Since the pandemic, there has been a huge rise in the companies which are in the business of making vaccines. Moreover, with the ongoing rise in cases of COVID-19, the demand for vaccines is continuously rising. After all, vaccines remain one of the most prominent lines of defense against the coronavirus pandemic now. And covid-19 vaccine stocks are one of the best investment options.

Since the pandemic, there has been a huge rise in the companies which are in the business of making vaccines. Moreover, with the ongoing rise in cases of COVID-19, the demand for vaccines is continuously rising. After all, vaccines remain one of the most prominent lines of defense against the coronavirus pandemic now. And covid-19 vaccine stocks are one of the best investment options.

According to WHO, there have been 223,022,538 confirmed cases of COVID-19, including 4,602,882 deaths and a total of 5,352,927,296 vaccine doses have been administered.

Many companies have already gotten their vaccines approved and are distributing them on a large scale. Still, some companies have been unable to get regulatory approvals. Therefore, before investing in stocks, the first step should be to discover the status of the company’s vaccine. Also, before deciding to invest in vaccines companies have other successful drugs they are selling. Hence a wise investment decision would be to seek vaccine companies with successful drugs in the market and/or pipeline.

List of Covid-19 Vaccine Stocks To Invest In Now

Here we have listed the top 5 Vaccine stocks which have proven in the last year that they are capable of making the best vaccines and are also providing an excellent return to shareholders.

Pfizer

Pfizer is the world’s premier biopharmaceutical company which was the first company to get an FDA-approved Covid-19 vaccine in the market, in collaboration with BioNTech. This is a messenger RNA (mRNA) vaccine, which uses relatively new technology. It remains one of the major players in the vaccine industry today.

A total of 1 billion vaccines have been shipped from December 2020 till June 2021. In addition to Covid-19 vaccines, the product portfolio of Pfizer includes some popular drugs which include:

- Eliquis – A total of $1.48 million revenue reported in Q2,

- Prevnar – A total of $1.24 million revenue reported in Q2

- Ibrance – A total of $1.4 million revenue was reported in Q2,

The vaccine was approved in Dec’2020 with the immediate distribution. Since then, the company’s stock has been on a bullish journey. At the start of the year 2021, the stock of Pfizer was trading at $37.13, and currently, it’s at $45.59, representing a 22% increase in these nine months.

In its recent quarterly report, the drug maker reported strong financial performance reporting an 86% increase in operating revenue of $19 billion. The Covid-19 vaccine alone contributed $7.83 billion to the quarterly revenues. The dividend for the quarter was announced at $0.39.

In its recent quarterly report, the drug maker reported strong financial performance reporting an 86% increase in operating revenue of $19 billion. The Covid-19 vaccine alone contributed $7.83 billion to the quarterly revenues. The dividend for the quarter was announced at $0.39.

Being first in the production, approval, and distribution of vaccines has proven to be very beneficial for the company. The demand for Pfizer vaccines continues to increase with current contracts stating 1.6 billion vaccines are to be delivered this year. Based on this, the company forecasts a total of $26 billion in sales from Covid-19 by the end of the year. Pfizer aims to produce up to 2.5 billion COVID-19 vaccine doses this year. By using the stock signals, you can avoid hours of technical analysis to understand the market.

Other key products and pipeline milestones achieved include:

- FDA approvals received for two major drugs Myfembree and Prevnar 20

- The Covid-19 vaccines BNT162b2 pediatric pivotal trial started

With these milestones achieved and the expected increase is Covid-19 vaccines distribution. Pfizer is undoubtedly one of the best stocks to invest in today.

Also read: Best EV Stocks and Best Stock Forecasts & Prediction Services

BioNTech

BioNTech SE is a next-generation immunotherapy company. This company has been making headlines since it partnered up with Pfizer and introduced the first Covid-19 vaccines in the market. With the demand for Covid-19 vaccines continuing to increase, along with booster shots of vaccines being introduced, this company might go bigger than imagined.

BioNTech has supplied more than one billion doses of Covid-19 vaccines to more than 100 countries till the first half of 2021. Furthermore, BioNTech SE has signed agreements for approximately 2.2 billion doses of the vaccines to be delivered in 2021. BioNTech in collaboration with Pfizer expects the annual manufacturing capacity to reach three billion doses by the end of 2021. This capacity is further expected to increase to four billion in 2022.

In the second-quarter report published recently, the biopharma company posted:

-

- Total revenues were estimated to be €5,308.5 million as compared to €41.7 million for the same period last year

- Earnings per share were reported at €11.42

The driving force behind this increase in revenues is the sale of COVID-19 vaccines. To expand its product portfolio, BioNTech aims to develop a well-tolerated and highly effective Malaria vaccine and supply solutions on the African continent. In addition to this, BioNTech’s oncology pipeline has advanced. The company is moving further ahead in its clinical trials.

The share of BioNTech is currently trading around $337. The share performance has seen a remarkable improvement since the development of the Covid-19 vaccine. From a price of approximately $30, pre-covid, the stock has undergone a 1000% increase in price. Within the current year, the stock has grown by approx. 250%, rising from $100.

The stock of BioNTech has shown exceptional growth since last year. Despite the extraordinary growth wall street analysts are positive about further growth. Moreover, with the demand for vaccines rising, along with booster shots being launched, it is expected to give a huge boost to the company’s financial position. Side by side, with the expansion of BioNTech in other drugs like malaria and oncology, the future of the biopharma company is expected to continue its upward ride. Therefore, BioNTech is one of the best Covid-19 vaccine stocks to invest in in 2024.

The stock of BioNTech has shown exceptional growth since last year. Despite the extraordinary growth wall street analysts are positive about further growth. Moreover, with the demand for vaccines rising, along with booster shots being launched, it is expected to give a huge boost to the company’s financial position. Side by side, with the expansion of BioNTech in other drugs like malaria and oncology, the future of the biopharma company is expected to continue its upward ride. Therefore, BioNTech is one of the best Covid-19 vaccine stocks to invest in in 2024.

Also read:

Read more:

- Best Stocks for Inflation

- Best Healthcare Stocks

- Best Gas Stocks

- Best 5G Stocks

- Best Solar Energy Stocks

Moderna

Moderna is a leading pharmaceutical and biotechnology company. It is currently working to build the industry’s leading mRNA technology platform, the infrastructure to accelerate drug discovery and early development, a rapidly expanding pipeline, and a world-class team. The pipeline project of Moderna includes development candidates for mRNA-based vaccines and therapies spanning several therapeutic areas. In addition, they have conducted several clinical trials with other development candidates progressing toward the clinic. Also, the company has numerous discovery programs advancing toward development. Get to know the best tech stocks to invest in now.

Moderna Covid Vaccine was approved in late Dec’2020. Since then more than 199 million doses have been delivered till the first half of 2021.

Advanced purchase agreements signed for product sales of $20 billion by the end of 2021. Moreover, advanced purchase agreements have already been signed for $12 billion and an additional $8 billion in options for the year 2022. In addition to it, numerous negotiations are in process for additional agreements for the year 2022. The global Manufacturing supply of Moderna vaccines is expected to reach between $800 million to $1 billion doses by the end of 2021.

Get to know the best covered call stocks to buy now.

In the recent second-quarter report, the company published:

- Revenue was $4.4B out of which $4.2B of COVID-19 vaccine sales

- Net income was reported at $2.8B

- Earnings per share were reported at $6.46

The company is investing in additional manufacturing facilities along with new partnerships in Europe and Switzerland. Get to know the list of crypto mining companies that are leading the industry.

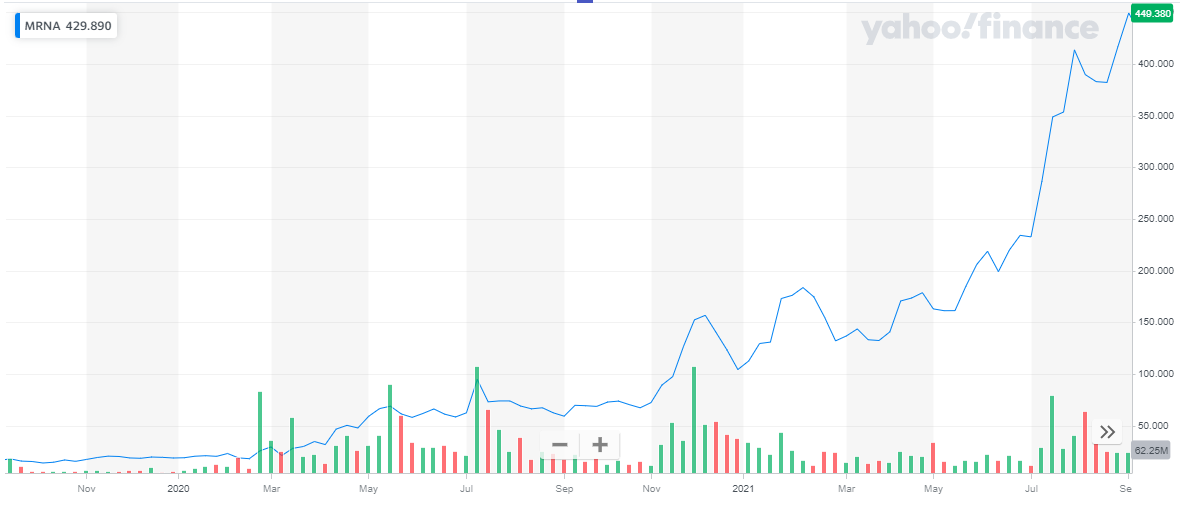

Moderna is currently standing at a valuation of $170 billion. The share of Moderna is currently trading at around $430. Since the approval and distribution of Covid-19 vaccines have commenced, the share of Moderna has skyrocketed. At the start of the year, the share of Moderna was trading at around $112. Currently, it has grown by more than 250%. As per the below chart, the stock of Moderna is on an upward streak since the start of the year and there seems no pull back on its journey.

Moderna is one of the most effective and in-demand vaccines. With U.S. President Biden’s promise of ‘enough vaccines for every U.S. adult’, the demand and pressure on the top vaccine-producing companies have increased. Hence, Moderna is expected to grow further in the coming months making it a more attractive investment for investors and one of the best Covid-19 vaccines to invest in today.

Moderna is one of the most effective and in-demand vaccines. With U.S. President Biden’s promise of ‘enough vaccines for every U.S. adult’, the demand and pressure on the top vaccine-producing companies have increased. Hence, Moderna is expected to grow further in the coming months making it a more attractive investment for investors and one of the best Covid-19 vaccines to invest in today.

Read: Best Gold Trading Signal Providers.

Johnson & Johnson

Johnson and Johnson is the world’s largest and most broadly-based healthcare company. The company’s brand portfolio includes some popular brand names which include Neutrogena, Listerine, Aveeno, Band-Aid to name a few. Johnson & Johnson had their COVID-19 vaccine approved at end of Feb’21. Johnson and Johnson’s has a wide range of products, hence its dependence on the sale of Covid-19 vaccines is very low. The company committed to pay 55 million doses to the EU by June end. It has also signed an advance purchase agreement with Gavi, the vaccine alliance, to supply 200 million doses in 2021.

In its second-quarter report for 2021, the company reported:

- Sales of $23.3 billion, a 27% rise from last year same period

- EPS of $2.48, an increase of 47% from last year same period

Johnsons and Johnsons have three major divisions:

- Consumer Health – contributed $3.7 billion in sales. The major sales of this segment come from over-the-counter medicines and Skin Health / Beauty products.

- Pharmaceuticals – contributed $12.6 billion in sales. The major sales of this segment come from immunology and oncology medications.

- Medical Devices – contributed $7 billion in sales. The major sales of this segment come from surgical equipment and orthopedics equipment.

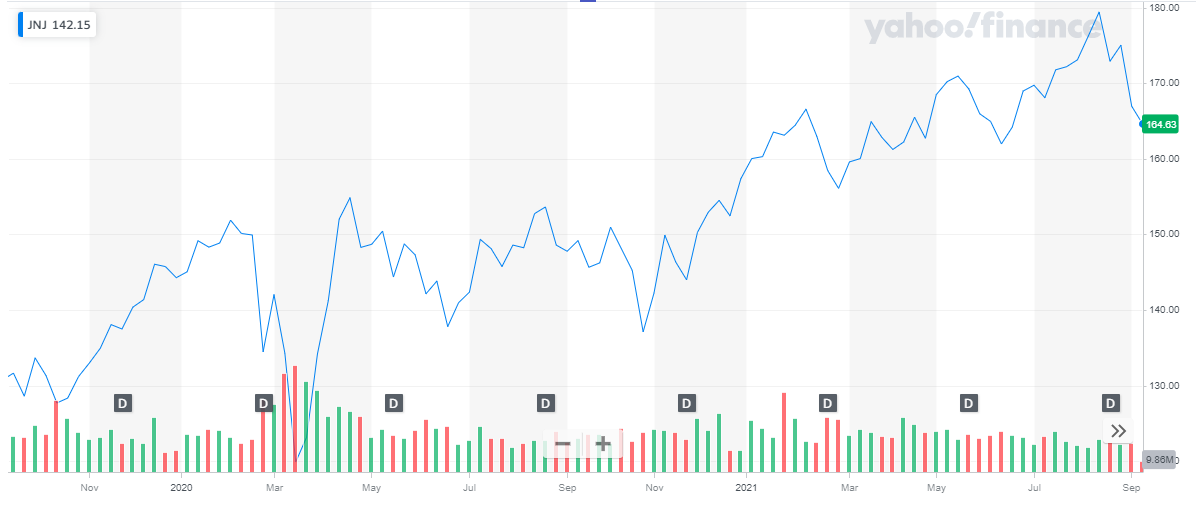

Currently, the market valuation of Johnsons and Johnsons is $433 billion. The share of the company is currently trading at around $164. After a huge dip due to a market crash because of Covid-19, the stock recovered very soon and is an upward streak since. The stock of Johnson and Johnson kicked off the year at $160.

Johnson and Johnson is one of the oldest companies which has increased its product portfolio with the Covid-19 vaccine. The demand for the J&J vaccine is also rising because of its effectiveness. Despite the issues with meeting the supply-demand, J&J is exhibiting excellent financial performance and is one of the best Covid-19 vaccine stocks to invest in today. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

Johnson and Johnson is one of the oldest companies which has increased its product portfolio with the Covid-19 vaccine. The demand for the J&J vaccine is also rising because of its effectiveness. Despite the issues with meeting the supply-demand, J&J is exhibiting excellent financial performance and is one of the best Covid-19 vaccine stocks to invest in today. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

Read more:

AstraZeneca

AstraZeneca is a global, science-led biopharmaceutical company. It is known for its innovative medicines in Oncology, Rare Diseases & Bio-Pharmaceuticals. The company currently has 22 Phase III medicines and significant lifecycle projects in the pipeline. AstraZeneca has acquired Alexion with the name Alexion dissolved and the share base of AstraZeneca expanded. As a result of this acquisition, the company will benefit from:

- Accelerated expansion into immunology and rare diseases

- Further-sustained, industry-leading double-digit revenue growth

- Improved profitability and strengthened cash flow

AstraZeneca has been a prolific distributor of COVID-19 vaccines. Till the first half of 2021, around 1 billion vaccines have been distributed with more expected.

In its half-yearly report of 2021, the company reported:

- Total revenue of $15.5 billion, an increase of 18% from the same period last year

- Earnings per share were recorded at $1.61

The three major divisions of AstraZeneca and its recent growth rates as reported in the half-yearly report are:

- Oncology – contributed $6.36 billion in sales. The sales of this division grew by 15% year on year.

- New CVRM- contributed $2.73 billion in sales. The sales of this division grew by 16% year on year.

- Respiratory & Immunology- contributed $2.97 billion in sales. The sales of this division grew by 6% year on year.

- Emerging markets -contributed $2.31 billion in sales. The sales of this division declined by 6% year on year.

Covid-19 vaccine sales contributed a total of $1.12 billion sales, representing 7.5% of the total revenues for the first half of 2021. The company officials are very hopeful about the year-end financial performance and have forecasted:

- Total revenue is expected to increase by a low-twenties percentage,

- Faster growth in core EPS from $5.05 to $5.40

AstraZeneca has a market capitalization of around $174 billion. The share of the company is trading at around $56. The stock of the pharma company has been on a bumpy ride for the past two years. But what is noteworthy is the quick comeback of the share price after the market crash in March’20 due to Covid-19. The share kicked off the year 2021 at $50.86. Using stock indicators, one can make wiser decisions in understanding the underlying market dynamics. Investing in best ETFs is one of the most easiest and safe investment option.

AstraZeneca is an excellent Covid-19 vaccine stock to invest in. It is one of the best investment opportunities. Its huge portfolio of products along with the recent acquisition of Alexion has elevated the company’s position in the pharma industry and led to double-digit growth rates. Moreover, the increased presence in the immunology and rare diseases segment will boost the revenues further.

AstraZeneca is an excellent Covid-19 vaccine stock to invest in. It is one of the best investment opportunities. Its huge portfolio of products along with the recent acquisition of Alexion has elevated the company’s position in the pharma industry and led to double-digit growth rates. Moreover, the increased presence in the immunology and rare diseases segment will boost the revenues further.

Also read: Best NFT Stocks

Conclusion

Since March’20, when the pandemic broke, the whole world went on a crazy pattern and everything thing. Therefore, when the vaccine was introduced and approved in Dec’20, the company’s valuations skyrocketed and the bullish pattern of the company’s share see no roadblocks on the way. Even after more than nine months since the vaccines have been approved and are being supplied, the valuations of the company’s manufacturing the vaccines are soaring. Therefore, there is still a lot of room for the above leading companies to grow and for investors to benefit from the growth rate.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

Read More:

- Best Day Trading Stocks

- Bonds vs Stocks – Where to Invest in 2024

- Fibonacci Retracement, Extension & Trading Strategies

- Best Forex Signal Providers

- Best Crypto Currencies To Invest

- Monthly Dividend Stocks to Buy

- Best Renewable Energy Stocks to Invest

- Most Volatile Stocks

- Best Drone Stocks

- Best Penny Stocks

- Best Undervalued Stocks

- Best Artificial Intelligence Stocks