List of the Best Mid-Cap Stocks

| Sr. | Company Name | Symbol | Market Cap | Price (As of 25th May 2023) |

| 1 | West Fraser Timber | WFG | $ 6.1 billion | $ 72.8 |

| 2 | IPG Photonics | IPGP | $ 5.24 billion | $ 110.77 |

| 3 | Louisiana-Pacific | LPX | $ 4.32 billion | $ 59.98 |

| 4 | Silicon Motion Technology | SIMO | $ 2.067 billion | $ 62.57 |

| 5 | ArcBest | ARCB | $ 2.29 billion | $ 94.38 |

| 6 | Valvoline | VVV | $ 5.87 billion | $ 34.14 |

| 7 | AXOS Financial | AX | $ 2.143 billion | $ 35.71 |

| 8 | Crestwood Equity Partners | CEQP | $ 2.58 billion | $ 24.43 |

| 9 | Foot Locker, Inc. | FL | $ 3.834 billion | $ 41.03 |

| 10 | Silicon Motion Technology | SIMO | $ 2.067 billion | $ 62.53 |

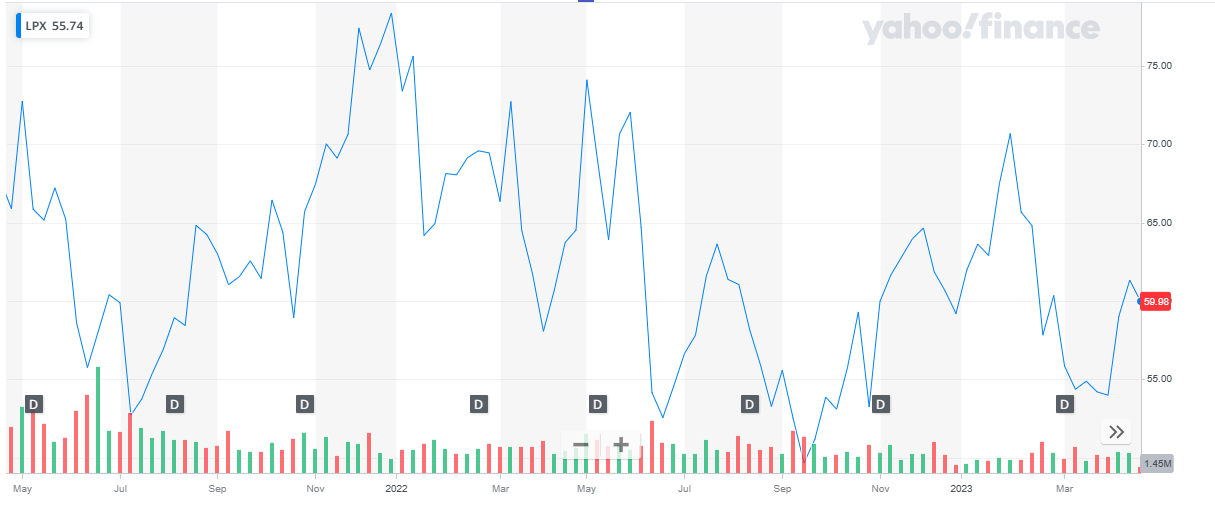

West Fraser Timber (WFG)

West Fraser Timber (WFG)

West Fraser Timber is a Canadian forestry company that produces lumber and other specialized wood-based products such as pulp and plywood. It has more than 60 facilities in Canada, the United States (“U.S.”), the United Kingdom (“U.K.”), and Europe. From responsibly sourced and sustainably managed forest resources, the Company produces lumber, engineered wood products (OSB, LVL, MDF, plywood, and particleboard), pulp, newsprint, wood chips, other residuals and renewable energy. West Fraser’s products are used in home construction, repair and remodeling, industrial applications, papers, tissue, and box materials.

The company recently reported its first quarter results for 2023:

- Total sales were reported at $ 1.627 billion.

- Total Earnings were reported at ($ 42) million.

- Earnings per share were reported at ($ 0.52) per share.

West Fraser has a market cap of $ 6.1 billion. Its shares are trading at $ 72.8.

The share of the company has been extremely volatile. The stock started the year 2022 at $ 95.36. After multiple ups and down during the year the stock closed at $ 72.29. Overall, the stock declined by 24.2 %.

In 2023, the stock continued with its volatile behavior. In the first few months of the year 2023, the stock went as high as $ 86.97 and as low as $ 69.34 and last closed at $ 72.8. Till date the stock has almost maintained its price levels.

Also, learn:

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

IPG Photonics (IPGP)

IPG Photonics is a company that develops, manufactures, and sells high-performance fiber lasers, fiber amplifiers, and diode lasers. The company also manufactures optical delivery cables, fiber couplers, beam switches, optical processing heads, in-line sensors, chillers, and other products. Its products are used in materials processing, communications, medical, and advanced applications.

The company last reported its annual report for the year 2022:

- Net Sales were reported at $ 1.4 billion, as compared to $ 1.46 billion in the previous year

- Operating Income was reported at $ 169 million, as compared to $ 368 million, in the previous year

- Net Income was reported at $ 110.7 million, as compared to $ 278 million in the previous year

- Earnings per share was reported at $ 2.17 per share as compared to $ 5.21 in the previous year

IPG Photonics has a market cap of $ 5.24 billion. Its shares are trading at $ 110.77.

The stock of the company has been on a bearish trend since the last quarter of 2021. The stock started the year 2022 at $ 172.14. Throughout the year, the stock remained bearish and closed off at $ 94.67. Overall, the stock declined by 45 % during the year.

In 2023, the stock started to recover and has been appreciating. The stock last closed at $ 110.77 representing a 17 % appreciation till date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

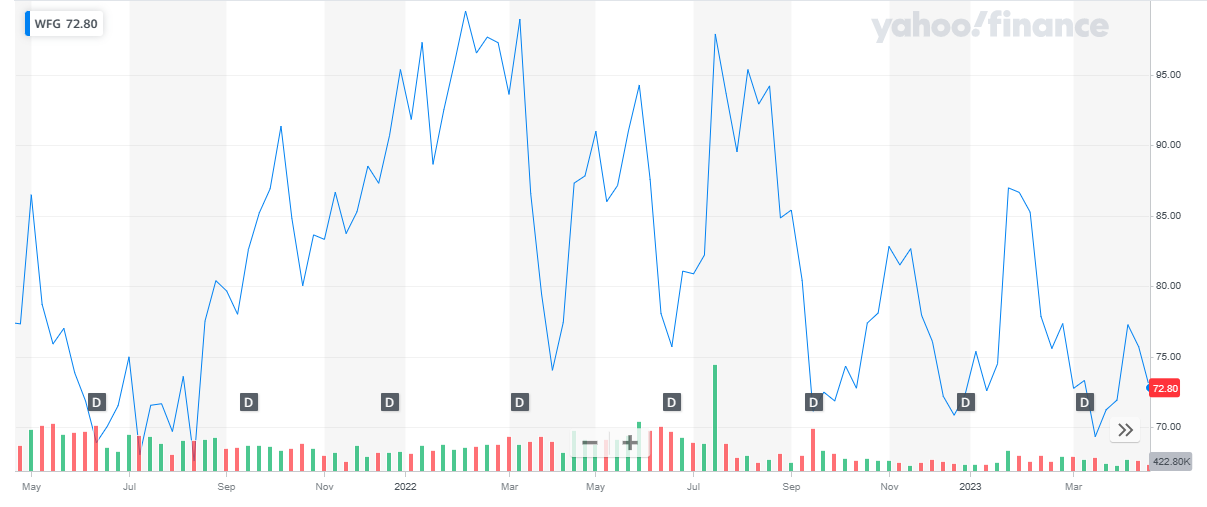

Louisiana-Pacific (LPX)

Louisiana-Pacific Corp (LP) is a manufacturer of building materials. It provides building solutions to builders, remodelers, and homeowners. The company’s portfolio of products includes framing, siding, panels, and other applications such as furniture panels and outdoor building products. I LP offers various building products and accessories such as siding solution, LP structural solutions, and oriented strand board. It also operates business through various brands such as LP, CanExel, SmartSide, FlameBlock, ExpertFinish, SolidStart, TechShield, WeatherLogic, Legacy, TopNotch, and SolidStart. The company manufactures and distributes laminated veneer lumber (LVL), laminated strand lumber (LSL) and other related products. It has operations in the US, Canada, Brazil, and Chile. LP is headquartered in Nashville, Tennessee, the US.

Louisiana-Pacific recently reported its financial report for the year 2022:

- Net Sales were reported at $ 3,854 million, as compared to $ 3,915 million in the previous year

- Income from operations was reported at $ 1,250, as compared to $ 1,734 million in the previous year

- Net Income was reported at $ 1,086 million, as compared to $ 1,377 million in the previous year

- Earnings per share was reported at $ 13.94, as compared to $ 14.19

Louisiana-Pacific has a market cap of $ 4.32 billion. Its shares are trading at $ 59.98.

The stock started the year 2022 at $ 78.35. Throughout the year the stock remained volatile continued to decline. Eventually the stock closed the year at $ 59.2. Overall, the stock depreciated by 24.4 %.

In 2023, the stock started to recover and went as high as $ 70.67. The stock eventually closed at $ 59.98 representing a 15 % decline till date.

Checkout:

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Silicon Motion Technology (SIMO)

Silicon Motion Technology Corp (Silicon Motion) is a provider of low power solutions for embedded systems and industrial applications. Its product portfolio comprises controllers used in embedded storage products which include client solid-state drive (SSDs) and embedded MultiMediaCard (eMMCs), memory cards, and universal serial bus (USB) flash drives. The company offers its products under the brands including Shannon Systems, SMI, Ferri SSD, Ferri-eMMC, VirtualStor, Bigtera, Hyper-IO, StorVisor, and PCIe-RAID. It operates in South Korea, Japan, Hong Kong, China, Malaysia, Singapore, Taiwan, and the US. Silicon Motion is headquartered in Zhubei City, Taiwan.

Silicon Motion last reported its financial report for the year 2022:

- Net Sales were reported at $ 945.9 million, as compared to $ 922.1 million in the previous year

- Operating Income was reported at $ 213.9 million, as compared to $ 245.9 million in the previous year

- Net Income was reported at $ 172.5 million, as compared to $ 200 million in the previous year

- Earnings per share was reported at $ 5.19, as compared to $ 5.74 in the previous year

Silicon Motion has a market cap of $ 2.067 billion. Its shares are trading at $ 62.57.

The stock started the year 2022 at $ 95.03. The stock remained volatile during the year, it dropped to the lows of $ 54.29 before closing the year at $ 64.99. Overall, the stock depreciated by 31.6 %.

The stock started to recover in the last quarter of 2022 and entered 2023 at the price of $ 62. Till date the stock has almost maintained its stock price.

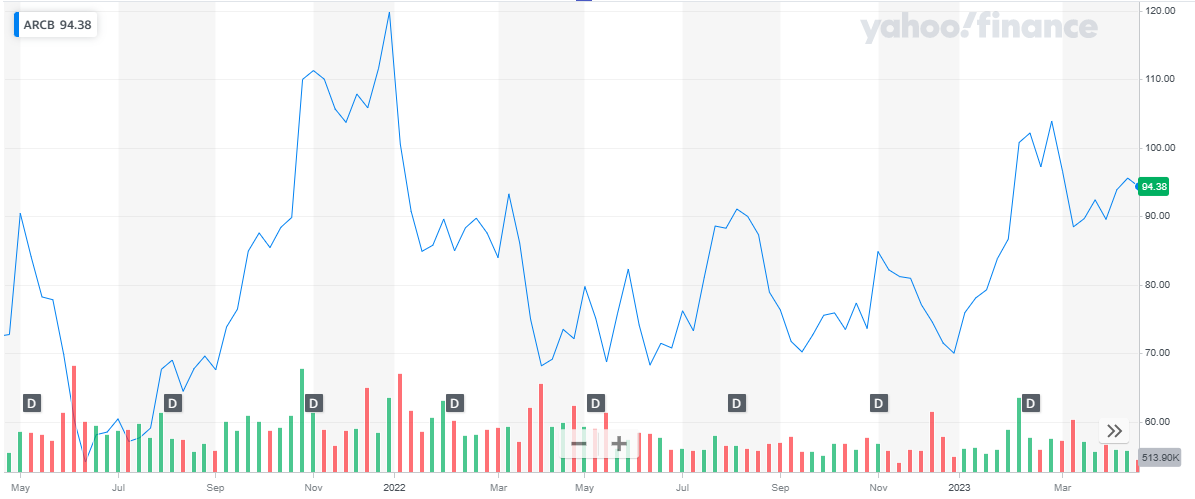

ArcBest (ARCB)

ArcBest (ARCB)

ArcBest Corp (ArcBest) is a provider of logistics solutions. ArcBest’s solutions include logistics, supply chain, product launch and trade show shipping, less-than-truckload (LTL), commercial vehicle maintenance and repair, warehousing and distribution, and network and ground expedite services. The company serves automotive and heavy truck, manufacturing, life sciences, consumer goods and retail, high tech, events and entertainment, government and defense, and energy and utilities industries. The company offers solutions under brands such as ArcBest, Panther Premium Logistics, U-Pack and FleetNet America. The company has operations in the US, Canada, Puerto Rico, and Mexico. ArcBest is headquartered at Fort Smith, Arkansas, the US.

In the last financial report, the company reported its annual figures for the year 2022:

- Revenue was reported at $ 5.324 million, as compared to $ 3,980 million in the previous year

- Operating Income was reported at $ 399 million, as compared to $ 280.1 million in the previous year

- Net Income was reported at $ 298 million, as compared to $ 213 million, in the previous year

- Earnings per share was reported at $ 12.13, as compared to $ 8.38 in the previous year

ArcBest has a market cap of $ 2.29 billion. Its shares are trading at $ 94.38.

The stock started the year 2022 at $ 119.85. The stock picked up a bearish run and continued to decline throughout the year. After dropping to the lows of $ 68.19, the stock recovered slightly and closed off the year at $ 70.04. Overall, the stock declined by 41 %.

In 2023, the stock started off with an upward trend. The stock last closed at $ 94.38 representing a 35 % appreciation till date.

Checkout:

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

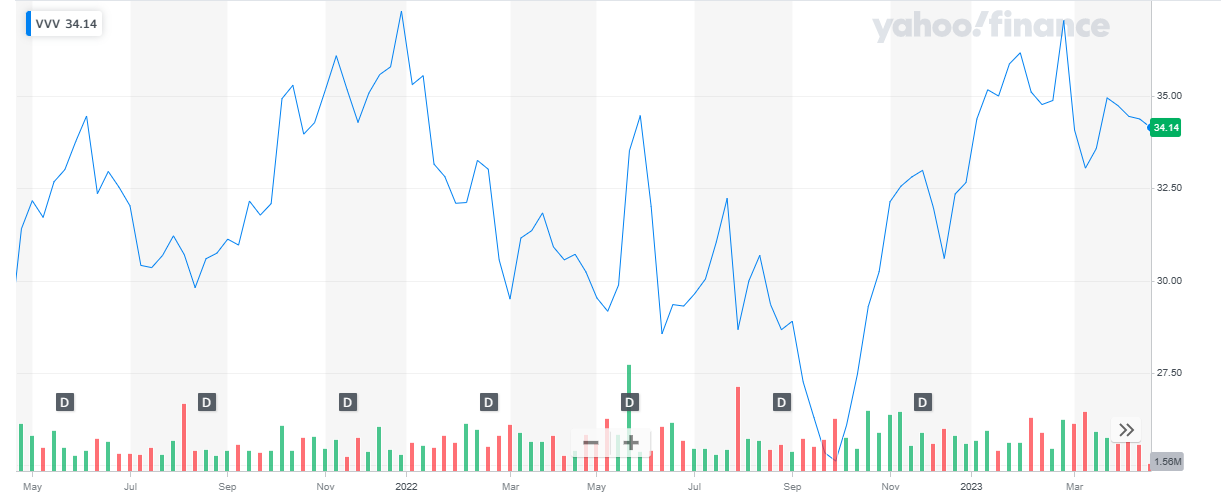

Valvoline (VVV)

Valvoline Inc (Valvoline) is a manufacturer and distributor of finished lubricants and automotive chemicals. The company offers passenger car motor oils and other automotive lubricant products. It also provides automotive chemicals, fluids, and coatings. The company sells its products through retail auto part stores, mass merchandisers, independent auto part stores and distributors. The company has blending and packaging facilities located in the US, the Netherlands, India, Ecuador and Australia. Valvoline’s products find application in a range of vehicles and engines including light-duty, heavy-duty, and electric vehicles. The company markets its products worldwide with the majority of sales in North America. Valvoline is headquartered in Lexington, Kentucky, the US.

Valvoline reported its annual report for the year 2022:

- Total Sales were reported at $ 1,236 million as compared to $ 1,037 million in the previous year

- Operating Income was reported at $ 220 million, as compared to $ 240 million in the previous year

- Net Income was reported at $ 424 million, as compared to $ 420 million in the previous year

- Earnings per share was reported at $ 2.37 as compared to $ 2.3 in the previous year

Valvoline has a market cap of $ 5.87 billion. Its shares are trading at $ 34.14.

The stock has been volatile in the past two year. The stock started the year 2022 at $ 37.29. During the year it picked up a bearish trend and dropped to the lows of $ 25.12. Eventually the stock closed at $ 32.65. Overall, the depreciated by 12.44 %.

In 2023, the stock reversed its course and started to appreciate. The stock last closed at $ 34.14 representing a 4.6 % appreciation till date.

AXOS Financial (AX)

AXOS Financial (AX)

Axos Financial Inc (Axos Financial) is a provider of consumer and business banking services. The company services include residential mortgage loans, property lending, and treasury management services. It also offers business savings accounts, business checking accounts, commercial lending options, auto refinancing, mobile banking, and online banking services. Axos Financial provides clearing broker-dealing services, and digital financial advisory services to active trading, retail and institutional markets. It partners with real estate agents, financial advisors and commercial real estate markets. The company distributes its products through wholesale channels, retail distributions and other correspondents. Axos Financial is headquartered in Las Vegas, Nevada, the US.

AXOS recently reported its second quarter results for the year 2023:

- Net Interest Income was reported at $ 199.9 million, as compared to $ 145.6 million in the previous year same period

- Net Income was reported at $ 81.55 million, as compared to $ 60.8 million in the previous year same period

- Earnings per share was reported at $ 1.36, as compared to $ 0.98

AXOS Financial has a market cap of $ 2.143 billion. Its shares are trading at $ 35.71.

The stock started the year 2022 at $ 55.91. After an initial hike in price, where it went as high as $ 60.53, the stock started to decline. The stock continued its declining trend throughout the year and closed off at $ 38.22. Overall, the stock depreciated by 31.6 %.

In 2023, the stock again spiked high initially and hit $ 51.14. The stock last closed at $ 35.71 representing 6.5 % decline till date.

Also read:

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

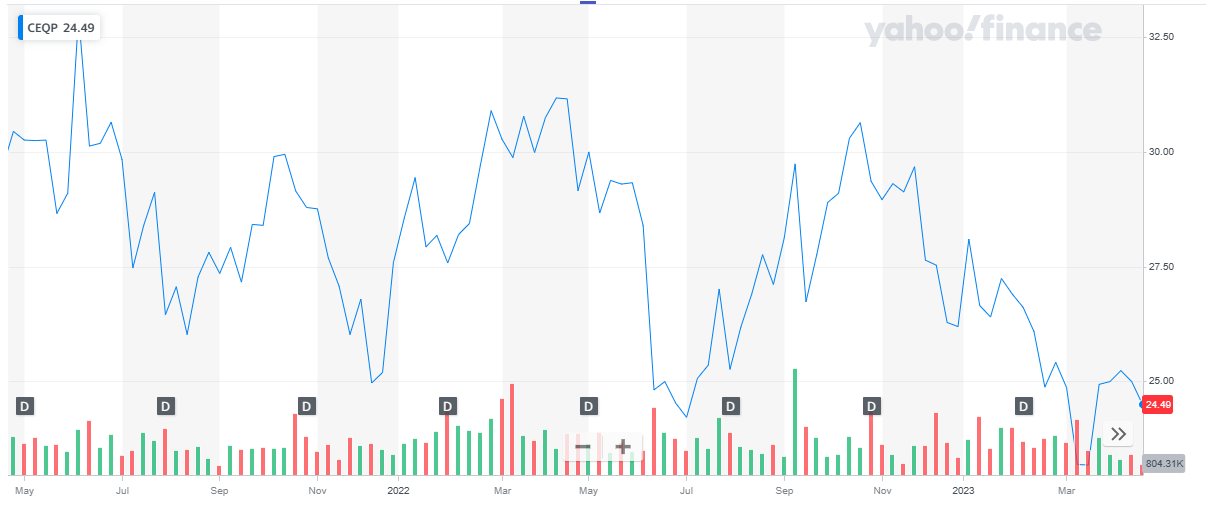

Crestwood Equity Partners (CEQP)

Crestwood Equity Partners LP (Crestwood) is an infrastructure solutions provider. The company develops, acquires, owns, controls and operates crude oil, natural gas and natural gas liquids (NGL) midstream assets. Its operations are categorized into gathering and processing; storage and transportation; and marketing, supply and logistics. Crestwood’s gathering and processing operations provides gathering, compression, treating, and processing services for natural gas, crude oil, and produced water. The company’s storage and transportation offer crude oil, natural gas storage and transportation services to producers, utilities, and other customers. Its marketing, supply and logistics operations provide NGL and crude oil storage, marketing and transportation services to producers, refiners, marketers and others. Crestwood is headquartered in Houston, Texas, the United States.

Crestwood Equity Partners recently reported its annual report for the year 2022:

- Revenues were reported at $ 6,000.7 million, as compared to $ 4,569 million in 2021

- Operating Income was reported at $ 235.8 million, as compared to $ 222.7 million in 2021

- Net loss was reported at ($ 28.8) million, as compared to net loss of ($ 138.6) in 2021

- Loss per share was reported at ($ 0.29) as compared to ($ 2.11) in 2021

Crestwood Equity Partners has a market cap of $ 2.58 billion. Its shares are trading at $ 24.43.

The stock has been pretty volatile in the past few years. The stock started the year 2022 at $ 27.59. After multiple ups and downs throughout the year the stock eventually closed at $ 26.19. Overall, the stock declined by 5 %.

In 2023, the stock the year at $ 26.19. The stock continued to decline and last closed at $ 24.47 representing a 6.6 % depreciation till date.

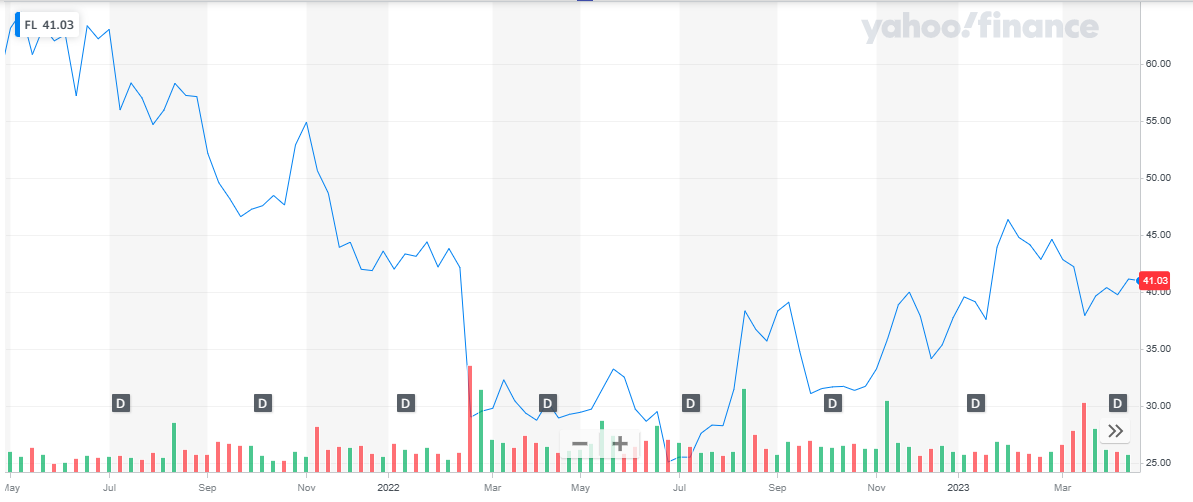

Foot Locker, Inc. (FL)

Foot Locker, Inc. (FL)

Foot Locker Inc (Foot Locker) is a specialty retailer of athletic footwear and apparel. Its product portfolio includes sports footwear and apparel for men, women, and kids, sports accessories, and athletic equipment. It operates stores under various banners such as Foot Locker, Kids Foot Locker, Lady Foot Locker, Champs Sports, Footaction, Atmos, WSS and Sidestep. The company merchandises its products through traditional brick and mortar stores and online e-commerce platforms including footlocker.com, ladyfootlocker.com, footaction.com, kidsfootlocker.com, shopwss.com, and atmosusa.com The company has operations across North America, Asia, the Middle East, Europe, Australia, and New Zealand. Foot Locker is headquartered in New York City, New York, the US.

Foot Locker reported its annual report for the year 2022:

- Net sales were reported at $ 8.7 million, as compared to $ 8.97 million in the previous year

- Operating Income was reported at $ 581 million, as compared to $ 870 million in the previous year

- Net Income was reported at $ 342 million, as compared to $ 893 million in the previous year

- Earnings per share was reported at $ 3.62, as compared to $ 8.72 in the previous year

Foot Locker has a market cap of $ 3.834 billion. Its shares are trading at $ 41.03.

The stock started the year 2022 at $ 43.63. The stock started with a declining trend and continued to decline till it dropped to the lows of $ 25.13. After that the stock recovered and eventually closed off the year at $ 37.79. Overall, the stock depreciated by 13.4 %.

In 2023, the stock continued to rise, slow and steady. The stock last closed at $ 41.04 representing a 8.6 % appreciation till date.

Read:

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

Silicon Motion Technology (SIMO)

Silicon Motion Technology Corp (Silicon Motion) is a provider of low power solutions for embedded systems and industrial applications. Its product portfolio comprises controllers used in embedded storage products which include client solid-state drive (SSDs) and embedded MultiMediaCard (eMMCs), memory cards, and universal serial bus (USB) flash drives. The company offers its products under the brands including Shannon Systems, SMI, Ferri SSD, Ferri-eMMC, VirtualStor, Bigtera, Hyper-IO, StorVisor, and PCIe-RAID. It operates in South Korea, Japan, Hong Kong, China, Malaysia, Singapore, Taiwan, and the US. Silicon Motion is headquartered in Zhubei City, Taiwan.

Silicon Motion Technology Corp reported its annual report for the year 2022:

- Net sales were reported at $ 945.9 million, as compared to $ 922.1 million in the previous year

- Operating Income was reported at $ 213.9 million, as compared to $ 245.9 million in the previous year

- Net Income was reported at $ 200 million, as compared to $ 172.5 million in the previous year

- Earnings per share was reported at $ 5.74, as compared to $ 5.19 in the previous year

Silicon Motion Technology Corp. has a market cap of $ 2.067 billion. Its shares are trading at $ 62.53.

The stock started the year 2022 at $ 95.03. The stock remained highly volatile throughout the year with huge dips and rise in price. Eventually, the stock closed at $ 64.99 representing a 31.6 % decline during the year.

In 2023, the stock remained almost stagnant with a mere 3.7 % decline till date.

Also, read:

Also, read: