What are Fuel Cell Stocks?

A fuel cell is a cell that generates electric power using the constant flow of fuel (usually hydrogen) with the addition of air (oxygen). The process is clean, quiet, and highly efficient, and the technology has many applications, notably in alternative fuel vehicles.

Benefits of Fuel Cell Technology

- High Efficiency – Fuel cells can attain over 80% energy efficiency

- Good reliability – It generated good quality energy that does not degrade over time.

- Noise – The energy generation process is much smooth and noise-free as compared to conventional energy production.

- Environmentally beneficial – Fuel cells have very low CO2 and harmful pollutant emissions as compared to traditional energy-producing methods. The emergence of clean energy stocks has brought new investment opportunities to the horizon.

- Easy and lightweight to handle comes in a compact size

Stock trading advisory websites help investors make the right financial decisions. Investors always choose the best brokers that better suits his/her trading goals.

Disadvantages of Fuel Cell Technology

- Fuel Cell is expensive to manufacture due to the high cost of catalysts (platinum)

- Lack of infrastructure to support the distribution of hydrogen

- A lot of the currently available fuel cell technology is in the prototype stage and not yet validated.

- Hydrogen is expensive to produce and not widely available. Hydrogen stocks worth investing in 2023

- Using electrolysis to produce hydrogen and then using it again to produce electricity causes significant energy losses

- Hydrogen storage and transport need to be done at low temperatures and high pressure, which itself requires substantial energy

- Hydrogen’s highly combustible nature adds to the challenges in its storage and transport

List of Best Fuel Stocks to Buy in 2023

| Sr. | Company Name | Symbol | Market Cap | Price ( As on 18th August 2022) |

| 1 | Fuel Cell Energy | FCEL | $ 1.7 billion | $ 4.64 |

| 2 | Ballard Power Systems | BLDP | $ 2.25 billion | $ 7.55 |

| 3 | Plug Power | PLUG | $ 15.4 billion | $ 26.5 |

| 4 | Bloom Energy Corporation | BE | $ 4.5 billion | $ 26.57 |

| 5 | Hyzon Motors | HYZN | $ 512 million | $ 2.065 |

| 6 | Nikola | NKLA | $ 2.655 billion | $ 6.6 |

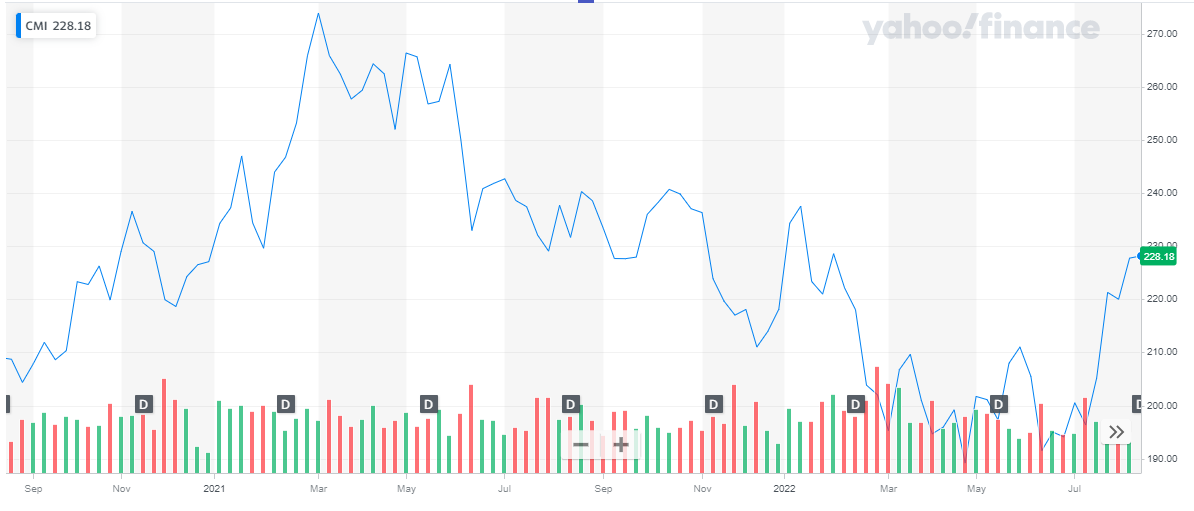

| 7 | Cummins Inc. | CMI | $ 32.2 billion | $ 230.2 |

| 8 | Air Products and Chemicals Inc. | APD | $ 28.24 billion | $ 267.6 |

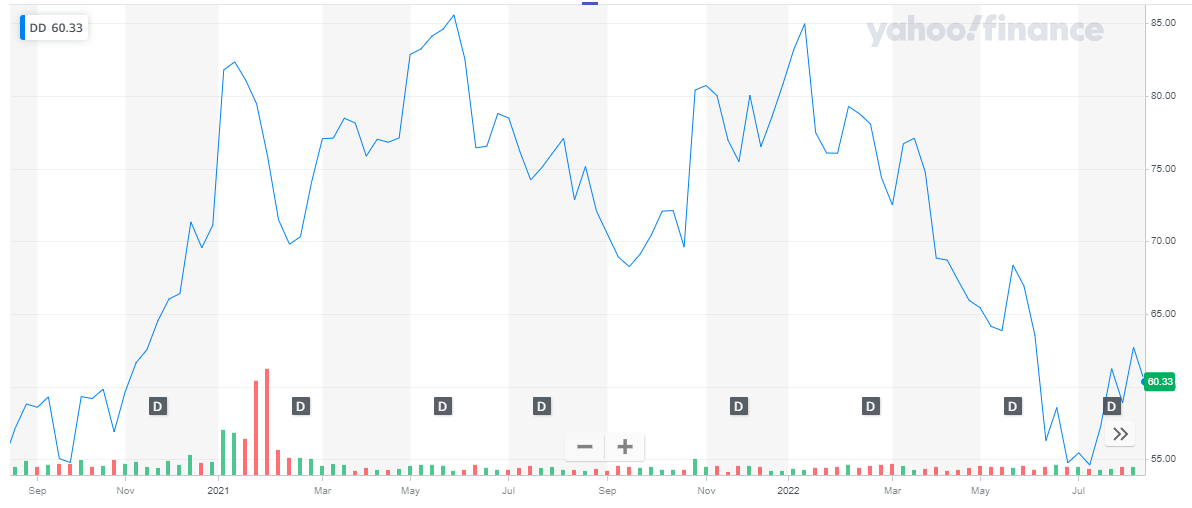

| 9 | DuPont de Nemours Inc | DD | $ 30.2 billion | $ 60.32 |

| 10 | Linde | LIN | $ 151.9 billion | $ 310.17 |

Fuel Cell Energy

Fuelcell Energy manufactures and operates fuel cell power plants. Its specific focus is on SureSource HFC power plants. These resource plants create hydrogen that’s suitable for transportation and industrial applications. These products enable customers to generate ultra-clean power on-site. Green energy stock is all ready to be a part of the upcoming future.

FuelCell Energy aims to become a global leader in decarbonizing power. The company is continuously working towards producing low-to-zero-carbon power, capturing carbon and other greenhouse gasses while producing power, and supplying green and blue hydrogen power

Additionally, Fuel Cell Energy is also focusing on ways to store energy from intermittent renewable energy by converting it to hydrogen, which it can convert back to electricity when needed. The company is investing in its power generation and ways to expand it. With increased manufacturing capacity, Fuel Cell will be able to better compete in the Fuel Cell Energy market and also fulfill the company’s needs.

FuelCell Energy, Inc. is a global leader in decarbonizing power and producing hydrogen through our proprietary, state-of-the-art fuel cell platforms to enable a world empowered by clean energy. It recently reported its financial results for the quarter ending April, 20th 2022:

- Revenues were reported at $ 16.4 million, as compared to $ 14 million during the same period last year

- Gross loss of reported at $ (7.3) million compared to $ (4.8) million during the same period last year

- Loss from operations was reported at $ (28.2) million compared to $ (17.4) million during the same period last year

Fuel Cell has a market cap of $ 1.7 billion. Its share is currently trading at $ 4.64. Investing in fintech stocks is a smart investment move today.

The stock of FCEL picked up pace during Nov 2020. After being stagnant for many months, the stock started rising and peaked at $ 26.2. In four months, the stock of FCEL increased 12-fold. After that, the stock reversed its course and is following a bearish trend till today. Overall, in 2021, the stock depreciated by 54 %.

In 2022, the stock started trading at a price of $ 5.2 and last closed at $ 4.64. This represents an 11 % decline to date.

Also read:

Ballard Power Systems

Ballard Power Systems makes hydrogen fuel cells for automobiles. The Canadian company also manufactures proton exchange membrane fuel cell products. Some of Ballard Power Systems’ products include bus & tram applications, material handling, portable power, and engineered services. Ballard Power Systems also makes clean hydrogen fuel cells for automobiles. Also learn about Best Day Trading Stocks.

The company continues to score new deals with international companies looking to benefit from its innovative technology. Some of these partnerships include companies like Audi, which has a deal running through at least 2022.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

Ballard Power recently announced consolidated financial results for the second quarter ended June 30, 2022

- Revenue was reported at $ 20.9 million, a 16 % decline year-over-year

- Net loss was reported at $ (55.8) million

- Earnings per share were reported at $ (0.19)

Ballard Power Systems has a market capitalization of $ 2.25 billion. Its share is trading at a price of $ 7.55.

For the major part of 2022, the stock of Ballard Power has remained bearish. The stock started in 2021, at a price of $ 23.4. During the year, the stock went as high as $ 38.68 and closed the year at $ 12.56. Overall, the stock declined by 46 %.

In 2022, the stock started at $ 12.56 and last closed at $ 7.55. This represents a 40 % decline to date.

We also have covered the best ETFs to buy in all categories.

Plug Power

Plug Power is a pioneer in the hydrogen fuel cell industry. It is an HFC development company based in New York. Plug Power created the first commercially viable market for hydrogen fuel cell technology. It has deployed an industry-leading 50,000 fuel cell system for the e-mobility market (using electric powertrain technologies to power vehicles and fleets). Plug Power owns the title of one of the world’s largest hydrogen buyers. And it operates a leading hydrogen refueling network in North America.

Get to know about top Infrastructure stocks to invest.

The cells of Plug Power replace the conventional batteries in electric-powered vehicles and other equipment. Plug Power developed an incorporated hydrogen technology storage system that allows fuel cells to recharge in a matter of minutes, as compared to the many hours required by traditional batteries need. The company’s system also integrates fuel cells produced by both Plug Power and Ballard Power Systems.

Plug Power Inc, a leading provider of turnkey hydrogen solutions for the global green hydrogen economy, recently announced its 2022 second-quarter results:

- Revenue was reported at $ 151.3 million, a 17.7 % increase from the previous year’s same period

- Net Loss was reported at $ (173.3) million

- Net loss per share was reported at $ (0.3)

Plug Power has a market capitalization of over $ 15.4 billion. Its share is trading at a price of $ 26.5. The stock of Power Plug has been volatile in the past 2 years.

In 2021, the stock started trading at a price of $ 33.91. It peaked at $ 66.87 in the first month of 2021 and after that started declining. The stock closed off the year at $ 28.23, representing a 17 % decline during the year.

In 2022, the stock started off at $28.23, dropped to $ 15.03, and last closed at $ 26.51, representing a 6 % decline to date.

Semiconductor stocks are one of the best investment opportunities.

Bloom Energy Corporation

Bloom Energy is a California-based company manufacturing solid oxide fuel cells that produce hydrogen electricity on site. The company focuses on converting conventional energy plants to zero-carbon emissions plants for its clients. Since the government finds its services very valuable, Bloom Energy is subsidized by federal green incentives programs. Bloom Energy has installed over 300 megawatts worth of hydrogen fuel cells. Get to know the best tech stocks to invest in now.

The company has announced that it will be deploying a 100% hydrogen-based system in South Korea. Its existing partnership with SK E&C has already sold 120 megawatts of fuel cells in South Korea, generating over $1 billion in revenue for the company.

Bloom Energy Corporation recently announced financial results for its second quarter ended June 30, 2022:

- Revenue was reported at $ 243.2 million

- Net Loss was reported at $ (118.8) million

- Loss per share was reported at $ (0.67)

Bloom Energy has a market cap of $ 4.5 billion. Its share is trading at a price of $ 26.57. The stock has been very volatile in the past two years.

In 2021, the stock started at $ 28.6, went as high as $ 42.36, and closed off the year at $ 21.93. Overall, the stock declined by 23.3 % during the year.

Also, learn about top shipping stocks in 2023.

In 2022, the stock started at $ 21.93, went as high as $ 31.46, and last closed at $ 25.25. Overall, the stock appreciated by 15 % during the year.

Hyzon Motors

Hyzon Motors

Hyzon Motors focuses on manufacturing fuel cell-powered vehicles for heavy-duty trucks, buses, and coaches. Its heavy trucks have a range of 400 miles with a full tank. Its trucks have several use cases, including cargo trucks, milk trucks, and sewage trucks. But it’s always wise to limit your exposure to risky investments like best altcoins.

Hyzon motors inc. recently reported first quarter 2022 financial and operational results:

- Revenues were reported at $ 0.4 million

- Net loss attributable to Hyzon of $ (9.1) million

- Loss per share was reported at $ (0.04)

Hyzon Motors has a market cap of $ 512 million. Its share is trading at a price of $ 2.065. During the past two years, the stock has been on a bearish run. The company went public in 2021.

In 2022, the stock started at $ 6.49 and last closed at $ 2.05. This represents a 68 % decline to date.

Check our updates for NASDAQ Forecast.

Nikola

Nikola has produced a number of zero-emission vehicles since 2016. The company became most famous for its introduction of the Nikola-One hydrogen-powered electric vehicles. It operates through two business units:

- Truck – The business unit develops and commercializes battery hydrogen-electric and battery-electric semi-trucks for the trucking sector.

- Energy – The Energy business unit develops and constructs a network of hydrogen fueling stations; and offers BEV charging solutions for its FCEV and BEV customers, as well as other third-party customers.

The cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

The company also assembles, integrates, and commissions its vehicles in collaboration with its business partners and suppliers. Nikola recently entered an agreement with Arizona Public Service Company for the development of hydrogen-based fuel solutions in the transportation sector.

Nikola corporation recently reported second-quarter 2022 results:

- Revenues were reported at $ 18.1 million

- Net loss was reported at $ (173) million

- Net loss per share was reported at $ (0.41)

Nikola Corp has a market capitalization of $ 2.655 billion. Its share is trading at a price of $ 6.6. In the past two years, the stock of the company has been on a bearish trend.

Get to know the best DRIP stocks to buy now.

In 2021, the stock started at $ 15.26 and closed at $ 9.87, representing a 35 % decline during the year.

In 2022, the stock traded at $ 9.87 and last closed at $ 6.6. This represents a 33 % decline to date

Cummins Inc.

Cummins Inc.

Cummins is an American multinational design and manufacturing company for multiple automobile parts. These parts include hydrogen fuel cell systems, filtration, engines, air handling, controls, and more. Headquartered in Indiana, Cummins sells its products in a network of over 190 countries and territories with approximately 6,000 dealers. Get to know the list of crypto mining companies that are leading the industry.

Its recent partnerships and deals include:

- Cummins partnered with Enbridge Gas on a project which aims to reduce its carbon footprint and greenhouse gas emissions in Ontario. This $5.2 million pilot sustainability project is now up and running, serving the Markham community well.

- Cummins entered an ongoing acquisition deal with Rush Enterprises to purchase its momentum fuel technology.

Cummins recently shared its financial results for the quarter ending June 30th, 2022:

- Revenue was reported at $ 6.6 billion, a 7.8 % increase on a year-on-year basis

- Net Income was reported at $ 702 million, a 17 % increase on a year-on-year basis

- Earnings per share were reported at $ 4.97

Cummins has a market capitalization of $ 32.2 billion. Its share is trading at a price of $ 230.2. The stock of Cummins has been pretty volatile in the past two years. The stock started the year 2021 at a price of $ 227.1 with a bullish trend. The stock peaked at $ 273.92 and then reversed its course. Throughout the year, the share remained volatile with multiple dips and peaks and finally closed off the year at $ 218.14. Overall, the stock declined by 4 %.

Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2023.

In 2022, the stock started at $ 218.14 and after multiple dips and peaks last closed at $ 228.15. Overall, the stock appreciated by 4.5 % to date.

Air Products and Chemicals Inc

Air Products and Chemicals Inc

Air Products is one of the world leaders in supplying industrial gases. It’s a global leader in liquefied natural gas (LNG) processing technology and equipment. The Company provides industrial gases and related equipment to dozens of industries, including refining, chemical, metals, electronics, manufacturing, and food and beverage. We supply a unique portfolio of atmospheric and process gases, equipment, and services. It is also one of the world’s largest suppliers of merchant hydrogen and a leader in hydrogen fuel infrastructure. Investors are now looking for the finest solar energy stocks to invest in.

Air Products reports third quarter financial results for the fiscal year 2022:

- Sales were reported to be $ 3.2 billion, a 22 % increase from the previous year’s same period

- Net income was reported at $ 587 million, a 10 % increase from the previous year’s same period

- Earnings per share were reported at $ 2.62

Air Products and Chemicals has a market capitalization of $ 28.24 billion. Its share is trading at a price of $ 267.6.

The stock of Air Products and Chemicals has been very volatile in the past two years. In 2021, the stock started at $ 273.22, went as high as $ 310, and closed at $ 304.26 after multiple declines and rises throughout the year. Overall, the stock appreciated by 11.4 %.

In 2022, the stock started at $ 304.26, went as low as $ 219.38, and last closed at $ 262.79. This represents a 14 % decline to date.

Learn about the best defense stocks in 2023.

DuPont de Nemours Inc.

DuPont de Nemours, Inc. operates as a holding company, which engages in the development of specialty materials, chemicals, and agricultural products. It operates through the following segments:

- Electronics & Imaging – This segment provides permanent and process chemistries for the fabrication of printed circuit boards to include laminates and substrates, electroless and electrolytic metallization solutions, as well as patterning solutions and materials and innovative metallization processes for the metal finishing, decorative, and industrial applications.

- Nutrition & Biosciences – This segment provides solutions for the global food and beverage, dietary supplements, pharma, home and personal care, energy, and animal nutrition markets.

- Transportation & Industrial – This segment engineering resins, adhesives, silicones, lubricants, and parts to engineers and designers in the transportation, electronics, healthcare, industrial, and consumer end-markets to enable systems solutions for demanding applications and environments

- Safety & Construction – This segment provides engineering products and integrated systems for a number of industries including, worker safety, water purification and separation, aerospace, energy, medical packaging, and building materials.

- Non-Core – This segment supplies key materials for the manufacturing of photovoltaic cells and panels, including SOLAMET metallization pastes, TEDLAR back-sheet materials, and FORTASUN silicone encapsulants and adhesives.

Also check out: List of Most Volatile Stocks

Dupont Nemours has a market capitalization of $ 30.2 billion. Its share is trading at a price of $ 60.32.

The stock started in the year 2021 at a price of $ 71.11. During the year, the stock went through multiple dips and peaks but remained bullish. The stock closed the year at $ 80.78, representing a 14 % decline during the year.

In 2022, the stock started at a price of $ 80.78. During the year, the stock dropped as low as $ 54.6 and last closed at $ 60.36. To date, the stock declined by 25 %.

Linde

Linde

Linde Plc engages in the production and distribution of industrial gases. It operates through the following segments: Americas; Europe, Middle East, and Africa (EMEA); Asia and South Pacific (APAC); and Engineering. The company also designs and constructs turnkey process plants for third-party customers, as well as for the gas businesses in various locations, such as olefin, natural gas, air separation, hydrogen, and synthesis gas plants. With the gas prices soaring, there are many gas stocks to benefit from.

Linde Pls. recently reported its second-quarter earnings report for the fiscal year 2022:

- Sales were reported at $ 16.7 billion, an increase of 12.5 % from the previous year same period

- Net Income was reported at $ 1.55 billion, a 15 % decline from the previous year same period

- Earnings per share were reported at 3.07

Linde Plc. has a market capitalization of $ 151.9 billion. Its share is trading at a price of $ 310.17.

The stock of the company has been on a bullish trend in the past two years.

In 2021, the stock started off at $ 263.51 and closed off the year at $ 346.43. This represents a 31 % appreciation during the year.

In 2022, the stock started trading at $ 346.43. The stock exhibited volatile behavior in 2022. After multiple dips and peaks, the stock last closed at $ 304.73. This represents a decline of 12 % to date.

Read Best Crypto Staking Platforms.

Conclusion

Conclusion

Fuel cell technology is one of the solutions that is gaining significant attention both in the technological field as an advancement and from the financial point of view also. Investing in fuel cell stocks can prove to be very lucrative as the technology goes mainstream.

By investing in fuel cell stocks, you will be promoting the use of alternative energy and helping drive the agenda for environmental protection and sustainable growth. I believe the above-mentioned companies engaged in the production of Fuel Cell energy are progressing towards growth based on government incentives and a growing market.

You may also like reading:

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy