Dividend stocks are companies that pay out a portion of their earnings to a class of shareholders regularly. Companies with stable and consistent earnings can pay Dividends to their shareholders. Dividends can be in the form of cash and/or additional stocks of the company. Usually, companies pay out dividends quarterly but some companies pay the dividend monthly.

Monthly dividend stocks are very few. As per Forbes, out of nearly 20,000 U.S.-listed stocks and funds you can sort through via S&P Global Market Intelligence, only a few hundred pay their dividends monthly. To identify the sustainability of a company’s dividend payments, investors make use of the dividend payout ratio. This creates a safety net for investors who are interested in a regular stream of income from their investments. Get to know about bonds vs stocks – where to invest.

Below we have compiled the best monthly dividend stocks for 2024.

Best Monthly Dividend Stocks For 2024

They are the safest monthly dividend stocks for the current year:

| Sr. | Company Name | Symbol | Monthly Dividend (Year 2021) | Dividend Yield (2020) |

|---|---|---|---|---|

| 1. | STAG Industrial | STAG | $ 0.121 | 4.22% |

| 2. | Shaw Communications (SJR) | SJR | CAD 0.099 | 3.43% |

| 3. | Realty Income (O) | O | $ 0.235 | 4.4% |

| 4. | LTC Properties (LTC) | LTC | $ 0.19 | 5.17% |

| 5. | TransAlta Renewables (TRSWF) | TRSWF | CAD 0.078 | 4.74% |

| 6. | Dynex Capital | DX | $ 0.13 | 8.22% |

| 7. | Main Street Capital | MAIN | $ 0.205 | 6.25% |

| 8. | Gladstone Capital Corp | GLAD | $ 0.065 | 7.54% |

| 9. | SL Green Realty (SLG) | SLG | $ 0.3033 | 4.74% |

| 10. | Whitestone REIT (WSR) | WSR | $ 0.0358 | 4.41% |

| 11. | Prospect Capital | PSEC | $ 0.06 | 8.05% |

| 12. | Gladstone Investment | GAIN | $ 0.07 | 5.09% |

| 13. | Orchid Island Capital | ORC | $ 0.065 | 15.85% |

1. STAG Industrial (STAG)

STAG Industrial is a real estate investment trust focused on the acquisition and operation of single-tenant, industrial properties throughout the United States. By targeting this type of property, STAG has developed an investment strategy that helps investors find a powerful balance of income plus growth. The total company’s worth is $6.8 billion and is spread across 39 states of the US.

Monthly dividend payment for the ongoing year paid/declared by STAG Industrial:

| Month | Dividend ($) |

|---|---|

| January | 0.121 |

| February | 0.121 |

| March | 0.121 |

STAG paid a monthly dividend of $0.120 in the year 2020 accumulating it to $1.439 annually. In the year 2019, the company paid a monthly dividend of $0.119 making it a total of $1.429 annually. STAG industrial has been paying out a dividend for many years now and for the past 7 years, it has been increasing its dividend by 0.82%.

STAG Industrial is a good investment stock at a good price and good yield. It is one of the safest monthly dividend stocks with a billion-dollar company at the back and a stable dividend payout ratio. Get to know about best drone stocks to invest.

Read more:

2. Shaw Communications (SJR)

Shaw is a leading Canadian telecommunications company focused on connecting its customers to the world through a best-in-class, seamless connectivity experience. Its Consumer Division serves residential customers with broadband Internet, Shaw Go WiFi, video, and digital phone. Shaw’s Business Division provides business customers with Internet, data, WiFi, digital phone, and video services

Shaw Communications has maintained good earnings which are consistently growing over the years. It has a market capitalization of over $9.7 Billion and has maintained steady earnings per share of CAD1.32 over the past three years.

Also read: Best Stock Forecasts & Prediction Services

Monthly dividend payment for the ongoing year paid/declared by Shaw communications:

| Month | Dividend (CAD) |

|---|---|

| January | 0.099 |

| February | 0.099 |

| March | 0.099 |

| April | 0.099 |

| May | 0.099 |

Shaw communications paid a monthly dividend of $0.099 in the year 2020 accumulating it to $1.185 annually. In the year 2019, the company paid a monthly dividend of $0.099 making it a total of $1.185 annually. Shaw Communications have been paying dividends for many years now. Its monthly dividend amount has been consistent for the past many years now.

Shaw Communications is a good investment for investors seeking predictable and consistent dividend earnings. It is one of those monthly dividend stocks which offers stable return and bond-like security. Get to know about best forex brokers for trading

3. Realty Income (O)

Realty Income, The Monthly Dividend Company, is an S&P 500 company dedicated to providing stockholders with dependable monthly income. The company is structured as a REIT. The company has paid 607 consecutive common stock monthly dividends throughout its 52 years of operations and has raised the dividend 109 times since it was publicly listed.

Read: Best Gold Trading Signal Providers.

Realty Income has a diversified Real Estate portfolio and has a market capitalization of over $22 Billion. The company has a steady growth in revenue and its Price Earnings Ratio is also increasing. The company acquired 171 properties in the first nine months of 2020, which saved its net growth from falling. The company reported an Earnings per share of $1.15 for the year 2020.

Monthly dividend payment for the ongoing year paid/declared by Realty Income

| Month | Dividend ($) |

|---|---|

| January | 0.235 |

| February | 0.235 |

| March | 0.235 |

Realty Income paid monthly dividend between $0.233 and $0.238 in the year 2020 accumulating it to $2.794 annually. In the year 2019, the company paid a monthly dividend between $0.221 and $0.227 making it a total of $2.711 annually. Realty Income has been paying dividends for many years now. Get to know about fibonacci retracement, extension & trading strategies

Realty Income is one of the strongest monthly dividend stocks. It has maintained its growth over the years and is on the road to recovering the loss in stock price it faced during COVID. Realty Income is one of those monthly dividend stocks which investors can hold forever.

Read more:

4. LTC Properties (LTC)

LTC is a health care REIT investing in seniors housing and health care real estate, focused on developing relationships while delivering strong returns to shareholders. It has a market capitalization of $1.7 Billion.

LTC Properties stock was hit pretty badly during COVID losing almost 50% of its stock value. Since then, it has recovered a lot and is on the road to achieving the previous price levels. Earnings of LTC Properties are steady. They declined in 2019 but have risen again in 2020. The Price Earnings ratio is also good; for the year 2020, and earnings per share were reported to be $2.42.

Monthly dividend payment for the ongoing year paid/declared by LTC Properties

| Month | Dividend ($) |

|---|---|

| January | 0.19 |

| February | 0.19 |

| March | 0.19 |

LTC Properties paid a monthly dividend between $0.19 in the year 2020 accumulating it to $2.28 annually. In the year 2019, the company paid a monthly dividend between $0.19 making it a total of $2.28 annually. LTC Properties have been consistently paying dividends for many years now.

LTC Properties is one of the better-performing stocks in the seniors housing and health care real estate. It offers better dividends and a good payout ratio. It has a good portfolio and offers a better yield. Investors who are interested in a steady stream of monthly dividends should be investing in this stock.

Read more:

5. TransAlta Renewables (TRSWF)

TransAlta Renewables is among the largest of any publicly traded renewable independent power producers in Canada. The company owns, operates, and develops a diverse fleet of electrical power generation assets in Canada, the United States, and Australia with a focus on long-term shareholder value. Today, TransAlta is one of Canada’s largest producers of wind power and Alberta’s largest producer of hydro-electric power. TransAlta has been recognized by CDP (formerly Climate Disclosure Project) as an industry leader on Climate Change Management, having recently achieved an A- score from CDP.

It has a market capitalization of over $4 Billion. Earnings per share reported for the year 2020 was CAD 0.35. Earnings declined in the year 2020 due to multiple factors including the global pandemic. The company’s energy production has been steadily increasing and it has been able to maintain its earnings with a slight drop in 2020.

Monthly dividend payment for the ongoing year paid/declared by TransAlta Renewables:

| Month | Dividend (CAD) |

|---|---|

| January | 0.078 |

| February | 0.078 |

| March | 0.078 |

| April | 0.078 |

| May | 0.078 |

| Jun | 0.078 |

TransAlta Renewables paid a monthly dividend between $0.078 in the year 2020 accumulating it to $0.940 annually. In the year 2019, the company paid a monthly dividend between $0.078 making it a total of $0.940 annually. TransAlta Renewables has been consistently paying dividends for many years now.

TransAlta has a very promising future with expected earnings to increase by 80% in the year 2021. It has been regularly paying dividends despite the drop in net earnings in 2020. TransAlta has a better dividend yield than the majority of the dividend-paying stocks. From an investment point of view, it is one of the best monthly dividend stocks right now.

6. Dynex Capital (DX)

Dynex Capital, Inc. is an internally managed mortgage real estate investment trust (REIT) that manages a diversified, high-quality, leveraged fixed-income portfolio. The company manages its assets in a way that provides our shareholders with attractive, risk-adjusted returns over the long term.

Dynex Capital was also hit hard by the global pandemic and lost a major chunk of its stock price. Since then, it has been recovering and has almost recovered completely. Dynex is one of the highest quality operators in the REIT market and 95% of its portfolio is invested in agency mortgage securities, which is what the Federal Reserve itself buys. Earnings per share reported for the year 2020 was $6.93 and the Price Earnings Ratio was 2.68.

Get to know the best covered call stocks to buy now.

Monthly dividend payment for the ongoing year paid/declared by Dynex Capital:

| Month | Dividend ($) |

|---|---|

| January | 0.13 |

| February | 0.13 |

Dynex Capital paid a monthly dividend between $0.13 and $0.15 in the year 2020 accumulating it to $1.66 annually. In the year 2019, the company paid a monthly dividend between $0.15 and $0.18 making it a total of $1.41 annually.

The year 2022 will be marked by low-interest rates. Hence the investors are likely to shift their interests in mortgage REITs. Also, Dynex, as one of the highest paying monthly dividend stocks which makes it an even more attractive investment. With a positive future, Dynex is one of the best monthly dividend stocks to invest in, in 2024.

7. Main Street Capital (MAIN)

Main Street Capital is one of the best-in-class business development companies that provides equity and debt capital to smaller and middle-market companies. Main Street Capital has helped over 200 private companies grow or transition by providing flexible private equity and debt capital solutions.

Main Street has an interesting model in that it pays a relatively modest monthly dividend, but then tops up that payout twice per year with bonus payouts. During COVID Main Street Capital was struck hard like other companies but still, it maintained its monthly dividend but did not give out any bonus payouts. Earnings for the year 2020 also declined and earnings per share were reported to be $0.45.

Monthly dividend payment for the ongoing year paid/declared by Main Street Capital:

| Month | Dividend ($) |

|---|---|

| January | 0.205 |

| February | 0.205 |

| March | 0.205 |

| April | 0.205 |

| May | 0.205 |

Main Street Capital paid a monthly dividend between $0.205 in the year 2020 accumulating it to $2.46 annually. In the year 2019, the company paid a monthly dividend between $0.195 and $0.24 making it a total of $2.9 annually

A high yield and a long history of paying dividends make Main Street Capital an attractive investment. It is one of the preferred monthly dividend stocks for investors. Get to know about relative strength index – basics and RSI trading strategies

8. Gladstone Capital Corp. (GLAD)

Gladstone Capital Corporation is a Business Development Company (“BDC”) that focuses on investing in loans to lower middle-market businesses. Gladstone Capital partners with management teams, entrepreneurs, and private equity sponsors to provide financing solutions for lower middle-market companies nationwide.

Gladstone Capital Corporation has a market capitalization of over $327 Million. Gladstone Capital Corporation’s portfolio is well-diversified, spanning 48 companies in 18 industries. A noteworthy point here is that the company has very low exposure to volatile sectors of the economy like the energy sector. Revenue has slightly declined in the year 2020 but it is expected to increase over the next years.

Monthly dividend payment for the ongoing year paid/declared by Gladstone Capital Corp:

| Month | Dividend ($) |

|---|---|

| January | 0.065 |

| February | 0.065 |

| March | 0.065 |

Gladstone Capital Corp paid monthly dividends between $0.065 and $0.07 in the year 2020 accumulating it to $0.795 annually. In the year 2019, the company paid a monthly dividend between $0.07 making it a total of $0.840 annually. The company has been paying dividends for many years now and it has maintained the same dividend over the years.

Gladstone Capital Corp has been able to maintain a steady dividend over the past years. It has a good payout and has been able to maintain its earnings per share. For investors, it is one of the best monthly dividend stocks with a steady income and secure company portfolio.

9. SL Green Realty (SLG)

SL Green Realty Corp. is a fully integrated real estate investment trust (REIT), that focuses primarily on acquiring, managing, and maximizing the value of Manhattan commercial properties.

The company continues to invest in new properties. During the quarter, SLG signed 44 Manhattan office leases at comparatively lower rates when compared to previous leases. In total, the Company has signed 107 office leases in its Manhattan office portfolio in 2021.

In its third-quarter report for the year 2021, the REIT reported a net income of $388.2 million as compared to a net income of $13.9 million, for the same quarter last year. Also, three monthly dividends of $0.3033 per share were announced, which was paid every month of the quarter. Manhattan same-store office occupancy was 93.1% as of September 30, 2021.

SL Green has a market capitalization of $5.16 billion and its stock is currently trading at $77.16. The below table includes the recent dividend payments to stockholders.

| Month | Dividend ($) |

| August | 0.3033 |

| September | 0.3033 |

| October | 0.3033 |

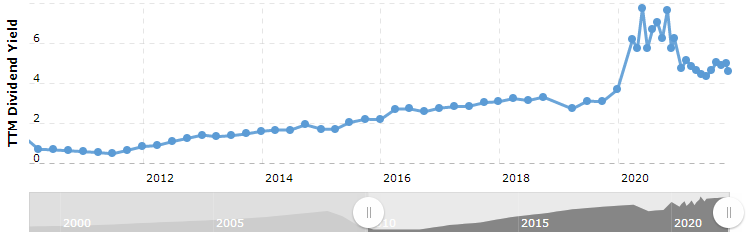

SLG has been paying dividends for more than 20 years. The below chart shows its dividend yield over the past 10 years:

10. Whitestone REIT (WSR)

Whitestone REIT (NYSE: WSR) is a community-centered retail REIT that acquires, owns, manages, develops, and redevelops high quality “e-commerce resistant” neighborhood, community, and lifestyle retail centers principally located in the largest, fastest-growing high-household-income markets in the Sunbelt. Whitestone is a solid growth company. Its properties are located in the fastest-growing states of the US where the population is highly educated and the household incomes are high along with strong job growth.

In its third-quarter report, the company stated net revenues of $32.4 million. The company declared a quarterly cash distribution of $0.1075 per common share to be paid in three equal installments of $0.035833. As of September 30, 2021, Whitestone wholly-owned 59 Community-Centered Properties with 5.1 million square feet of gross leasable area.

Whitestone has a market capitalization of around $486 million. Its stock is currently trading at $9.91. The below table includes the recent dividend payments to stockholders.

| Month | Dividend ($) |

| July | 0.0358 |

| August | 0.0358 |

| September | 0.0358 |

Whitestone has a history of paying a monthly dividend for more than a decade. It has a record of 131 consecutive dividend payments. Its current dividend yield is 4.41%.

11. Prospect Capital

Prospect Capital Management is an established private debt and equity manager with $7.1 billion of assets under management as of 6/30/21. Prospect invests across a diversified range of industries and companies, primarily in the United States. Prospect Capital offers capital under four different categories:

- Middle-Market Direct Lending

- Real Estate Private Equity

- Structured Credit

- Investment Vehicles

For the quarter ending September 2021, the company reported revenues of $169.47 million. The fair value of Prospect Capital’s total investment portfolio was $6.43 billion as of Sep 30, 2021, up 3.7% from the previous quarter.

Prospect Capital has a market capitalization of $3.46 billion. Its stock is currently trading at $8.88. The below table includes the recent dividend payments to stockholders

| Month | Dividend ($) |

| September | 0.06 |

| October | 0.06 |

| November | 0.06 |

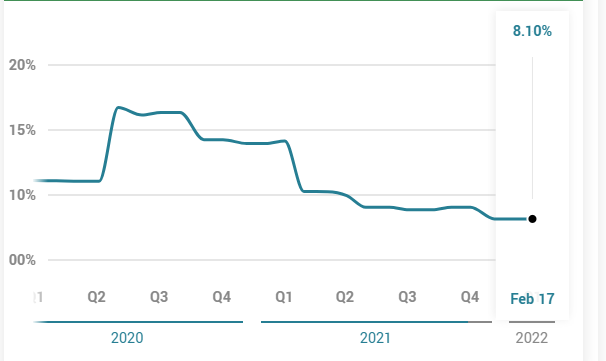

The below chart shows the Dividend yield over the past 3 years:

Prospect Capital is paying dividends to shareholders for almost a decade.

12. Gladstone Investment (Nasdaq: GAIN)

Gladstone Investment Corporation is a private equity fund focused on acquiring mature, lower-middle-market companies with attractive fundamentals and strong management teams. Gladstone usually invests up to $30 million of debt and equity in a transaction. The businesses GAIN invests in belongs to stable industries. These companies are the market leader with profitable businesses supported by a strong workforce. Also, the past performance of these companies during different economic situations is good indicating strong sustainable companies.

In its third-quarter report, the company reported:

- Net income of $1.5 million

- Collected 100% of cash rents due during July, August, and September

- Purchased six fully-occupied industrial properties for $26.7 million

- Renewed 104,446 square feet with remaining lease terms ranging from 0.3 to 10.4 years at three of our properties

At the start of the year 2021, Gladstone invested $45.9 million in eight industrial assets within its target markets. Also, the company financials reflect consistent performance and stabilized revenues from same-store property occupancy. This along with rent collection and growth, accretive real estate investments made during 2020 is a positive sign towards growth.

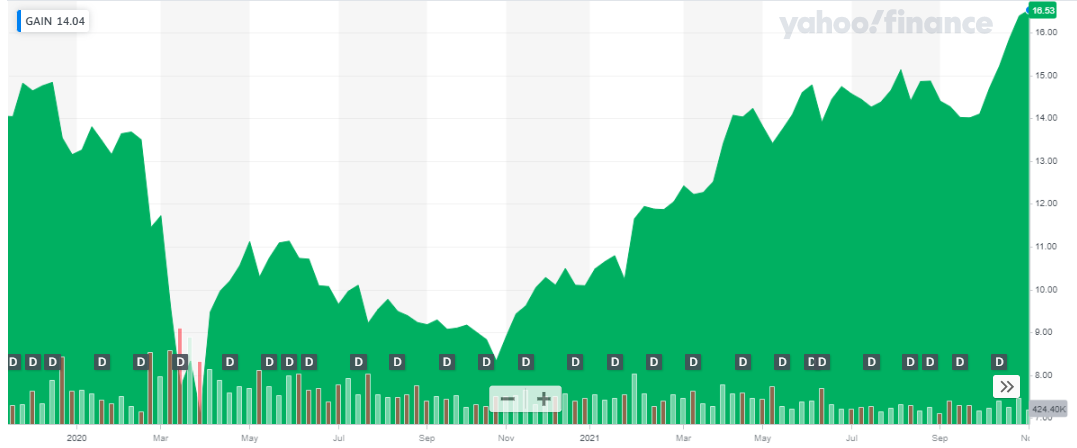

Gladstone Investment has a market capitalization of $549 million. Its stock is currently trading at $16.53. The below table includes the recent dividend payments to stockholders.

The last 3 paid dividends are shown below:

The last 3 paid dividends are shown below:

| Month | Dividend ($) |

| August | 0.075 |

| September | 0.07 |

| October | 0.07 |

Gladstone also declared a special dividend of $0.02 in September 2021.

13. Orchid Island Capital

Orchid Island Capital, Inc. is a specialty finance company that invests in residential mortgage-backed securities (RMBS) on a leveraged basis. Their investment strategy and portfolio consist of, two categories of Agency RMBS:

- Traditional pass-through Agency RMBS, such as mortgage pass-through certificates and CMOs issued by the GSEs

- Structured Agency RMBS, such as IOs, IIOs, and principal only securities, among other types of structured Agency RMBS

The company earns through the difference between the yield on its mortgage assets and the cost of its borrowings.

In its third-quarter report, the company reported:

- Net income of $26.0 million

- Interest Earnings of $32.6 million

By generating capital raised through the ATM program, Orchid Island Capital was able to increase its Agency RMBS portfolio during the third quarter.

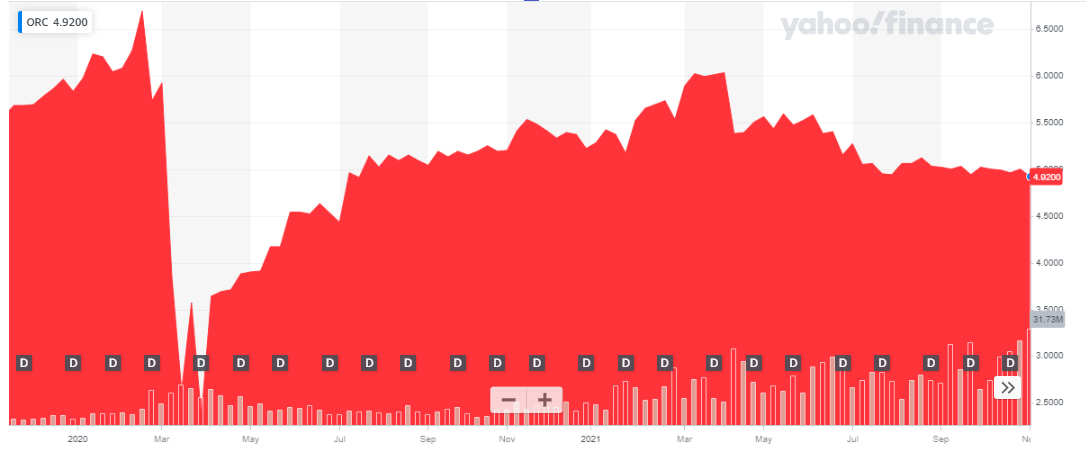

The last 3 paid dividends are shown below:

| Month | Dividend ($) |

| September | 0.065 |

| October | 0.065 |

| November | 0.065 |

Orchid Capital has a market valuation of around $832 million. Its stock is currently trading at $4.91. The below table includes the recent dividend payments to stockholders:

Disclaimer: None of the information published in this article should be construed as investment advice. Article is based on author’s independent research, we strongly advise our readers to always do their due diligence before investing.

You may also like reading:

- Best Day Trading Stocks to invest in

- Best Cryptocurrencies to Invest in

- Head and Shoulders Patterns – Trading Guide with Rules and Examples

- Best Stock & Forex Trading Courses

- Best Penny Stocks to Invest in

- Best trading and forex signal providers

- Best Renewable Energy Stocks to Invest