Consumer staples are the basic goods we consume in our daily lives. All the companies that manufacture, distribute and sell products like food, beverages, and personal hygiene products fall under this category. The consumer staple industry is less prone to economic ups and downs. Stock trading advisory websites help investors make the right financial decisions.

Types of Consumer Staples Stocks

The consumer staples sector can be categorized as follows:

- Retail – Retail stores like Walmart and Target fall under this category

- Food and beverage – PepsiCo and Coca-Cola fall under this category

- Household products – Furniture, decor, and cleaning products fall in this category

- Personal products – Companies like Estee Lauder and L’Oréal fall under this category

- Tobacco

Benefits of Investing in Consumer Staple Stocks:

- Consumer staple stocks are among the sound investments. They are not affected by the overall economic conditions. They are the best stocks to have in your portfolio during a recession.

- Solid Dividend Income – Consumer staple stocks are good dividend-paying stocks. These companies have a good history of paying dividends for good consecutive years.

- Good performing stable companies – Consumer staple companies are usually having a decades-long history of operations. Since consumer products never go out of demand, consumer staple stocks are considered long-term value investments. Investing in Long-term stocks involves building wealth over a long period.

Get to know about top Infrastructure stocks to invest in.

Despite the benefits, no industry is free from the risks and challenges of business. The risk and challenges of investing in consumer staple stocks are listed below:

Risks of investing in Consumer staple stocks

- Slow growth companies – Consumer goods have a very low margin of profit. Therefore, these companies usually have fewer growth opportunities. Investors always choose the best brokers that better suits his/her trading goals.

- Rising interest rates directly affect consumer spending. And this in return affects consumer spending which impacts the overall sector

- The shift in consumer preferences- the shift of consumers towards e-commerce is hugely affecting the industry, especially the retail companies. More and more efforts are required from the company’s side to keep up their sales.

Semiconductor stocks are also one of the best investment opportunities.

List of the Best consumer Staple Stocks

Some of the best consumer staple stocks are listed below for investment:

| Sr. | Company Name | Symbol | Share Price (As of 27th May 2022) | Market Capitalization |

| 1 | Coca-Cola | KO | $ 64.3 | $ 280.4 billion |

| 2 | Costco Wholesale | COST | $ 470.76 | $ 208.6 billion |

| 3 | Procter & Gamble | P&G | $ 148.72 | $ 356 billion |

| 4 | PepsiCo | PEP | $ 171.77 | $ 237.5 billion |

| 5 | Nestle SA | NSRGY | $ 121.58 | $ 335.6 billion |

| 6 | Walmart Inc. | WMT | $ 128.48 | $ 354 billion |

| 7 | Philips Morris International | PM | $ 106.97 | $ 166.6 billion |

| 8 | Unilever | UL | $ 43.98 | $ 112.3 billion |

| 9 | Estee Lauder | EL | $ 251.86 | $ 90 billion |

| 10 | L’Oréal SA | LRLCY | $ 324.8 | $ 174.2 billion |

Coca-Cola

Coca-Cola is the world’s largest and most popular beverage company. It manufactures and distributes various nonalcoholic beverages worldwide.

Coca-Cola reported quarterly results for 2022:

- Net revenues of $10.5 billion, an increase of 16% from the previous year’s first quarter

- Net Income of $ 2.7 billion, an increase of 24 % from the previous year’s first quarter

- EPS of $ 0.64, an increase of 23 % from the previous year’s first quarter

Coca-Cola has been consistently paying dividends for many decades. It has also announced a $ 0.44 dividend for the first quarter.

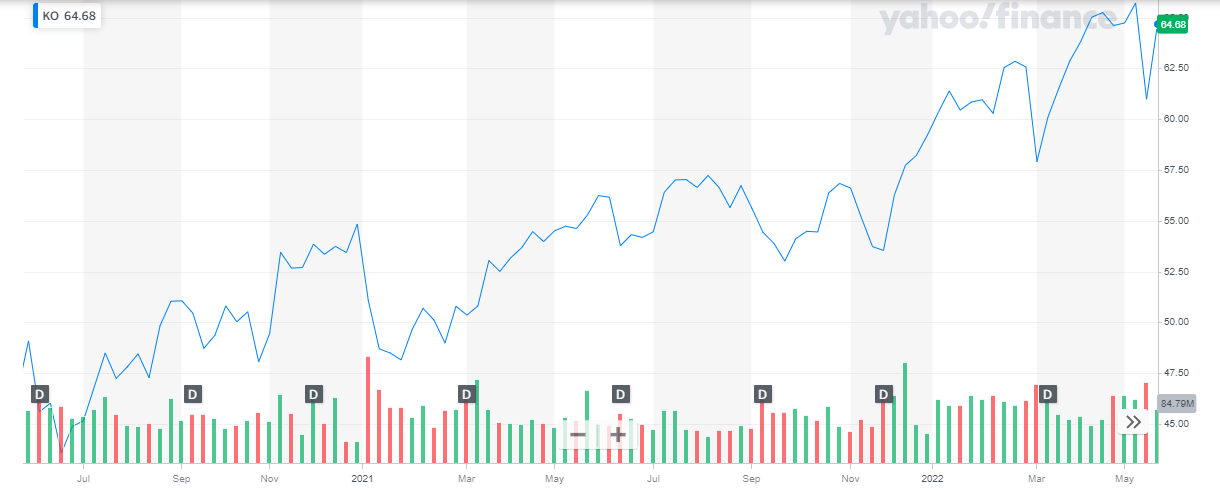

The share of KO is currently trading at $ 64.3. The company has a market valuation of $ 280 billion. The below chart shows the stock performance of KO in the market. The stock of Coca-Cola has been consistently rising. In 2021, the stock appreciated by 8 %, from $ 54.84 to $ 59.21. During the current year, the stock has appreciated by 18 %.

Oil stocks are one of the riskier yet most profit-generating sectors.

Oil stocks are one of the riskier yet most profit-generating sectors.

Costco Wholesale

Costco Wholesale engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, the United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China, and Taiwan. It offers branded and private-label products in a range of merchandise categories. The company offers sundries, dry groceries, candies, coolers, freezers, liquor, and tobacco and deli products. If you are seeking a steady stream of income, you should invest in REIT stocks.

Costco recently shares its third-quarter results for FY 2022:

- Total Revenue of $ 52.6 billion

- Net income was $1.4 billion

- EPS was $3.04 per diluted share

Costco currently operates 830 warehouses, which includes

- The United States and Puerto Rico – 574

- Canada – 105

- Mexico – 40

- Japan – 30

- United Kingdom – 29

- Korea – 16

Costco also operates e-commerce sites in the U.S. and many other countries.

Costco’s market capitalization is around $ 208 billion. Its share is currently trading at $ 470.76. The below chart shows the stock performance of Costco for the past two years. After having a stagnant 2021, the stock of Costco started rising after May’21. Since then, it has been appreciated immensely. During the year 2021, the stock appreciated by almost 50%.

During the current year, the stock hit the peak of $ 600, in April. After that, the stock took a huge dip. To date, the stock has declined by 17%.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Thinking to invest in bonds? Get to know whether its a good decision to invest in bonds or stocks.

Procter & Gamble

P&G serves consumers around the world with one of the strongest portfolios of consumer products. Some of the most popular products under the P&G umbrella are:

- Always

- Ariel

- Gillette

- Head and Shoulders

- Oral-B

- Pampers

- Tide

- Vicks

P&G reported the third-quarter report for the year 2022:

- Net sales were reported to be $ 19.4 billion, an increase of 7 % from the previous year’s same period

- Earnings per share were $ 1.33, an increase of 6 % from the previous year

P&G has been paying a dividend for over a century. It recently declared an increased dividend of $0.9133 per share.

Procter and Gamble have a market capitalization of over $ 356 billion. Its shares are currently trading at a price of $ 148.72. The below chart shows the stock performance of P&G over the past two years. The stock exhibits volatility in the below graph. Despite being volatile, the stock has been steadily appreciating. The stock picked up pace after September’2021. In 2021, the stock appreciated by 7 %. In 2021, the stock continued its volatility. To date, the stock has declined by roughly 10 %. Get to know the best vaccine stocks to invest in now.

PepsiCo

PepsiCo

PepsiCo is one of the leading beverage names around the globe. But it’s more than just a beverage company. It has many other popular brands under its umbrella which include:

- Frito-Lay

- Gatorade

- Quaker

- Tropicana

- SodaStream

PepsiCo recently published its first-quarter report for the year 2022:

- Net Revenue of $ 16.2 billion, an increase of 9.3 % from the previous year’s same period

- Net Income of $ 4.3 billion. This more doubled because of the gain from selling off juice brands during the quarter

- Earnings per share of $ 3.06

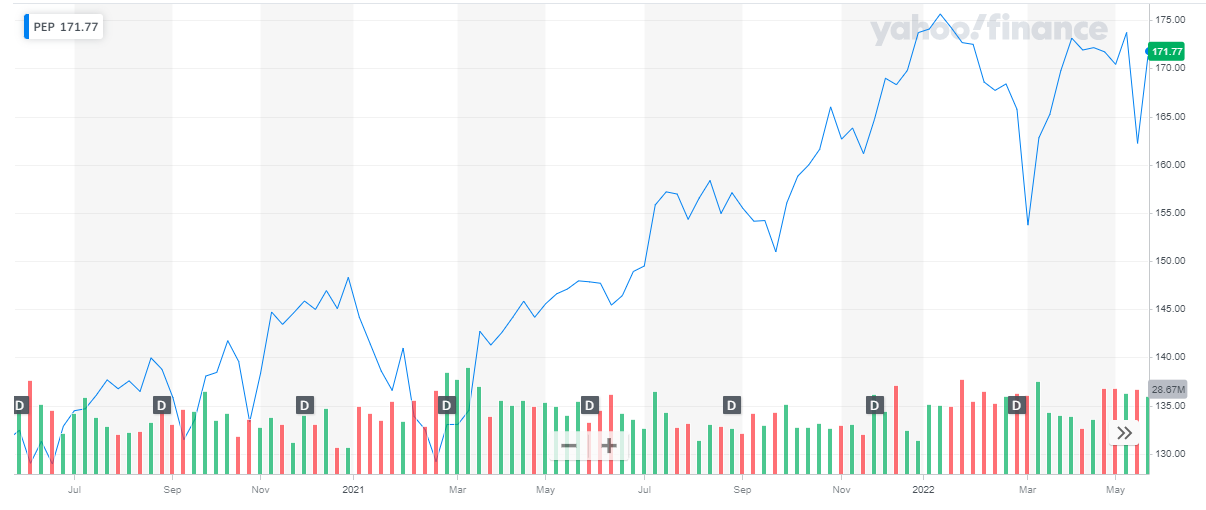

PepsiCo has a market capitalization of over $ 237.5 billion. Its shares are trading at a price of $ 171.77. the below chart shows the performance of PepsiCo’s share in the market for the past two years. The share of PepsiCo has been on a rising streak since 2020. In 2021, the stock appreciated by 16 % closing off the year at $ 171.77. In the current year, the stock continued its volatile behavior and has maintained its price level.

Also learn about:

Also learn about:

Nestle SA

Nestle is one of the oldest operating food and beverage companies. It has been serving for more than 150 years and has spread its network across 186 countries via its 2000-plus brands. The company offers a variety of product categories, which include:

- Baby Food – Cerelac, Nido

- Bottled water – Nestle Pure Life

- Cereals – Nesquik, cheerios

- Chocolate and confectionery products – KitKat, Milky bar, Smarties

- Coffee – Nescafe

Also check out: List of Most Volatile Stocks

Nestle recently announced first-quarter results for the year 2022 ending 31st March 2022:

- Total sales were reported at CHF 22.2 ($ 23.19) billion, an increase of 5.4 % from the previous year’s first quarter

Nestle has a market capitalization of $ 335.5 billion. Its share is trading at a price of $ 121.58. The below chart shows the stock performance of Nestle for the past two years. The stock has been following a mixed trend during these past two years. Overall, the stock appreciated by 19 % in 2021. The stock peaked at $ 140.37 on the last trading day of 2021. After that, the stock started declining. During the current year, the stock has declined by roughly 14 %, to date.

Get to know the list of crypto mining companies that are leading the industry.

Get to know the list of crypto mining companies that are leading the industry.

Walmart Inc.

Walmart is the world’s largest discount retailer and grocery store chain. The company operates through three segments:

- Walmart U.S.

- Walmart International

- Sam’s Club

In the quarterly report for FY 2023, Walmart reported:

- Total revenue was $141.6 billion, a 2.4 % increase from the same period last year

- Operating Income of $ 5.3 billion, a 23 % decline from the same period last year

- Earnings per share of $ 0.74

Walmart has a market capitalization of $ 354 billion. Its shares are trading at a price of $ 128.48. The below chart shows the stock performance of Walmart for the past two years. The stock of Nestle has maintained its price level, despite being volatile. In 2021, the stock started off in the market at a price of $ 144.15. after multiple ups and down the stock closed off at $ 144.69. during the current year, the stock started off at $ 144.69 and last closed off at $ 128.48, representing an 11 % decline to date. Get to know the best tech stocks to invest in now.

Philips Morris International

Philips Morris International

Philip Morris International Inc. operates as a tobacco company. It is working to deliver a smoke-free future and evolving portfolio for the long-term to include products outside of the tobacco and nicotine sector. The company’s product portfolio primarily consists of cigarettes and smoke-free products, including heat-not-burn, vapor, and oral nicotine products that are sold in markets outside the United States. Learn about head and shoulders patterns trading guide.

Philips Morris has recently published its first-quarter report for the year 2022, ending 31st March 2022:

- Total Revenues were reported at € 4 billion

- Income from continued operations was reported to be negative € 152 million

- Net income was reported at a negative € 151 million

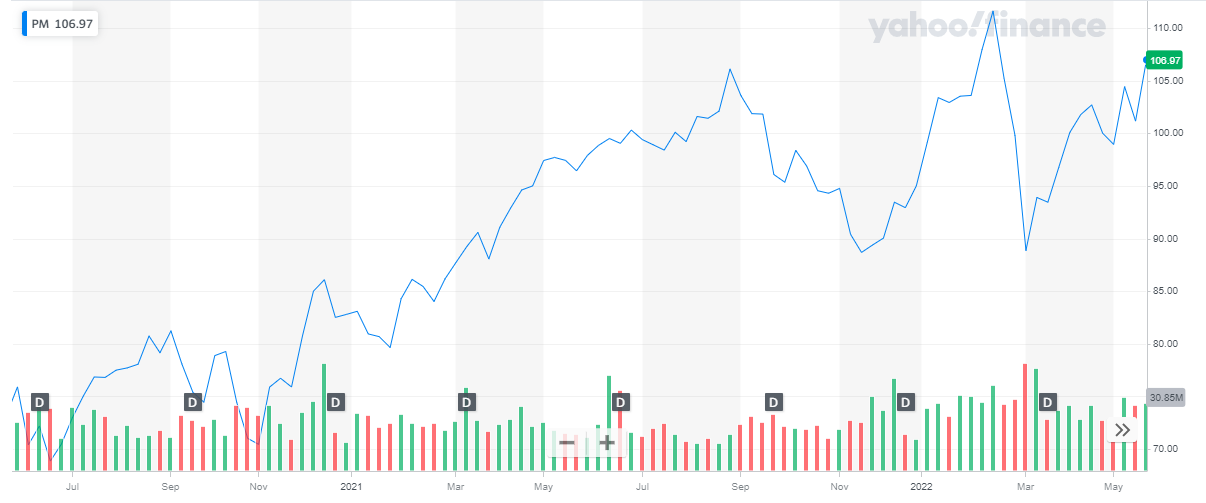

Philips Morris has a market capitalization of $ 166.58 billion. Its share is trading at a price of $ 106.97. The below chart shows the stock performance of PM during the last two years. The stock has been on an upward streak for the last two years. In 2021, the stock rose from $ 82.79 to $ 95, representing a 15 % increase during the year. In 2022, the stock started off at $ 95 and peaked at $ 111.61. To date, the stock has appreciated by 12.6 %.

Check our updates for NASDAQ Forecast.

Check our updates for NASDAQ Forecast.

Unilever

Unilever PLC is a fast-moving consumer goods company. The company has a wide range of products under the below categories:

- Beauty & Personal Care – Sun silk, Lux,

- Foods & Refreshment – Magnum, Knorr, Ben and Jerry’s

- Home Care segments – Comfort

The company has recently shared its first-quarter report for 2022:

- Revenue of € 13.8 billion, an 11.8 % increase from the previous year

Unilever has a market capitalization of $ 112.3 billion. The share of the company is trading at $ 43.98. The below chart shows the stock performance of Unilever for the past two years. The stock maintained its price level for the major part of 2021. The stock started declining continuously during the second half of 2021. Overall, the stock went from $ 60.36 to $ 53.79 in 2021, representing an 11 % decline during the year. in the current year, the stock has declined by 18 % to date.

Cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

Cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

Estee Lauder

Estée Lauder Companies Inc. is one of the world’s leading manufacturers and marketers of quality skin care, makeup, fragrance, and hair care products. The company’s products are sold in approximately 150 countries and territories under brand names including:

- Estée Lauder

- Aramis

- Clinique

- Lab Series

- Origins

- Tommy Hilfiger

- M·A·C

- Bobbi Brown

- Michael Kors.

Estee Lauder recently published its quarterly earnings report:

- Net sales of $4.25 billion, an increase of 10 % from the previous year’s same period

- Net earnings of $0.56 billion, compared with net earnings of $0.46 billion in the prior-year period

Estee Lauder is a $ 90 billion company. The share of the company is trading at $ 251.86. The below chart shows the stock performance for the past two years. The stock has been on an upward trend for the major part of 2020 and the whole of 2021. In 2021, the stock appreciated by 39 %, from $ 266.19 to $ 370. In 2022, the stock hanged course and started declining. To date, the stock has appreciated by 29 %.

Also read: Best EV Stocks

Also read: Best EV Stocks

L’Oréal SA

L’Oréal is the world’s leading beauty player which has been operating for over 110 years. The company has a balanced geographical footprint and sales across all distribution networks: e-commerce, mass market, department stores, pharmacies, hair salons, branded and travel retail. It has 35 international brands under its umbrella. There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

With 20 research centers across 11 countries around the world and a dedicated Research and Innovation team, L’Oréal is focused on inventing the future of beauty and becoming a Beauty Tech powerhouse.

The company recently published its quarterly report for the year 2022:

- Sales were reported to be € 9.06 billion

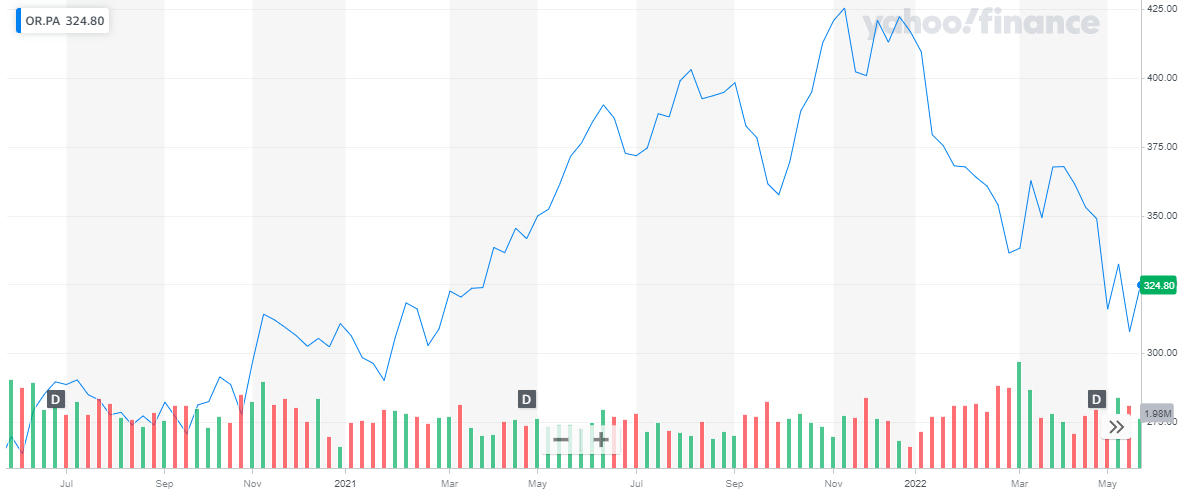

L’Oréal has a market capitalization of $ 174.2 billion. The share of the company is trading at a price of $ 311.95. The below chart shows the stock performance of L’Oréal over the past two years. The stock maintained a bearish trend during 2021. From a price of $ 310.8 to $ 416.95, the stock appreciated by 34 % during the year. In 2022, the stock reversed its course and started declining. To date, the stock has declined by 22 %.

Also read Best Stocks for Covered Calls in 2023.

Also read Best Stocks for Covered Calls in 2023.

CONCLUSION

We may not realize but we rely on consumer staples every day. And consumer staple is bought regardless of how the economy is operating. These are a necessity that everyone depends upon. This sector might not have experienced fast-paced growth but offers reliable profits and safe investment. Therefore, investing in consumer staples is an excellent and safe choice. The above-listed companies are one of the oldest and top-performing companies and have years and decades of experience within the industry.

You may also like reading:

- List of Best Forex Brokers for Trading

- Best Commodities to invest in

- Best Swing Trading Stocks To Buy Now

- Best Swing Trading Stocks to Buy Now

- Best Stock & Forex Trading Courses

- Gold Stocks to Buy in 2023

- 11 Best ESG ETFs to Buy in 2023

- Best Penny Stocks to Invest

- Monthly Dividend Stocks to Buy