The stock market opened in 2024 amongst huge uncertainties and shaky ground. Rising inflation led to a record high inflation rate. Moreover, the political tension between Russia and Ukraine had an effect on the stock market. But amidst all this chaos, there are a handful of companies that have managed to grow ahead of the downward trend.

Here we have selected those companies which have proven through their numbers that they are amongst the best-performing stocks of 2024.

| Sr. | Company Name | Symbol | Market Capitalization | Price (As of 3rd Jan 2022) | Price (As of 24th March 2022) | % Increase |

| 1 | Abraxas Petroleum Corporation | AXAS | $ 19.29 Million | $ 0.78 | $ 2.29 | 193 % |

| 2 | NexTier Oilfield Solutions Inc. | NEX | $ 2.35 Billion | $ 3.58 | $ 9.44 | 164 % |

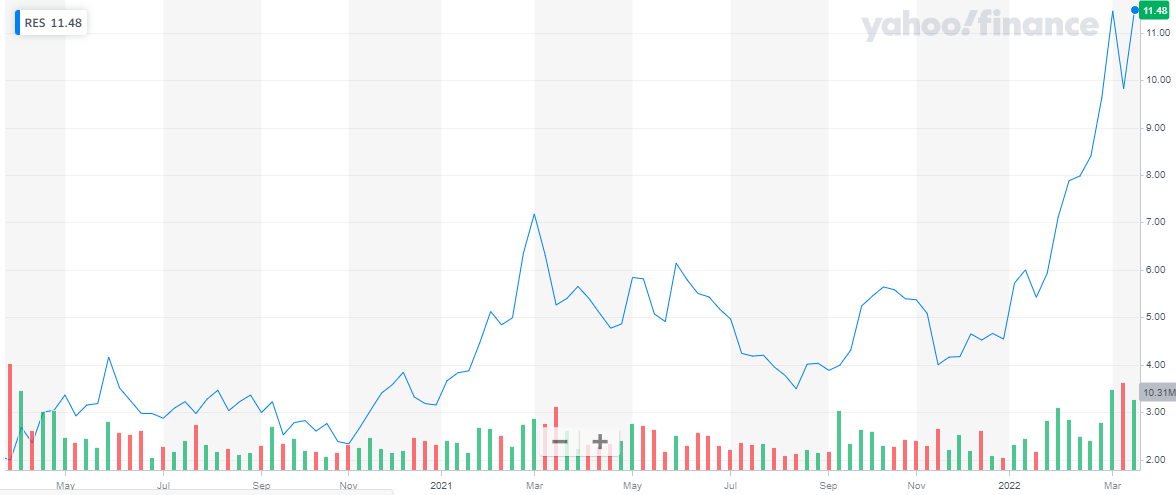

| 3 | RPC Inc. | RES | $ 2.2 Billion | $ 4.55 | $ 10.19 | 124 % |

| 4 | Occidental Petroleum Corporation | OXY | $ 54.84 Billion | $ 29.21 | $ 58.71 | 101 % |

| 5 | APA Corporation | APA | $ 14.4 Billion | $ 27.08 | $ 41.53 | 98 % |

| 6 | Lantheus Holdings, Inc. | LNTH | $ 3.47 Billion | $ 28.94 | $ 50.93 | 76 % |

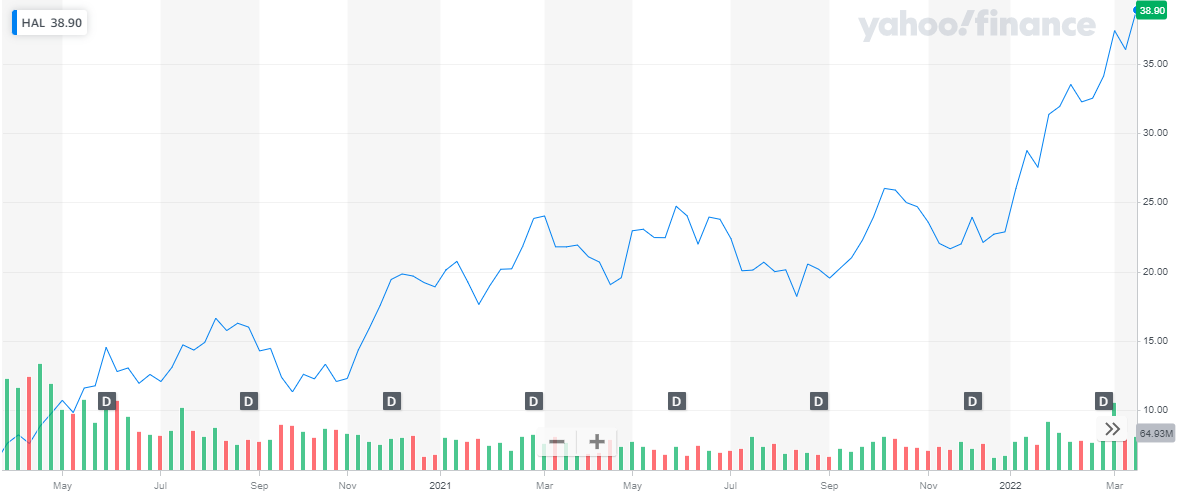

| 7 | Halliburton Company | HAL | $ 35 billion | $ 23.14 | $ 37.68 | 63 % |

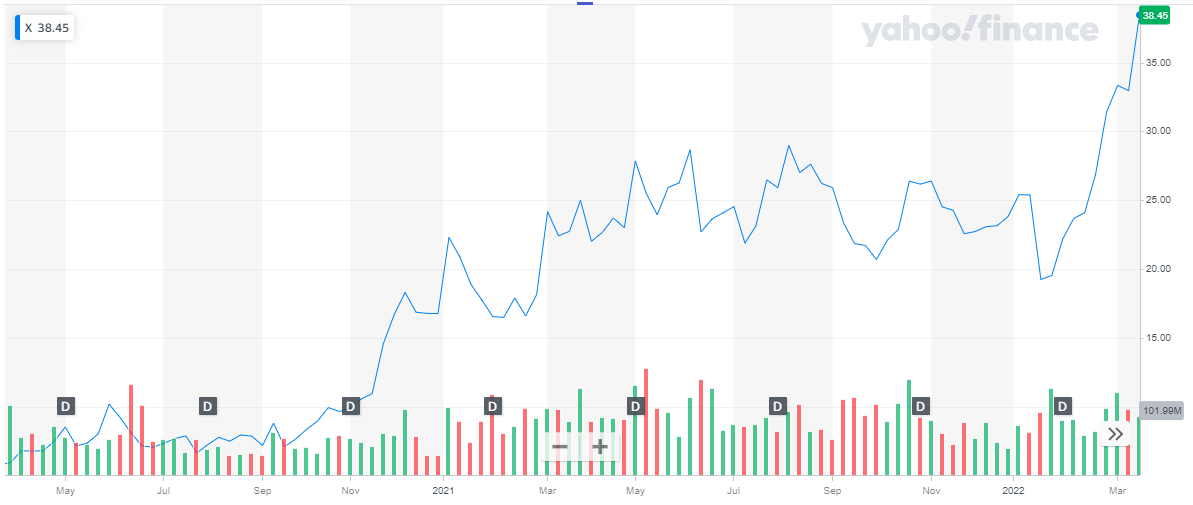

| 8 | United States Steel Corporation | X | $ 10 Billion | $ 24.11 | $ 38.2 | 58 % |

| 9 | Tenneco Inc. | TEN | $ 1.51 Billon | $ 11.58 | $ 18.18 | 57 % |

| 10 | Chevron | CVX | $ 329.7 Billion | $ 117.42 | $ 169.31 | 44 % |

| 11 | Zynga Inc | ZNGA | $ 10.4 Billion | $ 6.42 | $ 9.09 | 42 % |

| 12 | Digital World Acquisition Corp | DWAC | $ 2.69 Billion | $ 51.4 | $ 72.53 | 41 % |

Abraxas Petroleum Corporation

Abraxas Petroleum Corporation, an independent energy company, engages in the acquisition, exploration, exploitation, development, and production of oil and gas properties in the United States. The company operates oil and gas assets in the Permian/Delaware Basin and the Rocky Mountain regions. As of December 31, 2020, its estimated net proved reserves were 16.8 million barrels of oil equivalent. Get to know the best quantum computing stocks.

Abraxas Petroleum has a market valuation of around $ 19.29 million. During the current year, the stock of the company has appreciated by 193%. The stock started off in the year 2022 at a price of $ 0.78 and closed off at a price of $ 2.29 on 24th March 2022.

In the previous year, the stock depreciated by around 64%. Starting off at a price of $ 2.29 and closing off the year at $ 0.82.

There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

NexTier Oilfield Solutions Inc.

NexTier Oilfield Solutions Inc., through its subsidiaries, provides well completion and production services in various active and demanding basins. The company operates through two segments, Completion Services, and Well Construction and Intervention Services. As of December 31, 2021, it had approximately 17 coiled tubing units and 74 cementing units. The company serves integrated and large independent oil and natural gas exploration and production companies in the United States and internationally. By using the stock signals, you can avoid hours of technical analysis to understand the market.

The company recently published its annual results for the year 2021:

- Total revenue of $1.4 billion, as compared to $ 1.2 billion for the year 2020

- Net loss of $119.4 million and $0.53 per diluted share, as compared to a net loss of $346.9 million, or $1.62 per diluted share, for the year 2020

NexTier Oilfield has a market capitalization of over $ 2.35 billion. The share of the company has appreciated by 164%, year to date, starting from a price of $ 3.58, at the start of the year, to $ 9.44 as of 24th March 2022.

The stock of the company started trading at a price of $ 3.44 at the start of the year 2021. The stock appreciated by approx. 3% during the year and closed off the year at a price of $ 3.55.

Check out the best NFT stocks to buy now.

Check out the best NFT stocks to buy now.

RPC Inc.

RPC, Inc. provides a range of oilfield services and equipment for the oil and gas companies involved in the exploration, production, and development of oil and gas properties. The company operates through Technical Services and Support Services segments. RPC operates in the United States, Africa, Canada, Argentina, China, Mexico, Eastern Europe, Latin America, the Middle East, and internationally. Founded in 1984, RPC Inc is headquartered in Atlanta, Georgia. Semi conductor stocks are also one of the best investment opportunities.

The company recently published its annual report and reported:

- Revenues of $ 865 Billion, representing an increase of 45% year-on-year

- Net Income of $ 7 billion, a substantial improvement from last year when the company reported a net loss of $ 212 million

- EPS of $ 0.03

RPC Inc currently stands at a market capitalization of around $ 2.2 Billion. From a price of $ 4.55, at the start of the current year, the share of the company has increased to a price of $ 10.19, representing a growth of 124%, year-to-date.

During the year 2021, the stock appreciated by 44%, from a price of $ 3.15 at the start of the year, to a price of $ 4.54.

Get to know everything about high frequency trading.

Get to know everything about high frequency trading.

Occidental Petroleum Corporation

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, Africa, and Latin America. It operates through three segments: Oil and Gas, Chemical, Midstream, and Marketing. Investing in oil stocks offers great rewards in terms of high returns

During the previous year, the company achieved

- Increased in proved reserves by 600 MMboe to 3,500 MMboe2

- Multiple drilling and completion records set across the business

In the recent annual report for the year 2021, the company reported:

- Net Sales of $25.9 Billion, an increase of 46%

- Net Income of $ 2.3 Billion, a substantial increase from last year, when the company reported a net loss of $ 14.8 billion

OXY has a market capitalization of $ 55 billion. The stock started trading at a price of $ 29.21 at the start of the year and has appreciated by 101% year-to-date.

During the year 2021, the stock price increased by 67%, starting at a price of $ 17.31 and closing off the year at a price of $ 28.99.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

APA Corporation

APA Corporation, through its subsidiaries, explores for, develops, and produces oil and gas properties. It has operations in the United States, Egypt, and the United Kingdom, as well as has exploration activities offshore Suriname. The company also operates gathering, processing, and transmission assets in West Texas, as well as holds ownership in four Permian-to-Gulf Coast pipelines. To give investors an idea where to start and which companies to look for investment, we have compiled a list of top best oil and gas ETFs to buy now.

The company recently published its annual report for the year 2021:

- Revenues were reported at $ 6.5billion, an increase of 61% from last year

- Net Income of $ 973 million, a substantial increase from last year’s net loss of $ 4.8 billion

APA has a market capitalization of $ 14.4 billion. The share of the company has appreciated by approx. 98% year-to-date during the current year. The share started off in the year 2022 at a price of $ 27.08 and closed off at $ 41.53 on 24th March 2022.

In 2021, the stock rose from a price of $ 14.19, on the first trading day of the year, to a price of $ 26.89, on the last trading day of 2021. The stock price appreciated by 89% during the year.

Tech Stocks is one of the best investment option.

Tech Stocks is one of the best investment option.

Lantheus Holdings Inc.

Lantheus Holdings, Inc. develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in the diagnosis and treatment of heart, cancer, and other diseases worldwide. It is a global leader in the development, distribution, and commercialization of innovative diagnostic image agents and products. Also the global pharmaceutical stock market has experienced significant growth in recent years.

The company successfully launched PYLARIFY. This is expected to be the best-in-class PSMA PET imaging agent for prostate cancer. Also, the company received FDA approval for its on-site manufacturing facility for DEFINITY, a microbubble ultrasound enhancing agent used in ultrasound exams of the heart;

The company recently published its annual report for the year 2021:

- Revenue of $425.2 million for the full year 2021, representing an increase of 25.3% over the prior-year period

- Net Loss of $34.0 million

Lantheus Holdings has a market capitalization of around $ 3.47 Billion. The share started in the year 2022 at a price of $28.94 and is currently trading around $ 50.93. The company’s stock has grown by approx. 76% year to date.

During the previous year, the share of the company started at $ 13.94 and closed off the year at $ 28.89, representing a 107% increase in the year 2021.

Get to know the list of crypto mining companies that are leading the industry.

Get to know the list of crypto mining companies that are leading the industry.

Halliburton Company

Halliburton Company provides products and services to the energy industry worldwide. It operates in two segments, Completion and Production, and Drilling and Evaluation. If you are seeking a steady stream of income, you should invest in REIT stocks.

The company recently reported its full-year report for the year 2021:

- Total revenue was $15.3 billion, an increase of $850 million, or 6% from 2020

- Operating income was reported at $1.8 billion, as compared to an operating loss of $2.4 billion in 2020

Halliburton has a market capitalization of $35 billion. During the current year, the share of the company has appreciated by 63%, from a price of $ 23.14, at the start of the year, to a price of $ 37.68 on 24th March 2022.

During the previous year, the share of the company rose by 21%, from a price of $ 18.9 to a price of $ 22.87 at the end of the year.

There are multiple paid courses and technical analysis books available which provide in-depth knowledge about Technical Analysis.

There are multiple paid courses and technical analysis books available which provide in-depth knowledge about Technical Analysis.

United States Steel Corporation

United States Steel Corporation produces and sells flat-rolled and tubular steel products primarily in North America and Europe. It operates through four segments: North American Flat-Rolled (Flat-Rolled), Mini Mill, U. S. Steel Europe (USSE), and Tubular Products (Tubular).

In its recent quarterly report, the company reported:

- Revenues of $ 20.2 billion, compared to revenues of $ 9.7 billion

- Net earnings of $ 4.174 billion, compared to a net loss of $ 1.165 in 2020

United Steel Corp is a $10 billion company. Its share has appreciated by 58% year-to-date during 2022. The share of the company started off at a price of $ 24.11 at the start of the year and closed off at $38.2 on 24th March 2022.

In the previous year, the stock started off from a price of $ 22.29 to a price of $ 23.81, representing a small increase of 7%.

Check our updated for NASDAQ Forecast.

Check our updated for NASDAQ Forecast.

Tenneco Inc.

Tenneco Inc. designs manufacture and sells clean air, and powertrain products and systems for light vehicle, commercial truck, off-highway, industrial, motorsport, and aftermarket customers worldwide. It operates through four segments: Motorparts, Performance Solutions, Clean Air, and Powertrain.

Also read:

The company recently announced its full-year results for 2021:

- Revenue of $18.0 billion, representing an increase of 17% year-over-year

- Net income of $35 million

- Strong cash generation led to reduced debt

Tenneco is a $ 1.5 billion company. The company’s share kicked off the year 2022 at a price of $ 11.58 and is currently trading at a price of $ 18.18, representing an increase of 57% year-to-date.

During the year 2021, the share appreciated by approx. 7%, starting off at a price of $ 10.6 and closing off the year at a price of $ 11.3.

Chevron

Chevron

Chevron Corporation is engaged in integrated energy and chemicals operations worldwide. The company operates in two segments, Upstream and Downstream. The Upstream segment is involved in the exploration, development, production, and transportation of crude oil and natural gas amongst other related operations. The Downstream segment engages in refining crude oil, manufacturing, and marketing renewable fuels, transporting crude oil and refined products, and manufacturing and marketing of commodity petrochemicals, plastics for industrial uses, and fuel and lubricant additives. The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

Chevron reported annual results for the year 2021:

- Revenues of $ 155.6 billion, as compared to $94 billion sales in 2020

- Earnings of $15.6 billion, compared to a loss of $5.5 billion in 2020

- The company increased its quarterly dividend per share by 4 percent to $1.34

Chevron has a market capitalization of $ 329.7. The share of the company appreciated by 44% during the year, starting off at $ 117.42 and closing off at $ 169.31 on 24th March 2021.

During the year 2021, the stock rose from $ 84.45 to a price of $ 117.35, representing an increase of 39%.

You may also like reading: Best Monthly Dividend Stocks to Buy

You may also like reading: Best Monthly Dividend Stocks to Buy

Zynga Inc

Zynga Inc. develops, markets, and operates social game services in the United States and internationally. The company provides social games as live services played on mobile platforms, such as Apple iOS and Google’s Android operating systems; social networking platforms, such as Facebook and Snapchat; and personal computers consoles, such as Nintendo’s Switch game console, and other platforms and consoles. It also provides advertising services comprising mobile advertisements, engagement advertisements and offers, and branded virtual items and sponsorships for marketers and advertisers; and licenses its brands. Get to know the best artificial intelligence stocks.

In its recent full-year report for the year 2021, the company reported:

- Revenues of $ 2.8 billion, compared to $ 1.9 billion in 2020

- Net loss of $ 104 million, compared to a net loss of $ 429 million in 2020

Zynga Inc has a market valuation of $ 10.4 billion. The share of the company has appreciated by 42% during the year, from a price of $ 6.42 to a price of $ 9.09 on 24th March 2022.

During the previous year, the stock declined from a price of $ 9.92, at the start of the year, to a price of $ 6.4 at the end of the year.

Digital World Acquisition Corp

Digital World Acquisition Corp

Digital World Acquisition Corp. is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination with one or more businesses. The company pursues an initial business combination target in any business or industry. Moreover, it intends to focus on combining with a leading tech company. Tech Stocks is one of the best investment option.

Digital World Acquisition Corp has a market capitalization of around $ 2.69 billion. The company’s share started in 2022 at a trading price of $51.4. To date, the stock has appreciated by 41% and closed off on 24th March 2022 at a price of $72.53.

During the year 2021, the stock was launched in the market and started trading at a price of $ 9.95. after appreciating by more than 400%, the stock closed the year at a price of $51.43.

You may also like reading:

You may also like reading:

- Best Penny Stocks to Invest

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy

- Best Stock Forecasts & Prediction Services & Websites

- Best Drone Stocks to Invest

- Best Forex Trading Platforms

- Best Stock Trading Apps

- Best Day Trading Stocks

- Best Forex Signals

- Most Volatile Stocks

- Best Crypto Signals

- Best Undervalued Stocks

- Best Lithium Stocks to Buy in 2024

- Best Robinhood Stocks to Buy in 2024

Chevron

Chevron Digital World Acquisition Corp

Digital World Acquisition Corp