to news and the overall market sentiment. Therefore, news and sentimental analysis is often used by traders for Bitcoin and another cryptocurrency trading. Also, to benefit from this strategy, traders need to stay updated on recent news. Whether the news is good for trading or not, the market is going to respond. Therefore, as a trader, you have to act and seize the opportunity by making a decision on time. With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

For this strategy, trading bots can be extremely helpful. These bots can be adjusted according to the preferences of the trader. Also, they save you from manual work of constant market monitoring. Examples of such platforms are Cryptohopper, BTC Robot, and Crypto Trader.

Get to know bonds vs stocks where to invest.

Tips For Crypto Day Trading

In addition to the above mentioned day trading strategies there are a few additional tips to follow to make the best out of your trades:

- In day trading crypto, avoid averaging into a position. Because averaging means buying an asset at a successively lower price or selling at a successively higher price for a short position. This is best suited for long term trading strategies

- Don’t play with strategies that you are unable to understand. Since the volatility and risk of the crypto market are very high, trading unknown territories are highly unadvisable

- Always take the aid of indicators to assure the trading position you are entering. But don’t overdo the use of indicators

- Always pick a couple of cryptocurrencies to start. Never start trading with more the 3 currencies at a time. It will not only overwhelm you but will also make it difficult to manage multiple currencies simultaneously

You may also like reading:

- Best Lithium Stocks to Buy in 2023

- Best Robinhood Stocks to Buy in 2023

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest