What Is Green Energy?

Green energy is energy generated from natural resources. The major sources of green energy are sunlight, wind, and water amongst others. The reason green energy is becoming increasingly popular is that they don’t harm the environment by emitting greenhouse gases into the atmosphere.

The major forms of green energy are:

- Solar Power

- Wind Power

- Hydropower

- Geothermal Power

- Biomass

- Biofuels

Green energy is a low-cost solution for the increasing energy demand. This will only improve as costs continue to fall, further increasing the accessibility of green energy, especially in the developing world. If you are seeking a steady stream of income, you should invest in REIT stocks.

Green energy is important for the environment. It does not cause damage to the environment and replaces the negative effects of fossil fuels with more environmentally-friendly alternatives. Green energy can also lead to stable energy prices. Since they can be more easily produced, it does not cause price spikes, supply chain disruption, and/or geopolitical crisis. The emergence of clean energy stocks has brought new investment opportunities to the horizon.

List of Best Green Energy Stocks

Here is a list of Best Green Energy Stocks to Buy in 2024:

| Sr. | Company Name | Symbol | Market Cap | Price (As on 12th August 2022) |

| 1 | NextEra Energy | NEE | $ 187 billion | $ 90.47 |

| 2 | Enphase Energy | ENPH | $ 40.5 billion | $ 299.26 |

| 3 | Albemarle | ALB | $ 33 billion | $ 281.57 |

| 4 | Brookfield Renewable Partners | BEP | $ 25.5 billion | $ 39.66 |

| 5 | SolarEdge Technologies | SEDG | $ 18.4 billion | $ 330.52 |

| 6 | Clearway Energy | CWEN | $ 7.7 billion | $ 39.3 |

| 7 | SunRun Inc. | RUN | $ 7.7 billion | $ 36.1 |

| 8 | ChargePoint Holdings, Inc | CHPT | $ 6.36 billion | $ 18.87 |

| 9 | Bloom Energy | BE | $ 5.45 billion | $ 30.46 |

| 10 | TransAlta Corporation | TAC | $ 2.7 billion | $ 9.95 |

Albemarle

Albemarle

Albemarle is a North Carolina-based company that manufactures lithium compounds which are the most important element in Electric Vehicles. It is a global specialty chemicals company with leading positions in lithium, bromine, and refining catalysts. Albemarle powers the potential of companies in many of the world’s largest and most critical industries, from energy and communications to transportation and electronics. Oil stocks are one of the riskier yet most profit-generating sectors.

Albemarle Corporation recently reported its results for the second quarter ending June 30, 2022:

- Net sales were reported at $ 1.48 billion, an increase of 91 % on a year-on-year basis

- Net income was reported at $ 406.8 million, a 4.2 % decline on a year-on-year basis

- Earnings per share were reported at $ 3.46

Albemarle has a market capitalization of over $ 33 billion. Its share is trading at a price of $ 281.57. The stock has been on a bullish trend for the past two years. In 2021, the stock started at $ 147.52, peaked at $ 281.43, and closed off the year at $ 233.77. Overall, the stock appreciated by 59 % during the year.

In 2022, the stock has been volatile with multiple dips and peaks. Overall, the stock appreciated by 20 % during the year.

In 2022, the stock has been volatile with multiple dips and peaks. Overall, the stock appreciated by 20 % during the year.

Get to know the best shipping stocks in 2024.

Clearway Energy

Clearway Energy is one of the leading renewable energy pure-plays in the U.S. It operates an extensive wind, solar, and natural gas portfolio and district energy assets. It owns over 5,000 net MW of installed wind and solar generation projects. The company also owns approximately 2,500 net MW of environmentally sound, highly efficient natural gas generation facilities. ETFs offer a low-cost option to get exposure to oil and gas ETFs.

The company signed a binding agreement to acquire a 413 MW wind portfolio in 2021.

Clearway Energy, Inc. recently reported second-quarter financial results for FY 2022:

- EBITDA was reported at $ 366 million, as compared to $ 365 million last year

- Net Income was reported at $1.15 million as compared to $ 32 million during the same period last year. The main reason behind this huge jump was the one-time $1.29 billion gain from the sale of the Thermal Business.

- A quarterly dividend of $ 0.3604 per share was announced

Clearway Energy has a market capitalization of $ 7.7 billion. Its share is currently trading at a price of $ 39.3. The stock of the company has been volatile in the past two years. The stock started at $ 31.93 at the start of 2021. During the year it went as low as $ 26.19 and as high as $ 38.66. The share closed the year at $ 36.03, representing a 12.8 % increase during the year.

Read:

Bloom Energy

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a power generation platform that converts fuel, such as natural gas, biogas, hydrogen (Best Hydrogen Stocks), or a blend of these fuels, into electricity through an electrochemical process without combustion. Formerly known as Ion America Corp., it changed its name to Bloom Energy Corporation in September 2006. With the gas prices soaring, there are many gas stocks to benefit from.

Bloom Energy Corporation recently announced its financial results for the second quarter ending June 30, 2022:

- Revenue was reported at $ 243,236, as compared to $ 201,039 during the same period last year.

- Net Loss was reported ta $ (118,800), as compared to a net loss of $ (78,359) during the same period last year

- Net Loss per share was reported at $ (0.67)

Bloom Energy has a market capitalization of $ 5.5 billion. Its share is currently trading at a price of $ 30.46. The stock has been extremely volatile in the past two years with huge drops.

In 2021, the stock started off at $ 28.66. In less than a month the stock spiked up to $ 42.3. The stock then dropped as low as $ 18.47. The stock last traded at $ 21.93 before the year ended. This represents a 23.5 % decline over the year.

In 2022, the stock started at $ 21.93, went as low as $ 13.59, and last closed at $ 30.46. This represents a 39 % appreciation during the year.

Also check out: List of Most Volatile Stocks

ChargePoint Holdings Inc.

ChargePoint is facilitating mass electric vehicle adoption as one of the largest charging networks in the world with a strong leadership position in North America and a growing presence in Europe.

ChargePoint has more than 4,000 commercial and fleet customers and has delivered more than 87 million charging sessions to date, but this is just the beginning. The total cumulative investment in EV charging infrastructure in the United States and Europe is expected to be $60 billion by 2030 and $192 billion by 2040. Also read: Best EV Stocks

ChargePoint Holdings, Inc. is a leading electric vehicle (EV) charging network. It recently reported results for its first quarter of fiscal 2023 ended April 30, 2022:

- Revenue was reported at $ 81.6 million, representing an increase of 102 % on a year-on-year basis

- Net loss was reported at $ (89.3) million, as compared to a net loss of $ (46.6) million during the same period last year

ChargePoint Holdings has a market capitalization of $ 6.36 billion. Its share is trading at a price of $ 18.87. During the past two years, the stock picked up a downward trend after peaking at $ 46.1 in Dec 2020. In 2021, the stock went from $ 40.08 to $ 19.05, representing a 110 % decline during the year.

In 2022, the stock started off at $ 19.05 and dropped to $ 10.39 in May’22. It last closed at $ 18.87.

In 2022, the stock started off at $ 19.05 and dropped to $ 10.39 in May’22. It last closed at $ 18.87.

Learn about the best defense stocks in 2024.

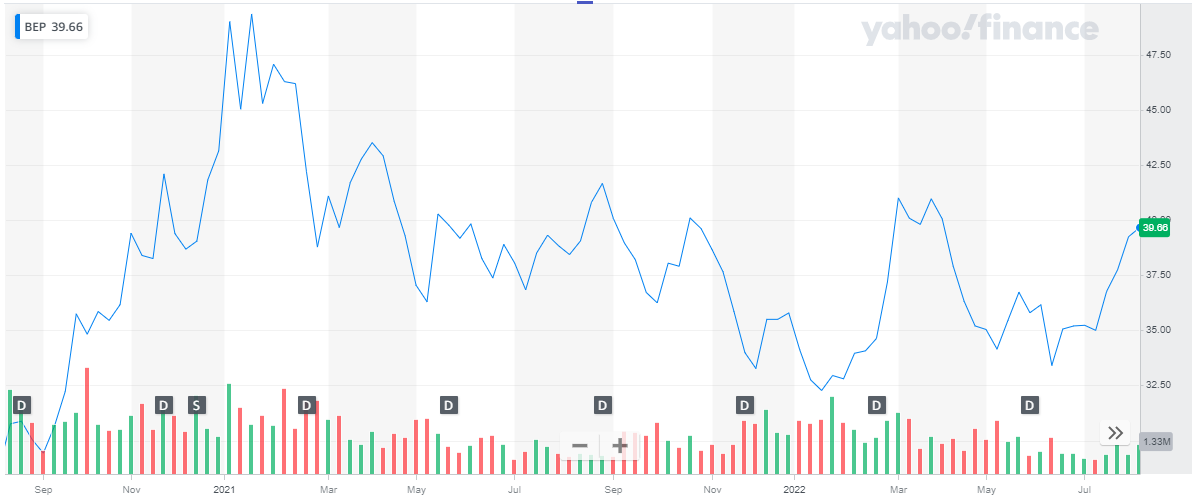

Brookfield Renewable Partners

Brookfield Renewable Partners generates electricity through a host of green options, including hydroelectric, wind, and solar. It is a US-based, operator and developer of renewable power, delivering innovative renewable power solutions that accelerate the world towards a sustainable, low-carbon future. It has a diversified portfolio of hydropower, wind, solar, and storage facilities that extend across 34 states, totaling approximately 7,830 megawatts of generating capacity. As per recent reports, the company has avoided net 11 million metric tons of emissions, annually. Investors are now looking for the finest solar energy stocks to invest in.

Brookfield Renewable Partners recently shares its second-quarter earnings report for 2022:

- Revenues were reported at $ 1.27 million, an increase of $ 25 % on a year-on-year basis

- Net Income was reported at $ 1 million, as compared to the loss of $ (63) million the previous year

Brookfield Renewable Partners has a market capitalization of $ 25.5 billion. Its share is trading at a price of $ 39.66. During the past two years, the share hit the peak of $ 49.36, in Jan 2022. After which it reversed its course and picked a bearish trend. In 2021, the stock depreciated by 17 % ending the year at $ 35.79. Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

In 2022, the stock changes its course again and started rising. To date, the stock has appreciated by 11 %.

In 2022, the stock changes its course again and started rising. To date, the stock has appreciated by 11 %.

NextEra Energy

NextEra Energy is one of the world’s premier providers of green energy. NEE’s first company, Florida Power & Light, is now simply a subsidiary of the much larger company, NextEra Energy. Today, NEE generates electricity for approximately 11 million people in Florida and beyond through wind, solar, nuclear, coal, and natural gas. By using the stock signals, you can avoid hours of technical analysis to understand the market.

NextEra Energy recently reported second-quarter 2022 financial results:

- Total revenues were reported at $ 5.1 billion

- Net Income was reported at $ 1.38 billion

- Earnings per share were reported at $ 0.81

NextEra Energy has a market capitalization of $ 186.9 billion. Its share is trading at a price of $ 90.47. The share has remained extremely volatile in the past two years with huge dips throughout.

Get to know the list of crypto mining companies that are leading the industry.

In 2021, the share started trading at a price of $ 77.15. Throughout the year, the stock dipped as low as $ 70.7 and peaked at $ 93.36. Overall, the stock appreciated by 36.3 % in 2021.

In 2022, the stock started at $ 93.36, and it dropped to $ 72.5 during the first month of trading. During the year the share experienced huge drops twice. To date, the stock has declined by 3 %

Get to know the best DRIP stocks to buy now.

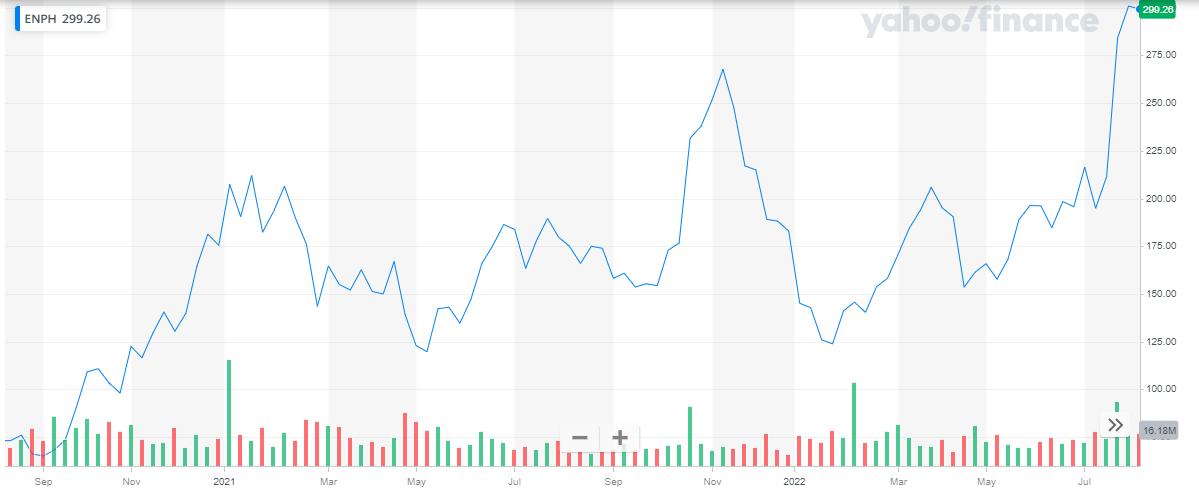

Enphase Energy

Enphase Energy is a leader in the domestic and international solar industry. The company’s semiconductor-based microinverters convert solar rays into usable energy and then, with the help of proprietary software, monitor and control that stored energy. These systems can be sold to both solar distributors and individual homeowners.

Enphase Energy recently reported financial results for the first quarter of 2022:

- The company reported a record quarterly revenue of $ 441.3 million, an increase of 7 % from the previous year’s same period

- Net income was reported at $ 51.8 million, a decrease of 1.5 % from the previous year’s same period

- Earnings per share were reported at $ 0.37

Enphase Energy has a market capitalization of $ 40.5 billion. Its share is trading at a price of $ 299.26. In the past two years, the stock remained bullish, despite being volatile. The cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

In 2021, the stock started at $ 175.47 and after peaking at $ 267.64 closed at $ 182.94. This represents a 4.3 % appreciation during the year.

In 2021, the stock has appreciated by 64 %, to date, from a price of $ 182.94 to $ 299.26

Check our updates for NASDAQ Forecast.

SunRun

SunRun Inc. is a leading home solar, battery storage, and energy services company. It was founded in 2007. Sunrun pioneered home solar service plans to make local clean energy more accessible to everyone for little to no upfront cost. Sunrun’s innovative home battery solution brings families affordable, resilient, and reliable energy. The company can also manage and share stored solar energy from the batteries to provide benefits to households, utilities, and the electric grid while reducing our reliance on polluting energy sources. But it’s always wise to limit your exposure to risky investments like best altcoins.

Sunrun is the nation’s leading provider of residential solar, battery storage, and energy services. It recently announced its financial results for the quarter ended June 30, 2022:

- Total revenue was reported at $ 584.5 million, a 46 % increase from the previous year’s same period

- Net loss was reported at $ (209.7) million, as compared to a net loss of $ (213.4) during the same period last year

- Net loss per share was reported at $ (0.06)

- Customer Additions were 34,403, including 25,339 Subscriber Additions

As of June 30, 2022, Sunrun had 724,177 Customers, including 614,280 Subscribers. Customers grew 21% in the second quarter of 2022 compared to the second quarter of 2021.

Check out the best fintech stocks to buy now.

SunRun has a market capitalization of $ 7.7 billion. Its share is trading at a price of $ 36.12. In the past two years, the stock started its bearish run after peaking at $ 96.5 on the first day of trading in 2021. Over the course of the year, the stock declined by 51 % during the year.

In 2022, the stock continues its bearish trend and went from $ 34.3 to the lows of $ 19.98. After hitting the low price, the stock started rising again. Overall, the stock appreciated by 5 % in 2022 to date.

Also, learn about top shipping stocks in 2024.

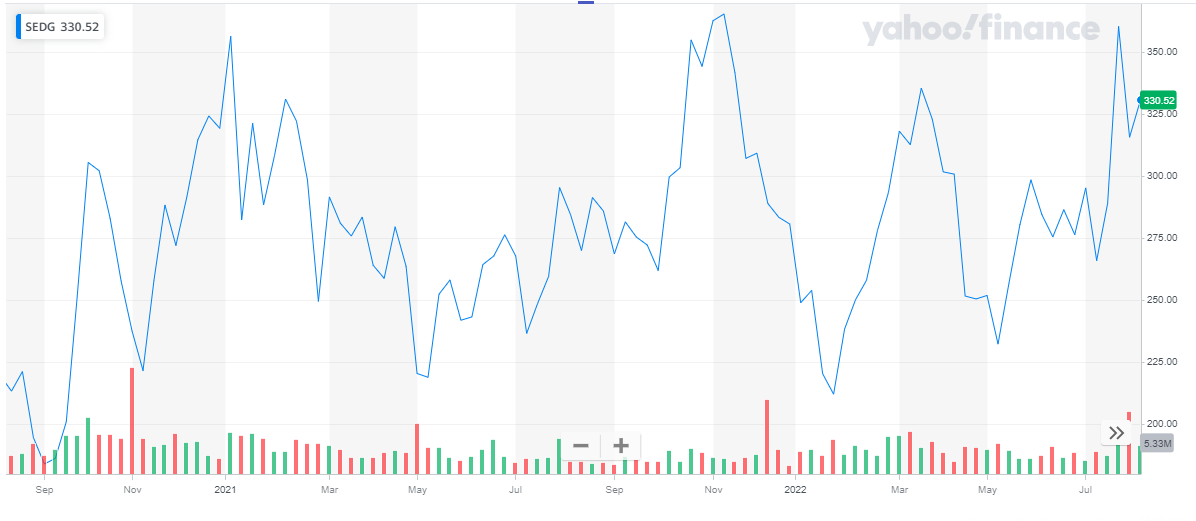

SolarEdge Technologies

SolarEdge Technologies specializes in inverter systems for solar installations around the globe. This makes them an important part of the global clean energy boom – and one of the best green energy stocks to watch going forward.

Get to know the best tech stocks to invest in now.

The company is growing and is investing to increase its manufacturing facility.

SolarEdge Technologies, Inc is a global leader in smart energy technology. It recently announced its financial results for the second quarter ended June 30, 2022:

- Revenues were reported at $ 727.8 million, as compared to $ 480 million during the same period last year. This represents an increase of 52 % on a year-on-year basis

- Net income was reported at $ 15.1 million, as compared to $ 45.1 million during the same period last year. This represents a decline of 54 % on a year-on-year basis.

- Earnings per share were reported at $0.26

SolarEdge Technologies has a market capitalization of $ 18.4 billion. Its share is trading at a price of $ 330.52. The stock of SolarEdge technologies has remained pretty volatile in the past two years. Semiconductor stocks are one of the best investment opportunities.

In 2021, the stock experienced multiple dips and peaks. From a price of $ 319.12 the stock went as low as $ 218.87 and closed off the year at $ 280.57. Overall, the stock declined by 12 % during the year

The stock started at $ 280.57 on the first trading day of 2022. The stock dropped as low as $ 212.07 and last closed at $ 330.52. Overall, the stock appreciated by 18 % to date.

Get to know about top Infrastructure stocks to invest.

TransAlta Corporation

TransAlta Corporation engages in the production and sale of electric energy. The company is a non-regulated electricity generation and energy marketing company with an aggregate net ownership interest of 7,976 megawatts (MW) of generating capacity operating in facilities having approximately 9,697 MW of aggregate generating capacity. The company also has facilities under construction with a net ownership interest of 456 MW, with an aggregate generating capacity of 681 MW. It focuses on generating electricity in Canada, the United States, and Australia through its diversified portfolio of facilities fueled by coal, gas, hydroelectric, wind, and geothermal resources.

The company is divided into two segments:

- Generation – This segment is responsible for constructing, operating, and maintaining electricity generation facilities.

- Commercial Operations and Development – This segment is responsible for managing the sale of production, purchasing natural gas, transmission capacity, and market risks associated with the company’s generation assets, and for non-asset-backed trading activities.

TransAlta recently reported second-quarter financial results for the year 2022:

- Revenues were reported at $ 458 million, a decline of 26 % from the same period last year

- Net loss was reported at $ (80) million, as compared to a net loss of $ (12) from last year’s same period

- Net loss per share was reported at $ 0.30 per share

TransAlta has a market capitalization of $ 2.7 billion. Its share is trading at a price of $ 9.95. The stock of TransAlta has remained bullish over the past two years. There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

In 2021, the stock started at $ 7.59 and closed at $ 9.95. This represents a 31 % appreciation during the year.

In 2022, the stock went from $ 11.12 to $ 9.95, to date. The stock peaked at $ 11.62 in June 2022. To date, the stock has declined by 10.5 %.

We also have covered the best ETFs to buy in all categories.

CONCLUSION

Green energy has the capacity to replace fossil fuels in the future. But we might have to make the best use of multiple sources to achieve this. Therefore, by bringing together multiple green energy sources along with the advancements that are being made with regard to the production and development of these green energy production I believe that fossil fuels could be replaced with green energy.

Also learn about Best Day Trading Stocks

Green energy is all ready to be a part of the upcoming future, offering a cleaner alternative to many of today’s energy sources. By smart and efficient use of green energy solutions, we can create a totally sustainable future for our energy provision, without damaging the world.

You may also like reading: