Investing in financial stocks is not as simple as picking the best bank stocks. Financial stocks cover a wide variety of companies which include

- Banks

- Insurance Companies Firms,

- Financial technology (fintech) Firms

- Blockchain Technology Companies

The Best Financial Stocks 2024

Here are some of the best financial stocks to buy now:

| Sr. | Company Name | Symbol | Market Cap | Price (As of 16th September 2022) |

| 1 | Steel Partners Holdings | SPLP | $ 925 million | $ 42.05 |

| 2 | Berkshire Hathaway | BRK.B | $ 606 billion | $ 274.81 |

| 3 | Trinity Capital | TRIN | $ 535 million | $ 15.29 |

| 4 | Visa | V | $ 411 million | $ 193 |

| 5 | Mastercard | MA | $ 304.3 billion | $ 315.13 |

| 6 | The Joint Corp. | JYNT | $ 239 million | $ 16.5 |

| 7 | Capital One Foundation | COF | $ 39 billion | $ 101.68 |

| 8 | Citizens Financial Group | CFG | $ 17.89 billion | $ 36.87 |

| 9 | Signature Bank | SBNY | $ 10.8 billion | $ 171.91 |

| 10 | Dillard’s | DDS | $ 4.92 billion | $ 287.3 |

| 11 | Prospect Capital Corporation | PSEC | $ 2.92 billion | $ 7.35 |

| 12 | Danaos Corp | DAC | $ 1.31 billion | $ 63.77 |

Steel Partners Holdings

Steel Partners Holdings

Steel Partners Holdings is a global diversified holding company that engages in multiple businesses, including diversified industrial products, energy, defense, supply chain management and logistics, banking, food products and services, oilfield services, sports, training, education, and the entertainment and lifestyle industries. To give investors an idea of where to start and which companies to look for investment in oil and gas, we have compiled a list of the top best oil and gas ETFs to buy now.

Steel Partners Holdings shared its quarterly earnings report for 2022:

- Revenues were reported at $ 441 million, as compared to $ 386.4 million in the previous year’s same period

- Net Income was reported at $ 92 million, as compared to $ 27 million in the previous year’s same period

- Earnings per share were reported at $ 3.52

Steel Partners Holdings has a market cap of $ 925 million. Its share is trading at a price of $ 42.05.

The stock of the company has been on a bullish streak for the past two years. In the year 2021, the stock started trading at $ 10.75 and closed the year at $ 42. This represents an approx. The 3-fold increase during the year.

In 2022, the stock maintained its price level and last closed at $ 42.05.

Get to know the top stocks in S&P 500.

Berkshire Hathaway

Led by Warren Buffett, Berkshire Hathaway is the parent company of GEICO – The government employees insurance company. It also runs an enormous reinsurance operation.

Regional bank stocks offer an excellent return to investors.

Investors in the company gain exposure to its massive stock portfolio, which happens to own large stakes in several major U.S. banks. Berkshire Hathaway is very popular for its stock portfolio which includes blue-chip stocks and many solid, consistent companies. This has attracted a lot of attention in the industry.

In the recent quarterly report, the financial company reported:

- Total revenue of $ 76 billion, a 10 % increase from the previous year’s same period

- Net loss was reported at $ 43.75 billion, as compared to a net income of $ 28 billion

Berkshire Hathaway has a market capitalization of $ 606 billion. Its share is trading at a price of $ 274.81.

The share of Berkshire Hathaway has been on an upward trend for the major part of the last two years. In 2021, the stock went from $ 231.87 to $ 299, representing a 30 % appreciation during the year. In 2022, the stock started off with a bearish trend. After peaking at $ 358.76, the stock reversed its course and started declining. The stock went from $ 299.1, at the start of the year, to $ 274.81, representing an 8 % decline to date.

The share of Berkshire Hathaway has been on an upward trend for the major part of the last two years. In 2021, the stock went from $ 231.87 to $ 299, representing a 30 % appreciation during the year. In 2022, the stock started off with a bearish trend. After peaking at $ 358.76, the stock reversed its course and started declining. The stock went from $ 299.1, at the start of the year, to $ 274.81, representing an 8 % decline to date.

Go through the best recession stocks in 2024.

Trinity Capital

Trinity Capital, is a leading provider of debt, including loans and equipment financing, to growth stage companies, including venture-backed companies and companies with institutional equity investors. Trinity’s investment objective is to generate current income and, to a lesser extent, capital appreciation through investments consisting primarily of term loans and equipment financings and, to a lesser extent, working capital loans, equity, and equity-related investments. Trinity believes it is one of only a select group of specialty lenders that has the depth of knowledge, experience, and track record in lending to growth stage companies. Fintech is also an emerging industry. Fintech stocks provide a low cost of service and promote transparency.

Trinity Capital Inc. a leading provider of financing solutions to growth stage companies, recently announced its financial results for the quarter ended June 30, 2022:

- Total investment income was $ 33.5 million compared to $ 19.5 million for the previous year’s same period

- Net investment income was approximately $ 15.7 million,

- Earnings per share were $ 0.51

Trinity Capital has a market cap of $ 535 million. Its share is currently trading at a price of $ 15.29.

The company went public in 2021. For the first year, the company went on a bullish journey, starting at $ 14 and closing at $ 17.58. Overall, the stock appreciated by 25 % during the year.

The company went public in 2021. For the first year, the company went on a bullish journey, starting at $ 14 and closing at $ 17.58. Overall, the stock appreciated by 25 % during the year.

In 2022, the stock continued with its bullish journey and went as high as $ 19.73. After that, the stock reversed its course and last closed at $ 15.29. Overall, the stock declined by 22.5 %

There are many stock advisory services that recommend a few of the best stocks to their members and subscribers.

Also read:

Visa

Visa Inc. operates as a payment technology company worldwide. The company facilitates digital payments among consumers, merchants, financial institutions, businesses, strategic partners, and government entities.

Visa has many strong characteristics which make it one of the best financial stocks for investment. Visa is one of the biggest players in the payment process facilitation industry. It is geographically diverse in more than 200 countries. Visa has a very healthy cash flow and its dividend has been growing over the past years. Get to know the safest monthly dividend stocks.

There is a largely untapped opportunity for Visa to expand its business over the coming decades. And it has been expanding itself via multiple acquisitions. A recent example is the 10 % stake it bought in Square, which is a merchant services and mobile-payment platform.

Visa recently reported its second quarter report for the year 2022:

- Net revenues were reported at $ 7.2 billion, a 25 % increment from the previous year’s same period

- Net Income was reported at $ 3.6 billion, a 21 % increment from the previous year’s same period

- Earnings per share were reported at $ 1.7

Visa has a market cap of $ 411 billion. Its share is currently trading at a price of $ 193.3.

The share of the company has remained significantly volatile in the past two years. In 2021, the stock started at $ 218.73, went as low as $ 193.25, and was as high as $ 249.02. Finally, the stock closed at $ 216.71. Overall, the stock declined by 1 % during the year.

The share of the company has remained significantly volatile in the past two years. In 2021, the stock started at $ 218.73, went as low as $ 193.25, and was as high as $ 249.02. Finally, the stock closed at $ 216.71. Overall, the stock declined by 1 % during the year.

In 2022, the stock went on a bearish streak while being volatile. The stock last closed at $ 193.3 representing an 11 % decline to date.

Get to know about bonds vs stocks – where to invest.

Mastercard

Mastercard is a global technology company in the payments industry. The company aims to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart, and accessible. Using secure data and networks, partnerships, and passion, our innovations and solutions help individuals, financial institutions, governments, and businesses realize their greatest potential. The company has a presence and connections in more than 210 countries.

Get to know about best drone stocks to invest.

Mastercard shared its second quarter results for the year 2022:

- Net Revenue was reported at $ 5.5 billion, a 21 % increase from the previous year’s same period

- Net Income was reported at $ 2.5 billion, a 29 % increase from the previous year’s same period

- Earnings per share were reported at $ 2.56

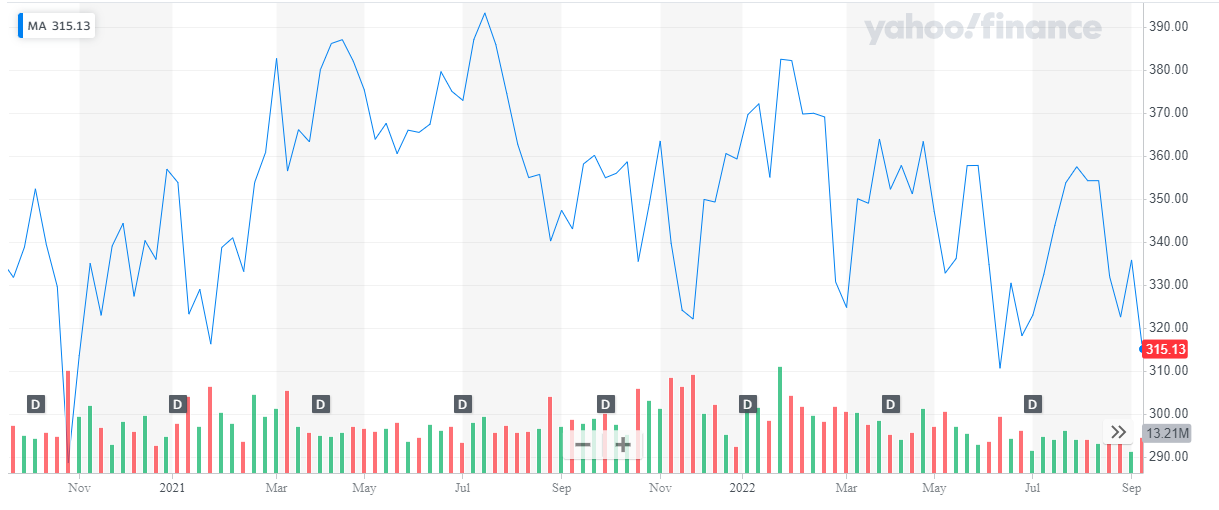

Mastercard has a market cap of $ 304 billion. Its share is currently trading at $ 315.13.

The stock has been extremely volatile in the past two years.

The stock has been extremely volatile in the past two years.

In 2021, the stock started at $ 356.94, went as high as $ 393.26 and as low as $ 322.11, and finally closed at $ 359.32. Overall, the stock maintained its price level by the end of the year.

In 2022, the stock started at $ 359.32, went as high as $ 382.51 and as low as $ 310.69, and last closed at $ 315.13. This represents a 12 % decline to date.

Get to know about best forex brokers for trading

The Joint Corp.

The Joint Corp. develops, owns, operates, supports, and manages chiropractic clinics. The company operates in two segments, Corporate Clinics, and Franchise Operations. It operates through direct ownership, management arrangements, franchising, and regional development. As of March 1, 2022, the company operated approximately 700 locations in the United States.

Also, check out the best swing trading stocks.

The Joint Corp recently shared its second quarter report for the year 2022:

- Revenues were reported at $ 25 million, as compared to $ 20 million in the previous year’s same period

- Net Income was reported at $ 0.344 million, as compared to $ 2.7 million in the previous year’s same period

- Earnings per share were reported at $ 0.02

The Joint Corp has a market cap of $ 239.17 million. Its share is trading at a price of $ 16.5.

The share of the company started off the year 2021 with a bullish trend. From a price of $ 26.26, at the start of the year, the stock peaked at $ 107.3. After that, the stock started to decline and closed off the year at $ 65.69. Overall, the stock underwent a 1.5-fold increase during the year.

The share of the company started off the year 2021 with a bullish trend. From a price of $ 26.26, at the start of the year, the stock peaked at $ 107.3. After that, the stock started to decline and closed off the year at $ 65.69. Overall, the stock underwent a 1.5-fold increase during the year.

In 2022, the stock continued its bearish streak. It last closed at $ 16.5, representing a 75 % decline to date.

Investing in value stocks is a long-term investment.

Capital One Foundation

Capital One Financial Corporation is a financial holding company whose subsidiaries, are

- Capital One, N.A.

- Capital One Bank (USA), N.A.,

The bank had $307.9 billion in deposits and $440.3 billion in total assets as of June 30, 2022. Capital One offers a broad spectrum of financial products and services to consumers, small businesses, and commercial clients through a variety of channels. Capital One, N.A. has branches located primarily in New York, Louisiana, Texas, Maryland, Virginia, New Jersey, and the District of Columbia. Cybersecurity stocks are also one of the best investment opportunities.

Capital One Foundation recently reported second-quarter results for 2022:

- Total Revenue was reported at 8.2 billion

- Net income was reported at $ 2.0 billion, as compared to $ 2.4 billion in the previous year’s same period

- Earnings per share were reported at $ 4.96, as compared to $ 5.62 in the previous year’s same period

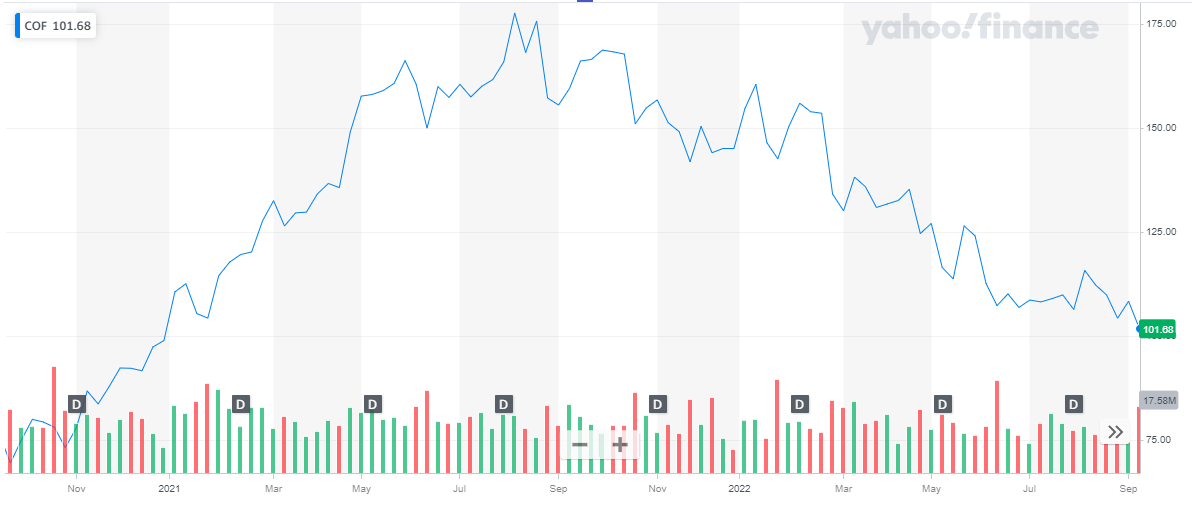

Capital One Foundation has a market capitalization of $ 39 billion. Its share is trading at a price of $ 101.68.

The stock of the bank maintained a bullish trend for the year 2021. From a price of $ 98.85, at the start of the year, the stock went as high as $ 177.73 and closed the year at $ 145.09. Overall, the stock appreciated by 47 % during the year.

The stock of the bank maintained a bullish trend for the year 2021. From a price of $ 98.85, at the start of the year, the stock went as high as $ 177.73 and closed the year at $ 145.09. Overall, the stock appreciated by 47 % during the year.

In the year 2022, the stock changed course and started on a bearish run. From $ 145.09, the stock last closed at $ 101.68. This represents a 30 % decline to date.

Get to know the best vaccine stocks to invest in 2024.

Citizens Financial Group

Citizens Financial Group (CFG) is a retail bank holding company offering retail and commercial banking products and solutions. It operates in two segments:

- Consumer Banking – The Consumer Banking segment provides deposit products, mortgage, home equity lending, auto financing, student loans, personal unsecured lines and loans, credit cards, business loans, wealth management, and investment services.

- Commercial Banking – The Commercial Banking segment delivers lending and leasing, deposit and treasury management, foreign exchange, interest rate and commodity risk management solutions, loan syndications, corporate finance, merger and acquisition, and debt and equity capital markets capabilities.

The company serves individuals, small businesses, middle-market companies, large corporations, and institutions. Investors are now looking for the finest solar energy stocks to invest in.

Citizens Financial Group recently published its second-quarter report for the year 2022:

- Total Revenue was reported at $ 2 billion

- Net Income was reported at $ 364 million

- Earnings per share were reported at $ 0.67

Citizens Financial Group has a market cap of $ 17.89 billion. Its share is trading at a price of $ 36.87.

The stock of the company remained bullish throughout 2021. From a price of $ 35.76, at the start of the year, the stock closed the year at $ 47.25. Overall, the stock appreciated by 32 % during the year.

The stock of the company remained bullish throughout 2021. From a price of $ 35.76, at the start of the year, the stock closed the year at $ 47.25. Overall, the stock appreciated by 32 % during the year.

In 2022, the stock changed its course and started declining. From $ 47.25, the stock last closed at $ 36.87, representing a 22 % decline to date.

Get to know about RSI trading strategies.

Signature Bank

Signature Bank, founded in 2001, is a New York-based full-service commercial bank with 38 private client offices. It is a commercial bank focused specifically on the needs of privately owned businesses and the people who own and manage them. While the account minimums and service fees might make a lot of the offerings unusable for low- to middle-income consumers, there are still options that can work even for someone that doesn’t have the wealth typical of Signature Bank clients. Get to know the best EV stocks to invest in today.

Signature Bank recently shares its quarterly report for 2022:

- Net Income was reported at $ 339.2 Million, a 58.1 % increase from the previous year same period

- Total Deposits were reported at $ 104.12 Billion, a $ 5 billion decline

- Loans were reported at $ 72 Billion

- Earnings per share were reported at $ 5.26

Signature Bank has a market cap of $ 10.8 billion. Its share is currently trading at $ 171.91.

The stock of the company remained bullish throughout the year 2021. It started at $ 139.21 and closed the year at $ 323.47. This represents a 132.4 % appreciation during the year.

The stock of the company remained bullish throughout the year 2021. It started at $ 139.21 and closed the year at $ 323.47. This represents a 132.4 % appreciation during the year.

In 2022, the stock picked up a bearish trend. From $ 323.7, at the start of the year, the stock closed at $ 171.9 representing a 47 % decline to date.

Tech stocks is also one of the best investment opportunity.

Dillard’s

Dillard’s is fashion apparel, cosmetics, and home furnishing retailer. It operates stores, clearance centers, and an Internet store offering a selection of merchandise including fashion apparel for women, men, and children, accessories, cosmetics, home furnishings, and other consumer goods. With the demand for AI technology increasing, investor interest in Artificial Intelligence stocks has also increased.

The company’s growth and success are because of its stringent strategies. Some of these were the extension of vendor payment terms, the reduction of discretionary and capital expenditures, and payroll deduction. Also, efficient inventory management has helped the company reduce excess inventory, which has been very beneficial for the company.

Dillard’s, Inc. announced operating results for the second quarter ending July 30, 2022:

- Net sales were reported at $ 1.589 billion, compared to $1.570 billion during the same period last year

- Net income was reported at $ 163.4 million compared to a net income of $185.7 million during the same period last year.

- Earnings per share were reported at $ 9.30

Dillard’s has a market cap of $ 4.9 billion. Its share is currently trading at a price of $ 287.3.

The stock of Dillard’s has been on a bullish streak in the past two years.

The stock of Dillard’s has been on a bullish streak in the past two years.

In 2021, the stock started at $ 63.05. After peaking at $ 360.27 the stock closed at $ 245.02. Overall, the stock exhibited a 2.9-fold increase.

In 2022, the stock started trading at $ 245 and last closed at $ 287.3, representing a 17 % appreciation to date

Get to know everything about high frequency trading.

Prospect Capital Corporation

Prospect Capital Corporation is a business development company that focuses on lending to and investing in private businesses. Their investment objective is to generate both current income and long-term capital appreciation through debt and equity investments. Also read Forex trading vs Stocks trading.

Prospect Capital Corporation recently announced financial results for its fiscal quarter and year ended June 30, 2022:

- Net Investment income was reported at $ 90 million

- Net Loss was reported at $ 56.6 million

- Net Loss per share was reported at $ 0.18

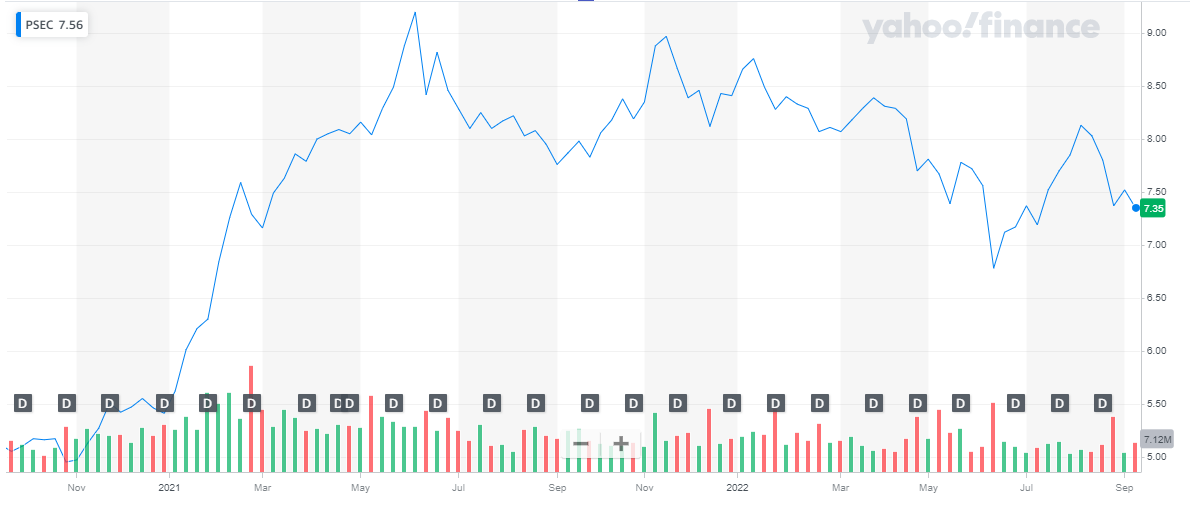

Prospect Capital has a market cap of $ 2.92 billion. Its share is trading at a price of $ 7.35.

The stock of the financial company is on a bullish streak. In 2021, the stock started off at $ 5.41. The stock peaked at $ 9.2 during the year and closed the year at $ 8.41. Overall, the stock appreciated by 55 % during the year.

The stock of the financial company is on a bullish streak. In 2021, the stock started off at $ 5.41. The stock peaked at $ 9.2 during the year and closed the year at $ 8.41. Overall, the stock appreciated by 55 % during the year.

In 2022, the stock declined slightly. It last closed at $ 7.35. The stock declined by 12.6 % to date.

Give a read to a list of the Best NFT Stocks that can earn you great returns if you invest in them today.

Danaos Corp

Danaos Corp. is one of the largest independent owners of modern containerships. What makes it unique is its disciplined business model:

- Long-term charters with the world’s leading liner companies

- The strategy seeks to protect free cash flow generation and limit market risk

- Focused on relationships with high-quality counterparties

- Well-positioned to opportunistically expand the fleet

If you are seeking a steady stream of income, you should invest in REIT stocks.

Danaos Corporation recently reported quarterly results for the period ended June 30, 2022:

- Operating revenues were reported at $ 250.9 million, as compared to $ 146.43 million during the previous year’s same period

- Net income was reported at $ 157.1 million, as compared to $ 68.9 million during the previous year’s same period

- Earnings per share were reported at $ 7.59 per share, as compared to $ 3.34 during the previous year’s same period

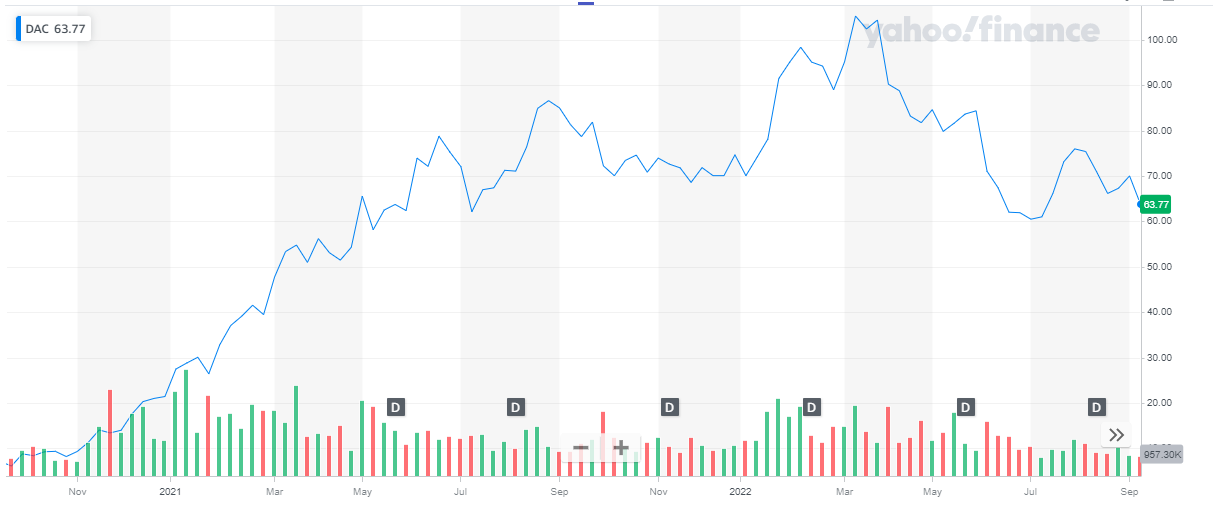

Danaos Corp has a market cap of $ 1.31 billion. Its share is currently trading at a price of $ 63.77.

The share of Danaos Corp is on a bullish run in the past two years. In 2021, the stock started trading at $ 21.43 and closed the year at $ 74.65. This represents a more than 3-fold increase during the year.

The share of Danaos Corp is on a bullish run in the past two years. In 2021, the stock started trading at $ 21.43 and closed the year at $ 74.65. This represents a more than 3-fold increase during the year.

In 2022, the stock continued its bullish streak till it hit the peak of $ 105.23. After that, the stock started declining. The stock last closed at $ 63.77, representing a 15 % appreciation to date.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2024

- 11 Best ESG ETFs to Buy in 2024

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy