Index funds are mutual funds or exchange-traded funds (ETFs) that are designed to track the performance of a market index like the S&P 500. Index funds are passive investments meaning that portfolio managers do not have to spend all the time managing the portfolio. These investments are long-term investments that are considered safe. Read: Mutual Funds Vs. Stocks: Which Should You Invest In?

Index funds are mutual funds or exchange-traded funds (ETFs) that are designed to track the performance of a market index like the S&P 500. Index funds are passive investments meaning that portfolio managers do not have to spend all the time managing the portfolio. These investments are long-term investments that are considered safe. Read: Mutual Funds Vs. Stocks: Which Should You Invest In?

Types of Index Funds

- International index funds – These index funds are based on indexes that are not limited to any country or the stock market, giving the investor exposure to international companies in emerging markets and more.

- Earnings-based index funds – These index funds are based on the type of companies and their profits. These funds include growth stocks and value stocks.

- Bond-based index funds – These index funds provide a combination of short, intermediate, and long-term bonds. These type of index funds not only helps you diversify your investment portfolio but also yields steady and healthy returns month-on-month.

Also, if you are seeking whether you should invest in ETFs or Index funds, read ETFs vs Index funds. ETFs and Index Fund both provide a diversified portfolio.

Benefits of Investing in Index Funds

- Low Risk because of diversification – Index fund contains stocks, bonds, and often both. This diversification helps reduce the risk of the portfolio because if one category of investment is not operating well, chances are the other is doing well. Hence, index funds minimize losses.

- Low Taxes – The index funds portfolio does not change regularly. Therefore, it leads to fewer taxable capital gains distributions from the fund, which could reduce your tax bill.

- Low Costs – All index funds are operated by professionals; hence investors do not need to hire any other professionals to run and manage their portfolios.

To give investors an idea of where to start and which companies to look for investment in oil and gas, we have compiled a list of the top best oil and gas ETFs to buy now.

List of Best Index Funds of 2024

Below is the list of the 10 Best Index Funds for 2024:

- Vanguard 500 Index Fund Admiral Shares (VFIAX)

- Fidelity Nasdaq Composite Index Fund (FNCMX)

- Fidelity 500 Index Fund (FXAIX)

- Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

- Schwab S&P 500 Index Fund (SWPPX)

- Schwab Total Stock Market Index Fund (SWTSX)

- Schwab Fundamental US Large Company Index Fund (SFLNX)

- Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX)

- Fidelity Total Bond Fund (FTBFX)

- Invesco QQQ Trust ETF (QQQ)

Vanguard 500 Index Fund Admiral Shares (VFIAX)

Vanguard 500 Index Fund Admiral Shares (VFIAX)

The goal of the Vanguard 500 Index Fund is to track the performance of the S&P 500, which includes stocks with large market capitalizations. As such, it invests most of its assets in stocks that appear in the index. The Fund employs an indexing investment approach. The Fund attempts to replicate the target index by investing all of its assets in the stocks that make up the Index with the same approximate weightings as the Index. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 7.20 % |

| Microsoft Corp. | MSFT | 5.83 % |

| Amazon.com Inc. | AMZN | 3.30 % |

| Tesla Inc. | TSLA | 2.07 % |

| Alphabet Inc. Cl A | GOOGL | 1.93 % |

| Alphabet Inc. Cl C | GOOG | 1.80 % |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.51 % |

| UnitedHealth Group Inc. | UNH | 1.45 % |

| Johnson & Johnson | JNJ | 1.26 % |

| Exxon Mobil Corp. | XOM | 1.20 % |

Regional bank stocks offer an excellent return to investors. This fund was created in Nov 2000. The total net assets in this fund are $ 343.667 billion.

- Minimum investment: $ 3,000

- Expense ratio: 0.04 %

- Dividend yield: 1.76

- Year-to-date return: – 22.06 %

- Five-year average return: 9.41 %

The stock of the fund has been on a bullish run throughout the year 2021. From a price of $ 346.57, the stock closed the year at $ 439.83, representing a 27 % appreciation during the year. In 2022 the stock of the fund reversed its course. From a price of $ 439.83, the stock last closed at $ 330.83, representing a 25 % decline to date. Go through the best recession stocks in 2024. Also read:

The stock of the fund has been on a bullish run throughout the year 2021. From a price of $ 346.57, the stock closed the year at $ 439.83, representing a 27 % appreciation during the year. In 2022 the stock of the fund reversed its course. From a price of $ 439.83, the stock last closed at $ 330.83, representing a 25 % decline to date. Go through the best recession stocks in 2024. Also read:

Fidelity Nasdaq Composite Index Fund (FNCMX)

This fund tracks the performance of the Nasdaq Composite Index and includes major positions in several technology stocks. It carries a higher-than-average risk but has delivered strong returns over the years. This index invests in companies with market values greater than $ 10 billion that fund managers believe are poised for growth. Growth can be based on a variety of factors, such as revenue or earnings growth. Growth funds are typically focused on generating capital gains rather than income. Fintech stocks provide a low cost of service and promote transparency. 97.93 % of the funds are invested in large growth companies. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 12.93 % |

| Microsoft Corp. | MSFT | 10.32 % |

| Amazon.com Inc. | AMZN | 6.75 % |

| Tesla Inc. | TSLA | 4.54 % |

| Alphabet Inc. Cl C | GOOG | 3.59 % |

| Alphabet Inc. Cl A | GOOGL | 3.44 % |

| NVIDIA Corp. | NVDA | 2.23 % |

| Meta Platforms Inc. | META | 1.80 % |

| PepsiCo Inc. | PEP | 1.19 % |

| Costco Wholesale Corp. | COST | 1.18 % |

There are many stock advisory services that recommend a few of the best stocks to their members and subscribers. The fund was created in September 2003. It has a total net asset worth of $ 9.835 billion.

- Minimum investment: $ 0

- Expense ratio: 0.29 %

- Year-to-date return: – 31.35 %

- Five-year average return: 10.92 %

The stock of the fund has been on a bullish run in the year 2021. From a price of $ 161.79, the stock rose to $ 202.64 and closed off the year at $ 196.83. Overall, the stock appreciated by 21.65 % during the year. In 2022, the stock reversed its course and followed a bearish pattern throughout the year. The stock started at $ 196.82 and closed off at $ 130.96 representing a 33 % decline to date. Get to know the safest monthly dividend stocks.

The stock of the fund has been on a bullish run in the year 2021. From a price of $ 161.79, the stock rose to $ 202.64 and closed off the year at $ 196.83. Overall, the stock appreciated by 21.65 % during the year. In 2022, the stock reversed its course and followed a bearish pattern throughout the year. The stock started at $ 196.82 and closed off at $ 130.96 representing a 33 % decline to date. Get to know the safest monthly dividend stocks.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Fidelity 500 Index Fund (FXAIX)

Fidelity may be an ideal choice for those looking for the best index funds for beginners, thanks to the resources it provides customers, including tools that offer investment advice and research. This index normally invests at least 80% of assets in common stocks included in the S&P 500® Index, which broadly represents the performance of common stocks publicly traded in the United States. Also, it aims to earn income for the fund by lending securities. This index invests in companies with market values greater than $10 billion. These funds invest in a combination of growth and value-oriented stocks. 99.95 % of stocks are invested in large blend companies. Get to know about bonds vs stocks – where to invest. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 7.16 % |

| Microsoft Corp. | MSFT | 6.01 % |

| Amazon.com Inc. | AMZN | 3.38 % |

| Tesla Inc. | TSLA | 2.14 % |

| Alphabet Inc. Cl A | GOOGL | 2.00 % |

| Alphabet Inc. Cl C | GOOG | 1.84 % |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.56 % |

| UnitedHealth Group Inc. | UNH | 1.46 % |

| Johnson & Johnson | JNJ | 1.32 % |

| NVIDIA Corp. | NVDA | 1.30 % |

Get to know about best drone stocks to invest. Founded in 1988, its 500 Index fund is a balanced fund that invests at least 80% of its assets in S&P 500 stocks. It has a total net asset worth of $ 326.83 billion.

- Minimum investment: $ 0

- Expense ratio: 0.015 %

- Year-to-date return: – 24.02 %

- Five-year average return: 9.23 %

The stock of the fund started at $ 130.17. It remained bullish throughout the year and closed off the year at $ 165.32, representing a 27 % appreciation during the year. In 2022, the stock reversed its course and started a bearish run. From $ 165.32, the stock last closed at $ 124.36, representing a 24.7 % decline to date

The stock of the fund started at $ 130.17. It remained bullish throughout the year and closed off the year at $ 165.32, representing a 27 % appreciation during the year. In 2022, the stock reversed its course and started a bearish run. From $ 165.32, the stock last closed at $ 124.36, representing a 24.7 % decline to date

Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX)

The aim of Vanguard’s Total Stock Market Index Fund is to give investors exposure to all U.S. equities, including small-, mid-and large-cap growth and value stocks. This is an excellent fund if you want a diversified investment in a broad range of companies and markets. Get to know about best forex brokers for trading The Fund employs an indexing investment approach to track the performance of the CRSP US Total Market Index. The Fund invests by holding a collection of securities that approximates the Index. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | 0AAPL | 6.10 % |

| Microsoft Corp. | MSFT | 4.94 % |

| Amazon.com Inc. | AMZN | 2.77 % |

| Tesla Inc. | TSLA | 1.84 % |

| Alphabet Inc. Cl A | GOOGL | 1.65 % |

| Alphabet Inc. Cl C | GOOG | 1.46 % |

| UnitedHealth Group Inc. | UNH | 1.23 % |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.19 % |

| Johnson & Johnson | JNJ | 1.07 % |

| Exxon Mobil Corp. | XOM | 1.02 % |

Also, check out the best swing trading stocks. The fund was created in Nov 2000. It has a total net worth of $ 257.6 billion.

- Minimum investment: $ 3,000

- Expense ratio: 0.04 %

- Dividend Income: $ 0.38

- Year to date: – 23.07 %

- Five-year average return: 8.77 %

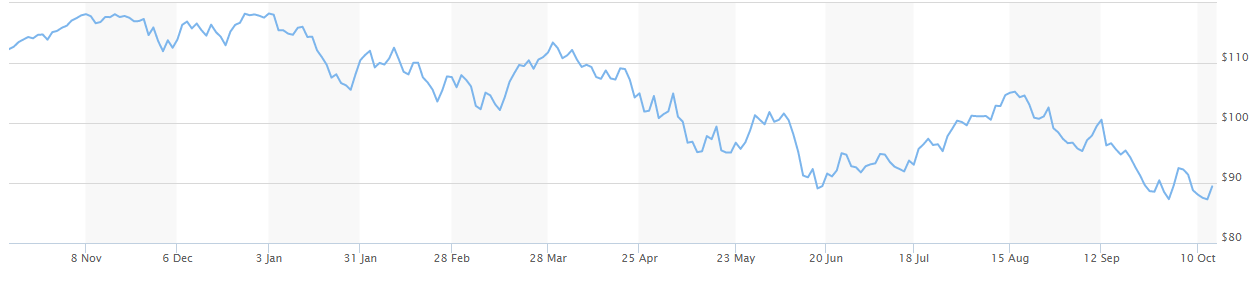

The stock started the year 2021 at $ 94.74. The stock remained bullish throughout 2021 and closed off the year at $ 117.56, representing a 24 % appreciation during the year. In 2022, the stock started at $ $117.56 but reversed its course. Following a downward trend, the stock last closed at $ 87.27 representing a 25.7 % decline to date. Investing in value stocks is a long-term investment.

The stock started the year 2021 at $ 94.74. The stock remained bullish throughout 2021 and closed off the year at $ 117.56, representing a 24 % appreciation during the year. In 2022, the stock started at $ $117.56 but reversed its course. Following a downward trend, the stock last closed at $ 87.27 representing a 25.7 % decline to date. Investing in value stocks is a long-term investment.

Schwab S&P 500 Index Fund (SWPPX)

Designed to compete directly with Vanguard and Fidelity index funds, the Schwab S&P 500 Index fund is a low-cost fund with no investment minimum. It invests in 500 of the leading U.S. companies and has exposure to about 80 % of U.S. market capitalization. The Fund generally will seek to replicate the performance of the index by giving the same weight to a given stock as the index does. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 7.18 % |

| Microsoft Corp. | MSFT | 5.81 % |

| Amazon.com Inc. | AMZN | 3.30 % |

| Tesla Inc. | TSLA | 2.06 % |

| Alphabet Inc. Cl A | GOOGL | 1.93 % |

| Alphabet Inc. Cl C | GOOG | 1.79 % |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.51 % |

| UnitedHealth Group Inc. | UNH | 1.45 % |

| Johnson & Johnson | JNJ | 1.26 % |

| Exxon Mobil Corp. | XOM | 1.20 % |

Cybersecurity stocks are also one of the best investment opportunities. The index was created in May 1997. It has a total net asset of $ 56.4 billion

- Minimum investment: $0

- Expense ratio: 0.02%

- Dividend Income: $ 0.86

- Year-to-date return: – 22.03 %

- Five-year average return: 9.42 %

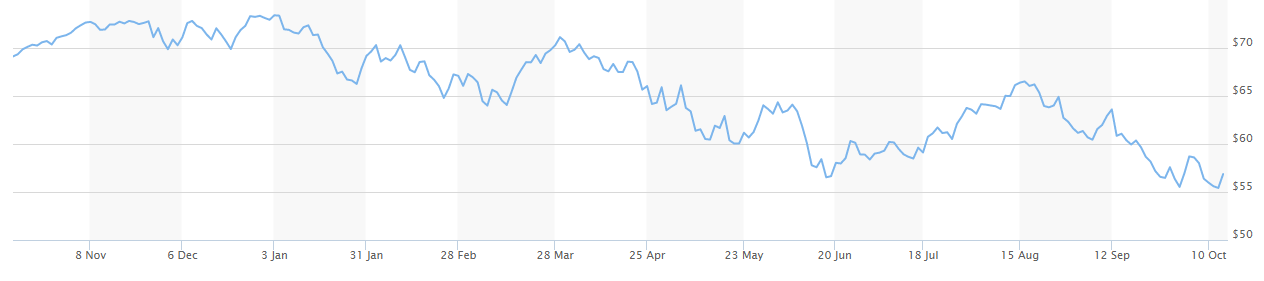

The year 2021 was marked by bullish performance. The fund started at $ 57.42 and closed off at $ 72.94. This represents a 27 % appreciation during the year. The fund started the year 2022 at a price of $ 73.13. Throughout the year, the fund’s price has been steadily declining and it last closed at $ 56.87. To date, the stock has declined by 22 %. Get to know the best vaccine stocks to invest in 2024.

The year 2021 was marked by bullish performance. The fund started at $ 57.42 and closed off at $ 72.94. This represents a 27 % appreciation during the year. The fund started the year 2022 at a price of $ 73.13. Throughout the year, the fund’s price has been steadily declining and it last closed at $ 56.87. To date, the stock has declined by 22 %. Get to know the best vaccine stocks to invest in 2024.

Schwab Total Stock Market Index Fund (SWTSX)

The Schwab Total Stock Market Index fund tracks the total return of the U.S. stock market based on the Dow Jones U.S. Total Stock Market Index. It’s a balanced fund with shares of large-cap, mid-cap, and small-cap U.S. securities. It is a straightforward, low-cost fund with no investment minimum. The Fund can serve as part of the core of a diversified portfolio. It offers simple access to the entire U.S. stock market in one fund. The index is designed to provide a comprehensive measure of large-cap, mid-cap, and small-cap U.S. equity securities. Investors are now looking for the finest solar energy stocks to invest in. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 6.07 % |

| Microsoft Corp. | MSFT | 4.91 % |

| Amazon.com Inc. | AMZN | 2.79 % |

| Tesla Inc. | TSLA | 1.74 % |

| Alphabet Inc. Cl A | GOOGL | 1.64 % |

| Alphabet Inc. Cl C | GOOG | 1.51 % |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.28 % |

| UnitedHealth Group Inc. | UNH | 1.22 % |

| Johnson & Johnson | JNJ | 1.07 % |

| Exxon Mobil Corp. | XOM | 1.01 % |

Get to know about RSI trading strategies. The fund was created in 1999. It has a total net asset value of $ 15.173 billion.

- Minimum investment: $ 0

- Expense ratio: 0.03 %

- Year-to-date return: – 18.05 %

- Five-year average return: 8.45 %

The stock of the fund started in the year 2021 at a price of $ 65.49. Throughout the year, the stock remained bullish and it closed off the year at $ 82.78, representing a 26 % appreciation during the year. In 2022, the stock remained bearish. From $ 82.78, at the start of the year, the stock declined to $ 63.38, representing a 23 % decline to date. Get to know the best EV stocks to invest in today.

The stock of the fund started in the year 2021 at a price of $ 65.49. Throughout the year, the stock remained bullish and it closed off the year at $ 82.78, representing a 26 % appreciation during the year. In 2022, the stock remained bearish. From $ 82.78, at the start of the year, the stock declined to $ 63.38, representing a 23 % decline to date. Get to know the best EV stocks to invest in today.

Schwab Fundamental US Large Company Index Fund (SFLNX)

Schwab’s Fundamental U.S. Large Company Index Fund aims to achieve results that track the Russell RAFI U.S. Large Company Index. This is a high-return fund with low expenses and a risk level that’s just slightly above average. The fund offers simple access to the largest U.S. companies based on fundamental measures. A straightforward, low-cost fund with no investment minimum. Offers contrarian investing and disciplined rebalancing through a systematic process based on an index with an established track record. Offers the potential for value and yield factor exposure. The Fund can serve as part of the core or complement to market-cap indexing and active management in a diversified portfolio. Tech stocks is also one of the best investment opportunity. The top 10 holdings of the index are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 4.26 % |

| Exxon Mobil Corp. | XOM | 2.98 % |

| Microsoft Corp. | MSFT | 1.96 % |

| Chevron Corp. | CVX | 1.82 % |

| JPMorgan Chase & Co. | JPM | 1.47 % |

| AT&T Inc. | T | 1.43 % |

| UnitedHealth Group Inc. | UNH | 1.33 % |

| Berkshire Hathaway Inc. Cl B | BRK.B | 1.25 % |

| Wells Fargo & Co. | WFC | 1.25 % |

| Verizon Communications Inc. | VZ | 1.21 % |

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased. The fund was created in 2007. It has a total net assets value of $ 6.058 billion.

- Minimum investment: $ 0

- Expense ratio: 0.25 %

- Year-to-date return: – 17.21 %

- Five-year average return: 8.74 %

The stock of the fund followed a bullish pattern throughout 2021. From a price of $ 18.77, the stock rose to $ 23.99 and closed at $ 22.63. Overall, the stock appreciated by 20.5 % throughout the year. In 2022, the stock picked up a bearish pattern. From $ 22.63, the stock last closed at $ 19.81, representing a 12.5 % decline to date. Get to know everything about high frequency trading.

The stock of the fund followed a bullish pattern throughout 2021. From a price of $ 18.77, the stock rose to $ 23.99 and closed at $ 22.63. Overall, the stock appreciated by 20.5 % throughout the year. In 2022, the stock picked up a bearish pattern. From $ 22.63, the stock last closed at $ 19.81, representing a 12.5 % decline to date. Get to know everything about high frequency trading.

Vanguard Mid-Cap Index Fund Admiral Shares (VIMAX)

The original Vanguard Mid-Cap Index is closed to new investors, but an Admiral Shares mutual fund and ETF are available. The fund tracks stocks with more volatility than larger companies, making it better suited to already diversified portfolios. The Fund seeks to track the performance of a benchmark index that measures the investment return of mid-capitalization stocks. The top 10 holdings of the fund are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Vanguard Market Liquidity Fund | 1.04 % | |

| Synopsys Inc. | SNPS | 0.87 % |

| Centene Corp. | CNC | 0.86 % |

| Cadence Design Systems Inc. | CDNS | 0.79 % |

| Devon Energy Corp. | DVN | 0.76 % |

| Corteva Inc. | CTVA | 0.73 % |

| Amphenol Corp. Cl A | APH | 0.72 % |

| Realty Income Corp. | O | 0.67 % |

| Motorola Solutions Inc. | MSI | 0.67 % |

| IQVIA Holdings Inc. | IQV | 0.66 % |

Also read:

The fund was created in Nov 2021. It has a total asset valuation of $ 47.5 billion.

- Minimum investment: $ 3,000

- Expense ratio: 0.05 %

- Year-to-date return: -26.05 %

- Five-year average return: 6.20 %

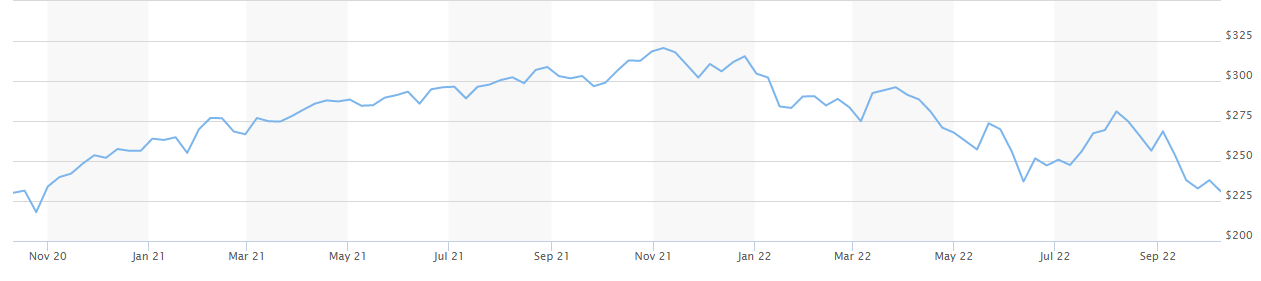

The stock of the index started the year 2021 at $ 256.4. It continued an upward trend throughout the year and closed at $ 315.46. Overall, the stock appreciated by 23 % during the year. In 2022, the stock started at $ 315.46 and picked up a bearish trend. It last closed at $ 230.99, representing a 27 % decline to date Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

The stock of the index started the year 2021 at $ 256.4. It continued an upward trend throughout the year and closed at $ 315.46. Overall, the stock appreciated by 23 % during the year. In 2022, the stock started at $ 315.46 and picked up a bearish trend. It last closed at $ 230.99, representing a 27 % decline to date Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Fidelity Total Bond Fund (FTBFX)

Fidelity’s Total Bond fund is a diversified fund that uses the Bloomberg Barclays U.S. Universal Bond Index as a guide. Its assets are invested in high-yield and emerging market classes, which increases both the risk and potential return. It is a core fixed-income fund for investors seeking income and a measure of protection from stock market volatility. The fund seeks income from a broad selection of fixed-income securities, with a core exposure to investment-grade bonds. This diverse allocation may help the fund add value in a variety of markets. The fund focuses on high-quality investments and invests at least 80% of assets in investment-grade bonds. It offers enhanced return potential and invests up to 20% of assets in below-investment-grade securities. The fund also balances return potential against risk—Co-managers seek to provide a conservative experience in line with an investor’s expectation of a core bond fund. If you are seeking a steady stream of income, you should invest in REIT stocks. The top 5 holdings of the fund are:

| COMPANY | TOTAL NET ASSETS |

| Corporate Notes/Bonds | 39.06 % |

| Government Agency Securities | 27.91 % |

| GNMA and Other Mtg Backed | 22.08 % |

| US$ Denominated Fgn. Gvt. | 2.85 % |

| Asset-Backed Securities | 1.38 % |

The fund has a total net asset worth of $ 29.53 billion invested in 6,192 different holdings, as on September 22, 2022. Its portfolio consists primarily of investment-grade bonds issued by U.S. firms and U.S. government bonds. It also holds positions in various types of mortgage-backed securities.

- Minimum investment: $ 0

- Expense ratio: 0.45 %

- Year-to-date return: -14.59 %

- Five-year average return: 1.42 %

The stock of the fund started in the year 2021 at a price of $ 11.32. The stock maintained a slow and steady decline throughout the year and closed the year at $ 11.06, representing a 2.3 % decline during the year. In 2022, the stock continued its downward trend and last closed at $ 9.11 representing a 17.6 % decline to date.

The stock of the fund started in the year 2021 at a price of $ 11.32. The stock maintained a slow and steady decline throughout the year and closed the year at $ 11.06, representing a 2.3 % decline during the year. In 2022, the stock continued its downward trend and last closed at $ 9.11 representing a 17.6 % decline to date.

Invesco QQQ Trust ETF (QQQ)

Invesco QQQ is an exchange-traded fund (ETF) that tracks the Nasdaq-100 Index. The Index includes the 100 largest non-financial companies listed on the Nasdaq based on market cap. The Fund will, under most circumstances, consist of all of the stocks in the Index. The Index includes 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market based on market capitalization. The Fund and the Index are rebalanced quarterly and reconstituted annually. It is rated the best-performing large-cap growth fund (1 of 328) based on total return over the past 15 years by Lipper, as of June 30, 2022. It is the 2nd most traded ETF in the US based on the average daily volume traded, as of Jun 30, 2022. The top 10 holdings of the fund are:

| COMPANY | SYMBOL | TOTAL NET ASSETS |

| Apple Inc. | AAPL | 13.54 % |

| Microsoft Corp. | MSFT | 10.41 % |

| Amazon.com Inc. | AMZN | 6.86 % |

| Tesla Inc. | TSLA | 4.56 % |

| Alphabet Inc. Cl C | GOOG | 3.64 % |

| Alphabet Inc. Cl A | GOOGL | 3.46 % |

| Meta Platforms Inc. | META | 2.98 % |

| NVIDIA Corp. | NVDA | 2.83 % |

| PepsiCo Inc. | PEP | 2.09 % |

| Costco Wholesale Corp. | COST | 2.04 % |

Invesco was incorporated in March 1999. Its total net asset worth is $ 147.8 billion.

- Expense ratio: 0.2 %

- Year-to-date return: – 29.28 %

- Five-year average return: 16.14 %

The stock of the fund started trading at a price of $ 313.74 in 2021. Throughout the year, the stock remained bullish and closed off the year at $ 397.85. Overall, the stock appreciated by 26.8 % during the year. In 2022, the stock reversed its course and started a bearish trend. From $ 394.85, the stock last closed at $ 259.9, representing a 34 % decline to date.

The stock of the fund started trading at a price of $ 313.74 in 2021. Throughout the year, the stock remained bullish and closed off the year at $ 397.85. Overall, the stock appreciated by 26.8 % during the year. In 2022, the stock reversed its course and started a bearish trend. From $ 394.85, the stock last closed at $ 259.9, representing a 34 % decline to date.

Should I Invest in Index Funds?

Before deciding to invest in index funds, it is important to understand how much risk you can take as an investor, what are your investment goals and how long you intend to invest. Also, it is important to consider the below factors before investing:

- Risk – Index funds offer low risk

- Expense Ratio – With index funds, the biggest advantage is that their expense ratio is very low comparatively.

- Returns – Returns from index funds are pretty much the same as that of the market index.

Index funds are a great way to get involved in the stock market, especially because of the low cost and less time needed. Always do your research about the funds you plan to invest in. You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy