The 3D printing industry has been developing for some time. This technology has been revolutionizing the way we make things. Like all industries, the 3D printing industry was also affected by the COVID-19 lockdown. However, this industry managed to rebound rather quickly by taking advantage of its technology.

The 3D printing market was valued at USD 13.7 billion in 2020, and it is expected to reach a value of USD 63.46 billion by 2026, at a CAGR of 29.48% over the forecast period (2021 – 2026), as per Mordor Intelligence.

The tech sector is huge and increasing by the moment. Since the development of technologies like AI enables automated printing for efficient production, the adoption of 3D Printing devices has accelerated. Like AI stocks, tech stocks governments worldwide have started investing in R&D on 3D printing. Within this sector, selective laser sintering (SLS) has been identified as the most preferred technology. It is expected to record the highest CAGR over the forecast period, owing to its various benefits over other technologies.

List of Top Best 3D Printing Stocks

| Sr. | Company Name | Symbol | Price (As on 26th January 2022) | Market Capitalization |

| 1 | HP Inc. | HPQ | $ 35.23 | $ 38.78 billion |

| 2 | 3D Systems | DDD | $ 16.39 | $ 2.115 billion |

| 3 | Nano Dimension | NNDM | $ 3.51 | $ 867.29 million |

| 4 | Stratasys | SSYS | $ 21.51 | $ 1.41 billion |

| 5 | FARO Technologies | FARO | $ 53.14 | $ 950.147 million |

| 6 | Desktop Metal Inc. | DM | $ 3.88 | $ 1.137 billion |

| 7 | Materialise NV | MTLS | $ 18.38 | $ 1.09 billion |

| 8 | Proto Labs | PRLB | $ 47.76 | $ 1.3 billion |

| 9 | Ansys | ANSS | $ 318.07 | $ 27.62 billion |

| 10 | Autodesk Inc. | ADSK | $ 233.28 | $ 51.55 billion |

| 11 | Organovo Holdings, Inc | ONVO | $ 1.84 | $ 16.32 million |

| 12 | Danimer Scientific, Inc. | DNMR | $ 2.15 | $ 218 million |

| 13 | Raytheon Technologies Corporation | RTX | $ 98.68 | $ 145.1 billion |

| 14 | Markforged Holding Corporation | MFKG | $ 1.38 | $ 267.9 million |

HP Inc. (NYSE: HPQ)

HP is well known for its computers and laptops. In the past two years, HP is focusing on enhancing its 3D printing business capabilities. During the pandemic, the company upscaled its 3D business capabilities. As per the company officials, HP and its partners have 3D printed more than 2.3 million parts to bridge supply chain gaps, enable local production, and help healthcare professionals on the front lines.

HP posted its yearly earnings report. The company reported:

- Net revenue of $63.5 billion, up 12.1% from the prior-year

- Non-GAAP diluted net earnings per share of $3.79

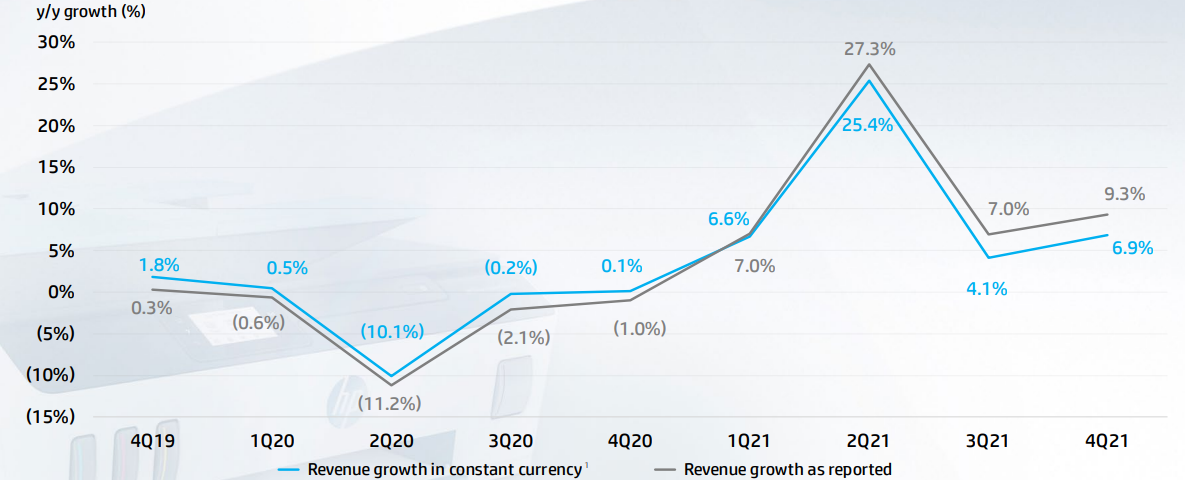

The company has reported a consistent increase in revenue. The below chart shows the quarterly breakdown of revenue growth over the past two years.

HP has a market valuation of around $39.3 billion. Its share is trading at a price of $36. The stock of the company has shown huge growth in the past two years. From a price of $25.53 at the start of 2021, the price of the HP share was $3767 at the end of 2021.

HP has a market valuation of around $39.3 billion. Its share is trading at a price of $36. The stock of the company has shown huge growth in the past two years. From a price of $25.53 at the start of 2021, the price of the HP share was $3767 at the end of 2021.

Checkout some of the best oil and gas ETFs to buy now.

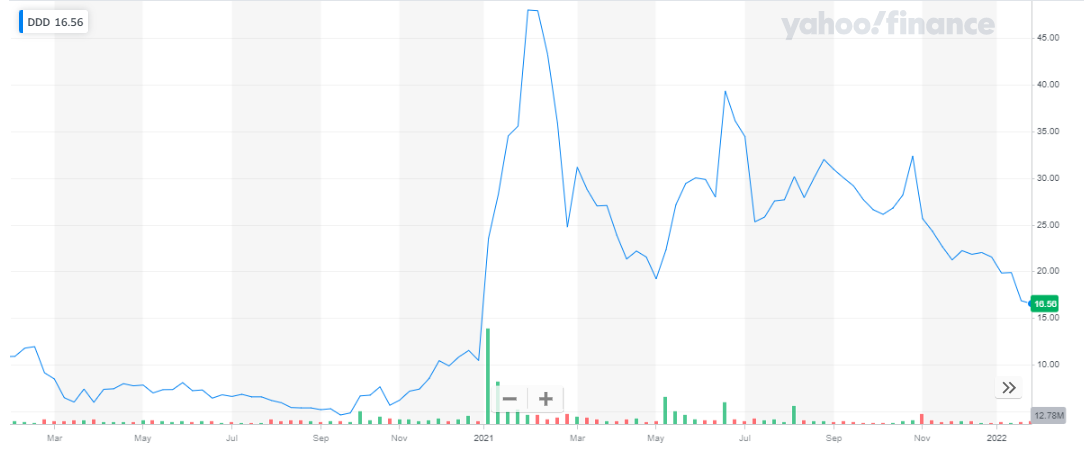

3D Systems (NYSE: DDD)

3D Systems Corporation provides 3D printing and digital manufacturing solutions. The company’s products and solutions include 3D printers for plastics and metals, materials, software, maintenance and training services, and on-demand solutions. Its solutions support applications in two key industries

- Healthcare, which includes dental and medical devices services

- Industrial, which includes aerospace and transportation

The company offers 3D printers, such as stereolithography, selective laser sintering, direct metal printing, multi-jet printing, and color jet printers that transform digital data input generated by 3D design software, computer-aided design (CAD) software, or other 3D design tools into printed parts under the Accura, DuraForm, LaserForm, CastForm, and VisiJet brand names. Robotic stocks is an exciting investment opportunity for traders. Get to know everything about high frequency trading.

In its recent earnings report, the company reported:

- Revenue of $156.1 million, representing double-digit growth on a year-on-year basis

- Operating cash flow of $20.7 million, the fourth consecutive quarter of positive cash flow from operations

The company announced two acquisitions in the past year, which are expected to position the company for continued high-margin growth:

- Oqton,

- Volumetric Biotechnologies,

These new additions to the company’s portfolio will expand and accelerate the company’s growth in human and laboratory applications for bioprinting.

3D Systems has a market valuation of around $ 2.127 billion. The share of the company is currently trading at $16.56. during the pandemic when the demand for 3D products rose due to its efficient production, the share of the company at $47.88. During the year 2021, the stock went from $10.48 to $21.54, representing an appreciation of over 100% within a year.

Go through a list of crypto mining companies that are leading the industry.

Nano Dimension (NASDAQ: NNDM)

Nano Dimension’s Products Have High Gross Margins And Recurring Revenue from:

- System sale

- Service contracts

- Consumables, i.e., materials

The company has recently introduced/acquired:

- DragonFly IV- It is a unique and innovative, first-to-market Dielectric & Conductive-Materials Additive Manufacturing System for the fabrication of High-Performance Electronic Devices

- Acquired Essemtec AG from Lucerne, Switzerland. Essemtec’s product portfolio is comprised of production equipment for placing and assembling electronic components on printed circuit boards. The products are leaders in adaptive highly flexible surface mount technology (SMT) pick-and-place equipment, sophisticated dispensers suitable for both high-speed and micro-dispensing, and intelligent production material storage and logistic system.

Also, investing in oil stocks offers great rewards in terms of high returns.

In the recent quarterly report, the company reported:

- Revenues of $1,340,000

- operating loss was $24,507,000

- Cash and deposits balance of $1,385,391,000

Checkout our updates for NASDAQ Forecast.

Nano Dimension has a market capitalization of around $864 million. Its share is trading at a price of $3.37. the company stock peaked during the first quarter of 2021 at a price of $15.6.

Get to know some of best gaming stocks to invest in now.

Also Read:

Stratasys (NASDAQ: SSYS)

Stratasys manufactures 3D printers and 3D production systems for office-based rapid prototyping and direct digital manufacturing. The company is ready to launch two new mass production systems. Moreover, Stratasys is en route to being the first choice for polymer 3D printing.

Healthcare has been the fastest-growing business with huge developments taking place. 3D Bone printing and the life-changing impact illustrated through conjoined twin separation have created quite an uproar for the company’s technology.

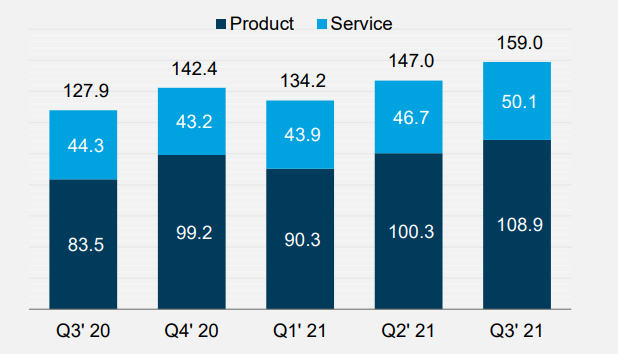

Third-quarter results demonstrate continued strength in growing our market. Stratasys reported a 24.3 % increase in revenue, in the third quarterly report. The below chart shows the quarterly breakdown of revenue in $ million. Revenues have been consistently rising. But Stratasys remains an unprofitable operation.

Stratasys has a market capitalization of around $1.434 billion. Its share is trading at $21.91. The share experienced a huge spike in price at the start of 2021. During the year 2021, the share appreciated by approx. 6% from a price of $20.72 to $21.91.

Check out the best NFT stocks to buy now.

FARO Technologies (NASDAQ: FARO)

FARO Technologies designs, develops, manufactures, markets, and supports computer-aided measurement and imaging devices and software. They are used for inspecting components and assemblies, production planning, documenting large volume spaces or structures in 3D, surveying, and construction as well as for investigation and reconstruction of accident sites or crime scenes. Globally, approximately 15,000 customers are operating more than 30,000 installations of FARO’s systems. Investors who are looking to benefit from the rising technology by earning profits should consider the drone stocks for investment.

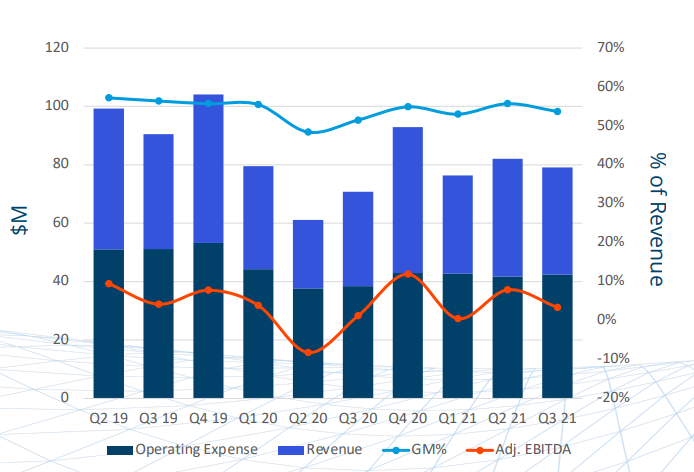

The quarterly breakdown of Revenue and gross margin is shown in the graph below. The company has maintained its revenue after the setback during the pandemic. Moreover, the company has managed to maintain its gross margin ratio, despite a small drop in Q2 2020.

FARO has a market valuation of around $937.4 million. Its shares are trading at $51.49. after the deep plunge due to the pandemic, the company’s stock recovered pretty quickly. In fact, the stock price spiked up to $94.79 from the lows of $36.28. By using the stock signals, you can avoid hours of technical analysis to understand the market.

Checkout our updates for IBEX Index News including real-time updates, forecast and technical analysis.

Desktop Metal Inc. (NASDAQ: DM)

Desktop Metal manufactures 3D printing solutions for all scales of production—from complex prototypes and on-demand tooling to the rapid manufacture of thousands of parts. The company is en route to becoming the leader in additive manufacturing for mass production. There are plenty of investment opportunities to take advantage of this rapidly growing sector. EV stocks is one of them.

Its flagship product is the Production System P-50 printer. The company recently announced that it will be upscaling its production after increasing the manufacturing capacity at its Massachusetts facility

Desktop Metal has a global distribution and network of 200 plus partners spanned across more than 65 countries.

In the recent quarterly report, the company reported:

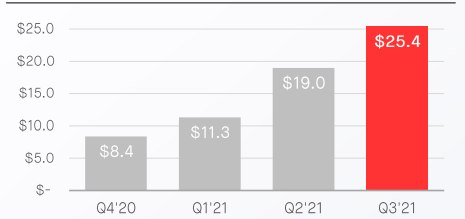

- $25.4 million revenue, a 907% increase on a year-on-year basis

- Gross Margin of 27%

- Cash and cash equivalents of $423.9 million

Read: Best Gold Trading Signal Providers.

Revenue has been consistently increasing since last year, as shown in the below chart.

The market valuation of Desktop Metals is $1.17 billion. Its share is trading at $3.75.

Materialise NV (MTLS)

Materialise NV (MTLS)

Materialise NV is a Belgium-based company that provides additive manufacturing software and three-dimensional (3D) printing services. It operates through the following business segments:

- Materialise Software

- Materialise Medical

- Materialise Manufacturing

In the recent quarterly report, the company reported:

- Total revenue of 52,195 kEUR (approx, $58,531) an increase of 28% year on year

- Net profit of 8,652 kEUR, (approx. $ 9,702)

- Total cash was 194,946 kEUR (approx. $ 218,612) at the end of the quarter.

Materialise has a market capitalization of around $1.2 billion. Its share is trading at $20.44. After the pandemic-driven market crash, the stock price picked up the pace and peaked at $77.37, from the lows of $12.95.

Cybersecurity stocks are currently the hot niche that is accelerating in terms of growth and investor money.

Proto Labs (NYSE: PRLB)

Proto labs are the world’s fastest source for custom prototypes and low-volume production parts. The company uses industrial 3D printing, CNC machining, sheet metal fabrication, and injection molding technologies to produce parts within days. The company offers the following services:

- Injection Molding

- CNC Machining

- 3D Printing

- Sheet Metal

In the recent quarterly report, the company reported:

- Record Revenue of $125.3 million, an increase of 16.6% year-on-year

- Earnings per share of $0.35

Proto labs have a market valuation of around $1.37 billion. Its share is trading at $49.78. the share of Proto labs shot during 2020 till the first quarter of 2021. After that, the stock started depreciating.

There are multiple paid courses and technical analysis books available which provide in-depth knowledge about Technical Analysis.

Ansys (NASDAQ: ANSS)

Ansys is the global leader in engineering simulation. The company offers the best and broadest portfolio of engineering simulation software. Through its products, its clients solve the most complex design challenges and engineer products limited only by imagination.

In the recent quarterly report, the company reported:

- Revenue of $441.2 million

- Earnings per share of $0.97

- Operating cash flows of $157.8 million

The company has experienced double-digit growth during the third quarter which is backed by multi-physics product leadership and strong customer relationships. The recent acquisition of Zemax technologies is likely to enhance the services Ansys offers to its customers. As a result of this new addition, Ansys product portfolio will offer customers comprehensive, end-to-end solutions for simulating next-generation optical and photonics products.

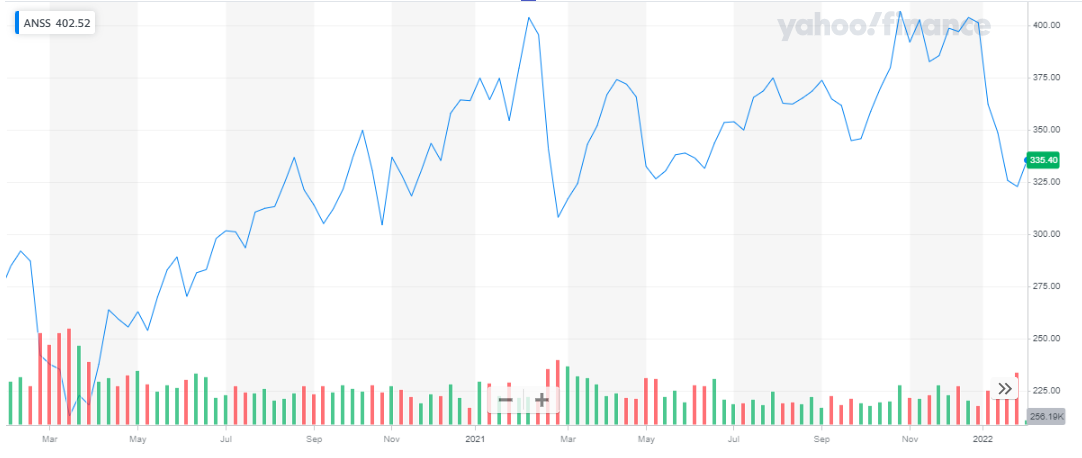

As an investor, you need to stay put and wait a while before you can benefit from your investment. Investing in value stocks is a long-term investment. The company has a market valuation of $29.3 billion. Its share is trading at $335.51. the company’s share is on an upward streak for the past two years. Despite the volatility, the share has appreciated by almost 10% during the year 2021. The share peaked at $406 during the year and the lowest it dropped was at $308.

Autodesk Inc. (NASDAQ: ADSK)

Autodesk Inc. (NASDAQ: ADSK)

Autodesk is a global leader in design and making technology. It has expertise across:

- Architecture, engineering, and construction professionals

- Product design and manufacturing professionals

- Media and entertainment professionals.

The company has smartly shifted from a legacy software model to a software-as-a-service model. As a result, the company is growing and experiencing double-digit growth. The pharmaceutical stocks growth rate has accelerated in the past few years and the pandemic has pushed the growth of this industry in an upward direction.

In the recent quarter, the company reported:

- Total revenue of $1.12 billion

- Free cash flow of $257 million

- Operating margin of 32%

The company’s market valuation is at $54.54. the share of the company is trading at $247.72. the share price has shown moderate level volatility in the past two years. Despite the volatile performance the share has continued to climb. In the year 2021, the share has declined by roughly 10%.

Organovo Holdings, Inc. (NASDAQ: ONVO)

Organovo Holdings, Inc., a biotechnology company, focuses on developing 3D tissues that recapitulate key aspects of human disease. Its 3D human tissue platform includes its proprietary NovoGen Bioprinters, which are automated devices that enable the fabrication of 3D living tissues comprised of mammalian cells; and related technologies for preparing bio-inks and bioprinting multicellular tissues with complex architecture. The company offers ExVive human liver tissue and ExVive human kidney tissue used for predictive preclinical testing of drug compounds.

Organovo Holdings Inc recently reported its third quarter report for the year 2022:

- Revenue was reported at $ 77,000

- Loss from operation was reported at ($ 3.5) million

- Net loss was reported at ($ 3.3) million

Organovo Holdings, Inc has a market cap of $ 16 million. Its shares are trading at $ 1.84.

The stock has been on a bearish pattern for the past two years. In 2021, the stock started off at $ 12.3. Initially, the stock spiked and reached its peak at $ 19.39. Since then the stock has been on a downward trajectory. It closed the year at $ 3.63 representing a 70 % decline in 2021.

In 2022, the stock continued its downward fall and declined by 61 % closing the year at $ 1.41

Danimer Scientific (NYSE: DNMR)

Danimer Scientific, Inc., a performance polymer company, develops, produces, and provides bioplastic replacements for traditional petroleum-based plastics. It produces polyhydroxyalkanoate, a biodegradable plastic feedstock alternative used in a range of plastic applications, including films, straws, food containers, and other things under the Nodax brand name; polylactic acid-based resins for coating disposable paper cups; and other biopolymers. The company offers its products for biopolymers, including additives, aqueous coatings, fibers, filaments, films, thermoforming, and injection-molded articles. It also markets its products to consumer packaging brand owners, converters, and manufacturers in the plastics industry.

Danimer Scientific recently reported its third quarterly report for the year 2022:

- Revenues were reported at $ 10.5 million as compared to $ 13.4 million in the previous year’s same period

- Loss from operations was reported at ($ 94.9) million as compared to ($ 31.8) million in the previous year’s same period

- Net loss was reported at ($ 94.9 million) as compared to a net profit of $ 7.8 million in the previous year’s same period

- Earnings per share were reported at ($ 0.94) as compared to $ 0.08 in the previous year’s same period

Danimer Scientific has a market cap of $ 218 million. Its shares are trading at $ 2.15.

The stock has been on a bearish pattern for the past two years. The stock started in the year 2021 at $ 23.5. Initially, the stock spiked high and reached a peak of $ 57.8. After that, the stock started its downward trajectory and closed off, the year at $ 8.52. Overall, the stock declined by 63.7 %.

In 2022, the stock continued its downward trajectory. The stock closed the year at $ 1.79 representing a 79 % decline during the year.

Raytheon Technologies Corporation (NYSE: RTX)

Raytheon Technologies Corporation (NYSE: RTX) is an aerospace and defense company that provides systems and services for commercial, military, and government customers across the world. The company is branching out into the 3D printing sector with its 3D-printed guided missile.

Raytheon Technologies Corporation recently announced its quarterly report for the year 2022:

- Net Sales were reported at $ 17 billion, as compared to $ 16.2 billion in the previous year’s same period

- Net Income was reported at $ 1.39 billion as compared to $ 1.4 billion in the previous year’s same period

- Earnings per share were reported at $ 0.94 as compared to $ 0.92 in the previous year’s same period

Raytheon Technologies Corporation has a market cap of $ 145.1 billion. Its stock is trading at $ 98.68.

The stock of the company has been on an upward streak for the past two years. It started off the year 2021 at $ 71.51 and closed off at $ 86.06 representing a 17 % appreciation during the year.

In 2022, the continued its bullish run while exhibiting volatile behavior. The stock closed the year at $ 100.92 representing a 17.3 % appreciation during the year.

Read more:

Markforged Holding Corporation (NYSE: MKFG)

Markforged Holding Corporation produces and sells 3D printers, materials, software, and other related services worldwide. The company offers desktop, industrial, and metal 3D printers; composite, continuous fiber, and metal parts, as well as advanced 3D printing software. It serves customers in aerospace, military and defense, industrial automation, space exploration, healthcare, and automotive industries.

Markforged Holding Corporation recently reported its quarterly report for the year 2022:

- Revenue was reported at $ 25.2 million, as compared to $ 24.1 million in the previous year’s same period

- Loss from operations was reported at ($ 22.8) million, as compared to at ($ 22.8) million in the previous year’s same period

- Net loss was reported at ($ 23) million, as compared to $ 21.7 million in the previous year’s same period

- Earnings per share were reported at ($ 0.12) as compared to at ($ 0.13) in the previous year’s same period

Markforged Holding Corporation has a market cap of $ 268 million. Its stock is trading at $ 1.38.

The stock has been declining in the past two years. It started the year 2021 at $ 10.77 and closed the year at $ 5.37 representing a 50 % decline during the year.

In 2022, the stock continued its volatile behavior and closed off the year at $ 1.16 representing a 78.4 % decline the year.

CONCLUSION

The story of using realistic 3D-printed models to separate cojoined twins not only brought joy for many people. It also paved the way for the increased demand for 3D technology and the companies developing it. The technology is remaking a growing number of industries — from aviation to auto manufacturing, to clothing, and even fast food. 3D printing is a top trend that investors should take advantage of, today. Moreover, the growth within this sector is outstanding.

Get to know the best quantum computing stocks.

The above-listed stocks are amongst the key players within the 3D industry, Not only, each company has been successful in contributing towards the revolutionary change this technology is bringing. The above-listed companies have been heavily investing in making lives easier by providing efficient solutions to problems.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Semiconductor Stocks to Buy in 2024

- Best Lithium Stocks to Buy in 2024

- Best Robinhood Stocks to Buy in 2024

- Best Penny Stocks to Invest

- Best Oil Stocks to Buy in 2024

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy

- Most Volatile Stocks

- Best Crypto Signals

- Best Artificial Intelligence Stocks