Main Talk points:

- Bonds vs Stocks

- How To Invest In Bonds?

- How To Invest In Stocks?

- Pros and Cons of Investing in Bonds

- Pros and Cons of Investing in Stocks

- Bonds vs Stock in Last 30 Years

- A Comparison of Returns on Bonds vs Stocks

- Bonds Vs Stocks in 2024 – Outlook

- Bond Market

- Stock Market

- Stocks or Bonds – Where to Invest?

Bonds and Stocks are two major sources of investment and have the power to make or break an economy. Understanding how each one of them works is very important for investors before deciding upon the appropriate investment option for you. In this article, you will learn the basics about bonds vs stocks, their pros and cons, their historical performance and, which investment options are best in the current year 2024. Investing in best ETFs is one of the most easiest and safe investment option.

Read more:

Bonds Vs Stocks

Stocks, also called capital stock, are equity instruments that represent ownership in a company. Whereas, Bonds are financial instruments that highlight the loans from the government or any company.

In the battle of Bonds vs Stocks, stocks are considered a riskier investment in the short run because of the riskier nature of the stock market. Bonds, on the other hand, pay off fixed interest which makes them a safer choice in the short run. Bonds are usually sold over the counter, whereas stocks are sold on the stock market.

The below table highlights the major differences between Bonds and Stocks

| Bonds | Stocks | |

|---|---|---|

| Type of Instrument | Financial | Equity |

| Issuers | Government Institutions, Financial Institutions, Companies, etc. | Companies |

| Holder Status | Holders are lenders | Holders are owners |

| Risk Level | Relatively Low | High |

| Return | Interest, which is fixed | Dividend, which is neither fixed nor guaranteed |

| Platform of Trading | Over the Counter | Stock Market |

| Investment Type | Debt | Equity |

| Duration of Investment | Fixed | Depends on the Investor |

| Additional Benefits | Liquidation and preference in terms of repayment | Voting rights in the company |

How To Invest In Bonds?

There are a few options where you can buy bonds:

- Broker- Bonds can be purchased from an online broker. This is a way of buying from other investors who want to liquidate their investments.

- Exchange-Traded Fund (ETF)- An ETF is an excellent option for individual investors as it provides a diversified portfolio and you don’t have to buy every bond in $1000 denominations.

- Government- Investors can directly buy from the “Treasury Direct Website” without the involvement of any broker or middleman.

Also read: Best Stock Forecasts & Prediction Services

How To Invest In Stocks?

To invest in Stocks, you have to first open an online investment account through which you can start investing in the stock market. For that, the first thing you need to consider is your investment approach. In choosing your investment approach you have two options:

- You want to manage your investments yourself

- You want an investment manager to manage your account

Once you decide, you can open a Brokerage account, if you choose to manage your investments yourself, or a Robo-Advisor account, if you seek the services of an investment manager.

Pros and Cons of Investing in Bonds

Bonds are a haven for investor’s money. It’s a less risky option in comparison to stocks as debtholders are given priority over shareholders. In case the company goes bankrupt, debtholders are prioritized over shareholders at the time of repayment. Government bonds are completely risk-free as you will never lose your principal amount invested. Bonds offer predictable returns in terms of fixed interest. Investing in Bonds is the best option for people who seek security and predictability in their investments. Moreover, the returns on Bonds are usually higher than the interest rates paid by banks in their savings account. If you are looking for a long-term, less-risky, secure investment option, Bonds should be your pick.

The below table highlights the pros and cons of investing in bonds

| Pros | Cons |

| Bonds offer a fixed return in terms of interest payments | The majority of the Bonds require a huge amount of money to buy |

| Bonds are less risky and are the first to pay off in case of liquidation | Investment in Bonds also foregoes higher potential gains because of its less-risky nature |

| Bonds are less volatile as they are not fluctuating as quickly as the stocks on the stock market | |

| Bonds are universally credited by Credit Agencies which gives assurance to investors |

Get to know the best covered call stocks to buy now.

Pros and Cons of Investing in Stocks

Stocks provide the highest possible return but also, they are the most-risky investment because of the volatility of the stock market. The returns, though unpredictable, are higher in terms of capital growth and dividend. You can start investing in the stock market from as low as $10. If the company you have invested in performs well, the price of your investment can go up to $50 in no time. Investing in stocks can maximize your profits. If you are looking for higher returns and can accept the risk associated with them, then Stocks is your ultimate choice.

The below table highlights the pros and cons of investing in bonds:

| Pros | Cons |

| With Stocks, you can take advantage of the growing economy. As the economy soars, the earnings of the company improve. This leads to better dividends and improvement in the share price. | You get exposed to market volatility. With the stock market reaching new highs and lows every day your investment rises and falls side-by-side. |

| Stocks can be easily converted into cash by instantly selling them on the stock market. | In case you need to liquidate your assets for immediate cash, you might have to realize losses that cannot be avoided. |

| You can easily buy and sell shares of the company of your choice once you have set up your account. You can do it yourself if you prefer. | – |

| You earn a return in form of dividend and capital return | Return on the stock investment is not guaranteed |

| Stocks offer the highest returns | Investing in Stocks is the most-risky investment |

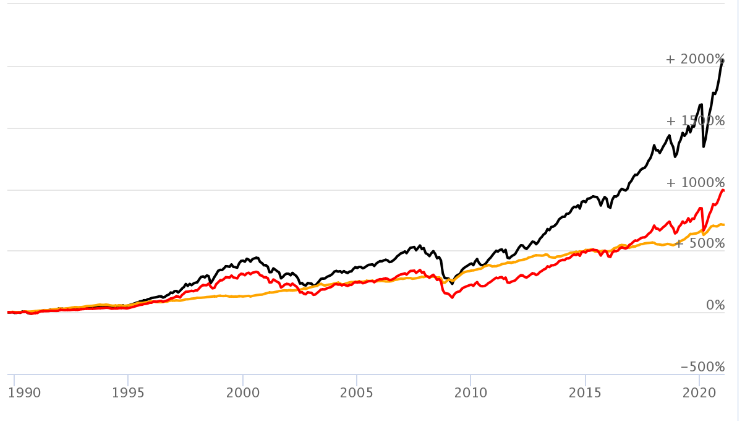

Bonds vs Stock in Last 30 Years

The Black chart represents “Total Return Stock Index”;

The Red chart represents the “S&P 500”;

The Yellow chart represents the “Total Return Bond Index”

A Comparison of Returns on Bonds vs Stocks

The below table compares the annual percentage change of the S&P 500 index and the annual return on the Bloomberg Barclays US Aggregate Index (Bond). The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed-rate agency MBS, ABS, and CMBS (agency and non-agency).

| Year | S&P 500 (%) | Bloomberg Barclays U.S. Agg Index (%) |

|---|---|---|

| 2020 | 16.26 | 7.51 |

| 2019 | 28.88 | 8.72 |

| 2018 | -6.24 | 0.01 |

| 2017 | 19.42 | 3.54 |

| 2016 | 9.54 | 2.65 |

| 2015 | -0.73 | 0.55 |

| 2014 | 11.39 | 5.97 |

| 2013 | 29.60 | -2.02 |

| 2012 | 13.41 | 4.21 |

| 2011 | 0 | 7.84 |

| 2010 | 12.78 | 6.54 |

| 2009 | 23.45 | 5.93 |

| 2008 | -38.49 | 5.24 |

| 2007 | 3.53 | 6.97 |

| 2006 | 13.62 | 4.33 |

| 2005 | 3 | 2.43 |

| 2004 | 8.99 | 4.34 |

| 2003 | 26.38 | 4.1 |

| 2002 | -23.37 | 10.26 |

| 2001 | -13.04 | 8.44 |

| 2000 | -10.14 | 11.63 |

Bonds Vs Stocks in 2024 – OUTLOOK

The year 2020 has been an eventful and tremulous year for the stock and bond market. Despite the unexpected damage done during March 2020, due to an alarming increase in COVID-19 cases, when investors sold any instrument, they could sell to raise cash, the return on the stock and bond market has been surprisingly better.

Read more:

Bond Market

This year, when the COVID situation is being controlled, the Bond market is likely to give a tougher response to investors due to the revised interest rate policies. The interest rates are expected to be set at historically low levels which will be the key reason behind the dampening performance of the bond market in 2023. This year, the regular income-seeking investors are in for a disappointment. Such investors need to revise their risk acceptance capability if they need better yield. If you are into trading checkout how the head and shoulders pattern has proved itself to be a reliable pattern in the chaotic market trends.

Low-interest rates will adversely affect bond prices and bond yields in the year 2021. As the Central Bank makes decisions to revive the economy, short term securities, those with a maturity of fewer than 3 years are most likely to be affected. Bonds with a maturity of five years and more get affected by growth and inflation expectations are less affected by short-term changes in interest rates. In the latter half of the year when vaccine distribution is expected to improve, the economy is expected to perform better and the GDP will accelerate.

Bonds for Income

If you are an investor who relies upon bonds as a source of income, you will face the challenging task of seeking that income within their risk acceptance capability. You need to look for options that include riskier assets which include higher-yielding, lower-credit bonds. These higher-yielding, lower-credit bonds started to outperform late in 2020.

Bonds for Diversification

As an investor, if your investment strategy for investing in bonds is diversification, then choose high-quality, longer duration bonds in the year 2023. Also remember, that diversification does not guarantee a profit.

To make the most out of investment in Bonds in the year 2023, we advise you to design your portfolio with government bonds and a diverse mix of h higher-yielding fixed-income sectors. Safe financial instruments like government bonds perform well when high yielding corporate bonds are under-performing. This approach towards investment will enable you to capitalizes on relative value opportunities all the while benefitting the differing correlations among sectors

Stock Market

The year 2020 has shown us that events that are outside your control like the global pandemic can shatter all predictions and forecasts to pieces. In March-2020 when the stock market reached record low levels, no one expected the year to end with a 67% improvement in S&P 500 index. The year 2022 is also expected to end with an optimistic index level of 4,300, as predicted by Goldman Sachs, which reflects an increase of 16%. This return is dependent on increased earnings of corporations along with low-interest rates which are likely to drive investors towards the stock market.

If stocks follow the trend of earnings in the year 2023, the year will prove to be good for all equity investors. During the pandemic, when the world faced unexpected circumstances, many businesses managed their operations pretty well which resulted in lower operating costs. If the earning continues to improve in 2022, S&P 500 earnings are expected to rise by 25 % as predicted by the LPL Financial Analysts. The bullish trend in the market will continue to run in this year also. Analysts predict that this bullish trend is set for better-than-average first two years based on the market performance during the 2008-09 financial crisis. Analysts further predict a good year for the stocks with the first six months comparatively slow and the later six months to pass with continuously increasing returns.

Read: Best Gold Trading Signal Providers.

Stocks or Bonds – Where to Invest?

- We expect growth style stock to perform exceptionally well in 2023. With the economy paving the way towards normalcy, we expect this young bull market to broaden and boost cyclical value stocks (A cyclical stock is a stock that is highly affected by macroeconomic factors or systematic changes in the economy)

- Small-cap stocks have a history of outperforming at the initial stages of a bull market (Small-cap stocks are those which have a relatively smaller market capitalization, normally between $300 million to $2 billion). We expect Small-Cap Stocks performance to improve further this year

- We expect Technology to be a top-performing sector in 2023 because of its strong earnings and favorable positioning in the pandemic situation. It is expected to outperform in the coming year.

In the year 2023, to play the stock market make sure your portfolio is adequately diversified. You need to spread your investments amongst different sized firms, stocks with growth characteristics and companies dispersed in different countries. This will ensure that irrespective of the economic conditions, one part of your investment portfolio will always be working and your investment picture will not be ruined.

Conclusion

The battle between bonds and stocks might always persist. They have an inverse relationship with each other. In the current environment, making the smart choice of a well-diversified portfolio of stocks and bonds might help you reach your profit and return goals

Disclaimer:

None of the information published in this article should be construed as investment advice. We strongly advise our readers to always do their due diligence before investing. It is the reader’s responsibility to know the laws regarding investments in their region.

Master Elliott Wave and Elliott Wave Theory like a Pro. Download Free E-book.

- Best Crypto Currencies To Invest

- Best Penny Stocks to Invest

- Best Renewable Energy Stocks to Invest

- Monthly Dividend Stocks to Buy