What are OTC Stocks?

OTC stands for over-the-counter. Over-the-counter stocks are not traded on a public-exchanges like the New York Stock Exchange. Instead, they are traded through a broker-dealer network. OTC is often called unlisted stocks as they cannot meet the listing requirements of a public exchange.

OTC stocks are considered riskier investments as they are not regulated on exchanges.

OTC majorly focuses on equities, which are stocks. But it also includes other securities like:

- Derivatives

- Corporate bonds

- Government securities

- Foreign currency (forex)

- Commodities

Pros and Cons of OTC Trading

Stock trading advisory websites help investors make the right financial decisions. OTC stocks are considered riskier investments as they are not regulated on exchanges. But trading higher-risk stocks result in bigger rewards.

Pros

- Investors who are seeking companies that have yet to go public cannot find better investments than OTC stocks.

- OTC markets allow investors to invest in foreign companies

- Investors can take larger positions in a company of their choice

- Ongoing trends within the OTC stocks offer a good opportunity for active traders

Cons

- Small-cap stocks in the OTC lack historical performance data

- In case of price decline, an investor with a large position in a company will have to face huge losses

- Since its an unregulated market, the chances of fraudulent activities are higher

- The OTC market is not a liquid market which sometimes makes it hard to sell stocks

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

When choosing the best OTC stocks to invest an investor should look for the below three things:

- Choose a company with strong fundamentals and a profitability

- Focus on companies with a niche market or unique product or service

- Be ready to take the risk involved in investing in OTC stocks

Top OTC Stocks to Invest in 2023

- Lundin Energy AB (LNDNF)

- Tencent Holdings (TCEHY)

- Just Eat Takeaway (JTKWY)

- Fukuoka Financial Group (FKKFF)

- Senior (SNIRF)

- Ascend Wellness (AAWH)

- Revival Gold (RVLGF)

- Auto Parts 4Less Group, Inc. (FLES)

- Pernod Ricard (PRNDY)

- American Battery Technology Company (ABML)

Here we have compiled the top OTC stocks to invest in:

Lundin Energy AB (LNDNF)

Lundin Energy AB is an independent oil and gas company that engages in the exploration, development, and production of oil and gas properties primarily in Norway. It has more than 1 billion barrels of reserves and resources and the company expects production to increase to more than 200 mboepd by 2021. Semi conductor stocks are also one of the best investment opportunities.

The company recently published its first quarterly report for the year 2022:

- Energy Production of 191 Mpoed

- Energy Sale of Mpoed

- EBITDAX of 1,889 MUSD (MUSD is a decentralized stable coin running on Ethereum that attempts to maintain a value of US$1.00)

- Free Cashflow of 822 MUSD

The share of LNDNF is trading at a price of $ 40.15 in the OTC. The below graph shows its past two-year performance. Despite exhibiting multiple ups and downs, the energy company’s stock maintained its bullish streak. From the price of $ 26.75, at the start of the year, the stock closed off at $ 36.61 at the end of 2021. This represents an increase of 37% during the year. In the current year, the stock maintained its bullish streak and has appreciated by approx. 10%. Oil stocks is one of the riskier yet most profit-generating sectors.

Tencent Holdings (TCEHY)

Tencent Holdings (TCEHY)

Tencent Holdings Limited is an investment holding company that provides value-added services (VAS) and online advertising services in Mainland China and internationally. The company operates through VAS, Online Advertising, FinTech and Business Services, and other segments. It offers online games and social network services; FinTech and cloud services, and online advertising services. We also have covered the best ETFs to buy in all categories.

The company recently shared its first-quarter report for the year 2022. The company reported:

- Total revenue of 135.5 billion yuan ($21.3 billion) as compared to 135.3 billion yuan during the same period last year

- Net Profit was reported at 25.5 billion yuan, this represents a 23 % year-on-year

The stock of the company is currently trading at $ 43.51. The company has a market capitalization of $ 448 billion. The below graph shows the stock performance of Tencent Holdings over the past two years. The stock peaked at $ 99 in February’2021. After hitting the peak price, the stock has been on a downward trend. In 2021 the stock went from $ 71.89 to $ 58.3, representing a decline of 19 %. In the current year, the stock has depreciated by approx. 25 % to date.

If you are seeking a steady stream of income, you should invest in REIT stocks.

If you are seeking a steady stream of income, you should invest in REIT stocks.

Just Eat Takeaway (JTKWY)

Just Eat Takeaway.com operates an online food delivery marketplace. It is a leading global online food delivery marketplace, connecting nearly one hundred million consumers with 634 thousand local partners through its apps and websites, and with leading positions in attractive markets. As of 31 December 2021, Just Eat Takeaway.com operates in 23 markets. Penny stocks are also one of the best investment opportunities.

In the recent earnings report, the company reported:

- Processed 1.1 billion Orders from 99 million Active Consumers

- Completed the acquisition of Grub hub in the United States

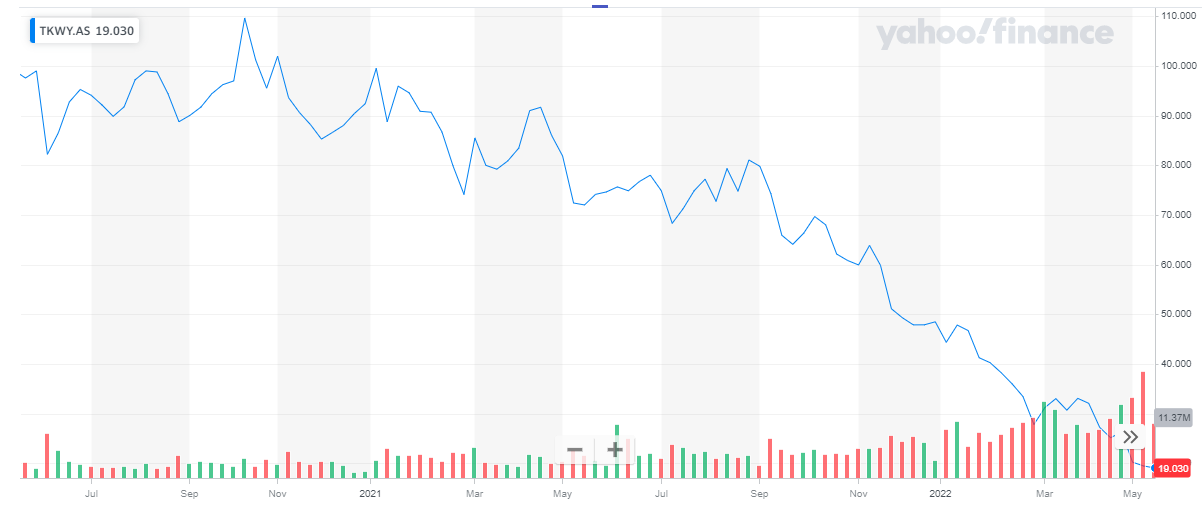

The stock of the company is currently trading at EUR 19. The below graph shows the stock performance for the past two years. The stock has been on a bearish trend for the past two years. During the current year, the stock started off at $ 48.4. To date, it has declined by 61% till date. This decline is proof of the risks associated with OTC stocks. But with the recent focus on marketing and advertising, the company’s stock is expected to rebound in the near future.

Get to know about top Infrastructure stocks to invest in.

Get to know about top Infrastructure stocks to invest in.

Fukuoka Financial Group (FKKFF)

Fukuoka Financial Group (FFG) is a Japanese financial organization with a network that covers the entire Kyushu area while focusing primarily on the prefectures of Fukuoka, Kumamoto, and Nagasaki.

The company recently publishes its annual report for the year 2021, ending March 2022.

- Income of 280 billion Yen, an increase of 2.1 % from last year

- Net Income of 54 billion Yen, an increase of 21 % from last year

The company’s stock is currently trading at a price of $ 17.35. The below chart shows the stock performance of the stock. The sudden hike in price exhibits the extreme volatility OTC stocks can show. From a price of $ 3.06, the stock jumped up to $ 17.35 within a week. This represents a whopping 5-fold increase within 7 days.

Are you thinking to invest in bonds? Get to know whether it’s a good decision to invest in bonds or stocks.

Are you thinking to invest in bonds? Get to know whether it’s a good decision to invest in bonds or stocks.

Senior (SNIRF)

Senior plc designs manufacture, and markets high-technology components and systems for the principal original equipment producers in the aerospace, defense, land vehicle, and power and energy markets worldwide. The company operates in two divisions, Aerospace and Flexonics. Get to know the list of crypto mining companies that are leading the industry.

In the annual report for 2020, the company reported:

- Revenue of £ 658.7 million, a 10 % decline from the previous year

- Net profit before tax of £ 23.7 million, a huge improvement from last year when the company generated losses.

- Earnings per share of 0.17 p

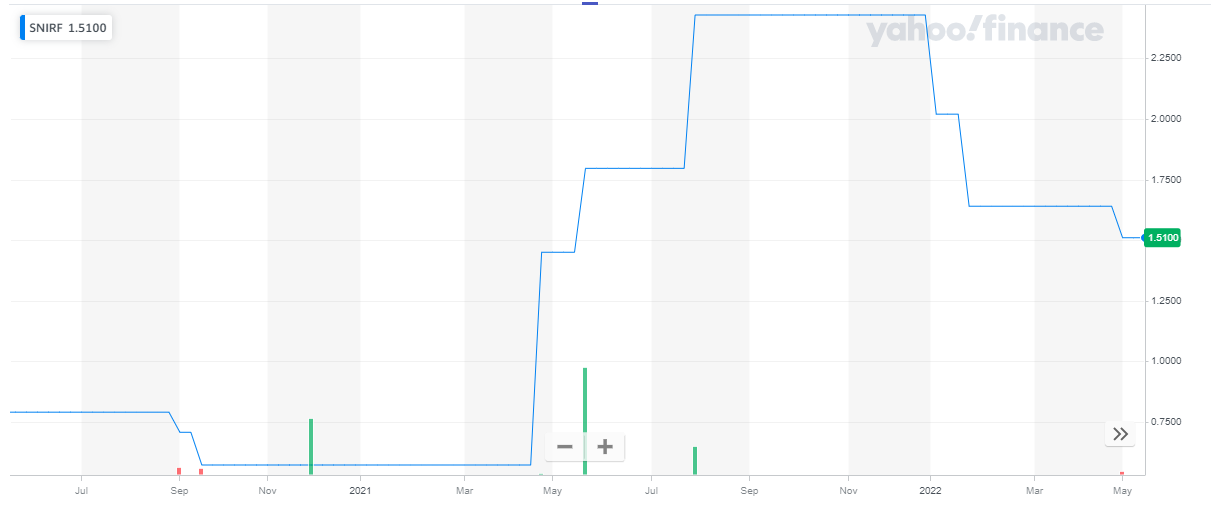

The company’s stock is currently trading at $ 1.5. The below chart shows the volatile behavior of this OTC stock over the past 2 years. Within the past 2 years, the stocks have gone to as low as $ 0.57 and as high as $ 2.43. During the current year, the stock has depreciated by almost 40 %.

Get to know best vaccine stocks to invest in now.

Get to know best vaccine stocks to invest in now.

Ascend Wellness (AAWH)

Ascend Wellness Holdings, Inc. engages in the cultivation, manufacture, and distribution of cannabis consumer packaged goods. Its cannabis product categories include flowers, pre-rolls, concentrates, vapes, edibles, and other cannabis-related products. It is a U.S. multi-state operator, currently operating in five states including Illinois, Michigan Massachusetts, New Jersey, and Ohio. AWH is committed to breaking down traditional barriers in the cannabis marketplace to redefine the industry from the ground up. The company owns and operates state-of-the-art cultivation facilities, grows award-winning strains, and produces a curated selection of premium products. Ammo Inc. (POWW).

Also, learn about the Best Day Trading Stocks

In the 2021 annual report, the company reported:

- Revenue of $ 85.1 million, an increase of 28.7 %, year-on-year

- Gross Profit of $ 36.5 million, an increase of 42.9 % year-on-year

The company’s stock is currently trading at $ 3.05. It has a market capitalization of around $ 574 million. The below chart shows the past two-year performance of this OTC stock. The stock has been on a bearish trend since 2021 and continues the journey in the current year. In the current year, the stock has declined by 53.5 %.

Learn about head and shoulders patterns trading guide.

Learn about head and shoulders patterns trading guide.

Revival Gold (RVLGF)

Revival Gold Inc. is a growth-focused gold exploration and development company. The Company is advancing the Beartrack-Arnett Gold Project located in Idaho, USA. Gold stocks are one of the best investment opportunities.

For the six months ending 31st Dec 2021, the company reported:

- Net loss for the period was $ 5.3 million

Revival Gold is a $ 40.3 million company. Its share is currently trading at a price of $ 0.4642. The below chart shows the past two-year performance of the company’s stock. The stock has been highly volatile and has been steadily declining. In the current year, the stock has continued its volatile behavior. The stock rose up to $ 0.59 and dipped to $ 0.393 during the current year. To date, it has declined by 5%.

Auto Parts 4Less Group, Inc. (FLES)

Auto Parts 4Less Group, Inc. (FLES)

AutoParts4Less.com is a stand-alone multi-vendor online marketplace entirely dedicated to automotive parts. Get to know the best tech stocks to invest in now.

Auto Parts published its annual report for the year ending Jan, 31st 2021:

- Sales were reported to be $ 11.02 million, as compared to $ 8.17 million the previous year

- Net loss was $ 8.07 million, as compared to a net income of $ 1.19 million the previous year

- Basic loss per share from continuing operations was $ 28.85 compared to basic earnings per share from continuing operations of $ 10.95 the previous year ago

Auto Parts 4Less Group is an $ 11.2 million company. Its share is currently trading at a price of $ 7.75. The below chart shows the company’s stock performance for the past two years. The stock has been following a bearish path after peaking at $ 47.4 in late 2020. During the current year, the stock has depreciated by 45 % to date.

Check our updated for NASDAQ Forecast.

Check our updated for NASDAQ Forecast.

Pernod Ricard (PRNDY)

Pernod Ricard produces and sells wines and spirits worldwide. It offers its products under various brands. It is currently number 2 in the global wine and spirits industry. Their comprehensive portfolio comprises over 200 premium brands distributed across more than 160 markets. Pernod Ricard owns 16 of the Top 100 Spirits Brands. Cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

The company recently published its 9 monthly earnings report for 2022:

- Sales were reported at € 8.4 billion, a 21 % increase from the same period last year

Pernod Ricard is a $ 48.3 billion company. The company’s shares are trading at a price of $ 38.1. the below chart shows the stock performance for the past two years. For the whole of 2021, the stock followed a bearish trend. After hitting the peak of $ 48.48 on the last trading day of 2021, the stock started its downward journey. During the current year, the stock has depreciated by 22.4 %.

Also read: Best Stocks for Covered Calls in 2023.

Also read: Best Stocks for Covered Calls in 2023.

American Battery Technology Company (ABML)

American Battery Technology Company is engaged in lithium-ion battery recycling, battery metals and material extraction, and resource production. It is a leading US-based battery metals company producing low-cost battery metals with a sustainable commitment to closed-loop, clean energy technologies. ABML delivers long-term stockholder value by focusing on the growth of our core assets and technologies.

Also check out:

The company owns 644 placer mining claims on approximately 12,880 acres in the Western Nevada Basin, located in Railroad Valley in Nye County, Nevada.

The company recently published its quarterly report, for the period ending March 2022:

- Net loss of $ 2.6 million

The company has a market cap of $ 626 million. The company’s stock is currently trading at a price of $ 0.927. The below chart shows the past two-year performance of the company’s stock. Just like other OTC stocks, ABML exhibits volatile share performance. The share peaked at $ 3.9 in early 2021. In the year 2021, despite multiple price hikes, the stock concluded the year with a decline of 28 %. During the current year, the share value has remained somewhat stagnant.

Also check out: List of Most Volatile Stocks

CONCLUSION

No doubt OTC stocks offer a great investment at a very low cost. In fact, some OTC has great potential. History is full of successful examples of OTC stocks. But it does not go without the risks. As an investor, the best approach to investing in OTC stocks is by setting aside a percentage of your portfolio that is exposed to the OTC stocks. This will help limit your exposure to the risks of the OTC market.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Swing Trading Stocks to Buy Now

- Best Stock & Forex Trading Courses

- 11 Best ESG ETFs to Buy in 2023

- Best Crypto Currencies To Invest

- Best Renewable Energy Stocks to Invest