Wheat is not only a food staple but is also used in the production of biofuels and other derivatives for various industries. Therefore, the value of wheat is high and it also explains the high profits of the industry.

The wheat Market is projected to register a CAGR of 4.5% over the forecast period (2022-2027), as per Mordor Intelligence. Imposing trade restrictions in response to the COVID-19 pandemic had a dramatic adverse impact on food security, particularly for grains like wheat, across the world. Initially, there was panic buying around the world at the beginning of the COVID-19 outbreak, as concerns built that supply chains would struggle to operate in the new environment. COVID-19 vaccine stocks provide excellent returns to shareholders. Due to the reduced supply, following the export restrictions by major grain exporting countries, wheat prices are expected to rise in many parts of the world. By using the stock signals, you can avoid hours of technical analysis to understand the market.

Over the long term, the increased consumption of wheat across the countries in various cuisines and by the processing industries for the production of products like flour, pasta, noodles, and beverages and the rising food demand are expected to drive the wheat market over the study period.

Check out: List of Most Volatile Stocks

List of Best Wheat Stocks to Invest in 2024

The following is a list of the 10 best wheat stocks to invest in 2024:

| Sr. | Company Name | Symbol | Market Capitalization | Price (As of 11th Nov 2022) |

| 1 | Deere and Co. | DE | $ 123 billion | $ 406.03 |

| 2 | Bunge | BG | $ 15.24 billion | $ 101.51 |

| 3 | Seaboard | SEB | $ 4.46 billion | $ 3,844 |

| 4 | Archer-Daniels-Midland | ADM | $ 52.34 million | $ 93.07 |

| 5 | The Andersons | ANDE | $ 1.26 billion | $ 37.74 |

| 6 | Corteva Inc. | CTVA | $ 47.85 billion | $ 64.77 |

| 7 | Arcadia Biosciences, Inc. | RKDA | $ 7.9 million | $ 0.32 |

| 8 | Adecoagro | AGRO | $ 839.77 million | $ 7.76 |

| 9 | AGCO Corporation | AGCO | $ 9.44 billion | $ 127.6 |

| 10 | MGP Ingredients Inc. | MGPI | $ 2.5 billion | $ 113.6 |

Solar energy stocks are also one of the best investment options.

Deere and Co.

Deere and Co.

Deere & Co. engages in the manufacturing and distribution of equipment used in agriculture, construction, forestry, and turf care. It operates through the following segments:

- Agriculture and Turf – This segment focuses on the distribution and manufacturing of a full line of agriculture and turf equipment and related service parts. Get to know the best agricultural stocks to buy now.

- Construction and Forestry – This segment offers machines and service parts used in construction, earthmoving, road building, material handling, and timber harvesting

- Financial Services – This segment finances sales and leases by John Deere dealers of new and used agriculture and turf equipment and construction and forestry equipment

Also, learn about top shipping stocks in 2024.

Deere & Company offers a portfolio of more than 25 brands to provide a full line of innovative solutions to its customers in a variety of production systems throughout the lifecycle of its machines. The company has been in business for more than two centuries, it continues to focus on innovation and leadership. It has more than 100 locations worldwide, with 75,600 employees working for them. Stocks are profitable. But it’s always wise to limit your exposure to risky investments like the best altcoins.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 14.1 billion | $ 13.4 billion | $ 9.6 billion |

| Net Income | $ 1.9 billion | $ 2.1 billion | $ 903 million |

| Earnings per share | $ 6.2 | $ 6.85 | $ 2.92 |

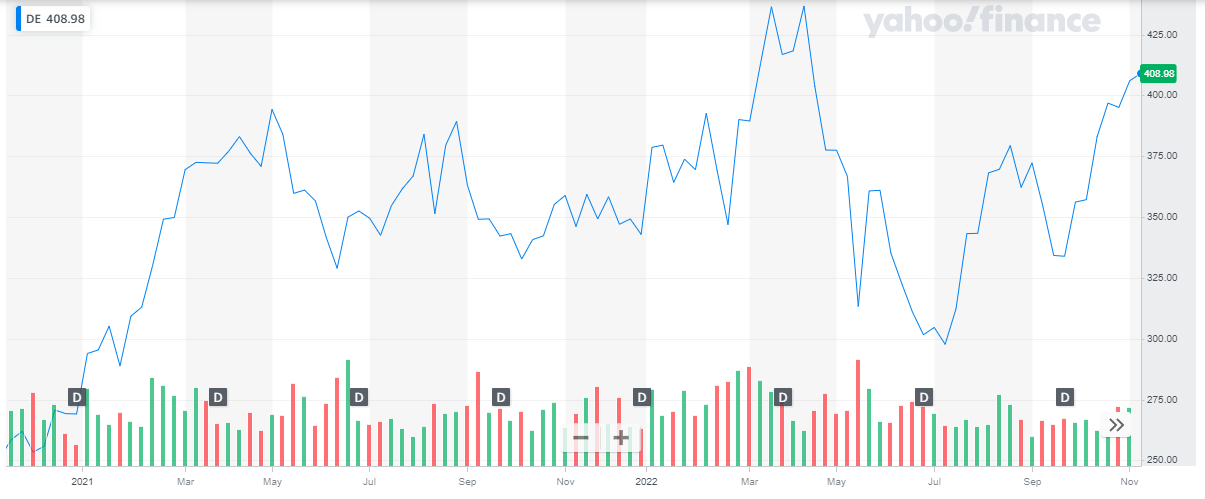

Deere and Company have a market cap of $ 123 billion. Its shares are trading at $ 406.03.

The stock of the company remained volatile throughout 2021 but managed to remain bullish. The stock started trading at $ 269.05 at the start of the year and closed off at $ 342.89. Overall, the stock appreciated by 27.5 % during the year.

In 2022, the stock went extremely volatile. It started off at $ 342, went as high as $ 436.45, and dropped as low as $ 297.7. It last closed at $ 406 representing an 18.7 % decline to date.

Also, renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

Also, renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Bunge

Bunge Ltd. operates as a holding company, which engages in the supply and transportation of agricultural commodities. It is a global agricultural and food enterprise. It procures, processes, and distributes oilseed, grain, and ingredient goods.

Learn about Best Day Trading Stocks

It operates through the following segments: Agribusiness, Edible Oil Products, Milling Products, Sugar and Bioenergy, and fertilizers. Bunge delivers sustainable solutions and opportunities to more than 70,000 farmers, together with 31,000 workers responsible for more than 360 port terminals, oilseed processing plants, grain silos, and food and ingredient manufacturing and packaging facilities worldwide. But investors who have money to invest for the long term should invest in nuclear energy stocks.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 16.8 billion | $ 17.9 billion | $ 15.9 billion |

| Net Income | $ 380 million | $ 206 million | $ 688 million |

| Earnings per share | $ 2.49 | $ 1.34 | $ 4.48 |

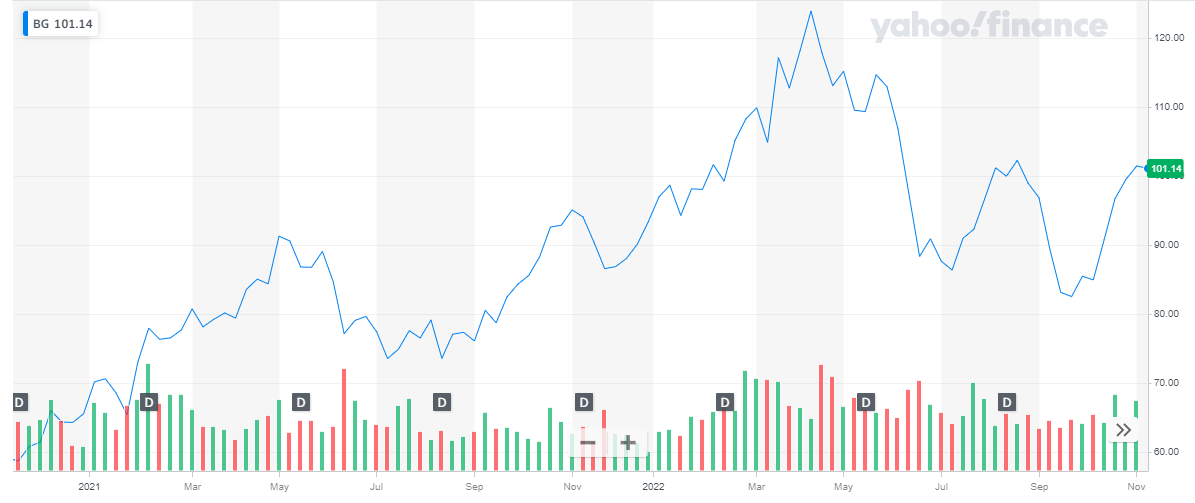

Bunge has a market cap of $ 15.2 billion. Its shares are trading at $ 101.51.

The stock started the year 2021 at $ 65.58. It picked up a bullish run and closed the year at $ 93.36. Overall, the stock appreciated by 42.4 %.

In 2022, the stock continued its bullish run till it peaked at $ 123.96. After that, the stock reversed its course and started declining. The stock last closed at $ 101.28 representing an 18.3 % decline to date.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Also read:

Seaboard

Seaboard Corporation is a vertically integrated agricultural powerhouse with a global reach and growing interest in developing regions. The company is one of the largest pork producers in the United States and a majority owner of the largest turkey producer in the United States. The company employs more than 13,000 people worldwide.

Also check out Best Forex Brokers for Trading

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 2.9 billion | $ 2.97 billion | $ 2.7 billion |

| Operating Income | $ 155 million | $ 192 billion | $ 146 million |

| Net Income | $ 146 million | $ 108 million | $ 103 million |

| Earnings per share | $ 125.78 | $ 92.53 | $ 89. |

Get to know the best stocks to buy for the holiday season.

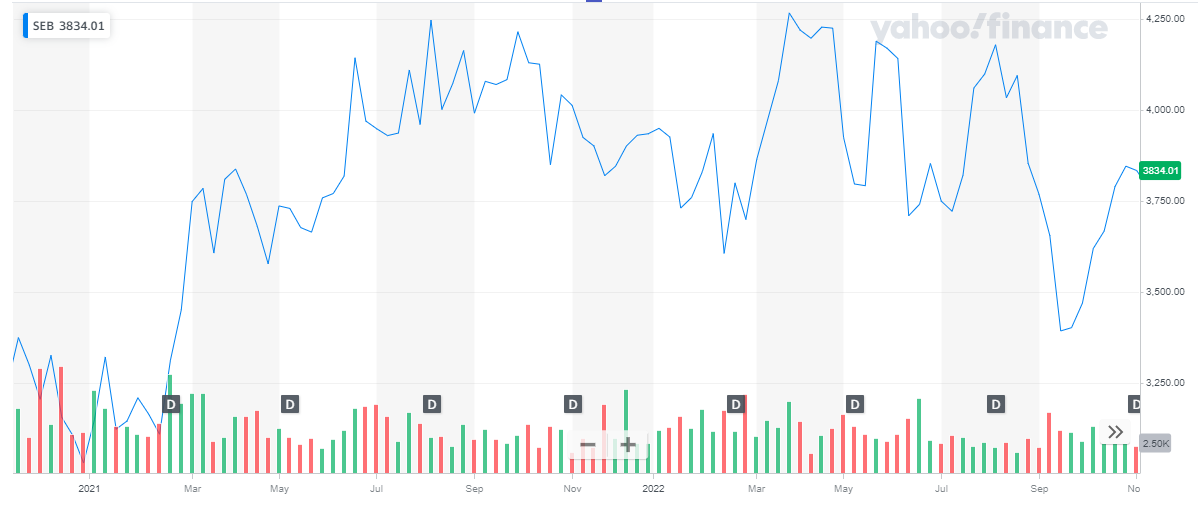

Seaboard has a market cap of $ 5.5 billion. Its shares are trading at $ 3,857.

The share started in the year 2021 at a price of $ 3,031. During the year the stock spiked high and hit $ 4,247. The share closed the year at $ 3,935. Overall, the stock appreciated by 30 % during the year.

In 2022, the stock followed a head and shoulder pattern with multiple peaks and dips. The share last closed at $ 3,834 representing a 2.5 % decline to date.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

Archer-Daniels-Midland

Archer Daniels Midland (ADM) is an agricultural origination and processing company. It offers a range of products, including specialty food and feed ingredients, animal nutrition solutions, ethanol, and biodiesel, as well as industrial chemicals, fertilizers, plastics, and paper. In addition, the company delivers related logistics, financial, and farmer services. ETFs offer a low-cost option to get exposure to oil and gas ETFs.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 24.7 billion | $ 27.3 billion | $ 23.6 billion |

| Net Income | $ 1 billion | $ 1.24 billion | $ 1.0 billion |

| Earnings per share | $ 1.83 | $ 2.18 | $ 1.86 |

Archer-Daniels-Midland has a market cap of $ 51.8 billion. Its shares are trading at $ 94.28.

The stock of the company has been on a bullish run for the past two years. It started the year 2021 at $ 50.41. The stock maintained its bullish streak throughout the year and closed off at $ 67.59. Overall, the stock improved by 25.5 %.

In 2020, the stock continued its bullish streak and reached new heights this time. During the year, the stock peaked at $ 96.91 and last closed at $ 94.25. To date, the stock appreciated by 39.4 %.

Get to know about Hydrogen stocks, which are companies focusing on the production of hydrogen fuel cells.

Get to know about Hydrogen stocks, which are companies focusing on the production of hydrogen fuel cells.

The Andersons

The Andersons is an agriculture company that conducts business in the trade, ethanol, plant nutrient, and rail sectors.

Its Trade segment specializes in the movement of physical commodities such as whole grains, grain products, feed ingredients, frac sand, domestic fuel products, and other agricultural commodities. Investing in fuel cell stocks can prove to be very lucrative as the technology goes mainstream.

If you have entered the crypto investment market, you should explore crypto staking platforms.

Its Ethanol segment produces, purchases, and sells ethanol as well as offers facility operations, risk management, and ethanol and corn oil marketing services to the ethanol plants it invests in and operates.

The company’s Plant Nutrient business provides warehousing, packaging, and manufacturing services to basic nutrient producers and other distributors as well as manufactures and distributes a variety of industrial products, including nitrogen reagents for air pollution control systems used in coal-fired power plants, and water treatment and dust abatement products.

Its Rail business leases, repairs, and sells various types of railcars, locomotives, and barges. In addition, it offers fleet management services to private railcar owners.

There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 4.2 billion | $ 4.45 billion | $ 3.977 billion |

| Net Income | $ 36.7 million | $ 79.8 million | $ 5.5 billion |

| Earnings per share | $ 0.51 | $ 2.36 | $ 0.16 |

The Andersons has a market cap of $ 1.24 billion. Its shares are trading at $ 37.44.

The stock of the company has been on a bullish run for the major part of the last two years. It started the year 2021 at $ 24.51 and closed the year at $ 38.71. Overall, the stock appreciated by 58 %.

In 2022, the stock spiked further. From $ 38.71, the stock climbed up to $ 58.39 and last closed at $ 37.44. To date, the stock appreciated by 51 %.

Get to know about Best Trading and Forex Signal Providers

Get to know about Best Trading and Forex Signal Providers

Corteva Inc.

Corteva is a company that specializes in balanced and diverse seed, crop protection, and digital service solutions. It provides agriculture products, develops, and supplies germplasm and traits in corn, soybean, and sunflower seed markets. No doubt oil is the largest energy market but natural gas stocks also play an important role.

The company also offers products that protect against weeds, insects, and other pests and diseases, as well as enhance crop health both above and below ground via nitrogen management and seed-applied technologies.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 2.8 billion | $ 6.3 billion | $ 4.6 billion |

| Net Income / Loss | ($ 331) million | $ 969 million | $ 564 million |

| Earnings per share | $ 0.46 | $ 1.34 | $ 0.78 |

There is no guarantee of success but a good crypto trading signal provider will contribute to your financial security.

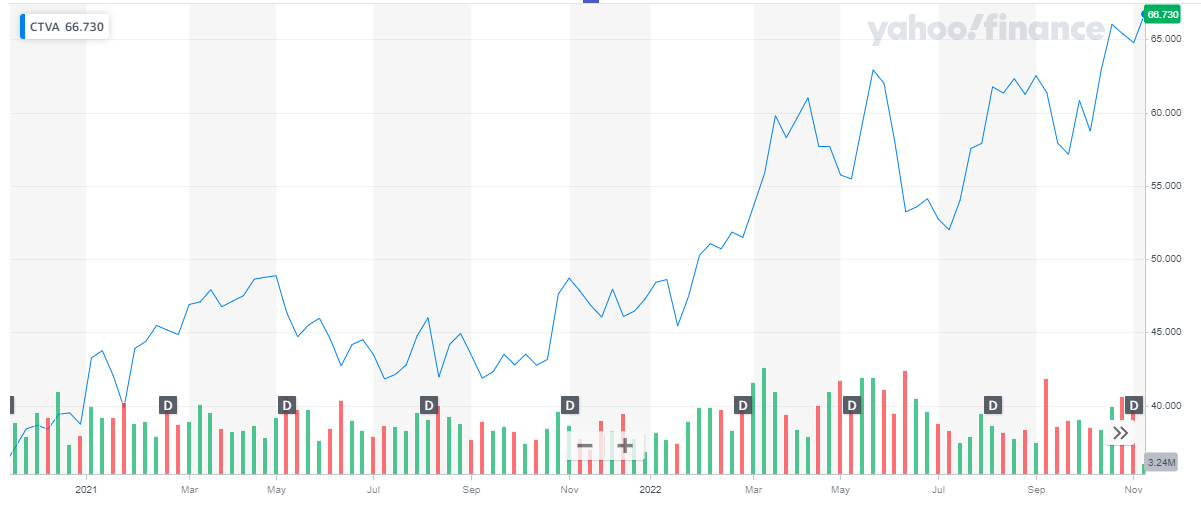

Corteva Inc. has a market cap of $ 47.7 billion. Its shares are trading at $ 66.73.

The stock of the company has been on a bullish run for the past two years. The stock started in the year 2021 at $ 38.72. Throughout the year it maintained its upward trend and eventually closed off at $ 47.27 representing a 22 % appreciation during the year.

In 2022, the stock continued its bullish run and reached new heights. It last closed at $ 66.73 representing a 41 % appreciation to date.

Get to know the best commodities to invest in now.

Get to know the best commodities to invest in now.

Arcadia Biosciences Inc.

Arcadia Biosciences Inc. produces and markets plant-based health and wellness products in the United States. The company develops crop improvements primarily in wheat to enhance farm economics by improving the performance of crops in the field, as well as their value as food ingredients, health and wellness products, and their viability for industrial applications. Its food, beverage, and body care products include GoodWheat, Zola coconut water, ProVault topical pain relief, and SoulSpring bath and body care. If you are seeking a steady stream of income, you should invest in REIT stocks.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 1.88 billion | $ 3.9 billion | $ 3.2 billion |

| Net Income / Loss | ($ 2.87) billion | ($ 3.8) billion | ($ 4.5) billion |

| Earnings per share | ($ 0.12) | ($ 0.17) | ($ 0.2) |

Also, check out the best swing trading stocks.

Arcadia Biosciences Inc. has a market cap of $ 8.25 million. Its shares are trading at $ 0.3351.

The share has been on a downward trend since last year. It started trading at $ 2.53 in 2021 and closed off the year at $1.04 representing a 59 % decline during the year.

In 2022, after an initial hike in price, the stock resumed its bearish trend. From $ 1.04, the stock last closed at $ 0.3351 representing a 68 % increase in price.

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

Also learn about Head and Shoulders Pattern – Trading Guide with Rules & Examples

Adecoagro

Adecoagro is a leading agro-industrial company in South America, active in Argentina, Brazil, and Uruguay. Its business involves the production of numerous grains and oilseeds, including soy. The company is involved in the planting, harvesting, and sale of grains and oilseeds, as well as wheat, corn, soybeans, peanuts, cotton, sunflowers, and others; provision of grain warehousing/conditioning, handling, and drying services to third parties; and purchase and sale of crops produced by third parties. It also plants, harvests, processes, and markets rice; and produces and sells raw milk, UHT, cheese, powdered milk, and others. In addition, the company engages in the cultivating, processing, and transforming of sugarcane into ethanol and sugar; and the sale of electricity cogenerated at its sugar and ethanol mills to the grid. Further, it is involved in the identification and acquisition of underdeveloped and undermanaged farmland, and the realization of value through the strategic disposition of assets. Get to know everything about high-frequency trading.

According to the company, Adecoagro is one of the largest owners of productive farmland in South America.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 378 million | $ 371.7 million | $ 201 million |

| Net Income / Loss | $ 22.6 million | $ 18.11 million | $ 65 million |

| Earnings per share | $ 0.43 | $ 0.40 | $ 0.13 |

Adecoagro has a market cap of $ 892 million. Its shares are trading at $ 8.02.

The stock of the company has shown volatile behavior in the past two years. In 2021, the stock started trading at $ 6.8. After rising for almost the first six months the stock changed course and started declining. Eventually, it closed the year at $ 7.68 representing an 11.5 % decline during the year. In 2022, the stock experienced a huge hike in price when it peaked at $ 13.5. After that, it started to decline and last closed at $ 8.02. To date, the stock appreciated by 4.4 %. Semiconductor stocks are also one of the best investment opportunities.

AGCO Corporation

AGCO Corporation

AGCO is a major worldwide manufacturer and distributor of agricultural equipment. It is a global leader in the design, manufacture, and distribution of agricultural solutions. AGCO offers a full product line including tractors, combines, hay tools, sprayers, forage equipment, and implements through more than 3,000 independent dealers and distributors in over 140 countries. The travel and tourism stocks have been performing extremely well and have shown great improvement in the post-pandemic era.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 3.12 billion | $ 2.945 billion | $ 2.7 billion |

| Net Income / Loss | $ 237.9 million | $ 177.6 million | $ 151.1 million |

| Earnings per share | $ 3.19 | $ 2.38 | $ 2.03 |

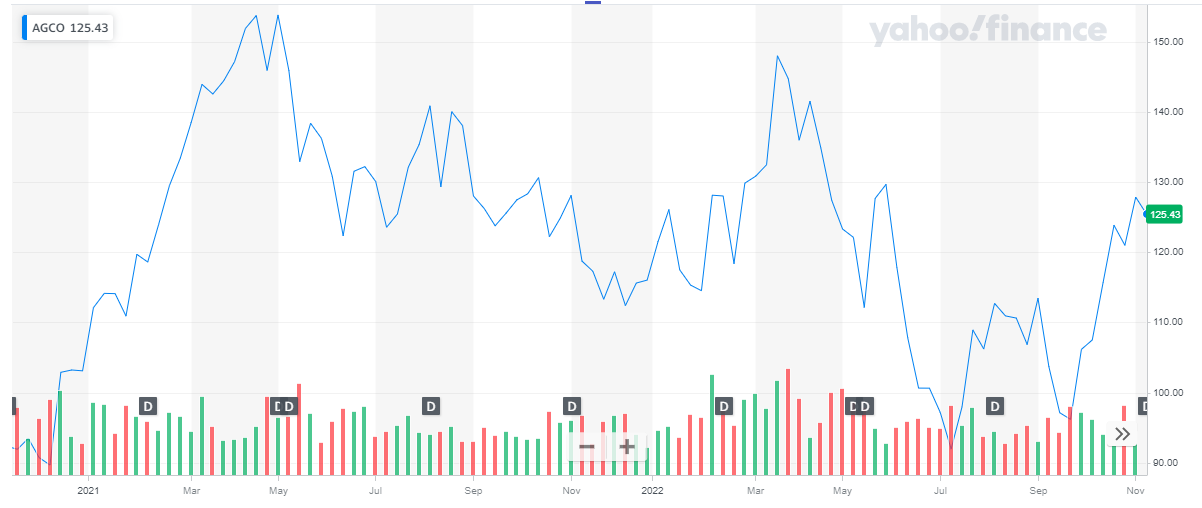

AGCO Corp has a market cap of $ 9.4 billion. Its shares are trading at $ 125.56.

The stock of the company has remained volatile in the past two years. It started off in 2021 at $ 103.09. Initially, the stock experienced a huge hike in price when it peaked at $ 153.72. After that, the stock changed course and started to decline. The stock closed the year at $ 116.02 representing a 25 % decline during the year.

In 2022, the stock continued its volatile behavior. The stock went as high as $ 116.02 and as low as $ 91.95. It last closed at $ 125.56 representing an 8.3 % decline to date.

Also read: Best EV Stocks

Also read: Best EV Stocks

MGP Ingredients Inc.

MGP Ingredients (also known as Midwest Grain Products) is a company providing distilled spirits and specialty wheat proteins and starches.

It operates through two segments:

- Distilled Spirits – The Distilled Spirits segment provides food-grade alcohol for beverage and grain-neutral spirits, food-grade industrial alcohol for pharmaceuticals, fuel-grade alcohol for blending with gasoline, etc.

- Food Ingredients – The Food Ingredients segment provides specialty wheat starches and proteins for food applications, commodity wheat starches for food and non-food applications, and commodity wheat proteins.

The company’s brands include Tanner’s Creek, Green Hat, Eight & Sand Blended Bourbon Whiskey, Remus Repeal Reserve, Rossville Union, George Remus, etc.

Get to know the best tech stocks to invest in now.

The below chart shows the financial reports for the year 2022:

| 3Q 2022 | 2Q 2022 | 1Q 2022 | |

| Revenue | $ 201 million | $ 195 million | $ 195.2 million |

| Operating Income | $ 33.9 million | $ 35.3 million | $ 50 million |

| Net Income / Loss | $ 23.6 million | $ 25.36 million | $ 37.1 million |

| Earnings per share | $ 1.07 | $ 1.15 | $ 1.69 |

MGP Ingredients Inc. has a market cap of $ 2.52 billion. Its shares are trading at $ 111.54.

The stock has been on a bullish run for the last two years. It started trading at $ 47.06 in 2021 and closed off the year at $ 84.99. Overall, the stock appreciated by 81 % during the year.

In 2022, the stock continued its bullish streak and continued to climb high. The stock last closed at $ 111.54 representing a 31 % appreciation to date.

Get to know the list of crypto mining companies that are leading the industry.

Get to know the list of crypto mining companies that are leading the industry.

CONCLUSION

In recent months, wheat prices have been increasing exponentially, which has resulted in a rise in all companies that deal with this commodity, which, in turn, raised the stock price per share for each one. However, before investing there are certain features to consider in wheat stocks that are:

- Whether the company is performing in line with the broader market

- The wheat industry comes with high production costs. Therefore, high profitability is important in order to get good earnings per share and dividends

Wheat is an excellent industry to invest in to diversify your portfolio. Also, commodities like wheat tend to rise in price in times of inflation. Therefore, investing in wheat when inflation rates are increasing is a good way to protect or ‘hedge’ against it. Also, over the past several years, agricultural commodities have performed better than the broader market. Making it an even further attractive investment option.

You may also like reading: