Utility stocks are companies that provide basics like gas, water, and electricity. One of the most sought-after stocks, utility stocks can never fail. Because the demand for the basics they provide is never-ending. With every passing day, these utilities are becoming a necessity rather than a comfort. No doubt they come with their set of pros and cons and have risks attached to them. But they are amongst the most competitive and stable sources of investment.

The Pros and Cons of Utility Stocks

Some of the benefits of investing in Utility stocks are:

- Dividends: Utility companies are among the highly regulated companies and have a stable cash flow generation. Hence, these companies give strong and regular dividends. Therefore, utility stocks are great income stocks.

- Utility stocks will always rise: No doubt, there are downfalls in every industry. But the utility stocks will always recover and continue to grow as the human population grows and the demand for utilities grows.

- A good investment during a recession: During economic recessions, every company undergoes a reduction in revenue and profits. Utility stocks will also see slight dips during such times but usually, they are resilient during recession. Stock trading advisory websites help investors make the right financial decisions.

Investing in Utility stocks has its drawbacks as well:

- Slow growth: Utility stocks offer stable investment but the growth of these companies is relatively slow. Hence, for investors seeking fast-paced growth in investment, utility stocks are not a good option. Investing in Long-term stocks involves building wealth over a long period.

- Chances of losing money are there: No industry is free from the risk of losing money. And there is no such thing as a 100% safe investment. Therefore, it is always advised to do research before investing in any sector or company.

Get to know about top Infrastructure stocks to invest in.

List of the Best Utility Stocks for 2024

Here are the 10 best utility stocks for 2024:

| Sr. | Company Name | Symbol | Market Cap | Share Price (As of 5th June 2022) | The latest quarterly Dividend Paid |

| 1 | NextEra Energy | NEE | $ 155 billion | $ 78.52 | $ 0.425 |

| 2 | Duke Energy | DUK | $ 85.6 billion | $ 111.26 | $ 0.98 |

| 3 | Dominion Energy | D | $ 67.1 billion | $ 83.48 | $ 0.67 |

| 4 | Exelon | EXC | $ 50 billion | $ 48.73 | $ 0.34 |

| 5 | American Water Works | AWK | $ 28.2 billion | $ 155.06 | $ 0.60 |

| 6 | Constellation Energy | CEG | $ 28.1 billion | $ 65.17 | $ 0.14 |

| 7 | AES Corp | AES | $ 15.78 billion | $ 22.27 | $ 0.158 |

| 8 | NiSource | NI | $ 12.94 billion | $ 31.42 | $ 0.23 |

| 9 | Brookfield Infrastructure | BIPC | $ 5.2 billion | $ 71.78 | $ 0.54 |

| 10 | Black Hills | BKH | $ 4.94 billion | $ 75.56 | $ 0.59 |

NextEra Energy.

NextEra Energy is America’s largest capital investor in infrastructure. It is also the world’s largest utility company with a market valuation of $ 155 billion. Through its subsidiaries, NextEra Energy generates clean, emissions-free electricity from seven commercial nuclear power units in Florida, New Hampshire, and Wisconsin. Investors always choose the best brokers that better suits his/her trading goals.

NextEra dominates America’s electricity market. Also, the company’s early adoption and strong investments in the renewables space, have led it towards becoming the largest generator of solar and wind energy in the world.

NextEra recently published its quarterly earnings report ending 31st March 2022:

- Operating Revenues were reported at $ 2.9 billion

- Net loss was reported at $ 451 million

- Earnings per share were reported at a negative $ 0.23

NextEra energy’s stock is currently trading at $ 80.21. The below chart shows the stock performance of NextEra for the past two years. The stock has been following a bearish trend as per the below chart. The year 2022 brought a huge dip in price at the start, but the stocks recovered soon. To date, the stock has declined by 14 %.

Semiconductor stocks are also one of the best investment opportunities.

Semiconductor stocks are also one of the best investment opportunities.

Duke Energy

Duke Energy Corporation is American electric power and natural gas holding company. Its electric utilities serve 8.2 million customers. Duke collectively owns 50,000 megawatts of energy capacity. Its natural gas unit serves a total of 1.6 million customers. Oil stocks are one of the riskier yet most profit-generating sectors.

It operates through three segments:

- Electric Utilities and Infrastructure

- Gas Utilities and Infrastructure

- Commercial Renewables

Also read Best Stocks for Covered Calls in 2024.

Duke Energy recently posted its first-quarter 2022 financial results:

- Revenue was reported at $ 7.13 billion

- Earnings per share of $ 1.30

Duke Energy has a market capitalization of over $ 85.6 billion. The share of Duke Energy is currently trading at $ 111.16. The below chart shows the share performance over the past two years. The share has been following an upward trend over the past two years. After being stagnant for the majority of 2021, the year 2022 brought a huge surge in price. To date, the stock has appreciated by 6 % during the current year.

If you are seeking a steady stream of income, you should invest in REIT stocks.

If you are seeking a steady stream of income, you should invest in REIT stocks.

Dominion Energy

Dominion Energy, Inc. produces and distributes energy. The company operates through four segments:

- Dominion Energy Virginia

- Gas Distribution

- Dominion Energy South Carolina

- Contracted Assets

In the recent quarterly report, the company reported:

- Revenues were reported at $ 4.3 billion, an increase of roughly 11 % from the same period last year

- Net Income Revenue was reported at $ 711 million, representing an approx. 30% decline from the same period last year

- Earnings per share were reported to be $ 0.83 share

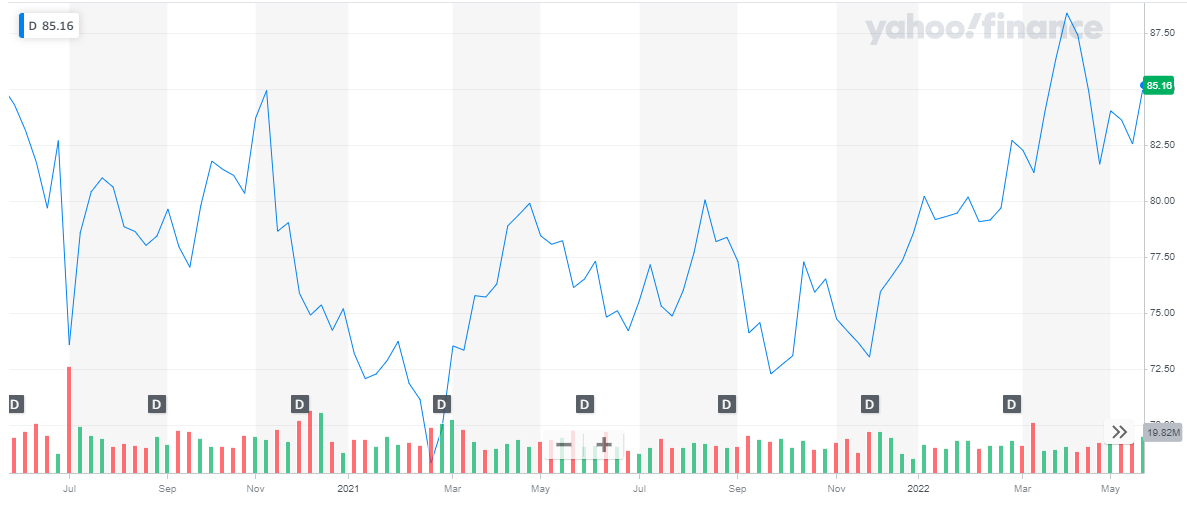

Dominion Energy has a market capitalization of $ 67 billion. The share of the company is currently trading at $ 82.82. The below chart shows the stock performance for the past two years. The stock has been extremely volatile with multiple dips and peaks.

During 2021. The share appreciated slightly by 4.5 %. In 2022, the share picked up the pace and has appreciated by 5.4 % to date.

Thinking to invest in bonds? Get to know whether it’s a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether it’s a good decision to invest in bonds or stocks.

Exelon

Exelon is America’s largest utility company, serving more than 10 million customers through six fully regulated transmission and distribution utilities. It owns nuclear, fossil, wind, hydroelectric, biomass, and solar generating facilities. The company also sells electricity to wholesale and retail customers; and sells natural gas, renewable energy, and other energy-related products and services. Get to know the best vaccine stocks to invest in now.

Exelon recently posted its first-quarter results for the year 2022:

- Total revenue was reported to be $ 5.3 billion

- Net income was reported at $ 597 million

- Net earnings per share were reported to be $ 0.49

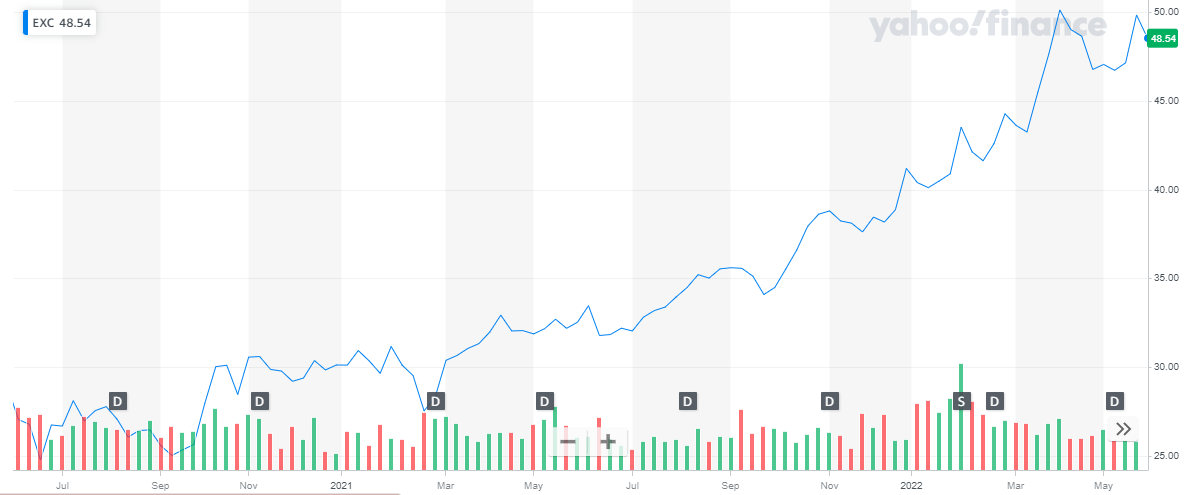

Exelon has a market capitalization of over $ 50 billion. The share of the company is currently trading at $ 48.55. The below chart shows the stock performance of Exelon over the past two years. The stock has been bullish over the past two years, as shown in the below chart. In 2021, the stock rose by roughly 37 %. During 2022, the stock appreciated by 18 %, to date.

Also learn about Best Day Trading Stocks.

Also learn about Best Day Trading Stocks.

American Water Works

American Water is the largest and most geographically diverse U.S. publicly traded water and wastewater utility company. AWK provides its services to an estimated 14 million people in 24 states.

In the recent quarterly earnings report, AWK reported:

- Operating revenues were reported at $ 842 million

- Net income was reported at $ 158 million

- Earnings per share of $ 0.87, an increase of 19 % from the same period last year

American Waterworks has a market capitalization of over $ 28.2 billion. The share of AWK is currently trading at $ 155. The below chart shows the stock performance of AWK over the past two years.

Despite a few dips, the stock of AWW has been on an upward trend. The share was appreciated by approx. 23 % during 2021. In 2021, the stock declined sharply. To date, the stock has depreciated by approx. 18 %

Also check out: List of Most Volatile Stocks

Also check out: List of Most Volatile Stocks

Constellation Energy

Constellation Energy Corporation generates and sells electricity in the United States. The company operates through five segments:

- Mid-Atlantic

- Midwest

- New York

- ERCOT

- Other Power Regions.

Constellation Energy is the nation’s largest producer of carbon-free energy and the leading competitive retail supplier of power and energy products and services for homes and businesses across the United States. They power more than 20 million homes and are helping to accelerate the nation’s transition to clean energy with more than 32,400 megawatts of capacity and annual output that is 90 percent carbon-free. It sells natural gas, renewable energy, and other energy-related products and services.

The company has set ambitious climate goals for the future which are:

- 95% carbon-free electricity by 2030

- 100% carbon-free electricity by 2040

- 100% reduction of operations-driven emissions by 2040

- Providing 100 percent of our business customers with customized data to help them reduce their carbon footprints

Get to know the list of crypto mining companies that are leading the industry.

In the recent quarterly report, the company reported:

- Total revenue of $ 5.6 billion

- Net income of $ 106 million

- EPS of $ 0.32

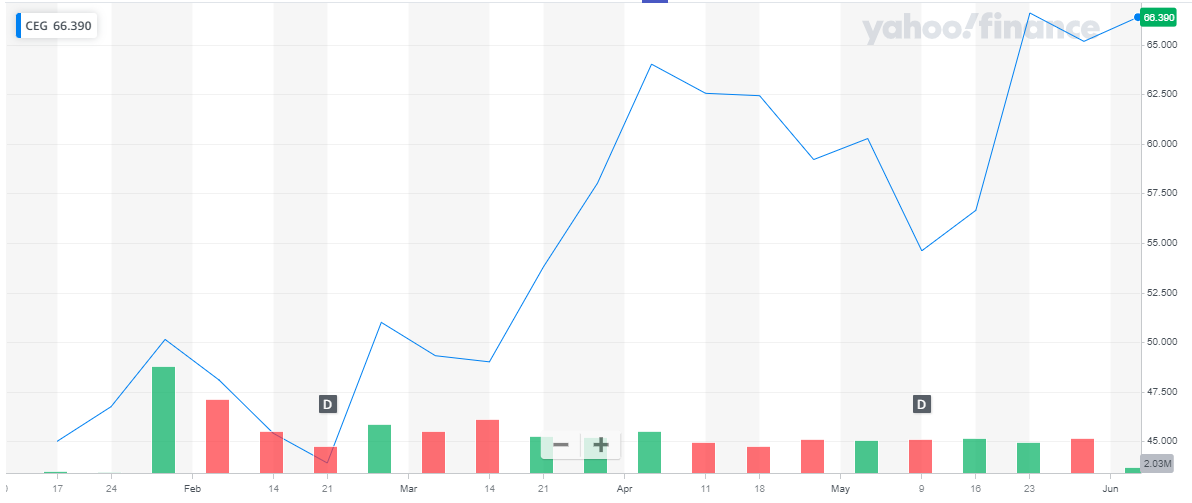

Constellation Energy has a market capitalization of around $ 21.7 billion. It recently separated from Exelon Corp and now operates as a stand-alone company.

The share of the company has been trading at a price of $ 66.39. The below chart shows the stock performance of the company since the company became a separate entity. As per the chart, the stock has been rising. From the time it started trading as an individual company on the stock market, the stock has appreciated by 47.5 %.

AES Corp

AES Corp

The AES Corporation operates as a diversified power generation and utility company. It owns and/or operates power plants to generate and sell power to customers, such as utilities, industrial users, and other intermediaries. There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

For the quarter ending 31st March 2022, the company reported:

- Revenues of $ 835 million, an increase of 18 % from the same period last year

- Net Income of $ 115 million, a substantial increase from the loss, generates during the same period last year

- EPS of $ 0.17

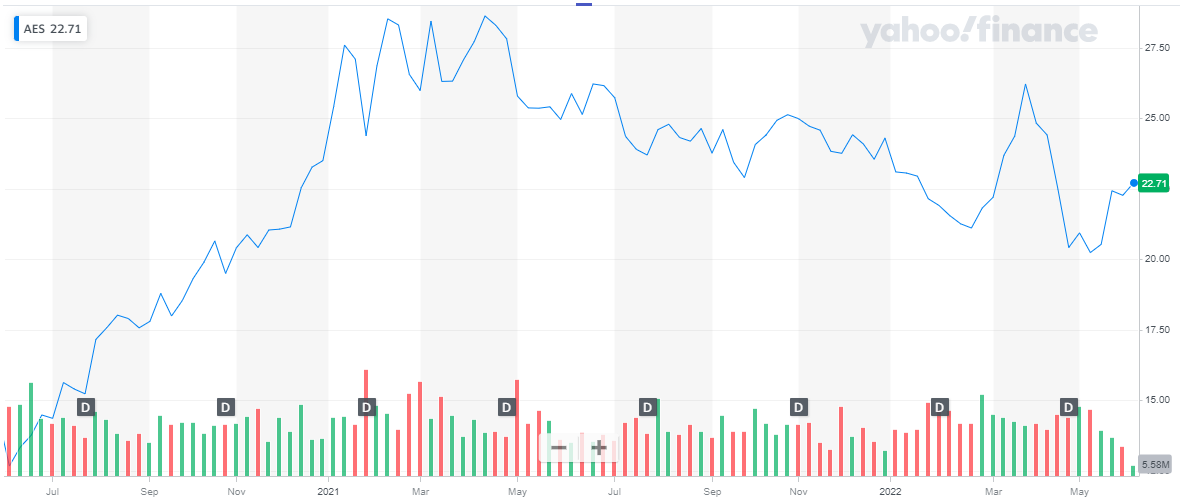

The AES Corporation has a market capitalization of $ 15.17 billion. The share of the company is currently trading at $ 22.71. The below chart shows the stock performance for the past two years. The stock peaked at $ 28.63 during the second quarter of 2021. Since then, the stock has been slowly declining. In 2022, the stock has almost maintained its price level, despite the volatility.

Get to know the best tech stocks to invest in now.

Get to know the best tech stocks to invest in now.

NiSource

NiSource is an energy holding company that operates as a regulated natural gas and electric utility company. It serves approximately 3.2 million natural gas customers and 500,000 electric customers across six states. It operates through two segments:

- Gas Distribution Operations

- Electric Operation

The company recently published its first-quarter report for 2022:

- Net Operating Earnings were reported at $ 328.7 million

- Earnings per share were $ 0.94

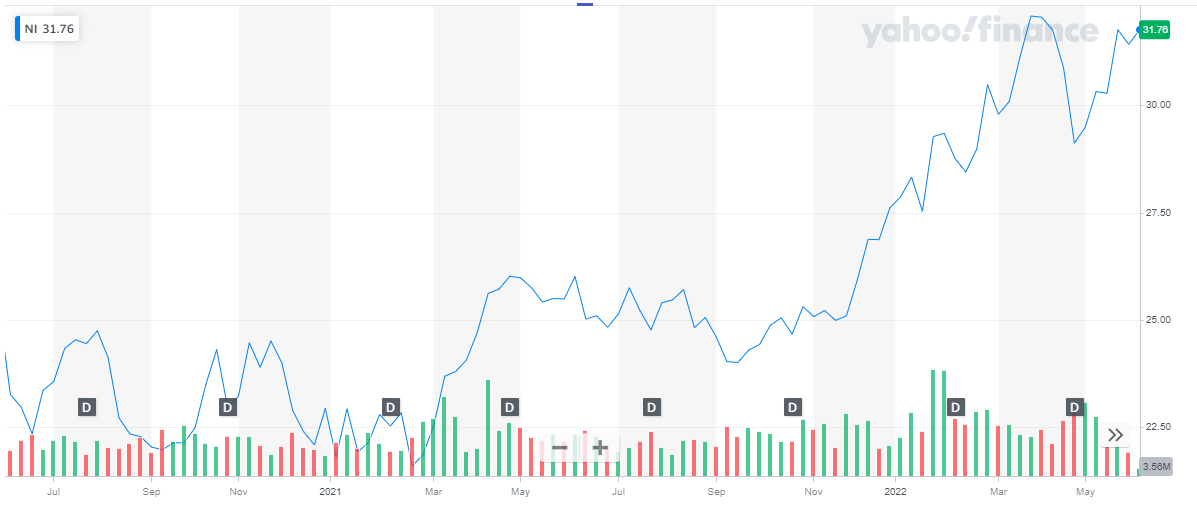

The market capitalization of NiSource is $ 12.9 billion. The share of the company is currently trading at a price of $ 31.76. The below chart shows the stock performance of NiSource for the past two years.

After maintaining the same price level for the majority of 2021 and the first half of 2021, the stock picked up the pace. In 2021, the stock appreciated by 20%. The year 2022 accelerated the growth of the stock. As a result, the stock has appreciated by 15 % to date

Learn about:

Learn about:

Brookfield Infrastructure

Brookfield Infrastructure Corporation owns and operates regulated natural gas transmission systems in Brazil. The company also engages in the regulated gas and electricity distribution operations in the United Kingdom; and electricity transmission and distribution, as well as gas distribution in Australia. It operates approximately 2,000 kilometers of natural gas transportation pipelines in the states of Rio de Janeiro, Sao Paulo, and Minas Gerais; 3.9 million gas and electricity connections; and 61,000 kilometers of operational electricity transmission and distribution lines in Australia.

In the recent quarterly report, the company reported:

- Net income of $ 2.9 billion

- Earnings per share $ 0.81

Brookfield has a market capitalization of around $ 5.13 billion. The share of the company is currently trading at a price of $ 69.63. The below chart shows the performance of Brookfield Infrastructure for the past two years.

The stock has been volatile for the past two years. After peaking at $ 78.68, the stock declined. In 2021, the stock declined by approx. 6 %. The stock changed course during 2022 and started rising. To date, the stock has risen by a very small percentage.

Check our updates for NASDAQ Forecast.

Check our updates for NASDAQ Forecast.

Black Hills

Black Hills Corporation, operates as an electric and natural gas utility company in the United States. The company serves 1.3 million natural gas and electric utility customers in eight states. It operates in two segments:

- Electric Utilities

- Gas Utilities

The Black Hills recently reported its first-quarter report for the year 2022. The company reported:

- Net Income of $ 117.5, an increase of 22 % from the same period last year

- EPS of $ 1.82, an increase of 18.2 % from the same period last year

Also read: Best EV Stocks

The stock of Black Hills Energy is currently trading at $ 76.31. The below chart shows the stock performance of Black Hill for the past two years. The stock has been on an upward trend for the past two years. In 2021, the stock appreciated by approx. 15 %. During the current year, the stock has appreciated by roughly, 8 % to date.

Cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention

Cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention

Conclusion

Investing in utility stocks is a way for some people to have a low-risk investment that also generates income by paying dividends.

The above list of companies has been selected after looking at the past growth pattern and the regular dividend payments. These companies have a strong foundation and good operational capabilities. Since the demand for utilities will never run out, these utility stocks will also continue to grow, But always do your research to avoid any fraud or wrong investment.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Swing Trading Stocks to Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy