What are Recession Stocks?

Recession stocks are stocks of companies whose products and services consumers will continue to purchase, no matter what the economic conditions. Certain industries such as the defensive, healthcare, utilities, or consumer staples are often resistant to the negative effects of the recession. Investors chose to include recession-proof stocks in their portfolios to help safeguard their portfolio and returns during an economic slowdown. Investors always choose the best brokers that better suit his/her trading goals.

Best Recession Stocks in 2024

| Sr. | Company Name | Symbol | Market Cap | Price (As of September 2022) |

| 1 | The Proctor and Gamble Company | PG | $ 336.6 billion | $ 140.1 |

| 2 | The Home Depot Inc. | HD | $ 304.6 billion | $ 297.54 |

| 3 | The Coca-Cola Company | KO | $ 270.3 billion | $ 62.5 |

| 4 | Danaher Corporation | DHR | $ 213.5 billion | $ 293.51 |

| 5 | McDonald’s | MCD | $ 191.55 billion | $ 260.37 |

| 6 | Nike Inc. | NKE | $ 176.3 billion | $ 112.38 |

| 7 | British American Tobacco | BTI | $ 93.17 billion | $ 41.01 |

| 8 | Zoetis Inc. | ZTS | $ 77.9 billion | $ 166.35 |

| 9 | GSK plc. | GSK | $ 66.97 billion | $ 32.45 |

| 10 | 3M | MMM | $ 68.787 billion | $ 124.25 |

| 11 | Synopsys Inc. | SNPS | $ 48.5 billion | $ 319.61 |

| 12 | Lowe’s Cos Inc | LOW | $ 122.9 billion | $ 203.2 |

| 13 | Walmart | WMT | $ 385.1 billion | $ 143.81 |

The Procter and Gamble Company

The Procter and Gamble Company

The Procter and Gamble Company has been around for more than a century. The company has survived many market crashes, prolonged inflation, and the Great Depression. Therefore, Procter and Gamble are on the top list for being the best stock to invest in during a recession.

P&G serves consumers around the world with one of the strongest portfolios of trusted brands which include: Always, Ambi Pur, Ariel, Bounty, Charmin, Crest, Dawn, Downy, Fairy, Febreze, Gain, Gillette, Head & Shoulders, Lenor, Olay, Oral-B, Pampers, Pantene, SK-II, Tide, Vicks, and Whisper. The P&G community includes operations in approximately 70 countries worldwide.

Investing in fintech stocks is a smart investment move today.

The Procter & Gamble Company reported the third quarter of fiscal year 2022:

- Net sales were reported at $ 19.4 billion, an increase of 7 % from the previous year’s same period

- Net Income was reported at $ 3.3 billion

- Earnings per share were reported at $ 1.33, a 6 % increase from the previous year’s same period

The company has been able to maintain good revenue growth. In the past 5 years, Procter and Gamble achieved more than 5 % revenue growth, on average.

P&G has a market cap of $ 336.6 billion. Its share is currently trading at $ 141.1.

The year 2021 was a good year for the company’s stock. The stock was on a bullish run, throughout the year. It started at $ 139.14 and closed at $ 163.58. This represents a 17.6 % stock appreciation during the year.

In 2022, the stock changed course and picked up a bearish trend while exhibiting volatility. The stock started at $ 163.58, dropped to the lows of $ 132.36, and last closed at $ 141.1. Overall, the stock declined by 13.7 %.

Get to know about top Infrastructure stocks to invest in.

Get to know about top Infrastructure stocks to invest in.

The Home Depot Inc.

The Home Depot is the largest home improvement retailer in the US. Home Depot is a safe investment. According to many investors, it is not a recession-proof but the historical record of the company proves that it has come out of every crisis safe and sound. There is no denying that during a recession, sales of the company decline. But once the effects of the recession settled down, sales start to grow again. Get to know the best quantum computing stocks.

The management of the company is always on the hunt to seek opportunities that strengthen the business. Therefore, the company is always able to exit the damaging effects of a downward economy.

The Home Depot reported results for the second quarter of fiscal 2022:

- Sales were reported at $ 43.8 billion, a 6.5 % increase from the previous year’s same quarter

- Net earnings were reported at $ 5.2 billion, an 8.3 % increase from the previous year’s same quarter

- Earnings per share were reported at $ 5.05

At the end of the second quarter, the Company operated a total of 2,316 retail stores in all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canadian provinces, and Mexico.

Home Depot has a market capitalization of $ 304.6 billion. Its share is trading at a price of $ 297.54.

During the year 2021, the stock went on a bullish streak. From a price of $ 265.62, the stock closed at $ 415, representing a 56 % increase during the year.

In 2022, the stock changed course. The stock went on a bearish streak. From $ 415 the stock dropped to the lows of $ 270.73 and last closed at $ 299.96. Overall, the stock depreciated by 28 % to date.

Oil stocks are one of the riskier yet most profit-generating sectors.

Oil stocks are one of the riskier yet most profit-generating sectors.

The Coca-Cola Company

The Coca-Cola company is one of the best recession stocks to buy in 2022. No doubt an economic slowdown is expected but a recession is not likely to hurt the demand for beverages, significantly. The social events are on the rise and the restaurants are back to full-scale operations, The company has taken price actions to aid its sales growth and margin expansion over the coming quarters. Investing in value stocks is a long-term investment.

Coca-Cola has had an excellent past year, despite the challenging economic environment. This is enough proof for investors that the beverage company can withhold any recessionary environment. The company continues to preserve capital in times of trouble, pay a growing dividend, and continue to innovate on its product portfolio.

What’s more, Coca-Cola has increased its dividend payout for 60 years in a row, making it a Dividend King. All the more reasons to invest in this stock.

The Coca-Cola Company recently reported second-quarter 2022 results:

- Net revenues were reported to be $11.3 billion, a 12 % increase from the previous year’s same period

- Net Profit was reported at $ 1.9 billion, a 28 % decline from the previous year’s same period

- EPS was reported at $ 0.44, a 28 % decline from the previous year’s same period

The Coca-Cola company has a market capitalization of $ 270.3 billion. Its share is currently trading at a price of $ 62.5.

The stock of the company has been on a bullish streak in the past two years. The stocks started the year 2021 at a price of $ 54.84. The stock continued its upward trend throughout the year and closed at $ 59.21. Overall, the stock appreciated by 8 % during the year.

In 2022, the stock continued its bullish journey. It went from $ 59.21 to $ 62.5. Overall, the stock climbed by 5.55 % to date.

Also, check out the best swing trading stocks.

Also, check out the best swing trading stocks.

Danaher Corporation

Danaher Corporation designs manufactures and markets professional, medical, industrial, and commercial products and services. The Company operates through three segments:

- Life Sciences offer a range of instruments and consumables that are used by customers to study the basic building blocks of life, including genes, proteins, metabolites, and cells, to understand the causes of disease, identify new therapies, and test and manufacture new drugs and vaccines

- Diagnostics which offer analytical instruments, reagents, consumables, software, and services

- Environmental & Applied Solutions, which offers products and services that help protect important resources and keep global food and water supplies safe. Cybersecurity stocks are also one of the best investment opportunities.

Its business research and development, manufacturing, sales, distribution, service, and administrative facilities are located in over 60 countries.

The company has benefited significantly from high demand for its COVID-19 testing and treatment products. The company continues to invest for growth across our businesses, expanding production capacity and accelerating innovation initiatives. No doubt, the company’s revenue growth may slow in the coming quarters as the demand for COVID-19-related products declines. But the company is expected to sustain its growth in the coming years.

Danaher Corporation recently announced results for the second quarter of 2022:

- Revenues were reported at $ 7.8 billion, a 7.5 % year-over-year increase

- Net earnings were reported at $ 1.7 billion, a 1.5 % year-over-year decrease

- Earnings per share were reported at $ 2.25

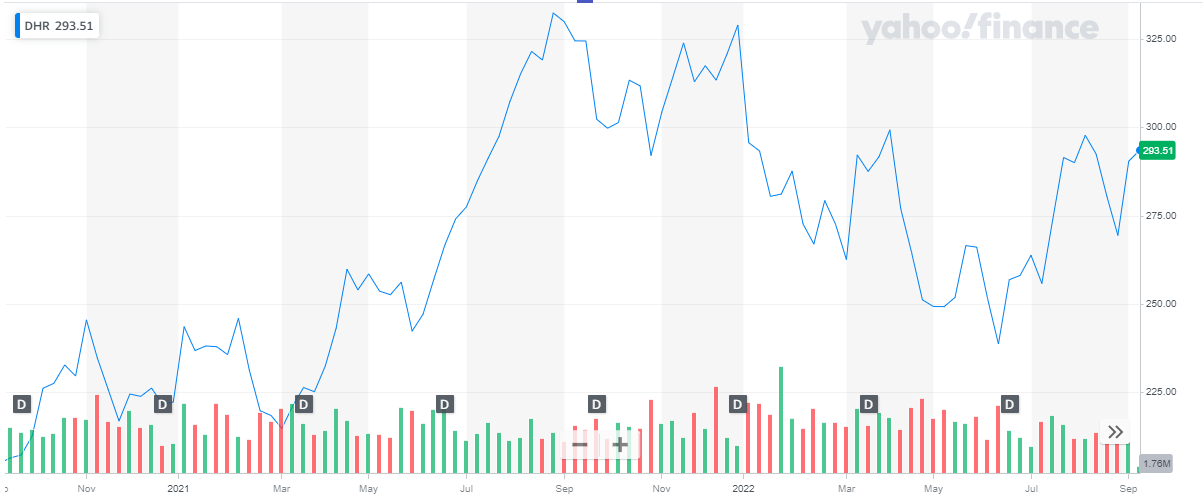

Danaher Corporation has a market cap of $ 213.5 billion. Its share is currently trading at a price of $ 293.51.

The share was on a bullish run during 2021. From $ 222.14 the stock went up to $ 329.01. This represents a stock appreciation of 48 % during the year.

In 2022, the stock of the company was comparatively volatile and slightly declined. From $ 329.01 the stock dropped to the low $ 238 and last closed at $ 293. To date, the stock has declined by 11 %.

Investors are now looking for the finest solar energy stocks to invest in.

Investors are now looking for the finest solar energy stocks to invest in.

Also read:

McDonald’s

McDonald’s Corporation operates in nearly 120 countries around the world. As a large global restaurant chain founded in 1955, it has extensive experience in adjusting to changing business conditions.

McDonald’s level of risk preparedness, experience in managing health and safety concerns, and supply chain planning all play a big role in the company’s excellent recession stock.

Get to know about RSI trading strategies.

McDonald’s Corporation recently announced results for the second quarter ended June 30, 2022:

- Total revenues were reported at $ 5.7 billion, a 3 % decline from the previous year’s same period

- Net Income was reported at $ 1.2 billion, a 46 % decline from the previous year’s same period

- Earnings per share were reported at $ 1.6

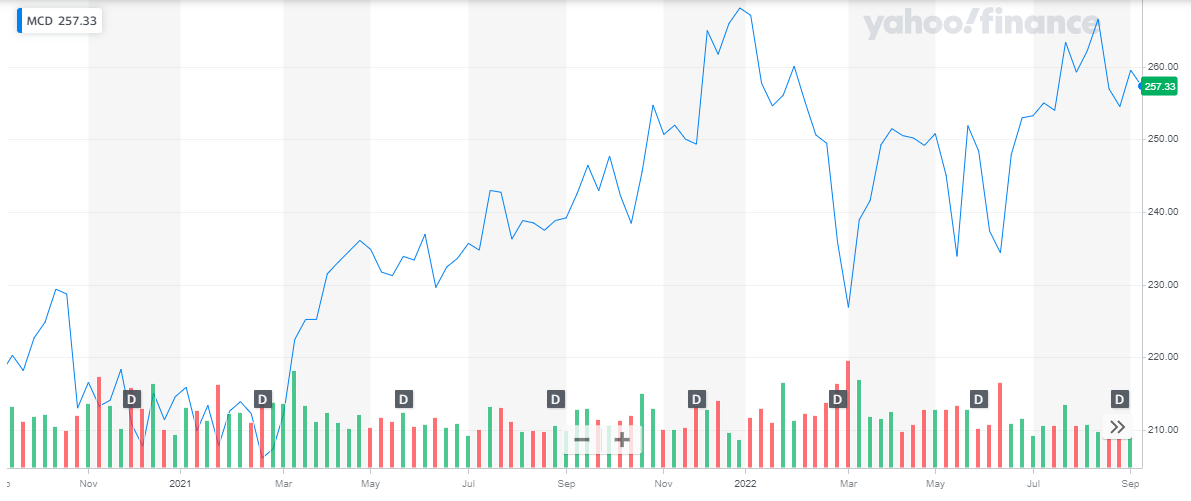

Mcdonald’s has a market cap of $ 189.34 billion. Its share is trading at a price of $ 260.37.

The stock remained bullish throughout 2021. From $ 214.58, the stock peaked and closed at $ 268.07. This represents a 25 % increase in price during the year.

In 2022, the stock picked up a bearish trend while being volatile. During the year the stock dropped to the lows of $ 226.86 and last closed at $ 257.25. This represents a 13.4 % decline in share price to date.

If you are seeking a steady stream of income, you should invest in REIT stocks.

If you are seeking a steady stream of income, you should invest in REIT stocks.

Nike Inc.

The figures don’t lie for any company. The blue-chip company has had a notable performance in the past recessions. During the 2009 recession, the sales of Nike actually grew, and, during the pandemic, led recession, Nike successfully revamped its e-commerce presence which prevented the company from any effects of the recession. Hence, it is one of the best recession stocks to invest in. Get to know the best regional bank stocks.

NIKE, Inc. recently reported financial results for its fiscal 2022 fourth quarter and full year ended May 31, 2022:

- Revenue was reported at $ 12.2 billion, a 1 % decline compared to the prior year’s same period

- Net income was reported at $ 1.4 billion, a 5 % decline compared to the prior year’s same period

- Earnings per share were reported at $ 0.9

For the complete year, the company reported:

- Revenue was reported at $ 46.7 billion, a 5 % increase compared to the prior year’s same period

- Net income was reported at $ 6 billion, a 6 % increase compared to the prior year’s same period

- Earnings per share were reported at $ 3.83

Nike has a market cap of $ 168 billion. Its share is currently trading at a price of $ 112.38.

The stock started the year 2021 at $ 141.47 and closed the year at $ 166.67. this represents a 17.8 % increase during the year.

In 2022, the stock went bearish. During the year, it dropped to the lows of $ 101.18 and last closed at $ 107. This represents a 6 % decline to date.

To give investors an idea where to start and which companies to look for investment in, we have compiled a list of the top best oil and gas ETFs to buy now.

To give investors an idea where to start and which companies to look for investment in, we have compiled a list of the top best oil and gas ETFs to buy now.

British American Tobacco

British American Tobacco PLC is one of the largest tobacco conglomerates. It is a global tobacco company that manages a large portfolio of brands. It continued its global expansion into 180 countries around the world. Its cigarettes include Dunhill, Lucky Strike, Kool, Camel, Newport, Natural American Spirit, and Pall Mall, and its vape brands include Vype, Vuse, and Glo. It also sells Grizzly and Camel Snus. It’s also aggressively pursuing new categories. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

BAT is focused on substantially transitioning to next-gen products. Investment in the company’s stock will provide exposure to the international tobacco sector, as BAT is spread around the globe. Also, its rising dividend yield and high-profit margins make it a good choice of investment during a recession.

British American Tobacco recently reported its six-month earnings report, ending 30 June 2022:

- Revenue was reported to be £ 12.9 billion

- Net Income was reported at £ 1.9 billion

- Earnings per share were reported at £ 81.2 p

British American Tobacco has a market cap of $ 91 billion. Its share is currently trading at a price of $ 41.01.

In 2021, the stock remained somewhat stagnant. From a price of $ 37.49, at the start of the year, the stock closed off the year at $ 37.41. There was a negligible change in price during the year.

In 2022, the stock spiked. The stock went as high as $ 46.5 and last closed at $ 41.01. Overall, the stock appreciated by 10 % to date.

Also read Forex trading vs Stocks trading.

Also read Forex trading vs Stocks trading.

Zoetis Inc.

Zoetis is a global animal health company dedicated to supporting customers and their businesses in ever better ways. It commercializes products primarily across species, including livestock, such as cattle, swine, poultry, fish, and sheep; and companion animals comprising dogs, cats, and horses.

Zoetis is a former Pfizer subsidiary that made a name for itself when it spun off as an independent company focused on animal health and medicine. The company expects that its vaccine can safely inoculate around 100 mammalian species – though, at this time, its vaccine remains in the experimental stage.

Read Top NASDAQ Stocks to buy in 2022.

Zoetis Inc recently reported its second-quarter results for the year 2022:

- Revenue was reported to be $ 2.1 Billion, representing a 5 % growth from the previous year’s same period

- Net Income was reported at $ 529 Million, representing a 3 % growth from the previous year’s same period

- Earnings per share were reported at $ 1.12, representing a 5 % growth from the previous year’s same period

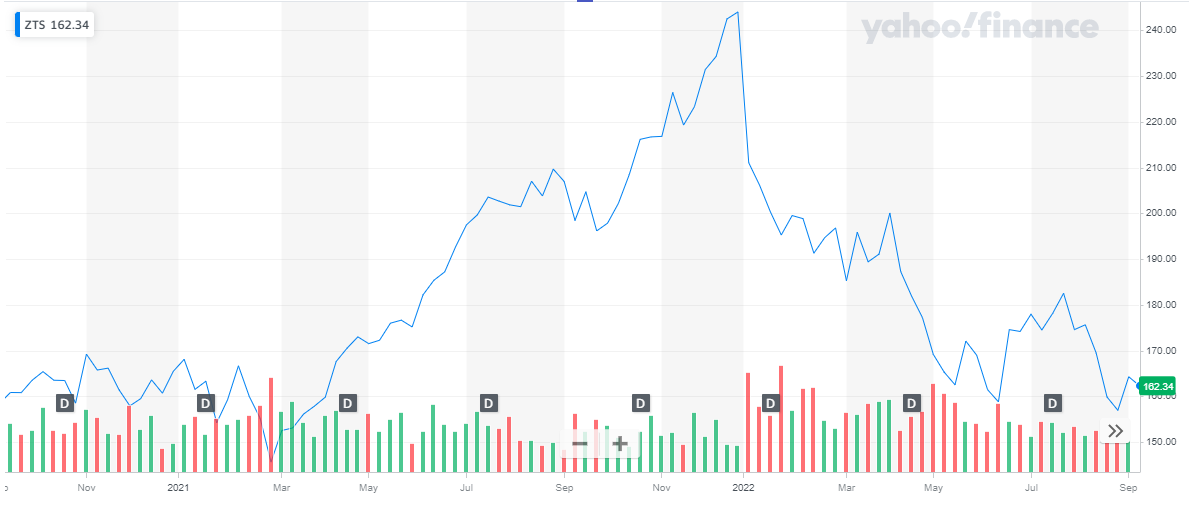

Zoetis has a market cap of $ 76 billion. Its share is currently trading at a price of $ 166.35.

The year 2021, was a good year for Zoetis stock as the share continued on a bullish streak. From $ 165.5 the stock rose up to $ 244.03, representing a 47 % increase during the year.

In 2022, the stock reversed its course and started on a bearish pattern. The stock recently closed at $ 166.35, representing a 32 % decline to date.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased

GSK Plc.

GlaxoSmithKline Plc is a healthcare company, which engages in the research, development, and manufacture of pharmaceutical medicines, vaccines, and consumer healthcare products. It operates through the following segments:

- Pharmaceuticals

- Vaccines

- Consumer Healthcare

- Corporate Executive Team (CET)

GlaxoSmithKline (GSK) boasts an impressive range of healthcare products that it provides to a global client base. The demand for GSK products is unmatchable and there seems no end to it. The coming future will only see a rise in demand and not a decline. Irrespective of economic conditions, healthcare remains a necessity, and GSK is the top provider. Therefore, no matter what the economic health is, GSK is very unlikely to be affected during a recession.

Get to know everything about high-frequency trading.

GSK recently shared its quarterly earnings report for the year:

- Sales were reported at £ 6.9 billion

- Earnings per share were reported at £ 20.8

GSK has a market cap of $ 66 billion. Its share is currently trading at $ 32.45.

In 2021, the stock remained bullish. It started trading at $ 36.8 and closed off the year at $ 44.1. This represents a 20 % appreciation during the year.

In 2022, the stock exhibited a mixed trend. The stock remained volatile and suffered a huge blow. From a price of $ 44.1, at the start of the year, the stock last closed at $ 31.76, representing a 28 % decline to date.

Get to know the best S&P companies for investment.

Get to know the best S&P companies for investment.

3M

3M Company operates as a diversified technology company worldwide. It operates through four segments:

- Safety and Industrial

- Transportation and Electronics

- Health Care

- Consumer

Tech stocks are also one of the best investment opportunities.

The company has some foreseeable growth opportunities:

- The automotive (original equipment manufacturer, or OEM and aftermarket) market looks is expected to show substantial growth in the current and coming years

- Ans an improvement in the overall semiconductor shortage will lead to increased sales of 3M’s electronics and consumer electronics division. Semiconductor stocks are also one of the best investment opportunities.

3M recently shared its quarterly report for the year 2022:

- Sales were reported at $ 8.7 billion, a 3 % decline on a year-on-year basis

- Earnings per share were reported at $ 0.14

3M has a market cap of $ 67.6 billion. Its share is currently selling at $ 122.

The stock started off the year 2021 at a price of $ 174.7. It went as high as $ 206.05 and closed off the year at $ 177.63. Overall, the stock appreciated by 1.72 % during the year.

In 2022, the stock picked up a bearish trend. The stock dropped to the lows of $ 121.65 and last closed at $122. To date, the stock declined by 31 %.

Synopsys Inc.

Synopsys, Inc. is the Silicon to Software partner for innovative companies developing the electronic products and software applications we rely on every day. As an S&P 500 company, Synopsys has a long history of being a global leader in electronic design automation (EDA) and semiconductor IP and offers the industry’s broadest portfolio of application security testing tools and services.

Whether it is a system-on-chip (SoC) designer creating advanced semiconductors, or a software developer writing more secure, high-quality code, Synopsys has the solutions needed to deliver innovative products.

The company recently reported its fourth quarter reports for the year 2022:

- Revenue was reported at $ 1.284 billion, compared to $ 1.152 billion for the fourth quarter of the fiscal year 2021

- Net Income was reported at $ 153.5 million, as compared to $ 201.4 million, for the fourth quarter of the fiscal year 2021.

- Earnings per share were reported at $ 0.99, as compared to $ 1.28 per diluted share, for the fourth quarter of the fiscal year 2021

Alongside, the company also reported an annual report for the fiscal year 2022:

- Revenue was reported at $ 5.082 billion, an increase of 20.9 % from $ 4.204 billion in the fiscal year 2021.

- Net Income was reported at $ 984.6 million, as compared to $ 757.5 million, for the fourth quarter of the fiscal year 2021.

- Earnings per share were reported at $ 6.29, as compared to $ 4.81 per diluted share, for the fourth quarter of the fiscal year 2021.

Synopsis has a market cap of $ 48.5 billion. Its shares are trading at $ 319.61.

During the year 2021, the stock remained bullish while exhibiting volatile behavior. The stock started the year at $ 262.8 and closed off at $ 368.5 representing a 40 % appreciation during the year.

In 2022, the stock exhibited high volatility. It started at $ 368.5, and after multiple dips and peaks throughout the year last closed at $ 319.22. To date, the stock declined by 13 %

Lowe’s Cos Inc.

Lowe’s is an American retail store that provides products and services in the home improvement area. Lowe’s is a household name in the US and some parts of Canada and is the second-largest home improvement retail store in the US.

Lowe’s Co reported third-quarter report for the year 2022:

- Sales were reported at $ 23.5 billion compared to $ 22.9 billion in the third quarter of 2021

- Net earnings were reported at $ 154 million compared to $ 1.9 billion in the third quarter of 2021

- Earnings per share were reported at $ 0.25 compared to $ 2.74 in the third quarter of 2021

Lowe’s Cos has a market cap of $ 122.9 billion. Its shares are trading at $ 203.2.

The stock went bullish in 2021. The stock started off at a price of $ 160.5. Throughout the year the stock maintained its bullish run and peaked at $ 261.38. Eventually, the stock closed at $ 258.48. Overall, the stock appreciated by 61 % during the year.

In 2022, the stock reversed its course of action and went bearish for the major part of the year. During the year the stock dropped to the low of $ 172.47 and then again reversed its course of action. The stock last closed at $ 203.17. To date, the stock has declined by 18 %.

Walmart

Walmart Inc. engages in the operation of retail, wholesale, and other units worldwide. The company operates through three segments:

- Walmart U.S

- Walmart International

- Sam’s Club

It operates supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry stores, and discount stores; membership-only warehouse clubs; e-commerce websites, such as walmart.com, walmart.com.mx, walmart.ca, flipkart.com, and samsclub.com; and mobile commerce applications. Walmart operates approximately 10,500 stores and clubs under 46 banners in 24 countries and eCommerce websites. They have around 2.3 million associates around the world — nearly 1.6 million in the U.S. alone.

Walmart recently reported its annual report for the year 2022:

- Revenue was reported at $ 572.8 billion, as compared to $ 559 billion for the fiscal year 2021

- Operating Income was reported at $ 26 billion, as compared to $ 22.5 billion for the fiscal year 2021

- Net Income was reported at $ 13.7 billion, as compared to $ 13.5 billion for the fiscal year 2021

- Earnings per share were reported at $ 4.9, as compared to $ 4.77 for the fiscal year 2021

Walmart has a market cap of $ 385.1 billion. Its shares are trading at $ 143.81.

The stock has been volatile in the past two years. In 2021, the stock started off at $ 144.15 and closed off at $ 144.69 with multiple dips and peaks throughout the year. all year the stock exhibited volatility and closed the year at approx. the same price.

In 2022, the stock continued its volatility. During the year, the stock suffered a huge drop from $ 157.41 to $ 119.2, a 24 % drop during the second quarter. After that, the stock recovered and peaked at $ 153.22. Eventually, the stock closed at $ 141.83 representing a 2 % decline.

Conclusion

A recession is very hard on the general public and the investor community. Therefore, building a diversified portfolio is very important for investors to keep their portfolio running and earn a good return even during an economic slowdown.

The best approach to constructing a diversified portfolio is not only holding different company stocks. But it means investing in companies across multiple sectors, including those that are recession-resistant.

A diversified portfolio must include financially strong blue-chip stocks that have the ability to withstand a recession. Also, these blue-chip companies attract investor attention because they typically pay dividends. Blue-chip stocks in recession-resistant industries tend to be especially stable, which can help lessen the blow of a market sell-off or recession.

You may also like reading:

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy

Back