What are Cyclical Stocks?

The term cyclical describes things that aren’t behaving in a stable and regular pattern but occur in irregular intervals. It is a cycle is where the same events happen repeatedly in the same order.

Cyclical stocks are securities that are heavily affected by economic cycles. These stocks go up and down with the economy. Cyclicals are usually discretionary products like luxury clothing, furniture, cars, or non-essential services like vacations, travel, and eating out in restaurants. By using the stock signals, you can avoid hours of technical analysis to understand the market.

Cyclical stocks rise and fall along with the general economic cycle and are affected by macroeconomic changes in the overall economy. In fact, the revenues and profits of these companies also rise and fall with the economic expansion and recession. The reason is, that consumers’ spending depends on the overall economic situation, prices of cyclical stocks usually increase when the economy is expanding and decrease when the economy is in a downturn. On the contrary, consumer spending on discretionary items is up during an economic boom, so cyclical stocks are also prospering and growing. Investing in value stocks is a long-term investment.

What to look for before investing in Cyclical Stocks?

Investing in stocks always involves some level of risk. Investing in cyclical is about managing expectations. The prices can rise and fall very quickly as the economic conditions change.

There is no set or fixed approach while investing in cyclical stocks. Because economic shifts are hard to predict, there are some important things to know before investing:

- Treat each company individually. Businesses are classified as cyclical according to the industry but each company has its own set of success factors.

- Cyclical stocks seem volatile but have been proven to provide excellent returns. Trading volatile stocks are usually done in short bursts which fall under the category of Day Trading. Check out our list of top day trading stocks

- One of the most beneficial features of cyclical stocks is that they can offer high growth and above-average returns during economic prosperity

- During a recession, be mindful and not sell at the wrong time. It can result in selling too low and losing money.

List of the Best Cyclical Stocks

Here is a list of the best cyclical stocks to invest in 2024:

| Sr. | Company Name | Symbol | Market Capitalization | Price (As on 15th august 2022) |

| 1 | The Walt Disney Company | DIS | $ 226.5 billion | $ 124.26 |

| 2 | Vale SA | VALE | $ 66.7 billion | $ 13.41 |

| 3 | KLA Corporation | KLAC | $ 54.5 billion | $ 384.32 |

| 4 | Schlumberger Limited | SLB | $ 50.6 billion | $ 35.76 |

| 5 | Suncor | SU | $ 43.7 billion | $ 31.99 |

| 6 | Nucor | NUE | $ 37.2 billion | $ 141.87 |

| 7 | Chewy | CHWY | $ 20.8 billion | $ 49.43 |

| 8 | Expedia Group | EXPE | $ 17.8 billion | $ 113.17 |

| 9 | Robinhood Markets Inc | HOOD | $ 9.2 billion | $ 11.01 |

| 10 | EPR Properties | EPR | $ 4.16 billion | $ 55.43 |

The Walt Disney Company

Consumers reduce their spending on discretionary purchases such as vacations during a recession. And The Walt Disney Company is a part of discretionary purchased get highly affected. However, Disney has seen a growing demand for its parks in 2022, despite the increased concerns of a downward economy.

Disney’s parks and movie businesses have benefitted hugely during the early stages of the pandemic. Also, Disney +, which is another entertainment offering of the company continues to grow alongside. Subscribers are continuously increasing as more and more people switch to streaming. This all contributed to Walt Disney continuing to boost revenue and earnings. There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

The Walt Disney Company today reported earnings for its third fiscal quarter ended July 2, 2022:

- Revenues were reported at $ 21.5 billion, a 26 % increase from the previous year’s same period

- Net Income was reported at $ 1.4 billion, a 53 % increase from the previous year’s same period

- Earnings per share were reported at $ 0.77

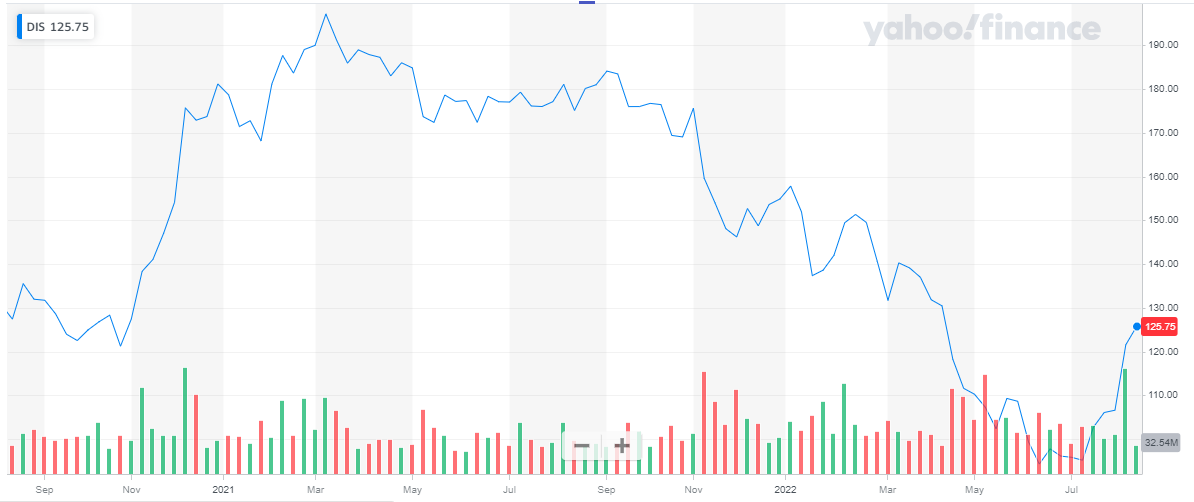

The Walt Disney company has a market capitalization of $ 229.2 billion. Its share is trading at a price of $ 124.26. The majority of 2021 was a very good year in terms of stock performance. The stock peaked at $ 197.16 in March’21 and the stock maintained the price level of above $ 170 for the major part of the year. The stock started off at $ 181.18 and closed the year at $ 154.89. Overall, the stock dropped by 14.5 % during the year.

In 2022, the stock started off at $ 154.89 and last closed at $ 124.26. During the year, the stock dropped to the lows of $ 94.34, representing a 40 % decline. But the stock made a recovery and to date, the stock performance represents a 20 % decline.

If you are confused between index funds and ETFs, read ETFs vs Index funds where you should invest.

If you are confused between index funds and ETFs, read ETFs vs Index funds where you should invest.

Vale SA

Vale SA

Vale S.A. is one of the world’s leading metallurgy and mining groups. It is a global mining company, which is transforming natural resources into prosperity and sustainable development. Headquartered in Brazil and it has its presence in about 30 countries and employs approximately 185,000 people between direct employees and permanent contractors

Vale reported its financial performance for the second quarter of 2022:

- Revenues were reported at $ 11.2 billion, as compared to $ 16.5 billion in the second quarter of 2021

- Net Income was reported at $ 4.1 billion, as compared to $ 8.2 billion in the second quarter of 2021

Read Best Crypto Staking Platforms.

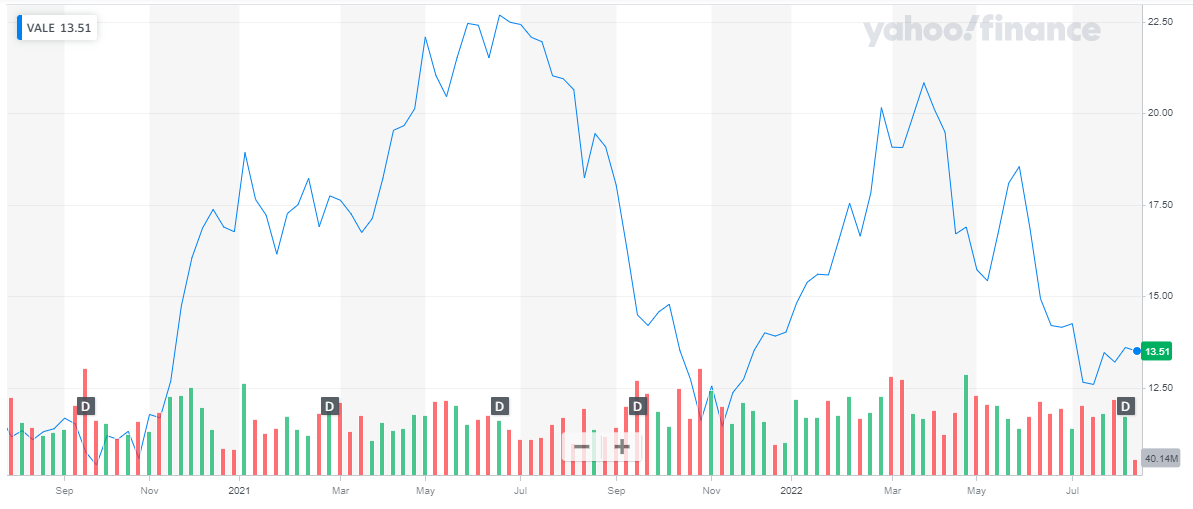

Vale SA has a market capitalization of $ 64.9 billion. The share of the company is currently trading at a price of $ 13.41. The share of Vale SA has exhibited multiple performance cycles in the past two years. The stock of Vale started rising in Nov 2020, During 2021, the stock peaked at $ 22.68 after which it started declining. The stock hit the low of $ 11.45 in Nov 2021. This marks the end of one cycle.

Next, the stock started rising again and this time peaked at $ 20.83. After hitting the peak, the stock started its downward journey and dropped to the lows of $ 12.65. The stock is currently trading at $ 13.4. We have yet to see when this second cycle concludes.

Get to know the best quantum computing stocks.

Get to know the best quantum computing stocks.

KLA Corporation

KLA Corporation designs manufacture, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide. It provides advanced process control and process-enabling solutions for manufacturing wafers and reticles, integrated circuits, packaging, printed circuit boards, and flat panel displays. The emergence of clean energy stocks has brought new investment opportunities to the horizon.

It operates through four segments:

- Semiconductor Process Control

- Specialty Semiconductor Process

- PCB, Display, and Component Inspection

- Others

KLA Corporation reports fiscal 2022 fourth-quarter results:

- Revenues were reported at $ 2.49 billion

- Net Income was reported at $ 805.4 million

- Earnings per share were reported to be $ 5.4

KLA Corporation reports fiscal 2022 full-year results

- Revenues were reported at $ 9.21 billion

- Net Income was reported at $ 3.32 billion

- Earnings per share were reported to be $ 21.92

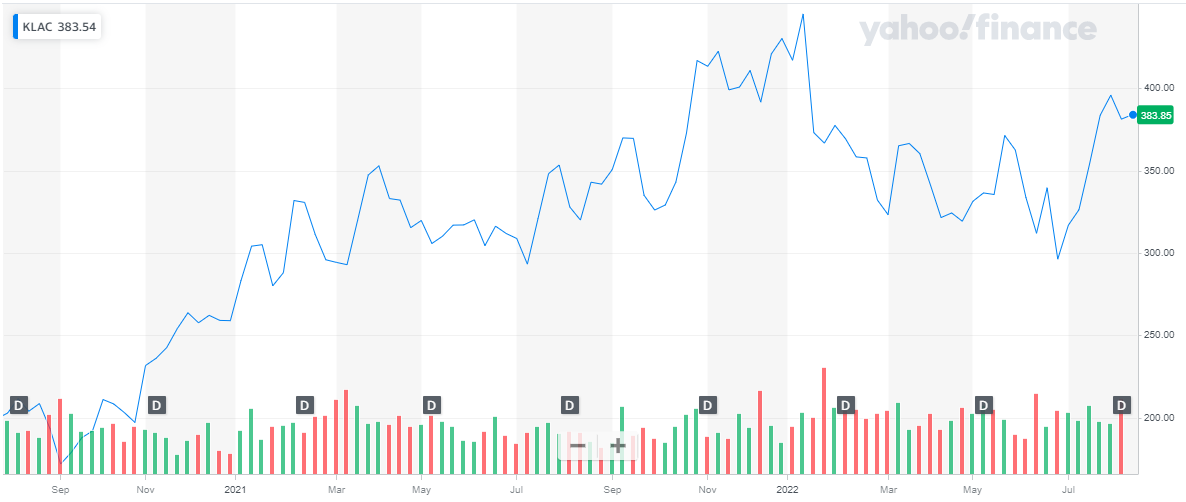

KLA corp. has a market capitalization of over $ 54.4 billion. Its share is trading at a price of $ 384.32. The stock was trading at its lows before November 2020. In Nov 2020, the stock of KLA Corp started rising. Throughout 2021, the stock continued its upward trend. From $ 258.91 to the peak of $ 430.11 at which the stock closed off the year. Overall, the stock appreciated by 66 % during the year.

In 2022, the stock changed its course after rising to the peak of $ 445. The stock dropped as low as $ 296 and recently closed at $ 383.91. To date, the stock has depreciated by 13.7 %.

Also, check out the best swing trading stocks.

Also, check out the best swing trading stocks.

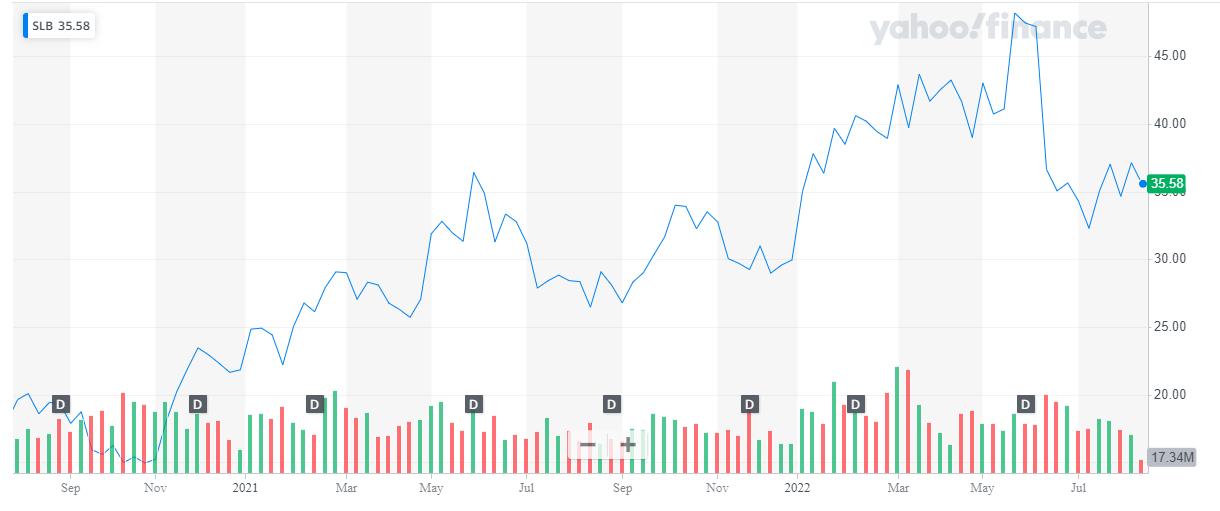

Schlumberger Limited

Schlumberger Limited provides technology for the energy industry worldwide. It operates through four divisions:

- Digital & Integration

- Reservoir Performance

- Well Construction

- Production Systems.

Schlumberger Ltd provides technology for reservoir characterization, production, drilling, and processing to the oil and gas industry. The company also supplies products and services to the industry, from exploration through production and integrated pipeline solutions for hydrocarbon recovery. Schlumberger’s products and services include an open hole and cased-hole wireline logging; drilling services; well completion services including well testing and artificial lift; well services such as cementing, coiled tubing, stimulations, and sand control; interpretation and consulting services; and integrated project management. Cybersecurity stocks are also one of the best investment opportunities.

Schlumberger recently announced second quarter results for the fiscal year 2022:

- Revenue was reported to be $ 6.8 billion, a 20 % year-on-year increase

- Net Income was reported at $ 959 million, a 123 % year-on-year increase

- Earnings per share were reported at $ 0.67

Schlumberger Limited has a market capitalization of $ 50.3 billion. Its share is trading at a price of $ 35.58. The stock of Schlumberger Limited is on a bullish track for the past two years.

The stock started off in the year 2021 at a price of $ 21.83 and closed off the year at $ 29.95. This represents a 37 % increase during the year.

In 2022, the stock started trading at $ 29.95, and after peaking at $ 48.21 it last closed at $ 35.58. To date, the stock has appreciated by 19 %.

Bank stocks usually reflect the economic performance, making them cyclical stocks.

Bank stocks usually reflect the economic performance, making them cyclical stocks.

Suncor Energy

Suncor Energy, Inc. is an integrated energy company, which develops petroleum resource basins. Its activities include oil sands development, and upgrading, onshore and offshore oil and gas production, petroleum refining, and product marketing. Investors are now looking for the finest solar energy stocks to invest in.

The company operates through the following business segments:

- Oil Sands – This segment handles operations in the Athabasca oil sands in Alberta to develop and produce synthetic crude oil and related products through the recovery and upgrading of bitumen from mining and in situ operations.

- Exploration & Production – This segment handles offshore activity in East Coast Canada the exploration and production of crude oil and natural gas in the United Kingdom, Norway, Libya, and Syria, and the exploration and production of natural gas and natural gas liquids in Western Canada.

- Refining & Marketing – This segment handles the refining of crude oil products and the distribution & marketing of these and other purchased products through retail stations located in Canada and the United State, as well as a lubricants plant located in Eastern Canada.

Suncor recently reported its second-quarter results for the fiscal year 2022:

- Total upstream production was 720,200 barrels of oil equivalent per day (boe/d)

- Revenues were reported to be $ 16.2 billion, a 40 % increase from last year’s same period

- Total earnings were reported to be $ 4 billion, a more than 3.5-fold increase from last year’s same quarter

- Earnings per share were reported to be $ 2.84

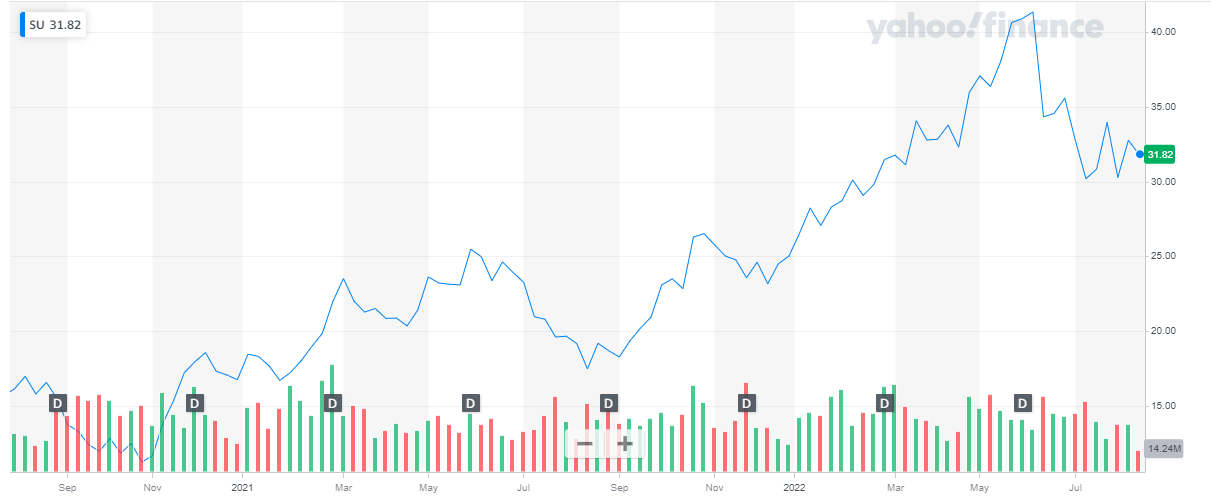

Suncor Energy has a market capitalization of $ 43.4 billion. Its share is trading at a price of $ 31.82. The stock of Suncor Energy has been on a bullish run in these past two years. In 2021, the stock started at $ 16.78 and closed off at $ 25.03. This represents an approx. 50 % appreciation during the year.

In 2022, the stock started at $ 25.03. It went as high as $ 41.31 and last closed at $ 31.82. Overall the stock appreciated by 27 %.

Also check out our list of best penny stocks to invest in.

Also check out our list of best penny stocks to invest in.

Also read:

Nucor

Nucor and its affiliates are manufacturers of steel and steel products, with operating facilities in the United States, Canada, and Mexico. Products produced include carbon and alloy steel — in bars, beams, sheets, and plates; hollow structural section tubing; electrical conduit; steel racking; steel piling; steel joists and joist girders; steel deck; fabricated concrete reinforcing steel; cold finished steel; precision castings; steel fasteners; metal building systems; insulated metal panels; overhead doors; steel grating; and wire and wire mesh. Get to know about RSI trading strategies.

Nucor recently reported quarterly earnings for the second quarter of 2022:

- Total Sales were reported to be $ 11.79 billion, a 12 % increase from the previous year’s same period.

- Net earnings were reported to be $ 2.6 billion, a 70 % increase from the previous year’s same period

- Earnings per share were reported at $ 9.69

Nucor has a market capitalization of $ 37.4 billion. Its share is trading at a price of $ 142.65. The stock of Nucor has been on an upward trend, despite being slightly volatile, for the past two years.

The stock started off in the year 2021 at a price of $ 53.12. The stock rose as high as $ 126.17 and closed off at $ 114.15. This represents a 115 % increase during the year.

In 2022, the stock started trading at $ 114.15 and went as high as $ 165.32. The stock last closed at $ 142.65. Overall, the stock appreciated by 25 % to date.

Get to know the best EV stocks to invest in today.

Get to know the best EV stocks to invest in today.

Chewy

Chewy, Inc. engages in the provision of pure-play e-commerce business. It is an online retailer of pet food and other pet-related products. The Company through its retail website and mobile application offers pet food, treats, supplies, and healthcare products for dogs, cats, fish, birds, horses, and reptiles, as well as provides a range of pet clothing and medications. Chewy serves customers in the United States. With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

Chewy, Inc. is a trusted destination for pet parents and partners everywhere. The company released its financial results for the first quarter of the fiscal year 2022 ended May 1, 2022:

- Net sales of $ 2.43 billion, a 13.7 % increase on year-over-year basis

- Net income of $ 18.5 million

Chewy has a market capitalization of $ 21 billion. Its share is trading at a price of $ 50.01. The stock started in the year 2021 at a price of $ 89.89. It went as high as $ 118.69 in 2021 and then started declining. The stock closed the year at a price of $ 58.97. Overall, the stock declined by 34.4 % in 2021.

In 2022, the stock started at $ 58.97, dropped to the lows of $ 24.47and last closed at $ 50.01. Overall, the stock declined by 15 % during the year.

Tech stocks is also one of the best investment opportunity.

Expedia Group

Expedia, Inc. is an American travel company headquartered in Seattle, Washington. The company operates through Retail, B2B, and trivago segments. Oil stocks are one of the riskier yet most profit-generating sectors.

The organization is made up of four segments:

- Expedia Services – It is focused on the group’s platform and technical strategy

- Expedia Marketplace – It is centered on product and technology offerings across the organization

- Expedia Brands – It is focused on housing all our consumer brands

- Expedia for Business – It is consisting of business-to-business solutions and relationships throughout the travel ecosystem.

The Expedia Group family of brands includes Expedia, Hotels.com, Expedia Partner Solutions, Vrbo, trivago, Orbitz, Travelocity, Hotwire, Wotif, ebookers, CheapTickets, Expedia Group Media Solutions, CarRentals.com, and Expedia Cruises.

Expedia Group, Inc. announced financial results for the second quarter ended June 30, 2022:

- Revenue was reported to be $ 3.2 billion, an increase of 51 % as compared to the second quarter of 2021

- Net loss was reported at $ 185

Get to know the best shipping stocks in 2024.

Expedia Group has a market cap of $ 18.5 billion. Its share is trading at a price of $ 117.16. The stock of the company remained bullish for the major part of the last two years.

The stock started in the year 2021 at a price of $ 132.4. Throughout the year, the share continued rising and it closed off the year at $ 180.72. This represents a 36.5 % appreciation during the year.

In 2022, the stock started trading at a price of $ 180.72. it dropped to the lows of $ 92.35 and last traded at a price of $ 117.16. This represents a 35.3 % depreciation to date.

Get to know everything about high frequency trading.

Get to know everything about high frequency trading.

Robinhood Markets Inc.

Robinhood Markets, Inc. is an online stock brokerage company with a stock-trading app aimed at young and newer investors. With Robinhood, people can invest with no account minimums through Robinhood Financial LLC, buy and sell crypto through Robinhood Crypto, LLC, spend, save, and earn rewards through Robinhood Money, LLC, and learn about investing through easy-to-understand educational content.

Robinhood Markets, Inc. was incorporated in 2013 and is headquartered in Menlo Park, California.

Robinhood Markets, Inc recently announced its financial results for the second quarter of 2022, which ended June 30, 2022:

- Total net revenues were reported to be $ 318 million

- Net loss was reported at $ 295 million

- Earnings per share were reported at $ 0.34

Also read Forex trading vs Stocks trading.

Robinhood Markets has a market cap of $ 9 billion. Its share is trading at a price of $ 10.9. The company went public in 2021. After an initial hike in price, the Robinhood Market share has been consistently declining. In 2021, the stock went from $ 35 to the peak of $ 55 and closed the year at $ 17.76. Overall, the stock declined by approx. 50 % in 2021, after going public.

In 2022, the stock started trading at $ 17.76 and last closed at $ 10.12. To date, the stock has declined by 43 %.

Read Best Crypto Staking Platforms.

Read Best Crypto Staking Platforms.

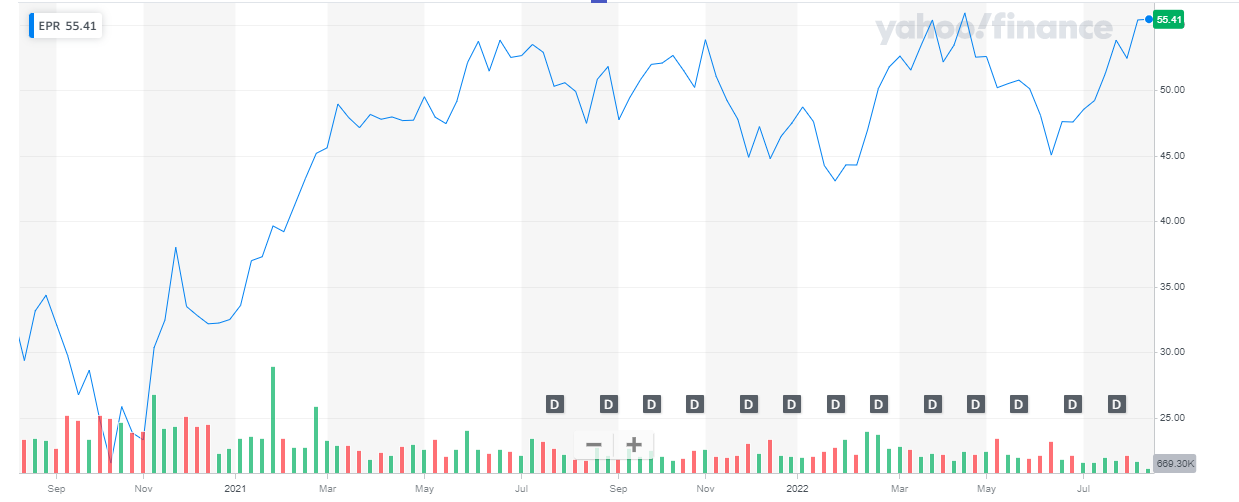

EPR Properties

EPR Properties is the leading diversified experiential real estate investment trust (REIT), specializing in select enduring experiential properties in the real estate industry. It has a presence in more than 358 locations, has 200 plus tenants in 44 states and Canada, and has made a total investment of $ 6.6 billion.

Also read: Best EV Stocks

EPR Properties recently announced operating results for the second quarter ended June 30, 2022:

- Revenues were reported at $ 160.5 million, a 20 % increase from the previous year’s same period

- Net Income was reported at $ 34.8 million, an approx. 2-fold increase from previous year same period

EPR Properties has a market cap of $ 4.16 billion. Its share is trading at a price of $ 55.41. The stock started in the year 2021 at a price of $ 32.5. The stock went as high as $ 53.85 and closed the year at $ 47.49. Overall, the stock appreciated by 46 % during the year.

In 2022, the stock started trading at a price of $ 47.49 and it was the last trading at a price of $ 55.41. This represents a 17 % appreciation to date.

Also read Best green energy stocks.

Also read Best green energy stocks.

CONCLUSION

Cyclical stocks rise and fall with the economic cycles. Investors should be very careful when they choose to invest in them. In a growing economy, cyclical can offer above-average gain. This makes them attractive. But we cannot ignore the fact that cyclical stocks are riskier and time-consuming, investments.

Investing in cyclical stocks requires a lot of market analysis, experience, risk, and speculation. And even then, there is no guarantee of risk-free trading and investment. Investors can only predict the market’s ups and downs.

Therefore, the best advice to investors is to maintain a balanced portfolio.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy