List of Best International & Foreign Stocks in 2024

International stocks are an excellent investment option. In fact for long-term investors, they are one of the best options to consider.

Here is a list of the top 10 International & Foreign Stocks for investment in 2024:

| Sr. | Company Name | Symbol | Price (As of ) | Market Cap |

| 1 | ASML Holding | ASML | $ 664.16 | $ 262.1 billion |

| 2 | CD Projekt | OTGL.Y | $ 112.14 | $ 12.96 billion |

| 3 | MercadoLibre | MELI | $ 1,187 | $ 59.7 billion |

| 4 | Shoprite Holdings | SRGH.Y | $ 11.99 | $ 6.5 billion |

| 5 | HDFC Bank | HDFC | $ 63.42 | $ 117.9 billion |

| 6 | Crescent Point Energy | CPG | $ 6.44 | $ 3.53 billion |

| 7 | International General Insurance Holdings | IGIC | $ 8.35 | $ 393 million |

| 8 | Toyota Motor Corporation | TM | $ 136.65 | $ 185.6 billion |

| 9 | Royal Bank of Canada | RY | $ 92.19 | $ 128 billion |

| 10 | Thomson Reuters Corporation | TRI | $ 127.12 | $ 60 billion |

ASML Holding

ASML Holding

ASML Holding NV (ASML) is a microelectronics solutions provider that offers semiconductor manufacturing equipment. The company’s product portfolio includes lithography systems, metrology and inspection systems, and refurbished systems. Its computational lithography and patterning control software solutions enable customers to attain high yields and better operational performance. ASML’s products cater to logic chip manufacturers, foundries, and NAND-flash memory and DRAM memory chip makers. The company markets sell and service its products through a network of facilities, and service and technical support specialists. It has a business presence in Asia, Europe, and the US. ASML is headquartered in Veldhoven, North Brabant, the Netherlands.

ASML recently reported its annual results for the year 2022:

| 2022 | 2021 | Percentage Increase | |

| Net Sales | € 21.1 billion | € 18.6 | 13.44 % |

| Income from Operations | € 6.5 billion | € 6.7 billion | -3 % |

| Net Income | € 5.624 billion | € 5.883 | -4.4 % |

| Earnings per share | € 14.14 | € 14.34 | -1.4 % |

- Net sales reported a 13.44 % annual increase

- Income from operations reported a 3 % annual decline

- Net Income reported a 4.4 % annual decline

- Earnings per share reported a 1.4 % annual decline

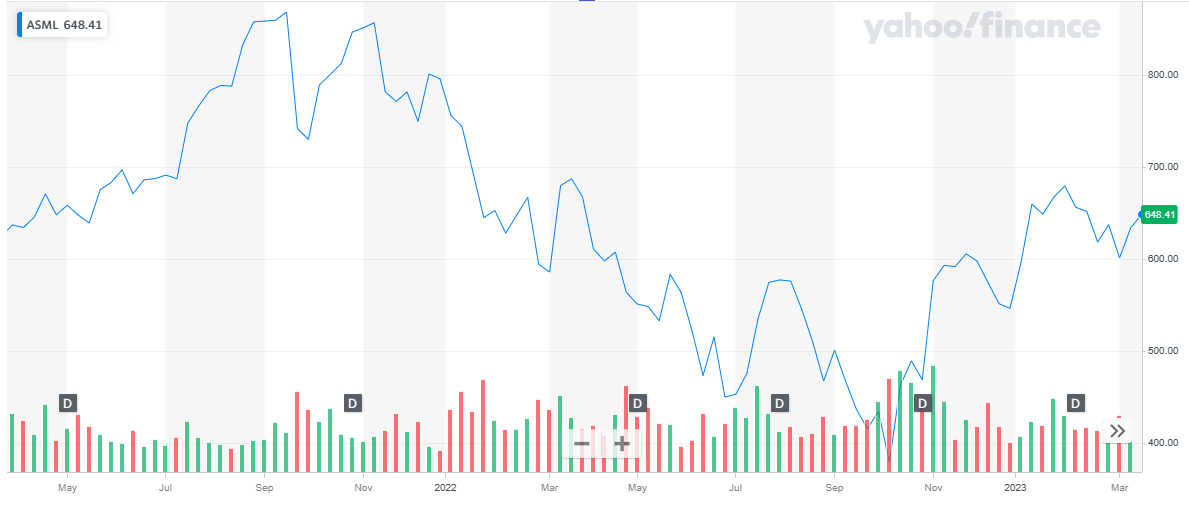

ASML Holdings has a market cap of $ 262.1 billion. Its shares are trading at $ 664.16.

The stock started in the year 2022 at $ 796.14. The stock picked up a bearish run and dropped to the low of $ 379.13. The stock eventually closed the year at $ 546.4 representing a 31.4 % decline to date.

In 2023, the stock continued rising and recently closed at $ 648.45 representing an 18.7 % appreciation to date.

Also, learn:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

CD Projekt

CD Projekt SA (CD Projekt) is a designer, developer, and publisher of role-playing video games. The product portfolio of the company includes the witcher; the witcher 2:assassins of kings; the witcher 3: wild hunt, cyberpunk 2077, throne-breaker, the witcher tales, the witcher adventure game, Gwent: the witcher card game. It also develops online multiplayer games and distributes digital video games through a wide range of online channels and digital distribution platforms directly to individual users across Russia, Asia, and the US. Its other activities include motion picture distribution and investment services. CD Projekt is headquartered in Warsaw, Poland.

CD Projekt recently reported its third quarter report for the year 2022:

| 3Q 2022 | 3Q s2021 | Percentage Increase | |

| Net Sales | € 133,041 | € 134,937 | -1.4 % |

| Income from Operations | € 50 035 | € 30 328 | 65 % |

| Net Income | € 45 320 | € 26 629 | 70.2 % |

| Earnings per share | € 0.45 | € 0.26 | 73 % |

- Net sales reported a 1.4 % annual decline

- Income from operations reported a 65 % annual increase

- Net Income reported a 70.2 % annual increase

- Earnings per share reported a 73 % annual increase

CD Projekt has a market cap of $ 12.96 billion. Its shares are trading at $ 112.14.

The stock started in the year 2022 at $ 192.9. After maintaining this price level for a few months, the stock dropped to a low of $ 82 and eventually closed the year at $ 129.64. Overall, the stock declined by 33 % in 2022.

In 2023, initially, the stock maintained its price level but then dropped and closed off the year at $ 112.32. Overall, the stock declined by 13.3 %.

Read: Top Information Technology Stocks

Read: Top Information Technology Stocks

MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, connecting a network of more than 140 million active users and 1 million active sellers as of the end of 2021 across an 18-country footprint. The company also operates a host of complementary businesses, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

MercadoLibre recently reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Increase | |

| Net Revenues | $ 6,149 million | $ 9,442 | -35 % |

| Income from Operations | $ 1,034 million | $ 441 million | 135 % |

| Net Income | $ 482 | $ 83 | 480 % |

| Earnings per share | $ 9.53 | $ 1.67 | 470 % |

- Net sales reported a 35 % annual decline

- Income from operations reported a 135 % annual increase

- Net Income reported a 480 % annual increase

- Earnings per share reported a 470 % annual increase

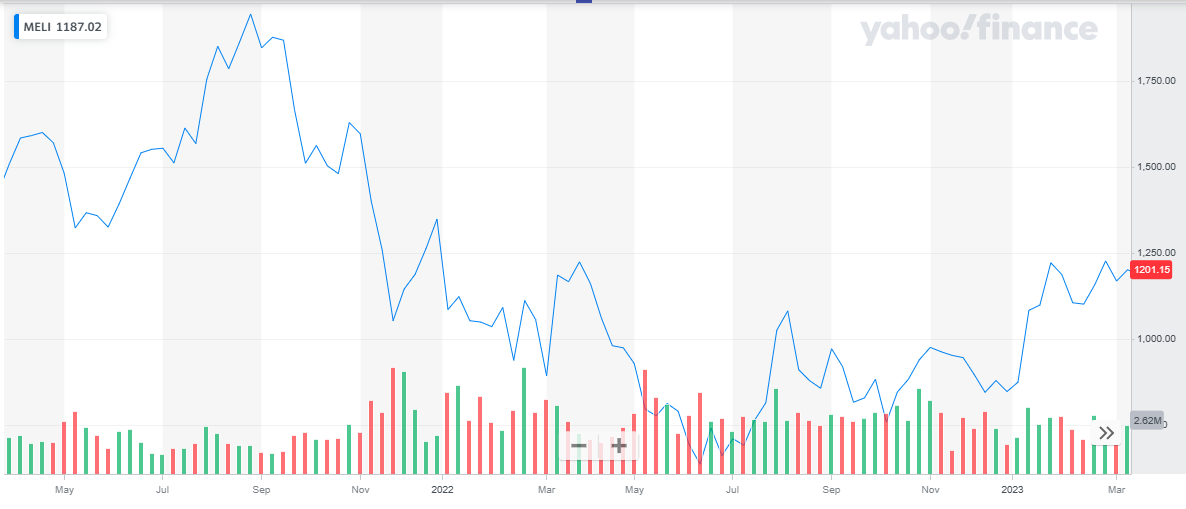

MercadoLibre has a market cap of $ 59.7 billion. Its shares are trading at $ 1,187.

The stock started the year 2022 at $ 1,348. The stock started with a bearish run and dropped as low as $ 635.22. Eventually, the stock closed the year at $ 846.24 representing a 37.2 % decline during the year.

In 2023, the stock picked up the pace and started to rise. It has appreciated by 40 % to date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Shoprite Holdings

Shoprite Holdings Ltd (Shoprite) is a retailer of food and non-food products. The company sells various products such as clothing, food items, fruit and vegetables, cosmetics, household appliances, liquor, general merchandise, and home entertainment systems. Shoprite markets these products through supermarkets, stores, and outlets. It also provides logistics, ticketing, hospitality, cellular services, and money market services. The company operates stores under various brand names such as Shoprite, Usave, Computicket, Checkers, K’nect, Checkers Hyper, Freshmark, Checkers Food Services, House & Home, LiquorShop, MediRite Pharmacy, TransPharm, OK Franchise, OK Furniture, and Computicket Travel. Shoprite is headquartered in Brackenfell, Western Cape, South Africa.

Shoprite recently reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Increase | |

| Net Revenues | Rm 184,078 | Rm 168,030 | 9.6 % |

| Income from Operations | Rm 3,118 | Rm 2,616 | 19.2 % |

| Net Income | Rm 5,740 | Rm 4,859 | 18.1 % |

| Earnings per share | 1,046 cents | 851.6 cents | 22.9 % |

- Net sales reported a 9.6 % annual increase

- Income from operations reported a 19.2 % annual increase

- Net Income reported an 18.1 % annual increase

- Earnings per share reported a 22.9* % annual increase

Shoprite has a market cap of $ 6.5 billion. Its shares are trading at $ 11.99.

The stock started in the year 2022 at $ 13.12. Initially, the stock price rose up to 16.77 and then declined. The stock remained volatile throughout the year and eventually closed the year at $ 12.63. Overall, the stock declined 2022 by 3.7 %.

In 2023, the stock again rose initially and went as high as $ $ 15. And the stock last closed at $ 11.99 representing a 5 % decline to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

HDFC Bank

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE; and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

HDFC recently reported its third quarter report for the year 2022:

| Q3 2022 | Q3 2021 | Percentage Increase | |

| Net Revenues | INR 41,206 crore | INR 31,297 crore | 31.7 % |

| Net Income | INR 7,429 crore | INR 5,312 crore | 40 % |

| Earnings per share | INR 36.59 | INR 32.27 | 13.4 % |

- Net sales reported a 31.7 % annual increase

- Net Income reported a 40 % annual increase

- Earnings per share reported a 13.4 % annual increase

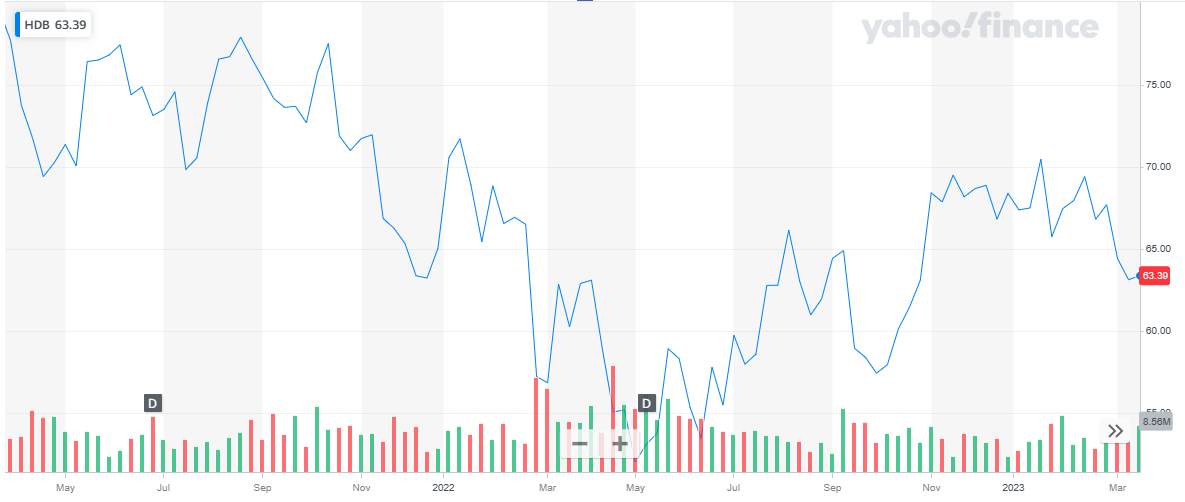

HDFB Bank has a market cap of $ 117.9 billion. Its shares are trading at $ 63.42.

The stock started in the year 2022 at $ 65.07. It started off with a bearish trend and dropped as low as $ 52.04. After that, the stock recovered and eventually closed off at $ 68.41 representing a 5 % appreciation during the year.

In 2023, initially, the stock maintained its price and eventually closed at $ 63.39 representing a 7.4 % decline to date.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

Crescent Point Energy

Crescent Point Energy Corp (Crescent Point), is an independent oil and gas company that acquires, explores for, and develops oil and gas properties. Its portfolio of products includes light and medium crude oil, heavy crude oil, tight oil, natural gas liquids, shale gas, and conventional natural gas. The company has an interest in light and medium oil and natural gas reserves in Western Canada and the US. Crescent Point has crude oil and natural gas properties in Alberta, Saskatchewan, and Manitoba provinces in Canada; and Montana and North Dakota in the US. The company’s portfolio of assets includes the Viewfield Bakken, Torquay, Shaunavon, and North Dakota basins. Crescent Point is headquartered in Calgary, Alberta, Canada.

Crescent Energy Point recently reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Increase | |

| Net Revenues | $ 3,578.4 million | $ 2,439.9 million | 47 % |

| Net Income | $ 1,483.4 million | $ 2,364 | -37 % |

| Earnings per share | $ 2.62 | $ 4.15 | -36.7 % |

- Net revenues reported a 47 % annual increase

- Net Income reported a 37 % annual decline

- Earnings per share reported a 36.7 % annual decline

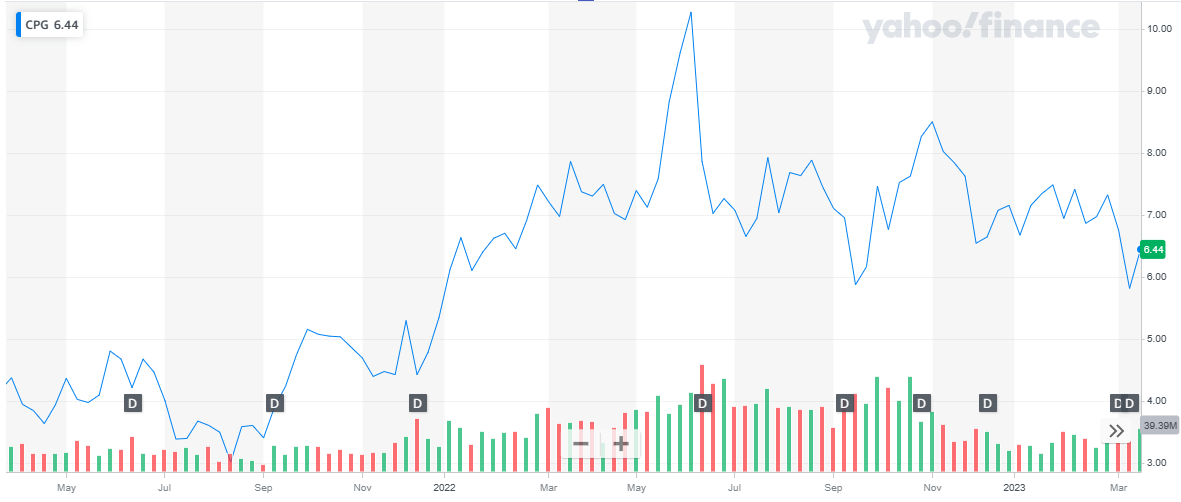

Crescent Point Energy has a market cap of $ 3.53 billion. Its shares are trading at $ 6.44.

The stock started the year 2022 at $ 5.34. It picked up a bullish trend and went as high as $ 10.27. After that, the stock pulled back and eventually closed off the year at $ 7.15. Overall, the stock appreciated by 34 %.

In 2023, the stock initially maintained its price and last closed at $ 6.44 representing a 10 % decline to date.

International General Insurance Holdings

International General Insurance Holdings

International General Insurance Holdings Ltd (IGI) is an international specialist commercial insurance and reinsurance group, writing a diverse portfolio of specialty lines in over 200 countries and markets across the globe. The company operates through three segments:

- Specialty Long-tail

- Specialty Short-tail

- Reinsurance

It underwrites a diversified portfolio of specialty risks, including energy, property, construction and engineering, ports and terminals, general aviation, political violence, casualty, financial institutions, marine, contingency, and treaty reinsurance. The company was founded in 2001 and is based in Amman, Jordan.

Crescent Energy Point recently reported its annual report for the year 2022:

| 2022 | 2021 | Percentage Increase | |

| Total Investment Income | $ 20.7 million | $ 14.2 million | 47 % |

| Net Income | $ 85.5 million | $ 43.6 million | -37 % |

| Earnings per share | $ 1.74 | $ 0.89 | -36.7 % |

- Net revenues reported a 47 % annual increase

- Net Income reported a 37 % annual decline

- Earnings per share reported a 36.7 % annual decline

International General Insurance Holdings has a market cap of $ 393 million. Its shares are trading at $ 8.35.

The stock started in the year 2022 at $ 8.1. Throughout the year the stock remained mildly volatile and eventually closed off the year at $ 8 representing a 1.23 % decline during the year.

In 2023, the stock picked up a bullish trend and last closed at $ 8.35 representing a 4.4 % appreciation to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Toyota Motor Corporation

Toyota Motor Corp (Toyota) is an automobile manufacturer. The company designs, manufactures, and sells passenger cars, buses, minivans, trucks, specialty cars, and recreational and sport-utility vehicles. It provides financing to dealers and customers for the purchase or lease of vehicles. The company also carries out housing, financial services, telecommunications and information technology businesses. The company pursues a vehicle electrification strategy with investment in electric battery technologies. Toyota’s financial services include retail leasing, retail financing, insurance, and wholesale financing. It operates across the Americas, Europe, Africa, Asia Pacific, and the Middle East. Toyota is headquartered in Toyota City, Aichi, Japan.

Toyota Motor Corp recently reported its third-quarter financial report for the year 2022:

| Q3 2022 | Q3 2021 | Percentage Increase | |

| Total Investment Income | 23,267 billion Yen | 27,464 billion Yen | 15.3 % |

| Income from Operations | 2,531 billion Yen | 2,098 billion Yen | 20.6 % |

| Net Income | 2,384 billion Yen | 1,964 billion Yen | 21.4 % |

| Earnings per share | 166.45 Yen | 138.78 Yen | 20 % |

- Net revenues reported a 15.3 % annual increase

- Net Income reported a 20.6 % annual increase

- Income from Operations reported a 21.4 % annual increase

- Earnings per share reported a 20 % annual increase

Toyota Motor Corp has a market cap of $ 185.6 billion. Its shares are trading at $ 136.65.

The stock started in the year 2022 at $ 185.3. It started with a declining trend and dropped to the low of $ 130.29. The stock closed off the year at $ 136.58 representing a 26 % decline during the year.

In 2023, till date, the stock has been mildly volatile and is trading at the same price levels as the start of the year.

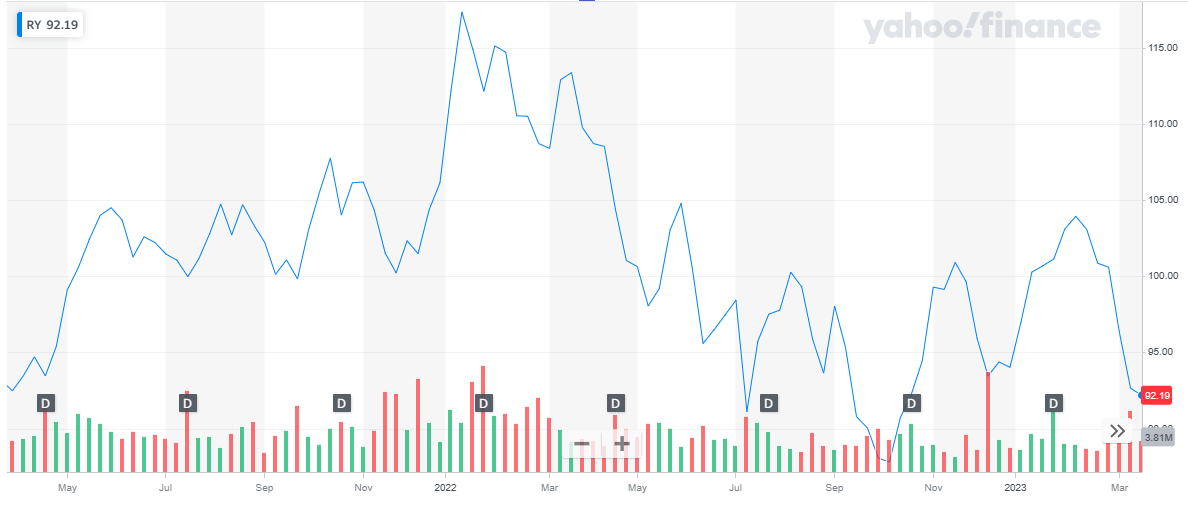

Royal Bank of Canada

Royal Bank of Canada

Royal Bank of Canada (RBC) is a provider of personal, institutional, and business banking products, and wealth and asset management services. Personal and business banking comprises deposit services, loans, insurance, credit cards, mortgages, investments, bancassurance, payments and receipts, business advisory, invoicing and accounting, business insights, and business registration and incorporation services. Institutional banking contains investor services, global asset management, and capital markets. Wealth management services include tax and estate planning, retirement and investment management, and wealth management strategies. RBC operates through a network of branch offices, ATMs, and online portals and serves individual, business, SMEs, institutional, and high and ultra-high net worth individual clients. The group operates in North America, the Caribbean, and Europe. RBC is headquartered in Toronto, Ontario, Canada.

Royal Bank of Canada recently reported its first quarter financial report for the year 2023:

| Q1 2023 | Q1 2022 | Percentage Increase | |

| Total Investment Income | $ 15,094 | $ 13,066 | 15.5 % |

| Net Income | $ 3.2 billion | $ 4,095 billion | -22 % |

| Earnings per share | $ 2.29 | $ 2.84 | -19 % |

- Net revenues reported a 15.5 % annual increase

- Net Income reported a 22 % annual decline

- Earnings per share reported a 19 % annual decline

Royal Bank of Canada has a market cap of $ 128 billion. Its shares are trading at $ 92.19.

The stock started the year 2022 at $ 106.14. Initially, it rose high up to $ 117.33. Then the stock stayed bearish for the remainder of the year and closed the year at $ 94.02. Overall, the stock declined by 11.4 %.

In 2023, the stock again initially spiked high up to $ 103.93 and last closed at $ 92.19. Till date, the stock has declined by 11.5 %.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Thomson Reuters Corporation

Thomson Reuters Corp (Thomson Reuters) is a provider of news and information services. The company provides the intelligence, technology, and expertise that professionals require for finding reliable data and trusted answers. It provides research and workflow products; intuitive tax offerings and automated tax workflow. Thomson Reuters also offers a full suite of offerings spanning tax, legal, regulatory, and compliance functions; and provides real-time, multi-media news and information services to television and cable networks, newspapers, radio stations, and websites worldwide. The company serves financial, corporate, legal, business, government, law, and accounting companies, among others. Thomson Reuters markets products and services directly, online, and also through a network of partners and authorized resellers. It has operations in North America, Europe, the Middle East, Africa, Asia Pacific, Latin America, and South America. Thomson Reuters is headquartered in Toronto, Canada.

Thomson Reuters Corporation recently reported a financial report for the year 2022:

| 2022 | 2021 | Percentage Increase | |

| Net Revenues | $ 6,627 million | $ 6,348 million | 4 % |

| Income from Operation | $ 1,834 million | $ 1,242 million | 48 % |

| Earnings per share | $ 2.88 | $ 11.5 | -75 % |

- Net revenues reported a 4 % annual increase

- Income from Operations reported a 48 % annual decline

- Earnings per share reported a 75 % annual decline

Thomson Reuter Corp has a market cap of $ 60 billion. Its shares are trading at $ 127.12.

The stock started the year 2022 at $ 119.62. it started with a declining trend and dropped to $ 94.39. After that, the stock started rising and eventually closed off the year at $ 114.07. Overall, the stock declined by 5 %.

In 2023, the stock continued to appreciate. To date, it has appreciated by 11.4 %.

Also read:

Also read: