What are Growth Stocks?

Growth stocks are stocks that offer a substantially higher growth rate as opposed to the mean growth rate prevailing in the market. Growth stock grows at a faster rate than the average stock in the market and consequently, generates earnings more rapidly.

Characteristics of a Growth Stock

-

High growth rate

Growth stocks tend to show a significantly higher growth rate than the average market growth rate. It implies that the stocks grow at a faster pace than the average stock in the market.

- Low or zero dividends

Growth stocks usually pay either low dividends or zero dividends at all. In order to support the high growth companies usually reinvest their retained earnings back into the company to boost the revenue-generating capacity of the business.

-

Competitive advantage

Growth companies tend to possess some kind of competitive advantage over other companies in the same industry. The competitive advantage gives growth companies a unique selling proposition (USP), which helps them sell and grow better than other companies within the same industry.

-

Loyal consumer base

Because of their competitive advantage, these companies tend to enjoy a loyal, growing consumer base. The USP that such companies enjoy over their competitors ensures a constantly growing consumer base, which contributes to their increasing growth rate.

-

Revenue

Investors are able to generate substantial revenues through capital gains, after seeing growth companies experience two-fold, three-fold, or multi-fold growth over the years.

-

Risk factor

Investments always come with some amount of risk. Such a fact is not also foreign to growth stocks. While growth stocks are a very attractive investment option and can generate substantial profits in the long term, the level of uncertainty surrounding them in the short term contributes to a high-risk factor.

Finding Growth Stocks

To find great growth stocks, investors need to look for the following things in the market:

- Identify powerful long-term market trends and the companies best positioned to profit from them. Companies that can capitalize on powerful long-term trends can increase their sales and profits for many years, generating wealth for their shareholders along the way. Here is a list of the current market trends:

- E-commerce

- Digital Advertising

- Digital Payments

- Cloud Computing

- Cord-cutting and streaming entertainment

- Electric Vehicles

- Narrow your list to businesses with strong competitive advantages. Some competitive advantages are:

- Network Effects

- Scale Advantages

- High Switching costs

- Next, narrow your list to companies with large addressable markets and long runways for growth still ahead. The larger the opportunity, the larger a business can ultimately become. And, the earlier in its growth cycle it is, the longer it can continue to grow at an impressive rate.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

- Reliable forex signals

List of the Top 8 Growth Stocks

Here is a list of the top 8 growth stocks to invest in today:

| Sr. | Company Name | Symbol | Price (As of 12th June 2023) | Market Cap |

| 1 | Tesla | TSLA | $ 258.8 | $ 820 billion |

| 2 | Shopify | SHOP | $ 65.01 | $ 81.39 billion |

| 3 | Block | SQ | $ 64.2 | $ 38.9 billion |

| 4 | ETSY | ETSY | $ 90.51 | $ 11.17 billion |

| 5 | Amazon | AMZN | $ 126.57 | $ 1.3 trillion |

| 6 | Salesforce | CRM | $ 209 | $ 203.644 billion |

| 7 | Airbnb | ABNB | $ 124.59 | $ 78.5 billion |

| 8 | Cloudflare | NET | $ 65.25 | $ 23.54 billion |

Tesla

Tesla

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. It operates in two segments:

Automotive – The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; non-warranty after-sales vehicles, used vehicles, retail merchandise, and vehicle insurance services. This segment also provides sedans and sport utility vehicles through direct and used vehicle sales, a network of Tesla Superchargers, and in-app upgrades; purchase financing and leasing services; services for electric vehicles through its company-owned service locations and Tesla mobile service technicians; and vehicle limited warranties and extended service plans.

Energy Generation and Storage – The Energy Generation and Storage segment engages in the design, manufacture, installation, sale, and leasing of solar energy generation and energy storage products, and related services to residential, commercial, and industrial customers and utilities through its website, stores, and galleries, as well as through a network of channel partners; and provision of service and repairs to its energy product customers, including under warranty, as well as various financing options to its solar customers.

Tesla recently reported its first quarter report for the year 2023:

- Total Revenues were reported at $ 23.3 billion, as compared to $ 18.756 billion in the previous year’s same period

- Income from operation was reported at $ 2.664 billion, as compared to $ 3.6 billion in the previous year’s same period

- Net Income was reported at $ 2.5 billion, as compared to $ 3.3 billion in the previous year’s same period

- Earnings per share were reported at $ 0.8, as compared to $ 1.07 in the previous year’s same period

Tesla has a market cap of $ 820 billion. Its shares are trading at $ 258.88.

The stock started the year 2022 at $ 352.26. The stock started off with a slow and steady decline. The stock closed the year at a low of $ 123.18 representing a 65 % decline during the year.

In 2023, the stock reversed its course of action and started to rise. The stock last closed at $ 258.88 representing a 110 % appreciation to date.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Shopify

Shopify is the leading global commerce company that provides essential internet infrastructure for commerce, offering trusted tools to start, scale, market, and run a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for speed, customization, reliability, and security while delivering a better shopping experience for consumers online, in-store, and everywhere in between. Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as Mattel, Gymshark, Heinz, FTD, Netflix, Kylie Cosmetics, SKIMS, Supreme, and many more.

Shopify recently reported its first quarter results for the year 2023:

- Total Revenues were reported at $ 1.5 billion, as compared to $ 1.2 billion in the previous year’s same quarter

- Loss from Operations was reported at ($ 193) million, as compared to ($ 98) million in the previous year’s same quarter

- Net Income was reported at $ 68 million, as compared to a net loss of ($ 1.4) billion in the previous year’s same quarter

- Earnings per share were reported at $ 0.05, as compared to ($ 1.17) in the previous year’s same quarter

Shopify has a market cap of $ 81.39 billion. Its shares are trading at $ 65.01.

The stock started the year 2022 at $ 137.74. The stock continued with a bearish pattern throughout the year and eventually closed the year at a low of $ 34.71. Overall, the stock lost 3/4th of its value during the year.

In 2023, the stock started to recover and appreciated by 87.3 %.

Block

Block

Block, Inc., together with its subsidiaries, creates tools that enable sellers to accept card payments and provides reporting and analytics, and next-day settlement. The company provides hardware products, including Square Register which combines its hardware, point-of-sale software, and payments technology; Square Terminal, a payments device and receipt printer to replace traditional keypad terminals, which accepts tap, dip, and swipe payments; Square Stand, which enables an iPad to be used as a payment terminal or full point of sale solution; Square Reader for contactless and chip that accepts EMV chip cards and NFC payments, enabling acceptance through Apple Pay, Google Pay, and other mobile wallets; and Square Reader for magstripe, which enables swiped transactions of magnetic-stripe cards by connecting with an iOS or Android smartphone or tablet through the headphone jack or Lightning connector.

It also offers various commercial products, including Square for Restaurants; Square Appointments; Square for Retail; Square Point of Sale; Square Online; Square Online Checkout; Square Invoices; Square Virtual Terminal; Risk Manager; Order Manager; Payment application programming interfaces (APIs); and Commerce APIs. In addition, the company provides Cash App, an ecosystem of financial products and services that enables customers to store, send, receive, spend, or invest their money.

Block recently reported its first quarter report for the year 2023:

- Total Revenues were reported at $ 4.88 billion, as compared to $ 3.96 billion in the previous year’s same quarter

- Loss from Operations was reported at ($ 6.17) million, as compared to ($ 226.8) million in the previous year’s same quarter

- Net Income was reported at ($ 16.9) million, as compared to a net loss of ($ 204.2) million in the previous year’s same quarter

- Loss per share was reported at ($ 0.03), as compared to a loss per share of ($ 0.38) in the previous year’s same quarter

Block has a market cap of $ 38.9 billion. Its shares are trading at $ 64.2.

The stock started the year 2022 at $ 161.51. The stock kicked off the year with a declining trend and dropped to a low of $ 51.51. Eventually, the stock closed the year at $ 62.84 representing a 68 % decline during the year.

In 2023, the stock recovered slightly and last closed at $ 64.2 representing an appreciation of a mere 2 %.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

ETSY

Etsy Inc (ETI) is an e-commerce company that connects both buyers and sellers. The company offers clothing and accessories, home and living, craft supplies, art and collectibles, mobile accessories, paper, and party supplies. Some of the products include body jewelry, jackets and coats, picture frames and displays, comics and graphic novels, and memorabilia. ETI also provides a wide range of tools and services for sellers which help creative entrepreneurs to start, manage and scale their businesses. The company has operations in the US, the UK, Canada, India, France, Australia and Germany. ETI is headquartered in Brooklyn, New York, the US.

ETSY reported its first quarter report for the year 2023:

- Total Revenues were reported at $ 640.8 million, as compared to $ 579.3 million in the previous year’s same quarter

- Income from Operations was reported at $ 78.2 million, as compared to $ 84.3 million in the previous year’s same quarter

- Net Income was reported at $ 74.5 million, as compared to a net loss of $ 86.1 million in the previous year’s same quarter

- Earnings per share were reported at $ 0.6, as compared to $ 0.68 in the previous year’s same quarter

ETSY has a market cap of $ 11.17 billion. Its shares are trading at $ 90.51.

ETSY started the year 2022 at $ 218.94. The stock kicked off a declining trend and dropped as low as $ 72.11. From here the stock recovered and eventually closed off the year at $ 119.78 representing a 45.3 % decline during the year.

In 2023, after an initial rise in price, the stock again dropped and last closed at $ 90.51 representing a 24.4 % decline to date.

Amazon

Amazon

Amazon.com Inc (Amazon) is an online retailer and web service provider. The company provides products such as apparel, auto and industrial items, beauty and health products, electronics, grocery, games, jewelry, kids and baby products, music, sports goods, toys, and tools. It also offers related support services including home delivery and shipping, cloud web hosting, and other web-related services. Amazon merchandises these products through company-owned online and physical platforms. It also manufactures and commercializes various electric devices such as Kindle e-readers, fire tablets, fire TVs, Echo, Alexa, and other devices. The company allows authors, musicians, filmmakers, and others to publish and sell content. Amazon is headquartered in Seattle, Washington, the US.

Amazon reported its first quarter report for the year 2023:

- Total Revenues were reported at $ 127 billion, as compared to $ 116.4 billion in the previous year’s same quarter

- Income from Operations was reported at $ 4.77 billion, as compared to $ 3.67 million in the previous year’s same quarter

- Net Income was reported at $ 3.1 billion, as compared to a net loss of ($ 3.8) billion in the previous year’s same quarter

- Earnings per share were reported at $ 0.31, as compared to a loss per share of ($ 0.38) in the previous year’s same quarter

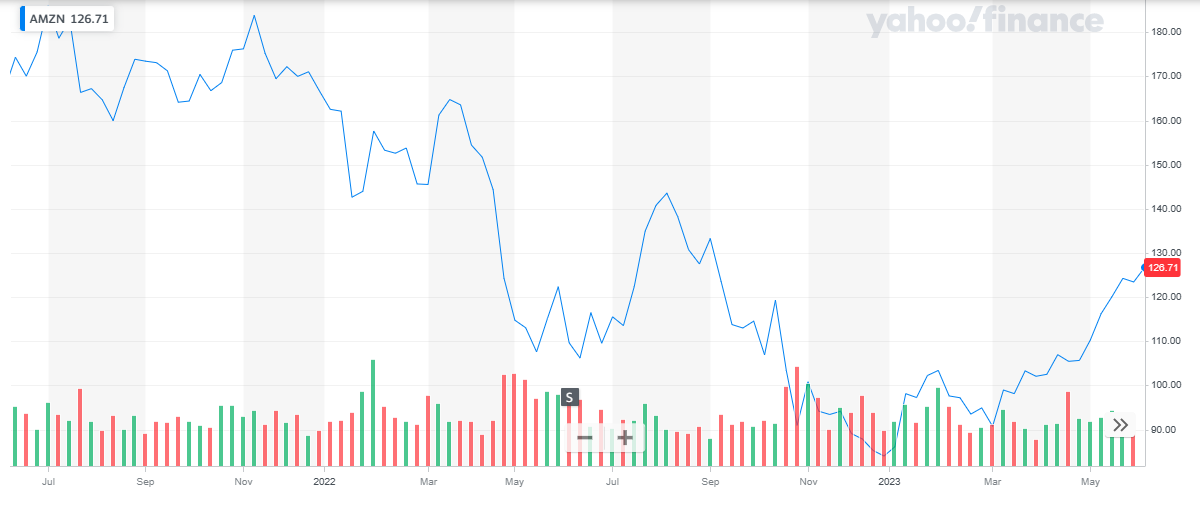

Amazon has a market cap of $ 1.3 trillion. Its shares are trading at $ 126.57.

The stock started the year 2022 at $ 166.72. The stock picked up a declining trend with multiple ups and downs during the year. Eventually, the stock closed at $ 84 representing a 50 % decline during the year.

In 2023, the stock reversed its course and started to recover. To date, the stock has appreciated by 50 %.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Salesforce

Salesforce Inc (Salesforce), formerly known as Salesforce.com Inc, is a provider of enterprise cloud computing solutions. The company’s Customer 360 Service platform offerings include customer data cloud services, marketing, automation, integration, commerce, and artificial intelligence. It provides its solutions as a service on a subscription basis, primarily through its direct sales efforts and indirectly through partners. The company also enables third parties to develop additional functionality and new apps that run on its platform. It offers services to customers in various industries such as financial services, manufacturing, healthcare and life sciences, automotive, consumer goods, education, media, nonprofits, retail, and technology. The company has a business presence across the Americas, Asia-Pacific, Europe, the Middle East, and Africa. Salesforce is headquartered in San Francisco, California, the US.

Salesforce reported its first quarter report for the fiscal year 2024:

- Total Revenues were reported at $ 8.25 billion, as compared to $ 7.4 billion in the previous year’s same quarter

- Income from Operations was reported at $ 412 million, as compared to $ 20 million in the previous year’s same quarter

- Net Income was reported at $ 199 million, as compared to $ 28 million in the previous year’s same quarter

- Earnings per share were reported at $ 0.2, as compared to $ 0.03 in the previous year’s same quarter

Salesforce has a market cap of $ 203.644 billion. Its shares are trading at $ 209.

The stock started the year 2022 at $ 254.13. It picked up a bearish trend and continued to decline throughout the year. The stock closed the year at the low price of $ 132.59 representing a 48 % decline during the year.

In 2023, the stock started its recovery path and has appreciated by 57.6 % to date.

Also, read:

Also, read:

Airbnb

Airbnb operates a travel marketplace that connects guests with rental properties listed by more than 4 million hosts around the world. That asset-light approach comes with two advantages over traditional hospitality companies.

First, Airbnb can onboard new hosts and expand its inventory in minutes, without spending millions of dollars. Second, Airbnb can offer guests a wider range of accommodations, both in terms of type and location. Listings on its platform range from cottages to castles, located anywhere from rural towns to big cities.

- Revenue was reported at $ 1.8 billion, as compared to $ 1.5 million in the previous year’s same period, representing an increase of 20 % from Q1 2022

- Net Income was reported at $ 117 million, as compared to a net loss of ($ 19) million in the previous year’s same period

- Earnings per share were reported at $ 0.18 as compared to a loss per share of ($ 0.03) in the previous year’s same period

Airbnb has a market cap of $ 78.5 billion. Its shares are trading at $ 124.59.

The stock started the year 2022 at $ 166.49. The stock picked up a bearish run and closed the year at $ 85.5 representing a 49 % decline during the year.

In 2023, after an initial rise, the stock maintained its price level representing a 37 % appreciation to date.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

Cloudflare

Cloudflare provides a growing range of applications, networks, and security services that accelerate and protect business-critical software and infrastructure. It also provides computing and storage solutions through its developer platform, which allows businesses to build performant applications, webpages, and streaming experiences.

Cloudflare distinguished itself as the fastest cloud computing network and developer platform on the market, and that advantage gave the company a strong foothold in several cloud verticals. Most notably, industry analysts recognized Cloudflare as a leader in content delivery network software, web application firewalls, and edge development tools, and the company is gaining traction with its zero-trust security suite.

Cloudflare recently reported its first quarter results for the year 2023:

- Total revenue was reported at $ 290.2 million, as compared to $ 212.2 million in the previous year’s same period representing an increase of 37% year-over-year.

- Loss from operations was reported at $ 47.3 million as compared to $ 40 million, in the first quarter of 2022

- Net loss was reported at $ 38.1 million, compared to $ 41.4 million in the first quarter of 2022

- Net Loss per share was reported at ($ 0.12) as compared to ($ 0.13) per share in the first quarter of 2022

Cloudflare has a market cap of $ 23.54 billion. Its shares are trading at $ 65.25.

The stock started the year 2022 at $ 131.5. The stock picked up a bearish run and continued to decline throughout the year. Eventually, the stock closed the year at $ 45.21 representing a 65.6 % decline during the year.

In 2023, the stock picked up pace and started to rise slowly and steadily. Overall, the stock appreciated by 45.4 %.

Also, learn:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares