What is a Non- Cyclical Stock?

Non-cyclical stocks are those whose underlying businesses are not disrupted by economic cycles. These companies offer products and services that meet consumers’ basic needs like food, power, water, and gas. Such non-cyclical stocks are also regarded as defensive stocks because they can help defend portfolios against an economic downturn

There are four basic stages of an economic cycle:

- Expansion: This is called a period of sustained growth. New jobs are being created and company profits increasing. This phase can last for several years.

- Peak: A time of slowing growth as growth hits a plateau. Inflation may begin to increase at this stage.

- Contraction: A period of economic decline, also called a recession. The economy shrinks rather than grows. Unemployment rates may increase, though inflation may be on the decline. How long a contraction period can persist, depends on the circumstances which lead to it.

- Trough: A transitional time when the economy stops declining and begins to recover. This is the lowest point in the economic cycle.

The key characteristics of a non-cyclical stock are:

- Better performers during periods of economic contraction

- Associated with goods or services that consumers consider essential

- Less sensitive to changing economic environments

- Earnings are relatively stable

- Are less volatile in terms of stock returns

- Typically hold up well during periods of economic contraction

- Most non-cyclical stocks pay dividends

Key Sectors of Non-cyclical Stocks

While not every cyclical stock can be categorized into the below industries, here is a list of key sectors of non-cyclical stocks:

- Consumer Staples

- Food and Staples Retailing

- Food, Beverage & Tobacco

- Household and Personal Products

- Telecommunication

- Energy

- Health Care

- Residential REITs

- Utilities

The Best Non-Cyclical Stocks

Here is the list of best Non-Cyclical stocks to invest in 2024:

| Sr. | Company Name | Symbol | Price (As of 10th May 2023) | Market Cap |

| 1 | The Procter & Gamble Company | PG | $ 153.71 | $ 362.29 billion |

| 2 | The Coca-Cola Company | KO | $ 63.39 | $ 274.135 billion |

| 3 | Philip Morris International Inc. | PM | $ 95.65 | $ 148.468 billion |

| 4 | Unilever Plc. | UL | $ 54.82 | $ 138.51 billion |

| 5 | PepsiCo | PEP | $ 194.14 | $ 267.465 billion |

| 6 | Tyson Foods | TSN | $ 48.82 | $ 20.77 billion |

| 7 | Catalyst Pharmaceuticals Inc | CPRX | $ 17.4 | $ 1.844 billion |

| 8 | British American Tobacco | BTI | $ 35.52 | $ 79.434 billion |

| 9 | Sanofi SA | SNY | $ 55.11 | $ 138.374 billion |

| 10 | NRG Energy Inc | NRG | $ 31.3 | $ 7.2 billion |

The Procter & Gamble Company

The Procter & Gamble Company

The Procter & Gamble Co (P&G) is a manufacturer and marketer of fast-moving consumer goods. The company’s products include conditioners, shampoo, male and female blades and razors, toothbrushes, toothpaste, dish-washing liquids, detergents, surface cleaners, and air fresheners. It also offers baby wipes, diapers and pants, paper towels, tissues, and toilet paper. P&G’s major brand names include Head & Shoulders, Tide, Ariel, Olay, Pantene, Pampers, Gillette, Braun, and Fusion, among others. The company sells its products through grocery stores, membership club stores, specialty beauty stores, high-frequency stores, online channels, pharmacies, drug stores, and department stores. It has a business presence across Asia-Pacific, Europe, the Middle East, Africa, and the Americas. P&G is headquartered in Cincinnati, Ohio, the US.

Here are the financial highlights for the recent periods of the company:

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | Percentage Change | |

| Net Sales | $ 20,068 million | $ 19,381 million | 4 % |

| Operating Income | $ 4,248 million | $ 4,024 million | 6 % |

| Net Profit | $ 3,424 million | $ 3,367 million | 2 % |

| Earnings per share | $ 1.41 | $ 1.37 | 3 % |

Proctor and Gamble have a market cap of $ 362.29 billion. Its shares are trading at $ 153.71.

The stock of the company has been volatile in the past few years. It started the year 2022 at $ 163.58. Throughout the year the stock remained bearish and volatile. Eventually, the stock closed the year at $ 151.56 representing a 7.3 % decline during the year.

In 2023, the stock continued its volatile behavior with an initial decline and a bullish trend after the first quarter. The stock has appreciated by a mere 1.4 %.

Also, read:

The Coca-Cola Company

Coca-Cola is home to one of the world’s most recognizable brands with more than 2,800 products available in more than 200 countries. The soft drinks company has continued to expand in recent years; its 2019 acquisition of coffee chain Costa for $4.9 billion was the largest brand acquisition in the company’s 130-plus–year history. In 2021, Coca-Cola joined a host of other major U.S. businesses in pledging $125 million to a fund dedicated to combating anti-Asian discrimination after a year in which the number of hate crimes against Asian Americans rose significantly.

Here are the financial highlights for the recent periods of the company:

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | Percentage Change | |

| Net Sales | $ 10,980 million | $ 10,491 million | 5 % |

| Operating Income | $ 3,367 million | $ 3,405 million | -1 % |

| Net Profit | $ 3,107 million | $ 2,781 million | 12 % |

| Earnings per share | $ 0.72 | $ 0.64 | 12 % |

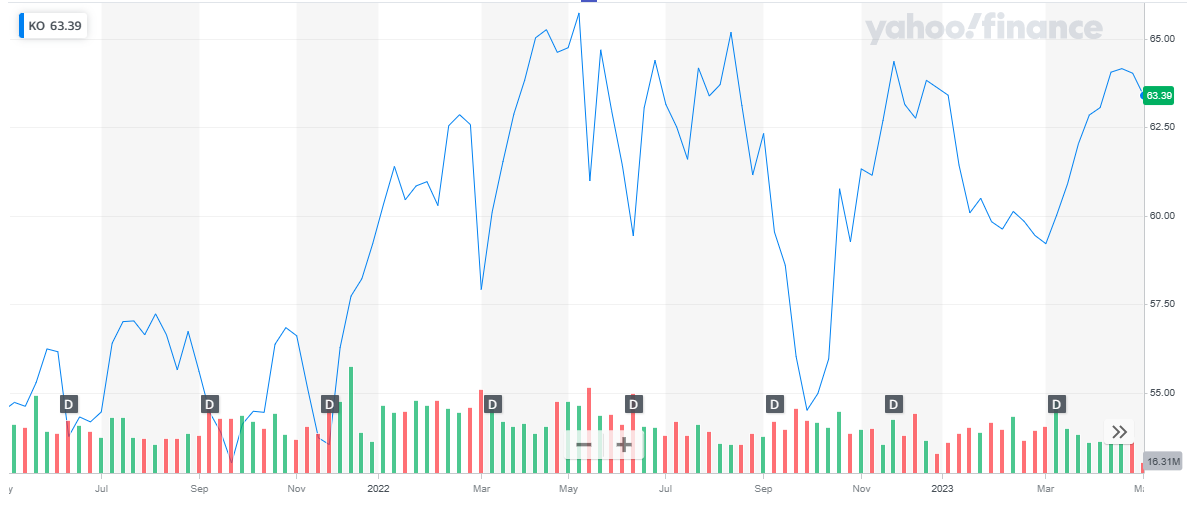

The Coca-Cola Company has a market cap of $ 274.13 billion. Its shares are trading at $ 63.39.

The stock started the year 2022 at a price of $ 59.2. After an initial bullish run, the stock suffered a huge blow in September and dropped to the low of $ 54.51. Eventually, the stock recovered and closed off the year at $ 63.61. Overall, the stock appreciated by 7.4 %.

In 2023, the stock started off with a declining trend. After dropping to the price of $ 59.21, the stock recovered and eventually closed off the year at $ 63.39. Overall, the stock maintained its price level to date.

Philip Morris International Inc.

Philip Morris International Inc.

Philip Morris International Inc (PMI) is a manufacturer and distributor of cigarettes, tobacco-related products, and other nicotine-containing products. It also offers combustible tobacco products, including e-vapor, heat-not-burn, and oral nicotine; wellness and healthcare products; and consumer accessories such as lighters and matches. The company markets several premium, mid-price, and low-price brands, including Marlboro, L&M, Chesterfield, Bond Street, Lark, Muratti, Next, Philip Morris, Merit, and Parliament. It also owns several local brands, including Fortune, and Jackpot in the Philippines, Optima in Russia, Morven in Pakistan and Dji Sam Soe, and Sampoerna A in Indonesia. PMI develops and commercializes reduced-risk products (RRPs). The company has business operations spanning the Americas, Asia-Pacific, Europe, the Middle East, and Africa. PMI is headquartered in New York City, New York, the US

Here are the financial highlights for the recent periods of the company:

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | Percentage Change | |

| Net Sales | $ 8,019 million | $ 7,746 million | 3.5 % |

| Operating Income | $ 3,019 million | $ 3,378 million | -10.6 % |

| Earnings per share | $ 1.28 | $ 1.5 | -6 % |

Philip Morris International Inc has a market cap of $ 146.1 billion. Its shares are trading at $ 94.15.

The stock started the year 2022 at $ 95. The stock started off with a huge spike in price and went as high as $ 111.16. This was followed by an immediate drop in price. Throughout the year, the stock remained volatile and eventually closed off at $ 101.21. Overall, the stock appreciated by 6.5 % during the year.

In 2023, the stock went bearish and depreciated by 6.9 %.

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Unilever Plc.

Unilever Plc (Unilever) is a manufacturer and supplier of fast-moving consumer goods. The company’s product portfolio comprises food products, beauty, and personal care products, beverages, home care products, vitamins, minerals, and supplements. It markets products under the Bango, Ben & Jerry’s, Hellmann’s, Knorr, Magnum, The Vegetarian Butcher, Wall’s, Axe, Dove, Lifebuoy, Lux, Rexona, Sunsilk, Domestos, Omo, Seventh Generation, Equilibra, Liquid I.V., and SmartyPants brand names. It sells products to bricks and mortar store partners, small family-owned shops, online retailers, and value retailers. The company has a business presence across the Americas, Europe, Asia-Pacific, Africa, and the Middle East. Unilever is headquartered in London, England, the UK.

Here are the financial highlights for the recent periods of the company:

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | Percentage Change | |

| Net Sales | $ 10,667 million | $ 6,552 million | 62 % |

| Operating Income | $ 3,568 million | $ 1,924 million | 85 % |

| Net Profit | $ 3,356 million | $ 1,828 million | 83.6 % |

| Earnings per share | $ 526.89 | $ 284.04 | 85 % |

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Unilever has a market cap of $ 136.4 billion. Its shares are trading at $ 53.96.

The stock started the year 2022 at $ 53.79. The stock continued throughout the year with a bearish trend. From October onwards the stock reversed its course and started appreciating. The stock closed the year at $ 50.35. Overall, the stock declined by 6.4 %.

In 2023, the stock continued to rise. To date the stock appreciated by 7.2 %

PepsiCo

PepsiCo

PepsiCo products are enjoyed by consumers more than one billion times a day in more than 200 countries and territories around the world. PepsiCo generated $ 86 billion in net revenue in 2022, driven by a complementary beverage and convenient foods portfolio that includes Lay’s, Doritos, Cheetos, Gatorade, Pepsi-Cola, Mountain Dew, Quaker, and SodaStream. PepsiCo’s product portfolio includes a wide range of enjoyable foods and beverages, including many iconic brands that generate more than $ 1 billion each in estimated annual retail sales.

Here are the financial highlights for the recent periods of the company:

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | Percentage Change | |

| Net Sales | $ 17,846 million | $ 16,200 million | 10.16 % |

| Operating Income | $ 2,629 million | $ 5,267 million | -50.1 % |

| Net Profit | $ 1,932 million | $ 4,261 million | -55 % |

| Earnings per share | $ 1.4 | $ 3.06 | -54 % |

PepsiCo has a market cap of $ 265.8 billion. Its shares are trading at $ 192.9. The stock started the year 2022 at a price of $ 173.71. The stock continued to rise with slight volatility and eventually closed the year at $ 180.65. Overall, the stock appreciated by 4 %.

In 2023, after an initial decline, the stock spiked high. To date the stock appreciated by 6.7 %.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

Tyson Foods

Tyson Foods Inc (Tyson Foods) is a food processor and marketer of chicken, beef, and pork. The company is involved in breeding stock, feed production, processing, marketing, and transportation of chicken and related allied products. It also offers a wide range of prepared foods such as bacon, turkey, breakfast sausage, hot dogs, lunchmeat, and tortillas among others. The company markets its products under Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, ibp, and State Fair brand names. It markets its products to food hotel chains, restaurant operators, service distributors, food retailers, and non-commercial food service providers, including schools, healthcare facilities, military and food processors, convenience stores, and international export markets. Tyson Foods is headquartered in Springdale, Arkansas, the US.

Here are the financial highlights for the recent periods of the company:

| Second quarter, 2023 | Second Quarter, 2022 | Percentage Change | |

| Net Sales | $ 13,133 million | $ 13,117 million | 0.12 % |

| Operating Income | ($ 49) million | ($ 1,156) million | – |

| Net Profit | ($ 97) million | $ 829 million | – |

| Earnings per share | ($ 0.28) | ($ 2.28) | – |

Tyson Foods has a market cap of $ 20.1 billion. Its shares are trading at $ 47.21.

The stock started the year 2022 at $ 87.16. initially, the stock maintained its price level and after May’22 it started to decline. The stock closed the year at $ 62.25, representing a 29 % decline during the year.

In 2023, the stock continued to decline further and depreciated by 24 %.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

Catalyst Pharmaceuticals Inc

Catalyst Pharmaceuticals Inc (Catalyst) is a biopharmaceutical company that develops and commercializes prescription drugs targeting rare neurological and neuromuscular diseases. The company focuses on specific conditions such as lambert-eaton myasthenic syndrome (LEMS), congenital myasthenic syndromes (CMS), musk-myasthenia gravis (MuSK-MG), type 3 spinal muscular atrophy (SMA) and downbeat nystagmus. Its product portfolio includes Firdapse, a proprietary form of amifampridine phosphate for the treatment of LEMS, CMS, MuSK-MG, and SMA. The company operates in the US and through its subsidiary in Ireland. Catalyst is headquartered in Coral Gables, Florida, the US.

Here are the financial highlights for the recent periods of the company:

| Year-end 2023 | Year-end 2022 | Percentage Change | |

| Net Sales | $ 213.9 million | $ 138 million | 55 % |

| Operating Income | $ 101.8 million | $ 52.4 million | 94 % |

| Net Profit | $ 83.1 million | $ 39.5 million | 110 % |

| Earnings per share | $ 0.8 | $ 0.38 | 110 % |

Catalyst Pharmaceuticals Inc. has a market cap of $ 1.845 billion. Its shares are trading at $ 17.41.

The stock started the year 2022 at $ 6.77. The stock started off with a bullish trend and continued to appreciate throughout the year. Eventually, the stock closed the year at $ 18.6 representing a 174 % appreciation during the year.

In 2023, the stock pulled back and declined by 6.3 % to date.

British American Tobacco

British American Tobacco

British American Tobacco plc (BAT) produces, markets, and sells cigarettes, tobacco and nicotine products, vapor and tobacco-heating products, and other tobacco-related products. The company’s product portfolio includes cigars, fine-cut tobacco, snus, moist snuff, and vapor. It markets these products under various brands, including Pall Mall, Vogue, Viceroy, Newport, Vype, glo, Dunhill, Lucky Strike, Natural American Spirit, Kool, Kent, Rothmans, Kodiak, and Camel. The company sells these products to an extensive network of retailers, wholesalers, and exclusive distributors. It has a business presence across Europe, Asia-Pacific, the Middle East and Africa, and the Americas. BAT is headquartered in London, Greater London, the UK.

Here are the financial highlights for the recent periods of the company:

| Year-end 2023 | Year-end 2022 | Percentage Change | |

| Net Sales | £ 27,655 million | £ 25,684 million | 7.7 % |

| Operating Income | £ 10,523 million | £ 10,234 million | 2.8 % |

| Net Profit | £ 6,846 million | £ 6,974 million | -1.83 % |

| Earnings per share | 293.3 p | 296.9 p | -1.21 % |

British American Tobacco has a market cap of $ 77.6 billion. Its shares are trading at $ 34.7.

The stock started the year 2022 at $ 37.41. After an initial hike in price, the stock started to decline and continued to do so throughout the year. Eventually, the stock closed the year at $ 39.98. Overall, the stock appreciated by 6.9 %.

In 2023, the stock continued to decline further and has depreciated by 13.3 % to date.

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Sanofi SA

Sanofi is a healthcare company, which is engaged in the discovery, development, manufacturing, and marketing of a wide range of medicines and vaccines. Its portfolio includes medicines for the treatment of cancer, rare diseases, and multiple sclerosis; human vaccines for protection against various bacterial and viral diseases; and other products. The company also offers consumer healthcare products for digestion; allergy; cough, cold, flu, and sinus; pain; women’s health; and vitamins, minerals, and supplements. Sanofi’s R&D efforts focus on advancing a combination drug to increase the effectiveness of treatments and on advancing the formulation of new biologics to produce precision medicines. It has operations in Europe, the Americas, Asia-Pacific, Africa, and the Middle East. Sanofi is headquartered in Paris, France.

Here are the financial highlights for the recent periods of the company:

| Year-end 2023 | Year-end 2022 | Percentage Change | |

| Net Sales | £ 42,997 million | £ 37,761 million | 13.9 % |

| Operating Income | £ 10,656 million | £ 8,126 million | 31.13 % |

| Net Profit | £ 8,484 million | £ 6,279 million | 35 % |

| Earnings per share | 6.69 p | 4.97 p | 32.5 % |

Sanofi SA has a market cap of $ 136.3 billion. Its shares are trading at $ 55.11.

The stock started the year 2022 at $ 50.1. During July’22, the stock suffered a huge drop and went as low as $ 38.02. After that, the stock recovered a bit and eventually closed off the year at $ 48.43. Overall, the stock declined by 3.3 %.

In 2023, the stock started to rise and has appreciated by 13.8 % to date.

NRG Energy Inc

NRG Energy Inc

Sanofi is a healthcare company, which is engaged in the discovery, development, manufacturing, and marketing of a wide range of medicines and vaccines. Its portfolio includes medicines for the treatment of cancer, rare diseases, and multiple sclerosis; human vaccines for protection against various bacterial and viral diseases; and other products. The company also offers consumer healthcare products for digestion; allergy; cough, cold, flu, and sinus; pain; women’s health; and vitamins, minerals, and supplements. Sanofi’s R&D efforts focus on advancing a combination drug to increase the effectiveness of treatments and on advancing the formulation of new biologics to produce precision medicines. It has operations in Europe, the Americas, Asia-Pacific, Africa, and the Middle East. Sanofi is headquartered in Paris, France.

Here are the financial highlights for the recent periods of the company:

| Three Months Ended March 31, 2023 | Three Months Ended March 31, 2022 | Percentage Change | |

| Net Sales | $ 7,722 million | $ 7,855 million | 62 % |

| Operating Income | (1,544) million | ($ 1,317) million | 85 % |

| Net Profit | ($ 336) million | ($ 297) million | 83.6 % |

| Earnings per share | $ 526.89 | $ 284.04 | 85 % |

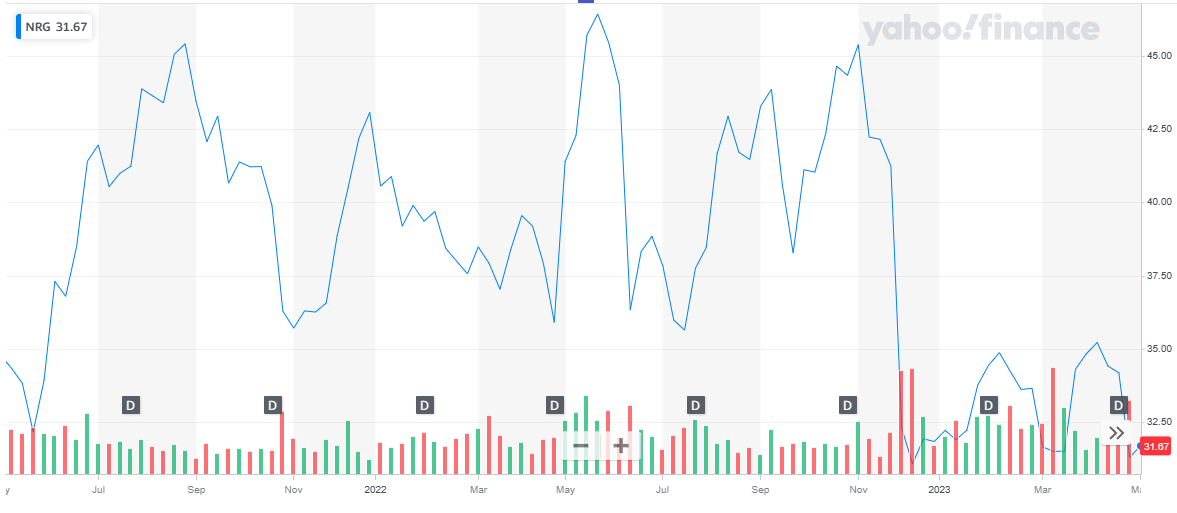

NRG Energy has a market cap of $ 7.3 billion. Its shares are trading at $ 31.3.

The stock started the year 2022 at $ 43.08. The stock remained extremely volatile throughout the year with multiple dips and peaks. However, in November the stock suffered a huge blow and dropped as low as $ 31.05. Eventually, the stock closed at $ 31.82 representing a 26 % decline during the year.

In 2023, the stock has maintained its price level at the start of the year.

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares