NASDAQ 100 is one of the most prominent large-cap growth indices in the world. It is composed of the 100 largest and most actively traded companies in the United States of America. The companies of this sector belong to the non-financial sector and are segmented under the technology, retail, industrial, biotechnology, health care, telecom, transportation, media, and services sectors.

NASDAQ 100 is home to the four iconic tech companies that reached the trillion-market cap in the US. They are Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOG, GOOGL). This index offers excellent investment opportunities for long-term investors. Historical charts of the index show a steady growth the index over time. By using the stock signals, you can avoid hours of technical analysis to understand the market.

NASDAQ 100 companies are carefully chosen based on growth potential and innovation. These companies adapt to the ever-evolving technology and emerging markets.

Top 10 Companies on Nasdaq

Here is the list of Top 10 companies on Nasdaq:

| Sr. | Company Name | Symbol | Market Cao | Price (As of 5th September 2022) |

| 1 | Amazon.com | AMZN | $ 1.29 trillion | $ 127.51 |

| 2 | Tesla | TSLA | $ 849 billion | $ 270.21 |

| 3 | NVIDIA | NVDA | $ 338 billion | $ 136.47 |

| 4 | PepsiCo. | PEP | $ 235 billion | $ 170.66 |

| 5 | Costco Wholesale Corp | COST | $ 230.7 billion | $ 519.11 |

| 6 | Cisco Systems Inc. | CSCO | $ 184.4 billion | $ 44.59 |

| 7 | Advanced Micro Devices Inc. | AMD | $ 127.25 billion | $ 78.85 |

| 8 | Intel Corp. | INTC | $ 125.3 billion | $ 30.52 |

| 9 | Upstart Holdings | UPST | $2 billion | $ 24.38 |

| 10 | Axsome Therapeutics | AXSM | $ 2.7 billion | $ 62.99 |

Check out our updates for Nasdaq Forecast.

Amazon.com

Amazon.com, Inc. engages in the provision of online retail shopping services. It operates through the following business segments:

- North America – This segment includes retail sales of consumer products and subscriptions through North America-focused websites such as www.amazon.com and www.amazon.ca.

- International – This segment offers retail sales of consumer products and subscriptions through internationally-focused websites

- Amazon Web Services (AWS) -This segment involves the global sales of computing, storage, database, and AWS service offerings for start-ups, enterprises, government agencies, and academic institutions.

Check out: List of Most Volatile Stocks

Amazon.com, Inc. announced financial results for its second quarter ended June 30, 2022:

- Net sales were reported to be $ 113 billion

- Net Income was reported at $ 7.8 billion

- Earnings per share were reported at $ 0.77 per share

Amazon has a market cap of $ 1.3 trillion. Its share is currently trading at a price of $ 127.51.

The stock of Amazon has been volatile in the last two years. The stock started the year 2021 at $ 162.85. It peaked at $ 185.97 and closed off the year at $ 166.72. Overall, the stock appreciated by 2.4 % during the year.

In 2022, the stock started at $ 166.72 and dropped to the lows of $ 106.22. The stock last closed at $ 126.31, representing a 24 % decline during the year.

Get to know about Best Trading and Forex Signal Providers

Tesla

Tesla, Inc. engages in the design, development, manufacture, and sale of fully electric vehicles, energy generation, and storage systems. It also provides vehicle service centers, supercharger stations, and self-driving capability. The company operates through the following segments:

- Automotive- This segment includes the design, development, manufacture, and sale of electric vehicles

- Energy Generation and Storage – This segment includes the design, manufacture, installation, sale, and lease of stationary energy storage products and solar energy systems, and the sale of electricity generated by its solar energy systems to customers. Solar energy stocks are also one of the best investment options.

Tesla reported quarterly results for the three months ending 30th June 2022:

- Revenue was reported at $ 13.7 billion

- Net Income was reported at $ 2.3 billion

- Earnings per share were reported at $ 2.18

Tesla has a market cap of $ 849 billion. Its share is currently trading at a price of $ 270.21.

For the major part of 2021, the stock remained bullish. Tesla’s stock started the year 2021 at $ 235.22 and closed the year at $ 352.26, representing a 50 % appreciation during the year.

In 2022, the stock followed a bearish pattern. It started at a price of $ 352.26 and last closed at $ 270.21. Overall the stock declined by 23 % to date

Get to know about Hydrogen stocks, which are companies focusing on the production of hydrogen fuel cells.

Also read:

NVIDIA

NVIDIA Corp. engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software.

It operates through the

- Graphics Processing Unit (GPU) – This segment comprises product brands, which aim at specialized markets including GeForce for gamers; Quadro for designers. Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users.

- Tegra Processor segments – This segment integrates an entire computer onto a single chip, and incorporates GPUs and multi-core CPUs to drive supercomputing for autonomous robots, drones, and cars, as well as for consoles and mobile gaming and entertainment devices.

Stocks are profitable. But it’s always wise to limit your exposure to risky investments like best altcoins.

NVIDIA reported results for the second quarter ended July 31, 2022:

- Revenue was reported at $ 6.70 billion, an increase of 3 % from the previous year’s same period

- Net Income was reported at $ 656 million, a 72 % decline from the previous year’s same period

- Earnings per share were reported at $ 0.26

NVIDIA is a $ 339 billion company. Its share is trading at a price of $ 136.47.

NVIDIA is a $ 339 billion company. Its share is trading at a price of $ 136.47.

In 2021, the stock started trading at a price of $ 130.55. During the year, the stock picked up a bullish trend and it went as high as $ 329.85. The stock closed the year at $ 294.11. Overall, the stock appreciated by 152 %.

Oil stocks are one of the riskier yet most profit-generating sectors. No doubt oil is the largest energy market but natural gas stocks also play an important role.

PepsiCo.

PepsiCo is a food and beverage consumer goods company. The Company, through its operations, bottlers, contract manufacturers, and other third parties are engaged in producing, marketing, distributing, and selling a range of beverages, foods, and snacks, across more than 200 countries worldwide. Get to know the best commodities to invest in now.

PepsiCo is organized into the below divisions:

- Frito-Lay North America

- Quaker Foods North America

- North America Beverages

- Latin America

- Europe

- Sub-Saharan Africa, Asia, Middle East and

- Asia Pacific, Australia, New Zealand, and China Region.

The Company’s brands portfolio includes a number of high-profile brands, such as Agusha, Amp Energy, Aquafina, Aquafina Flavorsplash, Aunt Jemima, Cap’n Crunch, Cheetos, Chester’s, Chipsy, Chudo, Cracker Jack, Diet Pepsi, Diet Sierra Mist, and Domik v Derevne. Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

PepsiCo, Inc. recently reported results for the second quarter of 2022:

- Total Revenue was reported at $ 20.23 billion.

- Frito-Lay North America generated $ 5.2 billion in revenue

- Quaker Foods North America generated $ 675 million in revenue

- North America Beverages generated $ 6.12 billion in revenue

- Latin America generated $ 2.4 billion in revenue

- Europe generated $ 3.02 billion in revenue

- Sub-Saharan Africa, Asia, Middle East generated $ 1.7 billion in revenue

- Asia Pacific, Australia, New Zealand, and China Region generated $ 1.115 billion in revenue

- Net Income was reported at $ 1.4 billion

- Earnings per share were reported at $ 1.03

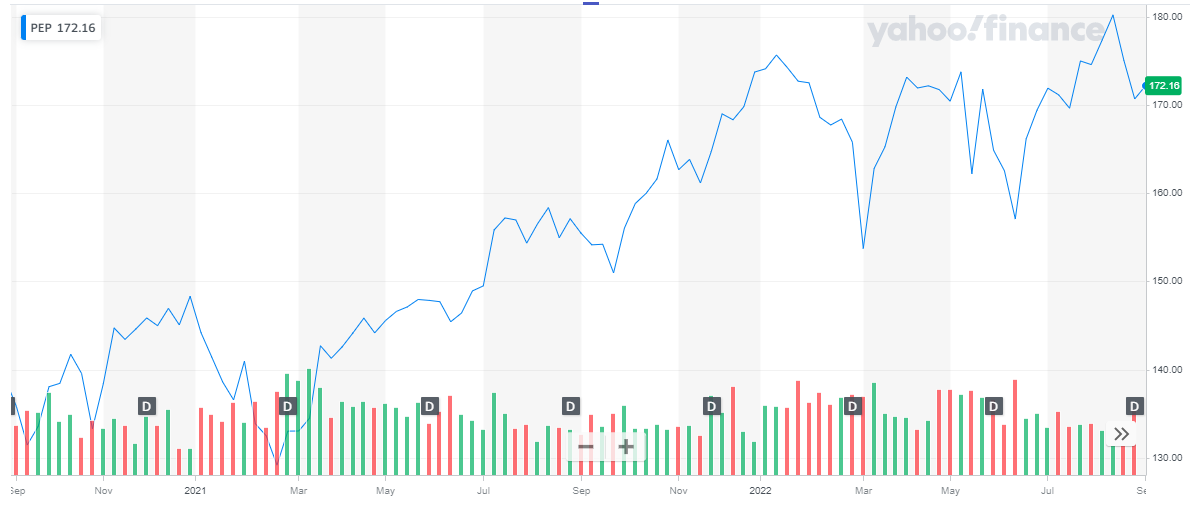

PepsiCo. has a market cap of $ 237.7 billion. Its share is trading at a price of $ 172.13. Despite being volatile, the stock of the beverage company has been on an upward trend in the past two years. If you have entered the crypto investment market, you should explore crypto staking platforms.

In 2021, the stock started off at $ 148.3. It went as low as $129 and closed off the year at $ 173.71. Overall, the stock appreciated by 35 % during the year.

In 2022, the stock started at $ 173.71, went as low as $ 153.71, and was as high as $ 180.17. It last closed at $ 172.46. To date, the stock has maintained its price level.

Costco Wholesale Corp

Costco Wholesale Corp

Costco Wholesale Corp. engages in the operation of membership warehouses. It is one of the largest retailers in the world. A Costco store typically carries supermarket items and an ever-changing selection of other merchandise, including some luxury goods. Also, learn about top shipping stocks in 2022.

It operates through the following segments:

- Unites States Operations

- Canadian Operations

- Other International Operations

Costco Wholesale Corporation recently announced its operating results for the third quarter ended May 8, 2022:

- Net Sales were reported at $ 51.6 billion, a 16.3 increase from last year’s same quarter

- Net income was reported at $1.34 billion

- Earnings per share were reported at $ 3.04 per diluted share

Costco currently operates 830 warehouses, including 574 in the United States and Puerto Rico, 105 in Canada, 40 in Mexico, 30 in Japan, 29 in the United Kingdom, 16 in Korea, 14 in Taiwan, 13 in Australia, four in Spain, two each in France and China, and one in Iceland. Costco also operates e-commerce sites in the U.S., Canada, the United Kingdom, Mexico, Korea, Taiwan, Japan, and Australia.

Costco has a market cap of $ 230 billion. Its share is currently trading at a price of $ 519.11.

The stock remained bullish during 2021. The stock started off the year at a price of $ 376.78. Initially, the stock dropped to the lows of $ 317.32. But it picked up the pace and rose up to $ 567.7 by the end of the year. Overall, the stock appreciated by 79 % during the year. There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

In 2022, the stock exhibited volatility. The stock started at $ 567.7 and after multiple dips and peaks clast closed at $ 520.42. This represents an 8 % decline to date.

Cisco Systems Inc.

Cisco Systems Inc.

Cisco is a US technology company that is best known for its networking products and other products related to the communications and information technology industry in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. It develops, manufactures, and sells networking hardware, telecom equipment, and other IT services and products. The company specializes.

It provides infrastructure platforms, including networking technologies of switching, routing, wireless, and data center products that are designed to work together to deliver networking capabilities, and transport and/or store data. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

In the recent quarterly report, Cisco reported:

- Revenue was reported at $ 13.1 billion

- Net Income was reported at $ 2.8 billion

- Earnings per share were reported at $ 0.68

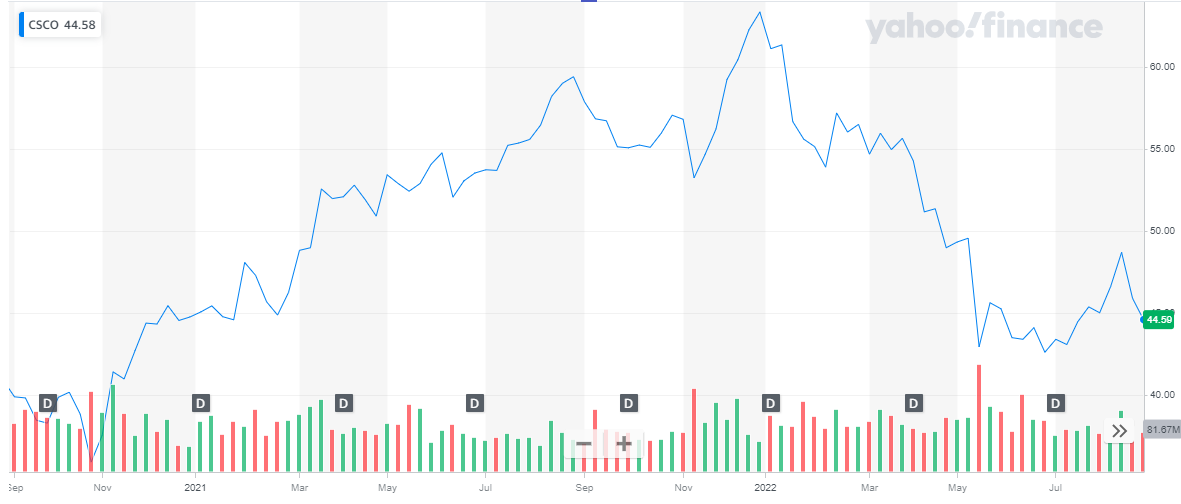

Cisco Systems has a market cap of $ 184.6 billion. Its share is trading at a price of $ 44.59.

In 2021, the share maintained a bullish trend. The stock started off at $ 44.75 and maintained its upward streak throughout the year. The stock peaked at $ 63.37 and closed off the year at the same price. Overall, the stock appreciated by 41.6 % during the year.

In the current year, the stock reversed its course and started declining. The stock dropped from $ 63.37 to the lows of $ 42.6 and recently closed at $ 44.59. Overall, the stock declined by 30 % to date.

Advanced Micro Devices Inc.

Advanced Micro Devices Inc.

Advanced Micro Devices inc. is an American semiconductor company that develops computer processors and related technologies for business and consumer markets. Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

It operates through the following segments:

- Computing & Graphics – This segment engages in desktop and notebook processors and chipsets, discrete and integrated graphics processing units, data center and professional GPUs, and development services

- Enterprise, Embedded, and Semi-Custom – This segment includes server and embedded processors, semi-custom System-on-Chip products, development services, and technology for game consoles

Advanced Micro Devices recently shares its quarterly report:

- Revenue was reported at $ 6.6 billion, a 70 % increase from the previous year second quarter

- Net income was reported at $ 447 million, a 37 % decline on a year-on-year basis

- Earnings per share were reported at $ 1.05

Advanced Micro Devices has a market cap of $ 129.5 billion. Its share is trading at a price of $ 80.24.

In 2021, the stock started trading at a price of $ 91.71. During the year the stock peaked at $ 155.41 and closed off the year at $ 143.9. Overall, the stock appreciated by 57 % during the year. Learn about Best Day Trading Stocks

In 2022, the stock started trading at $ 143.9. Over the year, the stock went through multiple dips and peaks and last closed off at $ 80.24. This represents a 44 % decline to date.

Intel Corp.

Intel Corp.

Intel Corp. is the world’s largest manufacturer of central processing units and semiconductors. The company is best known for CPUs based on its x86 architecture, which was created in the 1980s and has been continuously modified, revised, and modernized. Intel also offers graphics processing units (GPUs), networking accelerators, and communications and security products.

ETFs offer a low-cost option to get exposure to oil and gas ETFs.

It has transformed beyond a PC-centric company to have a stronger focus on data. Its main businesses include:

- Data Center Group (DCG)

- Internet of Things (IOTG)

- Mobileye

- Non-volatile Memory Solutions Group (NSG)

- Programmable Solutions Group (PSG)

- Client Computing Group (CCG)

Intel Corp recently reported its second quarter report for 2022. It reported:

- Revenue of $ 15.3 billion, a 17 % decline on a year-on-year basis

- Earnings per share were reported at $ 0.29

Intel has a market capitalization of $ 128.2 billion. Its share is trading at a price of $ 31.22.

In 2021, the share started trading at a price of $ 49.82. It peaked at $ 68.26 in March and started its downward journey. The share closed off the year at $ 51.5. Overall, the stock appreciated by 3.4 % during the year. If you are seeking a steady stream of income, you should invest in REIT stocks.

In 2022, the stock continued its bearish trend. From $ 51.5, at the start of the year, the stock last closed at $ 31.2. This represents a 39 % decline to date.

Semiconductor stocks are also one of the best investment opportunities.

Upstart Holdings

Upstart operates an artificial intelligence-powered platform, which is hired by an increasing number of lenders to evaluate individual credit risk.

It offers:

- Highly automated, all-digital experience

- Customizable to bank’s credit policies and risk appetite

- Improved credit access for all demographics tested

- Comprehensive fairness testing

In the recent quarterly report, the company reported:

- Revenue of $ 228 million, an 18 % increase on a year-on-year basis

- Loss from operations was reported at $ 32.1 million

- Net loss was reported at $ 29.9 million

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

The total number of borrowers has been steadily increasing every quarter. The total number of borrowers served more than doubled in the past year.

Upstart Holdings has a market capitalization of $ 1.98 billion. Its share is trading at a price of $ 24.38. In 2021 the share started trading at a price of $ 40.75, peaked at $ 390, and closed the year at $ 151.3, representing a 271 % increase during the year.

The year 2021, has been bearish. The stock started trading at a price of $ 151.3 and last closed at $ 25.95. This represents an 83 % decline to date.

Axsome Therapeutics

Axsome Therapeutics

Axsome Therapeutics, Inc. is a biopharmaceutical company developing novel therapies for central nervous system (CNS) conditions that have limited treatment options. Through the development of therapeutic options with novel mechanisms of action, we are transforming the approach to treating CNS conditions. Get to know everything about high-frequency trading.

The company’s product pipeline includes

- AXS-05, a therapeutic for the treatment of major depressive disorder and resistant depression disorders

- AXS-07, is a novel, oral, rapidly absorbed, multi-mechanistic, investigational medicine that has completed two Phase III trials for the acute treatment of migraine

- AXS-12, a selective and potent norepinephrine reuptake inhibitor, which is in Phase III trial to treat narcolepsy

- AXS-14, a novel, oral, and investigational medicine that is in Phase III trial for the treatment of fibromyalgia

In the recent quarterly report, the company reported:

- Revenue of $ 8.8 million

- Total Loss from operation was reported at $ 41.5 million

- Net loss per share was reported at $ 1.06

Axsome Therapeutics has a market capitalization of $ 2.7 billion. Its share is currently trading at a price of $ 62.99.

Also check out Best Forex Brokers for Trading

In 2021, the stock started trading at a price of $ 81.47. In August, the stock suffered a huge dip in price and it dropped to the low of $ 21.59. The stock closed the year at $ 37.78. Overall, the stock declined by 54 % during the year.

In 2022, the stock started at $ 37.78 and last closed at $ 62.99, representing a 67 % appreciation to date.

Conclusion

Conclusion

The Nasdaq-100 is one of the world’s preeminent large-cap growth indexes. It includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

Technology is a dominant segment in the index. But it is well-balanced by sectors such as consumer services, healthcare, consumer goods, and industrials which constitute almost 50% of the companies. One thing which makes this index unique is its focus on companies that are very focused on innovation and future growth. Also, Covid-19 vaccine stocks are one of the best investment options.

Since 2008, the Nasdaq-100 has generated higher growth rates than competing indexes, such as S&P 500 Index and the Russell 1000 Growth Index. Compared to others indexes, NASDAQ has proven to provide better returns at the end of the long-term investment.

Therefore, we advise investing in NASDAQ stocks to get better returns in the future. Also, investing money in the right place gives you a good return on investments like the NASDAQ stocks.

You may also like reading: