Some companies issue preferred stocks to raise cash. Similar to bonds, preferred stocks are fixed-income securities. Preferred stocks get preferential treatment over common stocks when dividends stocks are distributed. referred stocks represent ownership in a company. But they are different from common stocks in many ways too.

What are Preferred Stocks?

Preferred stock is a hybrid financial instrument that offers the benefits of both common stock and bonds. It offers the stable and consistent income payments of bonds along with the equity ownership advantages of common stock. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

Types of Preferred Stocks

The basic types of preferred stocks are

- Cumulative Preferred stocks: For this type of preferred stock unpaid dividends accumulate for a future payment date

- Non-cumulative preferred stocks: These types of preferred stocks can skip a dividend without it accumulating for a future pay period.

- Participating in preferred stocks: This type of preferred stock has linked shareholder rewards to company performance. Therefore, when the company exceeds certain profit goals, shareholders may receive additional dividends.

- Convertible preferred stocks: This type of preferred stock can be exchanged for a number of common shares in the same company. This option only exists if the company issues both preferred stock and common stock.

- Callable preferred stocks: These are stocks that can be called, or bought back, before reaching maturity. This means that the company can buy back these preferred shares before they reach the quoted/stated return price.

- Perpetual preferred stock: This type of preferred stock has no fixed call date. In fact, a company usually issues this type of preferred stock with no intention of calling it in. Perpetual preferred shares usually function like common shares.

Get to know the best quantum computing stocks.

Preferred Stocks and Bonds – Differences and Similarities

The preferred stock offers regular payments in the form of dividends. These payments are similar to the interest payments earned on bonds. Similar to bonds, preferred stock shares are issued at par value. By using the stock signals, you can avoid hours of technical analysis to understand the market.

But preferred stocks are not a debt, like bonds, that must be repaid. Income from preferred stock gets preferential tax treatment, since qualified dividends may be taxed at a lower rate than bond interest.

Also, preferred stock dividends do not have a 100% guarantee like the bond interest payments. The company can choose to reduce dividends or pay no dividend at all in line with the company’s financial position. Also check out the best swing trading stocks.

Difference between Preferred and Common Stock

| Common Stock | Preferred Stock |

| Common stockholders have voting rights | Preferred stockholders do not have voting rights |

| Common Stockholders receive dividends according to the company’s performance | Preferred stockholders are given preference when distributing dividends and receiving a fixed dividend. |

| Common stockholders have no guarantee of return on investment | Preferred stockholders have a fixed return over investment |

| In case of bankruptcy, common stockholders are paid at the end | In case of a bankruptcy, preferred stockholders are paid before common stockholders |

Bank stocks usually reflect the economic performance, making them cyclical stocks.

Downsides of Investing in Preferred Shares

Investors can convert their preferred stock into common stock at a special rate called the conversation ratio. This way the investors can take advantage of the capital appreciation.

Preferred stocks come with their set of downsides which are very important for every investor to know before planning to invest in them. Here we have listed the shortcomings of investing in preferred stocks:

- Fixed Dividend Rate – The dividend of preferred stocks is set at the time of sale. This rate remains the same until the stock matures, which is usually 30 years.

- Limited capital appreciation potential – The share price of preferred stock usually remains fairly steady. Therefore, there is little chance of profiting from an increase in share value when you sell the stock. Investing in value stocks is a long-term investment.

- Call Date – The call date is when a company calls back the shares and eliminates them. These are also limited duration securities which means that preferred shares usually are not long-term investments like common stock.

- Difficulty in understanding – Information on specific preferred stocks can be difficult to find and hard to understand. Usually, the information available is maturity dates, stock symbols, etc.

Get to know the best vaccine stocks to invest in 2024.

List of Best Preferred Stocks for 2024

Preferred stocks are a good and stable investment. Here we have compiled a list of 10 preferred shares and Preferred hare funds which are offering an excellent return to investors:

Compass Diversified Holdings 7.25% Series A Perpetual Preferred Shares (NYSE: CODI.PRA)

Compass Diversified is a publicly-traded holding company that provides shareholders with unique access to niche middle-market businesses. This is an attractive segment of the market historically reserved for private equity or other legacy players. Cybersecurity stocks is also one of the best investment opportunity.

This preferred stock was offered at a price of $ 25.

Compass diversified recently published its first-quarter results for 2022:

- Net sales were reported at $510.5 million, an increase of 25%

- Net income was reported to be $29.7 million, an increase of 35%

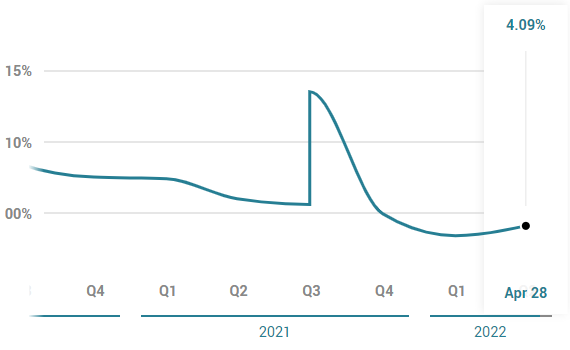

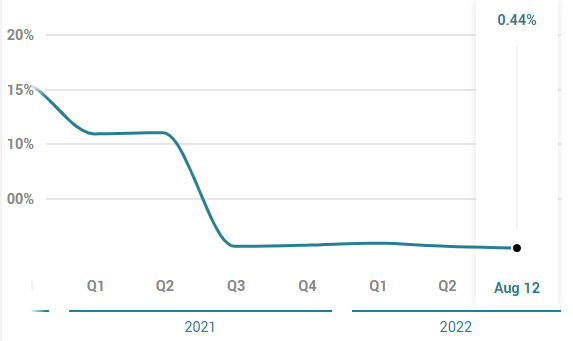

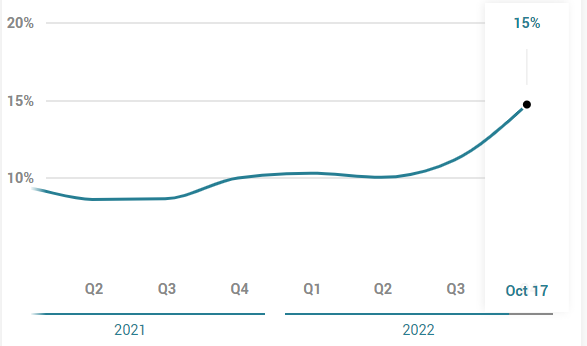

Compass Diversified offers a dividend yield of 4.41 %. The below chart shows the dividend yield over time:

Landmark Infrastructure Partners LP Series A Cumulative Redeemable Perpetual Preferred Units (Nasdaq: LMRKP)

Landmark Infrastructure Partners is engaged in the acquisition, development, ownership, and management of a portfolio of real property interests and infrastructure assets that are leased to companies in the wireless communication, outdoor advertising, and renewable power generation industries. Investors are now looking for the finest solar energy stocks to invest in.

This preferred stock was offered at a price of $ 25.47

Landmark Infrastructure shared its quarterly report for the three months ending September 2021:

- Revenue of $ 17.4 million was recorded

- A net income of $ 2.1 million was reported

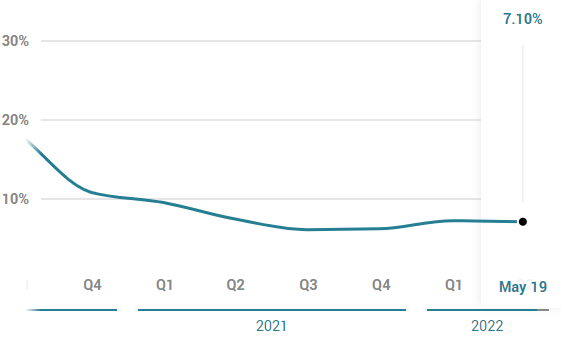

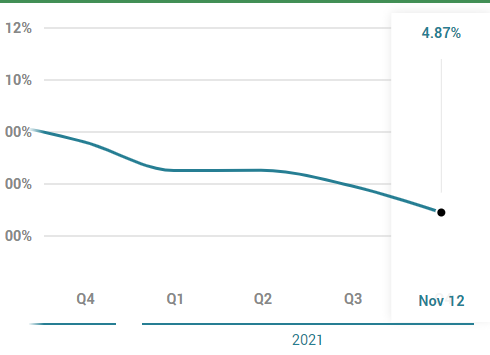

Landmark Infrastructure offers a dividend yield of 4.85 %. The below chart shows the dividend yield over time:

Get to know about:

Energy Transfer Operating LP 7.625% Series D Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (NYSE: ETP.PRD)

Energy Transfer Operating LP is one of the largest and most diversified midstream energy companies in the U.S. It has more than 90,000 miles of pipeline, transporting oil and gas products through 38 states. Get to know the best EV stocks to invest in today.

This preferred stock was offered at a price of $ 25.

Energy Transfer Partner recently shared their quarterly report:

- Net Income was reported to be $ 1.5 million

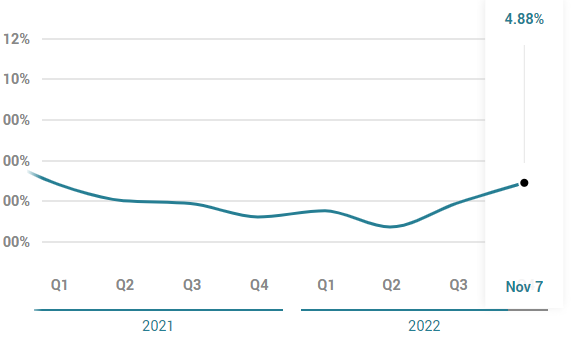

Energy Transfer offers a dividend yield of 6.86 %. The below chart shows the dividend yield over time:

There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

Global Ship Lease Inc. 8.75% Series B Cumulative Redeemable Perpetual Preferred Shares (NYSE: GSL.PRB)

Global Ship Lease is a leading independent owner of containerships with a diversified fleet of mid-sized and smaller containerships. It also focuses on the operation and technical management of each vessel, such as crewing, provision of lubricating oils, maintaining the vessel, periodic dry-docking, and performing work required by regulations. Tech stocks is also one of the best investment opportunity.

As of March 1, 2022, Global Ship Lease owned 65 containerships

Global Ship Lease reported its first-quarter report for the year 2022:

- Reported operating revenue of $153.6 million

- Net Income of $ 70.1 million

The company declared a cash dividend of $0.546875 for 8.75% Series B Cumulative Redeemable Perpetual Preferred shareholders.

InfraCap REIT Preferred ETF (PFFR)

Infrastructure Capital Advisors, LLC (ICA) is a registered investment advisor that manages four ETF funds and a series of a hedge funds.

- InfraCap Equity Income Fund ETF

- InfraCap Equity Income Fund ETF

- InfraCap MLP ETF

- InfraCap REIT Preferred Stock ETF

The InfraCap REIT Preferred ETF is the only ETF offering a diversified investment in preferred securities issued by Real Estate Investment Trusts (REITs). With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

InfraCap REIT Preferred ETF offers a dividend yield of 7.03 %.

InfraCap REIT Preferred ETF’s share is currently trading at $ 20.49. The below chart shows the performance of the fund’s share in the stock market. After following a bullish trend during the majority of 2020 and the whole of 2021, the stock changed course during 2022. In 2022, the ETF’s share has been on a bearish trend.

Also read: Forex trading vs Stocks trading.

Also read: Forex trading vs Stocks trading.

Innovative Preferred Plus Fund (IPPPX)

The fund’s investment strategy is two-fold:

- Preferred securities: the fund pursues its objective by investing in issues of preferred securities and debt securities that the Adviser believes to be undervalued,

- Credit spread options on the S&P 500 Index: the fund may expose up to 10% of its assets to a credit spread options strategy.

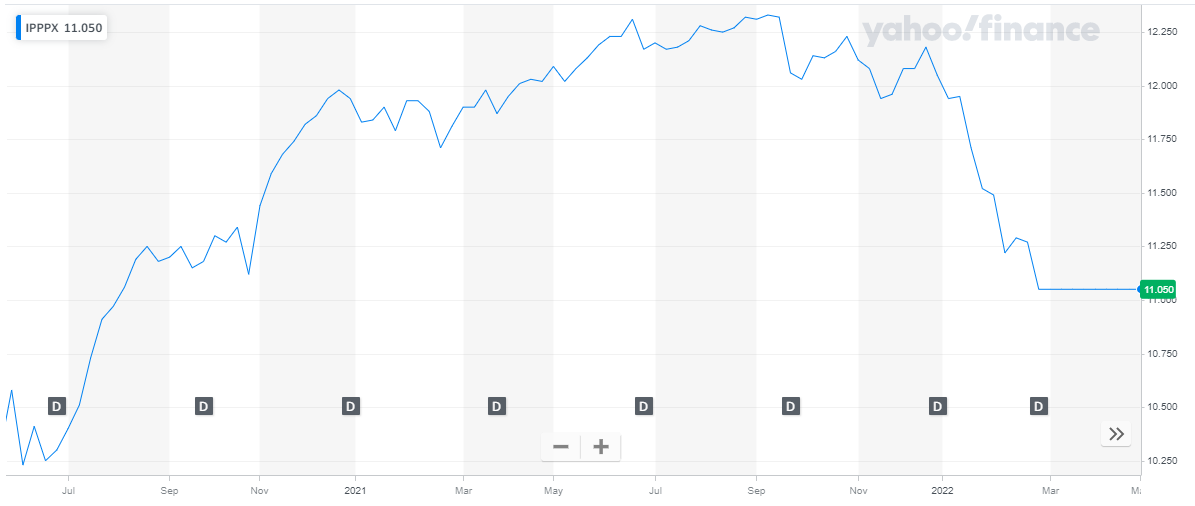

The fund has a total of $ 14.3 million in assets. The year-to-date return on this ETF is negative 6.56 %.

The below chart shows the performance of IPPPX stock on the market. The stock continued to rise during 2021 but reversed its course during 2022. To date, the stock has declined by 8.33 %.

Get to know everything about high frequency trading.

Get to know everything about high frequency trading.

Principal Capital Securities Fund (PCSFX)

The investment seeks to provide current income. The fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in capital securities at the time of purchase. It may invest up to 100% of its assets in below investment grade (sometimes called “junk”) preferred securities. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

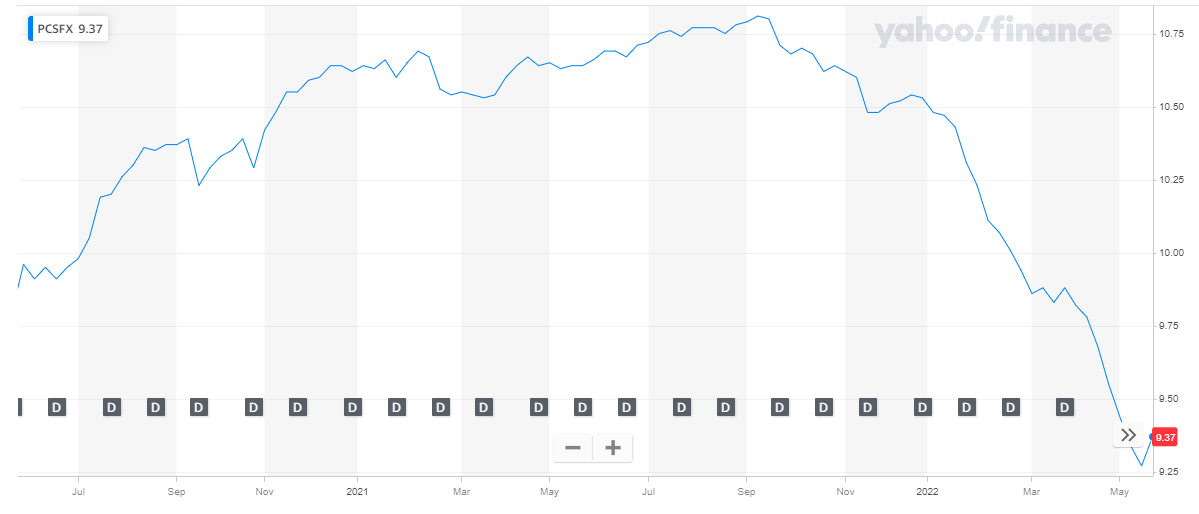

This fund has a total of $ 1.25 billion in assets. Its year-to-date return is negative 5.25 %.

The below chart shows the performance of the fund’s stock in the market. The stock has been seen following a rising pattern for the majority of 2020 and throughout 2021. But the stock started declining in 2022. To date, the stock has declined by 11 %.

To give investors an idea where to start and which companies to look for investment, we have compiled a list of top best oil and gas ETFs to buy now.

To give investors an idea where to start and which companies to look for investment, we have compiled a list of top best oil and gas ETFs to buy now.

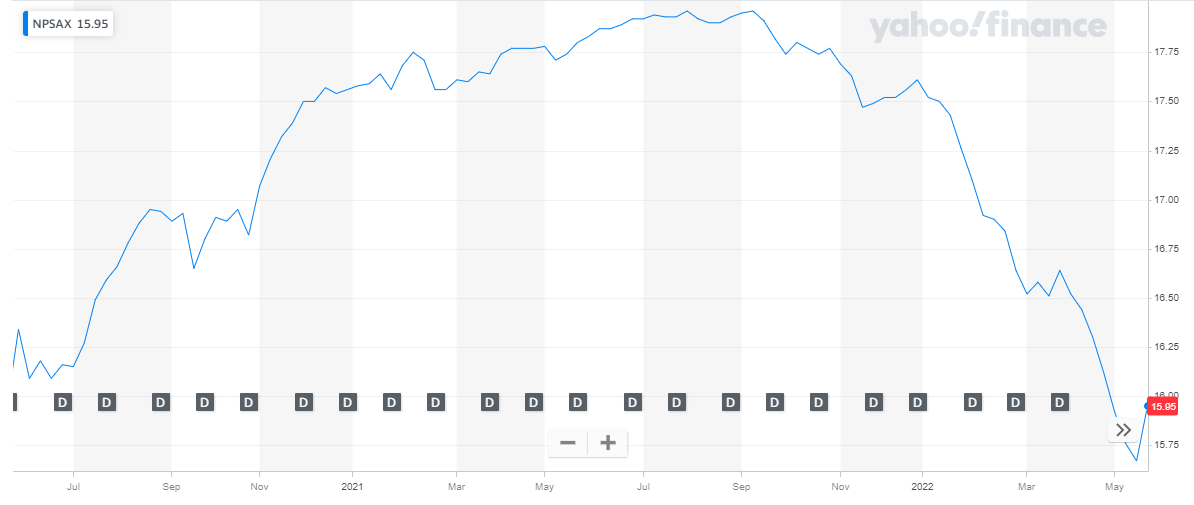

Nuveen Preferred Securities & Income Fd (NPSAX)

Nuveen Preferred Securities & Income Fd follows an income strategy that invests across the credit quality spectrum in both $25 par retail and $1000 par institutional preferred and other income-producing securities from the U.S. and non-U.S. issuers and seeks to provide a high level of current income and total return.

This fund offers broad market opportunity via its specialized team which actively invests across the global credit spectrum in both retail and institutional preferred securities and income issues. Moreover, this fund offers a risk and reward balance to investors by following a research-driven approach that optimizes value and minimizes risk in order to enhance yields and long-term performance.

This fund has a total of $ 5 billion in assets. Its year-to-date return is a negative 7.48%.

The below chart the performance of the fund’s stock in the stock market. 2021 was a good year for the fund’s stock. The stock fully recovered to the pre-Covid levels and maintained that level throughout the year.

In 2022, the fund’s stock started declining. To date, the stock has declined by 9.4 %

If you are seeking a steady stream of income, you should invest in REIT stocks.

If you are seeking a steady stream of income, you should invest in REIT stocks.

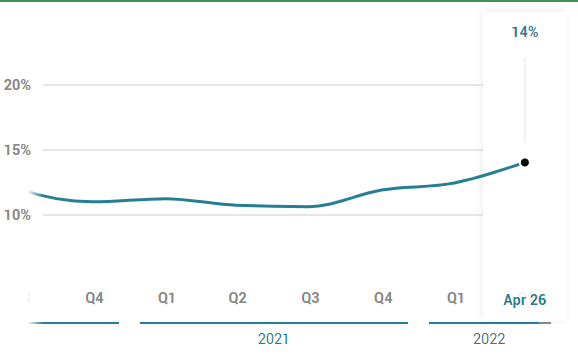

Cherry Hill Mortgage Preferred A

Cherry Hill Mortgage Investment Corporation is a real estate finance company that acquires, invests in, and manages residential mortgage assets in the United States.

In the recent quarter, the company declared a dividend of $ 0.5125 per share for the preferred shareholders.

In the recent quarterly report, Cherry Hill Mortgage reported:

- Total income of $ 36.1 million

- Net Income of $ 28.7 million

Cherry Hill Mortgage offers a dividend yield of 15.56 %.

The below chart shows the dividend declared over the past few quarters.

Get to know the best regional bank stocks.

Global Net Lease Preferred Stocks

Global Net Lease, Inc. is a real estate investment trust that focuses on acquiring and managing a globally diversified portfolio of strategically-located commercial real estate properties.

The company recently published its first-quarter results for 2022:

- Revenue increased to $ 97.1 million, an increase of 8.7 % from the first quarter of 2021

- Net income grew to $ 5.5 million as compared to the loss reported in the first quarter of 2021

- Liquidity was reported at $ 225.9 million

Global Net Lease offers two types of Preferred stocks:

- 7.25% Series A Cumulative Redeemable Perpetual Preferred Stock Dividend

| Quarterly, in Arrears, per Share Amount | Date Declared | Record Date | Payable Date |

| $0.453125 | 3/24/2022 | 4/8/2022 | 4/18/2022 |

- 6.875% Series B Cumulative Redeemable Perpetual Preferred Stock Dividend

| Quarterly, in Arrears, per Share Amount | Date Declared | Record Date | Payable Date |

| $0.4296875 | 3/24/2022 | 4/8/2022 | 4/18/2022 |

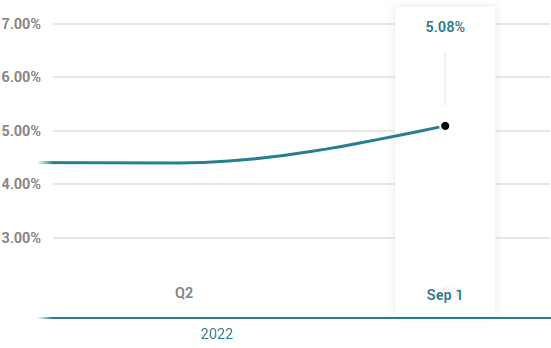

Safe Bulkers Inc. Series-D

Safe Bulkers is an international provider of marine dry bulk transportation services, transporting bulk cargoes, particularly coal, grain, and iron ore, along international shipping routes for some of the globe’s most prominent suppliers of marine dry bulk transportation services. The company has 44 vessels and 4.5 million deadweight tons.

Safe Bulkers Inc. Series-D preferred stock was initially offered at a price of $ 25. It pays dividend quarterly

In the recent quarterly report, the company reported:

- Net Revenue of $ 91.6 million, as compared to $ 77 million during the previous year’s same period

- Net Income was reported at $ 50.3 million, as compared to $ 36.4 million during the previous year’s same period

- Earnings per share were reported at $ 0.4

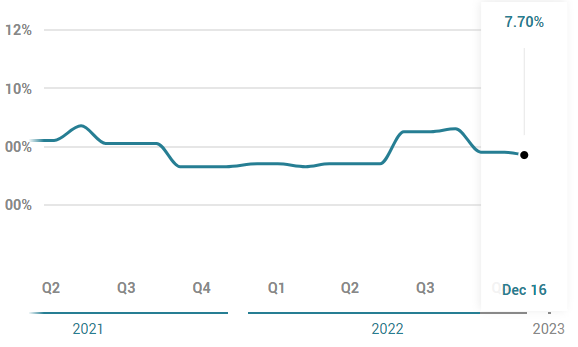

Safe Bulkers Inc has a dividend yield of 7.41 %. The below chart shows the dividend yield for the past two quarters:

Gabelli Utility Trust Series-C (GUT.PC)

The Gabelli Utility Trust is a closed-ended equity mutual fund managed by Gabelli Funds, LLC. The fund invests in stocks of companies providing products, services, or equipment for the generation or distribution of electricity, gas, water, telecommunications services, and infrastructure operations.

The fund is focused on the predictable and low-volatility utility sector; hence it is considered one of the safest investments.

The top 5 holdings of the Fund are:

| HOLDINGS | WEIGHT |

| NEXTERA ENERGY INC | 4.3% |

| WEC ENERGY GROUP INC | 3.5% |

| XCEL ENERGY INC | 2.9% |

| EVERSOURCE ENERGY | 2.7% |

| EVERGY INC | 2.5% |

The fund has a Net Asset Value of $ 320.9 million. Its year-to-date return is – 15.66 and the 5-year performance shows a 1.64 % return.

The stock was offered at a price of $ 25 and is currently trading at $ 24.97.

The Gabelli Utility Trust has a dividend yield of 8.86 %. It pays dividends monthly. The below chart shows the dividend yield for the past two quarters:

Costamare Inc. – Series B (CMRE.PB)

Costamare owns and operates containerships, which it leases to liner companies all over the world. As of its latest filings, the company had a fleet of 76 containerships with a total capacity of approximately 557,400 twenty-foot equivalent units. The company also owns 45 dry bulk vessels with a total capacity of approximately 2,435,500 deadweight tons. Costamare is one of the highest-quality companies in the shipping industry.

In the recent second-quarter report, the company reported:

- Net Income available to common stockholders of $ 114.1 million as compared to $ 82.8 million in Q2 2021

- Earnings per Share of $ 0.92 as compared to $ 0.67 in Q2 2021, representing an increase of 37 %.

The stock of Costamare Inc. – Series B was introduced at a price of $ 25. It is currently trading at $ 25.16

Costamare Inc. has a dividend yield of $ 4.86. It pays dividend quarterly. The below chart shows the dividend yield for the past few quarters:

Gladstone Commercial Corporation – Series E (GOODN)

Gladstone Commercial Corporation is a real estate investment trust, or REIT, that specializes in single-tenant and anchored multi-tenant net-leased industrial and office properties across the U.S. The trust targets primary and secondary markets that possess favorable economic growth trends, growing populations, strong employment, and robust growth trends. The trust’s stated goal is to pay shareholders monthly distributions, which it has done for more than 17 consecutive years. Gladstone owns over 100 properties in 24 states that are leased to about 100 unique tenants and has a market capitalization of $712 million.

Gladstone Commercial Corporation – Series E preferred stock was introduced at $ 25. It is currently trading at $ 21.12.

In the recent second-quarter report, the company reported:

- Total Operating Revenues of $ 36.4 million

- Net Income was reported at $ 1.6 million

Gladstone Commercial Corporation pays dividends monthly. It currently has a dividend yield of 9.19 %. The below chart shows the dividend yield for the past few quarters:

Höegh LNG Partners LP – Series A (HMLP.PA)

Höegh LNG Partners LP owns, operates, and acquires floating storage and regasification units (FSRUs), liquefied natural gas (LNG) carriers, and other LNG infrastructure assets under long-term charters. The company also offers ship management services. As of its latest reports, the company had a fleet of five FSRUs.

On May 25th, 2022, HMLP announced it entered into a definitive merger agreement with Höegh LNG Holdings Ltd. (the parent company), under which Höegh LNG will acquire, for cash, all the outstanding publicly held common units of the partnership.

In the recent quarterly report, the company reported:

- Time Charter Revenues were reported at $ 36.9 million as compared to $ 34.7 million of time charter revenues for the second quarter of 2021

- Net Income was reported at $ 13.1 million, as compared to $ 2.6 million during the second quarter of 2021

Höegh LNG Partners LP – Series A preferred stock was introduced at $ 25. It is currently trading at $ 23.05.

Höegh LNG Partner pays dividend quarterly. It currently has a dividend yield of 0.43 %. The below chart shows the dividend yield for the past few quarters:

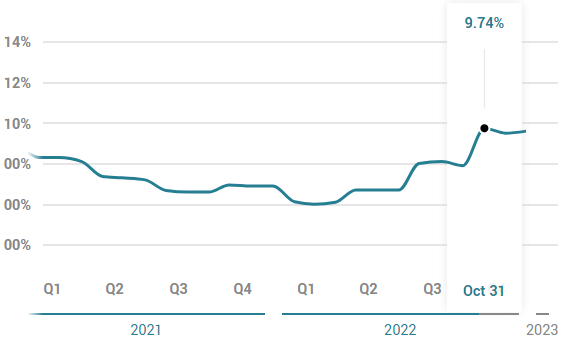

Global Net Lease – Series A (GNL.PA)

Global Net Lease is a publicly traded REIT listed on the NYSE focused on acquiring a diversified global portfolio of commercial properties, with an emphasis on sale-leaseback transactions involving single tenants, mission-critical income-producing net-leased assets across the United States, Western and Northern Europe. The company owns 300 properties, enjoying an ample occupancy of 98.7%, with a weighted average remaining lease term of 8.4 years.

Global Net Lease – Series A preferred stock was introduced at $ 25. It is currently trading at $ 21.73

In the recent quarterly report, the company reported:

- Total Revenue from Tenants was reported at $ 95.2 million, as compared to $ 99.6 million during the previous year’s same period

- Net Loss was reported at $ 0.716 million

- Loss per share was reported at $ 0.06

Global Net Lease has a dividend yield of 14.61 %. It pays dividend quarterly. The below chart shows the dividend yield for the past few quarters:

iShares Preferred and Income Securities ETF (PFF)

The iShares Preferred and Income Securities ETF seeks to track the investment results of an index composed of U.S. dollar-denominated preferred and hybrid securities.

This ETF provides exposure to U.S. preferred stocks, which have characteristics of bonds (pay a fixed dividend) and stocks (represent ownership in a company). It also gives access to the domestic preferred stock market in a single fund. And it is used to pursue income that can be competitive with high-yield bond

s.

The total Net Assets of the preferred stock ETF is $ 12.5 billion. It has an expense ratio of 0.45 %.

Its performance table is as below:

| 1 year | 3 years | 5 years | 10 years | Since Inception | |

| NAV | -8.99 % | 4.95 % | 1.64 % | 3.09 % | 3.38 % |

| Market Price | -8.96 % | 4.65 % | 1.65 % | 3.08 % | 3.38 % |

| Benchmark | -8.66 % | 5.48 % | 2.28 % | 3.73 % | 3.91 % |

| Fund Characteristics | |

| Beta vs. S&P 500 (3y) | 0.56 |

| Standard Deviation | 13.81 % |

| Price to Earnings | 9.38 |

| Price to Book Ratio | 1.03 |

VanEck Vectors Preferred Securities ex Financials ETF

The VanEck Preferred Securities ex Financials ETF (PFXF) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the ICE Exchange-Listed Fixed & Adjustable Rate Non-Financial Preferred Securities Index (PFAN), which is intended to track the overall performance of U.S. exchange-listed hybrid debt, preferred stock and convertible preferred stock issued by non-financial corporations.

The total Net Assets of the preferred stock ETF is $ 1.1 billion. It has an expense ratio of 0.4 %.

Its performance table is as below:

| Month End as of 04/03/23 | 1 MO | 3 MO | YTD | 1 YR | 3 YR | 5 YR | 10 YR | LIFE |

| PFXF (NAV) | 0.60 % | -2.81 % | 7.26 % | -2.50 % | 4.32 % | 4.03 % | 4.19 % | 4.57 % |

| PFXF (Share Price) | 0.47 % | -2.84 % | 6.75 % | -2.25 % | 4.34 % | 3.96 % | 4.17 % | 4.56 % |

| PFAN** (Index) | 0.59 % | -2.74 % | 7.27 % | -1.75 % | 4.80 % | 4.45 % | 4.33 % | 4.72 % |

| Performance Differential (NAV – Index) | 0.01 % | -0.07 % | -0.01 % | -0.75 % | -0.48 % | -0.42 % | -0.14 % | -0.15 % |

| Fund Characteristics | |

| Inception Date | 07/16/2012 |

| 30-Day SEC Yield | 6.8 % |

| Number of Holdings | 116 |

Innovator ETFs Trust II (EPRF)

The Innovator S&P Investment Grade Preferred ETF is based on the S&P U.S. High-Quality Preferred Stock Index, which selects floating, variable and fixed-rate investment grade preferred issues (BBB- or higher) from U.S. listed preferred stocks on a quarterly basis.

The total Net Assets of the preferred stock ETF is $ 113.7 million. It has an expense ratio of 0.47 %.

Its performance table is as below:

| 1 year | 3 years | 5 years | 10 years | Since Inception | |

| ETF NAV | 6.11 % | -1.32 % | -2.08 % | 1.03 % | 1.01 % |

| ETF Closing Price | 5.88 % | -1.11 % | -2.59 % | 1.08 % | 0.96 % |

| S&P U.S. High-Quality Preferred Index | 6.32 % | -0.99 % | -1.73 % | 1.43 % | 1.49 % |

| S&P U.S. Preferred Stock Index | 6.39 % | -0.17 % | 1.82 % | 2.50 % | 2.73 % |

| Fund Characteristics | |

| Dividend Yield | 5.65 % |

| SEC 30-Day Yield | 6.1 % |

| Weighted Premium / Discount | -14.43 % |

Global X SuperIncome Preferred ETF (SPFF)

The Global X SuperIncome Preferred ETF (SPFF) invests in 50 of the highest-yielding preferred stocks in the United States.

The Global X SuperIncome Preferred ETF (SPFF) seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Global X U.S. High Yield Preferred Index.

The total Net Assets of the preferred stock ETF is $ 186.3 million. It has an expense ratio of 0.48 %.

Its performance table is as below:

| 1 year | 3 years | 5 years | 10 years | Since Inception | |

| NAV | -10.79 % | 5.09 % | 1.25 % | 1.78 % | 2.19 % |

| Market Price | -10.17% | 5.35 % | 1.55 % | 1.08 % | 2.42 % |

| Benchmark | -10.4 % | 5.64 % | 1.72 % | 2.37 % | 2.79 % |

| Fund Characteristics | |

| Dividend Yield | 6.41 % |

| SEC 30-Day Yield | 6.44 % |

| 12-month trailing yield | 6.41 % |

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy