There are more than a thousand publicly traded companies you can invest in. In addition to them there are other options such as exchange-traded funds (ETFs) and mutual funds you can invest in. So many options often create confusion amongst investors regarding where to invest. And with the current stock market downturn, the majority of the stocks are trading at a significantly lesser price than a few months ago.

There are more than a thousand publicly traded companies you can invest in. In addition to them there are other options such as exchange-traded funds (ETFs) and mutual funds you can invest in. So many options often create confusion amongst investors regarding where to invest. And with the current stock market downturn, the majority of the stocks are trading at a significantly lesser price than a few months ago.

Top Trending Stocks in 2024

While there is no hard and fast rule to define the top stocks for investment. Neither there is a specific list that suits all. Here we have combined the top 10 stocks, that could prove to be excellent investment options in the current year:

| Sr. | Company Name | Symbol | Market Price (As of 22nd Feb 2022) | Market Cap |

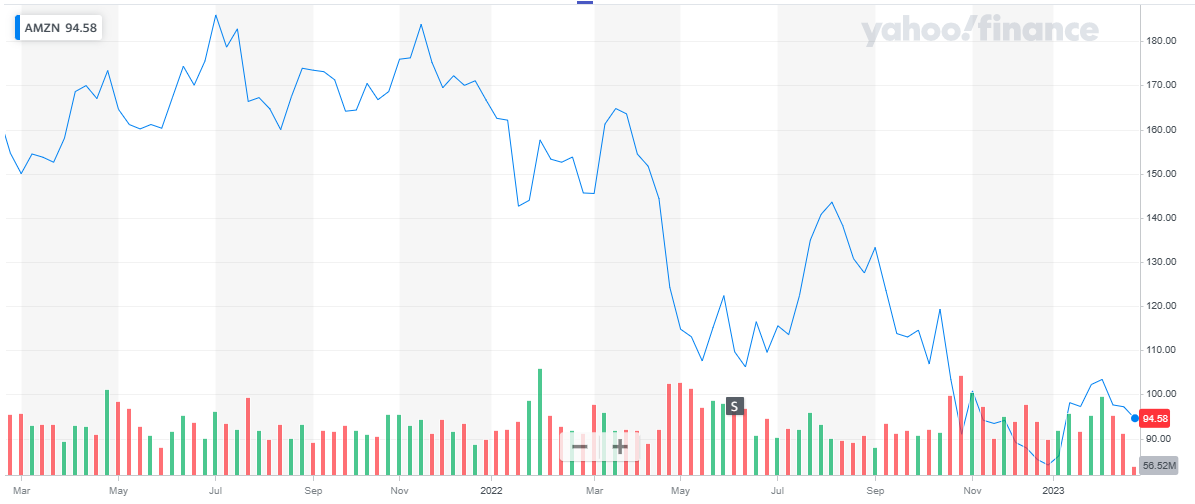

| 1 | Amazon | AMZN | $ 94.58 | $ 969.2 billion |

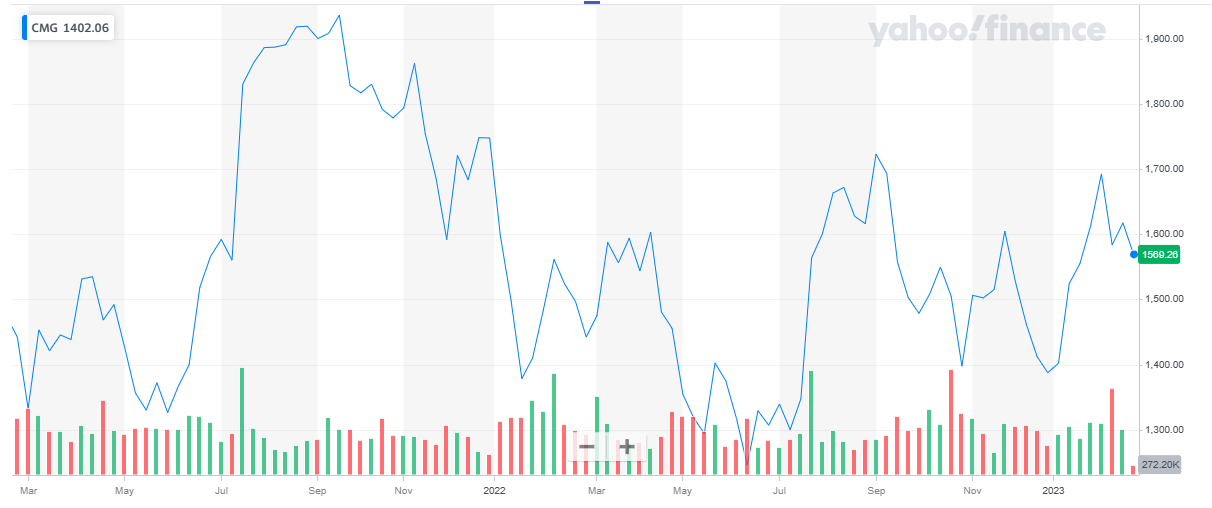

| 2 | Chipotle Mexican Grill | CMG | $ 1,569 | $ 43.4 billion |

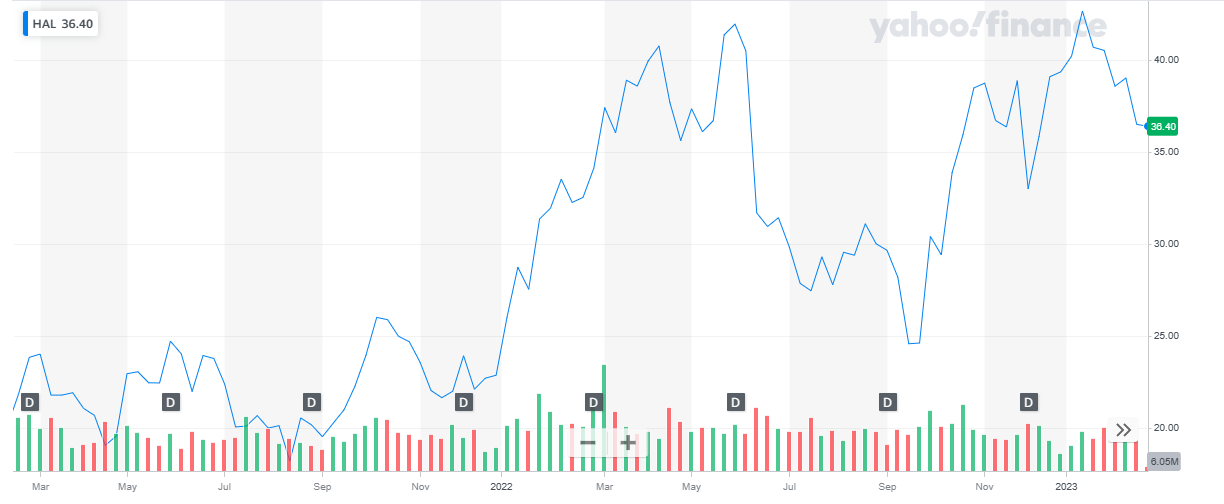

| 3 | Halliburton | HAL | $ 36.4 | $ 32.9 billion |

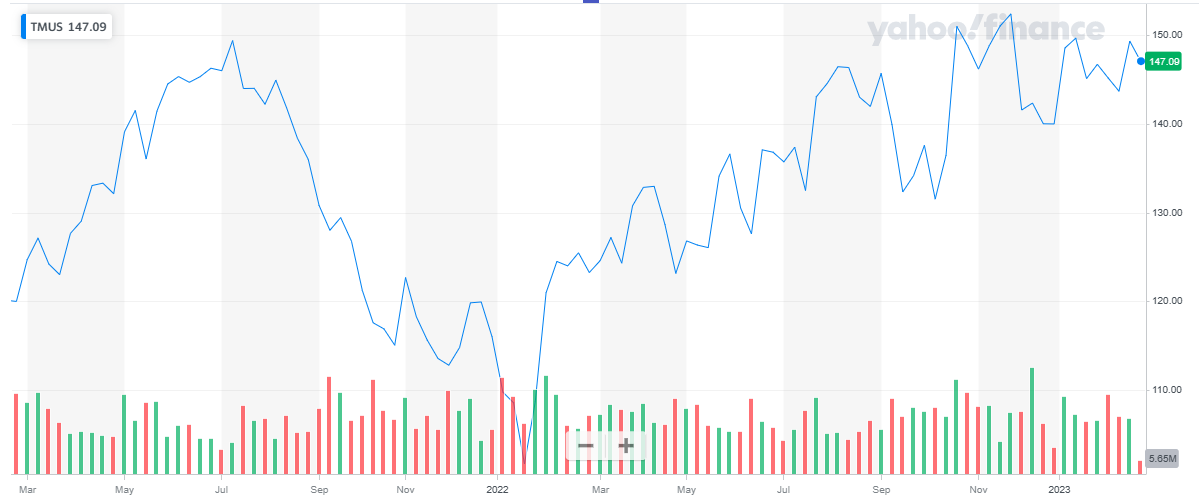

| 4 | T-Mobile US, Inc | TMUS | $ 147.09 | $ 179.4 billion |

| 5 | Workday | WDAY | $ 181.92 | $ 46.7 billion |

| 6 | Merck & Co. | MRK | $ 109.07 | $ 276.5 billion |

| 7 | Eli Lilly and Company | LLY | $ 327.51 | $ 311.2 billion |

| 8 | Walt Disney | DIS | $ 102.09 | $ 186.9 billion |

| 9 | Wells Fargo | WFC | $ 46.15 | $ 176.9 billion |

| 10 | Etsy Inc. | ETSY | $ 128.2 | $ 16 billion |

Amazon

Amazon

Amazon is a giant e-commerce retailer. However, it is not limited to online retail only.

- Amazon is the world’s largest cloud computing provider. The Amazon Web Services (AWS) platform has a larger market share than Microsoft’s Azure or Alphabet’s Google Cloud.

- Amazon earns commissions and sells warehousing and fulfillment services to third-party sellers on Amazon.com.

- Amazon also generates revenue through Prime, Kindle Unlimited, and other subscription services.

- The e-commerce giant owns physical stores, including the Whole Foods Market chain, purchased in 2017.

What makes amazon a good stock to invest in is its quality which is most sought after by individual investors or long-term investors: Its growth is reliable, and it is constant. Also, the leadership under the CEO Jeff Bezos is truly remarkable which has made the company reach new heights. The company continues to keep making money by growing bigger and becoming more profitable.

Amazon recently shared its full-year financials for the year 2022:

- Net sales were reported at $ 514 billion, a 9 % increase from the previous year’s sales of $ 469.8 billion

- Operating income was reported at $ 12.2 billion, as compared with $ 24.9 billion in 2021

- Net loss was reported at $ 2.7 billion in 2022 as compared with $ 33.4 billion in 2021

- Earnings per share were reported at $ 0.27, as compared to $ 3.24 per share in 2021

Amazon has a market cap of $ 969.2 billion. Its stock is trading at $ 94.58.

The stock enjoyed a prolonged bullish period during COVID-19. It maintained its high price range till 2021 after which the stock reversed its course.

The stock picked up a bearish cycle which started in 2022 and continued for the whole year. The stock declined by almost 50 % during the year. During the current year, the stock has picked up a bullish run and has appreciated by 13 % to date.

Also, learn:

Also, learn:

Chipotle Mexican Grill

Chipotle owns and operates more than 3,000 fast-casual restaurants serving made-to-order tacos, burritos, and bowls. The chain has locations in the U.S., Canada, France, Germany, and the U.K

Chipotle recently announced its full-year results for 2022:

- Total revenue was reported at $ 8.6 billion, a 14.4 % increase from the previous year

- Net Income was reported at $ 899 million, a 38 % increase from the previous year

- Earnings per share were reported at $ 32.04, a 39.9% increase from the previous year

Chipotle Mexican Grill has a market cap of $ 43.4 billion. Its shares are trading at $ 1,569.

The stock has been on a bullish run while being volatile. After hitting a peak of $ 1,937 in September 2021 the stock has declined a bit. Overall, in 2021 the stock appreciated by 26%. In the current year. In 2022, the stock declined by 11.69 %. And in the current year, the stock has appreciated by roughly 12 % to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Haliburton

Haliburton is amongst the largest energy services companies with more than 40,000 employees and operations in over 70 countries. It supplies products and services to assist in energy exploration and production, from locating the oil to constructing and completing the well to managing geological data.

Oil was already in short supply as the global economy opened up post-pandemic; then came the war in Ukraine. Haliburton stands to benefit as oil companies ramp up production.

Halliburton recently reported its full-year financial results for 2022:

- Total revenue was reported at $ 20.3 billion, a 33 % increase from 2021

- Operating income was reported at $ 2.7 billion, a 50 % increase from the previous year

- Net income was reported at $ 1.6 billion, a 9 % increase from the previous year

- The income per share was reported at $ 1.74, as compared to $ 1.63 for the previous year

Halliburton has a market cap of $ 32.9 billion. Its shares are trading at $ 36.4.

The stock of the company spiked high in 2022. From a price of $ 22.7, at the start of the year, the stock peaked at $ 41.95 and eventually closed the year at $ 36.4. Overall, the stock appreciated by 60 % in 2022.

In 2023, the stock has taken a reverse course and declined by 7.5 % to date.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

T-Mobile

T-Mobile US, Inc. is America’s supercharged Un-carrier, delivering an advanced 4G LTE and transformative nationwide 5G network that will offer reliable connectivity for all. T-Mobile’s customers benefit from its unmatched combination of value and quality, unwavering obsession with offering them the best possible service experience, and undisputable drive for the disruption that creates competition and innovation in wireless and beyond.

T-Mobile provides voice, messaging, and data services to more than 100 million customers in the U.S., Puerto Rico, and the U.S. Virgin Islands. The company’s two brands are T-Mobile and Metro by T-Mobile, formerly MetroPCS. T-Mobile is the second-largest wireless carrier in terms of U.S. market share.

T-Mobile recently reported its year-end results for 2022:

- Total revenues were reported at $ 79.5 billion, as compared to $ 80 million in the previous year

- Net Income was reported at $ 2.5 billion, as compared to $ 3 billion in the previous year

- Earnings per share were reported at $ 2.06, as compared to $ 2.41 in the previous year

T-Mobile has a market cap of $ 179.4 billion. Its shares are trading at $ 147.09.

The stock of T-Mobile has been on a prolonged bullish streak for many years, with a six-month-long setback in 2021. The stock continued to rise till it peaked at $ 149.41. After that, the stock declined for the next six months and hit a low of $ 101.62. From here on the stock started to recover and regained its previous highs.

Overall, in 2022 the stock appreciated by 20.9 %. In the current year, the stock has appreciated by 5 % to date.

Workday

Workday

Workday is a leading provider of enterprise cloud applications for finance and human resources, helping customers adapt and thrive in a changing world. Workday applications for financial management, human resources, planning, spend management, and analytics have been adopted by thousands of organizations around the world and across industries – from medium-sized businesses to more than 50% of the Fortune 500.

Workday recently reported its third quarterly report for the year 2022:

- Total revenues were reported at $ 1.6 billion, as compared to $ 1.3 billion in the previous year

- Operating loss was reported at $ 26 million, as compared to an operating profit of $ 23.9 billion in the previous year

- Net loo was reported at $ 74.7 million, as compared to net income of $ 43.4 million in the previous year

- Loss per share was reported at $ 0.29, as compared to earnings per share of $ 0.17 in the previous year

Workday has a market cap of $ 46.7 billion. Its shares are trading at $ 181.92.

The stock of Workday picked up a bullish trend during COVID-19. This trend continued for many months till it peaked at $ 296.45 in Nov 2021. After that, the stock reversed its course and started to decline. The stock continued to decline till it hit the low of $ 132.63 during the last quarter of 2022. After that, the stock started to rise again.

Overall, in 2022 the stock declined by 38.8 %. In 2023, the stock has appreciated by 8.7 % to date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Merck

Merck & Co., Inc. operates as a healthcare company worldwide. It operates through two segments:

- Pharmaceutical – The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes, as well as vaccine products, such as preventive pediatric, adolescent, and adult vaccines.

- Animal Health – The Animal Health segment discovers, develops, manufactures, and markets veterinary pharmaceuticals, vaccines, and health management solutions and services, as well as digitally connected identification, traceability, and monitoring products.

It serves drug wholesalers and retailers, hospitals, and government agencies; managed health care providers, such as health maintenance organizations, pharmacy benefit managers, and other institutions; and physicians and physician distributors, veterinarians, and animal producers.

Merck recently shared its annual report for the year 2022:

- Total sales were reported at $ 59.3 billion, as compared to $ 48.7 billion in the previous year

- Net Income was reported at $ 14.5 billion, as compared to $ 13 billion in the previous year

- Earnings per share were reported at $ 5.73 as compared to $ 5.16 in the previous year

Merck has a market cap of $ 276.5 billion. Its shares are trading at $ 109.07.

The stock of Merck has been steadily rising over the past years. In 2022, the stock spiked in the last quarter. The stock closed the year at $ 110.95 representing a 45 % appreciation. In the current year, the stock has declined slightly by a mere 1.2 % to date.

Eli Lilly

Eli Lilly

Eli Lilly is a pharmaceutical company that develops important treatments for diabetes, obesity, Alzheimer’s disease, immune system disorders, certain cancers, and Covid-19. The company distributes its products around the world through wholesale distributors and marketing agreements with other pharma companies.

The company has been pioneering life-changing discoveries for nearly 150 years, and today our medicines help more than 47 million people across the globe. Harnessing the power of biotechnology, chemistry, and genetic medicine, our scientists are urgently advancing discoveries to solve some of the world’s most significant health challenges, redefining diabetes care, treating obesity and curtailing its most devastating long-term effects, advancing the fight against Alzheimer’s disease, providing solutions to some of the most debilitating immune system disorders, and transforming the most difficult-to-treat cancers into manageable diseases.

Eli Lilly recently shared its full-year report for the year 2022:

- Total revenue was reported at $ 28.5 billion, as compared to 28.3 billion a 1 % increase over the year

- Operating income was reported at $ 7.13 billion, as compared to 6.4 billion a 12 % increase from the previous year

- Net income was reported at $ 6.24 billion, as compared to $ 5.6 billion a 12 % increase from the previous year

- Earnings per share were reported at $ 6.9 as compared to $ 6.12 a 13 % increase from the previous year

Eli Lilly has a market cap of $ 311.2 billion. Its shares are trading at $ 327.51.

The share has been on a bullish run for many years. In 2022 the stock appreciated by 32 % closing the year at $ 365.84.

During the current year, the stock has been declining since the start. The stock last closed at $ 327.51 representing a 10.5 % decline to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Walt Disney Company

Entertainment company Walt Disney has two segments. Disney Parks, Experiences, and Products operate theme parks around the world. Disney Media and Entertainment Distribution operate TV networks, runs film studios, produces and distributes television content, and runs direct-to-consumer streaming networks Disney+, ESPN+, Hulu, and others. Disney also licenses trade names and characters to third parties for use on merchandise and games.

Walt Disney recently reported its full-year financial results for 2022:

- Revenue was reported at $ 82.7 billion a 23 % increase from the previous year’s revenue of $ 67.5 billion

- Net income was reported at $ 3.2 billion a 58 % increase from the previous year’s income of $ 2 billion

- Earnings per share were reported at $ 1.75 as compared to $ 1.11 from the previous year’s same period

Walt Disney has a market cap of $ 187 billion. Its shares are trading at $ 102.32.

COVID-19 started a new bullish cycle for the cycle which continued for many months. After hitting the peak of $ 197.16, the stock declined slightly.

However, the major drop in share price happened in the year 2022. During this year the stock declined by 44 %. In 2023, the stock picked up the pace again and has appreciated by 18 % to date.

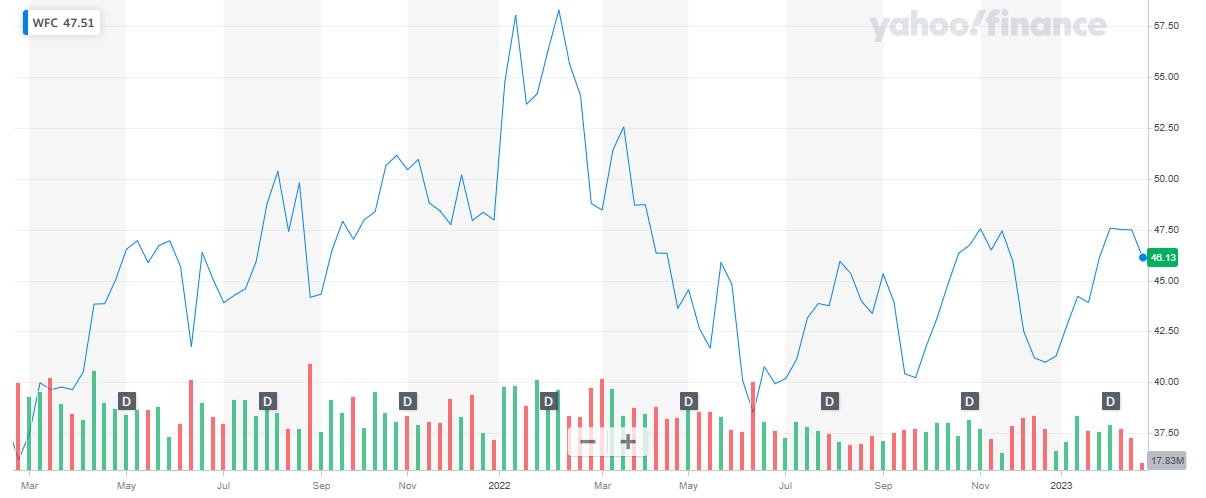

Wells Fargo (WFC)

Wells Fargo (WFC)

Wells Fargo & Company (NYSE: WFC) is a leading financial services company that has approximately $1.9 trillion in assets, proudly serves one in three U.S. households and more than 10 % of small businesses in the U.S., and is a leading middle market banking provider in the U.S. They provide a diversified set of banking, investment, and mortgage products and services, as well as consumer and commercial finance, through our four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate, and Investment Banking, and Wealth & Investment Management. Wells Fargo ranked No. 41 on Fortune’s 2022 rankings of America’s largest corporations. The company focuses its social impact on building a sustainable, inclusive future for all by supporting housing affordability, small business growth, financial health, and a low-carbon economy.

Wells Fargo recently published its full-year financial results for 2022:

- Total revenue was reported at $ 19.7 billion, as compared to 20.9 billion in the previous year

- Net Income was reported at $ 2.9 billion, as compared to $ 5.75 billion in the previous year

- Earnings per share were reported at $ 0.67, as compared to $ 1.38 in the previous year

Walls Fargo has a market cap of $ 176.9 billion. Its shares are trading at $ 46.15.

The stock picked up a bullish trend during the last quarter of 202. This bullish run continued for the next whole year. After peaking at $ 58.31 in Feb-2022, the stock changed its course and started to decline. In 2022, the stock declined by 14 %.

During 2023, the stock started to rise again and has appreciated by 15 % to date.

ETSY

ETSY

Etsy operates a top-10 e-commerce marketplace operator in the U.S. and the U.K., with sizable operations in Germany, France, Australia, and Canada. The firm dominates an interesting niche, connecting buyers and sellers through its online market to exchange vintage and craft goods. With $ 13.5 billion in 2021 consolidated gross merchandise volume, the firm has cemented itself as one of the largest players in a quickly growing space, generating revenue from listing fees, commissions on sold items, advertising services, payment processing, and shipping labels. As of the end of 2021, the firm connected more than 96 million buyers and more than 7.5 million sellers on its marketplace properties: Etsy, Reverb (musical equipment), Elo7 (crafts in Brazil), and Depop (clothing resale)

ETSY reported its third-quarter results for the year 2022:

- Total revenue was reported at $ 595 million, as compared to $ 532.5 million in the previous year’s same period

- Loss from operations was reported at $ 955 million, as compared to profit from operations at $ 83.7 million

- Net loss was reported at $ 963 million, as compared to $ 89.9 million

ETSY has a market cap of $ 16 billion. Its shares are trading at $ 128.2.

During COVID-19, the stock underwent a huge surge in price. From the low of $ 31.69, the stock rose as high as $ 294.38. After that, the stock was bound to decline. The stock continued to decline for the next six months till it dropped to the low of $ 72. The stock picked up the pace and last closed at $ 128.46. During 2023, the stock appreciated by 7.3 %.

Wrap Up

Wrap Up

Every year brings new challenges and economic volatility with it. And 2023 is sure to bring some market surprises too. However, sound investments can help your portfolio from unexpected market ups and downs

Also read: