Keeping a portion of your portfolio invested in safe investments is a smart investment move. When the market becomes volatile and markets become shaky, you’ll benefit from the stability provided by holding safe, highly liquid investment assets.

These safe investment choices provide the benefit of a very low risk of losing your principal investment. There is no denying the fact that they offer lower returns than riskier assets, but that’s for the best. Investors choose safe investments when they want to protect their capital.

While selecting stocks that are safe, the following factors should be considered:

- Low Price Volatility – Price volatility measures the range of price moves and compares them to other stock prices and industry benchmarks

- Defensive Sector – Like the energy sector and utilities sector

- The region it operates in – The markets the stock operates in also need to be considered. Emerging market stocks might do well when the global economy is expanding, but established economies like the US offer some security when markets go down.

The Best Safe Stocks to Invest In Now

Here is a list of the best safe stocks to invest in for the long term:

| Sr. | Company Name | Symbol | Price (As of 27th April 2022) | Market Cap |

| 1 | Cadence Design Systems Inc. | CDNS | $ 207.86 | $ 57.07 billion |

| 2 | Tractor Supply Company | TSCO | $ 239.09 | $ 26.118 billion |

| 3 | Costco Wholesale Corp. | COST | $ 501.27 | $ 222.788 billion |

| 4 | UnitedHealth Group Inc. | UNH | $ 490.47 | $ 458.358 billion |

| 5 | Elevance Health, Inc. | ELV | $ 465.4 | $ 111.096 billion |

| 6 | Lowe’s Companies | LOW | $ 204.53 | $ 123.941 billion |

| 7 | Honeywell International | HON | $ 198.61 | $ 133.03 billion |

| 8 | Apple | AAPL | $ 168.41 | $ 2.685 trillion |

| 9 | Medtronic | MDT | $ 91.38 | $ 121 billion |

| 10 | Texas Instruments | TXN | $ 165.27 | $ 151.76 billion |

Cadence Design Systems, Inc. (CDNS)

Cadence Design Systems, Inc. (CDNS)

Cadence Design Systems Inc (Cadence) is a provider of system design solutions that are used for designing electronics systems, integrated circuits, and electronic devices. The company’s product and solution portfolio includes electronic design automation software, emulation and prototyping hardware, system interconnect and analysis, verification intellectual property and design intellectual property. Cadence also offers hosted design solutions, engineering services, methodology services, and education services. Its products and services find application in designing and verifying advanced semiconductors, consumer electronics, networking and telecommunications equipment, and computer systems. The company operates its business through a network of subsidiaries and sales offices and has a business presence across Asia-Pacific, Europe, the Americas, the Middle East, and Africa. Cadence is headquartered in San Jose, California, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 1,021.7 million | $ 901.8 million | $ 736 million |

| Operating Income | $ 699 million | $ 583 million | $ 203.9 million |

| Net Income | $ 241.8 million | $ 235 million | $ 187.2 million |

| Earnings per share | $ 0.9 | $ 0.86 | $ 0.68 |

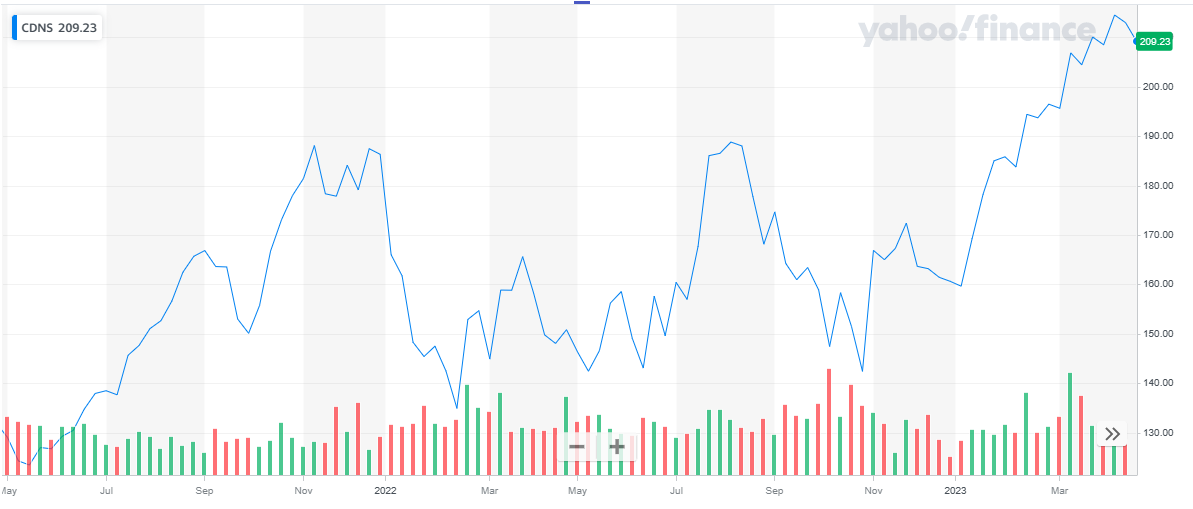

Cadence Design Systems has a market cap of $ 57.07 billion. Its shares are trading at $ 207.86. The stock started the year 2022 at $ 186.35. The stock maintained a volatile stance throughout the year, with the stock dropping as low as $ 134.95 and as high as $ 188.83. Eventually, the stock closed at $ 160.64, representing a 22.7 % decline during 2022.

In 2023, the stock picked up a bullish stance and continued to rise. The stock last closed at $ 209.01 representing a 30 % appreciation to date.

Also, read:

Also, read:

Tractor Supply Company (TSCO)

Tractor Supply Co (TSC) is a retailer of equipment and tools, and maintenance products. The company offers products for horses, poultry, livestock, pet, lawn and garden, trucks, tools, hardware and garage, heating and cooling, and outdoor living. It also offers home goods and toys, boots and shoes, clothing, and gift cards. TSC operates and sells products through retail stores under Tractor Supply Company, Orscheln Farm, and Home and Petsense by Tractor Supply brand names. It also sells products through e-commerce websites. The company’s stores are located in towns and rural communities. TSC is headquartered in Brentwood, Tennessee, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 3,299 million | $ 3,024 million | $ 2,792 million |

| Operating Income | $ 244.4 million | $ 244.3 million | $ 230.5 million |

| Net Income | $ 183.1 million | $ 187.3 million | $ 181.3 million |

| Earnings per share | $ 1.66 | $ 1.66 | $ 1.56 |

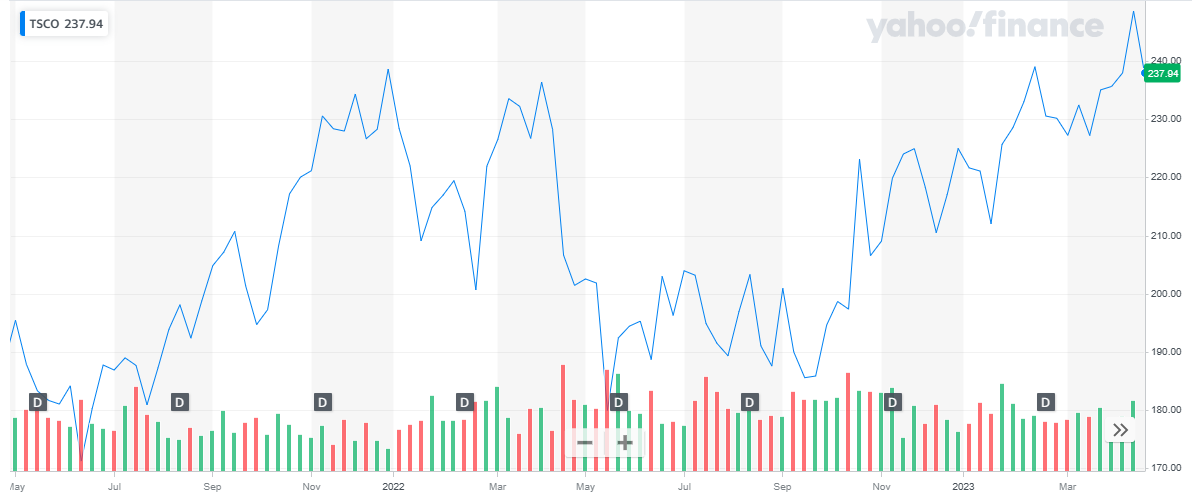

Tractor Supply Co has a market cap of $ 26.118 billion. Its shares are trading at $ 239.09.

The stock started the year 2022 at $ 238.6. The stock went through multiple ups and downs throughout the year and eventually closed the year at $ 224.97. Overall, the stock declined by 5.7 %.

In 2023, the stock picked up a bullish stance. The stock continued to decline to date and last closed at $ 239.09 representing a 6.3 % appreciation to date.

Costco Wholesale Corp. (COST)

Costco Wholesale Corp. (COST)

Costco Wholesale Corp (Costco) owns and operates a chain of membership warehouses. These warehouses are primarily involved in offering various products such as groceries, candy, appliances, television and media, tires, toys, hardware, automotive supplies, sporting goods, jewelry, watches, garden and patio, tickets, health and beauty aids, housewares, apparel, furniture, office supplies, domestics, postage at various competitive prices as compared to other wholesalers and retailers. In addition, it also owns and operates various self-service gas stations in the US, Canada, Australia, China, Japan, Spain, and the UK. The company also manages pharmacies, optical dispensing centers, food courts, gas stations, tire installation services, and hearing-aid centers. Costco is headquartered in Issaquah, Washington, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 54,239 million | $ 50,937 million | $ 44,769 million |

| Operating Income | $ 1,903 million | $ 1,812 million | $ 1,340 million |

| Net Income | $ 1,466 million | $ 1,299 million | $ 951 million |

| Earnings per share | $ 3.3 | $ 2.93 | $ 2.15 |

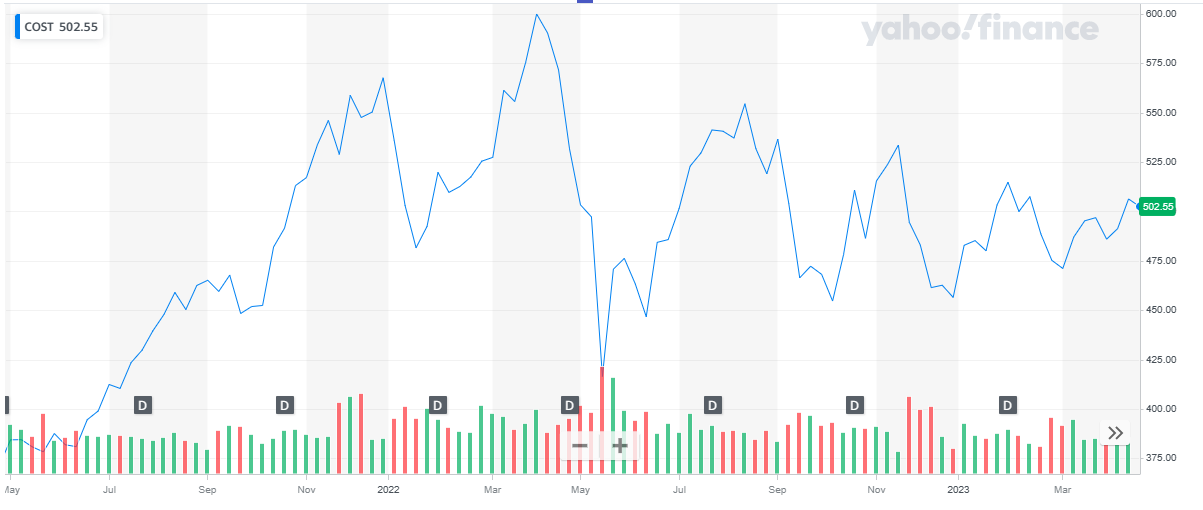

Costco has a market cap of $ 222.788 billion. Its shares are trading at $ 501.27.

The stock started in the year 2022 at $ 567.7. During the year the stock went as high as $ 600.04 and as low as $ 416.43 and eventually closed the year at $ 456.5. Overall, the stock declined by 19.6 %.

In 2023 the stock continued to move around within a small price range and last closed at $ 501.27 representing a 10 % appreciation to date.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

UnitedHealth Group Inc. (UNH)

UnitedHealth Group Inc (UnitedHealth Group) is a diversified healthcare company. It offers healthcare services and products through two distinct platforms, namely UnitedHealthcare and Optum. Its UnitedHealthcare platform provides healthcare coverage and benefit services and the Optum platform offers information and technology-enabled health services. The company provides health coverage, medicare plans, short-term health insurance, and Medicaid plans for individuals and families; health management and global health solutions for employers; health care network, value-based care; and clinician resources for physicians and health care professionals; and resources for brokers and consultants. The company offers its solutions and services to its members in the US and other countries. UnitedHealth Group is headquartered in Minnetonka, Minnesota, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 91,931 million | $ 80,149 million | $ 70,196 million |

| Operating Income | $ 8,086 million | $ 6,950 million | $ 6,739 million |

| Net Income | $ 5,611 million | $ 5,027 million | $ 4,862 million |

| Earnings per share | $ 5.95 | $ 5.27 | $ 5.08 |

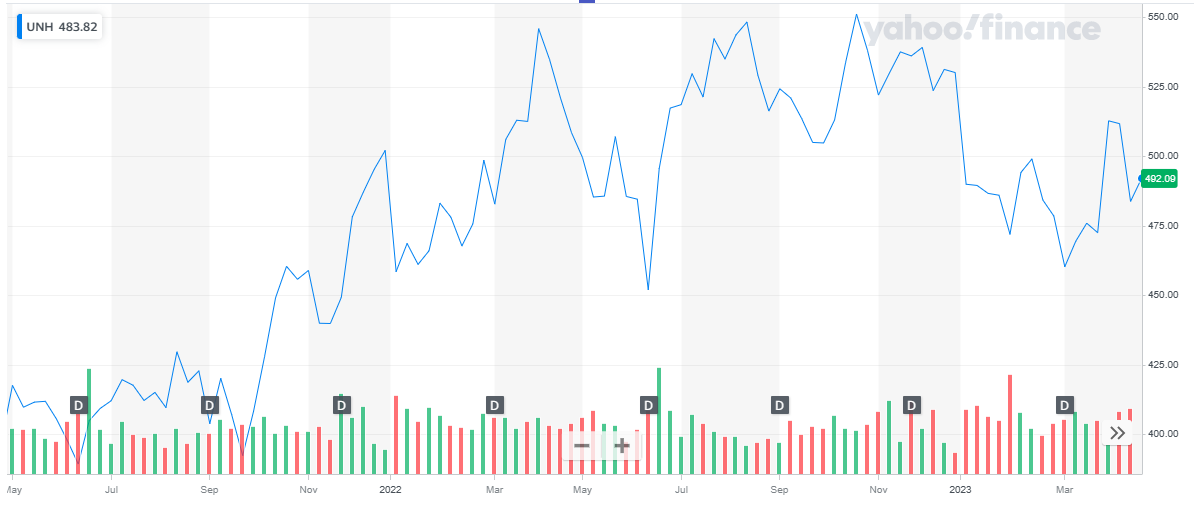

UnitedHealth Group has a market cap of $ 458.358 billion. Its shares are trading at $ 490.47.

The stock started the year 2022 at $ 502.14. The stock picked up a bullish stance and continued to climb till it hit $ 545.96. after that, the stock suffered a huge dip and dropped to $ 452.06. Eventually, the stock recovered and closed off the year at $ 530.18. Overall, the stock appreciated by 5.6 %.

In 2023, the stock picked up a bearish stance and has declined by 7 % to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Elevance Health, Inc. (ELV)

Elevance Health Inc (Anthem), is a health benefits company. The company offers managed healthcare-related products and administrative services. The company provides various specialty and insurance products and services including life, vision, dental, disability insurance benefits, and supplemental health insurance. Anthem offers its products and services to large and small groups, the federal government, Medicaid and Medicare markets, and individuals. Its various types of medical membership customers include Local Group, Individual, National Accounts, BlueCard, Medicare, Medicaid, and Federal Employees Health Benefits (FEHB). The company is an independent licensee of the Blue Cross and Blue Shield Association (BCBSA) and has a license for insurance operations across the US. Anthem is headquartered in Indianapolis, Indiana, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 42,172 million | $ 38,095 million | $ 32,385 million |

| Net Income | $ 1,989 million | $ 1,795 million | $ 1,665 million |

| Earnings per share | $ 8.3 | $ 7.32 | $ 6.71 |

Elevance Health Inc has a market cap of $ 111.096 billion. Its shares are trading at $ 465.4.

The stock started the year 2022 at $ 463.54. The stock kicked off the year with a bullish run and continued on this pattern throughout the year. The stock closed the year at $ 512.97, representing a 10.65 % appreciation during the year.

In 2023, the stock remained almost stagnant with a slight decline. To date, the stock has declined by 8.6 %.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

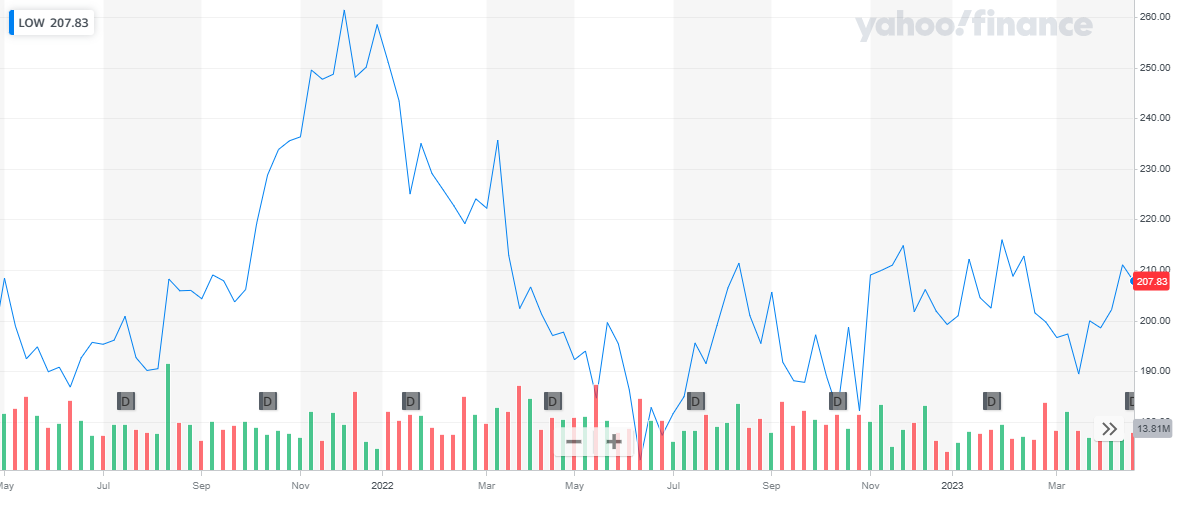

Lowe’s Companies (LOW)

Lowe’s Companies Inc (Lowe’s) is a retailer of home improvement products. The company’s product portfolio includes kitchen appliances, building materials, tools and hardware, and lawn and garden. It also offers fashion fixtures, rough plumbing and electrical, seasonal and outdoor living, paint, flooring, millwork, and outdoor power equipment.

Below are the company’s financial highlights for the recent past:

| FY 2022 | FY 2021 | FY 2020 | |

| Total Revenue | $ 97,059 million | $ 10,159 million | $ 89,597 million |

| Operating Income | $ 10,159 million | $ 12,093 million | $ 9,647 million |

| Net Income | $ 6,437 million | $ 8,442 million | $ 5,835 million |

| Earnings per share | $ 10.2 | $ 12.07 | $ 7.77 |

Lowe’s companies have a market cap of $ 123.941 billion. Its shares are trading at $ 204.53.

The stock started the year 2022 at a price of $ 258.48. The stock kicked off the year with a bearish stance and continued to decline till it dropped to $ 172.47. After that, the stock recovered and closed off the year at $ 199.24. Overall, the stock declined by 22.9 %.

In 2023, the stock maintained its price levels with a slight appreciation of 4 % to date.

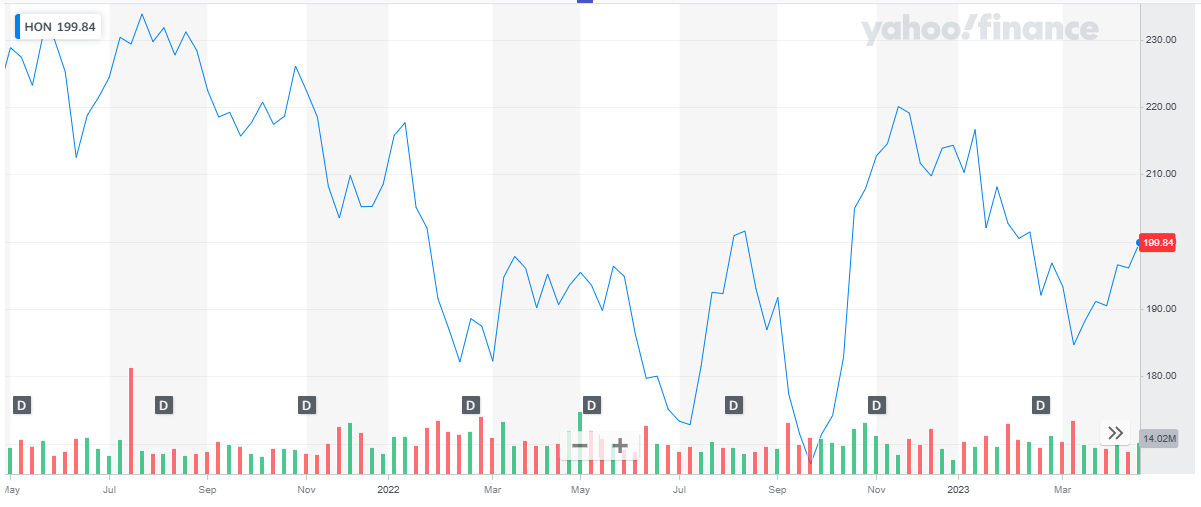

Honeywell International (HON)

Honeywell International (HON)

Honeywell International Inc (Honeywell) is an engineering and technology company. The company invents and manufactures technologies that address challenges in various sectors including energy, security, safety, productivity, and global urbanization. Honeywell offers specialty chemicals, process technologies, electronic and advanced materials, productivity, sensing, safety, and security technologies, and spare components. It also provides management and technical services, repair, overhaul, and maintenance services. Honeywell serves customers in the aerospace, refining, and petrochemicals, buildings, and industries in North America, Europe, and other regions. It has manufacturing and other facilities across the world. Honeywell is headquartered in Charlotte, North Carolina, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 8,864 million | $ 8,376 million | $ 8,454 million |

| Net Income | $ 1,408 million | $ 1,134 million | $ 1,448 million |

| Earnings per share | $ 2.09 | $ 1.66 | $ 2.05 |

Honeywell International Inc. has a market cap of $ 133.03 billion. Its shares are trading at $ 198.61.

The stock started the year 2022 at $ 208.51. It picked up a bearish run and continued to decline throughout the year till it dropped to $ 166.97. after that, the stock recovered and closed off the year at $ 214.3 representing a 2.78 % appreciation by the end of the year.

In 2023, the stock again picked up a bearish stance and declined by 7.3 %.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

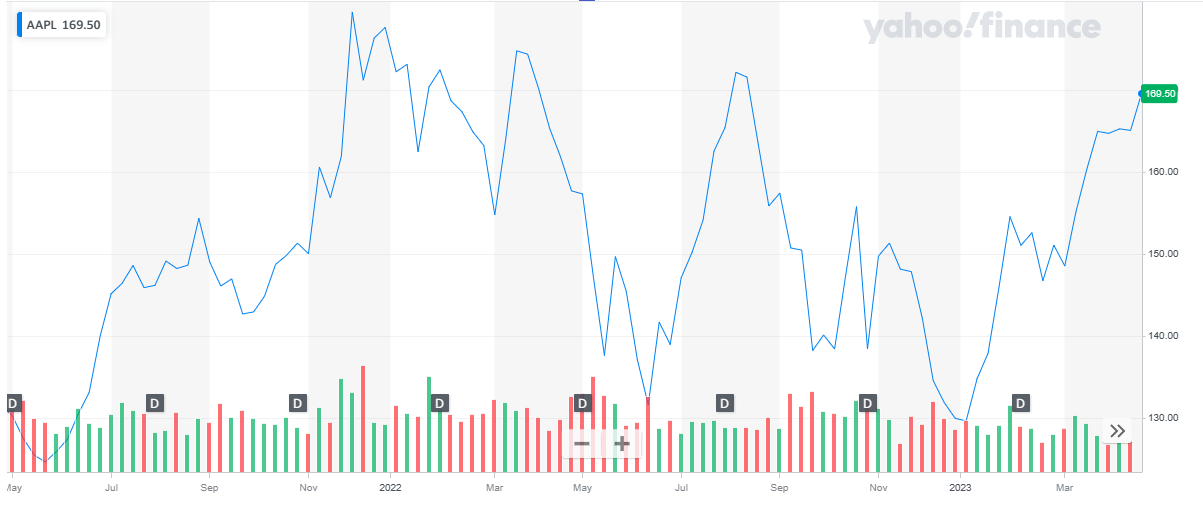

Apple (AAPL)

Apple Inc (Apple) designs, manufactures, and markets smartphones, tablets, personal computers, and wearable devices. The company also offers software applications and related services, accessories, and third-party digital content. Apple’s product portfolio includes iPhone, iPad, Mac, iPod, Apple Watch, and Apple TV. It offers various consumer and professional software applications such as iOS, macOS, iPadOS, watchOS, iCloud, AppleCare, and Apple Pay. Apple sells and delivers digital content and applications through App Store, Apple Arcade, Apple News+, Apple Fitness+, Apple Card, Apple TV+, and Apple Music. The company also provides advertising services, payment services, and cloud services. The company has a business presence across the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Apple is headquartered in Cupertino, California, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 117,154 million | $ 123,945 million | $ 111,439 million |

| Operating Income | $ 36,016 million | $ 41,488 million | $ 33,534 million |

| Net Income | $ 29,998 million | $ 34,630 million | $ 28,755 million |

| Earnings per share | $ 1.89 | $ 2.11 | $ 1.7 |

Apple has a market cap of $ 2.685 trillion. Its shares are trading at $ 168.41.

The stock started the year 2022 at $ 177.57. The stock exhibited volatile behavior throughout the year with steep dips and hikes. During the year the stock dropped to the low of $ 131.56 and eventually closed the year at $ 129.93. Overall, the stock declined by 26.8 %.

In 2023, the stock picked up a bullish stance and continued to climb. The stock last closed at $ 168.41 representing a 29.6 % appreciation to date.

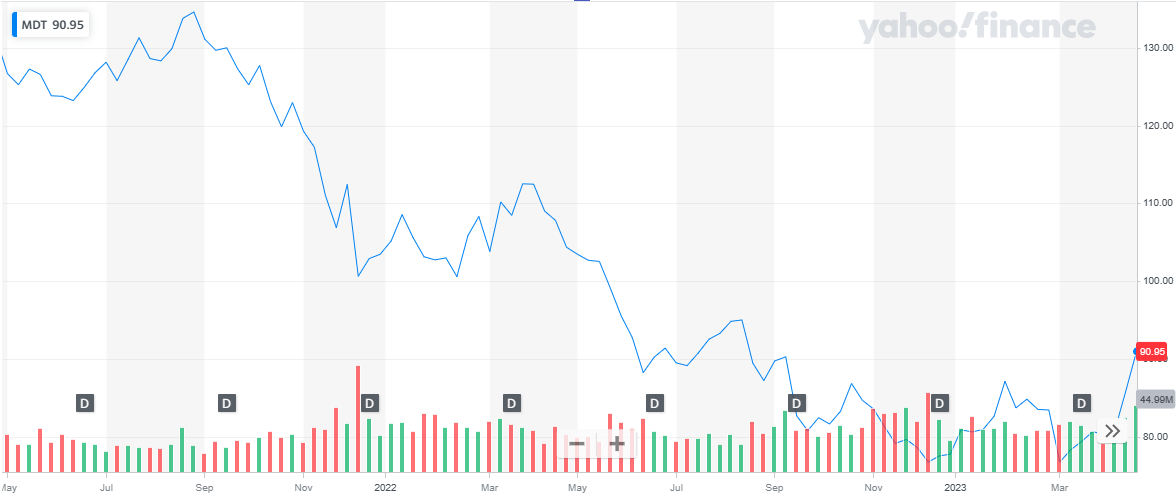

Medtronic (MDT)

Medtronic (MDT)

Medtronic Plc (Medtronic), formerly Medtronic Inc, is a medical technology company that designs, develops, manufactures, and markets a wide range of medical devices and solutions. It offers products for the treatment of heart valve disorders, heart failure, diseases of the coronary artery, aortic, peripheral vascular, venous renal, and neurological diseases, spine and musculoskeletal disorders, and diseases of the ear, nose, and throat. It also provides biologic solutions for the orthopedic and dental markets. It offers its products to hospitals, third-party healthcare providers, clinics, and institutions including governmental healthcare programs, distributors, and group purchasing organizations in Asia Pacific, Europe, the Americas, the Middle East, and Africa. Medtronic is headquartered in Dublin, Ireland.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 7,727 million | $ 7,763 million | $ 7,775 million |

| Operating Income | $ 1,392 million | $ 1,659 million | $ 1,277 million |

| Net Income | $ 1,222 million | $ 1,480 million | $ 1,270 million |

| Earnings per share | $ 0.92 | $ 1.1 | $ 0.94 |

Medtronic has a market cap of $ 121 billion. Its shares are trading at $ 91.38.

The stock has been on a bearish run for the past few days. The stock started the year 2022 at $ 103.45. By the end of the year, the stock declined to $ 77.72 representing a 25 % decline during the year.

In 2023, the stock maintained its low-price levels with a slight recovery. To date, the stock has appreciated by 17.3 %.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Texas Instruments (TXN)

Texas Instruments Inc (TI) designs, manufactures, and delivers semiconductors for the electronic designers and manufacturers. It offers application-specific standard semiconductor products through its analog and embedded processors divisions. The company’s analog chips portfolio includes power and signal chain products. It offers a wide range of digital signal processors (DSPs) and microcontrollers and applications processors products through its embedded processing category. TI also offers calculators, data converters, CAN transceivers, flip flops, voltage translation products, RF and microwave, sensors, switches, wireless connectivity, and custom semiconductors. The company operates through a network of subsidiaries across the Americas, Asia, Europe, the Middle East, and Africa. TI is headquartered in Dallas, Texas, the US.

Below are the company’s financial highlights for the recent past:

| Q1 2023 | Q1 2022 | Q1 2021 | |

| Total Revenue | $ 4,379 million | $ 4,905 million | $ 4,289 million |

| Operating Income | $ 1,934 million | $ 2,563 million | $ 1,939 million |

| Net Income | $ 1,708 million | $ 2,20 million | $ 1,753 million |

| Earnings per share | $ 1.85 | $ 2.35 | $ 1.87 |

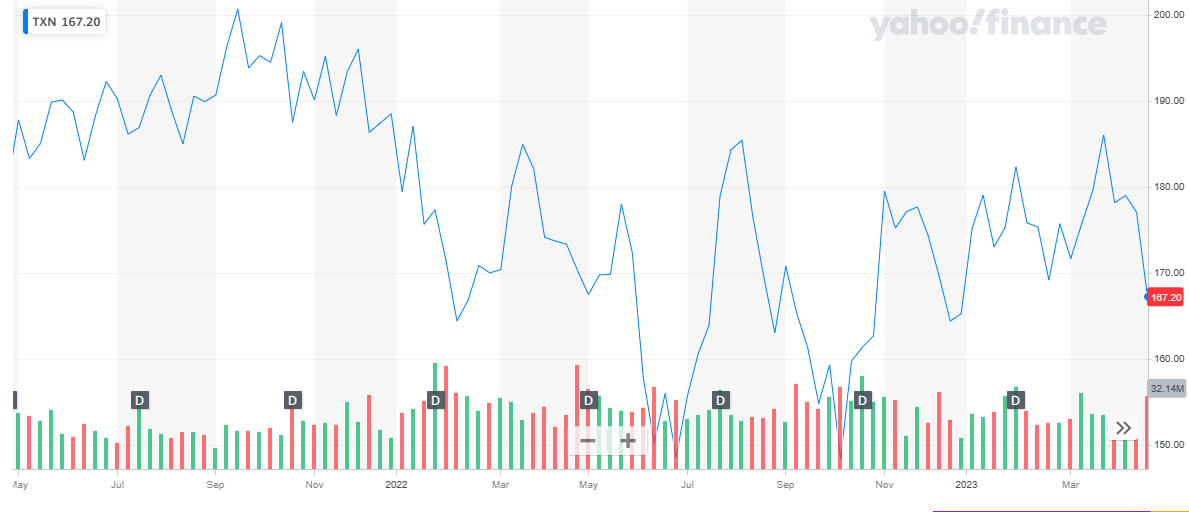

Texas Instruments has a market cap of $ 151.76 billion. Its shares are trading at $ 165.27.

The stock has been volatile in the past two years. The stock started the year 2022 at $188.47. After multiple ups and downs, the stock closed the year at $ 165.22 representing a 12.34 % decline during the year.

In 2023, the stock initially rose but eventually dropped and last closed at $ 165.27. To date, the stock has maintained its price levels.

Also, learn:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

CONCLUSION

No investment is completely safe from risk. It depends on how much risk the investor can take and how much liquidity you require. If having a safe, secure, and stable portfolio is your requirement, then the above-listed companies are one of the best stocks you can invest in.