ESG investing is investing in companies that promote good corporate citizenship and environmental sustainability. ESG stocks are shares in companies with a clear focus on sustainability and corporate citizenship. An ESG stock is one that meets certain criteria for social responsibility and sustainability

ESG stands for “Environmental, Social, Governance,” the three things ESG companies prioritize. Let’s explain them in detail:

- Environment: The kind of impact does a company have on the environment? The things to evaluate here are a company’s carbon footprint, toxic chemicals involved in its manufacturing processes, and sustainability efforts that make up its supply chain.

- Social: It includes how a company advocates for social good in the wider world, beyond its limited sphere of business. Also, it analyzes the social impact the company creates inside and outside the company. Social factors include everything from LGBTQ+ equality, racial diversity in both the executive suite and staff overall and inclusion programs and hiring practices.

- Governance: Governance includes everything from issues surrounding executive pay to diversity in leadership as well as how well that leadership responds to and interacts with shareholders. This factor analyzes how the company brings positive change.

Advantages and Disadvantages of ESG Stocks

Advantages of ESG Stocks

The key advantages of investing in ESG stocks are:

- Investors are contributing towards a better world by actually putting money where one’s beliefs and values lie. This way they can align their finances with their beliefs.

- Chances of putting money towards the next rising trend are there, especially as ESG screening could help find businesses that may grow significantly as a result of the massive global transition to clean technology and sustainability.

- ESG investing can drive innovation and growth as companies look for ways to manage environmental, social, and governance risks more effectively.

Disadvantages of ESG Stocks

The following are the key disadvantages of ESG stocks:

- There are too many rating scales and platforms doing their own analysis. As a result, ESG ratings are not consistent.

- Investors might have to compromise on financial performance in search of the best ESG companies. Sometimes, ESG funds have higher expense ratios. This ultimately eats into your returns.

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Top ESG Stocks to Invest in 2024

Here are the top 10 ESG stocks to invest in 2024:

| Sr. | Company Name | Symbol | Price (As of 13th April 2023) | Market Cap |

| 1 | Texas Instruments Ins. | TXN | $ 179.11 | $ 161.69 billion |

| 2 | JB Hunt Transport Services Inc | JBHT | $ 174.62 | $ 18.33 billion |

| 3 | NVIDIA Corporation | NVDA | $ 264 | $ 653.6 billion |

| 4 | Microsoft Corporation | MSFT | $ 289.84 | $ 2.127 trillion |

| 5 | Best Buy | |||

| 6 | Verisk Analytics | VRSK | $ 192.66 | $ 29.8 billion |

| 7 | Adobe | ADBE | $ 378.8 | $ 173 billion |

| 8 | Salesforce | CRM | $ 194.02 | $ 198.5 billion |

| 9 | Cadence Design Systems Inc | CDNS | $ 217.01 | $ 58.4 billion |

| 10 | Cisco Systems Inc. | CSCO | $ 50.8 | $ 206 billion |

Texas Instruments Inc

Texas Instruments Incorporated is a designer and producer of semiconductors. The company primarily provides analog integrated circuits (ICs) and embedded processors. TI sells its products to original equipment manufacturers (OEMs), original design manufacturers (ODMs), contract manufacturers, and distributors through a direct sales force and third-party sales representatives. It has a business presence across the Americas, Asia, Europe, the Middle East, and Africa. The company is headquartered in Dallas, Texas, US.

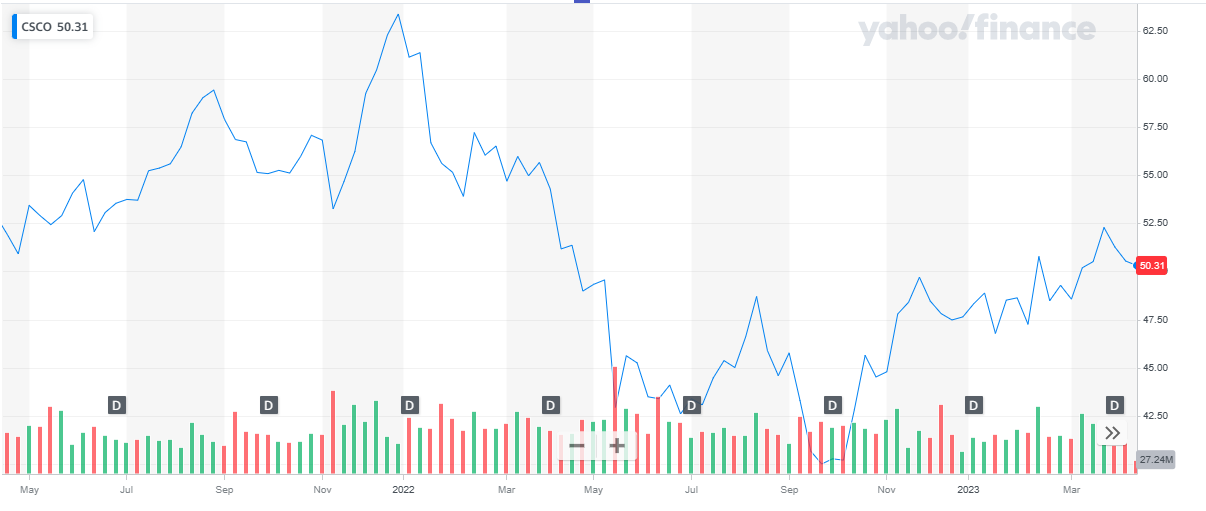

Texas Instruments has a market cap of $ 161.69 billion. Its shares are trading at $ 179.11.

The stock started in the year 2022 at $ 188.47. The stock remained volatile throughout the year. The stock went as high as $ 185.35 and as low as $ 148.54 and eventually closed the year at $ 165.22. Overall, the stock declined by 12 %.

In 2023, the stock went bullish. To date, it has appreciated by 8 %.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

JB Hunt Transport Services Inc.

J.B. Hunt Transport Services, Inc. provides surface transportation, delivery, and logistic services in North America. It operates through five segments:

- Intermodal (JBI) – The JBI segment offers intermodal freight solutions. It operates 115,150 pieces of company-owned trailing equipment; owns and maintains its chassis fleet of 95,553 units; and manages a fleet of 6,081 company-owned tractors, 615 independent contractor trucks, and 7,972 company drivers.

- Dedicated Contract Services (DCS) – The DCS segment designs, develops, and executes supply chain solutions that support various transportation networks. As of December 31, 2022, it operated 12,328 company-owned trucks, 570 customer-owned trucks, and 1 contractor truck. The company also operates 23,354 owned pieces of trailing equipment and 4,968 customer-owned trailers.

- Integrated Capacity Solutions (ICS) – The ICS segment provides freight brokerage and transportation logistics solutions; flatbed, refrigerated, expedited, and less-than-truckload, as well as dry-van and intermodal solutions; an online multimodal marketplace; and logistics management for customers to outsource the transportation functions.

- Final Mile Services (FMS) – The FMS segment offers delivery services through 1,506 company-owned trucks, 303 customer-owned trucks, and 20 independent contractor trucks; 1,297 owned pieces of trailing equipment and 316 customer-owned trailers.

- Truckload (JBT) – The JBT segment provides dry-van freight services by utilizing tractors and trailers operating over roads and highways through 620 company-owned tractors and 14,718 company-owned trailers.

The company published a Sustainability Report, a first of its kind for the company, which highlights many ESG achievements for the year, including:

- Avoiding an estimated 3.5 million metric tons of CO2e emissions by converting over-the-road loads to intermodal.

- Helping company drivers avoid an estimated 4.3 million empty miles with J.B. Hunt 360°®, a multimodal digital freight marketplace.

- Completing its first delivery using a heavy-duty class 8 electric vehicle.

- Adding its fifth employee resource group, PLUS(+), which provides a safe, authentic space for LGBTQIA+ employees and supporters.

- Celebrating the first five-million-mile safe driver in company history.

- Persevering through the COVID-19 pandemic and keeping the country’s freight moving.

- Developing and implementing new technologies that complement J.B. Hunt’s commitment to creating the most efficient transportation network in North America.

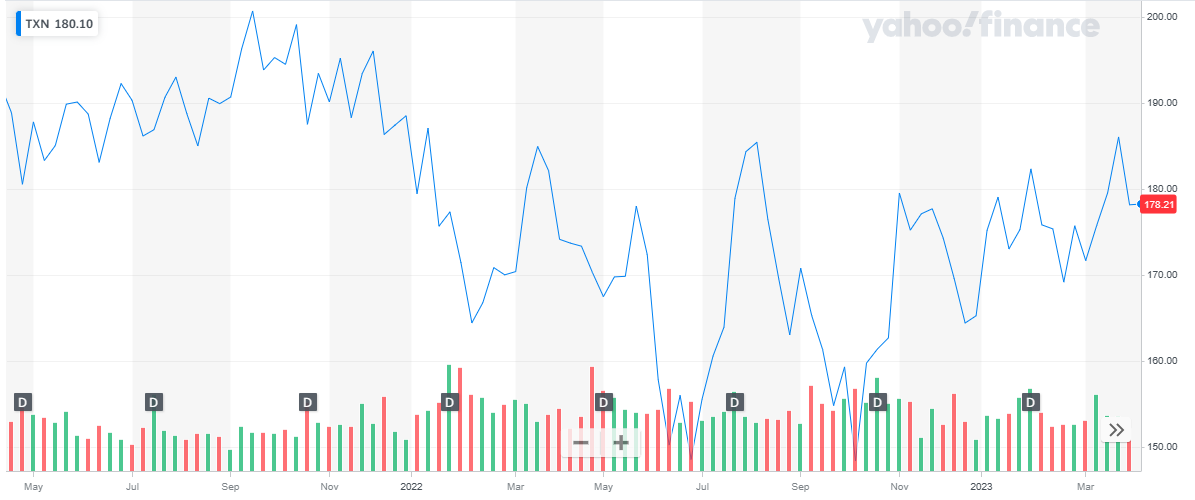

JB Hunt has a market cap of $ 18.33 billion. Its shares are trading at $ 174.62.

The stock started in the year 2022 at $ 204. It started with a bullish run and went as high as $ 215.07. after that, the stock declined sharply and went as low as $ 154.88. Eventually, the stock closed at $ 174.36. Overall, the stock declined by 24 % during the year.

In 2023, after an initial rise in price, the stock declined and last closed at $ 174.62 maintaining the same price level as the start of the year.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

NVIDIA Corporation

Nvidia is one of the world’s largest manufacturers of semiconductor chips. It is one of the world’s leading designers of graphics processing units (GPUs) and system-on-chip units (SOCs) for the gaming, mobile, and automotive industries.

As a manufacturer of chips, and at that scale, Nvidia has a massive carbon footprint. It mines materials, and its factories and labs are power-hungry and consume a lot of water. However, Nvidia is renowned for its sustainability practices, operating at power efficiencies as high as 35%. By 2025, it has pledged to increase its renewable energy usage to 65%.

NVIDIA has a market cap of $ 653.6 billion. Its shares are trading at $264.

The stock started in the year 2022 at $ 294.11. The stock started with a bearish pattern and dropped as low as $ 112.27. After that, the stock reversed its course and closed the year at $ 146.14. Overall, the stock declined by 50 % during the year.

In 2022, the stock continued with its upward trend and last closed at $ 264.97. To date, the stock has appreciated by 80 %.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

Microsoft Corporation

Microsoft Corp. develops, licenses, and supports software products, services, and devices. The company offers a comprehensive range of operating systems, cross-device productivity applications, server applications, software development tools, business solution applications, desktop and server management tools, video games, and training and certification services. It also designs, manufactures, and sells hardware products including PCs, tablets, gaming and entertainment consoles, and other intelligent devices. The company provides a broad spectrum of services including cloud-based solutions, solution support, and consulting services. Microsoft markets distribute and sell offerings through original equipment manufacturers, distributors, resellers, online marketplaces, Microsoft stores, and other partner channels. The company has a business presence across the Americas, Europe, Asia-Pacific, the Middle East, and Africa. Microsoft is headquartered in Redmond, Washington, the US.

Microsoft has a strong commitment to ESG principles, particularly in the areas of carbon reduction goals and diversity initiatives. The company has set ambitious goals to achieve carbon neutrality by 2030 and to be carbon negative by 2050.

Microsoft has a market cap of $ 2.127 trillion. Its shares are trading at $ 289.84.

The stock started the year 2022 at $ 336.32 with a bearish run. Throughout the year the stock remained bearish and closed off the year at $ 239.82. Overall, the stock declined by 29 %.

In 2023, the stock has appreciated by 19 % to date.

Best Buy

Best Buy

Best Buy Co Inc. is a multi-national retailer of electronic products. The company’s product offerings include consumer electronics, computing and mobile phones, appliances, entertainment products, and home office products. It also offers services including consultation, design, set-up, technical support, warranty-related services, health-related services and memberships, educational classes, delivery and installation for home theater, mobile audio, and appliances. Best Buy markets its products under Best Buy, Future Shop, Geek Squad, Magnolia, Best Buy Mobile, Dynex, Platinum, Yellow Tag, Insignia, Pacific Sales, 5Star, Rocketfish, Modal, and My Best Buy brand names. Best Buy merchandises products at retail stores, online, through mobile applications, and call centers. The company’s operations are across the US, Canada, and Mexico. Best Buy is headquartered in Richfield, Minnesota, the US.

Best Buy has a strong commitment to ESG principles, particularly in the areas of environmental and social responsibility. The company has implemented several initiatives to reduce its environmental impact, such as using renewable energy, recycling products, and reducing waste. Also, Best Buy is committed to promoting social responsibility and has a focus on diversity, inclusion, and ethical business practices.

Best Buy has a market cap of $ 15.93 billion. Its shares are trading at $ 73.19.

The stock started the year 2022 at $ 101.6. Throughout the year the stock remained bearish and closed the year at $ 80.21, representing a 21.2 % decline during the year.

In 2023, the stock last closed at $ 73.19 representing a 9 % depreciation to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Verisk Analytics

Verisk Analytics Inc (Verisk) is a provider of predictive analytics and decision support solutions to customers operating in insurance, financial services, and energy and specialized markets. The company offers anti-fraud solutions, expert scoring systems, catastrophe modeling, pricing, underwriting, and rating solutions for the insurance sector. Verisk also offers customized analytic services, decision algorithms, competitive benchmarking, and business intelligence to the financial services sector. The company also provides industry-standard insurance programs, and property-specific rating and underwriting information services to property and casualty insurance customers. It has a business presence across the Americas, Europe, Asia, Africa, and Oceania. Verisk is headquartered in Jersey City, New Jersey, the US.

Verisk has been ranked 3 out of the 100 Best ESG Companies in 2022 by Investor’s Business Daily. The fourth annual list recognizes companies with superior environmental, social, and governance (ESG) ratings, in addition to fundamental and technical stock performance. The ESG Activities at Verisk include:

- helped research greenhouse emissions from satellite data

- developed geospatial analytics that identifies the exposure of 80 sectors to 52 different ESG and political risks across 198 countries.

- provided claims estimating insights to help volunteers plan and report on their recovery efforts after disasters

- hosted and mentored interns from diverse and underserved communities, many of whom found full-time roles at Verisk

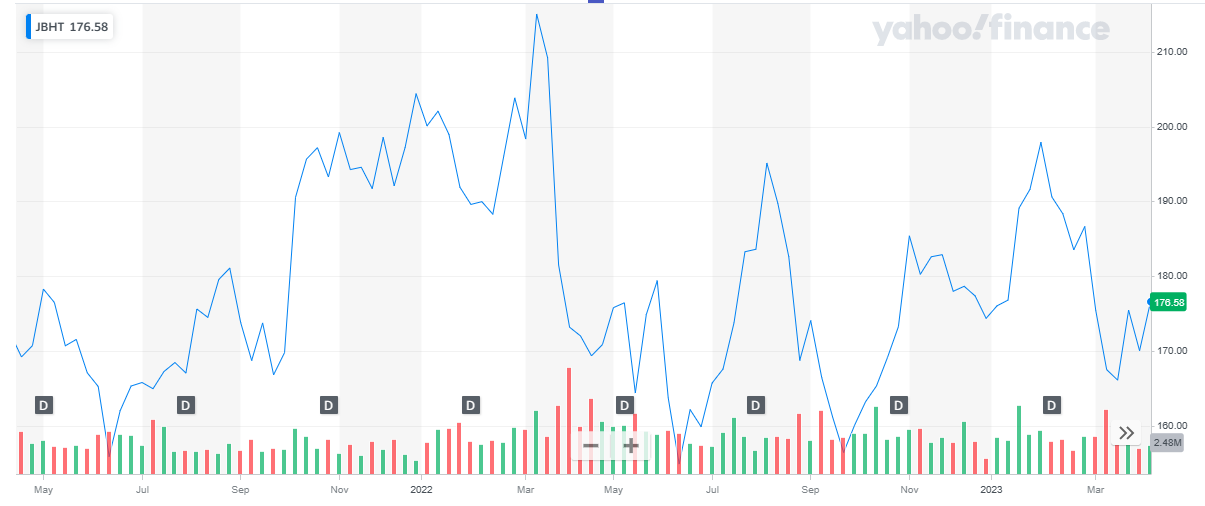

Verisk Analytics has a market cap of $ 29.8 billion. Its shares are trading at $ 192.71.

The stock started in the year 2022 at $ 228.73. The stock remained volatile throughout the year, with multiple dips and peaks. It closed the year at $ 178.42. Overall, the stock declined by 22 % during the year.

In 2023, the stock initially maintained its price and eventually rose and last closed at $ 192.71. To date, the stock has appreciated by 8 %.

Adobe

Adobe

ADOBE Inc. provides digital marketing, multimedia, and creativity software products. Its products and services are used by creative professionals, knowledge workers, students, marketers, application developers, consumers, and enterprises to create, manage, deliver, measure, optimize, engage, and transact with compelling content and experiences spanning devices, personal computers, and media. The company markets its products and services to enterprise customers through its own sales force and local field offices. It distributes products through distributors, systems integrators, independent software vendors, value-added resellers, software developers, retailers, and original equipment manufacturers (OEMs). Its business operations are spread across the Americas, Europe, the Middle East and Africa, and Asia-Pacific. Adobe is headquartered in San Jose, California, US.

Adobe has a strong commitment to ESG principles, particularly in the areas of environmental and social responsibility. The company has implemented several initiatives to reduce its environmental impact, such as using renewable energy, reducing waste, and promoting sustainable sourcing.

Adobe has a market cap of $ 173 billion. Its shares are trading at $ 378.8.

The stock started in the year 2022 at $ 567.07. The stock picked up a bearish trend and continued to decline throughout the year till it dropped to $ 275.2. Eventually, the stock closed at $ 336.53. Overall, the stock declined by 41 %.

In 2023, the stock recovered a bit and closed at $ 378.8. To date, the stock has appreciated by 12 %.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Salesforce

Salesforce Inc., formerly known as Salesforce.com Inc, is a provider of enterprise cloud computing solutions. The company’s cloud computing services enable businesses to connect, engage, sell, service, and collaborate with customers. Salesforce provides its solutions as a service through all major internet browsers and on leading mobile devices to all sizes of businesses on a subscription basis, primarily through its direct sales force and partners. The company also enables third parties to develop additional functionality and new apps that run on its platform. The company has a business presence across the Americas, Asia Pacific, Europe, the Middle East, and Africa. Salesforce is headquartered in San Francisco, California, US.

Salesforce is committed to ESG principles and has set ambitious goals to reduce its carbon footprint, increase renewable energy use, and promote diversity, equity, and inclusion in its workforce.

They have implemented a Green Cleaning Program to reduce the use of hazardous materials in their offices and established an Agriculture and Forest Protection Program to support sustainable farming practices and protect critical ecosystems.

Salesforce has a market cap of $ 198.5 billion. Its shares are trading at $ 194.02.

The stock started the year 2022 at $ 254.13. throughout the year the stock remained bullish and eventually closed the year at $ 132.59 representing a 48 % decline during the year.

In 2023, the stock reversed its course of action and picked up a bullish pattern. The stock last closed at $ 194.02. To date, the stock has appreciated by 47 %.

Cadence Design Systems Inc.

Cadence Design Systems Inc.

Cadence Design Systems Inc (Cadence) is a provider of system design enablement solutions that are used for designing electronics systems, integrated circuits, and electronic devices. The company’s product and solution portfolio includes electronic design automation software, emulation and prototyping hardware, system interconnect and analysis, verification intellectual property and design intellectual property. Cadence also offers hosted design solutions, engineering services, methodology services, and education services. Its products and services find application in designing and verifying advanced semiconductors, consumer electronics, networking and telecommunications equipment, and computer systems. The company operates its business through a network of subsidiaries and sales offices and has a business presence across Asia-Pacific, Europe, the Americas, the Middle East, and Africa. Cadence is headquartered in San Jose, California, US.

Cadence has a strong commitment to ESG principles, particularly in the areas of environmental and social responsibility. The company has implemented a number of initiatives to reduce its environmental impact, such as using renewable energy, reducing waste, and promoting sustainable sourcing.

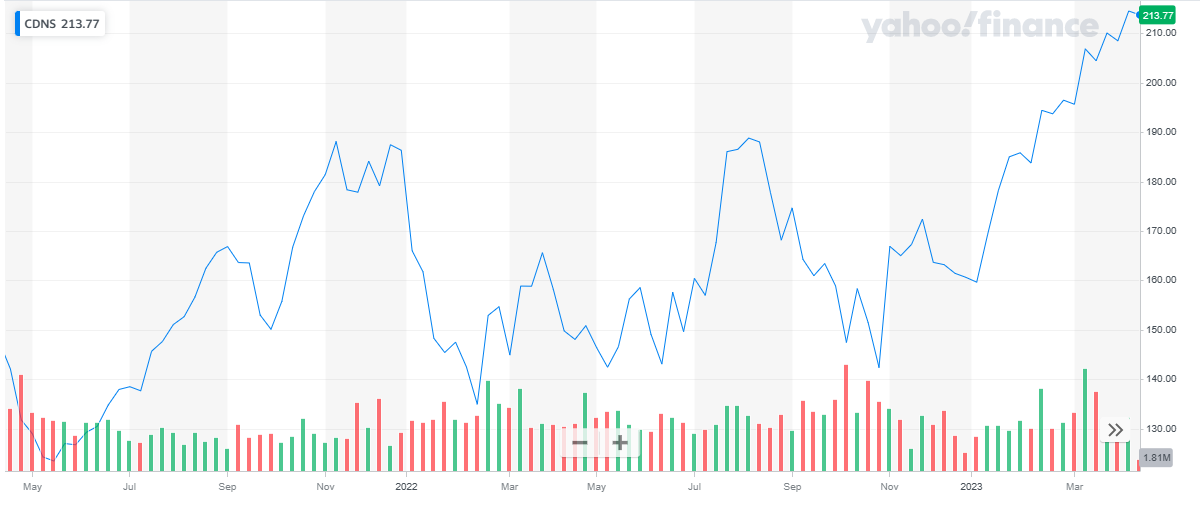

Cadence has a market cap of $ 58.4 billion. Its shares are trading at $ 217.01.

The stock started in the year 2022 at $ 186.35. The stock remained volatile in the past year. During the year the stock went as high as $ 188.83 and as low as $ 134.95. The stock closed the year at $ 160.64 representing a 27.6 % decline during the year.

In 2023, the stock reversed its course and spiked high. The stock last closed at $ 217.01 representing a 35.6 % decline to date.

Also read:

Also read:

Cisco Systems Inc.

Cisco ranks in the list of the world’s most eco-friendly companies. It is remarkably energy-efficient across its supply chain, from sourcing materials, designing products, and consuming electricity to promoting fair hiring and securing data. Cisco claims that 80% of its electricity (operations only) is clean. It has also reduced its Scope 1 and Scope 2 emissions by nearly 50%. (Scope 1 refers to emissions generated by direct, owned sources like company vehicles. Scope 2 refers to indirect sources like cooling or heating systems. While Scope 3 emissions are caused by the remaining aspects in the value chain, like employee commute and waste management.)

Equipment maker Cisco has a dedicated ESG hub, which it describes as an expanded way to enhance ESG reporting and transparency. It also releases an annual ESG report which states all the relevant stats and important info.

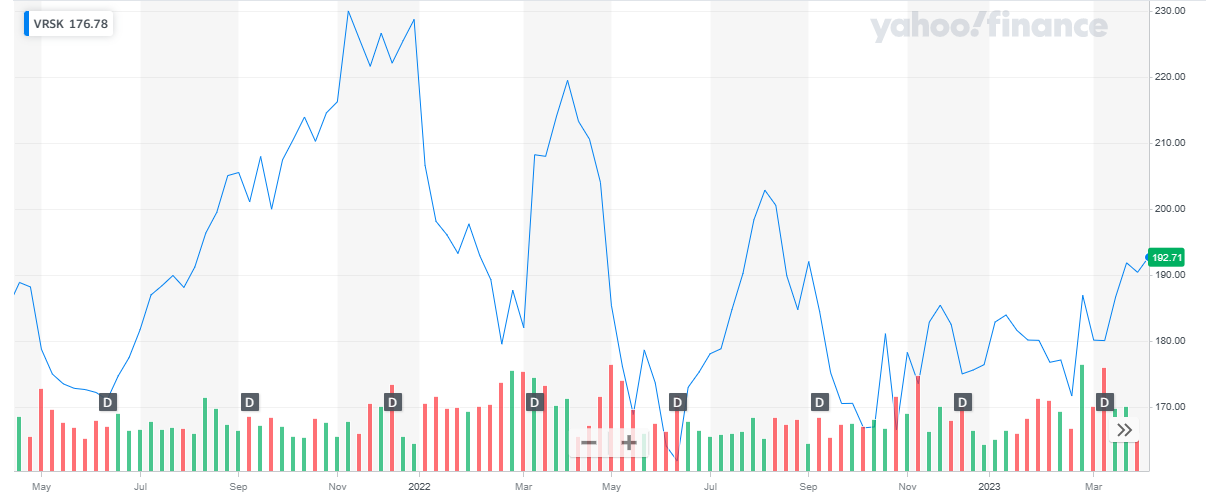

Cisco has a market cap of $ 206.1 billion. The stock is trading at $ 50.8.

The stock started the year 2022 at a peak price of $ 63.37. From here the stock started its bearish journey and dropped to the low of $ 42.94. Eventually, the stock closed at $ 47.64 representing a 25 % decline during the year.

In 2023, the stock started to recover and picked up a bullish run. The stock last closed at $ 50.8 representing a 6.6 % appreciation to date.