What are Value Stocks?

Value stocks are stocks that are currently trading at a price lower than their actual intrinsic price. The intrinsic value of a stock is its real value, i.e., true or calculated value. This indicates that these stocks are undervalued.

By identifying and purchasing stocks priced by the market below their intrinsic value, value investors aim to profit when the broader market in time also recognizes that the stocks are underpriced. If their fundamental analysis is correct, the value stocks should rise in price, earning them decent returns.

How is the intrinsic value calculated?

Intrinsic value is calculated via the following investing metrics:

- Price-to-Earnings (P/E) Ratio

The formula for calculating Price-to-Earnings (P/E) Ratio is

Price-to-Earnings Ratio = Stock Price / Total Earnings

This ratio talks about the relationship between a stock’s price and a company’s total earnings, giving a clear indication of whether it is an undervalued stock or not.

The lower the PE ratio the better.

- Price-to-Book (P/B) Ratio

The formula for calculating Price-to-Book Ratio is

Price-to-Book Ratio = Stock Price / Book Value

This ratio talks about the relationship between the stock’s price and its book value.

Earnings Per Share (EPS)

The formula for calculating Earnings per share is:

Earnings Per Share = (Net Income – Preferred Dividends) / Average Common Shares

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

- Reliable forex signals

What are the characteristics of a Value stock?

One of the most prominent characteristics of a value stock is that its valuation is lower compared to the value of its assets or its key financial metrics. However, they also have other attractive characteristics that make them appealing to investors:

- Well-established businesses with long histories of success

- A good record of consistent profit

- Stable revenue streams with a steady growth rate

- Dividend payments (This characteristic is not a must for value stock)

List of the Best Value Stocks to Invest in 2023

List of the Best Value Stocks to Invest in 2023

Here is a list of Best Value Stocks to invest in this year:

| Sr. | Company Name | Symbol | Price (As of 21st June 2023) | Market Cap |

| 1 | Berkshire Hathaway | BRK | $ 337.77 | $ 738.5 billion |

| 2 | Procter & Gamble | PG | $ 150.11 | $ 353.7 billion |

| 3 | Target | TRG | $ 132.18 | $ 60.8 billion |

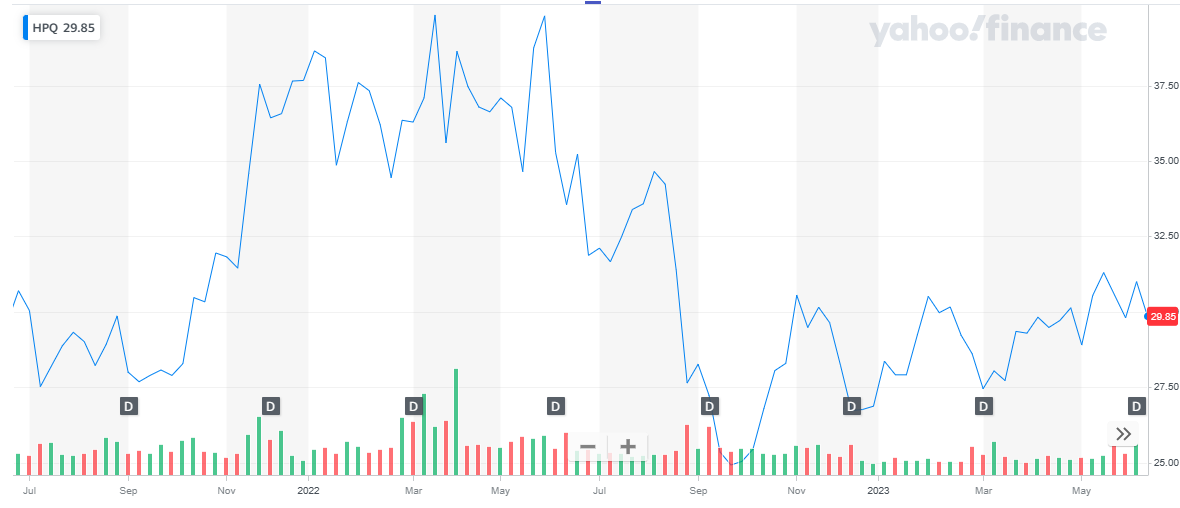

| 4 | HP Inc. | HPQ | $ 29.85 | $ 29.4 billion |

| 5 | U.S. Bancorp | USB | $ 33.43 | $ 49.7 billion |

| 6 | Moody’s Corporation | MCQ | $ 335.04 | $ 61.5 billion |

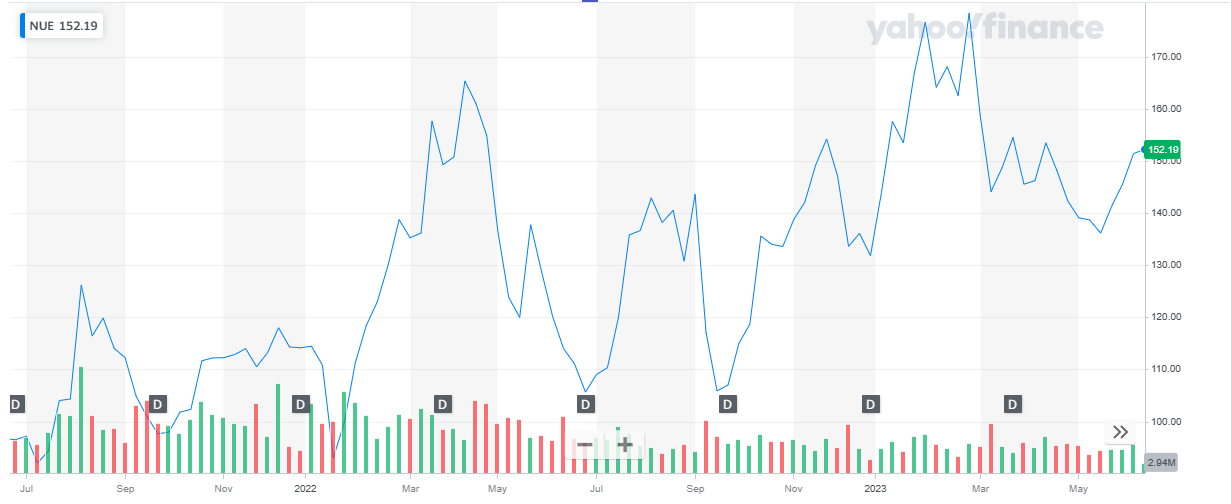

| 7 | Nucor Corporation | NUE | $ 152.04 | $ 38.3 billion |

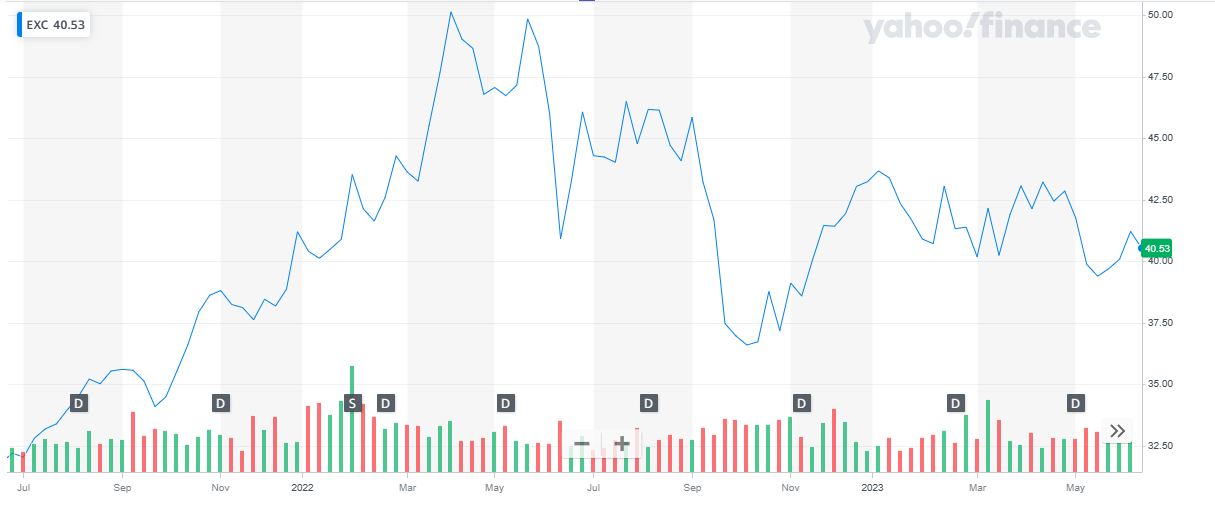

| 8 | Exelon Corp. | EXC | $ 40.44 | $ 40.23 billion |

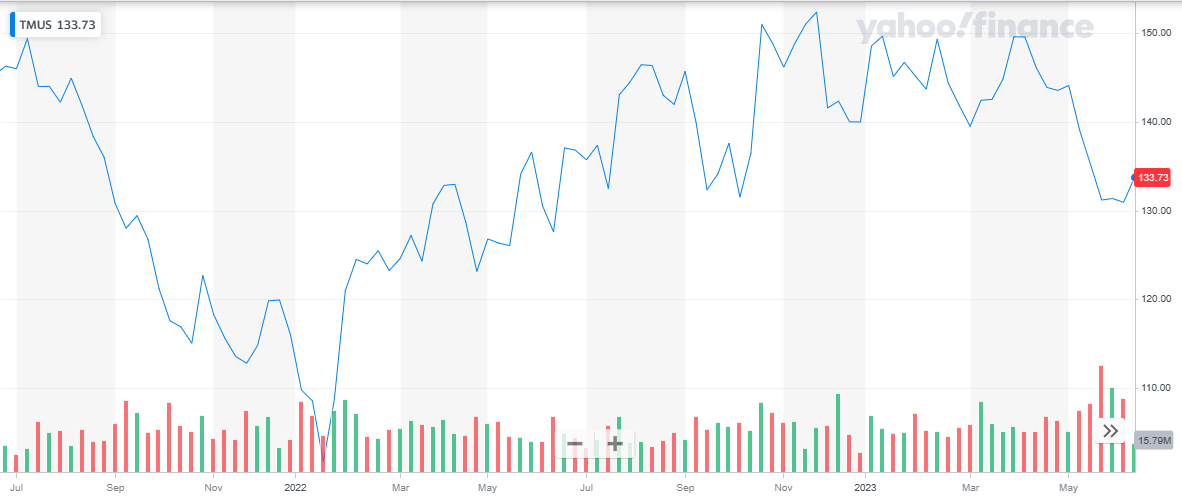

| 9 | T-Mobile US, Inc. | TMUS | $ 133.72 | $ 160.47 billion |

Berkshire Hathaway

Berkshire Hathaway Inc (Berkshire) is a diversified holding group. Berkshire through its subsidiaries, focuses on insurance and reinsurance, freight rail transportation, and utility and energy generation and distribution business. It offers property and casualty insurance and reinsurance, and life, health, and accident reinsurance products. The group operates railroad systems in North America, which serve the Midwest, Southwestern, Western, Pacific Northwest, and Southeastern ports and regions of the US. Berkshire also focuses on manufacturing, service and retailing, finance, and financial products activities. The group primarily operates in North America, Western Europe, and the Asia Pacific region. Berkshire is headquartered in Omaha, Nebraska, the US.

The CEO of Berkshire Hathaway, Warren Buffett is perhaps the best-known value investor. Buffett started value investing in his early 20s and used the strategy to deliver immense returns for investors in the 1960s before taking control of Berkshire in the 1970s.

Berkshire Hathaway Inc recently reported its first quarter report for the year 2023:

- Revenue was reported at $ 85.4 billion, as compared to $ 70.8 billion in the previous year’s same period

- Net Earnings were reported at $ 35.5 billion, as compared to $ 5.6 billion in the previous year’s same period

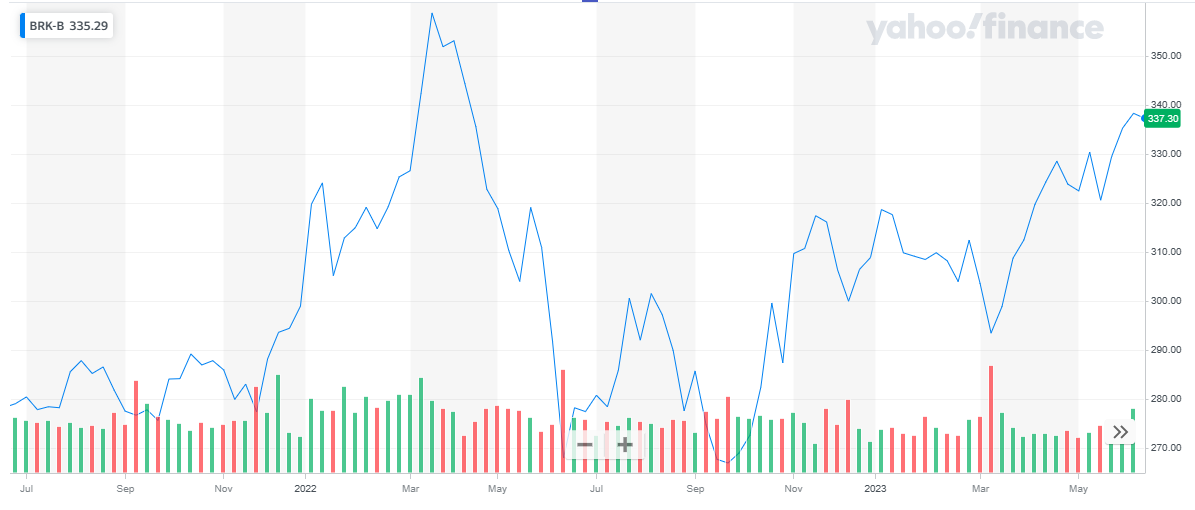

Berkshire Hathaway has a market cap of $ 738.5 billion. Its shares are trading at $ 337.77.

The stock of the company started the year 2022 at $ 299. The stock kicked off the year with a bullish run and spiked high up to $ 358.76. after hitting the peak, the stock dipped at the same pace and went as low as $ 268.08. This volatile behavior continued throughout the year and the stock closed the year at $ 308.9. Overall, the stock appreciated by 3.3 % during the year.

In 2023, the stock after an initial drop the stock rose and last closed at $ 337.77, representing a 9.3 % appreciation to date.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Procter & Gamble

The Procter & Gamble Co (P&G) is a manufacturer and marketer of fast-moving consumer goods. The company’s products include conditioners, shampoo, male and female blades and razors, toothbrushes, toothpaste, dish-washing liquids, detergents, surface cleaners, and air fresheners. It also offers baby wipes, diapers and pants, paper towels, tissues, and toilet paper. P&G’s major brand names include Head & Shoulders, Tide, Ariel, Olay, Pantene, Pampers, Gillette, Braun, and Fusion, among others. The company sells its products through grocery stores, membership club stores, specialty beauty stores, high-frequency stores, online channels, pharmacies, drug stores, and department stores. It has a business presence across Asia-Pacific, Europe, the Middle East, Africa, and the Americas. P&G is headquartered in Cincinnati, Ohio, the US.

Proctor and Gamble recently reported its third quarter report for the fiscal year 2023:

- Net Sales were reported at $ 20.1 billion, as compared to $ 19.4 billion in the previous year’s same period

- Operating income was reported at $ 4.3 billion, as compared to $ 4 billion in the previous year’s same period

- Net Earnings were reported at $ 3.4 billion, as compared to $ 3.35 billion in the previous year’s same period

- Earnings per share were reported at $ 1.41, as compared to $ 1.37 in the previous year’s same period

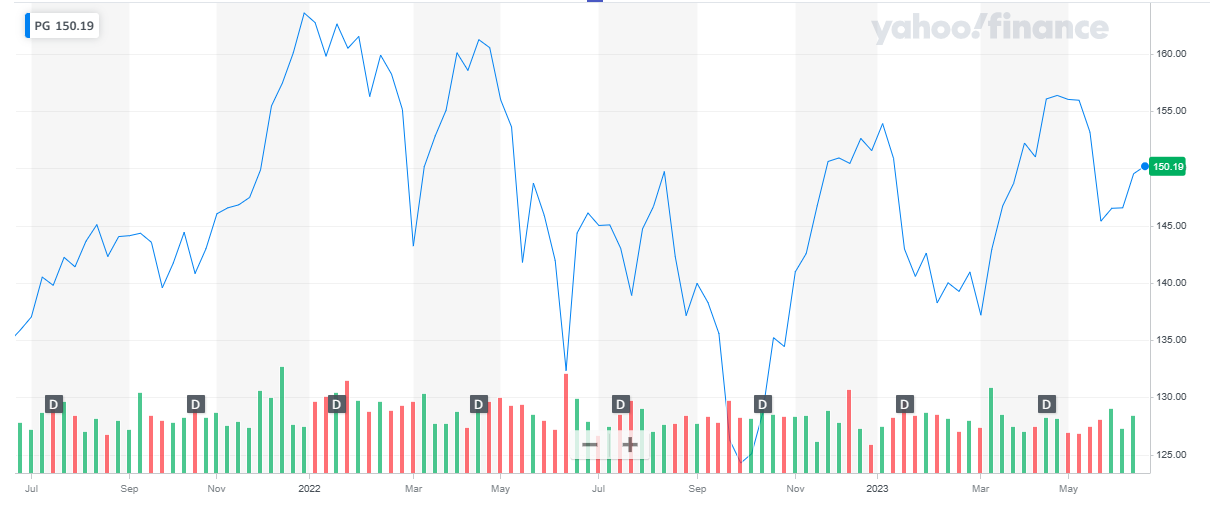

Proctor and Gamble have a market cap of $ 353.7 billion. Its shares are trading at $ 150.11.

The stock of the company started the year 2022 at $ 163.58. During the year the stock picked up a downward trend while exhibiting volatile behavior. The stock eventually closed the year at $ 151.56, representing a decline of 7.4 % during the year.

In 2023, after an initial dip in price, the stock recovered and last closed at $ 150.11. To date, the stock almost maintained its share price.

Target

Target

Target Corp (Target) is a retailer of general merchandise and food products. The company’s product portfolio comprises baby and beauty products, clothing, electronic equipment, furniture, grocery, home and pet products, school and office supplies, shoes, sports and outdoor products, toys, and sports equipment.

Target Corporation serves guests at nearly 2,000 stores and at Target.com, with the purpose of helping all families discover the joy of everyday life. Since 1946, Target has given 5% of its profit to communities, which today equals millions of dollars a week.

Target recently reported its first-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 25.3 billion, as compared to $ 25.17 billion in the previous year’s same period

- Operating income was reported at $ 1.33 billion, as compared to $ 1.35 billion in the previous year’s same period

- Net Earnings were reported at $ 950 million, as compared to $ 1.1 billion in the previous year’s same period

- Earnings per share were reported at $ 460.9 as compared to $ 464 in the previous year’s same period

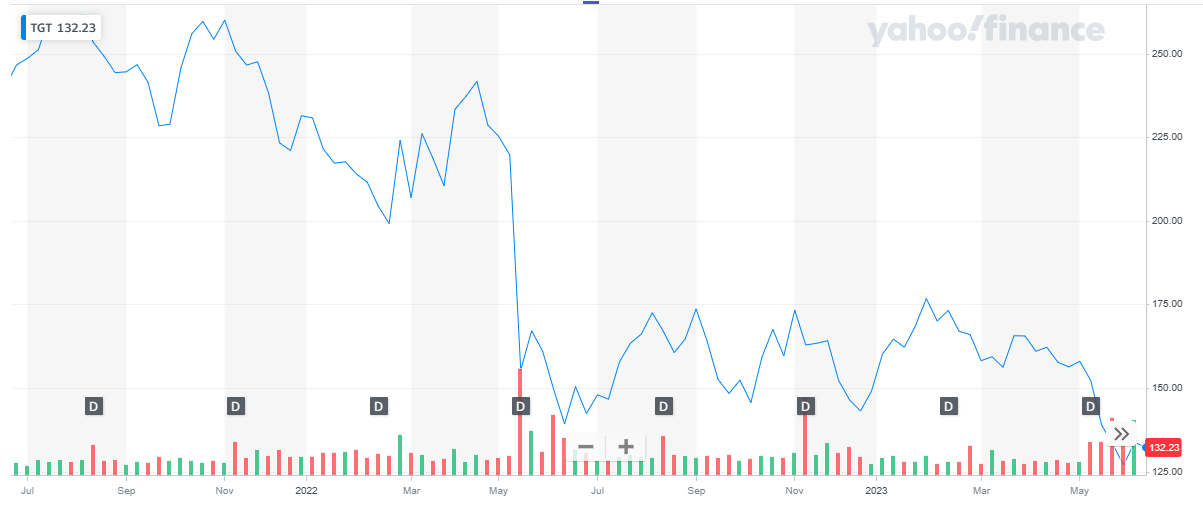

Target has a market cap of $ 60.8 billion. Its shares are trading at $ 132.18.

The stock started the year 2022 at $ 231.44. The stock suffered a huge drop in price during the year and went as low as $ 139.3. Eventually, the stock closed at $ 149.04 representing a 40 % decline during the year.

In 2023, after an initial rise in price the stock again declined and last closed at $ 132.18, representing an 11.3 % decline to date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

HP Inc.

HP Inc (HP) is a provider of technology products, software, solutions, and services. The company’s product portfolio includes personal computing and other access devices; imaging- and printing-related products and services; enterprise IT infrastructure; and multi-vendor customer services. HP provides commercial and industrial solutions to print service providers and packaging converters. It also delivers printing products and solutions for homes, home businesses, and micro businesses. HP offers its products to individual consumers, small and medium-sized businesses, and large enterprises, including customers in the government, health, and education sectors. The company has operations across the Americas, Europe, the Middle East, Africa and Asia-Pacific. HP is headquartered in Palo Alto, California, the US.

HP Inc. recently reported its second-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 12.9 billion, as compared to $ 16.5 billion in the previous year’s same period

- Operating income was reported at $ 762 million, as compared to $ 1.3 billion in the previous year’s same period

- Net Earnings were reported at $ 1.06 billion, as compared to $ 1 billion in the previous year’s same period

- Earnings per share were reported at $ 1.07 as compared to $ 0.49 in the previous year’s same period

HP Inc has a market cap of $ 29.4 billion. Its shares are trading at $ 29.85.

The stock started the year 2022 at $ 37.67. The stock remained volatile during the first three quarters of the year. After that, the stock suffered a huge dip and went as low as $ 24.92. Eventually, the stock closed the year at $ 26.87, representing a 29 % decline during the year.

In 2023, the stock started to recover slowly and steadily. To date, the stock has appreciated by 10 %.

U.S. Bancorp

U.S. Bancorp

U.S. Bancorp (USB) is a diversified financial services company that offers retail and commercial banking, private banking, and wealth management solutions through its subsidiaries. Its portfolio of products and services comprises savings and checking accounts, certificates of deposits, consumer and business loans, personal and business lines of credit, mortgages, insurance, savings, and investment products, brokerage and fund services, credit and debit cards, asset and wealth management, and financial planning solutions. The company also provides leasing, international banking, payment services, private banking, cash management, and online and mobile banking. It primarily operates in the Midwest and West regions of the US. USB is headquartered in Minneapolis, Minnesota, the US.

US Bancorp recently reported its first-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 7.2 billion, as compared to $ 5.6 billion in the previous year’s same period

- Net Earnings were reported at $ 1.7 billion, as compared to $ 1.6 billion in the previous year’s same period

- Earnings per share were reported at $ 1.04 as compared to $ 0.99 in the previous year’s same period

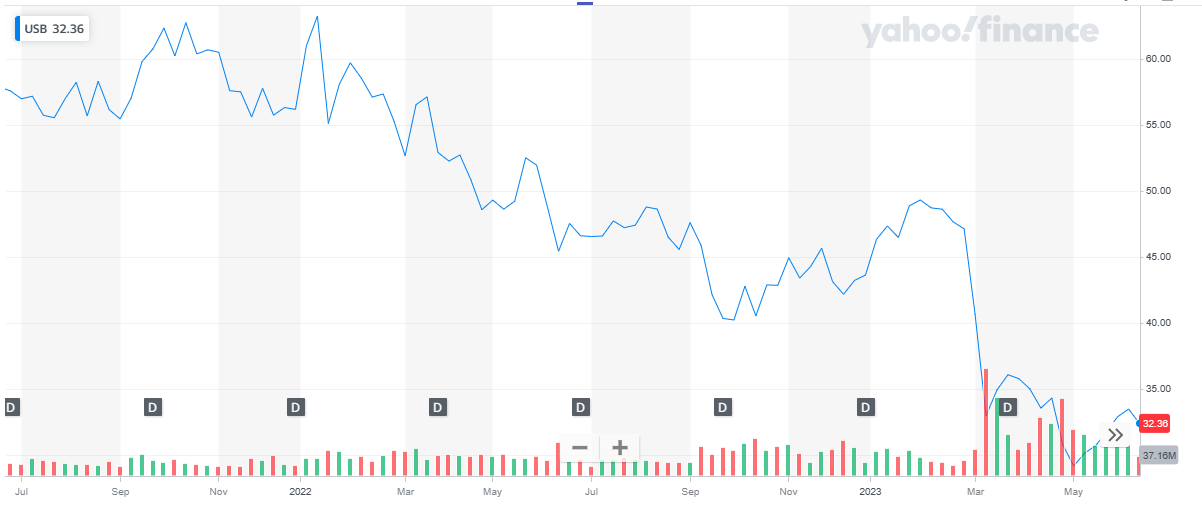

US Bancorp has a market cap of $ 49.7 billion. Its shares are trading at $ 33.43.

The stock started the year 2022 at $ 56.17. The stock continued with a slow and steady decline throughout the year and eventually closed off at $ 46.61. Overall, the stock declined by 17 % during the year.

In 2023, after an initial decline, the stock suffered a huge dip and went as low as $ 29.13. The stock last closed at $ 33.43, representing a 28 % decline to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Moody’s Corporation

Moody’s Corp (Moody’s) is a credit rating agency that provides credit ratings, quantitative credit risk measures, capital markets, economic-related research, software solutions, and related risk management services to institutional customers. The company also offers a credit risk calculator, fund monitoring, structured analytics and valuation, enterprise risk solutions, default recovery database, pricing and valuations tools, economic and consumer credit analytics, and municipal financial ratio analysis. The company serves securities traders, investors, and others across the Asia Pacific, the Americas, and EMEA regions. It has a rating relationship with corporate issuers and public finance issuers. Moody’s is headquartered in New York, the US.

Moody’s Corp recently reported its first-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 1.47 billion, as compared to $ 1.5 billion in the previous year’s same period

- Operating income was reported at $ 554 million, as compared to $ 656 million in the previous year’s same period

- Net Earnings were reported at $ 501 million, as compared to $ 498 million in the previous year’s same period

- Earnings per share were reported at $ 2.73 as compared to $ 2.69 in the previous year’s same period

Moody’s Corp has a market cap of $ 61.5 billion. Its shares are trading at $ 335.04.

The stock started the year 2022 at $ 390.58. The stock picked up a bearish trend during the year and went as low as $ 235.25. Eventually, the stock closed at $ 278.62 representing a 29 % decline during the year.

In 2023, the stock reversed its course and started to rise. The stock last closed at $ 335.04 representing a 20 % appreciation to date.

Nucor Corporation

Nucor Corporation

Nucor Corp (Nucor) is a provider of steel and steel products. It offers carbon steel, fasteners, alloy steel, raw materials, and other steel products. It also produces joists and joist girders, cold-finished steel bars, wire, and wire mesh, finished hex nuts, coiled rebars, roof decks, sheets and plates, and pipes and tubes. It also produces direct reduced iron that can be used in steel mills and processes ferrous and nonferrous metals, pig iron, and hot briquetted iron. The company together with its subsidiaries operates several facilities in the US, Canada, and Mexico. Nucor is headquartered in Charlotte, North Carolina, the US.

Nucor Corp recently reported its first-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 8.71 billion, as compared to $ 10.5 billion in the previous year’s same period

- Net Earnings were reported at $ 1.5 billion, as compared to $ 2.77billion in the previous year’s same period

Nucor Corp has a market cap of $ 38.3 billion. Its shares are trading at $ 152.37.

The stock started the year 2022 at $ 114.15. After an initial dip, the stock picked up pace and rose up to $ 165.32. after multiple dips and peaks, the stock closed the year at $ 131.81. Overall, the stock appreciated by 15 %.

In 2023, the stock kicked off with a bullish run and went as high as $ 178.31. the stock last closed at $ 152.37 representing a 16 % appreciation to date.

Also, read:

Also, read:

Exelon Corp.

Exelon Corp (Exelon) is a distribution and transmission company that delivers natural gas and electricity. Exelon is committed to maintaining high levels of operational excellence, meeting financial commitments, recovering investments in a timely manner to benefit customers, supporting clean energy policies, and upholding corporate responsibility. It offers its subsidiaries various assistance services at a reasonable price, such as legal, human resources, financial, information technology, and supply management services. Exelon is headquartered in Chicago, Illinois, the US.

Exelon Corp recently reported its first-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 5.56 billion, as compared to $ 5.32 billion in the previous year’s same period

- Operating income was reported at $ 1.1 billion, as compared to $ 900 million in the previous year’s same period

- Net Earnings were reported at $ 669 million, as compared to $ 597 million in the previous year’s same period

- Earnings per share were reported at $ 0.67 as compared to $ 0.49 per share in the previous year’s same period

Exelon Corp has a market cap of $ 40.23 billion. Its shares are trading at $ 40.44.

The stock started in the year 2022 at $ 41.2. The stock kicked off with a bullish run and went as high as $ 50.13. The stock closed the year at $ 43.23 representing a 5 % appreciation during the year.

In 2023, the stock exhibited volatility. After multiple dips and peaks, the stock last closed at $ 40.44 representing a 6 % decline to date.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

T-Mobile US Inc.

T-Mobile US Inc (T-Mobile), a subsidiary of Deutsche Telekom AG, is a provider of telecommunication services. The company offers wireless telecommunications services and a host of other services, including voice, text messaging, video calling, and data communications to customers. It serves postpaid, prepaid, and wholesale customers. The company provides its products and services under the T-Mobile and Metro T-Mobile brand names. It also carries out the distribution of a wide range of mobile phones, wearables, tablets, and mobile phones and accessories from established vendors such as Apple, Google, Motorola, OnePlus, Samsung, Alcatel, Beats, and LG. T-Mobile is headquartered in Bellevue, Washington, the US.

T-Mobile recently reported its first-quarter earnings for the fiscal year 2023:

- Total Revenues were reported at $ 19.6 billion, as compared to $ 20.1 billion in the previous year’s same period

- Net Earnings were reported at $ 1.9 billion, as compared to $ 713 million in the previous year’s same period

- Earnings per share were reported at $ 1.58 as compared to $ 0.57 per share in the previous year’s same period

T-Mobile has a market cap of $ 160.47 billion. Its shares are trading at $ 133.72.

The stock started the year 2022 at a price of $ 115.98. The stock’s long-running bearish run came to an end during the year when it hit the low of $ 101.62. From here the stock started rising and went as high as $ 152.41. Eventually, the stock closed the year at $ 140. Overall, the stock appreciated by 17 % during the year.

In 2023, the stock maintained its price level initially. But during the second quarter, the stock started to fall and last closed at $ 133.72. To date the stock declined by 4.5 %

Also, learn:

Also, learn: