What are Regional Bank Stocks?

Regional Banks are companies/banks which offer cash and other deposits and offer commercial and consumer loans. The regional banks operate within their respective local markets. The regional bank stock might not be as popular as the huge-cap best bank stocks. But they too offer an excellent return to investors.

Top 13 Best Regional Bank Stocks in 2024

Here we have compiled a list of the best regional stocks which are worth investing in 2024:

| Sr | Company Name | Symbol | Market Cap | Price (As of 24th May 2022) |

| 1 | Truist Financial Corp. | TFC | $ 62.3 Billion | $ 46.81 |

| 2 | Fifth Third Bancorp. | FITB | $ 25.12 Billion | $ 36.61 |

| 3 | Regions Financial Corp. | RF | $ 19.1 Billion | $ 20.43 |

| 4 | Key Corp. | KEY | $ 17.8 Billion | $ 19.05 |

| 5 | Signature Bank | SBNY | $ 12 Billion | $ 190.88 |

| 6 | Trustco Bank Corp | TRST | $ 604 Million | $ 31.49 |

| 7 | Farmers & Merchants Bancorp Inc | FMAO | $ 505.9 Million | $ 38.72 |

| 8 | First Guaranty Bancshares Inc | FGBI | $ 301.2 Million | $ 28.11 |

| 9 | Bank 7 Corp. | BSVN | $ 219.2 Million | $ 24.09 |

| 10 | Ohio Valley Bank Corp. | OVBC | $ 143.6 Million | $ 30.09 |

| 11 | East West Bancorp | EWBC | $ 9.11 billion | $ 64.82 |

| 12 | Citizens Financial Group | CFG | $ 19.3 billion | $ 39.21 |

| 13 | First Horizon Corp. | FHN | $ 13.13 billion | $ 24.48 |

Truist Financial Corp.

Truist Financial Corp is amongst the top 10 U.S. commercial banks, headquartered in Charlotte, North Carolina. The bank serves clients in several high-growth markets in the country, offering a wide range of financial services. Its services include:

- Retail

- Commercial real estate

- Payments

- Small business and commercial banking

- Corporate and institutional banking

- Specialized lending

- solutions

- Asset management

- Insurance

- Wealth management

- Capital markets

- Mortgage

Stock trading advisory websites help investors make the right financial decisions. The bank recently published its quarterly earnings report for 2022:

- Net income available to common shareholders of $1.3 billion

- Earnings per diluted common share were $0.99

- Total Assets of $ 544 billion

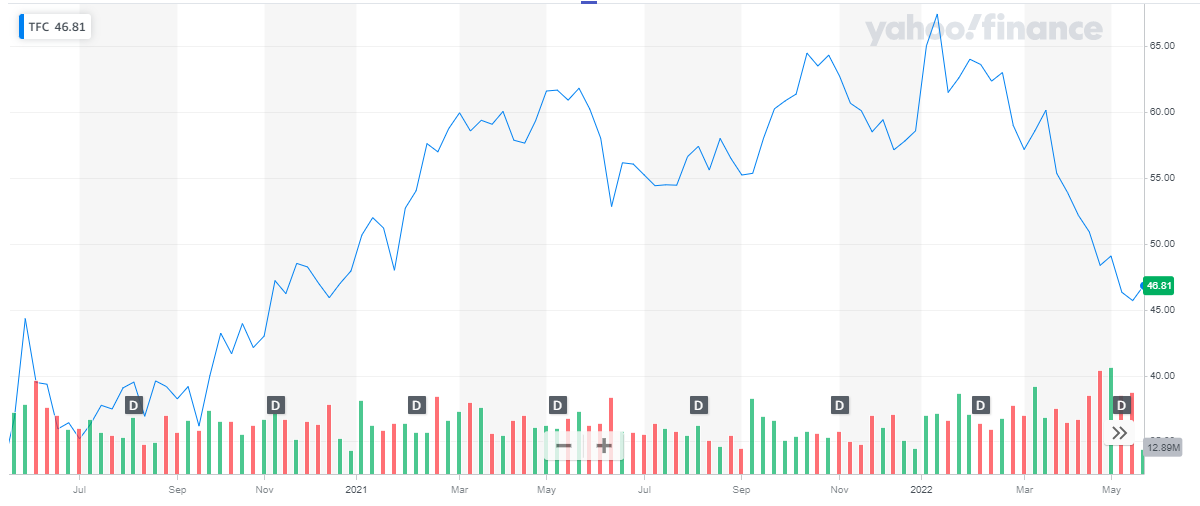

Truist Financial Corp has a market capitalization of around $ 62.3 billion. Its shares are currently trading at $ 46.81. The below chart shows the stock performance of Truist Financial Corp. for the past two years. The stock has been rising, steadily, since 2020. But after hitting the peak of $ 67.41 in January 2022, the stock started declining. During the current year, the stock has declined by 20 % to date.

Get to know about top Infrastructure stocks to invest in.

Get to know about top Infrastructure stocks to invest in.

Fifth Third Bancorp.

Fifth Third Bancorp is a diversified financial services company headquartered in Cincinnati, Ohio, and the indirect parent company of Fifth Third Bank, National Association, a federally chartered institution. Fifth Third operates four main businesses:

- Commercial Banking

- Branch Banking

- Consumer Lending

- Wealth & Asset Management.

Fifth Third is among the largest money managers in the Midwest. As of March 31, 2022, the Company had $211 billion in assets and operates 1,079 full-service Banking Centers, and 54,000 Fifth Third branded ATMs throughout the US. As of March 31, 2022, had $549 billion in assets under care. Semi conductor stocks are also one of the best investment opportunities.

Fifth Third Bancorp has recently shared its quarterly results for the first quarter of 2022:

- Net Income available to shareholders $ 474 million

- Earnings per share $ 0.69

- Total Average Deposits were reported to be $ 168 billion

Fifth Third Bancorp has a market capitalization of $ 25 billion. The share of the company is trading at a price of $ 36.61. The below chart shows the bank’s share performance for the past two years. The share was on a bullish trend for the major part of 2020 and 2021. After hitting the peak of $ 50.45 in January 2022, the share retreated back in price. In 2022, the stock has declined by 26 %.

Oil stocks are one of the riskier yet most profit-generating sectors.

Oil stocks are one of the riskier yet most profit-generating sectors.

Regions Financial Corp.

Regions Financial Corporation is one of the nation’s largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services. The bank serves customers across the South, Midwest, and Texas. If you are seeking a steady stream of income, you should invest in REIT stocks.

The bank has recently published its quarterly income report for the year 2022:

- Net income available to shareholders $ 524 million

- Earnings per share $ 0.56

Regions Financial Corp. has a market capitalization of $ 19 billion. The share of the bank is trading at $ 20.43. The below chart shows the stock performance of Regions Financial Corp. for the past two years. The stock has been on an upward trend for the past two years. After peaking at $ 25.41 in January 2021, the stock dropped in price slightly. During the current year, the stock has dropped by 19 % to date.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Key Corp.

KeyCorp is a bank-based financial services company. It provides a range of retail and commercial banking, commercial leasing, investment management, consumer finance, student loan refinancing, commercial mortgage servicing and special servicing, and investment banking products and services. It serves individual, corporate, and institutional clients.

For the first quarter of 2022, the company reported:

- Net Interest Income $ 1 billion

- Net Income for shareholders $ 420

- Average loans were $ 103.8 billion

Keycorp has a market capitalization of $ 17.8 billion. The bank’s share is currently trading at a price of $ 19.05 on the stock market. The below chart shows the performance of the stock for the past two years. The stock was on a bullish run during 2020 and 2021.

The stock peaked at $ 27, in January 2022. This is the highest the stock has reached in the past few years.

Get to know the best vaccine stocks to invest in now.

Get to know the best vaccine stocks to invest in now.

Signature Bank

Signature Bank is a New York-based full-service commercial bank with 38 private client offices in Connecticut, California, and North Carolina. Through its single-point-of-contact approach, the Bank’s private client banking teams primarily serve the needs of privately owned businesses, their owners, and senior managers. Also learn about Best Day Trading Stocks.

Signature Bank placed 19th on S&P Global’s list of the largest banks in the U.S., based on deposits at year-end 2021.

In the recent first quarterly report for the year 2022, the bank reported:

- Net Interest Income was reported at $ 573.6 million

- Net Income was recorded at $ 338.5 million

- Earnings per share were $ 5.3

- Total Deposits were reported to be $ 109.16 billion

- Loans were reported at $ 66.40 billion

Signature Bank has a market capitalization of $ 12 billion. The share of the company is trading at a price of $ 190.88. The below chart shows the stock performance of the bank for the past two years. The stock was on a bullish run for the past two years. After hitting the peak of $ 365 in January 2022, the stock changed course and started declining. During the current year, the stock has declined by 48 % to date.

Get to know the list of crypto mining companies that are leading the industry.

Get to know the list of crypto mining companies that are leading the industry.

Trustco Bank Corp

Trustco Bank is a federal savings bank that provides personal and business banking services to individuals, partnerships, and corporations. Trustco Bank has 147 branch locations, 53 of which are in the state of Florida. The bank offers a wide variety of great deposit and loan products; the bank specializes in residential mortgage lending. Get to know the best tech stocks to invest in now.

As of December 31, 2021, Trustco Bank’s assets were $6.2 Billion. Trustco Bank has been paying dividends to shareholders for more than 100 consecutive years.

In 2018, Trustco Bank was rated as the 15th best-performing savings bank in the country, by &P Global Intelligence. In addition to it, Trustco bank has achieved multiple milestones and received many recognitions and awards. In fact, Florida state achieved $ 1 billion in deposits and $ 1 billion in loans in 2021.

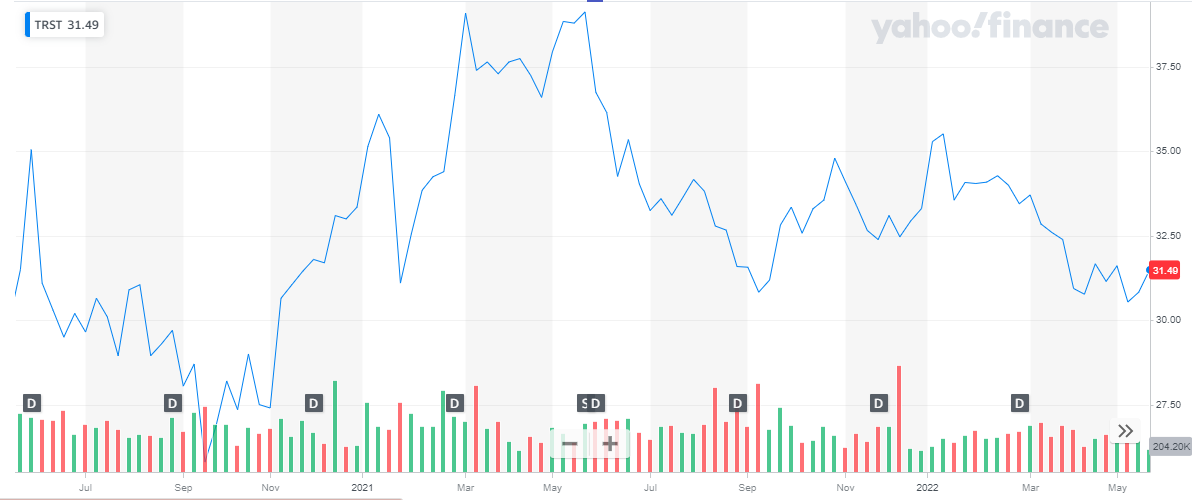

Trustco bank has a market capitalization of around $ 640 million. The shares of the bank are trading at a price of $ 31.49. the below chart exhibits the stock performance of Trustco Bank for the past two years. The stock has been volatile these past two years. However, the highest the stock has hit is $ 39.13 in May 2021.

Learn about head and shoulders patterns trading guide.

Learn about head and shoulders patterns trading guide.

Farmers & Merchants Bancorp Inc.

The Farmers & Merchants State Bank is a local independent community bank. It has been serving residents of Northwest Ohio and Northeast Indiana since 1897. The Farmers & Merchants State Bank provides commercial banking, retail banking, and other financial services. Our locations are in Champaign, Fulton, Defiance, Hancock, Henry, Lucas, Williams, and Wood counties in Western Ohio.

In the first quarter report for the year 2022, the bank reported:

- Net Interest Income of $ 21,899

- Net Income of $ 8,102, an increase of 65 %, from the previous year’s same period

- Earnings per share of $ 0.62, an increase of 41 %

- Total loans were reported at record levels of $1.962 billion, a 46 % increase from the previous year’s same period

- Total assets were reported at $2.686 billion, an increase of 34.8%

Farmers & Merchants Bancorp Inc. has a market cap of $ 506 Million. Its shares are currently trading at a price of $ 38.72. The below chart shows the stock performance of the Farmers & Merchants Bancorp Inc. The stock was trading within a small range of under $ 28 for 2020 and the major part of 2021. But in the last quarter of 2021, the stock picked up the pace and has been on an upward streak since then. During the current year, the stock has appreciated by 18.6 %.

Check our updates for NASDAQ Forecast.

Check our updates for NASDAQ Forecast.

First Guaranty Bancshares Inc

First Guaranty Bancshares, Inc.’s principal business consists of attracting deposits from the general public and local municipalities in its market areas. The deposits together with funds generated from operations and borrowings in lending and securities activities are used to serve the credit needs of the customer base, including commercial real estate loans, commercial and industrial loans, one-to four-family residential real estate loans, construction and land development loans, agricultural and farmland loan, and to a lesser extent, consumer and multifamily loans. Cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

First Guaranty Bancshares, Inc. reported earnings results for the first quarter ended March 31, 2022:

- Net interest income was $ 24.98 million

- Net income was $ 7.59 million

- Basic earnings per share from continuing operations was $ 0.65

First Guaranty Bancshares has a market capitalization of $ 304 million. Its shares are currently trading at a price of $ 28.26. The chart below shows the bank’s stock performance over the past two years. The stock has been on a bullish streak for the past two years. During the current year, the stock has appreciated by 27.5 %.

Also read:

Also read:

Bank 7 Corp.

Bank7 Corp. operates as a bank holding company for Bank7 that provides banking and financial services to individual and corporate customers. It offers commercial deposit services, including commercial checking, money market, and other deposit accounts; and retail deposit services. The bank focuses on serving business owners and entrepreneurs by delivering fast, consistent and well-designed loans and deposit products to meet their client’s financing needs. There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

The bank recently posted results for the three months ending March, 31st 2022:

- Net income of $6.2 million as compared to $5.1 million for the same period last year, representing an increase of 21.2%

- Earnings per share of $0.68 as compared to $0.56, for the same period last year, representing an increase of 21.5%

- Total assets of $1.4 billion as compared to $1.0 billion, for the same period last year, representing an increase of 35.9%

- Total loans of $1.1 billion as compared to $861.4 million, for the same period last year, representing an increase of 23.3%

- Total deposits of $1.3 billion as compared to $929 million, for the same period last year, representing an increase of 38.1%

Bank7 has a market capitalization of $ 221 million. The share of the bank is currently trading at $ 24.27. The below chart shows the performance of Bank7’s stock for the past two years. The share has been on a bullish streak for the past two years. During the current year, the stock has maintained its price level.

Also read: Best Stocks for Covered Calls in 2024.

Also read: Best Stocks for Covered Calls in 2024.

Ohio Valley Bank Corp.

The Ohio Valley Bank Company is a full-service bank offering commercial and retail services from 16 locations throughout southern Ohio and western West Virginia. Also check out: List of Most Volatile Stocks

It operates as the bank holding company for The Ohio Valley Bank Company which provides commercial and consumer banking products and services. The company operates in two segments,

- Banking

- Consumer Finance

It accepts various deposit products, including checking, savings, time, and money market accounts, as well as individual retirement accounts, demand deposits, NOW accounts, and certificates of deposit.

In the recent quarterly report, for the period ending March, 31st 2022, the bank reported:

- Net income of $ 4,125,000, an increase of 16.8%, from the same period the last year

- Earnings per share were $ 0.87, an increase of 17.5 % from the same period the last year

- Total assets were reported to be $ 1.258 billion

Ohio Valley Bank Corp has a market capitalization of $ 147.7 million. Its shares are currently trading at $ 30.95. The below chart shows the stock performance of Ohio Valley for the past two years. The bank’s stock has been volatile in the past two years with multiple peaks and dips. Despite being volatile, the stock has been steadily rising over time. During the current year, the stock started trading at $ 29.65 and has appreciated by roughly 5 % to date.

Also check out Best Forex Brokers for Trading

Also check out Best Forex Brokers for Trading

East West Bancorp

East West Bancorp, Inc. operates as the bank holding company for East West Bank that provides a range of personal and commercial banking services to businesses and individuals. It operates through three segments:

- Consumer and Business Banking – The Consumer and Business Banking segment provides financial service products and services to consumer and commercial customers through the company’s branch network in the U.S.

- Commercial Banking – The Commercial Banking segment primarily generates commercial loans and deposits through commercial lending offices located in the U.S. and Greater China

- Other – The Other segment includes treasury activities of the company and the elimination of inter-segment amounts.

The company accepts various deposit products, such as personal and business checking and savings accounts, money markets, and time deposits.

The bank recently reported its third-quarter financial report for the year:

- Net income was reported at $ 295.3 million, as compared to $ 225.4 million for the third quarter of 2021

- Earnings per share were reported at $ 2.08 per share, as compared to $ 1.57 per share for the third quarter of 2021

East West Bancorp has a market cap of $ 9.11 billion. Its shares are trading at $ 64.82.

The stock of the company remained volatile in 2021 while maintaining a bullish run. From a price of $ 50.71, at the start of the year, the stock closed off at $ 78.68. Overall, the stock appreciated by 55 %.

In 2022, after maintaining its price at the start of the year, the stock started to decline. The stock last closed at $ 64.68 representing an 18 % decline to date

Citizens Financial Group

Citizens Financial Group (CFG) is a retail bank holding company offering retail and commercial banking products and solutions. It operates in two segments:

- Consumer Banking – The Consumer Banking segment provides deposit products, mortgage, home equity lending, auto financing, student loans, personal unsecured lines and loans, credit cards, business loans, wealth management, and investment services

- Commercial Banking – The Commercial Banking segment delivers lending and leasing, deposit and treasury management, foreign exchange, interest rate and commodity risk management solutions, loan syndications, corporate finance, merger and acquisition, and debt and equity capital markets capabilities.

The company serves individuals, small businesses, middle-market companies, large corporations, and institutions. As of 19th October, the bank has $ 224.7 billion in assets. And as of 15th June 2022, the bank had a deposit base of $ 159 billion.

The bank recently reported its third quarter financial report:

- Total Revenue was reported at $ 2.2 billion as compared to $ 1.7 billion in the previous year’s same period

- Net Income was reported at $ 636 million, as compared to $ 546 million in the previous year’s same period

- Earnings per share were reported at $ 1.3

Citizens Financial Group has a market cap of $ 19.3 billion. Its shares are trading at $ 39.21.

During the year 2021, the stock maintained an upward trend. From a price of $ 35.76, at the start of the year, the stock continues its bullish run and closed off at $ 47.25. Overall, the stock appreciated by 32 %.

In 2022, after peaking at $ 56.35, the stock reversed its course and started declining. The stock last closed at $ 34.43 representing a 39 % depreciation to date.

First Horizon Corp.

First Horizon Bank is a leading regional financial services company, dedicated to helping our clients, communities, and associates unlock their full potential with capital and counsel. Headquartered in Memphis, TN, the banking subsidiary First Horizon Bank operates in 12 states across the southern U.S. The Company and its subsidiaries offer commercial, private banking, consumer, small business, wealth and trust management, retail brokerage, capital markets, fixed income, and mortgage services. First Horizon has been recognized as one of the nation’s best employers by Fortune and Forbes magazines and a Top 10 Most Reputable U.S. Bank.

First Horizon has an attractive combination of a profitable business and a very good valuation. The company’s Iberia bank merger also provides opportunities for geographical diversification and organic growth.

First Horizon recently released its third quarter report for the year 2022:

- Total Revenue was reported at $ 875 million

- Net Income was reported at $ 257 million

- Earnings per share were reported at $ 0.45

As of September 2022, First Horizon Bank has a total asset of $ 80.3 billion, total deposits of $ 66 billion, and loans of $ 57.4 billion.

First Horizon has a market cap of $ 13.13 billion. Its shares are trading at $ 24.48.

The stock of the company has been on a bullish run for the last two years. In 2021 the stock started at $ 12.76. Throughout the year the stock started to climb slowly and steadily and closed off the year at $ 16.33. Overall, the stock appreciated by 28 %.

In 2022, the stock continued its bullish journey. It started the year 2022 at $ 16.33. throughout the year, the stock climbed high and last closed at $ 24.68. To date, the stock appreciated by 51 %.

CONCLUSION

The Federal Reserve recently announced– a 25-basis-point increase in interest rates. This is hugely anticipated to benefit the financial sector, especially the banking industry.

Regional bank stocks are more likely to benefit from changing interest rates than any other financial instruments. Since regional banks have no other business than pure banking, they are more sensitive to the interest rate changes.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Swing Trading Stocks to Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy