As the demand for cleaner energy sources rises, alternate energy sources are on the rise. Despite being a non-renewable energy source, natural gas is a cleaner, cheaper, and less carbon-intensive alternative to coal. The International Energy Agency sees natural gas demand rising 31% by 2040.

Oil stocks are one of the riskier yet most profit-generating sectors. No doubt oil is the largest energy market but natural gas also plays an important role.

Best Natural Gas Stocks to Buy in 2023

Some of the best natural gas stocks for investors to consider buying include:

| Sr. | Company Name | Symbol | Market Capitalization | Price (As on 26th July 2022) |

| 1 | Exxon Mobil Corporation | XOM | $ 382 Billion | $ 89.63 |

| 2 | ConocoPhillips (COP) | COP | $ 119.8 Billion | $ 91.09 |

| 3 | EOG Resources (EOG) | EOG | $ 62.24 Billion | $ 103.75 |

| 4 | Pioneer Natural Resources Company | PXD | $ 53.82 Billion | $ 218.58 |

| 5 | Kinder Morgan | KMI | $ 40.4 Billion | $ 18 |

| 6 | Cheniere Energy | LNG | $ 37 Billion | $ 144.16 |

| 7 | EQT Corporation | EQT | $ 16.78 Billion | $ 45.57 |

| 8 | Ovintiv Inc. | OVV | $ 12.26 Billion | $ 46.13 |

| 9 | Chesapeake Energy Corporation | CHK | $ 11.69 Billion | $ 92.19 |

| 10 | CNX Resources Corporation | CNX | $ 3.78 Billion | $ 19.35 |

Exxon Mobil Corporation

Exxon Mobil Corporation

Exxon Mobil Corporation is an American multinational oil and gas corporation, with its headquarters in Texas. The Company’s principal business involves the exploration for, and production of, crude oil and natural gas, and the manufacture, trade, transport, and sale of crude oil, natural gas, petroleum products, petrochemicals, and a range of specialty products. The Company’s segments include Upstream, Downstream, and Chemical. ETFs offer a low-cost option to get exposure to oil and gas ETFs.

Recently, ExxonMobil began selling commercial volumes of certified natural gas after MiQ, an independent validator, certified the company’s assets in the Permian Basin with an “A” grade – the highest recognition possible – for its methane and emissions-reduction processes and technology applications. The company plans to expand the certification process to other operations in the United States.

Exxon Mobil Corporation announced the first-quarter 2022 earnings report:

- Natural gas production available for sale, million cubic feet per day was reported to be 8.45 mfcd

- Net Profit was reported to be $ 5.5 billion

- Earnings per share were reported to be $ 1.28 share

Also check out:

Exxon Mobil has a market capitalization of $ 382 billion. The share of the company is currently trading at $ 90.78. The stock has been on a bullish trend during the past years.

In 2021, the stock went from $ 41.22 to 61.19, representing a 48 % increase during the year.

In 2022, the stock went from $ 61.19 to $ 90.78 to date, representing a 48 % increase to date.

In the past eighteen months, the Exxon Mobil share has almost doubled in value.

The below chart shows the stock performance of Exxon Mobil for the past two years.

Conoco Philips

Conoco Philips

ConocoPhillips is one of the world’s largest independent E&P companies based on production and proved reserves. Conoco Philips is based in Houston and operates in 14 countries.

Conoco Philips reported its first quarter result for the year 2022:

- Total Natural Gas production was reported at 3,253 mmcfd

- Total revenue was reported to be $ 19.3 billion

- Net Income was reported at $ 5.8 billion

- Earnings per share were reported to be $ 4.41

Conoco Philips has a market capitalization of $ 119.7. Its share is trading at a price of $ 92.56.

For the past two years, the shares of Conoco Philips is on a bullish trend. After hitting the peak of $ 118.12, in May 2022, the stock reversed its course and started declining. Learn about Best Day Trading Stocks

In 2021, the stock went from $ 39.99 to $ 72.18, representing an 80 % increase in share value.

During the current year, the stock went from $ 72.18 to $ 92.56, representing a 28 % increase in value.

The below chart shows the stock performance of Conoco Philips for the past two years.

EOG Resources

EOG Resources

EOG Resources is a company that explores, develops, produces, and markets crude oil, natural gas liquids, and natural gas. It uses 3D seismic, core analysis, and micro-seismic technology to develop proprietary Petro-physical models. Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

EOG Resources recently reported its first quarter financial results for 2022:

- Natural Gas Production was reported at 1,458 mmcfd

- Total Revenue was reported at $ 3.9 billion

- Net Income was reported at $ 390 million

- Earnings per share were reported at $ 0.67

EOG Resources has a market capitalization of $ 62.9 billion. The share of the company is currently trading at $ 107.45. The share of EOG Resources has been on a bullish run for the past two years. The stock hit the peak of $ 144 in May 2022 and since then it has been declining.

Also, learn about top shipping stocks in 2023.

In 2021, the stock went from $ 49.87 to $ 88.83, representing a 78 % appreciation during the year.

In 2022, the stock went from $ 88.83 to $ 107.45, to date. This represents a 22 % increase in share value, to date.

The below chart shows the stock performance of EOG Resources for the past two years.

Also check out Best Forex Brokers for Trading

Also check out Best Forex Brokers for Trading

Pioneer Natural Resources Company

Pioneer Natural Resources Co. is an independent top-tier oil and gas exploration and production company. It has a proven track record of returning good value to its investors. The company has production and resource potential in low-risk, predictable basins in the United States. It carries multi-year drilling inventory in its core operating areas and is part of the S&P 500 index.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Pioneer’s dividend yield exceeds all S&P 500 index companies. It is one of the highest dividends-paying companies on the index.

Pioneer Natural Resources has recently reported its earnings report for the first quarter of 2022:

- Net Income was reported at $ 2 billion

- Earnings per share as reported at $ 7.85

Pioneer Natural has a market capitalization of $ 54.5 billion. The share of the company is trading at a price of $ 224.89. The share has been on a bullish run for the past two years. After hitting the peak of $ 280, the share has dropped down a bit.

If you have entered the crypto investment market, you should explore crypto staking platforms.

In 2021, the stock went from $ 113.89 to $ 181.88, representing a 60 % increase in share value.

In 2022, the stock went from $ 181.88 to $ 224.89, representing a 24 % increase in share value to date.

The below chart shows the stock performance of Pioneer Natural Resources for the past two years.

Get to know about Best Trading and Forex Signal Providers

Get to know about Best Trading and Forex Signal Providers

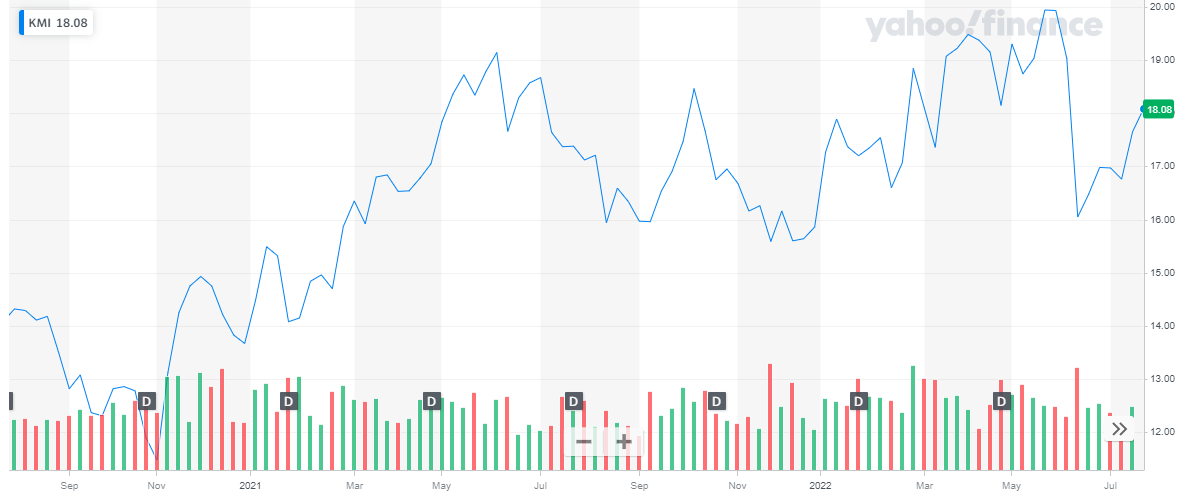

Kinder Morgan

Kinder Morgan is one of the largest energy infrastructure companies in North America. They own an interest in and/ or operate approximately 83,000 miles of pipelines and 144 terminals. Their pipelines transport natural gas, gasoline, crude oil, carbon dioxide (CO2), and more. Its terminals store and handle renewable fuels, petroleum products, chemicals, vegetable oils, and other product. There are many stock advisory services that recommends few of the best stocks to its members and subscribers.

Kinder Morgan supplies 40 % of the pipes that supply natural gas throughout the US. Also, it is the largest energy infrastructure company listed on the S&P index.

The company recently reported its second quarter report for the year 2022:

- Net Income was reported at $ 635 million

- Earnings per share were reported to be $ 0.28 share

Kinder Morgan has a market capitalization of $ 40.6 billion. The share of the company is trading at $ 18.1. The stock has remained pretty volatile in the past two years. Get to know about Hydrogen stocks, that are companies focusing on the production of hydrogen fuel cells.

Overall, in 2021, the stock appreciated by 16 %. The stock started off the year at $ 13.67 and closed off at $ 15.86.

In 2022, the stock started off at $ 15.86 and has appreciated by 13.9 % to date.

The below chart shows the stock performance of Kinder Morgan for the past two years.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

Cheniere Energy

Cheniere Energy, Inc. is an energy infrastructure company primarily engaged in LNG-related businesses. The Company provides clean, secure LNG to integrated energy companies, utilities, and energy trading companies worldwide. The Company owns and operates two natural gas liquefaction and export facilities:

- Sabine Pass LNG – It is located in Cameron Parish, Louisiana, which has natural gas liquefaction facilities consisting of six operational natural gas liquefaction Trains for a total production capacity of approximately 30 million tons per annum (mtpa) of LNG (the SPL Project)

- Corpus Christi LNG terminal – It owns and operates three Trains for a total production capacity of approximately 15 mtpa of LNG.

In addition, the Company operates a 21.5-mile natural gas supply pipeline that interconnects the Corpus Christi LNG terminal with several interstates and intrastate natural gas pipelines. By using the stock signals, you can avoid hours of technical analysis to understand the market.

Cheniere Energy, Inc. recently announced its financial results for the first quarter of 2022:

- Revenues were reported at $ 7.5 billion

- Net loss was reported at $ 865 million

Cheniere Energy has a market capitalization of $ 37.23 billion. Its share is trading at a price of $ 146.57. the share has been on a bullish run for the past two years. Altcoins can be profitable. But it’s always wise to limit your exposure to risky investments like best altcoins.

In 2021, the stock started at a price of $ 60.03. By the end of the year, the stock closed off at $ 101.42. During the year the stock appreciated by 69 %.

During the current year, the share went from $ 101.42 to $ 146.44 to date. This represents a 44 % increase in value.

The below chart shows the stock performance of Cheniere Energy for the past two years.

Also, Covid-19 vaccine stocks are one of the best investment options.

Also, Covid-19 vaccine stocks are one of the best investment options.

EQT Corporation

EQT Corporation is the largest producer of natural gas in the United States. As a natural gas production company with emphasis in the Appalachian Basin and operations in Pennsylvania, West Virginia, and Ohio, EQT has a renewed, strategic focus on its upstream business. As a technology-driven leader in advanced horizontal drilling, its ability to drill long laterals from large pads in some of the most productive areas in the world gives us one of the lowest cost structures in the natural gas industry, while consistently working safely and responsibly to minimize impacts to the environment. Get to know the best commodities to invest in now.

EQT Corporation recently announced its earnings results for the first quarter of 2022:

- Sales volumes were recorded at 492 Bcfe

- Net Loss was reported to be $ 1.5 billion

EQT has a market capitalization of $ 16.7 billion. The share of the company is currently trading at $ 45.44. The stock has been on a bullish streak for the past two years.

From a price of $ 12.71 at the start of the year to $ 21.81, the stock appreciated 72 % in value during 2021.

In 2022, the stock experienced a huge spike in price. From $ 21.81, the stock climbed high to $ 48.43, before dropping to the current levels of $ 45.95. Overall, the stock has increased by 122 % to date.

The below chart shows the stock performance of EQT Corporation for the past two years.

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

Ovintiv Inc.

Ovintiv is a leading North American energy producer focused on developing its multi-basin portfolio of oil, natural gas liquids, and natural gas producing plays. It operates through USA Operations, Canadian Operations, and Market Optimization segments. The company’s principal assets include Permian in west Texas and Anadarko in west-central Oklahoma; and Montney in northeast British Columbia and northwest Alberta. If you are seeking a steady stream of income, you should invest in REIT stocks.

Its other upstream assets comprise Bakken in North Dakota, Uinta in central Utah; Horn River in northeast British Columbia, and Wheatland in southern Alberta.

The company was formerly known as Encana Corporation and changed its name to Ovintiv Inc. in January 2020.

Ovintiv Inc. recently announced its first quarter 2022 Earnings results:

- Net loss was reported at $241 million

- Natural Gas production was 1,487 million cubic feet per day

- The company announced a 25% increase in quarterly dividend payments; increasing annualized dividends to $1.00 per share

Ovintiv has a market cap of $ 12.57 billion. The share of the company was trading at a price of $ 48.7. The share has been on a rising streak in the past two years.

In 2021, the stock started off at a price of $ 14.36. The stock continued its upward trend and closed off the year at $ 33.7. Overall, the stock appreciated by 135 % during the year.

In 2022, the stock continued its bullish streak and increased by 45 % in value from a price of $ 33.7 to $ 44.7.

The below chart shows the stock performance of Ovintiv Inc. for the past two years.

Semiconductor stocks are also one of the best investment opportunities.

Semiconductor stocks are also one of the best investment opportunities.

Chesapeake Energy Corporation

Chesapeake Energy Corporation is the second-largest producer of natural gas, a Top 15 producer of oil and natural gas liquids, and the most active driller of new wells in the U.S. Headquartered in Oklahoma City, the company’s operations are focused on discovering and developing unconventional natural gas and oil fields onshore in the U.S. The company also vertically integrated its operations and owns substantial midstream, compression, drilling, trucking, pressure pumping, and other oilfield services.

Get to know everything about high-frequency trading.

Chesapeake Energy Corporation recently reported its earnings report for the first quarter of 2022:

- Net loss was reported at $ 764 million

- Chesapeake’s net production rate in the first quarter of 2022 was approximately 620,000 boe per day (approximately 87% natural gas and 13% total liquids)

Chesapeake Energy Corporation has come a long way after filing bankruptcy in 2020. It has been quite successfully managing operations and the performance on the stock market continues to improve.

Chesapeake Energy Corp has a market capitalization of $ 11.75 billion. The share of the company is currently trading at $ 92.39. The stock has been on a bullish run after recovering from bankruptcy. Since then, the stock has appreciated by a whopping 117 % in less than 18 months.

In 2022 alone, the stock has improved by 43 % in value.

The below chart shows the stock performance of Chesapeake Energy Corporation for the past two years.

There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

CNX Resources Corporation

CNX is the premier independent natural gas development, production, and midstream company, with operations centered in the major shale formations of the Appalachian basin. Solar energy stocks are also one of the best investment options.

Commodity stocks have also evolved as an asset class.

CNX Resources recently reported its financial results for the first quarter of 2022:

- Net Loss was reported at $ 923 million

- Free cash flow was reported at $234 million. It is the Nine consecutive quarter of generating significant Free cash flow

CNX Resources has a market capitalization of $ 3.8 billion and its share is trading at a price of $ 19.52. The share of the company has been quite volatile in the past two years. But despite that, the share has been consistently rising.

In 2021, the stock started off at a price of $ 10.8. By the end of the year, the stock reached $ 13.75, representing a 27 % increase in share value.

In 2022, the stock started off at $ 13.75 and reached a high of $ 23.24. The share of CNX has recently closed off at $ 19.52, indicating a 42 % appreciation to date.

The below chart shows the stock performance of CNX Resources Corporation for the past two years.

CONCLUSION

CONCLUSION

Russia’s invasion of Ukraine has sent the oil and gas markets soaring in 2022. Prices for crude oil and natural gas have reached their highest levels since 2008. And the supply is expected to remain tight because of structural production constraints. The demand for natural gas has rebounded since the low demand during the pandemic which led to producers cutting output.

With the gas prices soaring, the above-mentioned companies are well positioned to benefit from it.

You may also like reading:

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy

- Best Bank Stocks to Buy Right Now

- Best Penny Stocks to Invest