Copper is the third-most-consumed metal in the world and is also known as a highly electrically conductive material. Due to the following properties copper has been high in demand:

- Good electrical conductivity

- Excellent thermal conductivity

- Corrosion resistance

- High ductile

- Recyclability

- Non-magnetic nature

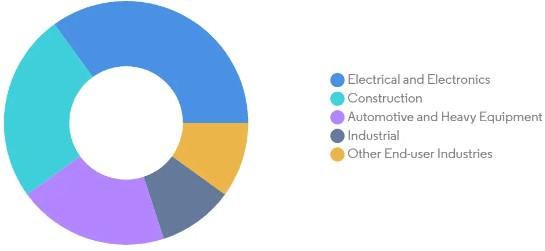

The Copper market is majorly divided according to the end-user industry, which includes:

- Automotive and Heavy Equipment

- Construction

- Electrical and Electronics

- Industrial

- Other End-user Industries which include Consumer products and medical devices

The below chart shows the copper market by percentage according to the end-user market segments:

The copper market is expected to grow at a CAGR of more than 6% globally till 2027, as per Mordor Intelligence. Copper mining has experienced multiple roadblocks in the past two years because of the pandemic. But going forward, the demand for copper is expected to rise, especially in the electronics segment. Moreover, the rising demand from the Asia-Pacific market will eventually result in this geographical location dominating the global market. Because of highly developed construction and power generation sectors in China, coupled with the continuous investments done in the region to advancements in the telecommunication, electronics sector through the years, the demand for copper is expected to rise from this area. In addition to it, the accelerated demand for EV stocks in China is expected to further escalate the demand for copper. Stock trading advisory websites help investors make the right financial decisions.

Top 5 Copper Stocks in 2024

Here we have selected the top five copper stocks to consider in 2024:

- Glencore

- BHP

- Freeport-McMoRan (FCX)

- Rio Tinto

- Southern Copper Corporation

- TECK Resources

- Fortescue Metals Group (OTCMKTS: FSUGY)

- Hudbay Minerals Inc.

Glencore

Glencore is one of the world’s largest globally diversified natural resource companies. It has a presence in 6 continents and 35 countries. Glencore is the world’s largest mining company by revenue, and a massive commodities trader. The company operates copper mining projects in key mining regions of Australia, Africa, and South America. Also, Glencore’s major copper mines include interests in the Antamina open-pit mine, located in the Peruvian Andes, as well as Chile’s Collahuasi mine. In Australia, it operates the Ernest Henry, Mount Isa, and CSA mines. In addition to it, the company also has a significant footprint in the Democratic Republic of Congo (DRC), where it mines copper alongside cobalt at the Katanga and Mutanda mines. There is a vast array of trading courses available online which you can join, each with its own merits and every course suitable for different types of traders.

As per the production details published by the company, own sourced copper production declined by 5% to 1.19mln tonnes in 2021. The decline was attributed to the Mopani disposal, lower copper grades at Antapaccay and lower copper by-products from the company’s mature zinc and nickel mines. For the next fiscal year, the company is forecasting 1.15mln tonnes of copper for 2022.

In the 2021 annual report, the company reported:

- EBITDA of $21.3 billion, an 84% increase from 2020

- Net income of $5 billion, a substantial improvement from last year when the company reported a loss of $1.9 billion

- Cash generated by operating activities of $15.6 billion. This amount has doubled when compared to the previous year’s figure

- Net debt was reduced during the year by $9.8 billion to $6.0 billion. This is a huge improvement in the company’s balance sheet

- Shareholder’s return accounts for up to $2.8 billion. This comprises of $1.6 billion base cash distribution (in respect of 2020 cash flows), $500 million special cash distribution, and $750 million of share purchases.

Glencore Plc has a market capitalization of around GBP 63 billion. The share of the company is currently trading at a price of 479p. The company’s share is on an upward streak Nov’21. From 155p in Nov’21 the stock has shot up to 479p in less than two years. In the year 2021, the stock started off at a price of 233p and closed off at a price of 374p. The stock appreciated by 60% during 2021.

The stock kicked off the year 2022 at a price of $374p. and till date, the stock has risen by approx. 28%.

Glencore has an impressive financial record and amazing stock growth. Moreover, excellent cash generation has enabled the company to not only pay off its debt but also give a good return to shareholders. With the future outlook of the company good, Glencore is undoubtedly one of the best copper stocks to invest in in 2024.

Glencore has an impressive financial record and amazing stock growth. Moreover, excellent cash generation has enabled the company to not only pay off its debt but also give a good return to shareholders. With the future outlook of the company good, Glencore is undoubtedly one of the best copper stocks to invest in in 2024.

Get to know about Top Infrastructure Stocks to Invest in 2024.

BHP

BHP Group Ltd. engages in the exploration, development, production, and processing of iron ore, metallurgical coal, and copper. It operates through the following segments: Petroleum, Copper, Iron Ore, and Coal. There has been a lot of focus on the long-term investment stocks.

Copper production was reported at 742 kt for the half-year of 2022. There was a 12% decline when compared to the same period last year. Maintenance activity at Olympic Dam led to a huge decline in production but the increased volumes from the Antamina mine helped offset the huge drop. Semi conductor stocks are one of the best investment opportunities.

BHP recently published its half-yearly report for 2022, ending 31st Dec 2021.

- EBITDA was reported at $ 18.5 billion

- Net Profit was $9.4 billion

- Net debt was reported to be $6.1 billion, a decline of 49%

- The dividend per share was 150 US cents per share ($1.5 per share)

BHP is a $244 billion company. Its share is trading at a price of $68.8. The share performance has been mixed with a prolonged bullish period followed by a drop in price. During the year 2020, after the huge plunge due to pandemic, the stock picked up an upward streak. The stock closed off in the year 2020, after appreciating by 20%, at a price of $65.34. During the year 2021, the first two quarters were marked by a seesaw motion all the while maintaining the price level. But the stock changed its course during August 2021 and started declining. The stock started declining from $77.82 to $52.36. Near the end of the year, the stock picked up the pace and started rising. During the year 2021, the stock depreciated by around 7%.

In the year 2022, the stock has appreciated by 14% till date, from a price of $60.35 to $68.7

BHP has an estimated copper production for the year 2022 between 1,590 – 1,760 kt. With the company’s ROCE reported 42.9% in the half-yearly report 2022, BHP is well-positioned for growth Hence it is an excellent copper stock to invest in in 2022.

BHP has an estimated copper production for the year 2022 between 1,590 – 1,760 kt. With the company’s ROCE reported 42.9% in the half-yearly report 2022, BHP is well-positioned for growth Hence it is an excellent copper stock to invest in in 2022.

Read more:

Freeport-McMoRan (FCX)

Freeport-McMoRan Inc. (FCX) is a mining company with proven and probable reserves of copper, gold, and molybdenum, and traded copper producer. The Company has organized its operations into five divisions, which include North American copper mines, South American mining, Indonesia mining, and Molybdenum mines. There are many stock forecasting websites providing information required by investors to build and manage a diversified portfolio

Freeport MacMoRan is one of the world’s leading producers of copper concentrate, cathode, and continuous cast copper rods. By 2021, 59 % of our mined copper was sold in concentrate, 21% as cathode, and 20% as a rod from the North American operations.

On December 31, 2021, the estimated consolidated recoverable proven and probable mineral reserves were reported to be:

- Copper: 107.2 billion pounds

- Gold: 27.1 million ounces

- Molybdenum: 3.39 billion pounds

The copper production from all three mines, during the year 2021, are as follows:

- 38% of the total copper comes from the North American copper mines

- 27% of the total copper comes from the South American mines

- 35% of the remaining copper comes from the Indonesian mine In the 2021 annual report, the company reported:

- Revenues of $22.8 billion, a 61% increase from last year

- Net Income of $4.3 billion, more than 600% increase

- Earning per share of $2.93, more than 600% increase

- Dividend per share $0.375

The below chart shows the projected consolidated sales volumes for 2022 and actual consolidated sales volumes for 2021

| Copper (millions of recoverable pounds) | % increase/decrease | 2022 (Projected) | 2021 (Actual) |

| North America copper mines | 7.9 % | 1,550 | 1,436 |

| South America mining | 11.85 % | 1,180 | 1,055 |

| Indonesia mining | 19.3 % | 1,570 | 1,316 |

| Total | 4,300 | 3,807 |

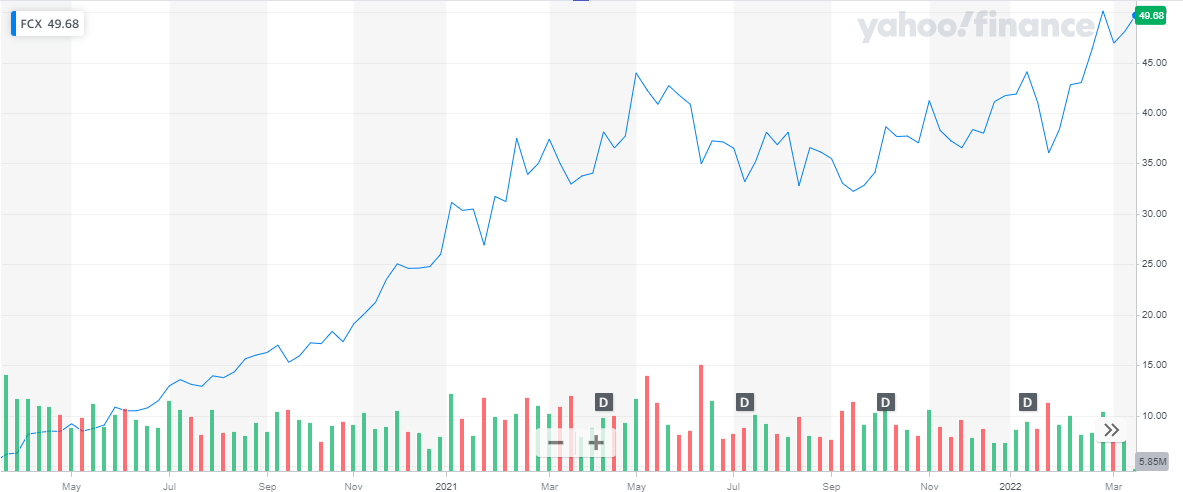

Freeport has a market capitalization of $73 billion. The share of the company is trading at a price of $48. The stock has been on a bullish streak for the past two years. During the year 2020, the stock appreciated by more than 100%. In the year 2021, the stock kicked off at a price of $26.02 and closed off the year at a price of $41.73, appreciating by 61%.

Freeport has strong strength and explosive growth through its financial performance. Despite a normal growth rate forecasted for the next year, the increased demand for copper coupled with the increased production of the company will lead it to new heights of development. And with the company continuing to focus on CAPEX will maintain future growth. Hence, Freeport is an excellent copper stock to invest in to yield an excellent return on money invested.

Freeport has strong strength and explosive growth through its financial performance. Despite a normal growth rate forecasted for the next year, the increased demand for copper coupled with the increased production of the company will lead it to new heights of development. And with the company continuing to focus on CAPEX will maintain future growth. Hence, Freeport is an excellent copper stock to invest in to yield an excellent return on money invested.

Also read: Best Stocks for Covered Calls in 2024.

Rio Tinto

Rio Tinto is involved in the exploration, mining, and processing of mineral resources. It operates through the following business segments:

- Iron Ore

- Aluminum

- Copper and Diamonds

- Energy and Minerals

- Other Operations

The company operated in 35 countries, has 37,000 suppliers and roughly 2,000 customers, as per the company’s website.

The company recently reported its 2021 financial results:

- Sales Revenue were reported to be $63.5 billion, a 42% increase from last year

- Net Earnings were reported to be $21.1 billion, a 116% increase from last year

- Total dividend per share was reported at $10.4, an 87% increase from last year During the year, Copper generated:

- $7.8 billion sales, an increase of 58% from last year

- EBITDA of $4 billion, an increase of 90% from last year The production guidance for 2022 is as follows:

| Copper | % increase / decrease | 2022 (Projected) | 2021 (Actual) |

| Mined Copper | 1.21% – 16% | 500 – 575 kt | 494 kt |

| Refined Copper | 14% – 44% | 230 – 290 kt | 202 kt |

Rio Tinto is a $132 billion company. Its shares are trading at a price of $75.43. The company’s stock has experienced prolonged bullish momentum before reversing the path. The stock peaked at $93.1 during Feb’21 but during Nov’21 the stock had dropped to $62.34. the stock started off in the year 2021 at a price of $75.22 and ended the year at $66.94. In the year 2022, the stock has appreciated by approx. 16% till date.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

Rio Tinto has had an impressive financial performance the past year and has an excellent future outlook. Moreover, the increased return to shareholders has further spiked investor interest in this stock. Therefore, Rio Tinto is an excellent copper stock to invest in during the year 2022.

Get to know Best Silver Stocks to Buy in 2024.

Southern Copper Corporation

Southern Copper operates the mining, smelting, and refining facilities in Mexico, Peru, Argentina, Ecuador, and Chile. Its major mining operations include Peru’s Toquepala and Cuajone mines and Mexico’s Buena Vista del Cobre (aka Cananea) and La Caridad mine. The company is involved in the mining, milling, and flotation of copper ore to produce copper and molybdenum concentrates; smelting of copper concentrates to produce blister and anode copper; refining of anode copper to produce copper cathodes; production of molybdenum concentrates and sulfuric acid; production of refined silver, gold, and other materials; and mining and processing of zinc and lead. Investing in oil stocks offers great rewards in terms of high returns.

SCC has the world’s largest copper reservoir. Some key facts about the company are:

- Number 1 mine life among copper producers

- Ranked Number 5 as the world’s largest producer of mined copper

- Highly diversified geographical presence

- Four large-scale open-pit mines

- A strong pipeline of world-class copper greenfield projects and several other opportunities In the recent financial report, the company reported:

- Net Revenue of $10.9 billion, a 37% increase from last year

- EBITDA of $6,853, a 77% increase from last year

- Net Income of $3,397, 116% increase from last year

- Earnings per share of $4.39, more than 100% increase from last year

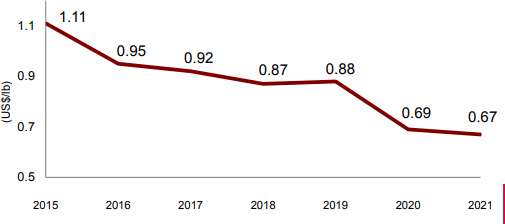

SCC’s strong point is its decreasing cost per pound of copper produced. The below chart and graph show this declining trend:

| US $ | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Per Pound of Copper | 1.11 | 0.95 | 0.92 | 0.87 | 0.88 | 0.69 | 0.67 |

Investing in value stocks is a long-term investment.

Copper is the major revenue-generating product, during the year 2021 the company’s revenue breakdown is:

- Copper 81%

- Molybdenum 10%

- Zinc 3%

- Silver 3%

- Other 3%

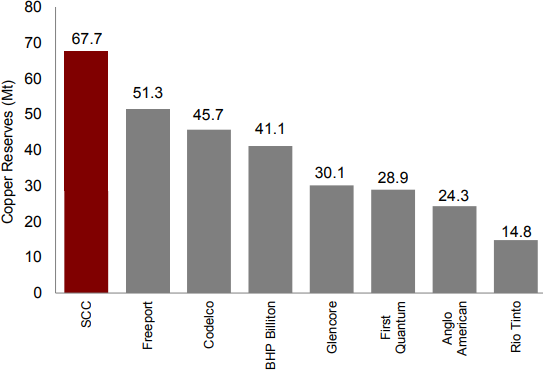

The below graph sums up the company’s rank according to the copper reserves it holds.

| Company Name | SCC | Freeport | Codelco | BHP | Glencore | First Quantum | Anglo American | Rio Tinto |

| Copper Reserves (Mt) | 67.7 | 51.3 | 45.7 | 41.1 | 30.1 | 28.9 | 24.3 | 14.8 |

According to the latest press release of the company, the company’s copper reserves stand at 67.7 MMT. The copper estimates for next year are:

| 2022 ( Projected) | |

| Copper Production | 922 kt |

| Sales | $ 10.4 billion |

| EBITDA | $ 6 billion |

Southern Copper Corporation is a $60 billion company. The company’s share is currently trading at a price of $74.31. After the pandemic drop in stock price, the stock continued to rise upwards and peaked. The cybersecurity stocks have become a high-growth sector and is attracting a lot of investor attention.

near $80. The stock started off the year 2021 at a price of $65.12 and after multiple dips and rises closed off the year at a price of $61.7.

The year 2022 gave a push to the stock price upwards. To date, the stock has appreciated by 25%.

The company’s rank amongst the world’s largest copper producers is expected to contribute substantially to the growing demand for copper. As the demand for electric vehicle increase, the copper demand is expected to soar. The projected production and sales figure further assure the continuing of the growth trend. Therefore SCC is one of the top copper stocks to invest in, in 2022.

The company’s rank amongst the world’s largest copper producers is expected to contribute substantially to the growing demand for copper. As the demand for electric vehicle increase, the copper demand is expected to soar. The projected production and sales figure further assure the continuing of the growth trend. Therefore SCC is one of the top copper stocks to invest in, in 2022.

Get to know the best monthly dividend stocks to invest in today.

TECK Resources

Teck Resources is a diversified mining company based in Canada. It produces copper, zinc, and steelmaking coal. In addition, it has investments in oil sand mining projects.

Teck Resource expects to deliver industry-leading copper production growth in the coming years. The main driver is its Quebrada Blanca Phase 2 (QB2) project in northern Chile, one of the world’s largest copper sources. The company is preparing to double its copper output by 2023 to take advantage of accelerated metal demand from global economic growth and the transition to a lower-carbon economy.

The mining executive of the company says Teck is well-positioned to benefit from the anticipated growth in global copper demand of 2.3 times by 2050. The company has a growth initiative in place at each of its core copper operations comprising four operating mines — Highland Valley in Canada, Antamina in Peru, Carmen de Andacollo in Chile, and Quebrada Blanca, also in Chile.

In the full-year report for 2022, the company reported:

- Total Revenue was reported at CAD $ 17.3 billion, as compared to CAD $ 12.8 billion in the previous year

- Net Profit of CAD $ 1.4 billion, as compared to CAD $ 2.9 billion in the previous year

- Earnings per share were reported at CAD $ 7.7, as compared to CAD $ 5.39 in the previous year

Copper production was 270,000 tonnes for the year. Gross profit from the copper business unit was CAD $ 1.4 billion as compared to CAD $ 1.7 billion in the previous year.

Teck Resources has a market cap of $ 20.65 billion. Its shares are trading at $ 39.92.

The stock picked up a bullish pace in the third quarter of 2021. This bullish run continued throughout the year and the next till it peaked at $ 43.89 in May 2022. After that, the stock suffered a huge decline and eventually closed off the year at $ 37.82. The stock went from $ 28.82, at the start of the year to $ 37.82 at the end, representing a 31 % appreciation during the year.

Fortescue Metals Group (OTCMKTS: FSUGY)

Fortescue Metals Group Ltd. engages in the development of iron ore deposits. It operates through China and Other geographical segments. Its projects include Chichester Hub, Solomon Hub, Port Hedland, Eliwana, Iron Bridgen, and copper-gold exploration.

The company is one of the largest iron ore miners in the world. Fortescue Metals has been heavily exposed to the copper industry thanks to its 19 % ownership of Candente Copper Corporation. It’s also exploring new gold and copper assets of its own around the world.

Along with iron ore exploration in the Pilbara region, FMG is in the process of exploring copper-gold opportunities in Western Australia. It is also involved in two exploration joint ventures in South Australia, where it is looking to unearth more copper and gold deposits.

The driving force for future growth, however, is likely to be yet more product diversification, as the company continues to broaden its horizons

The company recently published its half-year results for the year 2023:

- Revenue was reported at $ 7.8 billion, as compared to $ 8.1 billion in the previous year’s same period

- Net profit was reported at $ 2.4 billion, as compared to $ 2.77 billion in the previous year’s same period

- Earnings per share were reported at 77 cents as compared to 90 cents in the previous year’s same period

Fortescue Metals Group has a market cap of $ 44.5 billion. Its shares are trading at $ 28.9.

The stock of the company has been volatile in the past year. In 2022 the stock started trading at $ 28.07, went as high as $ 32.92, and closed off at $ 27.88. Overall, the stock maintained the same price level with a slight decline of 0.6 %.

In 2023, the stock started rising. It went as high as $ 32 and recently closed at $ 28.9

Hudbay Minerals Inc.

Hudbay Minerals Inc., a diversified mining company, together with its subsidiaries, focuses on the discovery, production, and marketing of base and precious metals in North and South America. It produces copper concentrates containing copper, gold, and silver; silver/gold doré; molybdenum concentrates; and zinc metals. The company owns three polymetallic mines, four ore concentrators, and a zinc production facility in northern Manitoba and Saskatchewan, Canada, as well as in Cusco, Peru; and copper projects in Arizona and Nevada, the United States.

In the recent financial report for the year 2022, the company reported:

- Revenue was reported at $ 1.46 billion as compared to $ 1.5 billion in the previous year

- Net profit was reported at $ 70 million, as compared to a net loss of $ 244 million in the previous year

- Earnings per share were reported at $ 0.27 as compared to a loss per share of $ 0.93 in the previous year

The company reported:

- Copper production of 104,173 tonnes, an increase of 5 % from the previous year

- Gold production of 219,700 ounces an increase of 13 % from the previous year

- Silver production of 3,161,294 an increase of 4 % from the previous year

The company has invested approximately $80 million in 2022 to successfully execute a new strategy at Copper World focused on project de-risking. The pre-feasibility study for Phase I of Copper World is well-advanced with the main facility engineering completed and metallurgical test work being analyzed as part of the concentrate leaching trade-off evaluations.

Hudbay Minerals has a market cap of $ 1.29 billion. Its shares are trading at $ 4.94.

The stock has been volatile in the past years. It started the year 2022 at $ 7.25 and closed off at $ 5.07 representing a 30 % decline. In 2021 the stock went from $ 5.07 to $ 4.94 on the last trading day.

CONCLUSION

The huge demand for Copper from China, which was the top copper consumer, drove the copper price. Moreover, the demand for copper is expected to rise further amid rising concerns about low copper inventories.

With the rise in prices, the revenues and return to shareholders are expected to rise side by side. The above-selected companies are the major player in the copper industry with huge copper reservoirs along with high sales and production. Also, the companies are well-positioned to benefit from the rise in copper demand.

With copper prices rising, the profitability of these companies will touch the sky. Therefore, if you want your portfolio’s net worth and your profitability to touch the sky as well, the above copper stocks are a must-buy for investment today.

You may also like reading:

- Best Lithium Stocks to Buy in 2024

- Best Robinhood Stocks to Buy in 2024

- Best Penny Stocks to Invest

- Best Oil Stocks to Buy in 2024

- Best Renewable Energy Stocks to Invest

- Most Volatile Stocks

- Best Artificial Intelligence Stocks

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now