Worldwide coal consumption in 2021 rebounded by 5.8 % to 7 947 million tonnes (Mt), according to research by IEA.org. While the economy recovered from the pandemic, the higher natural gas price shifted the consumers towards coal-fired power generation. As a result, global coal consumption rose above 2019 levels. Coal use for power generation increased by 7 % compared with the year before, reaching 5 350 Mt. Coal demand in China, the world’s largest consumer by far, increased by 4.6 %, or 185 Mt, in 2021, reaching an all-time high of 4 230 Mt.

In the first half of 2022, global coal consumption underwent a slight change compared with the first half of 2021. The economic slowdown more than offset any demand increase resulting from higher natural gas prices. To give investors an idea where to start and which companies to look for investment in, we have compiled a list of the top best oil and gas ETFs to buy now.

For 2022, IEA research shows global coal demand to increase by 0.7 % from 2021 to about 8 billion tonnes. This would be equal to the all-time peak reached in 2013.

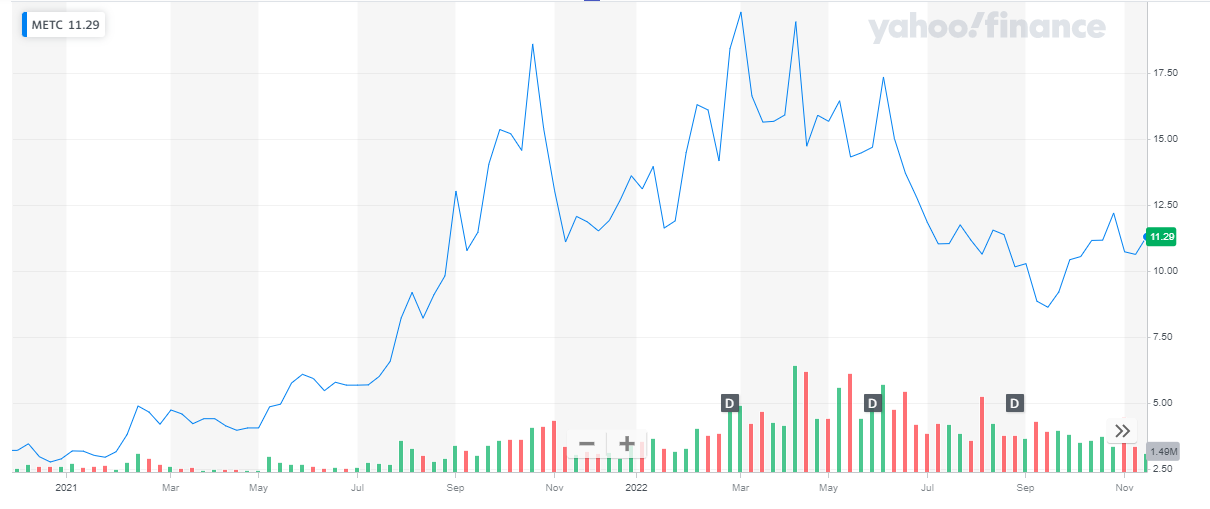

The below chart shows the Global coal consumption of major countries from the period 2020-2023:

Source: IEA.org

Source: IEA.org

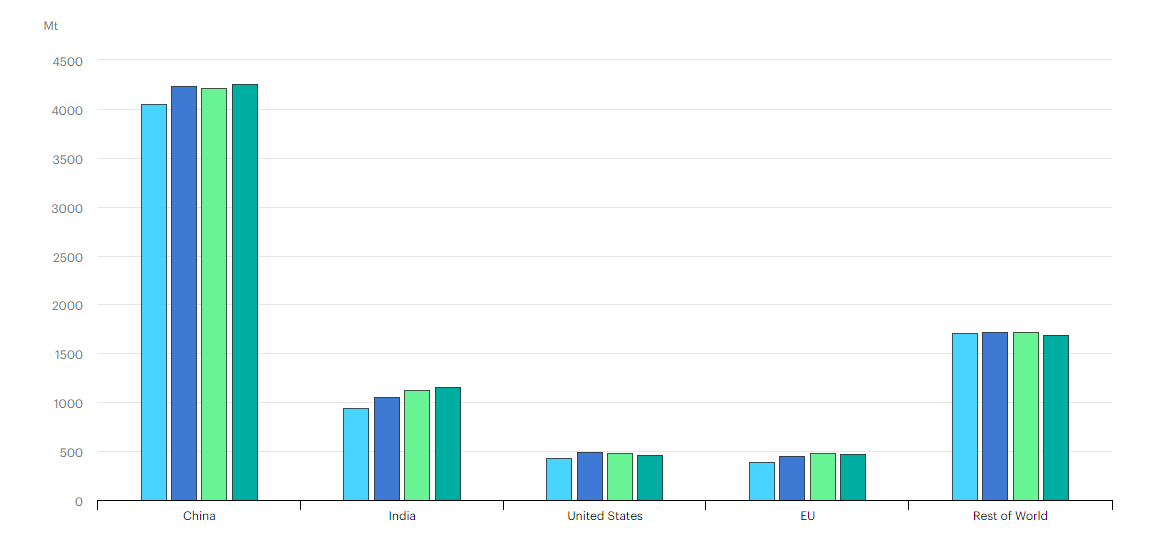

The below chart shows the changes in global coal consumption from the period H1 2021 – H1 2022 for the major countries that use coal:

Source: IEA.org

Source: IEA.org

Supply of coal is expected to remain tight due to stronger European coal demand. The reason behind this strong demand is the diversification of energy sources away from Russian coal and gas. Also, the rebounding demand from China is also expected to further increase the prices of power station fuel.

Investors when investing always choose the best brokers that better suit his/her trading goals.

The prospect of rebounding demand from China, which is reeling from fresh Covid-19 outbreaks, was also expected to further spike the price of power-station fuel.

As of 25 November, the Asian benchmark Newcastle coal index (NEWC) listed on the Intercontinental Exchange (ICE) quotes the price of $ 360.8.

The below chart shows historical coal price-performance:

Source: Trading Economics

Get to know about top Infrastructure stocks to invest in.

Global demand for coal is surging as the pandemic slowdown ebbs, and that has coal prices hitting new records. Coal stocks are like hotcakes these days. While they are high in demand, it is always wise to understand the risks of investing in the coal industry:

- Government policies – Due to greenhouse gas emissions, coal does not support the green economy. Therefore, with governments adopting stronger climate policies to reduce air pollution coal power generation will always be under strict government scrutiny.

- Competition. Renewable energy, including wind, solar power, and natural gas, is rising, and gradually removing coal from the market.

- Developments in China. Being a coal consumer giant, China strongly influences coal demand. China anticipates consumption to peak in 2025. Coal demand will steadily fall as China weans off coal and implements its cleaner energy strategy.

Get to know the best quantum computing stocks.

Best Coal Stocks to Invest in Now

Here are some of the best coal stocks to invest in now:

Warrior Met Coal (NYSE: HCC)

Warrior Met Coal, Inc. produces and exports non-thermal metallurgical coal for the steel industry. It operates two underground mines located in Alabama. These mines have an estimated annual production capacity of over 7 million metric tons of coal.

The company sells its metallurgical coal to a customer base of blast furnace steel producers located primarily in Europe, South America, and Asia. It also sells natural gas, which is extracted as a byproduct of coal production. Investing in value stocks is a long-term investment.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Coal produced | 1,643 tons | 1,512 ton | 1,395 ton |

| Total Coal Sold | 1,499 tons | 1,400 ton | 1,022 ton |

| Revenue | $ 390 million | $ 625 million | $ 378.6 million |

| Operating Income | $ 124.5 million | $ 372.5 million | $ 187 million |

| Net Income | $ 98.4 | $ 297 million | $ 146 million |

| Earnings per share | $ 1.9 | $ 5.75 | $ 2.84 |

Also, check out the best swing trading stocks.

Warrior Met Coal has a market cap of $ 1.833 billion. Its shares are trading at $ 35.49.

The stock of the company started the year 2021 at $ 21.32. After an initial decline, the stock recovered and closed the year at $ 25.7, representing a 21 % appreciation during the year.

In 2022, the stock continued its upward trend and went as high as $ 41.7. After hitting the peak, the stock declined slightly and last closed at $ 35.49. To date, the stock has appreciated by 38 %.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Arch Resources (NYSE: ARCH)

Arch Resources, Inc. produces and sells thermal and metallurgical coal from surface and underground mines. As of December 31, 2021, the company operated seven active mines. It also owned or controlled lands through long-term leases across the US. Cybersecurity stocks are also one of the best investment opportunities.

The company sells its products to utility, industrial, and steel producers in the United States, Europe, Asia, Central, and South America, and Africa.

The below table shows the financial information of the company for the current year:

| Q2 2022 | Q1 2022 | |

| Coal sold | 81.2 million ton | 83 million ton |

| Revenue | $ 1.13 billion | $ 868 million |

| Operating Income | $ 422.7 million | $ 277 million |

| Net Income | $ 407.6 million | $ 272 million |

| Earnings per share | $ 24.26 | $ 17.6 |

Investors are now looking for the finest solar energy stocks to invest in.

Arch Resources has a market cap of $ 2.84 billion. Its shares are trading at $ 156.87.

The stock of the company is on a bullish streak since 2021. From a price of $ 43.77 at the start of 2021, the stock started rising and closed the year at $ 91.32. Throughout the year the stock appreciated by 108 %.

This bullish trend continued in the year 2022 also. The stock continued to climb till it peaked at $ 174.26. The stock of Arch Resources last closed at $ 156.87. To date, the stock of the company has appreciated by 72 %.

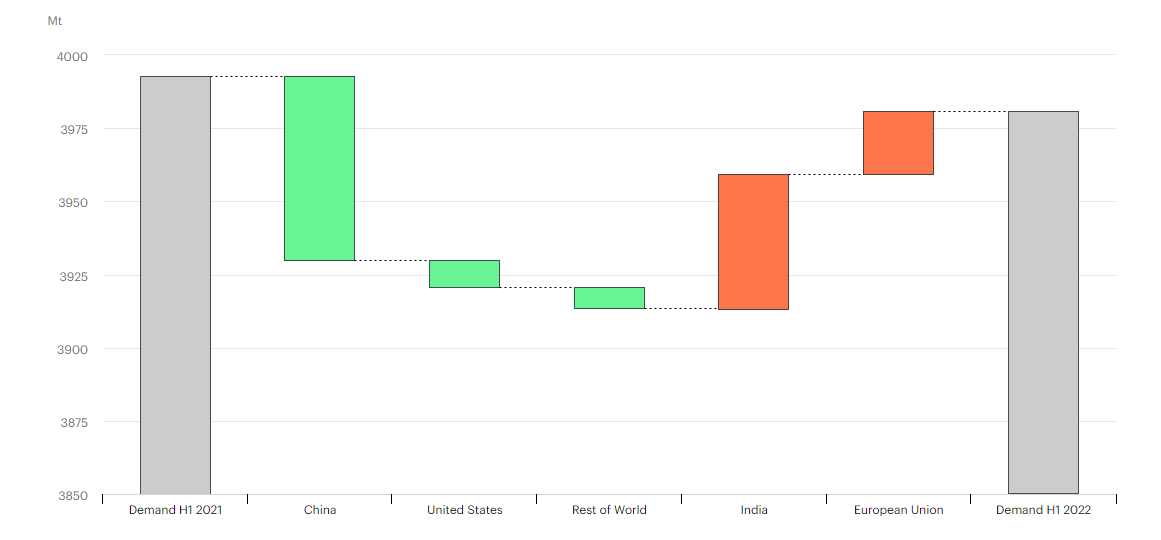

Ramaco Resources (NASDAQ: METC)

Ramaco Resources (NASDAQ: METC)

Ramaco Resources, Inc. produces and sells metallurgical coal.

It is an operator and developer of high-quality, low-cost metallurgical coal in central and southern West Virginia, southwestern Virginia, and southwestern Pennsylvania. They have a development portfolio of four long-lived projects: Elk Creek, Berwind, RAM Mine, and Knox Creek and are considered a pure-play metallurgical coal company with approximately 250 million tons of high-quality metallurgical coal reserves.

Get to know about RSI trading strategies.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Total Coal Sold | 602,000 tons | 578,000 ton | 1,022 ton |

| Revenue | $ 137 million | $ 139 million | $ 155 million |

| Operating Income | $ 37 million | $ 43 million | $ 52.9 million |

| Net Income | $ 27 million | $ 33.2 million | $41.5 million |

| Earnings per share | $ 0.61 | $ 0.75 | $ 0.94 |

If you are seeking a steady stream of income, you should invest in REIT stocks.

Ramaco Resources has a market cap of $ 498 million. Its shares are trading at $ 11.29.

The stock of the company has been on a bullish run since 2021. The stock started trading at $ 2.88, at the start of 2021. The stock went on climbing throughout the year and peaked at $ 18.59. The stock closed the year at $ 13.6 representing a 372 % increase during the year.

In 2022, the stock continued its bullish run. During the year it peaked at $ 19.8 and last closed at $ 11.29. To date, the stock represented a 17 % decline.

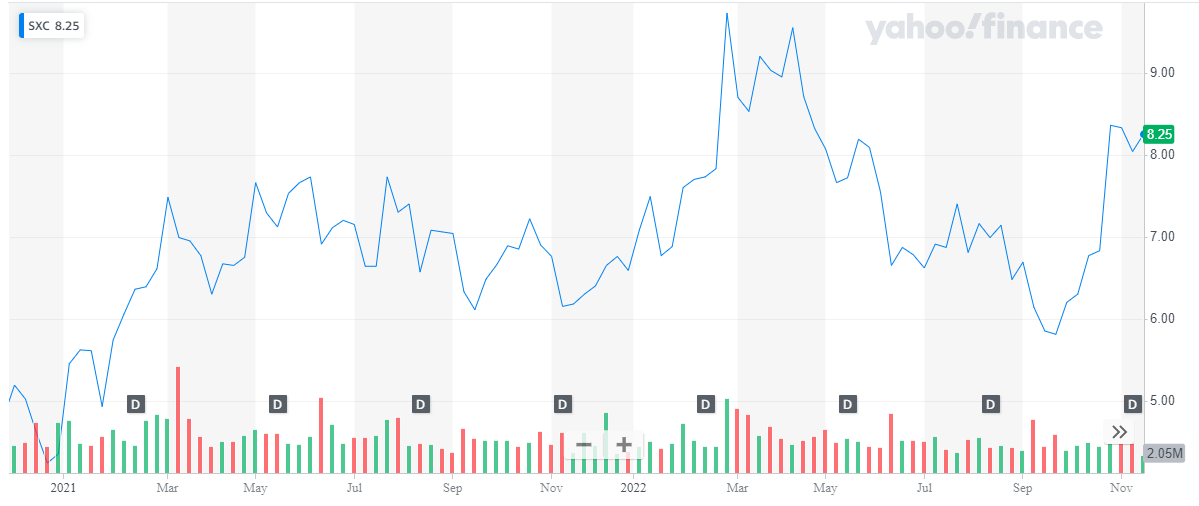

SunCoke Energy (NYSE: SXC)

SunCoke Energy (NYSE: SXC)

SunCoke Energy, Inc. operates as an independent producer of coke in the Americas and Brazil. The company operates through three segments: Domestic Coke, Brazil Coke, and Logistics. It offers metallurgical and thermal coal. The company also provides handling and/or mixing services to steel, coke, electric utility, coal producing, and other manufacturing-based customers. In addition, it owns and operates five coke-making facilities in the United States and one coke-making facility in Brazil.

Get to know the best regional bank stocks.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 517 million | $ 501.9 million | $ 439.8 million |

| Operating Income | $ 47.6 million | $ 34.5 million | $ 48.6 million |

| Net Income | $ 42.5 million | $ 18 million | $ 29.5 million |

| Earnings per share | $ 0.49 | $ 0.21 | $ 0.35 |

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

SunCoke has a market cap of $ 688 million. Its shares are trading at $ 8.25.

The stock of SunCoke is following a mixed trend in the past two years. It started off in the year 2021 at $ 4.35. After an initial rise in price, the stock maintained its price level for the remaining of the year. The stock closed the year at $ 6.59, representing a 51 % increase in price during the year.

In 2022, the stock started with an initial hike in price and peaked at $ 9.73. After that, the stock started to decline and dropped to the low of $ 5.81 and recently closed at $ 8.25. To date, the stock has depreciated by 25 %

Also read:

- Forex trading vs Stocks trading.

- Best Preferred Stocks

- Best Uranium Stocks

- Best Crypto Trading Signals

NACCO Industries (NYQ: NC)

NACCO Industries, Inc., together with its subsidiaries, engages in the natural resources business. The company operates through three segments:

-

- Coal Mining – The Coal Mining segment operates surface coal mines under long-term contracts for power generation companies and an activated carbon producer in North Dakota, Texas, Mississippi, and Louisiana in the United States, as well as Navajo Nation in New Mexico

- North American Mining – The North American Mining segment provides value-added contract mining and other services for producers of aggregates, lithium, and other minerals; and contract mining services for independently owned mines and quarries in Florida, Texas, Arkansas, and Indiana

Read Top NASDAQ Stocks to buy in 2022.

- Minerals Management – The Minerals Management segment is involved in the leasing of its royalty and mineral interests to third-party exploration and production companies, and other mining companies, which grants them the rights to explore, develop, mine, produce, market, and sell gas, oil, and coal.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 61.8 million | $ 61.4 million | $ 55 million |

| Net Income | $ 10.6 million | $ 37.1 million | $ 12.6 million |

| Earnings per share | $ 1.45 | $ 5.07 | $ 1.73 |

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

NACCO Industries has a market cap of $ 340 million. Its shares are trading at a price of $ 46.36.

The stock started in the year 2021 at $ 26.3. Throughout the year the stock remained steady and started t rise during the last quarter. The stock closed the year at $ 36.29 representing a 38 % appreciation the year.

In 2022, after staying steady during the first quarter the stock spiked high and peaked at $ 57.82. Eventually, the stock last closed at $ 46.36, representing a 28 % appreciation to date.

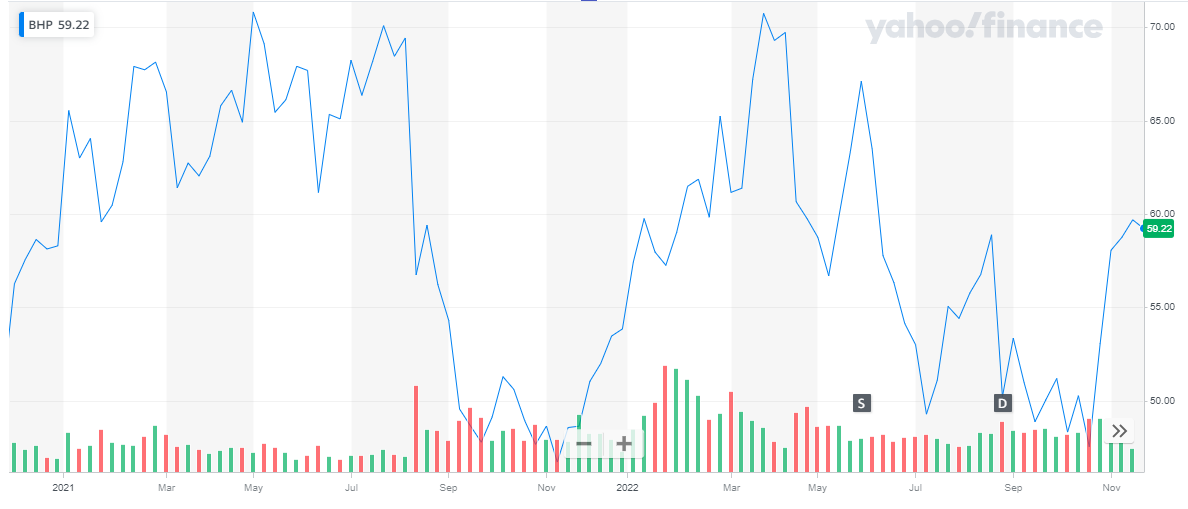

BHP Group (BHP)

BHP Group (BHP)

BHP Group Limited operates as a resources company in Australia, Europe, China, Japan, India, South Korea, the rest of Asia, North America, South America, and internationally. The company operates through the Copper, Iron Ore, and Coal segments. It engages in the mining of copper, silver, zinc, molybdenum, uranium, gold, iron ore, and metallurgical and energy coal. The company is also involved in mining, smelting, and refining of nickel; and potash development activities. In addition, it provides towing, freight, marketing and trading, marketing support, finance, administrative, and other services.

Get to know everything about high-frequency trading.

BHP Group has a market cap of $ $ 212.8 million. Its shares are trading at $ 59.22.

The stock of the company has been volatile in the past two years with huge spikes and big drops. In 2021, the stock started trading at $ 58.29. Initially, the stock picked up an upward trend. During the third quarter, the stock suffered a huge blow in price and dropped to the low of $ 46.71. And eventually closed the year at $ 53.84. The stock depreciated by 7.6 %.

In 2022, initially, the stock spiked high and peaked at $ 70.74. After that, the stock declined to a low of $ 47.53 and recently closed at $ 59.52. To date, the stock has appreciated by 10.5 %.

Natural Resource Partners

Natural Resource Partners

Natural Resource Partners L.P., a master limited partnership headquartered in Houston, TX, is a natural resource company that owns, manages, and leases a diversified portfolio of mineral properties in the United States, including interests in coal, industrial minerals, and other natural resources, and owns an equity investment in Ciner Wyoming, a trona/soda ash operation. Get to know the best S&P companies for investment.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Coal Sales Volume | 8.9 million ton | 8.4 million ton | 6.8 million ton |

| Revenue | $ 102.3 million | $ 99.9 million | $ 89.7 million |

| Net Income | $ 74.5 million | $ 66.8 million | $ 63.9 million |

| Earnings per share | $ 5.25 | $ 4.65 | $ 4.45 |

Tech stocks are also one of the best investment opportunities.

Natural Resource Partners has a market cap of $ 514.5 million. Its shares are trading at a price of $ 41.99.

The stock of the company has been on a bullish run since 2021. From a price of $ 13.75, at the start of the year, the stock continued a bullish pattern throughout the year and closed at $ 33.42. The stock appreciated by 143 % during the year.

In 2022, the stock continued its bullish pattern. It peaked at $ 49.72 and recently closed at $ 41.99. To date, the stock has appreciated by 49 %.

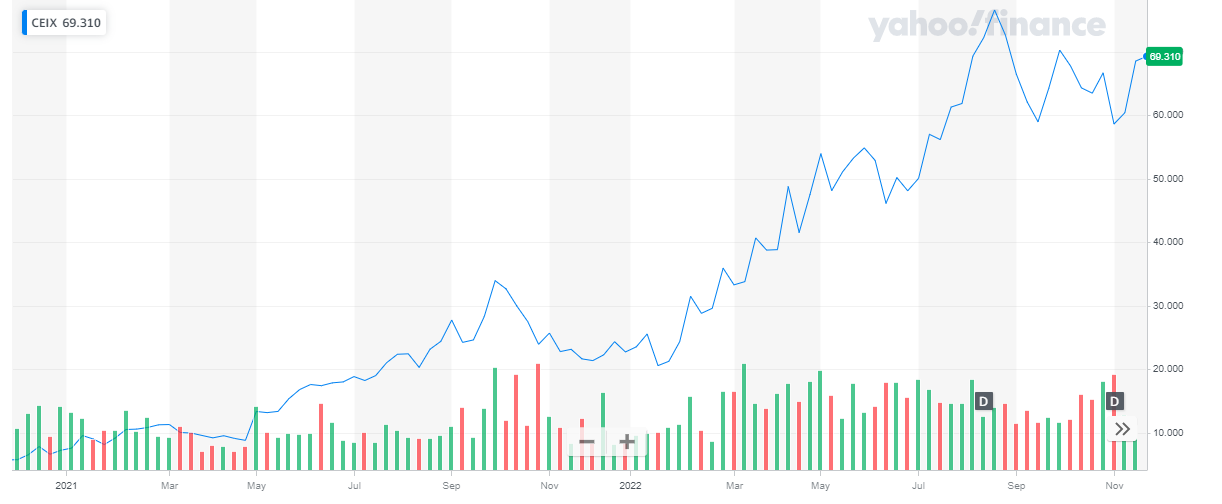

Consol Energy (NYSE: CEIX)

Consol Energy (NYSE: CEIX)

CONSOL Energy Inc. is a Pennsylvania-based producer and exporter of high-Btu bituminous thermal coal and metallurgical coal. It owns and operates some of the most productive longwall mining operations in the Northern Appalachian Basin.

Semiconductor stocks are also one of the best investment opportunities.

CONSOL’s flagship operation is the Pennsylvania Mining Complex, which has the capacity to produce approximately 28.5 million tons of coal per year and is comprised of 3 large-scale underground mines: Bailey Mine, Enlow Fork Mine, and Harvey Mine.

CONSOL also developed the Itmann Mine in the Central Appalachian Basin, which is expected, when fully operational, to produce roughly 900 thousand tons per annum of premium, low-vol metallurgical coking coal. The company also owns and operates the CONSOL Marine Terminal, which is in the port of Baltimore and has a throughput capacity of approximately 15 million tons per year. In addition to the 612 million reserve tons associated with the Pennsylvania Mining Complex and the 21 million reserve tons associated with the Itmann Mine, the company also controls approximately 1.4 billion tons of greenfield thermal and metallurgical coal reserves and resources located in the major coal-producing basins of the eastern United States.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 561 million | $ 544.6 million | $ 358.5 million |

| Net Income/ Loss | $ 152 million | $ 126.3 million | $ (4.45) million |

| Earnings per share | $ 4.36 | $ 3.62 | $ (0.13) |

If you are confused between investing in stocks or forex, go through investing in forex or stocks – which is more profitable?

Consol Energy has a market cap of $ 2.42 billion. Its shares are trading at $ 68.57.

The stock of the company has been on a bullish run since 2021. The stock started trading at $ 7.2 at the start of 2021. It followed a slow and steady run upwards and closed off the year at $ 22.72. During the year the stock appreciated by 215 %

In 2022, the stock continued its bullish run and climbed as high as $ 76.26 before the last closing at $ 68.57. To date, the stock of Consol Energy has appreciated by 202 % till date.

Peabody Energy Corporation

Peabody Energy Corporation

Peabody Energy Corp. engages in the mining of coal. It operates through five segments:

- Western U.S. Mining – The Western U.S. Mining segment consists of its Powder River Basin, and Southwest and Colorado mines. This segment engages in the mining, preparation, and sale of thermal coal.

- Midwestern U.S. Mining – The Midwestern U.S. Mining segment consists of its mines in Illinois and Indiana, which include a mix of surface and underground mining extraction processes and coal with sulfur and Btu content.

- Australian Mining – The Australian Mining segment consists of mines in Queensland and New South Wales, Australia. Its operations are primarily export-focused with customers spread across several countries and a portion of its coal is sold to Australia

- Trading & Brokerage – The Trading & Brokerage segment engages in the direct and brokered trading of coal and freight-related contracts through trading and business offices in Australia, China, Germany, India, Indonesia, Singapore, the United Kingdom, and the U.S. It also provides transportation-related services, which includes economic hedging, in support of its coal trading strategy, as well as cash flow hedging activities support of its mining operations. Forex indicators are constructive in making disciplined and informed decisions.

- Corporate and Other – The Corporate & Other segment includes selling and administrative items, activity associated with its joint ventures, resource management activity, past mining obligations, and its other commercial activities, which includes generation development and the evaluation of Btu conversion projects.

Check out our list the best day trading stocks in 2022.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 1.342 billion | $ 1.321 billion | $ 691 million |

| Net Income/ Loss | $ 375 million | $ 409.5 million | $ (119.5) million |

| Earnings per share | $ 2.61 | $ 2.85 | $ (0.87) |

Check our updates for EUR/USD.

Peabody Energy Corporation has a market cap of $ 4.25 billion. Its shares are trading at $ 30.2.

The stock of the company has been on a bullish run since 2021. It started off the year 2021 at a price of $ 2.4. Throughout the year, the stock maintained its upward run and closed off the year at $ 10.07. Overall, the stock climbed by 320 % during the year.

In 2022, the stock continued its upward pattern and last closed at $ 30.2. To date, the stock has climbed by 200 %.

Teck Resources (NYSE: TECK)

Teck Resources (NYSE: TECK)

Teck Resources Ltd. is a diversified resource company, which engages in the mining and development of mineral properties. Its product portfolio includes steelmaking coal, copper, zinc, energy, other metals, industrial products and fertilizers, and technology sites. The firm focuses on its project operations located in Canada, Peru, Chile, and the U.S.

The below table shows the financial information of the company for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 4.7 billion | $ 5.8 billion | $ 5 billion |

| Net Income/ Loss | $ (195) million | $ 1.675 billion | $ 1.57 million |

| Earnings per share | $ (0.37) | $ 3.3 | $ 2.93 |

Check our updates for NASDAQ Forecast.

Teck Resources has a market cap of $ 17 billion. Its shares are trading at $ 33.96.

The stock started in the year 2021 at $ 18.15. It carried on with an upward trend and continued this trend throughout the year till it closed at $ 28.82. During the year the stock appreciated by 59 %.

In 2022, the stock continued its rising trend till it peaked at $ 43.89. After that, the stock declined and recently closed at $ 33.96. To date, the stock appreciated by 18 %.

You may also like reading:

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy