Types of Communications Stocks

The communications sector is typically segmented into the following sub-sectors:

- Wired Telecommunications Carriers. Companies that are involved in fiber optic and other hard-wired communications infrastructures.

- Wireless Telecommunications Carriers. These are cell phone providers and other companies that provide telecom services.

- Telecommunications Resellers. Companies rely on the network of other providers to serve their customers.

- Satellite Telecommunications. These companies provide satellite phone services or other communications services that rely on satellites.

- Cable and Other Program Distribution. These include fiber optic cable network owners and other providers.

Advantages of Investing in Communications Stocks

- Innovation – Communications companies are one of the most innovative stocks for investment.

- High growth potential – Communication companies are regularly investing in new technologies and innovation. As a result, they are an excellent investment opportunity for investors.

- Global reach -The services these companies improve standards of living around the globe. Hence, they have a global reach.

- Reliable sales. The clients of these communication companies are businesses and consumers. Therefore, the chances of a decline in sales or customer bases are very few.

Risks of Investing in Communications Stocks

- Increased volatility- If a planned investment does not receive the expected result, the companies can lose a lot of money.

- Competition – All Communications stocks offer similar services. Hence the competition is high for every company.

- Regulatory threats – Communications companies are regulated by the Federal Communications Commission (FCC), and their businesses can be heavily impacted by changes in consumer privacy laws and other regulations.

List of the Best Communication Stocks in 2024

Here is the list of top communication stocks for investment:

| Sr. | Company Name | Symbol | Price (As of 19th March 2023) | Market Cap |

| 1. | Verizon Communications Inc. | VZ | $ 36.58 | $ 154.5 billion |

| 2 | Activision blizzard | ATVI | $ 78.99 | $ 62.64 billion |

| 3 | Comcast Corp | CMCSA | $ 36.03 | $ 152.7 billion |

| 4 | Omnicom Group Inc | OMC | $ 86.17 | $ 17.7 billion |

| 5 | T-Mobile | TMUS | $ 142.45 | $ 173.7 billion |

| 6 | Charter Communications Inc | CHTR | $ 350.01 | $ 53.4 billion |

| 7 | Netflix Inc | NFLX | $ 303.5 | $ 138 billion |

| 8 | Alphabet | GOOGL | $ 102.46 | $ 1.36 trillion |

| 9 | AT&T | T | $ 18.13 | 131.11 billion |

| 10 | NCE Inc. | BCE | $ 43.68 | $ 39.9 billion |

Verizon Communications Inc. (VZ)

Verizon Communications Inc. (VZ)

Verizon Communications Inc (Verizon) provides communications, information, and entertainment products and services. The company offers voice, data, and video services and solutions through its wireless and wireline networks. It offers value-added services such as broadband video and data, corporate networking solutions, data center and cloud services, security and managed network services, and local and long-distance voice services. Verizon’s multimedia offerings include music, video, gaming, and news content. Verizon serves small and medium, enterprises, the public sector, and wholesale businesses.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 136,83 | $ 133,613 | 2.4 % |

| Operating Income | $ 30,467 | $ 32,448 | -6.1 % |

| Net Income | $ 21,748 | $ 22,618 | -3.8 % |

| Earnings per share | $ 5.06 | $ 5.32 | -4.9 % |

- Revenue reported a 2.4 % increase in 2022, as compared to the previous year

- Operating income reported a 6.1 % decline in 2022, as compared to the previous year

- Net Income reported a 3.8 % decline in 2022, as compared to the previous year

- Earnings per share reported a 4.9 % decline in 2022, as compared to the previous year

Verizon Communications has a market cap of $ 154.5 billion. Its shares are trading at $ 36.58.

The stock of Verizon has been on a declining trend. The stock started the year 2022 at $ 51.96. Throughout the year the stock continued to decline and closed the year at $ 39.4. Overall, the stock declined by 24 % in 2022.

In 2023 the stock recovered a bit but then declined again and last closed at $ 36.79. To date, the stock has declined by 6.62 %.

Also, learn:

Also, learn:

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Activision Blizzard, Inc. (ATVI)

ATVI develops, publishes, and sells interactive software products and entertainment content for the console, personal computer, and mobile platforms. It also maintains a proprietary online gaming service and engages in creating original film and television content. ATVI was incorporated in 1979 and is headquartered in Santa Monica, California.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 7,528 | $ 8,803 | -14.4 % |

| Operating Income | $ 1,670 | $ 3,259 | -49 % |

| Net Income | $ 1,513 | $ 2,699 | -44 % |

| Earnings per share | $ 1.92 | $ 3.44 | -44 % |

- Revenue reported a 14.4 % decline in 2022, as compared to the previous year

- Operating income reported a 49 % decline in 2022, as compared to the previous year

- Net Income reported a 44 % decline in 2022, as compared to the previous year

- Earnings per share reported a 44 % decline in 2022, as compared to the previous year

Activision Blizzard has a market cap of $ 62.64 billion. Its shares are trading at $ 78.99.

The stock started the year 2022 at $ 66.53. The stock started the year with an immediate hike and after hitting $ 81.53 the stock maintained the price level and closed off the year at $ 76.55. Overall, the stock appreciated by 15 %.

In 2023, the stock inched up slightly and recently closed at $ 78.99, representing a 3 % appreciation to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Comcast (CMCSA)

Comcast Corp (Comcast) is a media and technology company that offers cable services, video services, voice-over-internet protocol, and high-speed internet services. The company operates through Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Sky segments. CMCSA delivers broadband, wireless, and video connectivity; creates, distributes, and streams entertainment, sports, and news; and operates theme parks and resorts. It offers services under Xfinity, NBCUniversal, Sky, and Comcast brand names. The company serves small and medium-sized businesses and residential and commercial customers.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 121,427 | $ 116,385 | 4.3 % |

| Operating Income | $ 14,041 | $ 20,817 | -32.5 % |

| Net Income | $ 5,370 | $ 14,159 | -62.1 % |

| Earnings per share | $ 1.21 | $ 3.04 | -60.2 % |

- Revenue reported a 4.3 % increase in 2022, as compared to the previous year

- Operating income reported a 32.5 % decline in 2022, as compared to the previous year

- Net Income reported a 62.1 % decline in 2022, as compared to the previous year

- Earnings per share reported a 60.2 % decline in 2022, as compared to the previous year

Comcast has a market cap of $ 152.7 billion. Its shares are trading at $ 36.03.

The stock started the year 2022 at $ 50.33. The stock picked up a bearish trend and went as low as $ 29.27. Then the stock recovered a bit and closed the year at $ 34.97. Overall, the stock declined by 30.5 %.

In 2023, the stock continued to climb. After hitting $ 39.97 the stock declined a bit and last closed at $ 36.03 representing a 5 % decline to date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Omnicom Group Inc. (OMC)

Omnicom Group Inc (Omnicom) is a provider of advertising, corporate communications, and marketing services through branded networks and agencies. The company offers digital and interactive marketing, strategic media planning and buying, direct and promotional marketing, public relations, and other specialty communications services. It also offers services such as marketing research, product placement, promotional marketing database management, data analytics, crisis communications, and mobile marketing. Omnicom’s offerings find applications in food and beverage, pharmaceuticals and health care, technology, consumer products, automobile, financial services, travel and entertainment, retail, telecommunications, and other industries.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 14,289.1 | $ 14,289.4 | 0 % |

| Operating Income | $ 2,083 | $ 2,197.9 | -5 % |

| Net Income | $ 1,316.5 | $ 1,407.8 | -6.5 % |

| Earnings per share | $ 6.36 | $ 6.53 | -2.6 % |

- Revenue reported a 0 % increase in 2022, as compared to the previous year

- Operating income reported a 5 % decline in 2022, as compared to the previous year

- Net Income reported a 6.5 % decline in 2022, as compared to the previous year

- Earnings per share reported a 2.6 % decline in 2022, as compared to the previous year

Omnicom has a market cap of $ 17.7 billion. Its shares are trading at $ 86.17.

The stock started the year 2022 at $ 73.27. The stock started rising and went as high as $ 85.68. After that, the stock declined to $ 63.09 and eventually closed the year at $ 81.57. Overall, the stock appreciated by 11.3 %.

In 2023, the stock continued to appreciate and hit as high as $ 93.72 and last closed at $ 86.17. To date, the stock has appreciated by 5.6 %.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

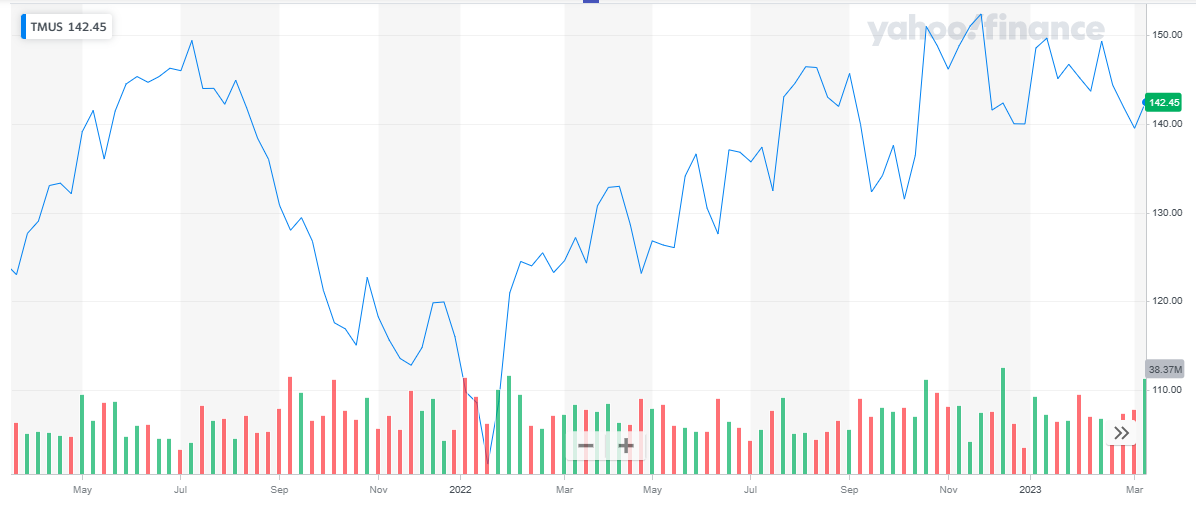

T-Mobile US Inc. (TMUS)

T-Mobile US Inc (T-Mobile), a subsidiary of Deutsche Telekom AG, is a provider of telecommunication services. The company offers wireless telecommunications services and a host of other services, including voice, text messaging, video calling, and data communications to customers. T-Mobile serves postpaid, prepaid, and wholesale customers. The company provides wireless internet access and other data services to commercial centers. It also carries out the distribution of a wide range of mobile phones, wearables, tablets, and mobile phone accessories from established vendors such as Apple, Google, Motorola, OnePlus, Samsung, Alcatel, Beats, and LG.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 79,571 | $ 80,118 | -0.7 % |

| Net Income | $ 2,590 | $ 3,024 | -14.4% |

| Earnings per share | $ 2.06 | $ 2.41 | -14.5 % |

- Revenue reported a 0.7 % decline in 2022, as compared to the previous year

- Net Income reported a 14.4 % decline in 2022, as compared to the previous year

- Earnings per share reported a 14.5 % decline in 2022, as compared to the previous year

T-Mobile has a market cap of $ 173.7 billion. Its shares are trading at $ 142.45.

The stock started the year 2022 at $ 115.98. After an initial dip in price, the stock started to climb. Throughout the year, the stock continued its bullish trend and closed the year at $ 140. Overall, the stock appreciated by 20.7 %.

In 2023, the stock maintained its price levels and declined slightly. The stock last closed at $ 142.45 representing a 1.78 % appreciation.

Read: Top Information Technology Stocks

Read: Top Information Technology Stocks

Charter Communications, Inc. (CHTR)

Charter Communications Inc (Charter) is a provider of cable entertainment and broadband communications services. The company offers video, voice, and internet services to residential and commercial customers. It offers subscription-based video services, including video on demand, high-definition television, digital video recorder service, internet services, voice, and mobile services. Charter also provides business services including static intellectual properties, business WiFi, e-mail and security, and multi-line telephone services. It also offers commercial services such as internet access, data networking, fiber connectivity, video entertainment services, and business telephone services. The company offers services under Spectrum and Charter brand names. It serves educational institutions, sports, software, media and communications, and other small and medium business enterprises.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 54,022 | $ 51,682 | 4.5 % |

| Operating Income | $ 11,962 | $ 10,526 | 13.6 % |

| Net Income | $ 5,055 | $ 4,654 | 8.6 % |

| Earnings per share | $ 31.3 | $ 25.34 | 23.5 % |

- Revenue reported a 4.5 % increase in 2022, as compared to the previous year

- Operating income reported a 13.6 % appreciation in 2022, as compared to the previous year

- Net Income reported an 8.6 % appreciation in 2022, as compared to the previous year

- Earnings per share reported a 23.5 % appreciation in 2022, as compared to the previous year

Charter Communications has a market cap of $ 53.4 billion. Its shares are trading at $ 350.01.

The stock started the year 2022 at $ 651.97. The stock continued with a bearish trend and closed the year at $ 339.1. Overall, the stock declined by 48 %.

In 2023, the stock recovered slightly and last closed at $ 350.01 reporting a 3.2 % appreciation to date.

Netflix

Netflix

Netflix Inc (Netflix) provides internet entertainment services for watching movies and television shows. The company offers TV shows and movies such as original series, documentaries, and feature films through an internet subscription on TV, computer, and mobile devices. It offers DVD by-mail service in the US. Netflix also operates a separate library of movies that can be watched instantly on subscribers’ TV through mobile applications, Netflix-ready devices, or computers. It licenses, acquires, and produces content, including original programming. The company markets and promotes its service through various marketing partners including multichannel video programming distributors, streaming entertainment providers, consumer electronics manufacturers, mobile operators, and internet service providers. It has a business presence across the Americas, EMEA, and APAC.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 31,615 | $ 29,698 | 6.5 % |

| Operating Income | $ 5,633 | $ 6,194 | -9 % |

| Net Income | $ 4,491 | $ 5,116 | -12.2 % |

| Earnings per share | $ 10.10 | $ 11.55 | -12.55 % |

- Revenue reported a 6.5 % increase in 2022, as compared to the previous year

- Operating income reported a 9 % decline in 2022, as compared to the previous year

- Net Income reported a 12.2 % decline in 2022, as compared to the previous year

- Earnings per share reported a 12.5 % decline in 2022, as compared to the previous year

Netflix has a market cap of $ 138. billion. Its shares are trading at $ 303.5.

The stock started the year 2022 at $ 602.44. The stock continued with a bearish trend and dropped to the low of $ 175.51 and eventually closed the year at $ 294.88. Overall, the stock declined by 51 %.

In 2023, the stock recovered slightly and last closed at $ 303.5 reporting a 3 % appreciation to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

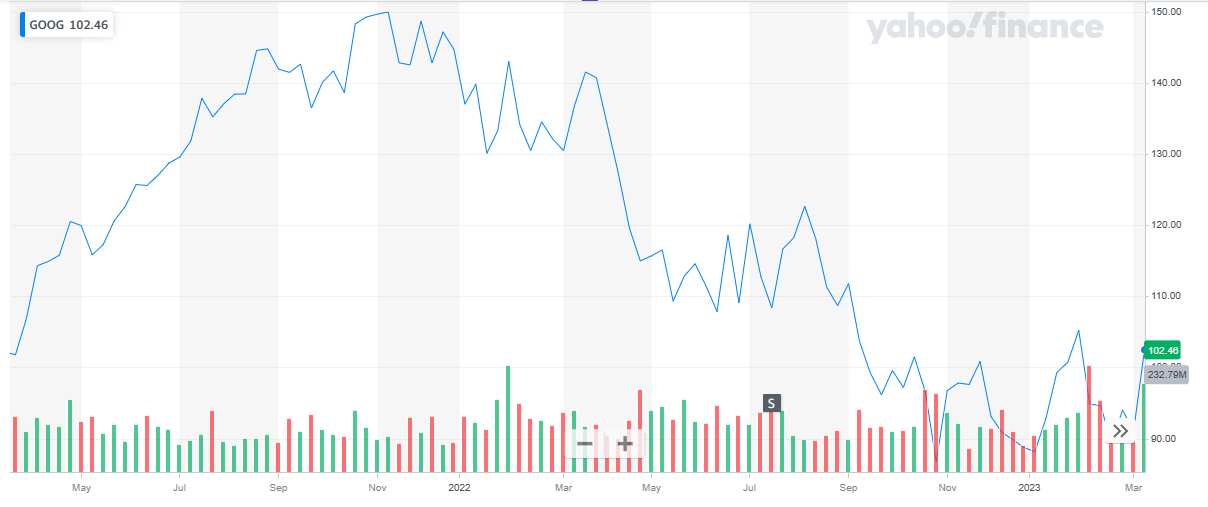

Alphabet (GOOGL)

Alphabet Inc (Alphabet), the holding company of Google, is a global technology company. It offers a wide range of products and platforms, including search, maps, calendar, ads, Gmail, Google Play, Android, google cloud, chrome, and YouTube. It also offers hardware products such as Pixel phones, smartwatches, Google Nest home products, and other related products. The company offers online advertising services through its AdSense, internet, TV services, licensing, and research and development services. Alphabet is also involved in investing in infrastructure, data management, analytics, and artificial intelligence (AI). The company has a business presence across the Americas, Europe, and Asia-Pacific.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 282,836 | $ 257,637 | 9.8 % |

| Operating Income | $ 74,842 | $ 78,714 | -5 % |

| Net Income | $ 59,972 | $ 76,033 | -21 % |

| Earnings per share | $ 4.59 | $ 5.69 | -19 % |

- Revenue reported a 9.8 % increase in 2022, as compared to the previous year

- Operating income reported a 5 % decline in 2022, as compared to the previous year

- Net Income reported a 21 % decline in 2022, as compared to the previous year

- Earnings per share reported a 19 % decline in 2022, as compared to the previous year

Alphabet has a market cap of $ 1.36 trillion. Its shares are trading at $ 102.46.

The stock started in the year 2022 at $ 144.68. It started with a bearish trend and continued throughout the year till it closed the year at $ 88.73. Overall, the stock declined by 38.7 %.

In 2023, the stock went volatile after a couple of dips and peaks the stock last closed at $ 102.46 representing a 15.5 % appreciation to date.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

AT&T Inc. (T)

AT&T Inc (AT&T) is a provider of telecommunications, media, and technology services. The company offers wireless communications, data/broadband and internet services, local and long-distance telephone services, telecommunications equipment, managed networking, and wholesale services. AT&T also develops, produces, and distributes feature films, television, gaming, and content in physical and digital formats. It also provides advertisement and entertainment services to household customers. The company serves individual customers and business enterprises. It markets services under AT&T, Cricket, SKY, AT&T TV, AT&T PREPAID, AT&T Fiber, and Unefon brand names. The company has a business presence in Asia-Pacific, North America, Europe, the Middle East and Africa, Latin America, and the Caribbean.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 120,700 | $ 134,000 | -9.9 % |

| Operating Income | ($ 4,600) | $ 25,900 | – % |

| Net Income | ($ 6,900) | $ 23,800 | – % |

| Earnings per share | ($ 1.11) | $ 3.02 | – % |

- Revenue reported a 9.9 % decline in 2022, as compared to the previous year

- The company reported an operating loss for the year 2022

- The company reported a net loss for the year 2022

- The company reported a loss per share for the year 2022

AT&T has a market cap of $ 131.11 billion. Its shares are trading at $ 18.13.

The stock started the year 2022 at $ 18.58. The stock exhibited volatility throughout the year. It went as high as $ 21.31 and as low as $ 14.94 and eventually closed the year at $ 18.41. Overall, the stock maintained its price levels.

In 2023, the stock initially rose and last closed at $ 18.13. To date, the stock has again maintained its price levels.

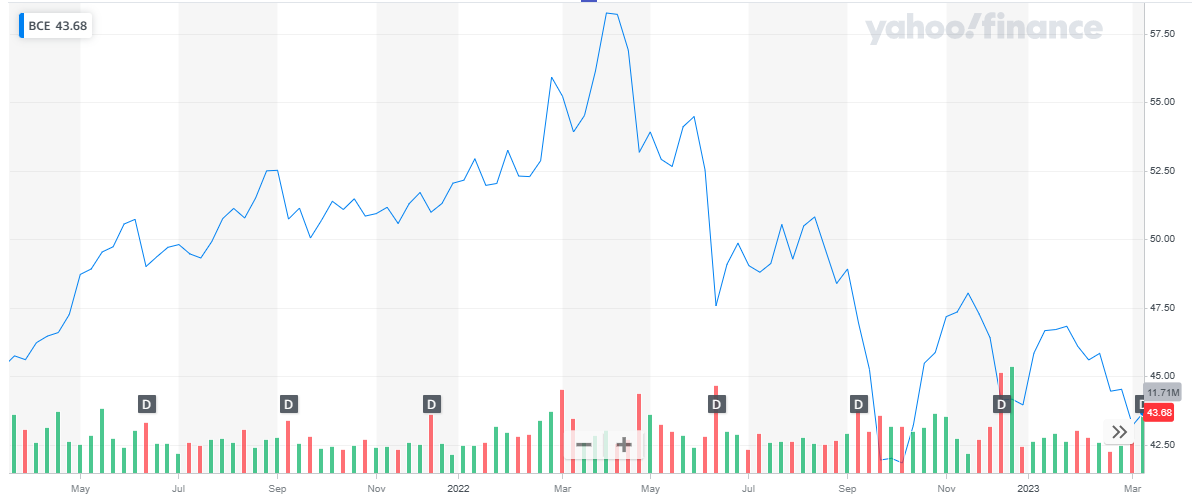

BCE Inc. (BCE)

BCE Inc. (BCE)

BCE Inc (BCE) is a provider of communications services. The company’s services include data, IPTV and Internet services, voice, long-distance and local telephone, and other communications products and services. It also provides satellite TV services, connectivity, competitive local exchange carrier (CLEC) services, specialty TV, conventional TV, pay TV, digital media services, streaming services, out-of-home (OOH) advertising services, and radio broadcasting services. It operates a wholesale business that buys and sells long-distance, local telephone, data, and other services from or to resellers and other carriers. BCE offers its services to consumer, residential, business, and government customers.

| 2022 (million) | 2021 (million) | Percentage Change | |

| Revenue | $ 24,174 | $ 23,449 | 3.1 % |

| Net Income | $ 2,926 | $ 2,891 | 1.2 % |

| Earnings per share | $ 2.98 | $ 2.99 | -0.3 % |

- Revenue reported a 3.1 % appreciation in 2022, as compared to the previous year

- Net Income reported a 1.2 % appreciation in 2022, as compared to the previous year

- Earnings per share reported a 0.3 % decline in 2022, as compared to the previous year

BCE has a market cap of $ 39.9 billion. Its shares are trading at $ 43.68.

The stock started the year 2022 at $ 52.04. It went as high as $ 58.25, during the year, and as low as $ 41.13. The stock eventually closed the year at $ 43.95 representing a 15.5 % decline to date.

In 2023, after an initial rise in price, the stock last closed at $ 43.68.

Also read:

Also read: