Silver is a valuable and very useful precious metal. It is vital for any industrial applications. Moreover, silver being the best electrical and thermal conductor of all metals, is very high in demand in the industrial sector. Silver is used in:

- Mobile Phones

- Electric Vehicles. EV stocks are one of the plenty of investment opportunities to take advantage.

- Photovoltaic cells- The main component of solar panels. Solar energy stocks have led this quarter’s stock market gains.

- As a catalyst for the production of ethylene oxide (an important precursor in the production of plastics and chemicals)

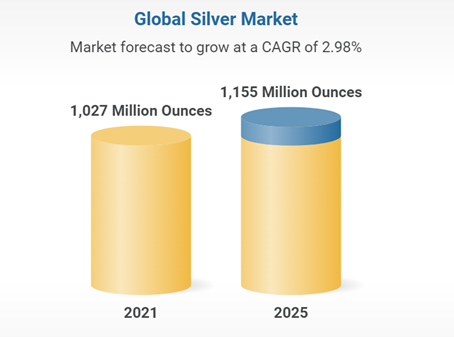

The global silver demand is expected to reach 1,155 million ounces in 2025, growing at a CAGR of 2.98%, for the period of 2021-2025. While the silver supply is likely to be recorded as 1,062 million ounces in 2025, increasing at a CAGR of 1.26%, during 2021-2025.

The global silver market from 2021 to 2025 is shown in the below graph:

Source: Research & Markets

Silver is also a valuable investment just like gold stocks. Using Gold Trading Signal Providers is a smart approach for traders. Silver also is an excellent hedge against inflation and during times of economic ups and downs.

Why Invest in Silver?

- The first and foremost advantage of investing in silver is that it can never be defaulted on.

- Silver is an industrial commodity that is frequently used in electronics and many other products

- Silver has intrinsic value and is cheap in price

- Silver is more practical and can be sold easily

- Silver stocks are declining which indicate the rise in prices in the near future.

List of the Best Silver Stocks

Here we have compiled a list of the Best Silver stocks to invest in 2024:

- First Majestic Silver (NYSE: AG)

- BHP Group (BHP)

- Pan American Silver Corp (NASDAQ: PAAS)

- Hecla Mining (NYSE: HL)

- Pan American Silver (NASDAQ: PAAS)

- Endeavour Silver Corp (NYSE: EXK)

- Silvercorp Metals (NYSE American: SVM)

- Fortuna Silver Mines Inc (NYSE: FSM)

First Majestic Silver (NYSE: AG)

First Majestic is a mining company focused on silver production in Mexico. The company is also dedicated to the development of its existing mineral property assets. The Company owns and operates the San Dimas Silver/Gold Mine, the Santa Elena Silver/Gold Mine, and the La Encantada Silver Mine.

In its recent annual report for 2022, First Majestic announced record production of silver at 26.9 million silver equivalent ounces, a 32% increase from last year. The silver production in 2021 was recorded at 12.8 million ounces, compared to 11.6 million ounces in 2020. For the future, the company expects total production to range between 32.2 to 35.8 million silver equivalent ounces out of which 12.2 to 13.5 million in ounces of silver. Get to know best vaccine stocks to invest in now.

The company has a market capitalization of around $3 billion. Its share is trading at a price of $11.66. During the year 2021, the stock peaked at $18.2.

First Majestic aims to become the world’s largest primary silver producer. For this purpose, the company is focused on growth and is investing millions of dollars each year towards the exploration and development of new silver mines. Therefore, First Majestic is one of the best silver stocks to buy in 2024.

First Majestic aims to become the world’s largest primary silver producer. For this purpose, the company is focused on growth and is investing millions of dollars each year towards the exploration and development of new silver mines. Therefore, First Majestic is one of the best silver stocks to buy in 2024.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

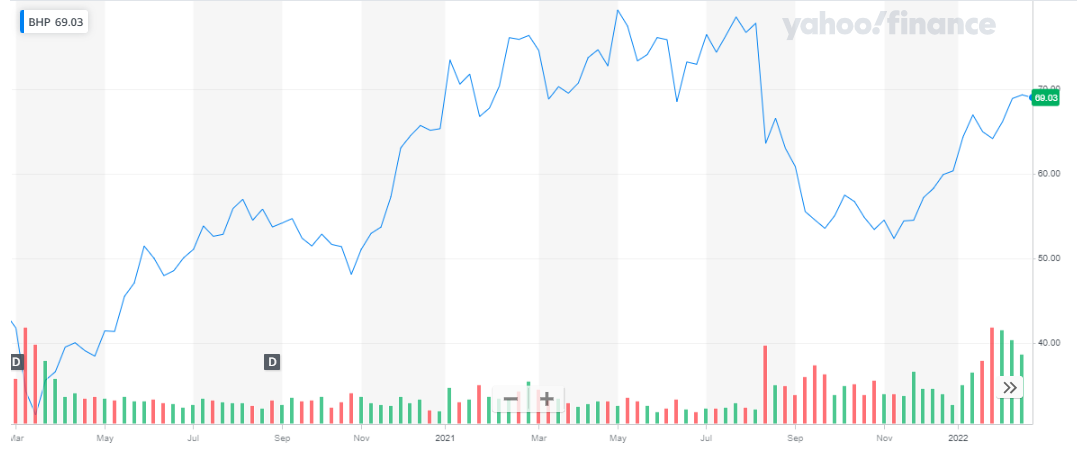

BHP Group (BHP)

BHP Group Ltd. engages in the exploration, development, production, and processing of iron ore, metallurgical coal, and copper. It operates through the following segments: Petroleum, Copper, Iron Ore, and Coal. The Copper segment refers to the mining of copper, silver, lead, zinc, molybdenum, uranium, and gold. Always do research and consider few crucial parameters that you as an investor should look into before selecting a crypto signal provider.

The Olympic Dam, owned fully by the BHP group holds one of the world’s most significant deposits of copper, gold, silver, and uranium. It comprises underground and surface operations and is a fully integrated processing facility from ore to metal.

In its recent annual report for the year 2021, the company reported silver production as follows:

| Silver | BHP Interest | 2021 |

| Payable metal in concentrate (‘000 ounces) | ||

| Escondida, Chile | 57.5% | 5,759 |

| Antamina, Peru | 33.75% | 5,965 |

| Olympic Dam, Australia (refined silver) | 100% | 810 |

| Total | 12,534 |

The company reported total revenue of $61.23 billion and a Net Income of $11.3 billion for the year 2021.

The BHP Group has a market capitalization of over $247 billion. Its share is trading at a price of $69.34. the share peaked at $79.38 during the year 2021.

The BHP Group has a market capitalization of over $247 billion. Its share is trading at a price of $69.34. the share peaked at $79.38 during the year 2021.

BHP is a huge group and considering its huge deposits of metals, it is one of the best silver stocks to buy in 2024. Get to know the list of crypto mining companies that are leading the industry.

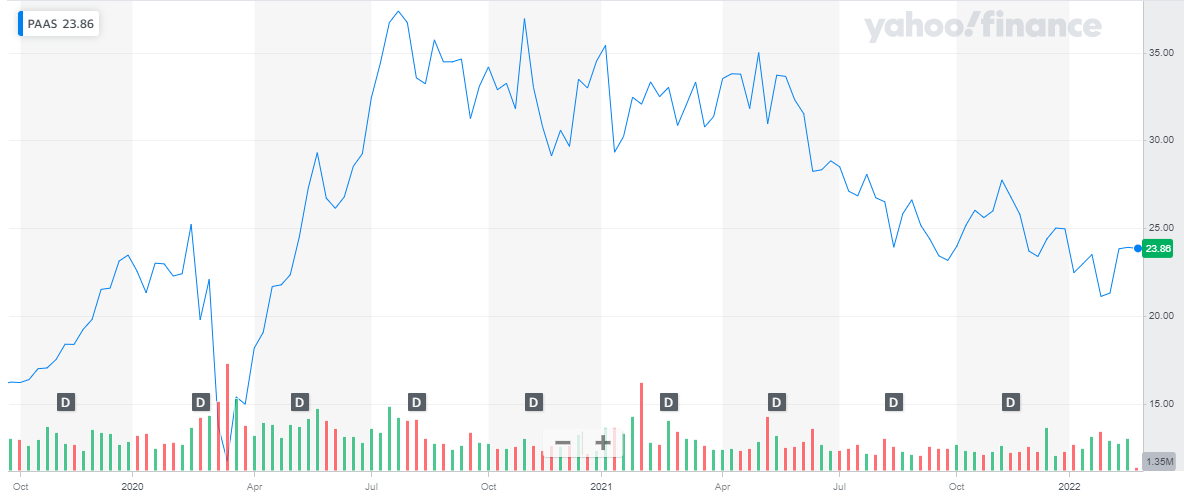

Pan American Silver Corp (NASDAQ: PAAS)

Pan American Silver Corp is a mining company focused exclusively on the exploration and development of silver mines. The company operates primarily in Central and South America. It also sells the byproducts from its silver mining operations, including zinc, lead, copper, and gold.

In the third quarter report for the year 2021, the company reported revenue of $460.35 million and Net Income of $20.22 million. The total silver production during the quarter was 4.8 million ounces. The company expects mine developments and mining rates to continue increasing over the coming quarters, with throughput rates increasing to approximately 2,000 tonnes per day by mid-2022. The company reported a strong financial position for the quarter with working capital of $618.8 million and it also announced a dividend of $0.01/ share for the quarter. Using stock indicators, and stock signals one can make wiser decisions in understanding the underlying market dynamics.

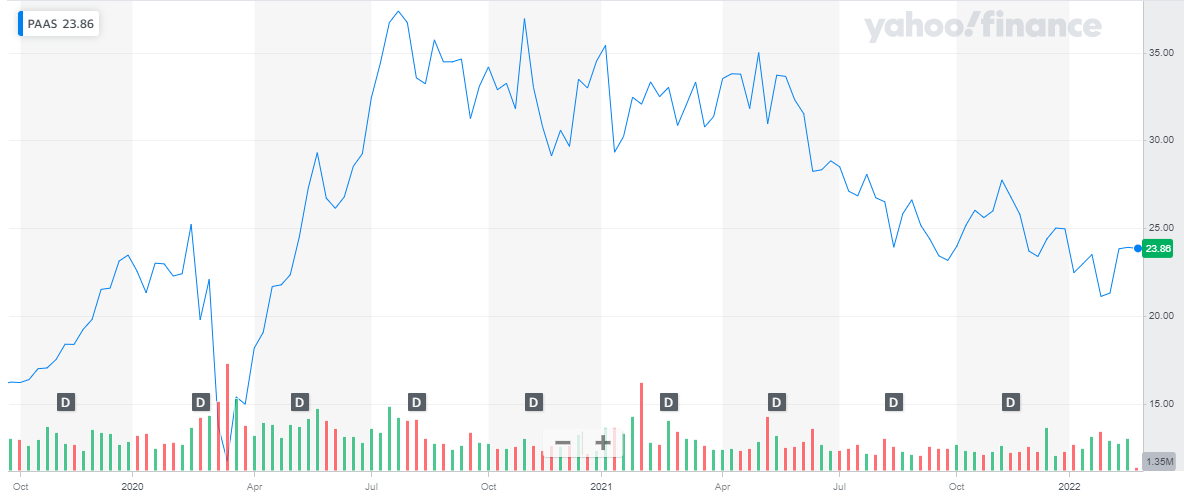

Pan American market capitalization is at $5 billion. The share is trading at a price of $23.86. the stock has been pretty volatile in the past two years with multiple trenches and peaks. The share is currently on a bearish run.

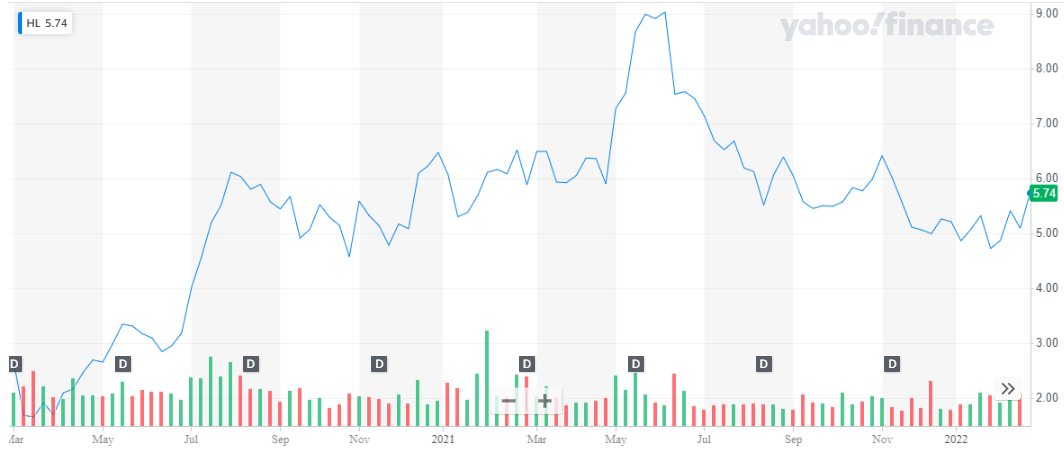

Hecla Mining (NYSE: HL)

Hecla Mining (NYSE: HL)

Hecla Mining Company is the largest silver producer in the United States. In addition to operating mines in Alaska (Greens Creek), Idaho (Lucky Friday), and Quebec, Canada (Casa Berardi) the Company owns several exploration properties and pre-development projects in world-class silver and gold mining districts throughout North America. Investing in best ETFs is one of the most easiest and safe investment option.

In the recent earnings report for the year 2021, the company reported production of 12.9 million silver ounces and 201,327 gold ounces. In addition to it, the company reported the second-highest reserves for both silver and gold in Company history. The silver production of the company has substantially improved because of the development of the Underhand Closed Bench (UCB) mining method at the Lucky Friday establishment. For the year, the company reported record sales of $807.5 million and a net income of $35.1 million. This resulted in the second-highest free cash flow in the company’s 130-year history. Checkout some of the best oil and gas ETFs to buy now.

The new and improved mining method is expected to increase silver production by almost one million during the year 2022.

The market valuation of the company is at $3.1 billion. The share of the company is trading at $5.72. During the year 2021, the stock peaked at $9.

Hecla is not only the largest producer of silver in the United States but also has the largest silver reserve base in the U.S. Therefore, it is one of the best silver stocks to buy in 2022 as investors are in an excellent position to benefit from the growing demand for silver in the transition to clean energy.

Hecla is not only the largest producer of silver in the United States but also has the largest silver reserve base in the U.S. Therefore, it is one of the best silver stocks to buy in 2022 as investors are in an excellent position to benefit from the growing demand for silver in the transition to clean energy.

Pan American Silver (NASDAQ: PAAS)

Pan American Silver is the world’s premier silver mining company, with large silver reserves and a diversified portfolio of producing mines.

The company announced preliminary results for the year 2021, where consolidated silver production was at 19.2 million ounces. In the third-quarter earnings report, the revenue of $460 million was reported. Net income was reported at $20.3 million.

The company has a market capitalization of around $5 billion. Its share is trading at $23.81. the stock remained pretty volatile during the last two years. Since the second half of 2021, the stock is on a bearish trend.

You may also like reading: Best Monthly Dividend Stocks to Buy

You may also like reading: Best Monthly Dividend Stocks to Buy

Endeavour Silver Corp (NYSE: EXK)

Endeavour Silver Corp is a silver-focused mid-tier producer. It has three producing silver-gold mines in Mexico: the Guanacevi Mine in Durango, the Bolanitos Mine in Guanajuato, and the El Compas Mine in Zacatecas. The company also operates three different exploration sites in North Chile.

The company announced full-year production for the year 2021 of 4,870,787 silver ounces (oz) and 42,262 gold oz, for silver equivalent1 (“AgEq”) production of 8.3 million oz. at the end of the year, the company reported sales of 1,413,699 oz silver and 8,715 oz gold. Also, the company reported an inventory of 1,028,340 oz silver and 1,044 oz gold and 54,270 oz silver and 2,630 oz gold in concentrate inventory on 31st Dec 2021. Learn about head and shoulders patterns trading guide.

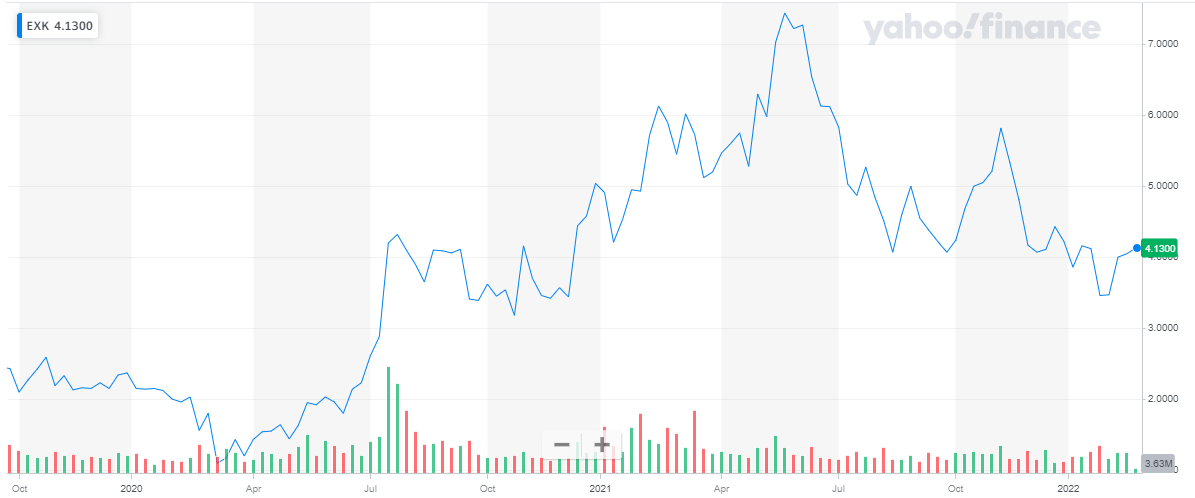

The company has a market capitalization of over $704 million. Its share is trading at a price of $4.2. during the year 2021, the stock peaked at $7.44. after the COVID-19 led market crash, the stock of Endeavour silver went on a bullish run and the share grew from $1.1 to $7.4 in about a year. Get to know top COVID-19 vaccine stocks to invest in now.

Endeavour is currently advancing the Terronera mine project towards a development decision, pending financing, and final permits. In addition to it, the company is focusing on exploring its portfolio of exploration and development projects in Mexico, Chile, and the United States to achieve its goal of becoming a premier senior silver producer. Hence, there is no doubt for investors that Endeavour is one of the best silver stocks to invest in 2021.

Endeavour is currently advancing the Terronera mine project towards a development decision, pending financing, and final permits. In addition to it, the company is focusing on exploring its portfolio of exploration and development projects in Mexico, Chile, and the United States to achieve its goal of becoming a premier senior silver producer. Hence, there is no doubt for investors that Endeavour is one of the best silver stocks to invest in 2021.

Get to know the best tech stocks to invest in now.

Silvercorp Metals (NYSE American: SVM)

Silvercorp is a Canadian mining company producing silver, lead, and zinc metals in concentrates from mines in China.

For the third quarter ending Dec, 31st 2021 the company reported revenue of $59 million and Net Income of $7.9 million. During the quarter the company increased production of silver to approx. 1.8 million ounces of silver, representing an 8% increase from the same period last year. For the complete nine months, the company reported 5.0 million ounces of silver production.

The company has a market capitalization of over $626 million. Its shares are trading at a price of $3.54. Due to the pandemic led market crash, the stock suffered a huge dip in price. But after that, the share of the company shot upwards from $2.3 to $8.4. Since hitting this peak price, the stock has been declining and continues to decline to date.

There has been a lot of focus on the long-term investment stocks.

There has been a lot of focus on the long-term investment stocks.

The company’s goal is to continuously create healthy returns to shareholders through efficient management, organic growth, and the acquisition of profitable projects. Considering the continuous investment in exploration mines and the exploration and resource upgrade drilling completed at its mines from 2020 to 2021, the company expects a significant increase in production in its 2023 financial year. Therefore, Silvercorp Metals is one of the best silver stocks to invest in in 2021.

Check our updated for NASDAQ Forecast.

Fortuna Silver Mines Inc (NYSE: FSM)

Fortuna Silver Mines Inc. is a Canada-based precious metals mining company with operating mines in Argentina, Burkina Faso, Mexico, and Peru. A fifth mine is under construction in Côte d’Ivoire. The Company is primarily engaged in producing silver and gold minerals. The Company operated mines and projects include San Jose Mine, Caylloma Mine, Lindero Mine, and Yaramoko Mine. Its commercial products are silver-lead and zinc concentrates.

Fortuna Silver reported production results for the full-year 2021 from its four operating mines. The company reported:

- Gold production of 207,192 ounces, representing a 274 percent increase over 2020

- Silver production of 7,498,701 ounces, representing a 5 percent increase over 2020

- Lead production of 32,989,973 pounds, representing an 11 percent increase over 2020

- Zinc production of 47,549,301 pounds, representing a 4 percent increase over 2020

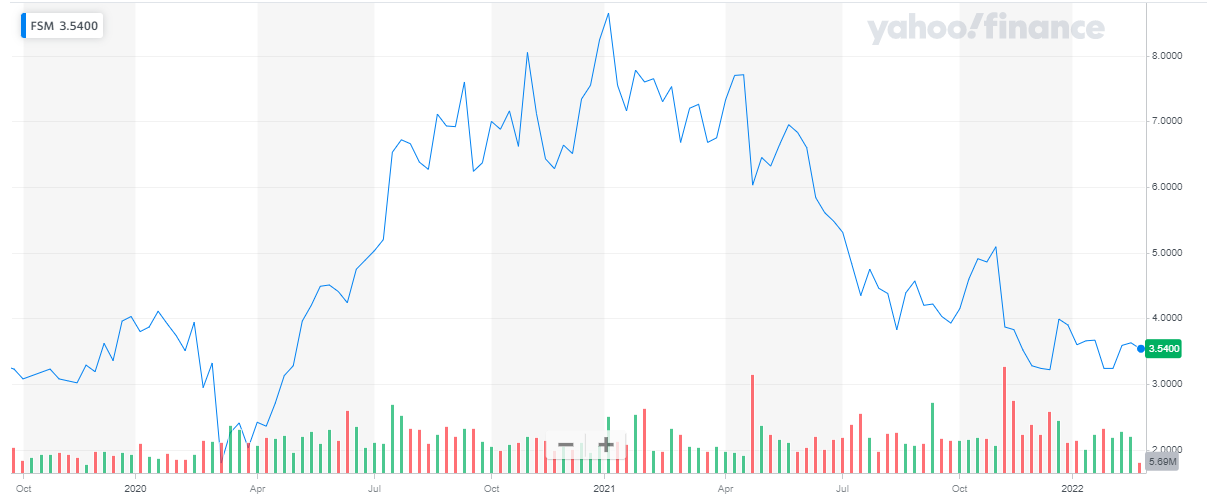

Fortuna is a $1 billion company with its share trading at a price of $3.54 at the stock exchange. The stock of the company was on a bullish journey from mid-2020 to mid-2021 when it peaked at $8.65. Since then, the stock has declined. Semi conductor stocks are one of the best investment opportunities.

Fortuna is a growth-oriented precious metal producer. It is selectively pursuing acquisition opportunities throughout the Americas and in select other areas. Hence Fortuna Silver Mines is one of the best silver stocks to buy in 2021.

Fortuna is a growth-oriented precious metal producer. It is selectively pursuing acquisition opportunities throughout the Americas and in select other areas. Hence Fortuna Silver Mines is one of the best silver stocks to buy in 2021.

Get to know everything about high frequency trading.

Future Outlook of Silver

Despite the drop in the price of silver in 2021, the future of this precious metal is promising. There are multiple factors contributing to the bullish outlook.

- The rise in demand for physical silver

- Delay in production

- Increased demand for silver from the energy sector

- Silver is being used extensively in the healthcare industry for its anti-microbial properties

- The demand for silver from China hit an all0time high in 2021 and it is expected to rise

- In near future, the global supply of silver is expected to be in deficit

Keeping these above factors in mind, investing in silver and silver stocks is an excellent approach today. The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

The above companies have been selected after analyzing the growth potential of the silver-producing companies. The above-listed companies have growth potential with high metal deposits and are currently in the best position to benefit from the growth in the silver market.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Lithium Stocks to Buy in 2024

- Best Robinhood Stocks to Buy in 2024

- Best Penny Stocks to Invest

- Best Oil Stocks to Buy in 2024

- Best Renewable Energy Stocks to Invest

- Most Volatile Stocks

- Best Artificial Intelligence Stocks

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now