The S&P 500 is a stock market index that tracks the stocks of 500 large-cap U.S. companies. S&P stands for Standard and Poor, the names of the two founding financial companies. The index accounts for 80% of the market value of the U.S. equities market.

The breakdown of sectors in the S&P 500, as of Aug 31, 2022, is as follows:

- Information technology – 28.1 %

- Health care – 13.3 %

- Consumer discretionary – 11.8 %

- Financials – 11.5 %

- Communication services – 9.6 %

- Industrials – 8 %

- Consumer staples – 6.2 %

- Energy – 3.7 %

- Real estate – 2.6 %

- Materials – 2.6 %

- Utilities – 2.6 %

The top 10 companies of the index by weight, as of April 2022, are:

| Sr. | Company Name | Symbol | Weight |

| 1 | Apple | AAPL | 7.14 % |

| 2 | Microsoft | MSFT | 6.1 % |

| 3 | Amazon.com | AMZN | 3.8 % |

| 4 | Tesla Inc. | TSLA | 2.5 % |

| 5 | Alphabet Class A | GOOGL | 2.2 % |

| 6 | Alphabet Class C | GOOG | 2.1 % |

| 7 | NVDIA Corp | NVDA | 1.8 % |

| 8 | Berkshire Hathaway | BRK | 1.6 % |

| 9 | Meta (formerly known as Facebook) | META | 1.4 % |

| 10 | United Health Group | UNH | 1.2 % |

Check our updates for S&P500 forecast, news, and analysis.

There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

While these are the top companies by weightage in the index, below is the list of best S&P 500 companies for investment:

List of Best S&P 500 Companies for Investment

| Sr. | Company Name | Symbol | Market Cap | Price (As of September 2022) |

| 1 | Apple Inc | AAPL | $ 2.506 Trillion | $ 155.96 |

| 2 | Amazon.com | AMZN | $ 1.319 Trillion | $ 129.48 |

| 3 | Johnsons and Johnsons | JNJ | $ 431.4 billion | $ 164.07 |

| 4 | Chevron | CVX | $ 303.617 billion | $ 155.11 |

| 5 | Merck | MRK | $ 220.1 billion | $ 86.87 |

| 6 | Caterpillar | CAT | $ 95.5 billion | $ 180.86 |

| 7 | Micron Technology | MU | $ 60.67 billion | $ 55 |

| 8 | Monolithic Power System | MPWR | $ 19.99 billion | $ 427.19 |

| 9 | Caesars Entertainment | CZR | $ 9.7 billion | $ 45.27 |

| 10 | Alaska Air Group | ALK | $ 5.84 billion | $ 46.09 |

Apple Inc.

Apple Inc.

Apple Inc. is famous for the iPhone, iPad, and iTunes. It is growing strong for the past 45 years. Apple Services offer music, TV, fitness channels, news, books, podcasts, Apple Pay, and iCloud amongst others.

Apple Inc is constantly innovating and bringing the latest tech consumer products to the market. Apple’s business has evolved to keep up with the technological changes and demands of the consumer.

Apple is one of the most valuable companies in the world with a market cap of $ 2.5 trillion. Moreover, Warren Buffett, the legendary investor has complete faith in the company claiming it as one of the best businesses.

Apple’s wearables business has huge potential for growth. The demand for these products is growing which is led by AirPods, AirPods Pro, and Apple Watch. Also, Apple is focusing a lot on its services. As of the end of the fiscal year 2021, there were 660 million paid subscribers across Apple’s services segment, which includes Apple TV+, Apple Music, the App Store, and iCloud, among others. And its dividend offering has become the most attractive feature for investment.

Apple Inc reported the third quarter earnings report for fiscal 2022, which ended June 25, 2022:

- Revenue was recorded at $ 83 billion, a 2 % increase from the previous year’s same period

- Earnings per share were reported at $ 1.2

- A cash dividend of $0.23 per share was declared

Apple stock is currently trading at $ 154.46.

The company’s stock has been on a bullish run since 2021. During the year 2021, the stock appreciated by 34 %, from $ 132.69 to $ 177.57.

In 20221, the stock maintained its price level while exhibiting volatility. The stock started at $ 177.57, dropped to the lows of $ 131.56, and last closed at $ 154.46.

Get to know the best quantum computing stocks.

Get to know the best quantum computing stocks.

Amazon.com

Amazon was one of those companies which benefitted hugely during the pandemic. As consumer dependency on online retail and web services increased for all essential and non-essential products, the e-commerce giant evolved to make itself one of the best online retail shops for consumers. Also, amazon assured it provided to its consumers no matter what the hurdles.

What makes this company an investor favorite and consumer favorite is its resilience during tough times. During the pandemic, Amazon delivered products and services nearly uninterrupted. Moreover, Amazon executed everything to the consumers’ utmost satisfaction at a time when it was most needed without any extra money or increased prices. It hired 500,000 people globally in 2020 and paid them well.

Another attractive feature of Amazon is its web services. Amazon Web Services is thriving. It has become a powerhouse with an extraordinary increase in profits over these past years.

Amazon.com, Inc. recently announced financial results for its second quarter ended June 30, 2022:

- Net sales were reported at $ 121.2 billion, compared to $113.1 billion in the second quarter of 2021.

- Net loss was reported at $ 2.0 billion

- Loss per share was $ 0.2

Amazon has a market capitalization of around $ 1.323 trillion. Its share is currently trading at a price of $ 129.82.

The year 2021 was an astounding year for the company’s share. They remained above $ 150 throughout the year. The share went as high as $ 185.97 and as low as $ 150. Overall, the stock appreciated by 2.3 %, from $ 162.85, at the start of the year to $ 166.72 at the end of the year.

In 2022, the stock started at $ 166.72 and suffered a huge drop. The share went as low as $ 106.22 and last closed at $ 131.08. Overall, the stock declined by 21 % to date.

Also, check out the best swing trading stocks.

Also, check out the best swing trading stocks.

Johnsons and Johnsons

Johnson & Johnson has a long history of operation with more than 10 years in business. JNJ is the leader in the pharmaceutical, medical devices, and consumer packaged goods industries. In fact, they are the largest independent biotech company in the world by market cap.

Jonson & Johnson has over 250 subsidiaries. It operated in 60 countries and its products are sold in 175 countries across the globe. Some of this company’s best-known products include Band-Aid, Tylenol, Johnson’s baby products, Acuvue contact lenses, Clean & Clear facial wash, and the Neutrogena range of skin and beauty products. Each brand is well established and trusted by consumers.

The company’s long history of operation and the global reach of its products makes it an attractive investment option for investors. And its diverse list of products along with an attractive dividend further attracts investors’ attention.

Johnson & Johnson recently announced results for second-quarter 2022:

- Sales were reported at $ 24 billion, a 3 % increase from last year’s same period

- Net Earnings were reported at $ 4.8 billion, a 23.3 % decline from last year’s same period

- Earnings per share were reported at $ 107

Johnson & Johnson is a $ 434.8 billion company. Its share is trading at a price of $ 165.39.

The stock remained bullish for the majority of 2021. It started at $ 157.38 and went as high as $ 179.44 and closed the year at $ 165.39. Overall, the stock appreciated by 5 % during the year.

In 2022, the stock exhibited volatile behavior. They started the year at $ 165.9, went as high as $ 182.29, and after multiple peaks and trenches last closed at 165.39. Overall, the maintained its price level as compared to the start of the year.

Bank stocks usually reflect the economic performance, making them cyclical stocks.

Bank stocks usually reflect the economic performance, making them cyclical stocks.

Also read:

Chevron

Chevron is one of the biggest integrated oil and gas companies in the world. The company’s position as one of the biggest players at both the upstream and downstream stages of the supply chain help ensure that it can generate outsized profits. The conflict between Russia and Ukraine has the potential to drive up the price of oil markedly. Which will benefit the company hugely.

The size of the company has enabled it to continue to grow despite the challenges and many supply chain issues in the recent past. Moreover, Chevron has considered a safe investment due to the steady stream of income investors earn from it. Chevron has paid a dividend for years without fail and has not neglected to increase the payout at any time over the last 35 years. Also, good earnings growth and asset utilization ratio have made Chevron a very lucrative investment. Investing in value stocks is a long-term investment.

Chevron recently announced second quarter results for the year 2022:

- Earnings were reported at $ 11.6 billion

- Earnings per share were reported at $ 5.95

Chevron has a market cap of $ 305 billion. Its share is currently trading at $ 155.95. The stock of the company has been on a bullish run in the past two years. In 2021, the stock went from $ 84.45, at the start of the year, to $ 117.35 at the end of the year. This represents a 39 % appreciation during the year.

In 2021, the stock spiked from a price of $ 117.35 to the peak of $ 178.28 and last closed at $ 155.95. To date, the stock has appreciated by 33 %.

Get to know the best vaccine stocks to invest in 2023.

Get to know the best vaccine stocks to invest in 2023.

Merck

Merck and Company design manufacture and distribute pharmaceutical products and drugs around the world. The company manufactures medicine and drugs that are used to treat cardiovascular, respiratory, HIV, some types of cancer, and many others.

Merck has a solid pipeline of upcoming drugs. The company plans to develop and distribute cancer treatments, various vaccines, and other treatments. With these advancements in promising and growing fields, Merck is a great long-term investment and lucrative option for investors. Get to know the best regional bank stocks.

Merck recently announced second quarter results for the year 2022:

- Total sales were reported at $ 14.6 billion, an increase of 28 % from the previous year’s same period

- Earnings per share were reported at $ 1.55

Merck has a market capitalization of $ 221 billion. Its share is currently trading at $ 87.3.

The share of Merck has been pretty volatile during the past two years. In 2021, the stock started trading at $ 78.05. During the year, the stock performance showed multiple peaks and trenches, it went as high as $ 88.05 and as low as $ 69.29. Finally, the stock closed the year at $ 76.64, exhibiting a 1.8 % decline during the year.

In 2022, the stock followed a bullish pattern. From a price of $ 76.64, at the start of the year, the stock peaked at $ 94.96 and last closed at $ 87.47. Overall the stock appreciated by 14 % to date.

Cybersecurity stocks are also one of the best investment opportunities.

Cybersecurity stocks are also one of the best investment opportunities.

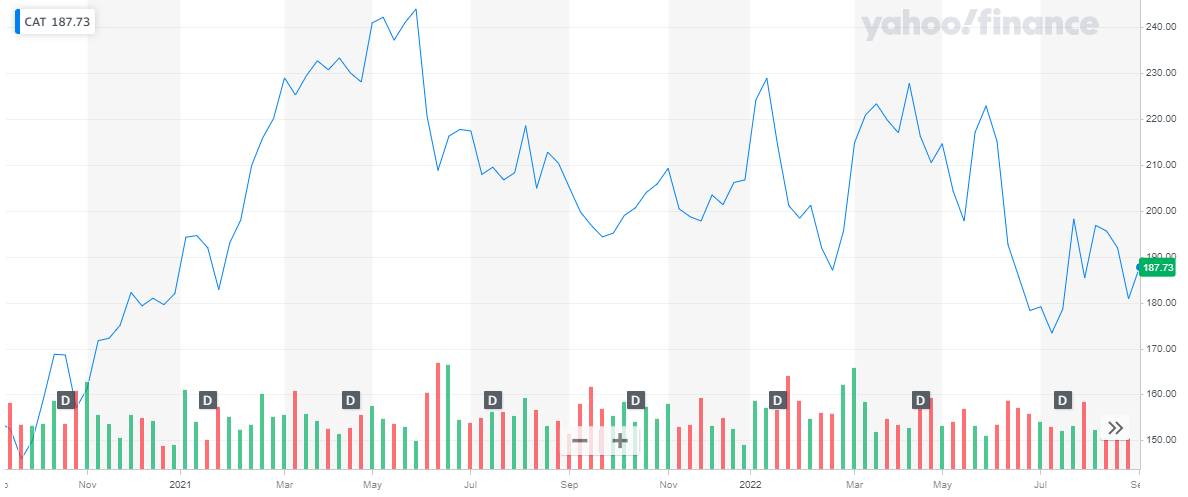

Caterpillar

Caterpillar Inc. is an American Fortune 100 corporation. It is the world’s largest construction-equipment manufacturer. The company designs develop, engineers, manufactures, markets, and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. Caterpillar products also include financial and insurance offerings via a worldwide dealer network.

Caterpillar’s list of products includes: Construction and mining equipment, diesel and gas engines, industrial turbines, and the locomotive are its main lines. Caterpillar is a strong brand and holds a good reputation for quality. Moreover, the company pays utmost attention to its quality and is always looking for growth opportunities. If you are seeking a steady stream of income, you should invest in REIT stocks.

Caterpillar Inc. recently announced second-quarter 2022 results:

- Revenue was reported at $ 14.2 billion, representing an increase of 11 % on a year-on-year basis

- Earnings per share were $ 3.13

Caterpillar has a market cap of $ 99 billion. Its share is currently trading at a price of $ 188.19.

The year 2021 has been a good year for Caterpillar’s stock. It started trading at $ 182.02 and went as high as $ 244.02 closing the year at $ 206. Overall, the stock appreciated by 13.2 % during the year.

In 2022, the stock started trading at $ 206. After multiple peaks and trenches during the year, the stock last closed at $ 188.03. To date, the stock has declined by 9 %.

Investors are now looking for the finest solar energy stocks to invest in.

Investors are now looking for the finest solar energy stocks to invest in.

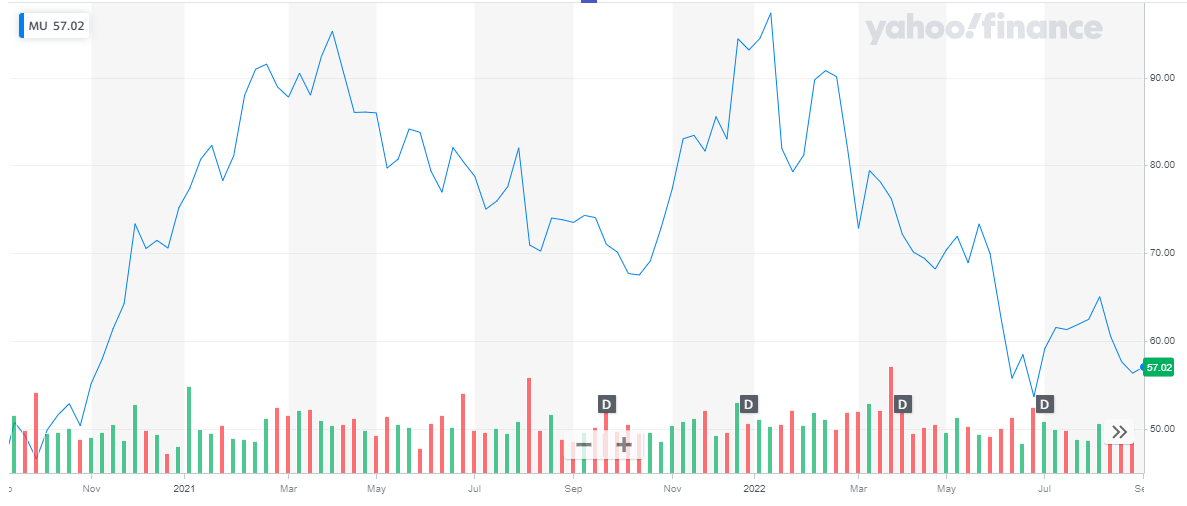

Micron Technology

Micron Technology Inc. develops and manufactures memory and storage products used in personal computers, networks, and data centers as well as in the healthcare and automotive industries. Across its global brands, including Micron and Crucial, the company produces memory cards, drives, and network infrastructure technology

Micron Technology is one of the world’s largest producers of DRAM and NAND memory chips. It’s the third-largest DRAM manufacturer and producer of NAND chips.

Get to know Top Nasdaq Stocks to Buy in 2023.

Unlike more broadly diversified companies like Samsung and Western Digital, which only generate a portion of their revenues from memory chips, Micron is a “pure play” on the memory market.

Micron Technology, Inc. recently announced its fiscal third-quarter earnings report:

- Revenue was reported at $ 8.6 billion, a 16 % year-on-year increase

- Net income was reported at $ 2.9 billion

- Earnings per share were reported at $ 2.59

Micron Technology has a market cap of $ 63 billion. Its share is trading at a price of $ 55.39.

The share of the company has been following a mixed trend in the past two years.

In 2021, the stock started trading at a price of $ 75.18. The stock peaked at $ 95.3 and dropped to the lows of $ 67.51 and finally closed off the year at $ 93.15. Overall, the stock appreciated by 24 % during the year.

In 2022, the stock went bearish. From $ 93.15, at the start of the year, the stock last closed at $ 56.18, representing a 40 % decline to date.

Get to know about RSI trading strategies.

Get to know about RSI trading strategies.

Monolithic Power System

Monolithic Power Systems (MPS) is a company that designs, develops, and markets integrated power semiconductor solutions and power delivery architectures. It offers power modules, power converters, isolation, battery management, motor drivers, analog, sensors, AC/DC and DC/DC lightning, and inductor solutions for electronic systems. The company caters to the consumer, industrial, computing and storage, medical, communications, and other sectors.

Monolithic Power Systems, Inc. recently announced financial results for the quarter ended June 30, 2022:

- Revenue was reported at $ 461 million, a 57.2 % increase from the previous year same quarter

- Net Income was reported at $ 157 million

- Earnings per share were $ 3.25

To give investors an idea of where to start and which companies to look for investment in, we have compiled a list of the top best oil and gas ETFs to buy now.

Monolith Power Systems has a market capitalization of $ 21.1 billion. Its share is trading at $ 438.78.

The share of Monolith Power Systems is a bullish streak in 2021. From $ 366.23, at the start of the year, the stock peaked at $ 570.59 and finally closed at $ 493.33. Overall, the stock appreciated by 35 % during the year.

In 2022, the stock started trading at a price of $ 493.33. The stock suffered a huge decline and remained volatile during the year. It last closed at $ 449.17. This represents a 9 % decline to date.

Get to know the best EV stocks to invest in today.

Get to know the best EV stocks to invest in today.

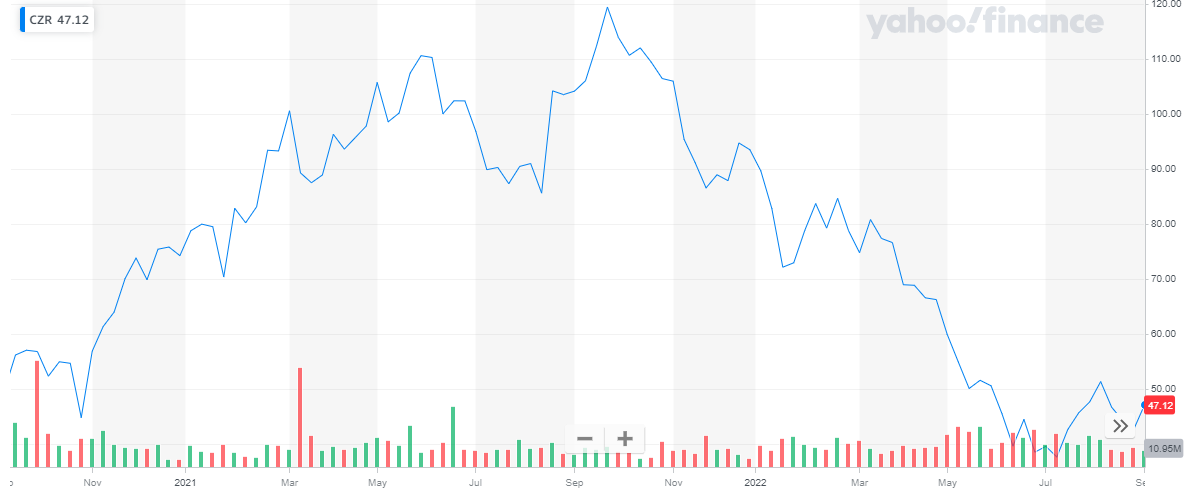

Caesars Entertainment

Caesars Entertainment Corp. is a holding company, which engages in the provision of casino entertainment and hospitality services.

It operates through the following segments:

- Las Vegas

- The other U.S.

- All Other – This segment includes managed and international properties as well as other businesses, such as Caesars Interactive Entertainment

Its brands include Caesars, Harrahs, Horseshoe, Wsop, Linq, Caesars, and Paris.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Caesars Entertainment, Inc., recently reported operating results for the second quarter ended June 30, 2022:

- Net revenues were reported at $ 2.8 billion as compared to $ 2.5 billion for the previous year’s same period.

- Net loss was reported at $ 123 million as compared to net income of $71 million for the previous year same period

Caesars Entertainment has a market cap of $ 10.1 billion. Its share is trading at $ 46.18.

The share picked up a bullish trend in 2021. From $ 74.27, the stock went as high as $ 119.49 and closed off the year at $ 93.53. This represents a 22 % appreciation during the year.

In 2022, the stock picked up a bearish trend. From $ 93.53, at the start of the year, the stock dropped to the lows of $ 37.65 and last closed at $ 46.18. To date, the stock has declined by 50 %.

Tech stocks is also one of the best investment opportunity.

Tech stocks is also one of the best investment opportunity.

Alaska Air Group

Alaska Air Group, Inc. is an airline holding company. The Company, through its subsidiaries, provides air services to passengers to multiple destinations. Alaska Air also offers freight and mail services. Alaska Air Group serves passengers worldwide.

Alaska Air Group recently announced financial results for the second quarter ending June 30, 2022:

- Revenues were reported at $ 2.7 billion

- Net income was reported at $ 139 million

- Earnings per share were reported at $ 1.09

Also read Forex trading vs Stocks trading.

Alaska Air Group has a market cap of $ 5.9 billion. Its share is trading at a price of $ 45.69.

The stock of Alaska Air started the year 2021 at $ 52. It spiked high to $ 72.63 and closed at $ 52.1. Overall, the stock maintained its price level.

In 2022, the stock exhibited volatility. From $ 52.1, at the start of the year, the stock closed at $ 46.17. To date, the stock declined by 11.4 %.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

CONCLUSION

Major firms with proven earnings and strong balance sheets have historically tended to provide stability, consistent returns, and dividends. Therefore, investing in an S&P500 Index Fund is one of the most profitable long-term investments for investors due to its low cost, low risk, and ease of purchase. With an average annual return of 10%, it is guaranteed that the investment will perform as well as the market.

The reasons why S&P stocks are considered good for investment:

- Good quality companies which are large-cap companies with relatively stable businesses

- Good yield. The yield on the S&P companies is even higher than the 10-year U.S. Treasury.

- The index and its companies have proven to stay strong during and after the recession

What’s more, investing in an S&P500 Index Fund has been declared Warren Buffett’s favorite long-term investment vehicle. All the more reasons to invest in the above-mentioned best S&P stocks.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy