The S&P 500 has been performing well in 2023. However, the federal government fears the emergence of a bear market very soon. While the market remains unpredictable and volatile, there are few stocks that always yield profits when invested in the long term.

Best Companies to Invest in 2023

Here is the list of the 10 Best Companies to Invest in Now:

| Sr. | Company Name | Symbol | Market Cap | Price ( As of 14th August 2023) |

| 1 | American Homes 4Rent | AMH | $ 14.75 billion | $ 36.1 |

| 2 | Bath & Body Works | BBWI | $ 8.577 billion | $ 37.48 |

| 3 | Lamb Weston | LW | $ 14.004 billion | $ 97.2 |

| 4 | Netflix | NFLX | $ 190 billion | $ 427.78 |

| 5 | Walt Disney | DIS | $ 159.72 billion | $ 88.81 |

| 6 | Wells Fargo | WFC | $ 156.958 billion | $ 43.74 |

| 7 | British American Tobacco | BTI | $ 71.854 billion | $ 32.35 |

| 8 | GSK PLC | GSK | $ 72.26 billion | $ 35.44 |

| 9 | ASML Holding NV | ASML | $ 261.133 billion | $ 666.55 |

| 10 | Devon Energy Corp | DVN | $ 31.623 billion | $ 50.29 |

American Homes 4Rent (AMH)

American Homes 4Rent (AMH)

American Homes 4 Rent (American Homes) is a real estate investment trust. It deals with the renovation and leasing of rental properties. The company’s leasing activity comprises establishing rental rates, marketing, and leasing properties, and collecting and processing rent. American Homes acquire properties through various acquisition channels, such as broker sales and portfolio sales. It constructs built-for-rental homes through the AMH development program; and supervises the renovation process for homes through traditional acquisition channels. It also develops in-house property management infrastructure; and advertises properties via channels such as yard signs, online marketplaces, and local brokers. American Homes is headquartered in Calabasas, California, the US.

In recent years, they have been named one of Fortune’s 2022 Best Workplaces in Real Estate, a 2023 Great Place to Work, a 2023 Top U.S. Homebuilder by Builder100, one of America’s Most Responsible Companies 2023 and America’s Most Trustworthy Companies 2023 by Newsweek and Statista Inc., and a Top ESG Regional Performer by Sustainalytics.

As of June 30, 2023, AMH owned nearly 59,000 single-family properties in the Southeast, Midwest, Southwest, and Mountain West regions of the United States.

In the recent second-quarter report for the year 2023, the company reported:

- Net income of $ 98.0 million as compared to $ 56.6 million, or, for the second quarter of 2022.

- Earnings per share were reported at $ 0.27 per diluted share, as compared to $ 0.16 per diluted share for the second quarter of 2022.

The stock of the company started the year 2022 at a price of $ 43.61. The stock picked up a bearish trend which continued throughout the year. The stock closed the year at $ 30.14, representing a 30.88 % decline during the year.

In 2023, the stock reversed its course and started to rise. The stock went as high as $ 37.2 and last closed at $ 36.1. To date, the stock has appreciated by 20 %.

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Bath & Body Works (BBWI)

Bath & Body Works Inc ((Bath & Body) formerly L Brands Inc, is a specialty retailer, operating both physical and online stores. The company’s product portfolio comprises women’s intimate and other apparel, body, and bath products, personal care, and beauty products. It also offers lingerie, cosmetics, fragrances, lotions, shower gels, accessories, and soaps. Bath & Body markets products under the Bath and Body Works brand name. It merchandises products through company-operated retail stores, international franchises, licenses, websites, and wholesale partners. The company has business operations in the US, Canada, the UK, Ireland, Greater China, and Hong Kong. Bath & Body is headquartered in Columbus, Ohio, the US.

In the recent first-quarter report for the year 2023, the company reported:

- Net sales of $ 1.396 billion, a decrease of 4%, compared to net sales of $1.450 billion for the first quarter ended April 30, 2022.

- Net Income was reported at $ 81 million, as compared to $ 155 million for the same period of the prior year.

- Earnings per diluted share was reported at $ 0.35, as compared to $ 0.64 for the same period of the prior year.

The stock started the year 2022 at $ 69.79. The stock suffered a huge drop during the year and went as low as $ 27.51. Eventually, the stock closed at $ 42.14, representing a 40 % decline during the year.

In 2023, the stock further declined and last closed at $ 37.48. To date, the stock depreciated by 11 %.

Lamb Weston (LW)

Lamb Weston (LW)

Lamb Weston Holdings Inc (Lamb Weston) is a manufacturer and marketer of frozen potato products. The company’s product portfolio comprises fries, sweet potato fries, other potato products, and appetizers. Lamb Weston offers products in several varieties, including straight, sliced, diced, and mashed. The company markets its products under Lamb Weston, Lamb Weston Supreme, Lamb Weston Private Reserve, Lamb Weston Colossal Crisp, Lamb Weston Stealth Fries, Lamb Weston Seasoned, Lamb Weston Crispy on Delivery, and Sweet Things brand names. It distributes products to wholesalers, restaurant chains, mass merchants, grocery and specialty retailers, food service distributors, educational institutions, regional chain restaurants, independent restaurants, and convenience stores. The company has an operational presence in the US, Australia, China, Mexico, Canada, Singapore, and Japan. Lamb Weston is headquartered in Eagle, Idaho, the US.

Lamb Weston recently reported its full-year results ending 25th July 2023:

- Net Sales were reported at $ 5.35 billion, a 31 % increase from the prior year’s net sales of $ 4.099 billion.

- Income from operations was reported at $ 882.1 million, as compared to $ 444.4 million in the prior year’s report

- Net income was reported at $ 1.09 billion, as compared to $ 200.9 million in the prior year’s report

- Earnings per share was reported at $ 6.98, as compared to $ 1.38 in the prior year’s report

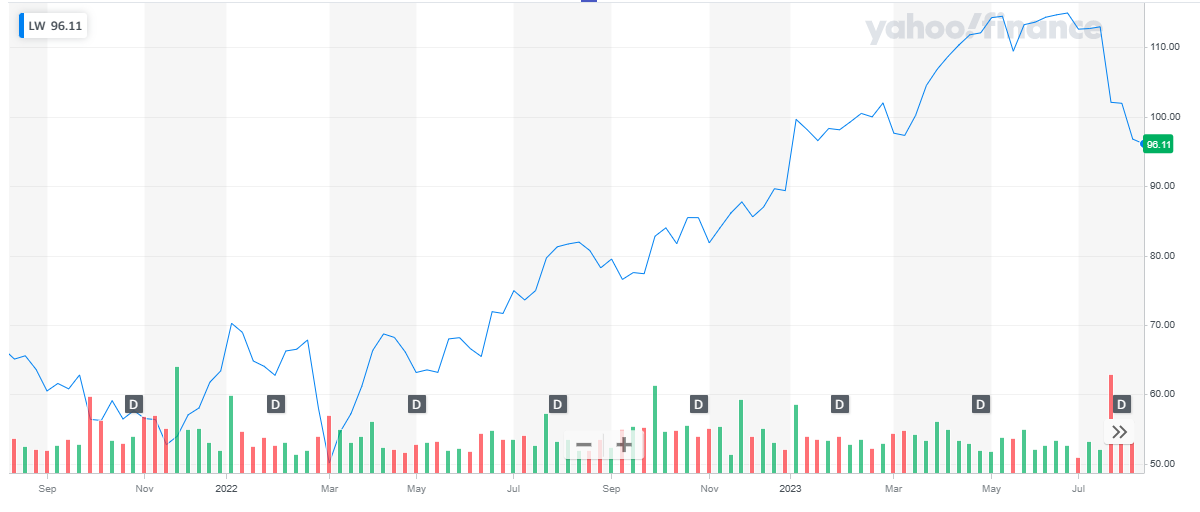

The stock started the year 2022 at a price of $ 63.38. After an initial dropped in price, the stock picked up pace and started to rise. The stock closed the year at $ 89.36 representing a 41 % appreciation during the year.

In 2023, the stock continued with the bullish trend. After peaking at $ 114.95, the stock pulled back and last closed at $ 97.2. Overall, the stock appreciated by 9 % to date.

Checkout:

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

- Reliable forex signals

Netflix (NFLX)

Netflix Inc (Netflix) provides entertainment services. The company offers TV shows and movies such as original series, documentaries, and feature films through an internet subscription on TV, computer, and mobile devices. It also offers a wide range of leisure activities, video games, and other sources of entertainment. Netflix also operates a separate library of movies that can be watched instantly on subscribers’ TV through mobile applications, or computers. It licenses, acquires, and produces content, including original programming. The company markets and promotes its service through various marketing partners including multichannel video programming distributors, streaming entertainment providers, consumer electronics manufacturers, mobile operators, and internet service providers. It has a business presence across the Americas, EMEA, and APAC. Netflix is headquartered in Los Gatos, California, the US.

In the recent second-quarter report for the year 2023, the company reported:

- Total revenues of $ 8.2 billion, as compared to $ 7.97 in the prior year’s second quarter.

- Operating Income of $ 1.827 billion, as compared to $ 1.578 in the prior year’s second quarter.

- Net income of $ 1.5 billion, as compared to $ 1.44 billion in the prior year’s second quarter.

- Earnings per share of $ 3.35, as compared to $ 3.24 in the prior year’s second quarter.

The stock started the year 2022 at $ 602.44. Initially, the stock suffered a huge drop and the stock went as low as $ 175.51. From here the stock started its slow and steady journey toward recovery and closed the year at $ 294.88. Overall, the stock declined by 51 % during the year.

In 2023, the stock continued its slow and steady recovery journey and last closed at $ 427.78. To date, the stock has appreciated by 45 %.

Also, learn:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Walt Disney (DIS)

The Walt Disney Co (Disney) is an entertainment and media company. It produces and acquires television programs, live-action films, and animated motion pictures. The company owns and operates theme parks and resorts, television networks and channels, develops and publishes books, comic books, and magazines, sells products related to Disney themes, and delivers an English language learning curriculum for Chinese children. Disney operates cable channels under the Disney, ESPN, FX, Freeform, and National Geographic brands and television networks under the ABC brand. It owns and operates stores in North America, Europe, and Asia. Disney is headquartered in Burbank, California, the US.

In the recent third-quarter report for the year 2023, the company reported:

- Total revenues of $ 22.3 billion, as compared to $ 21.5 in the prior year’s second quarter, reporting a 4 % increase.

- Operating Income of $ 3.6 billion, as compared to $ 3.6 in the prior year’s second quarter.

- Net loss of $ 460 million, as compared to net profit of $ 1.4 billion in the prior year’s second quarter.

- Loss per share of ($ 0.25), as compared to $ 0.77 in the prior year’s second quarter.

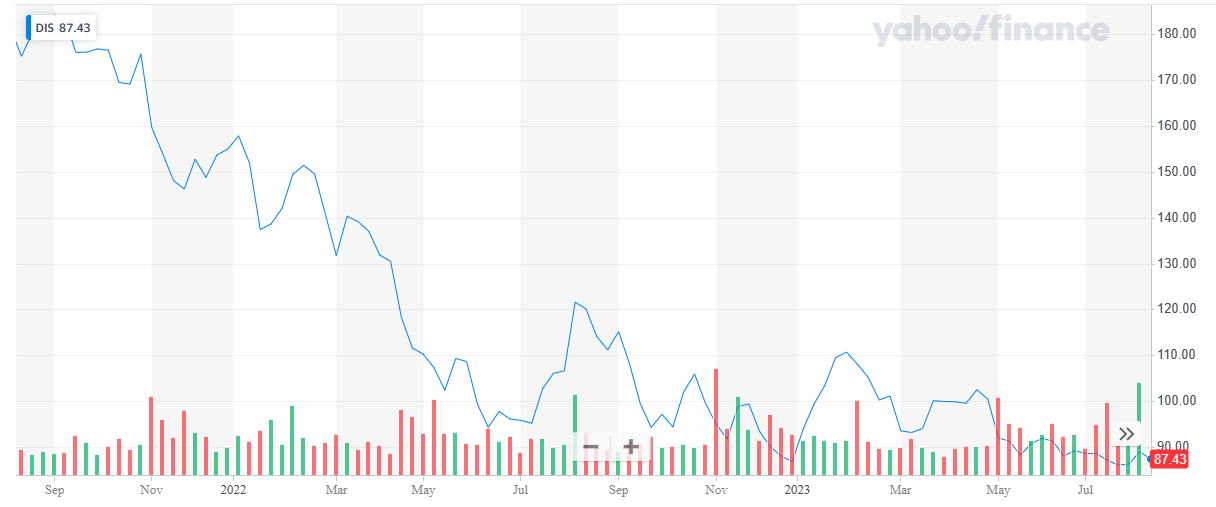

The stock started the year 2022 at $ 154.89. The stock continued with its ongoing bearish trend throughout the year. The stock closed the year at $ 86.88, representing a 44 % decline during the year.

In 2023, the stock initially maintained its stock price and eventually closed at $ 87.49.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Wells Fargo (WFC)

Wells Fargo & Co (WFC) is a diversified financial service holding company that offers retail and wholesale banking, and wealth management services to individuals, businesses, high-net-worth individuals, and institutions, through its subsidiaries. It provides a range of commercial and consumer loans, agricultural finance, card products, deposit services, and transaction services. It provides services such as mortgage banking, equipment leasing, insurance agency, and brokerage, securities brokerage and investment banking, trust services, computer and data processing, investment advisory, mortgage-backed securities servicing, and venture capital investment. It operates through branches, ATMs, and mobile and internet distribution channels globally. WFC is headquartered in San Francisco, California, the US.

In the recent second-quarter report for the year 2023, the company reported:

- Total revenues of $ 20.5 billion, as compared to $ 17 billion in the prior year’s second quarter.

- Net income of $ 4.9 billion, as compared to $ 3.14 billion in the prior year’s second quarter.

- Earnings per share of $ 1.25, as compared to $ 0.75 in the prior year’s second quarter.

The stock started the year 2022 at $ 47.98. Throughout the year the stock exhibited volatile behavior while staying bearish. The stock closed the year at $ 41.29 representing a 14 % decline during the year.

In 2023, the stock continued with its volatile behavior. After multiple ups and downs, the stock last closed at $ 42.78 representing a 3.6 % appreciation to date.

British American Tobacco (BTI)

British American Tobacco (BTI)

British American Tobacco plc (BAT) produces, markets, and sells cigarettes, tobacco and nicotine products, vapor and tobacco-heating products, and other tobacco-related products. The company’s product portfolio includes cigars, fine-cut tobacco, snus, moist snuff, and vapor. It markets these products under various brands, including Pall Mall, Vogue, Viceroy, Newport, Vype, glo, Dunhill, Lucky Strike, Natural American Spirit, Kool, Kent, Rothmans, Kodiak, and Camel. The company sells these products to an extensive network of retailers, wholesalers, and exclusive distributors. It has a business presence across Europe, Asia-Pacific, the Middle East and Africa, and the Americas. BAT is headquartered in London, Greater London, the UK.

In the recent half-yearly report for the year 2023, the company reported:

- Total revenues of £ 13.44 billion, as compared to £ 12.9 billion in the prior year’s second quarter.

- Profit from operations at £ 5.9 billion, as compared to £ 3.7 billion in the prior year’s second quarter.

- Profit of £ 4.0 billion, as compared to £ 1.94 billion in the prior year’s second quarter.

- Earnings per share of 176.6 p, as compared to 81.2 p in the prior year’s second quarter.

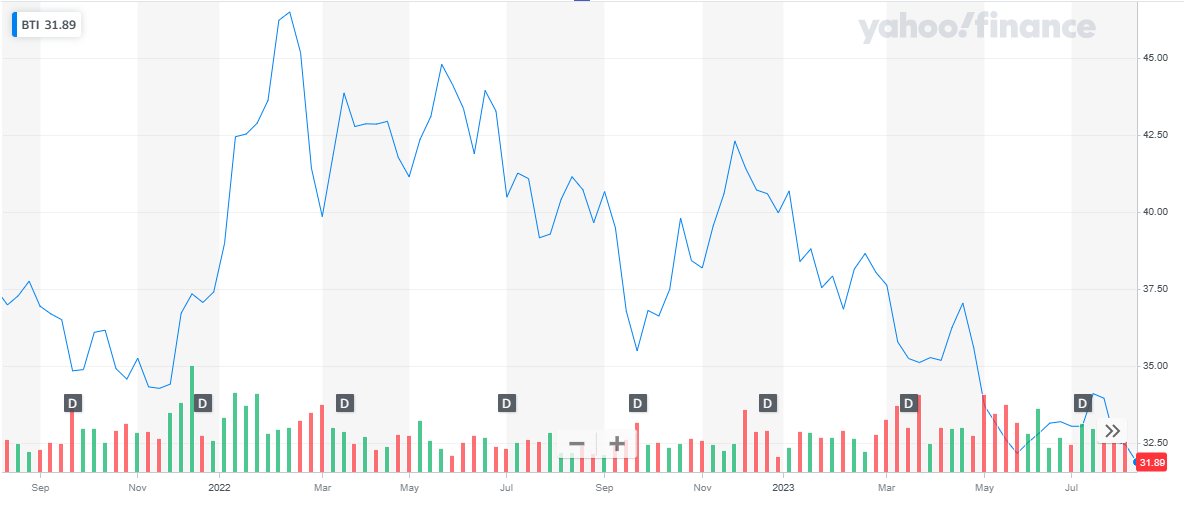

The stock started the year 2022 at $ 37.41. The stock spiked high and peaked at $ 46.5. From here the stock started to decline slowly and steadily and eventually closed the year at $ 39.98. Overall, the stock represented a 7 % appreciation during the year.

In 2023, the stock continued to decline further and last closed at $ 32.35, representing a 20 % decline to date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

GSK PLC (GSK)

British American Tobacco plc (BAT) produces, markets, and sells cigarettes, tobacco and nicotine products, vapor and tobacco-heating products, and other tobacco-related products. The company’s product portfolio includes cigars, fine-cut tobacco, snus, moist snuff, and vapor. It markets these products under various brands, including Pall Mall, Vogue, Viceroy, Newport, Vype, glo, Dunhill, Lucky Strike, Natural American Spirit, Kool, Kent, Rothmans, Kodiak, and Camel. The company sells these products to an extensive network of retailers, wholesalers, and exclusive distributors. It has a business presence across Europe, Asia-Pacific, the Middle East and Africa, and the Americas. BAT is headquartered in London, Greater London, the UK.

In the recent second-quarter report for the year 2023, the company reported:

- Total revenues of £ 7.2 billion,

- Operating Profit at £ 2.14 billion,

- Earnings per share of 40.1 p

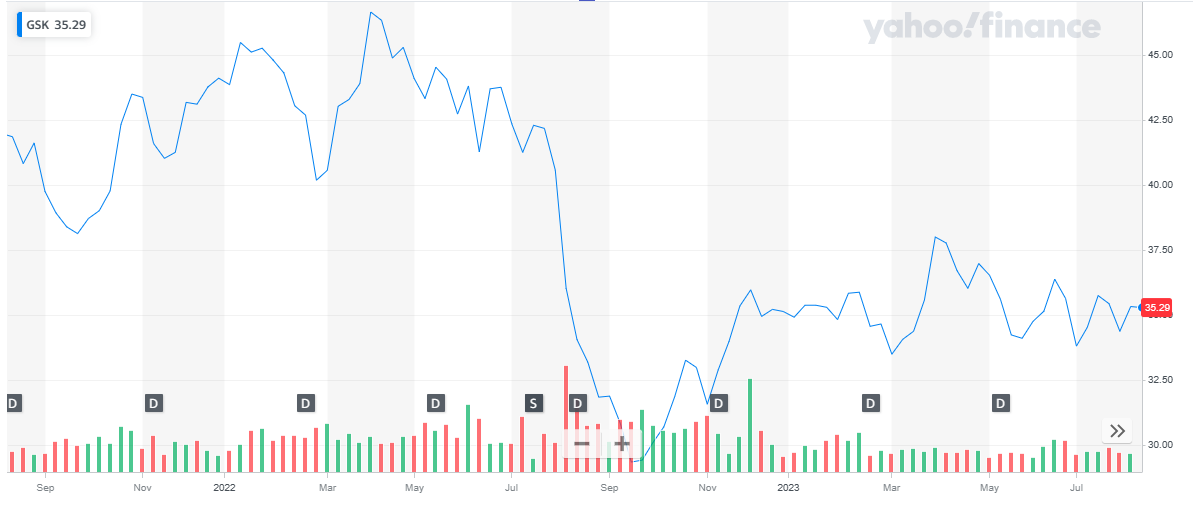

The stock started the year 2022 at $ 44.1. During the first half of the year, the stock maintained its price level but later on, suffered a huge drop and went as low as $ 29.36. Eventually, the stock closed the year at $ 35.14. Overall, the stock declined by 20 %.

In 2023, the stock continued to maintain its price level and last closed at $ 35.29

ASML Holding NV (ASML)

ASML Holding NV (ASML)

ASML Holding NV (ASML) is a microelectronics solutions provider that offers semiconductor manufacturing equipment. The company’s product portfolio includes lithography systems, metrology and inspection systems, and refurbished systems. Its computational lithography and patterning control software solutions enable customers to attain high yields and better operational performance. ASML’s products cater to logic chip manufacturers, foundries, and NAND-flash memory and DRAM memory chip makers. The company markets, sells, and services its products through a network of facilities, and service and technical support specialists. It has a business presence in the US, and countries across the Asia-Pacific and Europe. ASML is headquartered in Veldhoven, Noord Brabant, the Netherlands.

In the recent quarterly report for the year 2023, the company reported:

- Total net sales of £ 6.9 billion, as compared to £ 5.4 billion in the prior year’s second quarter.

- Income from operations at £ 2.263 billion, as compared to £ 1.653 billion in the prior year’s second quarter.

- Profit of £ 1.94 billion, as compared to £ 1.4 billion in the prior year’s second quarter.

- Earnings per share of £ 4.93, as compared to £ 3.54 in the prior year’s second quarter.

The stock started the year 2022 at $ 796.14. The stock picked up a bearish run and continued throughout the year. The stock went as low as $ 379.13 and eventually closed off the year at $ 546.4. Overall, the stock declined by 31.4 %.

In 2023, the stock reversed its course of action and started to rise. The stock last closed at $ 654, representing a 20 % appreciation to date.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

Devon Energy Corp (DVN)

Devon Energy Corp (Devon Energy) is an independent energy company. It carries out exploration, development, and production of oil, natural gas, and natural gas liquids (NGLs) in onshore areas of the US. Devon Energy’s US assets are in Delaware Basin, Anadarko Basin, Powder River Basin, Williston Basin, and Eagle Ford. Eagle Ford assets are located in DeWitt County in south Texas. In Delaware Basin, Devon Energy focuses on oil-rich Bone Spring, Wolfcamp, Avalon, and Delaware formations. The company’s Anadarko basin assets are in Oklahoma’s Canadian, Kingfisher, and Blaine counties. The Williston assets of the company are in the Bakken and Three Forks formations in the Fort Berthold Indian Reservation. The Powder River Basin consists of prospective oil opportunities in the Turner, Parkman, Teapot, and Niobrara formations. Devon Energy is headquartered in Oklahoma City, Oklahoma, the US.

In the recent second-quarter report for the year 2023, the company reported:

- Total revenues of $ 3.4 billion, as compared to $ 5.6 billion in the prior year’s second quarter.

- Net income of $ 690 million, as compared to $ 1.93 billion in the prior year’s second quarter.

- Earnings per share of $ 1.08, as compared to $ 2.94 in the prior year’s second quarter.

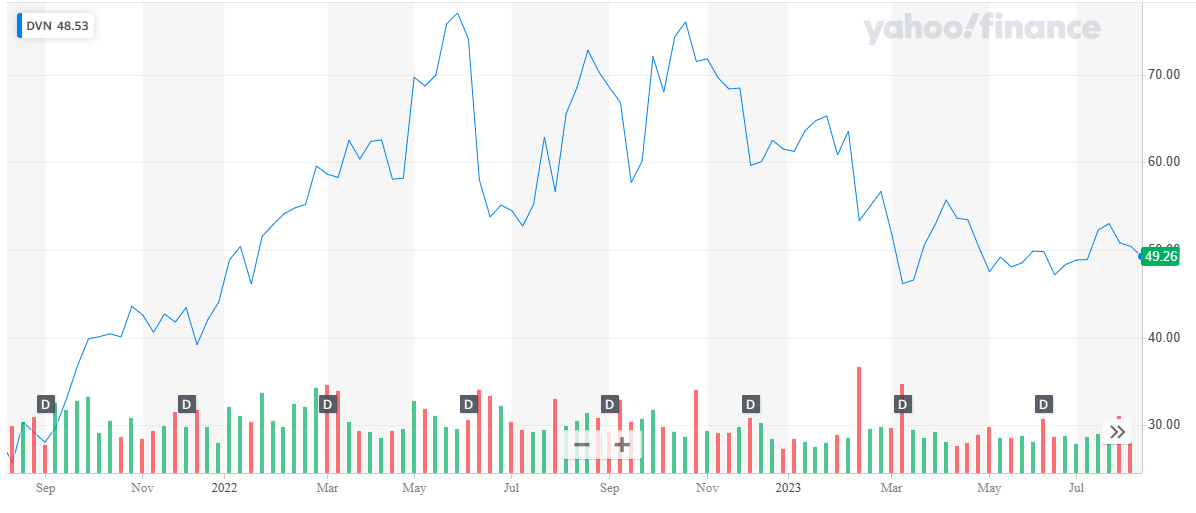

The stock started the year 2022 at $ 44.05. The stock continued with its ongoing bullish trend and went as high as $ 77.02. Eventually, the stock closed at $ 61.51 representing a 75 % appreciation during the year.

In 2023, the stock started its slow and steady decline and last closed at $ 49.29 representing a 35 % decline to date.

Conclusion

Conclusion

While 2023 has been a good year for the stock market, the market’s volatility is unpredictable. Therefore, for investors seeking good investments with a good return, the above list of companies is an excellent source.

Also, read:

Back