What is Scalp Trading?

What is Scalp Trading?

Scalping is a trading style employed by investors to earn from small price changes to make profits that eventually add up to bigger profits. These traders trade frequently and in small successions throughout the day.

For scalper traders having a strict exit policy is vital along with a solid understanding of the market. The traders should be knowledgeable enough to know the entry and exit points. This is the key to profitable scalp trading. Otherwise, one wrong move can lead to huge losses which can erode all the small profits

With these qualities and the right tools, you can become a successful scalp trader.

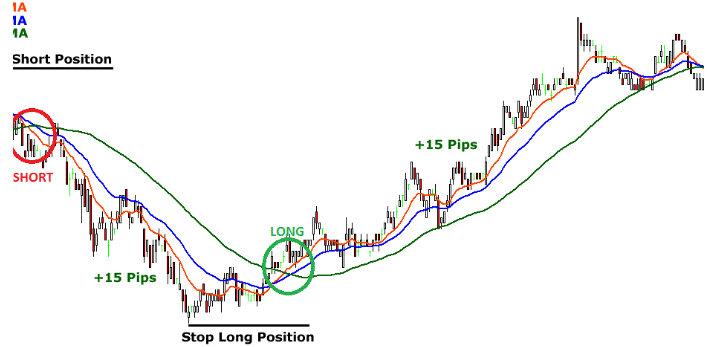

Below is an example of a 1-minute forex scalping strategy. It highlights the time frames for short, long, and the stop-long positions.

It is always suggested to choose the best forex signal service provider who is transparent, reliable, and focuses on long term business relations.

Below is a 15-minute scalp trade. It shows a wining trade. The graph highlights the strong bear move, the sluggish attempt to swing up and the point to short.

What is Swing Trading?

Swing trading is the trading style where investors seek to earn short-term gains or medium-term gains. In swing trading traders, make the most out of the market swings. Typically, trades are executed over the course of a few days or in some cases, a few weeks. Check out the list of best day trading stocks with their analysis to make your day trading journey convenient and rewarding.

Investors practicing swing trading rely entirely on technical analysis. They follow the market trends and patterns and then accordingly time the market for entry and/or exit. With the right tools, investors can successfully practice swing trading. Swing trading indicators are technical indicating tools that can help you discover potential trading strategies.

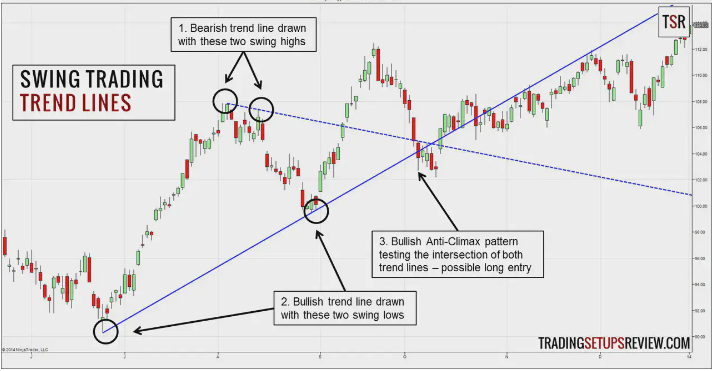

The below chart shows an example of swing trading with trend lines showing bullish and bearish trends.

Get to know the best 3d printing stocks.

Pros and Cons of Scalp Trading

Pros

- Scalp Trading is best suited for aggressive traders. They buy and sell multiple times throughout the day in order to benefit from small time changes. And this is the best practice for active traders.

- Scalp trading is one of the most exciting trading strategies. The quick “win or lose” can feel thrilling and competitive.

- Traders can start trading with this strategy with very low capital

- The traders need not know detailed info about the company; knowledge about the ongoing trend is enough to benefit from this trading strategy. But it’s always wise to limit your exposure to risky investments like the best altcoins.

- Once the trader sets a strict exit strategy, scalp trading can be very profitable.

- Traders will come across multiple opportunities to benefit from small changes in price throughout the day, during trading hours

- Scalp Trading is non-directional. Traders can find trading opportunities in any market condition. They do not rely on big price moves. They benefit from a slightly volatile market. All they need is a decent order flow.

It is the best time to invest in top shipping companies as they are poised for growth in the near future.

Cons

- With multiple trades throughout the day, the transaction cost adds up to quite a lump sum

- Scalp trading is very time-consuming and is a full-time job. Investors must dedicate full attention throughout the day to trading.

- In order to earn a substantial amount of profit, investors have to carry out dozens of trades throughout the day.

- Time is very important in scalp trading. A slight delay or miscalculated time can lead to missed profit opportunities

- Scalp Trading moves alongside the market trends. Therefore, it is prone to experience all the noise of the market which is very overwhelming and exhausting.

Get to know the best uranium stocks to invest in now.

Pros and Cons of Swing Trading

Swing trading is one of the most popular strategies traders use. However, it is important to note that this trading practice has its advantages and disadvantages. Let’s study both:

Pros

- For beginners swing trading is an excellent trading strategy. All that is required is a bit of technical analysis which can be done through software. And the investors are good to go.

- Less time-consuming. Check out some of the best recession stocks to buy now.

- Good return on investment – With a good strategy and proper risk management, swing trading can be very profitable. By being consistent with their strategy, investors can make reasonably good returns from swing trading.

If you are confused between swing trading and day trading, read Swing trading vs Day trading.

- Investors can easily practice swing trading part-time and can manage a full-time job alongside

- Greater flexibility with the funds. Investors need not worry about tieing their capital for long. In case a trade goes bad, they can easily liquidate their assets and invest in another trade. Investing in value stocks is a long-term investment.

Also, agricultural stocks offer excellent opportunities for investors.

Cons

- Swing Traders are exposed to the risk of overnight price changes and weekend price gaps. This happens when there is there are earnings reports or other market news during the after-hours market or over the weekend. The risk caused by these gaps is that they render a trader’s stop loss useless. Investing in fintech stocks is a smart investment move today.

- Swing trading aims to profit from individual price swings. The aim of an investor is to enter at the beginning of a market trend and exit when the market pullbacks. This trend following can often take days and weeks. And during this the investor losses out on potentially profitable stocks which might have earned more profit. Investors who are looking to benefit from the rising technology by earning profits should consider drone stocks for investment.

- Timing the market swings is one of the most difficult tasks for every investor.

- Swing trading incurs less cost compared to day trading. But these costs can easily add up to a huge amount

Also read: Best Preferred stocks as they are a hybrid financial instrument that offers the benefits of both common stock and bonds.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Scalp Trading Strategies

Technical indicators help traders to forecast market trends and predict patterns. This helps them execute successful trades. Usually, more than one indicator is needed. Generally, the best scalping indicators are combined to work for a successful scalping strategy.

Go through the list of the best forex indicators that are constructive in making disciplined and informed decisions.

The most common standard indicators scalpers use are:

- Stochastic oscillator strategy – A stochastic oscillator strategy is the most common trading strategy used by every investor. In this strategy, the stochastic relates to the point of the current price in relation to its range in a period.

- Moving average strategy (MACD) – MACD helps to indicate when the market price of the assets is bearish or bullish for the investor’s investment. In the MACD strategy, it is essential to maintain risk management with stops vital in order to avoid larger losses.

- RSI strategy: The relative Strength Index (RSI) is the most common indicator for investors to use in scalping trading. This strategy helps investors identify the entry and exit points for trading. Get to know the top stock indicators for stock analysis.

Also, read: The Best Travel and Tourism stocks.

Tips and Tricks for Successful Scalp Trading

- Create the best trading plan: Before investing money in scalping trading, it is necessary to have a trading plan because it is helpful to achieve the goal of the trading.

- Risk Management: Traders should only invest affordable funds to lose in trading. And for that, they should not exceed the limit of investment in trading. If you are seeking a steady stream of income, you should invest in REIT stocks.

- Advanced Charting Tools: Traders need to use precise charting tools in order to practice scalp trading. Scalpers look for tiny price fluctuations and for that a good charting tool acts as their eyes.

- Fact-based strategy – while devising your plan and trade strategy, never plan based on assumptions. The only thing that will help traders is fact-based decisions.

- Know the entry and exit rules: The trader has to strictly follow the entry and exit plan for trading. Otherwise, this can hurt their profits.

Also read:

Swing Trading Strategies

While there are many swing trading strategies available out there to swing trade, some tend to work out better over the longer term. This will be different for everyone.

Here is the list of trading strategies that can prove to be beneficial for investors

- Swing Trading Alerts – The time during the trade carries the highest value. Every investor does not have time to analyze chart patterns and identify trade opportunities based on technical indicators, investment research, technical analysis, and market news. It is a time-consuming process. Therefore, using swing trade alert services can be a clever alternative. Get to know the best swing trading stocks.

- Gap and go strategy – Major positive news often causes big up gaps, and traders tend to wait until the up gap gets filled. The trading setup works because the more the stock price increases, the more swing traders feel some sort of fear of missing out. Then they start buying at a higher price. For this setup, it is important to define the trading rules, profit target, and stop loss level.

Check our updates for NASDAQ Forecast.

- Stock Split Power – The psychology behind this type of investment strategy is swing traders see the price per share at a much lower price level, and therefore the price looks cheaper. The company valuation has not changed. The only change is in the number of shares being traded publicly. The same market cap is still the same. However, it appears to be cheap, and investors tend to invest in such price trends. The market sentiment is positive, and a long position can unfold meaningful gains shortly if the bullish trend continues.

- Trend Continuation Trading Strategy – For the swing trader, continuation gaps are one of the favorite ways to play the market. Usually, these gaps occur after an earnings report that beats expectations.

- Fibonacci Retracement Strategy – Traders all over the world use Fibonacci retracement tools to find a level to get involved in the market. The three most common levels are 38.2%, 50%, and 61.8% retracements.

- Flat EMA Trading Strategy- Investors need to look for a relatively flat exponential moving average that tells when the market is consolidating. Traders are looking to buy support on the lower side and sell or short several times at resistance. You need to take advantage of these consolidation frames because they happen all the time.

Get to know the best commodity stocks to invest in now.

Tips and Tricks for Successful Swing Trading

- Carefully choose the brokerage account. Find the one that best suits your needs as a trader.

- Be aware of the impact of external forces. Not only company research is important but the overall market and how it is performing in any given time frame

- Never Rely on a Single Stock Indicator. There are a number of indicators you can look at when forecasting the movement of a stock. There are the best stock market forecast and prediction services which offer accurate data, up-to-date news, superior tools for stock chart analysis, market research, online trading, and a whole community of traders.

- Pay attention to unusual volumes. Volume does not necessarily mean a lot of traders are interested in a stock, it can also mean that a large investment firm has purchased a huge number of shares in smaller blocks.

- Price action alone is not enough. Traders have to combine data together in order to formulate a good strategy for swing trading.

Give a read to some of the best hydrogen stocks worth investing in now.

Scalping Trading vs Swing Trading: Which one to Choose?

Understanding which trading style will go well with the trader’s investment goal might not be as easy as it sounds. But this is a choice that can always be changed. Many beginners will test and try multiple strategies and trading styles in order to understand which one suits the most. The trading style they choose will have a profound effect on their trading outcomes and profitability.

Here is a list of questions an investor should ask himself when deciding which trading style is best suited for them:

- Which style are you most comfortable with?

- How much time do you have for entering, managing, and exiting market positions? Swing traders can easily manage their positions while working a full-time job. While scalp traders cannot do this.

- What are your trading goals?

- Are you seeking to become a full-time trader or are you just looking for a side income?

- What style of trading do you prefer? (Fundamental analysis, technical analysis, pattern trading, price action, or indicators)

Swing trading is suitable for people who are patient and like taking time to think things through before making a trading decision. Whereas, scalping is for active people who prefer fast-paced work and make quick decisions.

Also, read: Best commodity ETFs.

Swing trading requires simple trading strategies with a slow-paced approach towards trading. For scalping, on the other hand, the trading strategy is comparatively complicated and requires fast execution. Also, it requires strict risk control to protect the small profits.

Swing Traders aim for a good profit against every trade. While scalp traders have a target of small profits in every trade.

The cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

Swing trading can be adopted by every type of investor: from beginners to experts. Scalping, however, is only suitable for highly experienced traders.

Swing Traders are comparatively more relaxed with lower stress. They take their time to make decisions. Scalp Traders are more active and face higher stress levels because they have to make decisions multiple times during the day.

Robotic stocks offer an exciting investment opportunity for traders.

Final Thoughts

Swing Trading is less risky and provides a profitable return to investors. On the other hand, scalp traders operate in a high-risk environment with a lower return. Swing Traders can earn a hefty profit with just one trade. Whereas, scalp traders need to carry out multiple successful trades to win the same amount of profit.

As a trader, Swing Trading is a comparatively better and safe choice to carry out trades.

You may also like reading: