One of the prime concerns of a trader is to decide which is the right time to enter or exit the market. To help determine, Best Forex Indicators are used, which indicate the best time to buy or sell. These indicators help understand the complex market movements and assist traders in understanding the momentum of the ongoing trading. These indicators are constructive in making disciplined and informed decisions. Here are some of the best forex trading platforms.

One of the prime concerns of a trader is to decide which is the right time to enter or exit the market. To help determine, Best Forex Indicators are used, which indicate the best time to buy or sell. These indicators help understand the complex market movements and assist traders in understanding the momentum of the ongoing trading. These indicators are constructive in making disciplined and informed decisions. Here are some of the best forex trading platforms.

List of Best Forex Indicators for Forex Currency Trading

Below is the list of indicators, which are very helpful and used by the majority of the traders in Forex Trading:

- Elliott Wave

- Swing sequences

- Fibonacci Extensions

- Fibonacci Retracements

- Trendlines

- Currency Correlations

- Relative Strength Index (RSI)

- Bollinger Bands

- Moving Average Convergence Divergence (MACD)

- Parabolic SAR

- Exponential Moving Average (EMA)

- Awesome Oscillator

Elliott Wave: The Psychology-Based Indicator

Elliott Waves is one of the most well-known indicators. This indicator has its niche in Forex trading analysis. Elliott Waves show that investor psychology is the driving force of the movements within the financial markets. This indicator gives more detailed and profitable results.

Many professional forex traders adopt the below approach while using Elliott Waves in Forex trading:

- Choosing a specific method for generating the count of Elliott Wave

- Let the Elliot Wave reach the “5” mark

- Confirmation of the trend

- Deciding a stop-loss point

- Place the stop-loss order by entering the Forex Market

- Deciding upon the target profits and stops

- Selecting a trade exit plan in case of losses

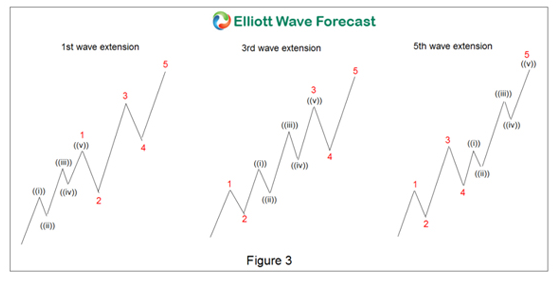

The Elliott Wave analysis Forex includes two different wave patterns: the five-wave pattern and the three-wave pattern. The five-wave pattern can be found with five other dominant waves, which include Wave 1, Wave 2, Wave 3, Wave 4, as well as Wave 5.

Extensions frequently occur in the third wave in the stock market and forex market.

While using Elliott Wave, a trader needs to be very careful in following its rules. The technique which is required to interpret Elliott Wave is essential. As a trader, you need to be very careful in framing the appropriate method for forex trading. Also, the use of proper filters is vital to receive authentic forex signals. Get to know Best Trading and Forex Signal Providers

Elliott Wave is a supportive indicator that can provide you with a good overview of the market and its potential moves, along with the correct placement of stop-losses and take-profits. Elliott Wave should be used for confirmation rather than identification.

Master Elliott Wave Theory like a Pro. Download Free E-book.

Read more:

Swing Sequences

Swing trading is used by forex traders who trade by profiting from price swings. Swing traders identify a possible trend and then hold the trade for some time, varying from two days to several weeks.

Also check out best swing trading stocks.

Swing Sequence is used best when combined with the Elliott Wave. The team of Elliott Wave Forecast regularly used both these indicators for Forex Trading Analysis.

The chart below depicts a 5-swing sequence from the high. A 5 swing is an inadequate sequence since a reparative sequence should therefore conclude with a 3, 7, or 11 swing. This trend may be labelled in two ways, but both lead to the very same ending: it is prone to having additional decline. The first method of labelling is to consider the 5 swing to be component of a 7 swing WXY dual three structure.

There are four types of trading strategies within the swing sequence:

- Reversal – A reversal is a change in the trend direction of an asset’s price

- Retracement (Pullback) – Retracement is a temporary reverse in price within an ongoing, more significant trend. The price pullbacks to an earlier price point; later, it continues to move in the same direction.

- Breakouts – A breakout involves entering the forex market when the price breaks during an upward trend

- Breakdown – A breakdown involves entering the forex market when the price breaks during a downward trend.

The below chart shows the Elliott wave chart of Nikkei (Stock Market Index of Tokyo Exchange) conducted by the team of Elliott Wave Forecast using Swing Sequence. As per the chart, the nikkei Index can be seen rallying in three waves to reverse the fall from the top on June 15, 2021 before resuming its downward trend. In any case, the Index is projected to fall further.

While using the Swing Sequence for Forex trading, you should be careful to follow one trading style as a trader. Since this trading style needs holding positions, switching trading styles is not recommended.

The technical indicators that go well with Swing Sequence are the Relative Strength Index, Simple Moving Average, and Moving Average Convergence Divergence (MACD). Swing Sequence is one of the proven best forex indicators. Forex and stocks are very volatile markets and have high trade frequency. Read more about forex vs stock trading.

Fibonacci Extensions

Fibonacci extensions are tools used by traders which help them determine profit targets. This tool enables the traders to identify how far the price may go before a pullback finish. The extension levels are periods where the chances are that the price may reverse. Common Fibonacci extension levels are 61.8%, 100%, 161.8%, 200%, and 261.8%.

The process of drawing a Fibonacci extension during the bullish period is:

- Recognize the Swing High Point (Mark with 1)

- Recognize the Swing Low Point (Mark with 2)

- Connect both 1 and 2 points

- Choose profit levels

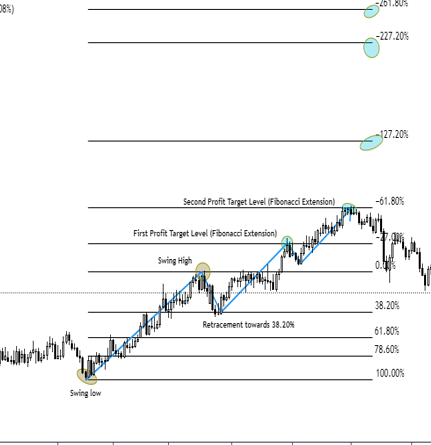

Below chart is an example of the Fibonacci Extension Tool:

The chart above elucidates a perfect example of Fibonacci extensions. Suppose that you took a buy on this chart at the 78.6% Fibonacci retracement level. Then, you have to look for a potential profit target, where the price would likely reach and reverse from. The Fibonacci extension tools allow you as different extension levels as possible target levels whenever you trade with the Fibonacci tool. There is a vast array of trading courses available online which you can join to learn trading.

The chart above elucidates a perfect example of Fibonacci extensions. Suppose that you took a buy on this chart at the 78.6% Fibonacci retracement level. Then, you have to look for a potential profit target, where the price would likely reach and reverse from. The Fibonacci extension tools allow you as different extension levels as possible target levels whenever you trade with the Fibonacci tool. There is a vast array of trading courses available online which you can join to learn trading.

The chart above shows that the trader took the buys at 38.2% for the EURJPY Daily Timeframe, with the potential target of fib extension levels 161.8%. The extension level was reached smoothly, and the trader took profits. Also, notice that how the price reversed after touching the 161.8% extension. This is how the magic of Fibonacci extensions work. Other extensions such as 200%, 227.2% and 261.8% are also used as target levels; however, the 161.8% is the most commonly used Fibonacci extension as a profit target. Therefore, it possesses a higher chance for being the perfect profit target level and much more reversal chances from that area. Get to know the best vaccine stocks to invest in 2023.

Read: Best Gold Trading Signal Providers.

Fibonacci Retracements

Fibonacci Retracements are tolls used by a forex trader to determine possible levels of support and resistance. These levels of support and resistance help traders find the entry or exit points of the market.

The process of implementing the Fibonacci retracement includes:

- Identifying the significant move up/down

- Draw Fibonacci connecting the highs and lows (For bear trend from high point to the low point, and for bullish trend low point to high)

- Choose possible retracement levels.

The key levels to look out for are 38.2% and 61.8%, respectively. The 50% level is not technically a Fibonacci level but is considered a necessary threshold.

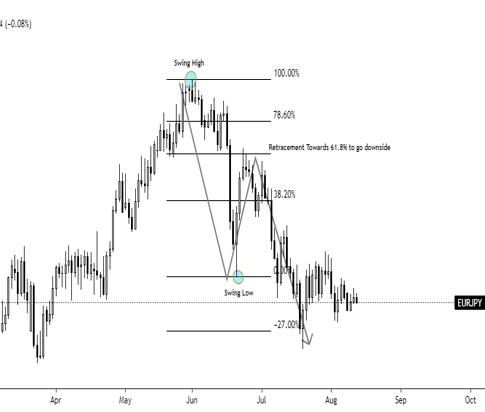

The below chart is an example of EURJPY D1 Timeframe using Fibonacci Retracements. The possible retracement levels have been marked at 38.2% and 61.8%.

Notice how the price touched the 61.8% Fibonacci retracement level (Commonly regarded as the “62%”) and continued the initial bear trend to the downside. Fibonacci is one of the most effective trading tools used in every aspect of our life. Nevertheless, it does not mean that you should use the Fibonacci retracement tool as the sole confluence of your trading plan. Using it in conjunction with several other confluences can be highly profitable and beneficial!

Notice how the price touched the 61.8% Fibonacci retracement level (Commonly regarded as the “62%”) and continued the initial bear trend to the downside. Fibonacci is one of the most effective trading tools used in every aspect of our life. Nevertheless, it does not mean that you should use the Fibonacci retracement tool as the sole confluence of your trading plan. Using it in conjunction with several other confluences can be highly profitable and beneficial!

Go through a list of crypto mining companies that are leading the industry.

Also read: Best Stock Forecasts & Prediction Services

Trendlines

Trendlines are the simplest and most common form of technical analysis in forex trading. It is also one of the most underutilized indicators. A trend occurs and can be recognized when the currency price moves in a zigzag pattern but follows a specific direction when looked at from a bigger picture. Trendlines connect significant lows in an uptrend and significant highs in a downtrend.

Traders look for patterns in the trend that create trade opportunities. There are 3 types of trendlines:

1. Uptrend (higher lows) –

- Swing high- end of a run and before a pullback begins

- Swing low- end of a pullback and before a run begins

This indicates the price movement: higher highs and higher low

2. Downtrend (lower highs)

- Swing high- end of a pullback and before a run begins

- Swing low- end of a run before a pullback begin

This indicates the price movement: lower lows and lower highs.

3. Sideways trend (ranging)

While drawing and understanding Trendlines, it is essential to note a few facts:

- Two tops (uptrend) or two bottoms (downtrend) make a valid trendline, but three tops/bottoms confirm a trendline.

- A trendline becomes less reliable if it goes steeper

Trendlines are excellent forex indicators. With a bit of patience, traders can take the best advantage of these indicators. While using trendlines, one important trading tip is to buy during bullish trendlines and sell during bearish trendlines.

Read more:

Below are examples of buying at bullish and selling at bearish trendlines:

Bearish Trendline

Bullish Trendline

Bullish Trendline

Trendlines are a form of support and resistance. A break of a trendline signals a trend change. Trendlines are one of the best indicators for forex trading.

Read more:

Currency Correlations

Correlation is a statistical measure of how two variables relate to one another. Since currencies are priced, compared, and analyzed in pairs, their correlation is significant. The more powerful the correlation, the more closely aligned they are. Understanding correlation amongst currencies is vital for you as a trader. It will help you improve your portfolio’s exposure. Always choose trusted and reliable forex broker as markets are already subjected to risk,

The correlation amongst currencies is of two types:

- Positive Correlation – This means that the currency pair will move in the same direction

- Negative Correlation – This means that the currency pair will move in the opposite direction

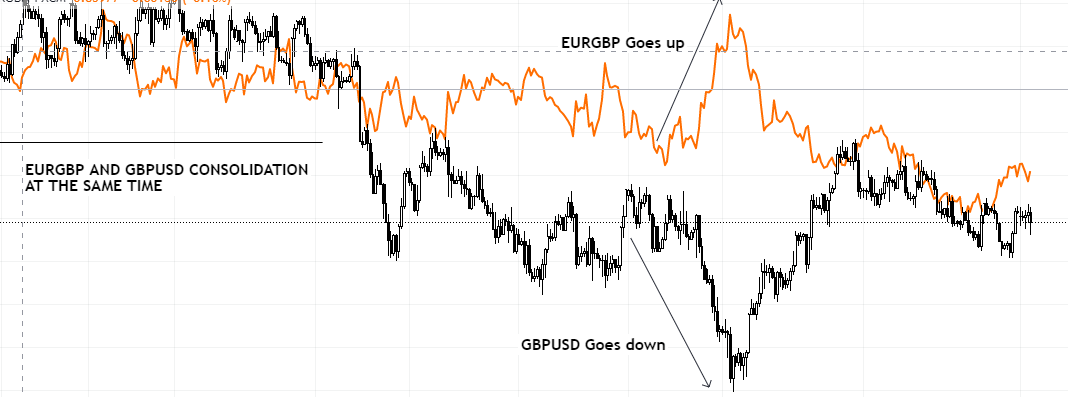

The below chart shows currency pairs reflecting positive and negative correlations:

Here you can see, the negative correlation between EURGBP and GBPUSD taking place.

Here you can see, the negative correlation between EURGBP and GBPUSD taking place.

On the left side of the chart, you can see how GBPUSD and EURGBP are consolidating at the same time. moreover, the right side elucidates how the bull & bear moves happen negatively and simultaneously. Traders can take advantage of these correlations by keeping in mind how another asset class or forex pair is moving.

Correlation offers traders a chance to get hold of more enormous profits. A correlation reading varies from negative 1 (-100) to positive 1 (+100). A correlation reading of 0 represents no correlation exists. The correlation between different pairs can be found here.

The below correlation table shows correlations among currencies that are highly traded in the world:

| EUR/USD | GBP/USD | USD/CHF | USD/JPY | EUR/JPY | USD/CAD | |

| EUR/USD | 1 | 0.83 | -0.54 | -0.09 | 0.79 | -0.68 |

| GBP/USD | 0.83 | 1 | -0.39 | -0.05 | 0.66 | -0.66 |

| USD/CHF | -0.54 | -0.39 | 1 | 0.48 | -0.17 | 0.20 |

| USD/JPY | -0.09 | -0.05 | 0.48 | 1 | 0.52 | -0.11 |

| EUR/JPY | 0.79 | 0.66 | -0.17 | 0.52 | 1 | -0.65 |

| USD/CAD | -0.68 | -0.66 | 0.20 | -0.11 | -0.65 | 1 |

| AUD/USD | 0.48 | 0.53 | -0.09 | 0.15 | 0.5 | -0.73 |

Source: MyFxBook

Trading currencies that move in the opposite direction leads to zero pairs. Hence, trading such currency pairs is not recommended. Currency correlation is used by traders to hedge and manage the risks of buying positions of the same currency pairs. This can help them avoid possible losses. The forex market is volatile, and multiple factors affect it daily. The trick is to understand the correlation between the currencies. Currency correlation is one of the most used forex trend indicators. Checkout best EV stocks to invest in today.

Relative Strength Index (RSI)

The RSI indicator is a technical trading tool that is considered a leading best forex indicator. This means that it gives out signals before a price event. The RSI measures the ratio of up-moves to down-moves and gives out a reading within the range of 0-100. Here you can read the Basic RSI Trading Strategies.

The Relative Strength Index consists of a single line, which fluctuates between 0-100. The index area is separated into three areas:

- 0-30: Oversold Area

- 30-70: Neutral Area

- 70-100: Overbought Area

The RSI line moves around these areas, giving different signals on the chart according to which traders act. The RSI line helps traders identify the ongoing trend and when the market is overbought or oversold. The trader is then able to determine the best price to enter or exit the forex market. Furthermore, the RSI also allows the trader to identify that which trading time-frame is most active.

RSI is a brilliant and accurate tool used by forex traders. It is amongst the best forex indicator.

Ready to succeed as a forex trader? Learn how Elliott Wave Forecast can help you improve your success.

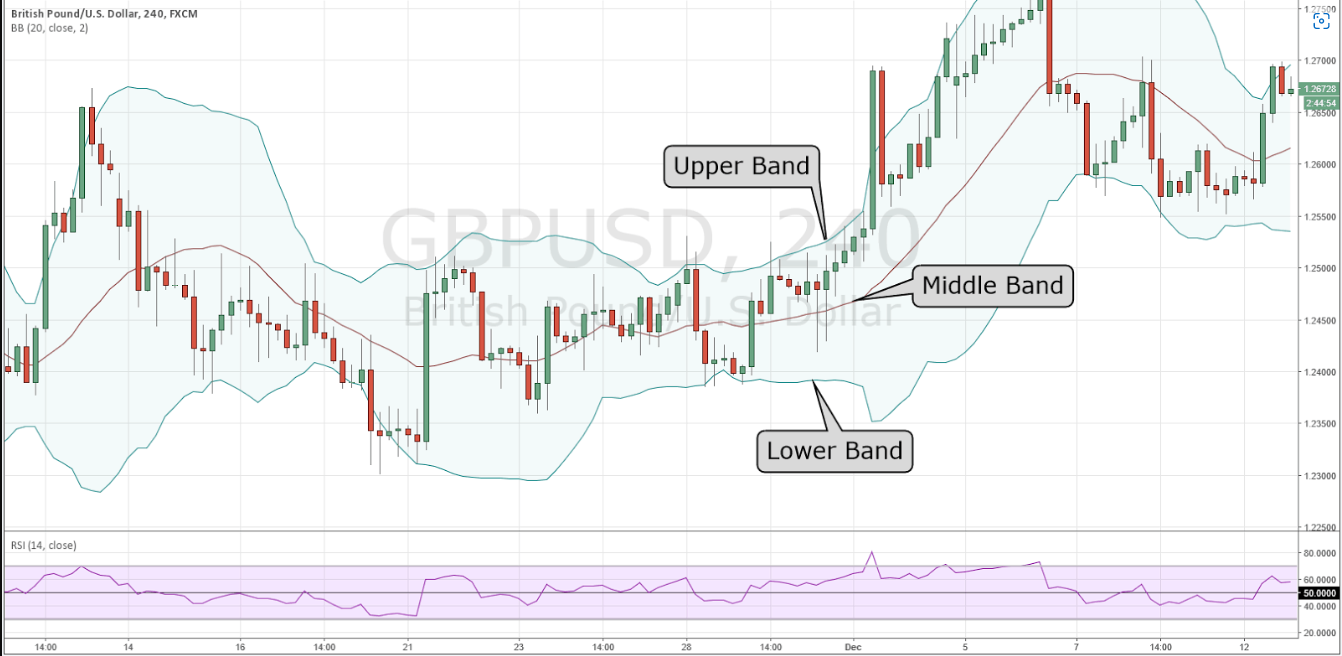

Bollinger Bands

The Bollinger band is a forex trading indicator that helps indicate the buy and sell signals, price up and price low levels, and the market overbought and oversold conditions. Bollinger Bands use standard deviation to establish possible support and resistance levels.

This strategy can be used for both short-term and long-term trading purposes.

Bollinger Bands is also a great indicator of market volatility and provides lots of useful information which includes:

- Trend continuation or reversal

- Periods of market consolidation

- Periods of upcoming large volatility breakouts

- Possible market tops or bottoms and potential price targets

The theory of this forex indicator is that the settings of the top and lower bands (the standard deviation from the moving average) indicate price action. Any price movement that touches or exceeds the upper or lower band indicates increased volatility. It indicates good trading opportunities.

Understanding the charts of the Bollinger bands:

- If the price is moving below the 20-period middle line then the market is in a downtrend.

- If the price is moving above the 20-period, consider the market is in an uptrend.

- Use the angle of the middle line if the price exceeds the moving average.

Source: Trading Strategy Guides

Source: Trading Strategy Guides

The Bollinger bands also have a built-in indicator for profit taking: the outer bands. Once the chart touches the middle line, for the buy or sells signal, wait for the price to hit the upper band or lower band, and then cash in your profits

Bollinger Bands can be applied to virtually any market or security. For beginners, the default Bollinger Band settings are a good starting point. They are an excellent Forex Market indicator

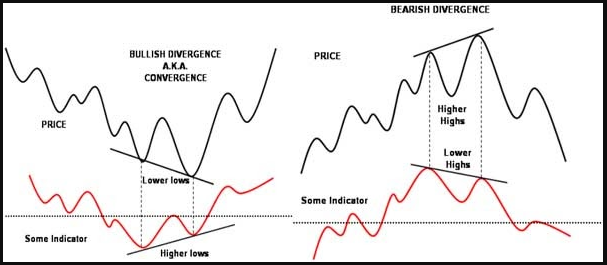

Moving Average Convergence Divergence (MACD)

MACD is an excellent indicator of price momentum, showing the direction of the stock price in the market. Forex traders can predict the direction in which the prices are moving in the market. This indicator spots shifts in momentum which is achieved by drawing a comparison between 2 moving averages.

The MACD technique tracks the convergence and divergence between two moving averages. The most commonly used are the 12-day and 26-day moving averages. The general rule of picking the values is that one should be of a shorter period, and the other should be of a longer period.

One drawback of this indicator, which traders should be careful about is that it detects trend reversals only after they happen. Therefore, forex traders should tread with caution while using this indicator.

The MACD indicator indicates as follows:

- The signal line: It illustrates the shifts in price momentum. It also acts as a trigger – in terms of sell and buy signals.

- The MACD line: This line calculates the gap between the 2 moving averages.

- The histogram: This line calculates the contrast between the signal line and the MACD.

A positive MACD indicates that the short-term moving averages are above the medium-term ones and, therefore, bullish. Negative MACD thus shows bearish trends. Overall, when the MACD crossed the central line in a bullish or bearish divergence, it indicated buy or sell.

This forex indicator is very easy and simple to use. Its signals are accurate and traders can easily depend upon it for trade signals. Traders can view the potential changes in the trend and can also tell how strong are the buy and sell signals.

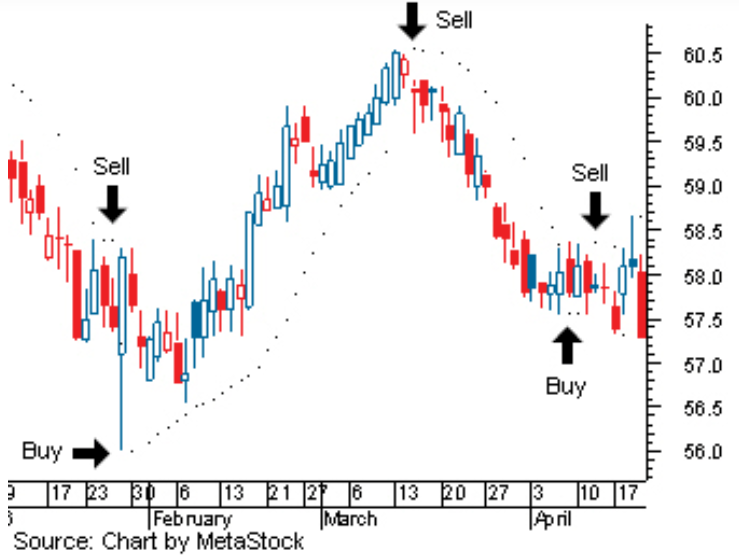

Parabolic SAR

The Parabolic SAR is a technical indicator that determines the direction of an asset that is moving. The indicator is also referred to as a stop and reverse system, which is abbreviated as SAR. This forex indicator aims to identify potential reversals in the price movement of currencies and also indicates entry and exit points.

The Parabolic SAR is shown on the chart as a set of dots that are placed near the price bars. Generally, when these dots are located above the price, it signals a downward trend. This is a sell signal. When the dots move below the price, it indicates a downward trend in the currency. This is a buy signal.

When the direction of these dots changes direction, it indicates trade signals. These are profitable signals.

The benefit of using a Parabolic SAR as a forex indicator is that it helps to determine the direction of price action. And it also indicates the potential reversal in prices. This indicator also helps identify potential entry and exit points. When the market is following a strong trending environment, the indicator produces good results. In addition to it, if the market moves against the trend, the indicator gives an exit signal of when a price reversal could occur.

Parabolic SAR also helps identify the strength of a trend based on the space between the plots. Therefore, it is one of the best forex indicators during long market rallies.

However, there are some downsides to this indicator. If the markets move sideways, chances are this indicator will give faulty signals. Since there is no trend, the indicators will move back and forth around the price bar. As a result, the signals in this situation are misleading. Therefore, totally relying on Parabolic SAR is not recommended

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) is a technical indicator that shows how the price of a currency changes over a certain period of time. The EMA is different from a simple moving average in that it places more weight on recent prices.

This indicator is best used to determine the direction in which the price of the currency is moving based on past prices. Therefore, they cannot be used for future price indicators.

Traders can use EMA in the following ways:

- Highlighting Trends – This is one of the most important functions of an EMA. A rising EMA indicates that prices are on an upward trend and vice versa. When the price is above the EMA line, it is likely to rise, and when it is below, it’s likely to fall

- Support and Resistance bands – The EMA and other types of moving averages also function as support and resistance levels for prices. Prices should not fall below the EMA line. This acts as a floor for the price levels. Similarly, prices do not rise above the EMA line. It acts as a resistance line.

Despite the advantages, every indicator has a few downsides to its practicality, which are:

- Traders cannot predict the future of the currency.

- There is a lag while using EMA. A 10-day exponential moving average will react quickly to price changes. Whereas, a 200-day moving average will take more time to react to changes.

- It does not work well in volatile markets. If prices are volatile, the EMA chart will swing along with the price. In such a case using longer time frames will help but the usefulness of the indicator is still questionable.

Awesome Oscillator

Awesome Oscillator is one of the most reputed and widely-used indicators for tracking market momentum. It is plotted as a histogram, which primarily uses red and green to signify price differences since the previous period.

When the price rises, the histogram produces a green bar. Similarly, when the price drops the histogram creates a red one. The Awesome Oscillator is a great momentum indicator. It is best used for new traders and also offers complexity, to experienced traders.

Awesome Oscillator offers a good overview of the market by comparing the recent market momentum with the general momentum over a wider time frame. The indicators offer the below signals for investors who can in turn identify potential trade opportunities:

- Zero-line crossover – A cross above the line represents a buying opportunity, and a cross under is generally viewed as a signal to sell.

- The twin peaks- This strategy is pretty versatile and applicable to both bullish and bearish markets. When there are two momentum peaks below the zero-line, it is called a bullish twin peak. Similarly, when there are two green peaks above the zero-line, it is called a bearish twin peak

- The saucer – Saucers can be either bullish or bearish, depending on their position with respect to the zero-line. When the Awesome Oscillator is positioned above the zero-line followed by two consecutive red bars, it indicates a Bullish saucer. Similarly, when the two consecutive green bars are below the zero-line and are immediately followed by a red bar it indicates a Bearish saucer

Just like other technical indicators, Awesome Oscillators also have their downsides. There are times when the indicators report low market momentum while the price continues to make new highs and high momentum signals during consolidatory movements.

Also, the signals of this indicator, do not always reflect the market’s immediate actions, which allows the indicator to detect market divergences. These divergences allow traders to put their investments in ideal positions.

Conclusion

Forex is a decentralized global market for the trading of currencies. It is also one of the most volatile markets, which fluctuate daily. This market determines foreign exchange rates for every currency. Like the stock market, this market is also very tricky with massive potential for profits and losses. The above tools and indicators have been shortlisted by us to make our readers better understand currency trading. These indicators are used by both professional and regular traders, both. Understanding the market and using the right tools and indicators is the key to designing a healthy portfolio of currencies. Using the above-listed tools and indicators will enable our readers and traders to make educated and well-informed decisions for their investments.

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

Read More:

Back