An exchange-traded fund, (ETF) is an investment fund that includes a large basket of individual stocks or government and corporate bonds. All of which can be bought with a single purchase.

There are many kinds of ETFs, which can cater to the needs of a variety of investors:

- Sector ETFs – Sector ETFs follow a specific sector-specific index to replicate.

- Stock ETFs – Stock ETFs hold a particular portfolio of equities or stocks and are like an index.

- Index ETFs – Index ETFs mimic a specific index, such as the S&P 500 Index.

- Bond ETFs– Bond ETFs are invested explicitly in bonds or other fixed-income securities. They are focused on a particular type of bond or offer a broadly diversified portfolio of bonds of different types and with varying maturity dates.

- Commodity ETFs – Commodity ETFs hold commodity exchange-traded funds and may hold a combination of investments in a physical commodity along with related equity investments.

- Currency ETFs – Currency ETFs are invested in a single currency or a basket of multiple currencies. These ETFs are used by investors who wish to gain exposure to the foreign exchange market.

- Inverse ETFs – An inverse exchange-traded fund earns profits through short selling when there is a decline in the broad market index or the securities.

- Actively Managed ETFs – These best ETFs are handled by professional managers that manage the portfolio and the allocation of portfolio assets.

- Leveraged ETFs – Leveraged ETFs consist of financial derivatives that offer the ability to leverage investments and thereby potentially amplify gains.

- Real Estate ETFs – These are funds invested in real estate investment trusts (REITs), real estate service firms, real estate development companies, and mortgage-backed securities (MBS).

Get to know the best ESG ETFs to buy now.

Benefits of Investing in ETFs

There are many advantages to investing in an Exchange-Traded Fund, including the following:

- Lower transaction costs and fees – ETFs typically have a lower expense ratio when compared to a mutual fund.

- Diversification – Investment in ETFs provide investors with a diversified portfolio with a low investment amount.

- Transparency – An ETF is traded in the stock market and all its holdings are disclosed publicly. It helps investors keep an eye on the Fund’s performance.

- Tax Benefits – Unlike mutual funds, ETFs only incur capital gain tax when investors sell their funds.

Oil and gas ETFs are one of the most pivotal investment products for investors because of their benefits and low risk.

Disadvantages of Investing in ETFs

While there are many benefits of investing in ETFs, it has its cons too which are listed below:

- When compared with stock trading, ETFs are more costly because of the expense ratio.

- Fewer Dividends.

- Liquidity issues – ETFs are not regularly traded on the stock market. Hence, they are difficult to sell.

Biggest ETF Companies

According to ETF.com, below is the list of top 10 fund companies, as on 14th Oct 2022, ranked by assets under management:

| Sr. | Brand | Assets Under Management ($, mm) | Net Flows ($, mm) | % Of Assets Under Management |

| 1 | iShares | $ 2,031,822.89 | 1,886.94 | 0.09 % |

| 2 | Vanguard | $ 1,755,512.95 | 632.86 | 0.04 % |

| 3 | SPDR | $ 909,172.57 | 3,619.83 | 0.40 % |

| 4 | Invesco | $ 311,935.76 | 646.56 | 0.21 % |

| 5 | Schwab | $ 237,407.22 | 10.52 | 0.00 % |

| 6 | First Trust | $ 118,147.79 | – 94.54 | – 0.08 % |

| 7 | JPMorgan | $ 80,203.74 | -119.40 | -0.15 % |

| 8 | Dimensional | $ 58,715.05 | – 27.33 | – 0.05 % |

| 9 | ProShares | $ 57,238.62 | 25.20 | 0.04 % |

| 10 | WisdomTree | $ 49,716.39 | 7.67 | 0.02 % |

What is Long Term ETFs?

What is Long Term ETFs?

A long-term bond ETF invests in long-term bonds, which are fixed-income securities with maturities longer than 10 years. These ETFs may be actively-managed or they may seek to passively track the performance of long-term bond indexes.

Read: ETFs vs Index funds, where should you invest?

List of Top Long-term ETFs to Invest in 2024

Here is the list of top long-term ETFs to invest in 2024:

| Sr. | ETF Name | Assets Under Management ($, mm) | Expense Ratio | Date of Incorporation |

| 1 | Vanguard S&P 500 ETF | $ 254.47 billion | 0.03 % | July 2010 |

| 2 | Invesco S&P 500 Equal Weight ETF | $ 28.71 billion | 0.20 % | April 2003 |

| 3 | iShares Russell 1000 Growth ETF | $ 56.72 billion | 0.18 % | May 2000 |

| 4 | Vanguard Real Estate ETF | $ 31.53 billion | 0.12 % | September 2004 |

| 5 | Schwab U.S. Dividend Equity ETF | $ 37.45 billion | 0.06 % | October 2011 |

| 6 | iShares Core MSCI EAFE ETF | $ 76.91 billion | 0.07 % | October 2012 |

| 7 | iShares Core Growth Allocation ETF | $ 1.86 billion | 0.15 % | November 2008 |

| 8 | Vanguard Mega Cap Growth ETF | $ 9.95 billion | 0.04 % | January 2004 |

| 9 | Vanguard Growth | $ 67.77 billion | 0.04 % | November 2008 |

| 10 | ARK Innovation ETF | $ 7.02 billion | 0.75 % | October 2014 |

Also read:

Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (NYSEMKT: VOO) is an index fund designed to track the S&P 500 index. That index represents 500 of the largest U.S. publicly traded companies. This ETF’s goals are to closely follow that index’s returns, which is the primary benchmark for the overall returns of the U.S. stock market.

It offers investors a high potential for investment growth, making it an ideal long-term investment. The total assets under management are $ 251.47 billion.

This ETF offers investors exposure to the largest U.S. stocks for a very low cost. It was created in July 2010 and has an expense ratio is 0.03 %. The fund’s year-to-date performance shows a return of -22.17 % and a 5-year performance shows a 9.19 % return.

Get to know the best day trading stocks.

Invesco S&P 500 Equal Weight ETF

The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) is an index fund designed to track the stocks in the S&P 500. However, it uses an equal-weight approach. As a result, this ETF’s top 10 holdings represent just 2.5% of its total assets.

Invesco S&P 500 Equal Weight ETF is one of the best-known equal-weighted ETFs, RSP simply takes all the stocks in the S&P 500 and weights them equally. Equal weighting greatly increases the footprint of smaller S&P 500 stocks, which results in a higher beta for the portfolio. However, equal weighting also lowers concentration, reducing blow-up risk from any one name.

The total assets under management are $ 28.71 billion. Solar energy stocks are also one of the best investment options.

It was created in April 2003 and has an expense ratio is 0.20 %. The fund’s year-to-date performance shows a return of -16.31 % and a 5-year performance shows a 7.89 % return.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

iShares Russell 1000 Growth ETF

The iShares Russell 1000 Growth ETF (NYSEMKT: IWF) provides exposure to U.S. companies expected to increase their earnings at an above-average rate compared to the broader stock market. The fund held shares of about 500 companies as of early 2022.

IWF is one of the most popular US large-cap growth ETFs with a long track record. IWF holds stocks selected from the popular Russell 1000 Index, based on higher I/B/E/S forecasts for medium-term growth and higher sales per share historical growth as compared to others in the index. The fund’s top holdings are mostly packed with tech giants. While IWF is considered a large-cap fund, a sizable portion of the portfolio is allocated to mid-caps due to its expansive Russell 1000 parent. Get to know the best stock signal providers.

The total assets under management are $ 56.72 billion.

It was created in May 2000 and has an expense ratio is 0.18 %. The fund’s year-to-date performance shows a return of -29.89 % and a 5-year performance shows an 11.61 % return.

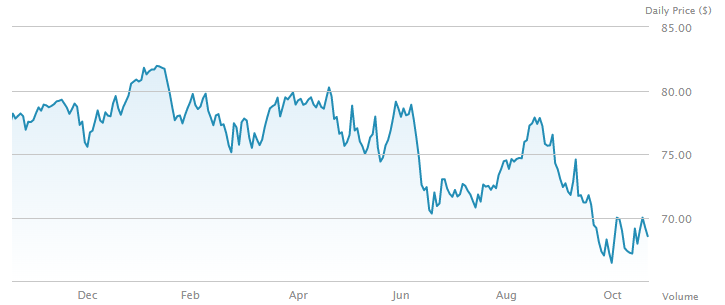

Vanguard Real Estate ETF

The Vanguard Real Estate ETF (NYSEMKT: VNQ) invests in real estate stocks, with a focus on real estate investment trusts (REITs). These entities typically own income-producing commercial real estates such as apartments, office buildings, retail properties, and industrial complexes.

The investment seeks to provide a high level of income and moderate long-term capital appreciation by tracking the performance of the MSCI US Investable Market Real Estate 25/50 Index which measures the performance of publicly traded equity REITs and other real estate-related investments.

Check out: List of Most Volatile Stocks

The fund managers attempt to track the index by investing all, or substantially all, of its assets-either directly or indirectly through a wholly owned subsidiary, which is itself a registered investment company-in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index

The total assets under management are $ 31.53 billion.

It was created in September 2004 and has an expense ratio is 0.12 %. The fund’s year-to-date performance shows a return of -31.63 % and a 5-year performance shows a 2.24 % return.

Schwab U.S. Dividend Equity ETF

The Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD) tracks an index focused on holding dividend stocks known for the quality and sustainability of their dividend payments. This ETF enables investors to benefit from the power of dividends in producing attractive total returns for investors over the long term.

SCHD is a market-cap-weighted fund whose selection universe only includes firms with a 10-year history of paying dividends. Within that universe, SCHD uses fundamental screens (cash-flow-to-debt ratio, ROE, dividend yield, and dividend growth rate) to build its portfolio. The objective is to focus on quality companies with sustainable dividends. As such, this approach gives the fund a modest large-cap tilt and excludes REITs entirely.

Individual securities are capped at 4% and sectors are capped at 25% of the portfolio. Its overall composition is reviewed annually, while the portfolio is rebalanced quarterly.

If you are seeking a steady stream of income, you should invest in REIT stocks.

The total assets under management are $ 37.45 billion.

It was created in October 2011 and has an expense ratio is 0.06 %. The fund’s year-to-date performance shows a return of -31.63 % and a 5-year performance shows a 2.24 % return.

iShares Core MSCI EAFE ETF

The iShares Core MSCI EAFE ETF (NYSEMKT: IEFA) is an ETF focused on international stocks. It provides investors with broad exposure to companies in Europe, Australia, and Asia. That enables investors to add some international diversification to their portfolio, which has outstanding long-term growth potential.

This ETF provides low-cost, comprehensive access to stocks in developed international countries. Also, the core of this portfolio is to diversify internationally and seek long-term growth. Unlike many competing funds, it includes smaller firms in marketlike proportion, making it more representative overall. Despite the challenges presented by small-caps, IEFA provides exposure well. The depth of coverage and flexibility of the product makes it suitable for long- and short-term investors alike.

The total assets under management are $ 76.91 billion.

Read: Mutual Funds Vs. Stocks: Which Should You Invest In?

It was created in October 2012 and has an expense ratio is 0.07 %. The fund’s year-to-date performance shows a return of -25.91 % and a 5-year performance shows a 0.61 % return.

iShares Core Growth Allocation ETF

The iShares Core Growth Allocation ETF (NYSEMKT: AOR) offers investors a simple way to build a diversified portfolio focused on long-term growth across several asset classes. The fund is a fund-of-funds that attempts to provide exposure to a global portfolio of iShares ETFs, with a 60% allocation to equity and a 40% allocation to fixed income. The underlying index uses a proprietary allocation model that aims to represent a “conservative” target-risk allocation strategy. The fund invests exclusively in iShares ETFs as it seeks exposure to a variety of fixed-income and equity funds. The underlying index’s exposure to fixed income intends to produce a current income stream and avoid excessive volatility of returns while the equities included seeks to protect long-term purchasing power. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

This fund provides investors with exposure to a broad mix of bonds and global stocks by holding seven ETFs:

- iShares Core Total USD Bond Market (NASDAQ: IUSB): This U.S.-focused bond ETF totaled 33.9% of the fund’s holdings.

- iShares Core S&P 500 ETF (NYSEMKT: IVV): This S&P 500 index fund made up 32.6% of the ETF’s assets.

- iShares Core MSCI International Developed Markets ETF (NYSEMKT: IDEV) This international ETF focused on developed markets accounted for 18.3% of its assets.

- iShares Core International Aggregate Bond ETF (NYSEMKT: IAGG): This international bond ETF comprised 6.2% of the fund’s assets.

- iShares Core MSCI Emerging Markets (NYSEMKT: IEMG) This emerging markets-focused ETF made up 6% of the fund’s assets.

- iShares Core S&P Mid-Cap ETF (NYSEMKT: IJH): This mid-cap stock-focused ETF accounted for 2% of the fund’s assets.

- iShares Core Small-Cap ETF (NYSEMKT: IJR): This small-cap stock-focused ETF totaled 0.9% of the fund’s assets.

The total assets under management are $ 1.86 billion.

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

It was created in November 2008 and has an expense ratio is 0.15 %. The fund’s year-to-date performance shows a return of -25.91 % and a 5-year performance shows a 0.61 % return.

Vanguard Mega Cap Growth ETF

Vanguard Mega Cap Growth ETF tracks the CRSP US Mega Cap Growth Index. The index selects stocks from the top 70% of investable market capitalization based on growth factors

MGK provides focused exposure to the largest growing companies in the US. It selects companies exhibiting six growth characteristics: future long-term growth in earnings per share (EPS), future short-term growth in EPS, three-year historical growth in EPS, three-year historical growth in sales per share, current investment-to-assets ratio, and return on assets. Securities are scored and ranked based on the composite of these six growth factors. With the same cap size split as its benchmark and similar weighting among sectors, MGK provides market-like exposure

The total assets under management are $ 9.95 billion.

It was created in December 2007 and has an expense ratio is 0.07 %. The fund’s year-to-date performance shows a return of -32.32 % and a 5-year performance shows an 11.38 % return.

Get to know the best commodities to invest in now.

Vanguard Growth ETF

The Vanguard Growth ETF (NYSEMKT: VUG) is a large-cap growth stock ETF. The fund aims to replicate the CRSP U.S. Large Cap Growth Index, which constitutes half of the CRSP U.S. Large Cap Index. The latter comprises the top 85% of U.S. stocks weighted by market capitalization, which includes companies with market caps as small as $535 million. So, while the index is primarily composed of large-cap stocks, it includes some mid-cap stocks as well. If you have entered the crypto investment market, you should explore crypto staking platforms.

The ETF tracks the CRSP US Large Cap Growth Index, which selects large- and mid-cap stocks with growth characteristics. The index selects stocks based on six growth factors: expected long-term growth in earnings per share (EPS), expected short-term growth in EPS, 3-year historical growth in EPS, 3-year historical growth in sales per share, current investment-to-assets ratio, and return on assets.

The total assets under management are $ 67.7 billion.

It was created in November 2008 and has an expense ratio is 0.04 %. The fund’s year-to-date performance shows a return of -32.67 % and a 5-year performance shows a 10.67 % return.

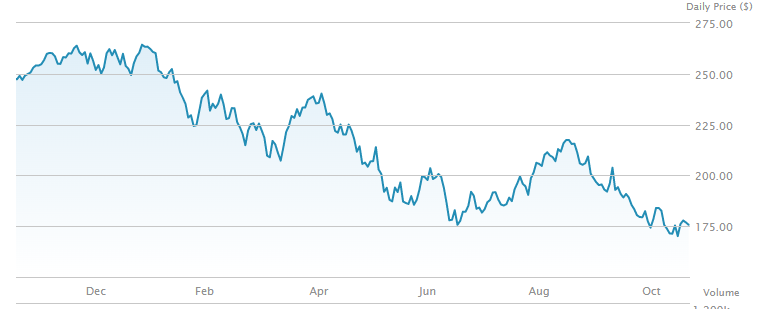

ARK Innovation ETF

The ARK Innovation ETF (NYSEMKT: ARKK) is an actively managed fund that invests in companies producing what it deems “disruptive innovation.” The team defines the term as “the introduction of a technologically enabled new product or service that potentially changes the way the world works.” It invests across industries, including biotechnology, automotive, energy, information technology, and finance. Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022. While it maintains a global outlook, it is heavily concentrated in U.S. companies, with more than 90% of the portfolio held in domestic stocks. More than half of the ETF’s portfolio remains invested in its top 10 holdings.

ARK Funds rose to prominence in 2020 when shares of the ETF more than doubled. However, shares faltered in 2021. Nonetheless, the ETF’s manager has proven their ability to find great companies producing innovative technology ought to lead to good long-term results.

The total assets under management are $ 7.02 billion.

It was created in October 2014 and has an expense ratio is 0.75 %. The fund’s year-to-date performance shows a return of -62.73 % and a 5-year performance shows a 1.7 % return.

Get to know about Best Trading and Forex Signal Providers

CONCLUSION

Investing in growth stocks is one of the most popular practices adopted by long-term investors. It can provide substantial returns to investors. However, there is no denying the fact that not every investor is well-equipped with the knowledge to find good growth stocks to invest in. And growth stocks are even harder to find because the decision all depends on potential growth which is always uncertain. Go through the best recession stocks in 2022.

Therefore, for these investors, Long Term ETFs are one of the best options. Not only can they fulfill their investment goals but they also get to invest in a pool of long-term growth securities which provides them with a good return. Through these ETFs, investors get exposure to the types of investments with massive potential for big capital returns without the need to analyze individual companies.

The above list has been curated after analyzing their current and potential performance while keeping track of their past performance. Also, the portfolio of securities in each ETF has been given due consideration.

You may also like reading:

- Monthly Dividend Stocks to Buy

- Best Bank Stocks to Buy Right Now

- Best Crypto Trading Signals

- Best Penny Stocks to Invest