Automotive Stocks are stocks of companies that are engaged in the design, manufacture, and distribution of automobiles.

Automotive Stocks are stocks of companies that are engaged in the design, manufacture, and distribution of automobiles.

Since the start of 2022, the automotive industry has seen huge changes in business models as the pace of electrification rises and advances in connectivity technology continue. These changes are giving rise to intense competition that is undermining existing brand strategies, and have given rise to huge new opportunities. The industry has shown resilience in the face of all challenges with a rise in both sales and values. Innovation within the industry is at its peak and investment in new products meaning electric vehicles (EVs), is soaring. Despite the pressures, the outlook for the industry is positive. By using the stock signals, you can avoid hours of technical analysis to understand the market.

EVs have proven to be the best-performing drivetrain type in terms of relative growth. As per Brand Finance, in 2021, about 6.4 million plug-in electric vehicles were sold – an increase of over 100%. This represents a rise from 4.5% of all vehicles sold in 2020 to 9% in 2021.

Trends Within the Automotive Industry

The trend highlights of the automotive industry for 2022 are:

- All sub-sectors within the industry are rebounding from the pandemic

- The industry and demand are growing for electric and connected cars. Demand is growing but the costs of transition to EV are significant.

- Despite OEM brands needing to carefully update their positioning for the EV revolution, marketing spending is falling

- Online sales continue to offer a route to improve brand experience

Check out: List of Most Volatile Stocks

The Challenges of The Industry

Through the first six months of the year, new threats to the auto industry and the general economy have emerged.:

- Inflation, at the highest levels in 40 years, rising interest rates, and rising gas prices. This has a direct impact on the automotive industry as it reduces the consumer’s ability to purchase and finance a new or used vehicle as well as the total vehicle miles traveled.

- The Russian invasion of Ukraine has had a huge impact on the production shortage of microchips. Raw materials, such as neon gas that have been compromised during this war, are a key component in the manufacturing of microchips.

- OEMs and the United States are trying to mitigate the impact of the microchip crisis and our dependence on importing these components by opening microchip production facilities domestically, but these will take some time to develop and begin production.

As per the research of IBIS World, the automobile industry will generate more than $2.7 trillion in revenue for sector participants in 2021 alone. The market size, measured by revenue, of the Global Car & Automobile Manufacturing industry, is $2.9tr in 2022. This sector is expected to increase by 3.1% in 2022.

Check out our updates for Nasdaq Forecast.

Check out our updates for Nasdaq Forecast.

This massive industry means constant opportunities within this sector of the stock market. Here we have compiled a list of the 10 best Auto Stocks to invest in 2024:

| Sr. | Company Name | Symbol | Market Cap | Share Price (As of 17th Oct 2022) |

| 1 | Ford Motor | F | $ 47.6 billion | $ 11.3 |

| 2 | Ferrari NV | RACE | $ 34.9 billion | $ 191.45 |

| 3 | Tesla | TSLA | $ 687.3 billion | $ 219.35 |

| 4 | Stellantis | STLA | $ 40.36 billion | $ 12.57 |

| 5 | General Motors Company | GM | $ 48.95 billion | $ 33.57 |

| 6 | NIO Inc. | NIO | $ 20.61 billion | $ 12.21 |

| 7 | Honda Motors Co Ltd | HMC | $ 37.5 billion | $ 22 |

| 8 | Toyota Motor Corp | TM | $ 187.6 billion | $ 134.86 |

| 9 | Volkswagen | VWAGY | $ 79.13 billion | $ 17.03 |

| 10 | Magna International | MGA | $ 14.66 billion | $ 50.89 |

Get to know about Best Trading and Forex Signal Providers

Ford Motor

Ford Motor Co. engages in the manufacture, distribution, and sale of automobiles. It operates through the following three segments:

- Automotive

- Mobility

- Ford Credit

Ford operates 48 manufacturing and assembly plants, making it the third largest light-vehicle manufacturer in the U.S. Ford continues to add facilities and scale, including plans to spend $5.6 billion to build its Blue Oval City facility in Tennessee that will produce F-Series EVs and batteries. Ford also has 9,955 distributors globally with 3,100 dealers in the U.S.

Ford reported sales for the month of September, in which it reported total vehicle sales of 142, 644, an 8.9 % decline from the previous year’s same month. What makes Ford a preferred choice of investment is its unique manufacturing and distribution networks which are hard to replicate. Also, the company’s strong free cash flow offers a big advantage in an increasingly capital-intensive industry. Solar energy stocks are also one of the best investment options.

After suspending dividend payments during the pandemic, Ford reinstated its dividend in 4Q21. Since 2017, Ford has paid $8.9 billion in cumulative dividends. The firm’s current dividend, when annualized, provides a 2.3% yield.

Ford has a market cap of $ 47.6 billion. Its share is trading at $ 11.83.

The year 2021 has been a great year for the company’s stock. The stock started off the year at $ 8.79 and continued throughout the year with a bullish run. The stock went as high as $ 21.45 and closed the year at this high price. Overall, the stock appreciated by 144% during the year.

Get to know about Hydrogen stocks, which are companies focusing on the production of hydrogen fuel cells.

In 2022, the stock maintained its bullish streak during the start of the year, it peaked at $ 25.19 before reversing its course. During the remaining year, the stock dropped to the low of $ 11.32 and last closed at $ 11.83, representing a 44 % decline to date.

Also read:

Ferrari NV

Ferrari N.V., through its subsidiaries, designs, engineers, produces and sells luxury performance sports cars. The company offers sports, GT, and special series cars; limited edition hypercars; one-off and track cars; and Icona cars. It also provides racing cars, spare parts, and engines, as well as after-sales, repair, maintenance, and restoration services for cars.

Ferrari recently shared its second-quarter report for 2022:

- Total shipments were up by 770 units, a 28.7% increase from the previous year’s same period

- Net Revenues were reported at € 1.291 billion, a 24.9 % increase from the previous year’s same period

- Net Profit was reported at €251 million, a 21.8 % increase from the previous year’s same period

- Earnings per share were €1.36, a 22.5 % increase from the previous year’s same period

Divided for the period was approved at € 1.362 or $ 1.48 per share.

Stocks are profitable. But it’s always wise to limit your exposure to risky investments like best altcoins.

The year 2021 was marked by the highest number of shipments for the company. Moreover, the company is extending its growth into new markets such as SUVs and electric vehicles.

Ferrari has a market cap of $ 34.9 billion. Its shares are trading at a price of $ 191.45.

The stock started in the year 2021 at $ 190.45. During the year, the share of Ferrari has seen multiple dips and peaks throughout the year. The stock went as low as $ 154.7 and as high as $ 240 during the year. However, overall, the stock appreciated by 19 % during the year closing at $ 227.1.

In 2022, the stock started off with a downward trend and maintained its volatility throughout the year. To date, the stocks declined by 17.4 %, the last closing at 187.5.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Tesla

Tesla, Inc. designs, develops, manufactures, sells, and leases electric vehicles and energy generation and storage systems, and offers services related to its sustainable energy products. The Company’s segments include automotive, and energy generation and storage.

In 2022, Tesla announced it will not be launching any new vehicle but it tested the Cybertruck prototype at an event. Tesla Cybertruck and the long-awaited truck will be manufactured at the new plant in Texas in the coming year. Oil stocks are one of the riskier yet most profit-generating sectors. No doubt oil is the largest energy market but natural gas stocks also play an important role.

In the second quarter report for the year 2022, Tesla reported 258,580 productions and 254,695 deliveries. The company reported:

- Revenues of $ 13.7 billion, as compared to $ 9.5 billion during the previous year’s same period

- Net Income of $ 2.3 billion, as compared to $ 1.2 billion during the previous year’s same period

- Earnings per share were reported at $ 1.95

Tesla has a market cap of $ 687.3 billion. Its share is trading at a price of $ 219.35.

The stock started the year 2021 at a price of $ 235.22. Initially, the stock followed a bearish run and dropped to the low of $ 193.63. But after that, the stock picked up the pace and started rising. It reached as high as $ 407.36 and finally closed the year at $ 352.26, representing a 50 % appreciation during the year.

Get to know the best commodities to invest in now.

In 2022, the stock exhibited volatile behavior while declining steadily. From $ 352, at the start of the year, the stock last closed at $ 219.35, representing a 37.8 % decline to date.

Stellantis

Stellantis

Stellantis is a leading global automaker and mobility provider that offers clean, connected, affordable, and safe mobility solutions. It offers 14 automotive brands offer a full spectrum of choices from luxury, premium, and mainstream passenger vehicles to pickup trucks, SUVs, and commercial vehicles.

Stellantis operates in almost 30 countries and caters to consumers’ needs in more than 130 markets. On Jan 16th, 2022 merger of Peugeot S.A. (PSA) with and into Fiat Chrysler Automobiles N.V. (FCA) took place and the combined company was renamed Stellantis N.V.

Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

In the half-yearly report for the year 2022, the company reported:

- Net Revenues of € 87,999, a 17 % increase from the previous year’s same period

- Net Profit was reported at € 7.9 billion, a 34 % increase from the previous year’s same period

- Industrial Free Cash Flow was reported at € 5.3 billion

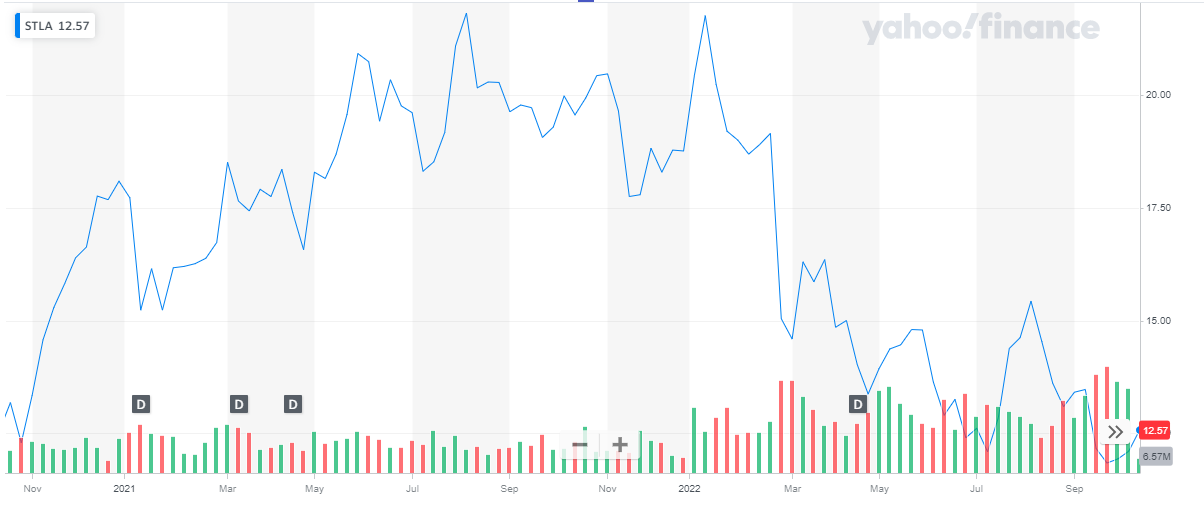

Stellantis has a market cap of $ 40.36 billion. Its shares are trading at $ 12.57.

The share has been volatile during 2021 while maintaining a bullish trend. The stock started the year at $ 18.09 and closed the year at $ 18.76, representing a 3 % appreciation during the year.

In 2022, after an initial hike in price when the stock peaked at $ 21.76, the stock suffered a huge blow and continued to decline through the remaining of the year. The stock last closed at $ 12.96, representing a 40 % decline to date.

General Motors Company

General Motors Company

General Motors is one of the oldest and most successful American auto companies. It is currently the USA’s largest automobile manufacturer through its four core brands: Chevrolet, Buick, GMC, and Cadillac. In recent years, GM has begun pushing its new environmentally friendly electric cars, especially as sales for its larger SUVs have seen steady declines

General Motors reported its second quarter results for the year 2022:

- Revenues were reported at $ 35.7 billion, a $ 1.6 billion increase from the previous year’s same period

- Earnings before interest and tax were reported at $ 2.3 billion, a decrease of $ 1.77 billion

- Earnings per share were reported at $ 1.14

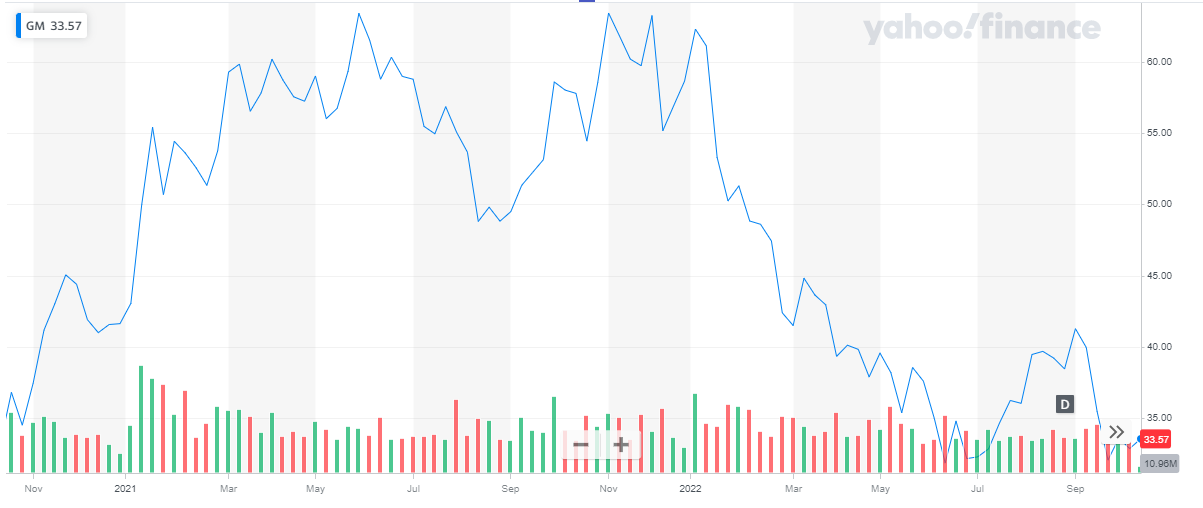

General Motors has a market cap of $ 48.95 billion. Its shares are trading at $ 33.57. If you have entered the crypto investment market, you should explore crypto staking platforms.

The stock started the year 2021 at $ 41.64. The stock remained bullish throughout the year and closed the year at $ 58.63. Overall, the stock appreciated by 40.8 % during the year.

In 2022, the stock reversed its course and picked up a bearish pattern. From $ 58.63, the stock last closed at $ 33.57, representing a 42.7 % decline to date.

NIO Inc.

NIO Inc.

NIO Inc. is a pioneer and a leading company in the premium smart electric vehicle market which was founded in November 2014. NIO designs develop, jointly manufactures, and sells premium smart electric vehicles, driving innovations in next-generation technologies in autonomous driving, digital technologies, electric powertrains, and batteries.

Also, learn about top shipping stocks in 2024.

NIO launched its first electric vehicle, the high-end EP9 supercar, back in 2016. However, this vehicle was never produced on a large scale. However, in late 2017, NIO launched its full-size ES8 SUV, which marked an official entrance into the mainstream EV market.

NIO is gradually expanding overseas into smaller European markets like Norway, but it still generates most of its revenue in China.

NIO reported its second-quarter results for the year 2022:

- Total revenues were reported at RMB 10,292.4 million ($ 1,536.6 million), representing an increase of 21.8 % from the second quarter of 2021

- Net loss was reported at RMB 2,757.5 million ($ 411.7 million), representing an increase of 369.6 % from the second quarter of 2021

- Earnings per share were reported at RMB 1.68 (US$0.25) compared with RMB 0.42 in the second quarter of 2021

NIO has a market cap of $ 20.16 billion. Its shares are trading at $ 12.21.

NIO Inc. went public in Sept. 2018 at $6.26 per share and surged to an all-time high of $62.84 in February 2021. But the investor excitement died down soon and the share price dropped to $ 14.

There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

In 2021, the stock went from $ 48.74 to a peak of $ 62.84 and closed the year at $ 31.68 representing a 35 % decline.

In 2021 the bearish trend continued and the stock further declined. From $ 31.68 the stock last closed at $ 12.73, representing a 60 % decline to date.

Honda Motors Co Ltd

Honda Motors Co Ltd

Honda Motor Company Limited is the third largest automaker in Japan. It also was the best world* s top motorcycle manufacturer. Honda’s biggest market is the US.

Honda’s automobile product line accounts for approximately 90 percent of its sales and includes well-known U.S. top-sellers such as the Accord, Legend, Civic, Prelude, and the luxury Acura. Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Honda Motors reported a total of 2,606,780 vehicles produced by the end of Aug-2021.

Honda Motors reported first quarter results for the fiscal year 2023, ending 30th June 2022:

- Sales revenue was reported at 3,829.5 billion yen, representing a year-on-year increase of 6.9 %

- Profit was reported at 149.2 billion yen, a year-on-year decrease of 32.9 %

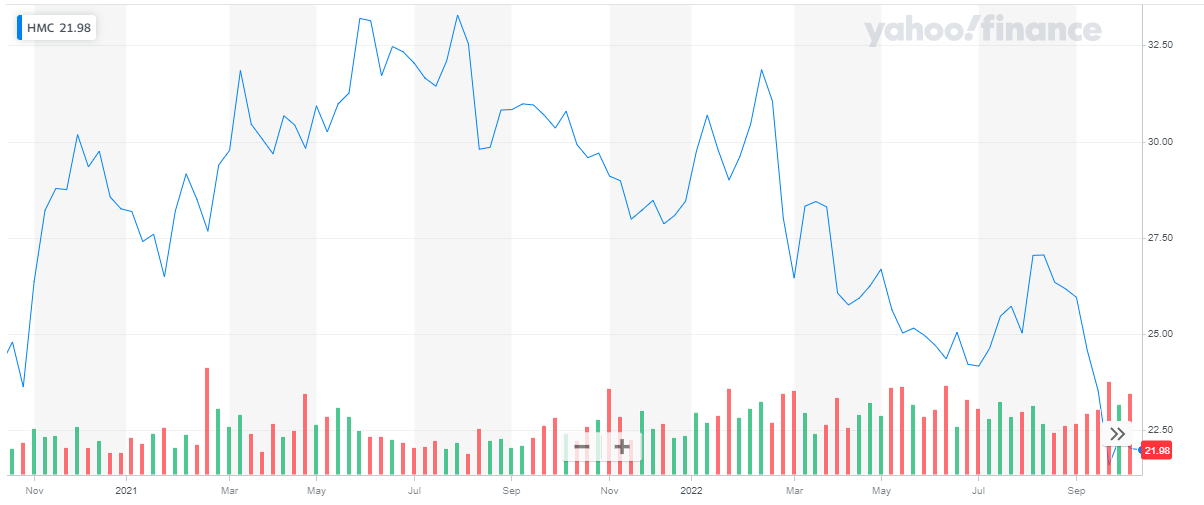

Honda Motors has a market cap of $ 37.5 billion. Its share is trading at $ 22.

The share of Honda Motors has been on a rising trend for the majority of 2021. It started off at $ 28.25, went as high as $ 33.29, and finally closed the year at $ 28.45. Overall, the stock maintained its price level by the end of the year.

In 2022, the stock initially rose from $ 28.45 to $ 31.87. After that, the share started climbing downwards. It last closed at $ 22, representing a 22.67 % decline to date.

Toyota Motor Corp

Toyota Motor Corp

Toyota Motor Corp. engages in the manufacture and sale of motor vehicles and parts. It operates through the following segments:

- Automotive – The Automotive segment designs, manufactures, assembles, and sells passenger cars, minivans, trucks, and related vehicle parts and accessories. It is also involved in the development of intelligent transport systems.

- Financial Services – The Financial Services segment offers purchase or lease financing to Toyota vehicle dealers and customers. It also provides retail leasing through lease contracts purchased by dealers.

- All Other – The All-Others segment deals with the design and manufacture and sale of housing, telecommunications, and other businesses.

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

For the month of August 2022, the company reported total sales of 844,028.

Toyota recently reported its first quarter results for the fiscal year 2023 ending 30th June 2022:

- Total revenues were reported at 8.5 billion Yen, a 7 % increase from the previous year’s same period

- Net Income was reported at 758 million Yen, an 18 % decline from the previous year’s same period

- Earnings per share were reported at 53.65 Yen

Toyota Motors has a market cap of $ 187.6 billion. Its shares are trading at $ 134.86.

In 2021, the stock maintained a bullish pattern. From a price of $ 154.57, the stock climbed high to $ 185.3. The stock also closed at this price, representing a 20 % increase during the year.

In 2022, the stock continued with its bullish run and rose up to $ 210.89. After that, the stock reversed its course and started declining. It last closed at $ 134.86 representing a 27 % decline to date.

Volkswagen

Volkswagen

Volkswagen AG engages in the production and sale of passenger cars and light commercial vehicles. The firm also develops vehicles and components for the brands of the group. It operates through the following segments: Passenger Cars, Commercial Vehicles, Power Engineering, and Financial Services. Learn about Best Day Trading Stocks

Volkswagen is emerging as one of the world’s most successful volume car manufacturers, and today offers cutting-edge solutions for future issues such as e-mobility and digitalization.

Volkswagen reported half yearly report for the year 2022:

- Sales revenue was reported at € 132.3 billion, a 2 % increase from the previous year’s same period

- Net Profit was reported at € 10.6 billion

Volkswagen has a market cap of $ 79.13 billion. Its shares are trading at $ 17.03.

The share of the company started in the year 2021 at $ 20.85. It picked up a bullish run and rose as high as $ 37.49. After that, the stock started to steadily decline. By the end of the year, the stock was trading at $ 29.2. Overall, the stock appreciated by 40 % during the year.

ETFs offer a low-cost option to get exposure to oil and gas ETFs.

In 2022, the stock continues its bearish run. The stock last closed at $ 17.03 representing a 42 % decline to date.

Magna International

Magna International

Magna International is a company that designs, develops, and manufactures automotive systems, assemblies, modules, and components. It is one of the world’s largest suppliers in the automotive space. Magna is also a mobility technology company with a global, entrepreneurial-minded team of over 161,000 employees. It has more than 65 years of expertise and a systems approach to designing engineering and manufacturing. The company’s global network includes 341 manufacturing operations and 89 product development, engineering, and sales centers spanning 28 countries. If you are seeking a steady stream of income, you should invest in REIT stocks.

Magna International reported second-quarter results for the year 2022:

- Total sales were reported at $ 9.4 billion, compared to $ 9.0 billion in the second quarter of 2021.

- Net loss was reported at $ 156 million compared to income of $ 424 million for the second quarter of 2021.

- Loss per share was reported at $ 0.54

Semiconductor stocks are also one of the best investment opportunities.

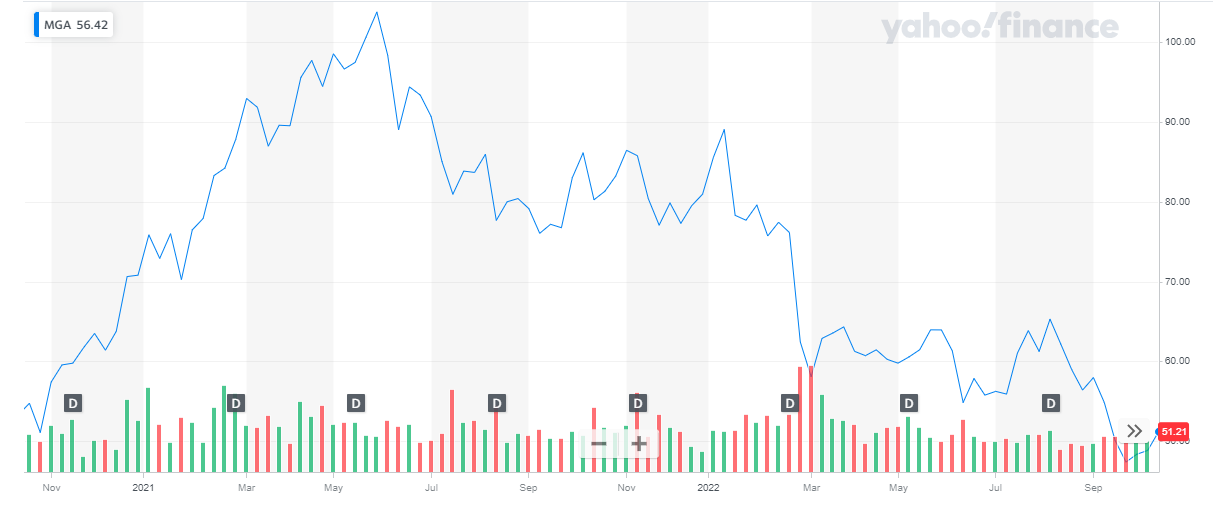

Magna International has a market cap of $ 14.66 billion. Its shares are trading at $ 50.89.

The stock started the year 2021 at $ 70.8 with a bullish trend. The stock price rose up to $ 103.74 after which the stock started to decline. The stock closed at $ 80.94, representing a 14 % appreciation during the year.

The stock continued its downward trend in 2022 also. From $ 80.94 the stock last closed at $ 51.3, representing a 37 % decline to date.

You may also like reading:

- Monthly Dividend Stocks to Buy

- Best Bank Stocks to Buy Right Now

- Best Crypto Trading Signals

- Best Penny Stocks to Invest