The energy crisis of 2021 left the whole economy shaken as market players saw a spike in oil prices. And with it followed an immediate rise in the value of energy stocks. Moreover, Russia’s invasion of Ukraine and the exclusion of energy from sanctions made all the European countries recognize the huge dependence on natural gas. Therefore, the European nations are seriously considering nuclear power generation. To give investors an idea of where to start and which companies to look for investment in oil and gas, we have compiled a list of the top best oil and gas ETFs to buy now.

Nuclear power is beneficial because it emits no carbon, requires little land, and is constantly available. Other green energy sources, such as wind and solar, are intermittent, and seasonal, and need costly infrastructure to move them from plenty to areas of scarcity. Solar and wind farms also use a lot of lands, and offshore wind licenses are few in the United States.

Get to know the top stocks in S&P 500.

The global need for energy continues to increase. Between 2020 and 2050, an annual average of 20 GW of new nuclear power will be required to reach net-zero goals. Also, Biden’s government is very optimistic about nuclear power as a great solution to climate challenges. Therefore, they have proposed a 50 % increase in the nuclear budget for the year. And the government plans to set up around 94 nuclear reactors in the United States will be “extremely necessary” to achieve its goal of a net-zero economy by 2050.

Top 10 Best Nuclear Energy Stocks

Here we have listed the top 10 best nuclear stocks to invest in now:

| Sr. | Company Name | Symbol | Market Cap | Price (As on 11th Nov 2022) |

| 1 | Nexgen Energy Ltd | NXE | $ 2.21 billion | $ 4.6 |

| 2 | Uranium Energy Corp | UEC | $ 1.49 billion | $ 4.07 |

| 3 | Cameco | CCJ | $ 10.6 billion | $ 24.44 |

| 4 | Energy Fuels | UUUU | $ 1.21 billion | $ 7.7 |

| 5 | Exelon Corporation | EXC | $ 38.9 billion | $ 39.11 |

| 6 | Denison Mines | DNN | $ 1.05 billion | $ 1.27 |

| 7 | Lightbridge Corporation | LTBR | $ 60.35 million | $ 5.21 |

| 8 | Centrus Energy Corp | LEU | $ 573.6 million | $ 39.45 |

| 9 | Bloom Energy Corporation | BE | $ 4.26 billion | $ 21.83 |

| 10 | BWX Technologies, Inc | BWXT | $ 5.5 billion | $ 60.39 |

Nexgen Energy Ltd (NYSE: NXE)

Nexgen Energy Ltd (NYSE: NXE)

Nexgen Energy has the world’s biggest high-grade uranium resources. It is a Canadian company focused on optimally developing the Rook I Project into the largest low-cost producing uranium mine globally, incorporating the highest levels of environmental and social governance. In Canada, the firm holds a sizable portfolio of uranium exploration properties. The corporation is well-positioned to become the world’s top uranium producer due to its ownership of its largest uranium resources. Therefore, it would be an excellent choice for an investor looking to benefit from rising uranium stock prices.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Loss | ($ 30.4) million | ($ 17.6) million | ($ 27.3) million |

| Loss Per Share | ($ 0.05) | ($ 0.03) | ($ 0.05) |

NextGen has a market cap of $ 2.2 billion. Its shares are trading at $ 4.6. The share has remained volatile in the past two years.

It started trading at $ 2.76 at the start of 2021. Throughout the year the stock remained volatile but kept on rising steadily. It closed the year at $ 4.37 representing a 58 % appreciation during the year.

In 2022, the stock continued its volatile behavior. From $ 4.37 at the start of the year, the stock went as high as $ 6.23 and last closed at $ 4.6 representing a 5.3 % increase to date.

Regional bank stocks offer an excellent return to investors.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Uranium Energy Corp. (UEC)

Uranium Energy Corp is the fastest-growing supplier of fuel for the green energy transition to a low-carbon future. UEC is the largest, diversified North American-focused uranium company, advancing the next generation of low-cost, environmentally friendly In-Situ Recovery (ISR) mining uranium projects in the United States and high-grade conventional projects in Canada. UEC has one of the nation’s biggest uranium exploration and development catalogs. UEC is active in several states around the southwestern United States. It is a significant player in the US uranium exploration market.

Go through the best recession stocks in 2023.

The Company has two production-ready ISR hub and spoke platforms in South Texas and Wyoming, anchored by fully licensed and operational central processing plants. UEC also has seven U.S. ISR uranium projects with all their major permits in place.

The below chart shows the quarterly financial reports for the year 2022:

| Year-end 2022 | Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 23 million | $ 9.9 million | $ 13.2 million | $ 1.7 million |

| Profit/ Loss from Operations | ($ 22.7) million | ($ 3.7) million | ($ 4.9) million | ($ 4.9) million |

| Net Income | $ 5.25 million | $ 7.34 million | ($ 5.5) million | ($ 2.1) million |

| Earnings Per Share | $ 0.02 | $ 0.03 | $ 0.02 | ($ 0.01) |

Uranium Energy Corp has a market cap of $ 1.486 billion. Its shares are trading at $ 4.07.

The stock of the company has been on a bullish run for the past two years. From $ 1.76, at the start of the year, the stock climbed as high as $ 5.47 and finally closed the year at $ 3.35. representing a 90 % appreciation during the year.

In 2022, the stock continued with its bullish trend. But after peaking at $ 6.4 the stock reversed its path and started to decline. The stock last closed at $ 4.07. To date, the stock has appreciated by 21.5 %.

Fintech is also an emerging industry. Fintech stocks provide a low cost of service and promote transparency.

Also read:

Cameco (NYSE: CCJ)

Cameco (NYSE: CCJ) is the world’s largest publicly traded uranium company. Located in Canada, Cameco Corporation supplies uranium via two segments: uranium and fuel services. It mines and processes uranium concentrate and purchases and sells it. The fuel services sector refines, converts, and fabricates uranium concentrate and provides conversion services. There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 389 million | $ 558 million | $ 398 million |

| Gross Profit | $ 25 million | $ 93 million | $ 50 million |

| Net Income | ($ 20) million | $ 84 million | $ 40 million |

| Earnings Per Share | $ 0.05 | $ 0.21 | $ 0.1 |

Get to know the safest monthly dividend stocks.

Cameco has a market cap of $ 10.6 billion. Its shares are trading at $ 24.44.

Throughout the year 2021, the share maintained a bullish run. From a price of $ 13.4, at the start of the year, the stock closed at $ 21.81. Overall, the stock appreciated by 63 % during 2021.

In 2022, the stock continued its bullish path and peaked at $ 31.4 and then at $ 30.2 before closing at $ 24.44. To date, the stock has appreciated by 12 %.

Get to know about bonds vs stocks – where to invest.

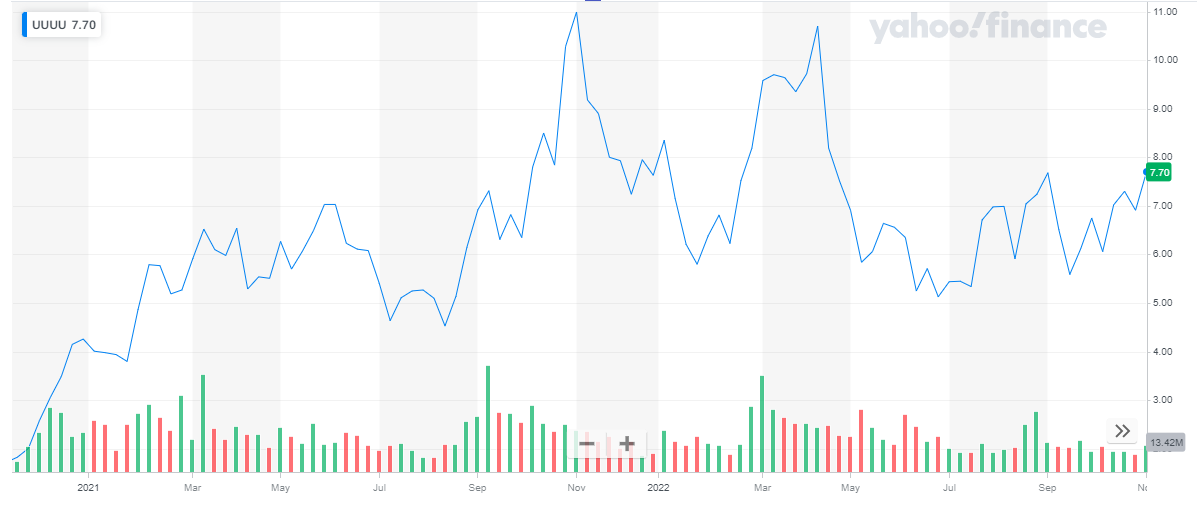

Energy Fuels (UUUU)

Energy Fuels Inc. is based in Lakewood, Colorado, and is engaged in the extraction, recovery, exploration, and sale of uranium and recovered uranium in the United States. The corporation owns and maintains three ranches in Wyoming: Nichols Ranch, Jane Dough, and Hank. Additionally, it runs the Alta Mesa Project in Texas and the White Mesa Mill in Utah.

Get to know about best drone stocks to invest.

The company has uranium and uranium/vanadium resources and projects in Utah, Wyoming, Arizona, New Mexico, and Colorado that are in different stages of exploration, permitting, and appraisal.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 2.9 million | $ 6.5 million | $ 2.9 million |

| Operating Loss | ($ 13.7) million | ($ 6.7) million | ($ 10.2) million |

| Net Income/ Loss | ($ 9.3) million | ($ 18.1) million | ($ 14.7) million |

| Loss Per Share | ($ 0.06) | ($ 0.11) | ($ 0.09) |

Energy Fuels has a market cap of $ 1.21 billion. Its shares are trading at $ 7.7.

The share started the year 2021 with a bullish run. It maintained its course till it peaked at $ 10.99. After that, the stock climbed down and closed off the year at $ 7.63. Overall, the stock appreciated by 79 %.

In 2022, the stock started with a bullish cycle till it peaked at $ 10.7. After that, the stock climbed down and last closed at $ 7.7 representing a 1 % appreciation during the year.

Get to know about best forex brokers for trading

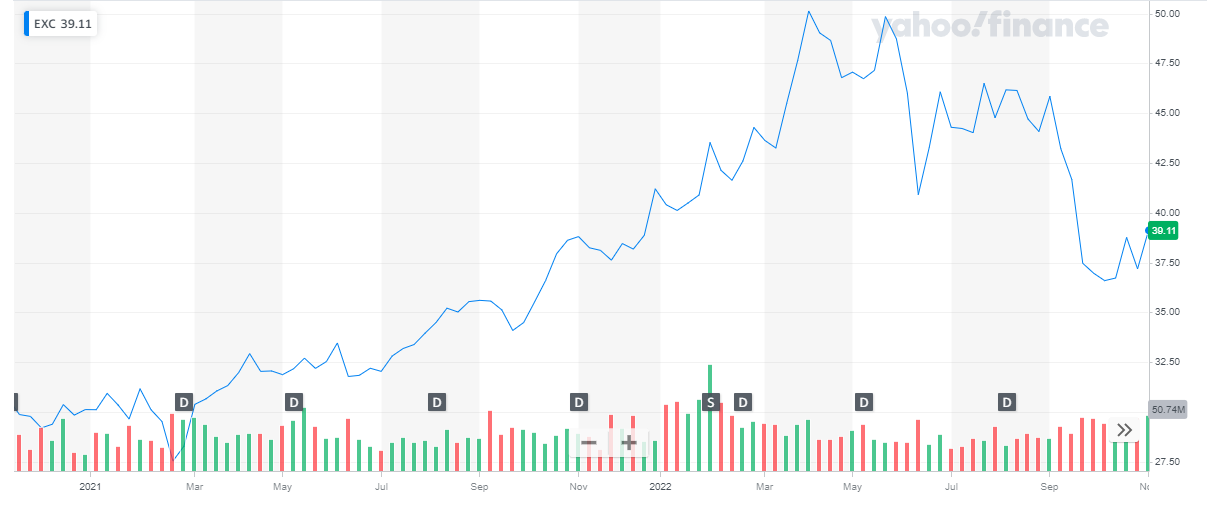

Exelon Corporation (NASDAQ: EXC)

Exelon Corporation is an American nuclear energy provider headquartered in Chicago, Illinois. The company is known for being the largest nuclear power plant operator in the country. The company supplies 10 million customers with power and electricity through 23 nuclear reactors and 14 nuclear power plants. Its services extend beyond nuclear, with an interest in wind, solar, and hydroelectric power also.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 4.85 billion | $ 4.2 billion | $ 5.3 billion |

| Operating Income | $ 1.01 billion | $ 694 million | $ 900 million |

| Net Income/ Loss | $ 676 million | $ 465 million | $ 597 million |

Also, check out the best swing trading stocks.

Exelon Corp has a market cap of $ 38.9 billion. Its shares are trading at $ 39.11.

The share started in the year 2021 at $ 30.11. It continued to climb up throughout the year and closed at $ 41.2 representing a 27 % increase during the year.

In 2022, the share continued its bullish path till it peaked at $ 49.85. After that, the stock reversed its course and last closed at $ 39.11. To date, the stock declined by 5 %.

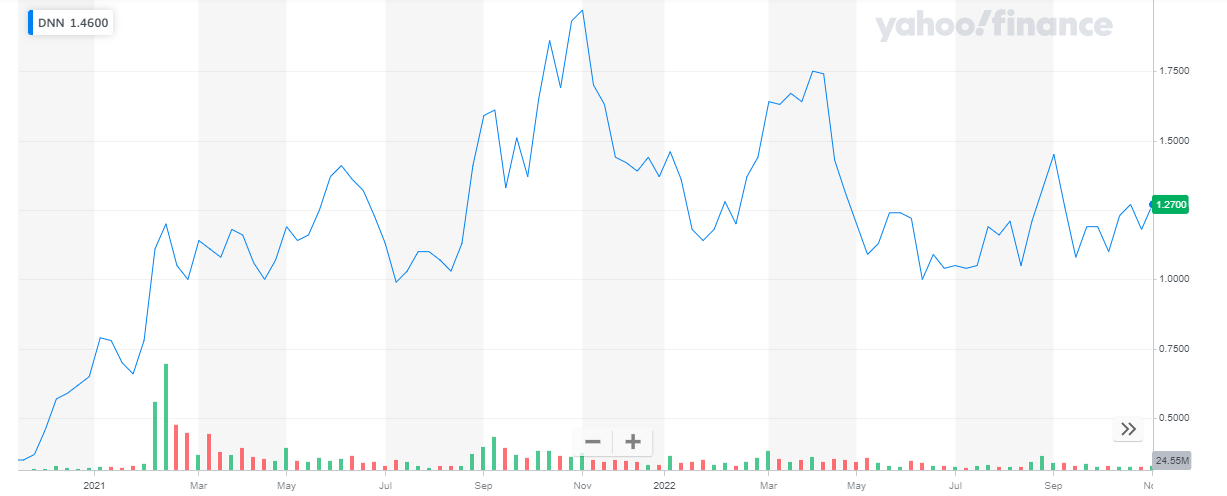

Denison Mines (DNN)

Denison Mines (DNN)

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. It is engaged in the acquisition, exploration, development, extraction, processing, selling off, and investing in uranium properties in Canada. Its flagship project is the 95% interest-owned Wheeler River uranium project located in the Athabasca Basin region in northern Saskatchewan. Investing in value stocks is a long-term investment.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | CAD $ 3.043 million | CAD $ 6.8 million | CAD $ 4.1 billion |

| Net Income/ Loss | (CAD $ 6.4) million | CAD $ 16.15 million | CAD $ 42.6 million |

| Earnings /Loss per share | (CAD $ 0.01) | (CAD $ 0.02) | (CAD $ 0.05) |

Denison Mines has a market cap of $ 1.04 billion. Its shares are trading at $ 1.2.

The share started the year 2021 with a bullish trend. It started off at $ 0.65 and closed off the year at $ 1.37 representing a 110 % appreciation during the year.

Cybersecurity stocks are also one of the best investment opportunities.

In 2022, the stock started at $ 1.37 and last closed at $ 1.27 representing a 7.3 % appreciation to date.

Lightbridge Corporation (NASDAQ: LTBR)

Lightbridge Corporation (NASDAQ: LTBR)

Lightbridge (NASDAQ: LTBR) is an advanced nuclear fuel technology development company positioned to enable carbon-free energy applications that will be essential in preventing climate change. The Company is developing Lightbridge Fuel, a proprietary next-generation nuclear fuel technology for small modular reactors, as well as existing large light-water reactors, which significantly enhance safety, economics, and proliferation resistance. To date, Lightbridge has been awarded twice by the U.S. Department of Energy’s Gateway for Accelerated Innovation in Nuclear program to support the development of Lightbridge Fuel

Lightbridge Corporation is a prudent investment for any investor interested in nuclear fuel technologies. The company also offers consultancy services in the field of nuclear energy. Its primary business is attempting to mitigate nuclear technology’s environmental effect, which has stymied its acceptance in several nations. Get to know the best vaccine stocks to invest in 2022.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | – | – | – |

| Operating Loss | ($ 2.125) million | ($ 1.6) million | ($ 2.053) million |

| Net Income/ Loss | ($ 2.03) million | ($ 1.5) million | ($ 2.049) million |

| Earnings /Loss per share | ($ 0.18) | ($ 0.14) | ($ 0.2) |

Investors are now looking for the finest solar energy stocks to invest in.

Lightbridge Corporation has a market cap of $ 60.35 million. Its shares are trading at $ 5.21.

The shares started trading at $ 4.23 in 2021. During the year it peaked at $ 13.9 and closed off at $ 6.63 representing a 57 % appreciation during the year.

In 2022, the stock started trading at $ 6.63, went as high as $ 10.54, and closed off at $ 5.21. To date, the stock has declined by 21 %.

Get to know about RSI trading strategies.

Centers Energy Corp. (NYSE: LEU)

Centers Energy is a trusted supplier of nuclear fuel and services for the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources – helping them meet the growing need for clean, affordable, carbon-free electricity. Since 1998, the Company has provided its utility customers with more than 1,750 reactor years of fuel, which is equivalent to 7 billion tons of coal. With world-class technical and engineering capabilities, Centrus is also advancing the next generation of centrifuge technologies so that America can restore its domestic uranium enrichment capability in the future.

Read: Best travel and tourism stocks to buy now.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 33.2 | $ 99.1 million | $ 35.3 million |

| Net Income/ Loss | ($ 6.1) million | $ 37.4 million | ($ 0.4) million |

| Earnings /Loss per share | ($ 0.42) | $ 2.56 | ($ 0.03) |

Get to know the best EV stocks to invest in today.

Centrus Energy Corp has a market cap of $ 573.9 million. Its shares are trading at $ 39.45.

The stock started trading at $ 23.13 at the start of the year. It went as high as $ 85.59 and closed off at $ 49.91 representing a 115 % appreciation during the year.

In 2022, the stock started to decline. It went as low as $ 21.29 and last closed at $ 39.45. To date, the stock closed by 21 %.

Tech stocks is also one of the best investment opportunity.

Bloom Energy Corporation (NYSE: BE)

Bloom Energy Corporation, based in San Jose, California, designs, manufactures, sells, and installs solid-oxide fuel cell systems for power generation in the United States and abroad. Without combustion, the Bloom Energy Server, a power-generating platform, converts fuels such as natural gas, biogas, hydrogen, or a combination of these fuels into electricity via an electrochemical process. The company provides power to hospitals, manufacturing facilities for healthcare products, biotechnology facilities, telecom facilities, and other small businesses.

Get to know everything about high frequency trading.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 292 million | $ 243 million | $ 201 million |

| Operating loss | ($ 52.6) million | ($ 102) million | ($ 65.7) million |

| Net Income/ Loss | ($ 57) million | ($ 118.8) million | ($ 78.4) million |

| Earnings /Loss per share | ($ 0.31) | ($ 0.67) | ($ 0.44) |

Also read Forex trading vs Stocks trading.

Bloom Energy has a market cap of $ 2.6 billion. Its shares are trading at $ 21.83.

The stock started trading at $ 28.66 at the start of 2021 and closed off the year at $ 21.93. Overall, the stock declined by 23.5 %.

In 2022, the stock started trading at $ 21.93 and last closed at $ 21.83. To date, the stock has remained steady.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

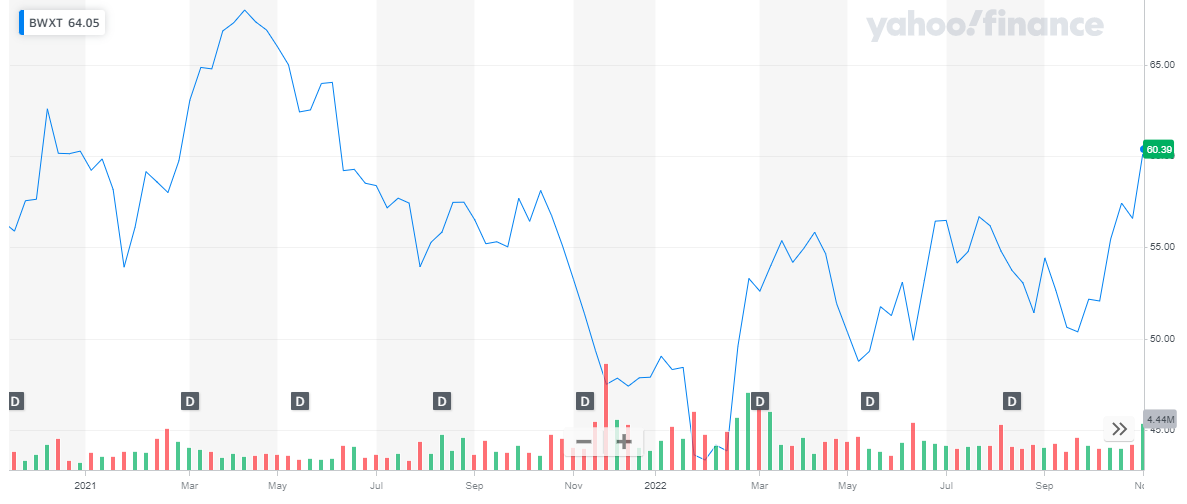

BWX Technologies, Inc. (NYSE: BWXT)

BWX Technologies is an American supplier of nuclear components, technologies, and fuel to different nuclear plants operated within the United States. The company also supports governments and private entities that operate nuclear facilities through its services.

The below chart shows the quarterly financial reports for the year 2022:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Revenue | $ 523.7 million | $ 554 million | $ 530.7 million |

| Net Income/ Loss | $ 61.8 million | $ 74.6 million | $ 59.10 million |

| Earnings /Loss per share | $ 0.67 | $ 0.82 | $ 0.64 |

If you are seeking a steady stream of income, you should invest in REIT stocks.

BWX Technologies has a market cap of $ 5.5 billion. Its shares are trading at $ 60.39.

The share started trading at $ 60.28 at the start of the year. It went as high as $ 68.02 during the year and closed off at $ 47.88. Overall, the stock declined by 20.5 %.

In 2022, the stock started to rise slowly and steadily. From $ 47.88, at the start of the year, the stock closed at $ 60.39. To date, the stock appreciated by 27 %.

Get to know the best stocks to buy for the holiday season.

CONCLUSION

The global demand for clean and renewable energy resources is rising sharply. And with-it nuclear power and nuclear technology are becoming increasingly demanding and lucrative industries.

Nuclear energy is not only one of the most reliable sources of power, but it is also one of the cleanest. But why investors are still reluctant to invest in this industry is the high upfront cost. This eventually turns into very low profits for many years after construction begins.

But investors who have money to invest for the long term should invest in the above-listed companies. In the long run, these companies will yield multi-fold returns to all investors.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy