United States Oil Fund Elliott Wave & Long Term Cycles $USO

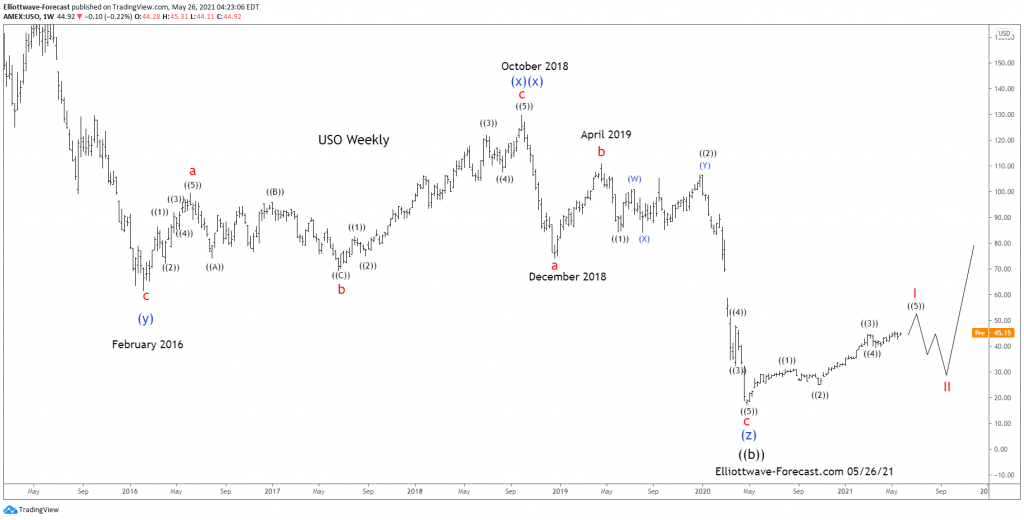

Firstly the USO instrument inception date was 4/10/2006. CL_F Crude Oil put in an all time high at 147.27 in July 2008. USO put in an all time high at 953.36 in July 2008 noted on the monthly chart. The decline from there into the February 2009 lows was in three swings. An a-b-c in red although it was a very steep pullback.

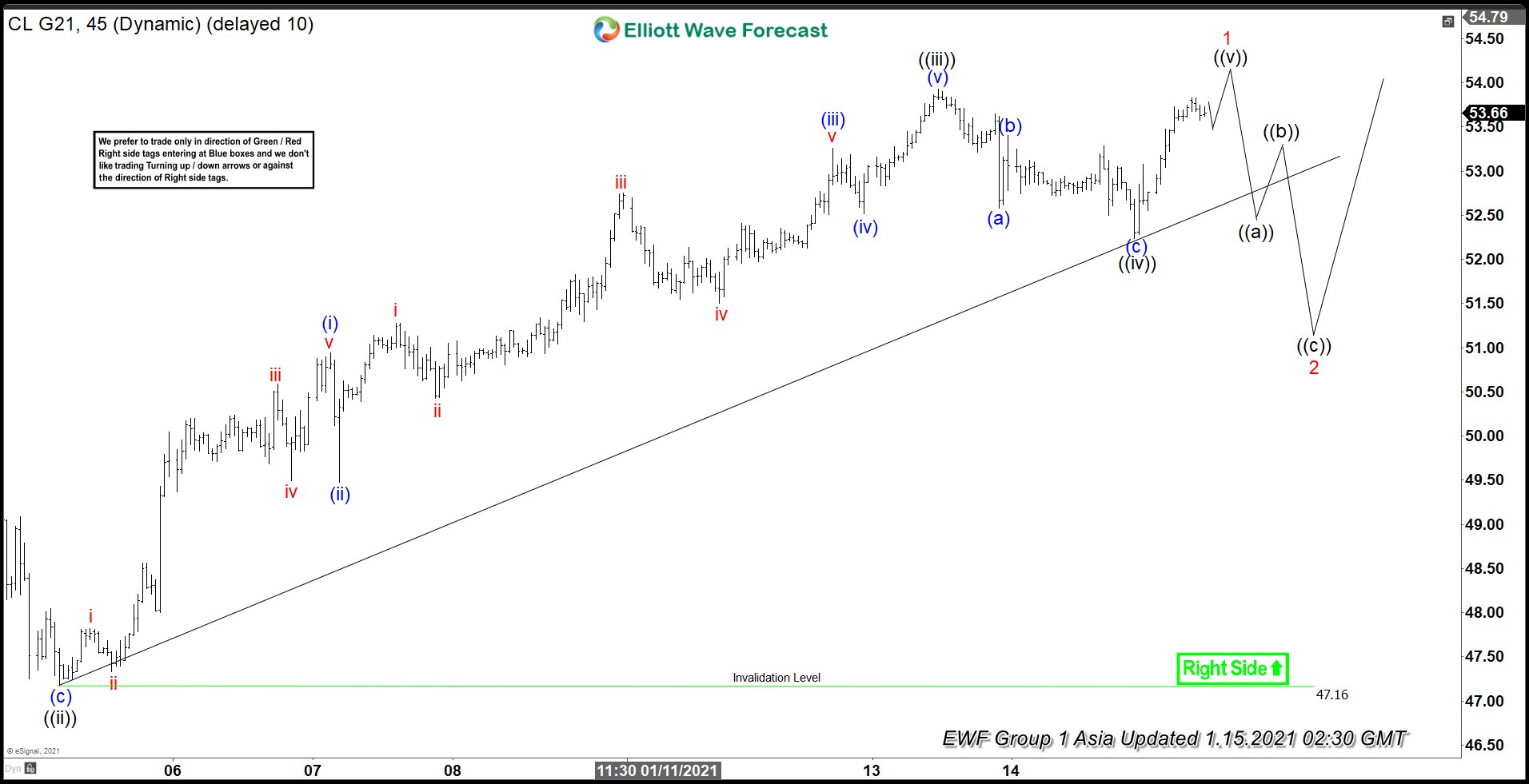

Further, the bounce from the 2009 lows is a complex double three combination with a triangle “y”. This is w-x-y in red to end the blue wave (x). In either a bullish or bearish market this particular structure always makes a high or low in the initial wave “w”. After a wave “x” correction, structures like this will be followed by a contracting or running triangle. In this case the structure ended in June 2014. The decline from those highs were very sharp again. As can be seen, this was in three swings again a-b-c in red to end the blue wave (y). This completed a three swing correction (w)-(x)-(y) in blue from the July 2008 highs.

The analysis continues below the USO Monthly chart.

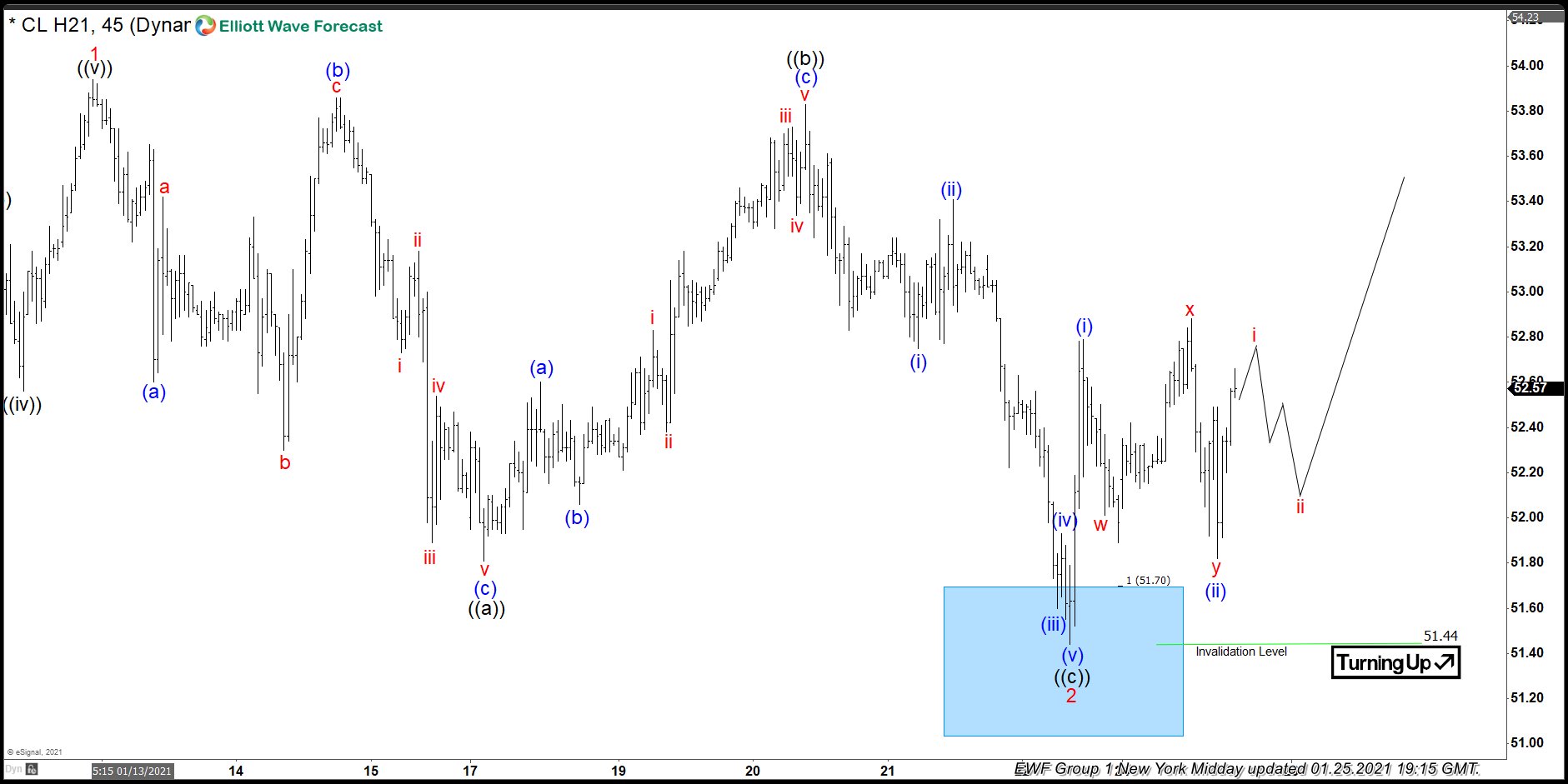

Secondly CL_F Crude Oil and the USO instrument as previously mentioned made an all time high back in July 2008. Each of the cycles appears to have declined in three big swings into the February 2016 lows. In the case of USO the price was 61.36. The bounce into the October 2018 highs was three swings again. The analysis continues below the USO Weekly chart.

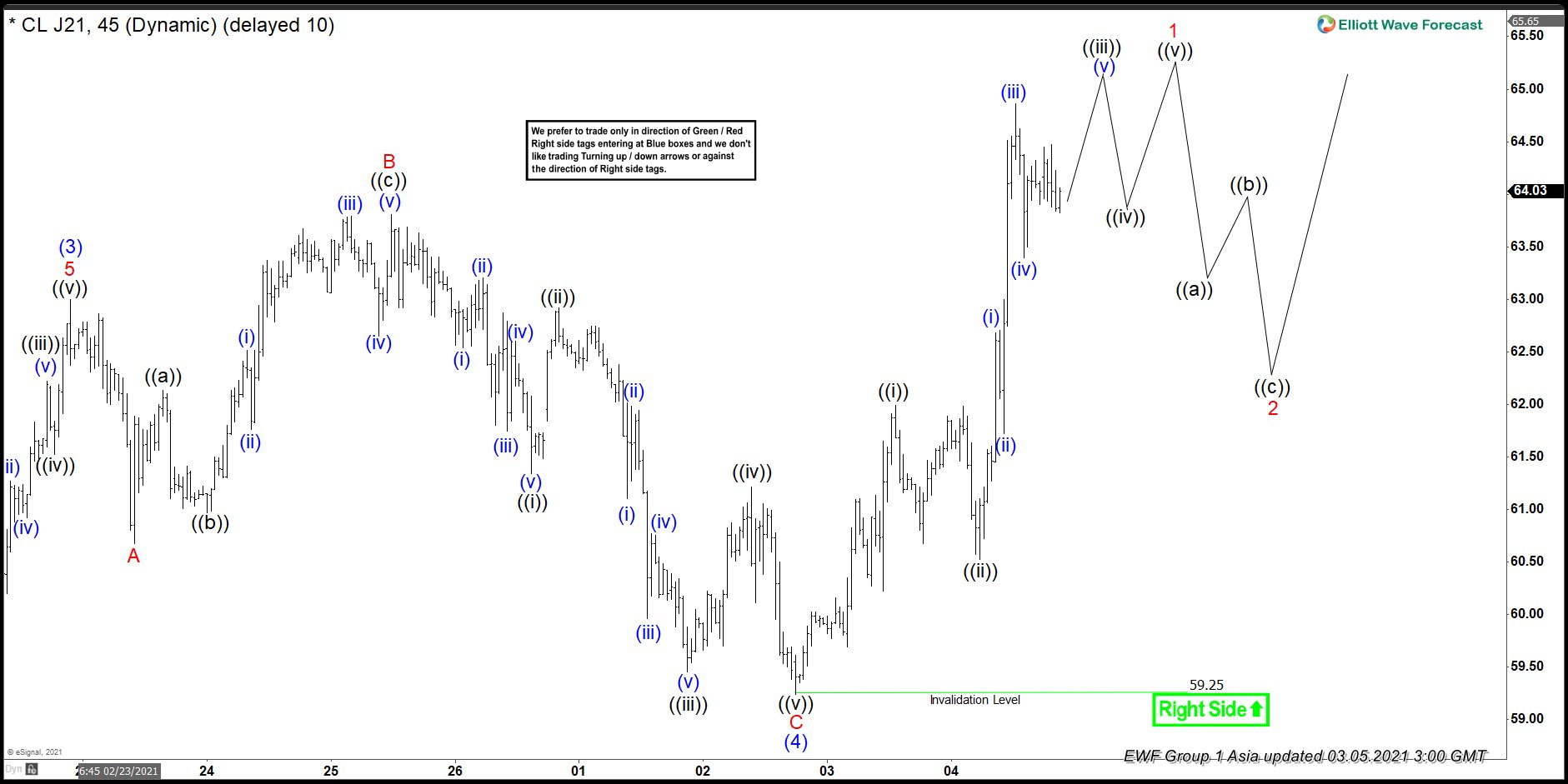

In conclusion: The USO mirrors CL_F Crude Oil. The bounce from the February 2016 lows into the October 2018 highs appeared to have been a zig zag. Further this is a second (x)(x). As can be seen the decline from the October 2018 highs to the December 2108 lows was five waves and labeled “a”. There was a bounce that failed in April 2019 labeled “b”. Wave “c” made new lows in April 2020. Lastly the bounce from there appears impulsive. While pullbacks remain above the April 2020 lows expect it turning higher again.

Thanks for looking. Feel free to come visit our website. Please check out our services Free for 14 days to see if we can be of help. Kind regards & good luck trading. Lewis Jones of the ElliottWave-Forecast.com Team

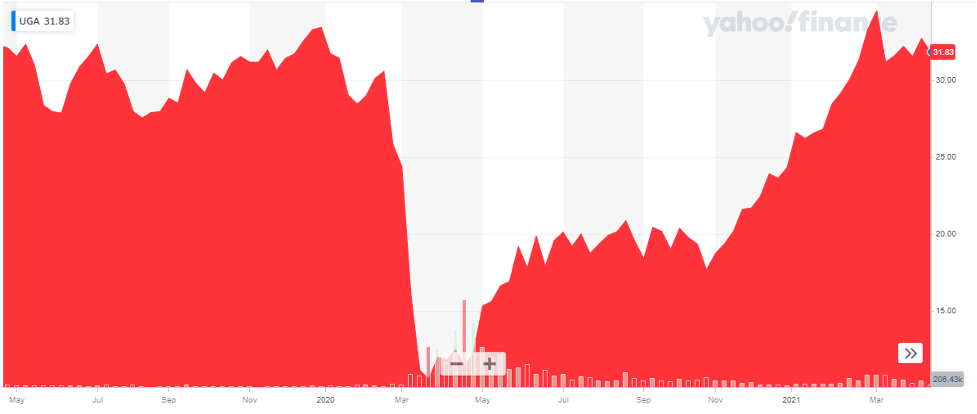

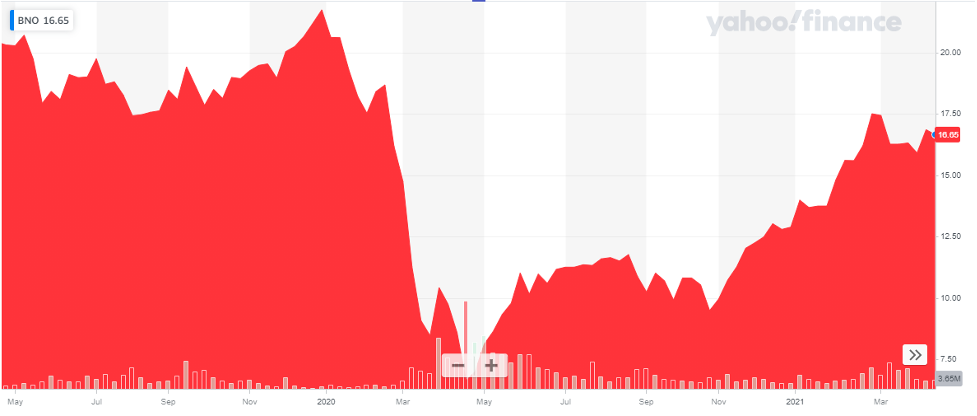

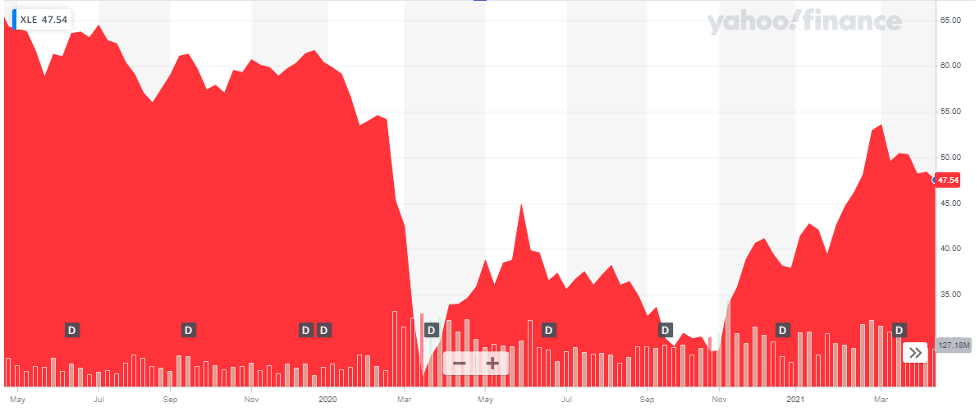

The below chart shows the price trend of the UGA for the last two years:

The below chart shows the price trend of the UGA for the last two years: The ETF price took a massive blow, dropped more than 50% in value when Covid reached pandemic status. Since then, it has managed to rise back to the pre-covid level in the market.

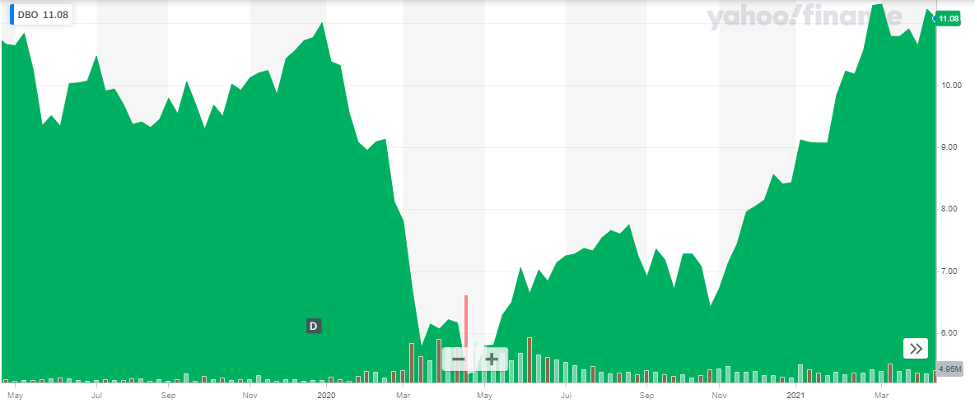

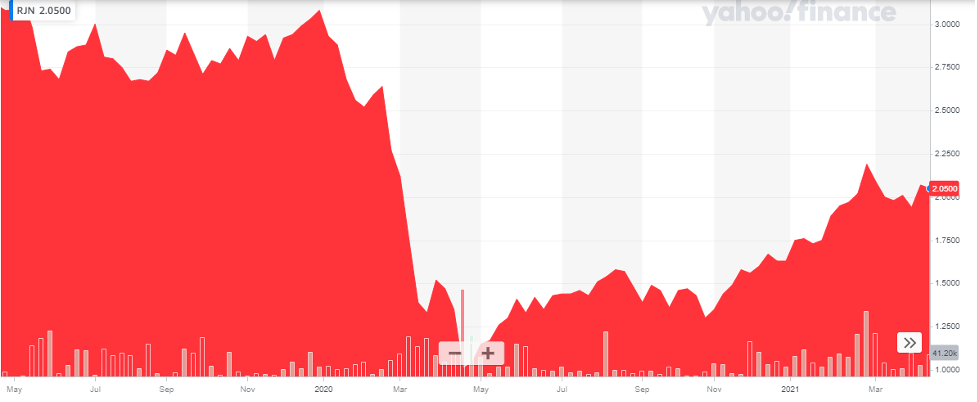

The ETF price took a massive blow, dropped more than 50% in value when Covid reached pandemic status. Since then, it has managed to rise back to the pre-covid level in the market. This ETF was hit pretty hard by the pandemic, as shown in the above chart. The index lost more than 50% of its value in March-20. DBO has managed to recover itself pretty well and has been able to reach the same value.

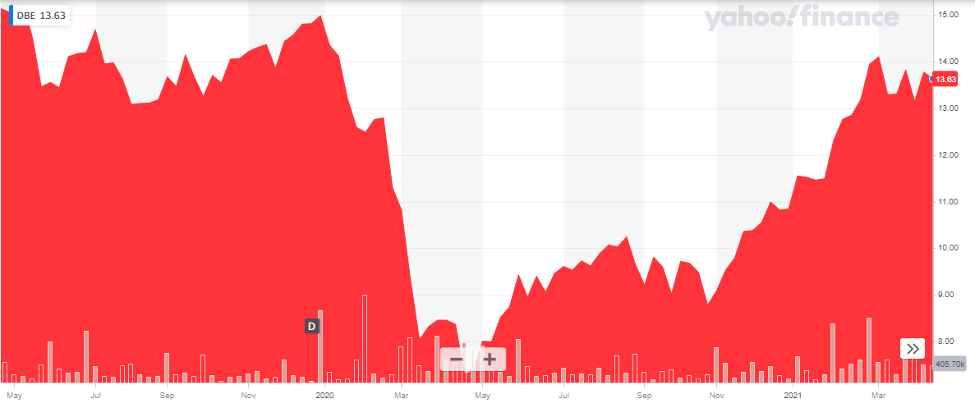

This ETF was hit pretty hard by the pandemic, as shown in the above chart. The index lost more than 50% of its value in March-20. DBO has managed to recover itself pretty well and has been able to reach the same value. This ETF was a bit late in showing the effects of Covid but it did drop drastically. It dropped to $8.11 in May’20 (from $19.62 in January 2020). The index has now recovered and is currently trading at a price above $18. This amazing recovery makes this the best crude oil ETF to buy in 2023.

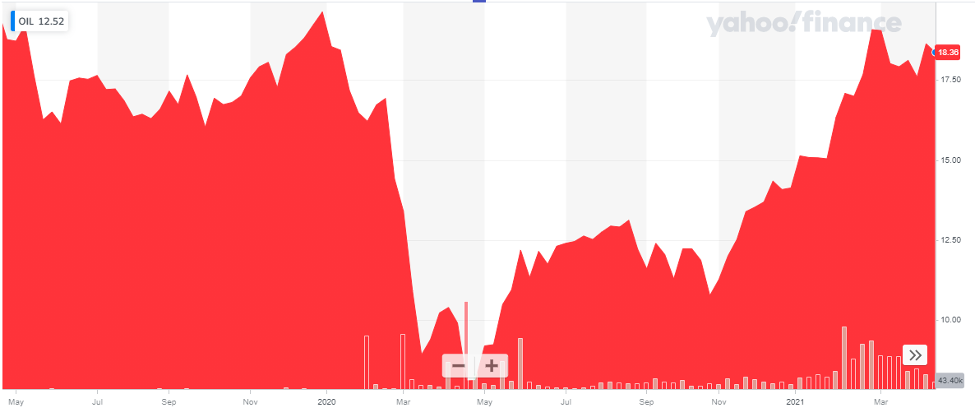

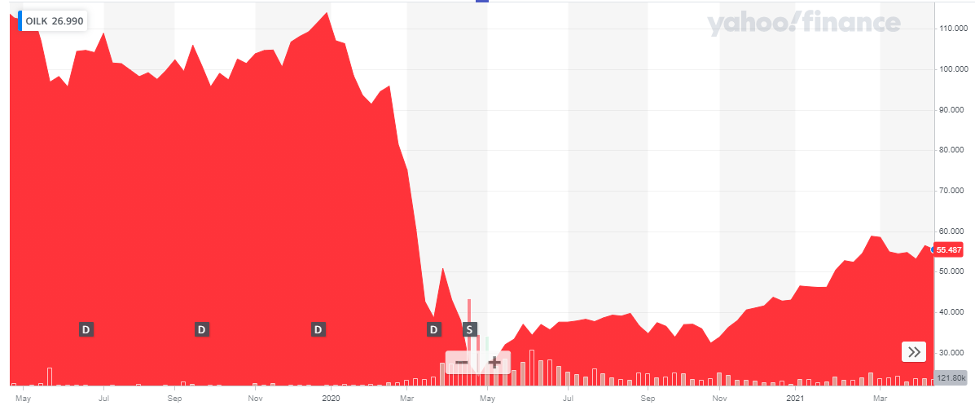

This ETF was a bit late in showing the effects of Covid but it did drop drastically. It dropped to $8.11 in May’20 (from $19.62 in January 2020). The index has now recovered and is currently trading at a price above $18. This amazing recovery makes this the best crude oil ETF to buy in 2023.  The below chart shows the price trend of the OILK for the last two years:

The below chart shows the price trend of the OILK for the last two years: This index was also hit pretty hard during Covid. Since then, it is on the path to recovery and is progressing at a comparatively slow rate.

This index was also hit pretty hard during Covid. Since then, it is on the path to recovery and is progressing at a comparatively slow rate. The below chart shows the price trend of the OILK for the last two years:

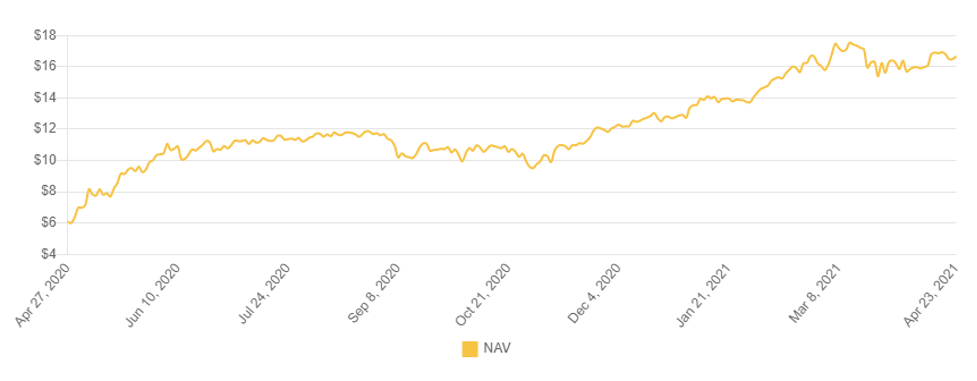

The below chart shows the price trend of the OILK for the last two years: Like other ETFs, this index also took a huge dip in price when Covid-19 hit. After reaching the low level of $6.63, the index has been gradually improving and has reached beyond $16.

Like other ETFs, this index also took a huge dip in price when Covid-19 hit. After reaching the low level of $6.63, the index has been gradually improving and has reached beyond $16. This index was also hit hard by the Covid. Due to complete lockdown, the supply of oil inflated while the demand dropped significantly. This led to a huge drop in the price of USO which tracks crude oil. The index is on the path to recovery and is performing better.

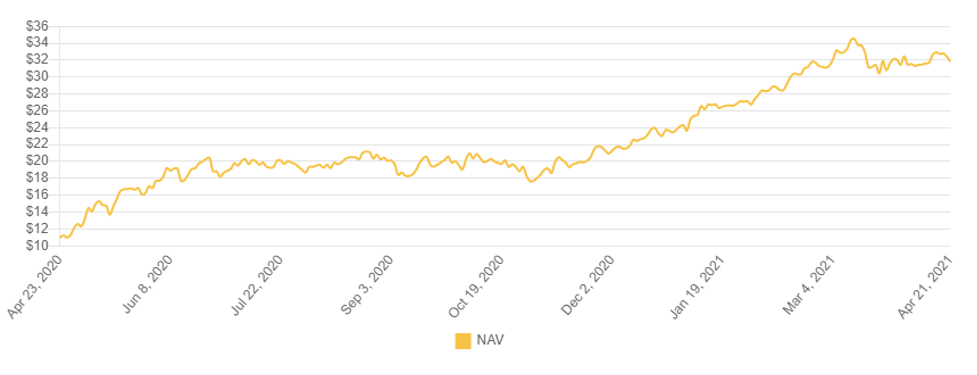

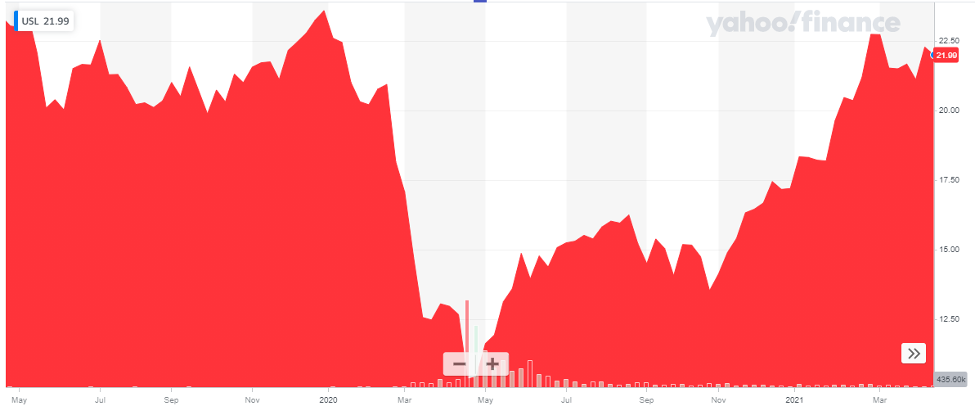

This index was also hit hard by the Covid. Due to complete lockdown, the supply of oil inflated while the demand dropped significantly. This led to a huge drop in the price of USO which tracks crude oil. The index is on the path to recovery and is performing better. Like other oil ETFs, USL also was adversely affected by Covid-19 and the resultant lockdown. The reduction in the supply of oil had its impact on the price of the index which dropped more than 50%. After hitting the lowest mark of $10.35, the index has improved itself and has fully recovered the loss by March-2021.

Like other oil ETFs, USL also was adversely affected by Covid-19 and the resultant lockdown. The reduction in the supply of oil had its impact on the price of the index which dropped more than 50%. After hitting the lowest mark of $10.35, the index has improved itself and has fully recovered the loss by March-2021.

After a tremendous drop due to Covid-19, the index value is gradually improving.

After a tremendous drop due to Covid-19, the index value is gradually improving. After a huge drop because of Covid-19, the index has shown remarkable recovery and has almost reached the pre-Covid valuation.

After a huge drop because of Covid-19, the index has shown remarkable recovery and has almost reached the pre-Covid valuation.