Technology has evolved everyone’s lives. Our lives are all technologically driven today. Therefore, technology companies are in focus for investors and offer great opportunities. The recent stock market growth is majorly concentrated in the technology companies.

Artificial Intelligence and Machine Learning have gained much popularity. These two are set to change the world and how it operates. Like every investment opportunity, Tech Stock investment has its own set of Pros and Cons which you should consider as an investor before deciding to invest.

Also read: Best Stock Forecasts & Prediction Services

| Pros | Cons |

| Tech stocks include blue-chip companies like Facebook and Google. | Some of the Tech companies are very high in price hence out of reach for the majority of the investors. |

| Some Tech Stocks are paying dividends. | The potential of Tech companies to be heavily affected by government regulations and scrutiny. |

| Investors can diversify within the Tech Sector: Social Media companies, Software Companies, Smartphone manufacturers, etc. | Some of the Tech companies’ businesses are hard to understand hence difficult to analyze prospects. |

The tech sector is huge and increasing by the moment. Here we have compiled a list of Best Tech Stocks to buy for 2024:

List of Best Tech Stocks to buy for 2024:

8. Advanced Micro Devices Inc (AMD)

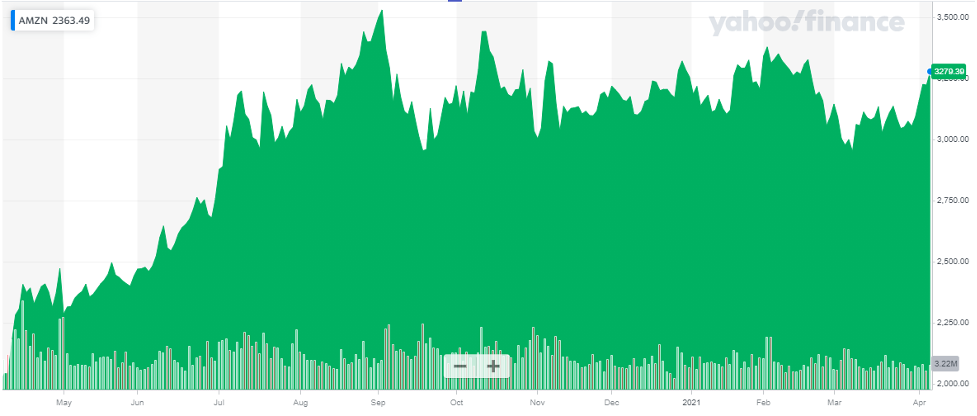

1. Amazon (AMZN)

Amazon is an American multinational technology company that focuses on e-commerce, cloud computing, digital streaming, and artificial intelligence. It is one of the blue-chip companies with a market capitalization of $1.65 Trillion. Its closing price on 9th April 2021 was $3,372.2.

Amazon is one of those companies which has benefited from the Covid-19 pandemic. The company sales spiked as online shopping boosted. The e-commerce retailer had to hire an additional workforce to fulfill the demand of increasing online orders. As a result, the company stock rose tremendously and reported an increase of approximately 80% by the year-end 2020. Amazon’s stock price closed at $3,256 on 31-Dec 2021. Amazon is one of the best stocks to buy and invest in for 2024.

The below graph shows the stock performance for the last year:

As an investor, you need to stay put and wait a while before you can benefit from your investment. Investing in value stocks is a long-term investment.

Read:

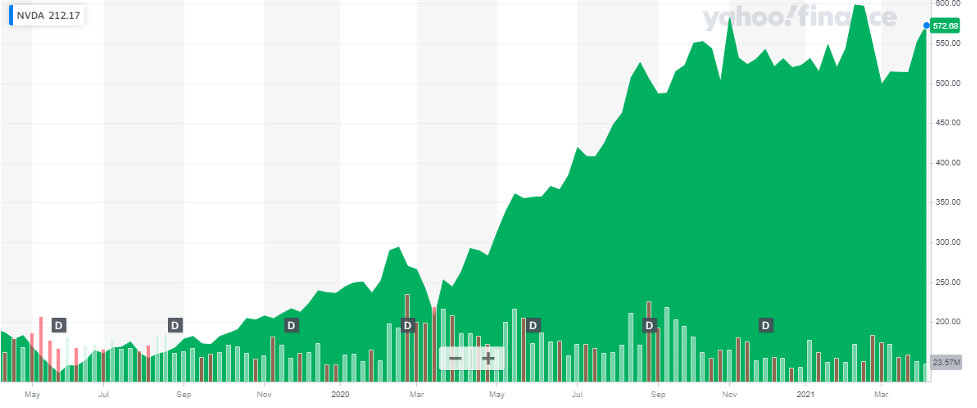

2. NVIDIA (NVDA)

NVIDIA introduced the graphics processing unit (GPU) in 1999 and changed the way computers were being used. NVIDIA’s expertise in programmable GPUs has led to breakthroughs in parallel processing which make supercomputing inexpensive and widely accessible. The company has a market capitalization of approximately $351 Billion. The stock price closed on 9th April 2021 at $576.

NVIDIA is expanding in AI chips, used in supercomputers, data centers, drug development, and driverless cars. It is partnering with Amazon and VMware on an AI-Driven cloud platform for big businesses. Just recently, Nvidia announced new chips for mining the cryptocurrency, Ethereum. During the pandemic, the demand for Nvidia chips spiked, in-home computing, videogames, and data centers. The demand has risen to the extent that there is an ongoing global shortage of chips.

Also check out our list of best cryptocurrencies.

In March 2020, the NVIDIA stock dropped to $200. Since then, it has been rising and is currently more than 2.5x the lowest price it reported in 2020. With the rise in gaming devices and data center demand, NVIDIA products will be more in demand. This will eventually lead to a further rise in stock price. NVIDIA is one of the best tech stocks to buy right now.

The below graph shows the stock performance for the last 2 years:

3. Apple (AAPL)

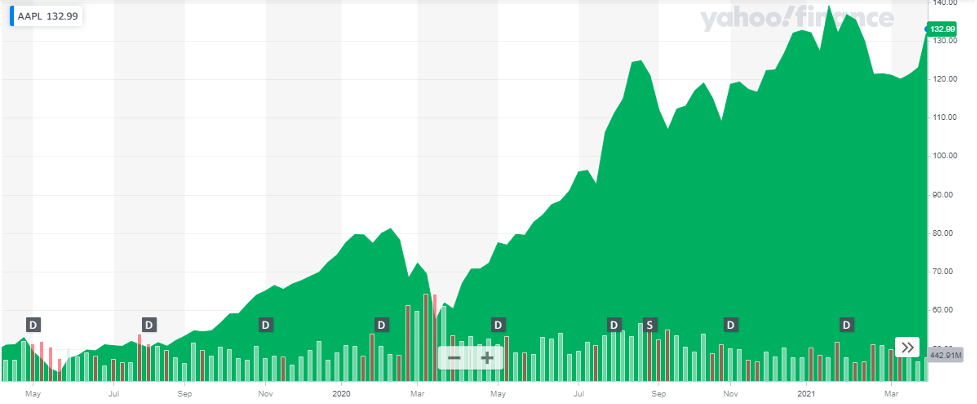

3. Apple (AAPL)

Apple Inc is an American manufacturer of personal computers, smartphones, tablet computers, computer peripherals, and computer software. It was the first successful personal computer company and the popularizer of the graphical user interface. It is one of the blue-chip companies with a market capitalization of $2.2 Trillion. The closing price of the company’s stock on 9th April 2021 was $132.99.

Apple stock had been underperforming the broader market since the tech stock selloff, which started in mid-February. In August 2018, Apple became the first company to reach a market value of $1 trillion. Apple’s stock price almost doubled in price within last year. The price dropped during the peak days of the pandemic, but the stock recovered quickly. During the current year, the company stock is lagging but with many projects lined up and speculations about Apple manufacturing s self-driving electric car, the stock is expected to perform well. Apple is amongst the best long-term tech stocks to invest in.

The below graph shows the stock performance for the last 2 years:

4. Alibaba (BABA)

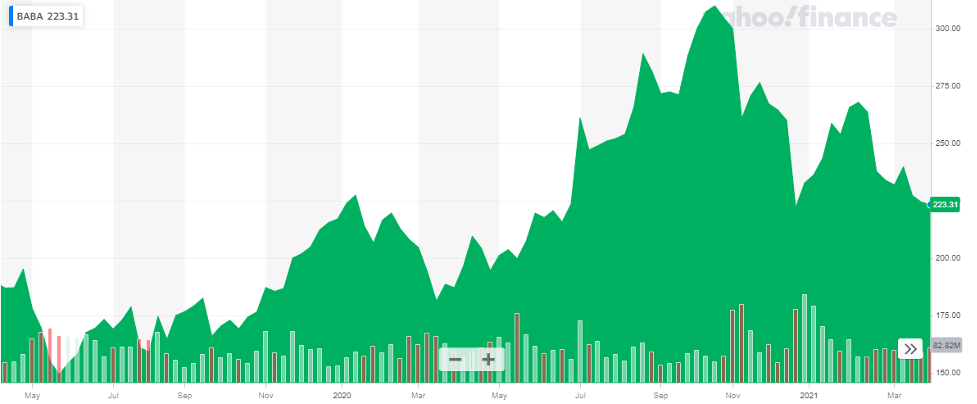

4. Alibaba (BABA)

Alibaba is a major player in the B2B eCommerce space. It is an online B2B marketplace where buyers and sellers from around the world can connect and carry out transactions. It is a secure, trusted platform that is used by millions and millions of businesses. Alibaba is one of the blue-chip companies with a market capitalization of $606 Billion. Its closing price on 9th April 2021 was $223.31.

Alibaba has an amazing record of growth. It has a five-year annualized earnings growth rate of 29% and a sales growth rate of 47%. Alibaba’s business in China looks a lot like Amazon’s in the U.S. The company’s stock price was hit by the pandemic but it recovered and rose to an all-time high of $312 in Oct-Nov 2020. Alibaba’s Singles Day annual shopping event in November 2020 reported twice the amount of sales, as compared to the previous year.

Get to know the best covered call stocks to buy now.

The below graph shows the stock performance for the last 2 years:

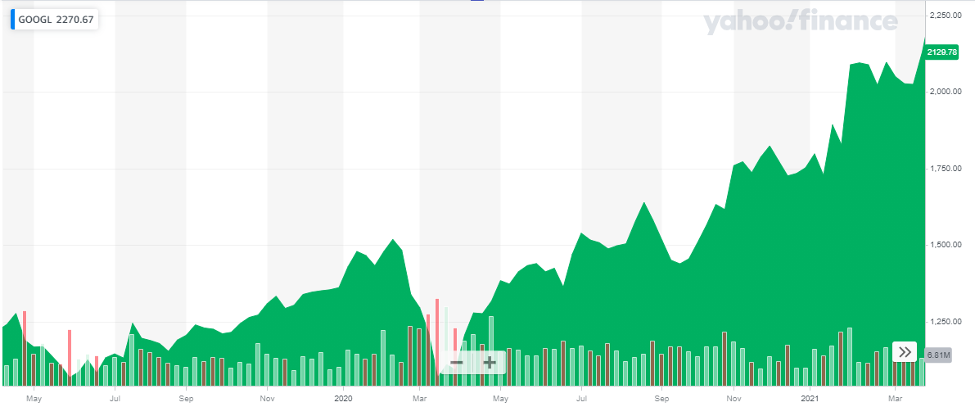

5. Alphabet (GOOGL)

5. Alphabet (GOOGL)

Alphabet, Inc. is a holding company. It operates through the Google and Other Bets segments. The Google segment includes its main Internet products such as ads, Android, Chrome, hardware, Google Cloud, Google Maps, Google Play, Search, and YouTube. Alphabet Inc. is one of the blue chips companies with a market capitalization of over $1.54 Trillion. It closed at $2,270 on 9th April 2021.

Google is one of those companies, which performed better during the pandemic. The company reported a 19% rise in revenues in 2020 with Google Cloud and YouTube ads segments leading the growth. As per Forbes, Google’s revenues are expected to rise by 20.3% to $219.6 billion for 2021 as compared to the previous year. Further, its net income is likely to increase to $45.9 billion.

The below graph shows the stock performance for the last 2 years:

Read more:

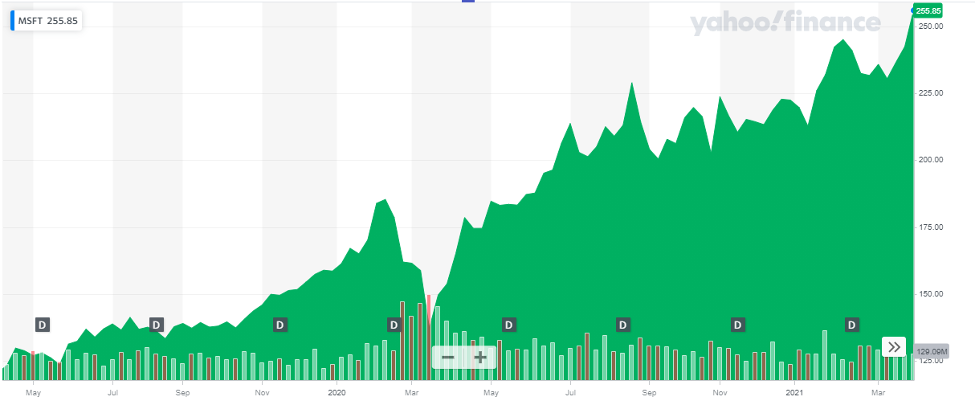

6. Microsoft (MSFT)

Microsoft Corporation develops, licenses, and supports software, services, devices, and solutions worldwide. It is one of the blue chips companies and has a huge market capitalization of $1.9 Trillion. The company stock price closed at $255.85 on 9th April 2020.

Microsoft has increased its market share from 10% to 20% over 16 quarters, according to Synergy Research Group. Microsoft’s increasing cloud market share has been a tailwind for MSFT stock. The recent announcement of a $21.9 billion deal with the U.S. Army has made the stock price rise by 7%, until today. This billion-dollar deal could build up Microsoft’s business further. This provides more reasons to invest in these tech stocks in 2024. Microsoft is amongst the best long-term tech stocks to invest in.

The below graph shows the stock performance for the last 2 years:

7. Twitter (TWTR)

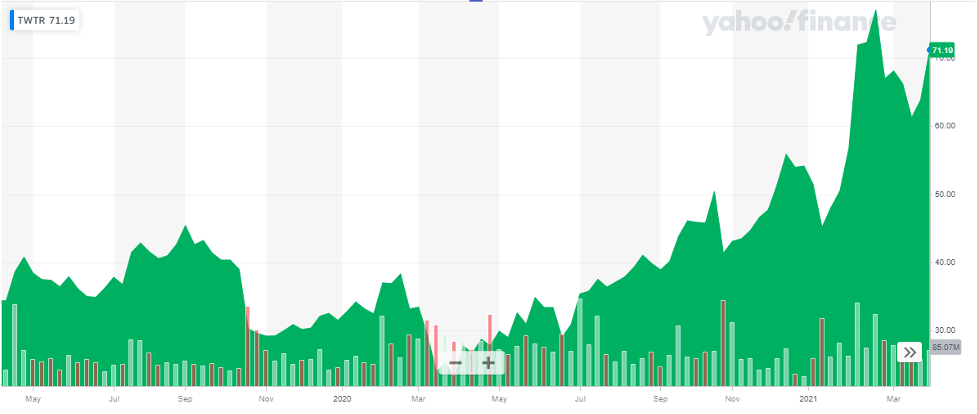

7. Twitter (TWTR)

Twitter is a microblogging and social networking system that allows you to send and receive short posts called tweets. It was founded in 2006. Twitter has a market capitalization of approximately $57 Billion. The company’s stock price closed at $71.19 on 9th April 2021.

The Covid-19 pandemic accelerated Twitter’s user growth in 2020. The company reported an increase in monetizable daily active users (mDAU) in 2020 to 192 million, a 27% increase from last year. The Twitter stock reached a record high since 2013, in Feb-March 2021, crossing $77. As per the analysts at Bloomberg, Twitter’s future is expected positive with an increasing use engagement and expectations of increased digital ad spending

The below graph shows the stock performance for the last 2 years:

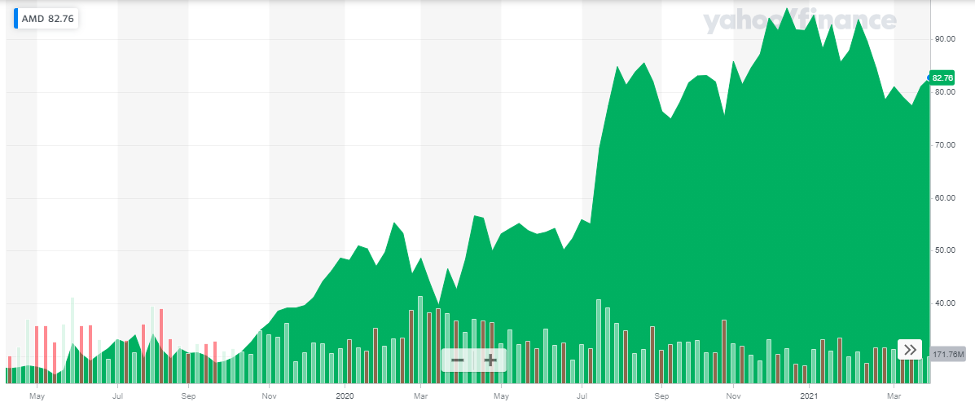

8. Advanced Micro Devices Inc (AMD)

8. Advanced Micro Devices Inc (AMD)

Advanced Micro Devices, Inc. (AMD), a global company that specializes in manufacturing semi-conductor devices used in computer processing. The company is a major supplier of computer chips). Today AMD develops high-performance computing and visualization products to solve some of the world’s toughest and most interesting challenges. The company has a market capitalization of over $100 Billion. The company’s stock closed at $82.76 on 9th April 2021.

AMD has shown amazing progress in the past five years. This progress is the result of new products and improved profitability. As a result, AMD stock has climbed. The stock has risen by more than 50% from the period before the pandemic. 2 major factors have driven the price upward. One of the factors is its merger with Xilinx. Xilinx is a leader in programmable logic devices (PLDs). This merger will create a top computing entity and will all-around enhance AMD’s portfolio. The second factor is the unprecedented demand because of the increasing number of users in the gaming industry. Advanced Micro Devices supplies chips for both Microsoft’s and Sony’s gaming consoles. These factors have a positive outlook for AMD and a sensible investment for investors. This is one of the best tech stocks to buy in 2024.

The below graph shows the stock performance for the last 2 years:

Read more:

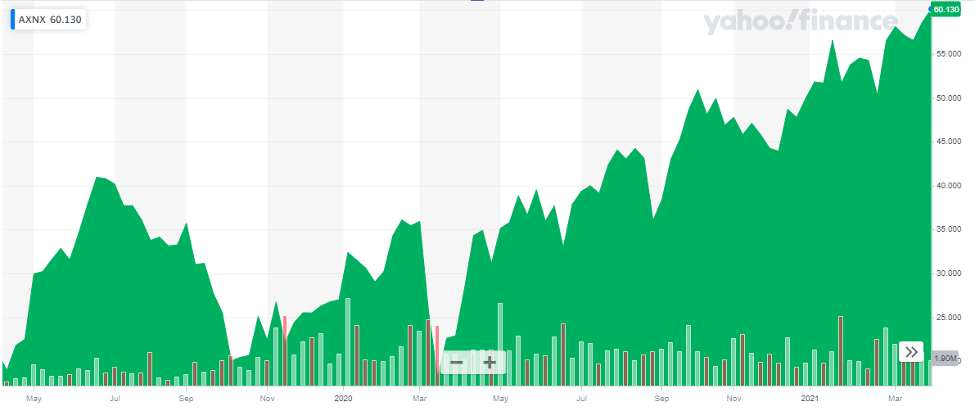

9. Axonics Modulation (AXNX)

Axonics is a medical device company that has developed and is commercializing novel implantable sacral neuromodulation (SNM) devices for the treatment of urinary and bowel dysfunction. It aspires to be the global leader in Sacral Neuromodulation. Axonics has a market capitalization of $2.5 Billion. The stock price of Axonics Modulation closed at $60.13 on 9th April 2021.

Axonics Modulation Technologies has recently acquired Contura. This acquisition will add the third generation of a stimulator for implantable neuromodulation devices, which has recently been approved by the FDA. Moreover, Axonics has reported a tremendous growth in its net revenue. For 2020 net revenue was reported to be $111.5 million whereas in 2019 it was $13.8 Million

The below graph shows the stock performance for the last 2 years:

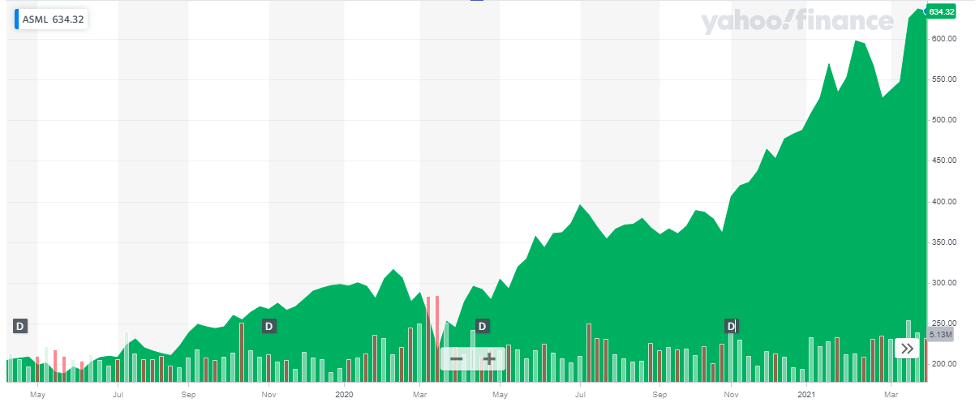

10. ASML Holdings (ASML)

10. ASML Holdings (ASML)

ASML is one of the world’s leading manufacturers of chip-making equipment. The company aims to create a world where semiconductor technology is prevalent everywhere. The company contributes towards this vision by creating products and services that let chipmakers define the patterns that integrated circuits are made of. ASML has a market capitalization of over $260 Billion. The company stock closed at $634.32 on 9th April 2021.

The company stock price has improved tremendously and has more than doubled since last year. ASML is performing better than the overall sector in terms of year-to-date returns. The company reported an increase of 37% in net profit and an 18% increase in sales. The company is also the only manufacturer of the latest, most precise generation of chip-making machines. ASML controls more than 60% of the market.

The below graph shows the stock performance for the last 2 years:

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Day Trading Stocks

- Best Forex Brokers for Trading

- Head and Shoulders Pattern – Trading Guide with Rules & Examples

- Fibonacci Retracement, Extension & Trading Strategies

- Best Stock & Forex Trading Courses Online

- Best Trading and Forex Signal Providers

- Best Penny Stocks to Invest

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy