What are Income Stocks?

Income stocks are financial securities that pay regular dividends to investors. They are purchased to generate a steady stream of dividend flows and the dividends are predictable.

Main Characteristics of Income Stocks:

Some of the most common characteristics of income stocks are:

- Low Price Volatility

This means that there are no sudden changes in price specifically over a short period. There may be small changes in the value over a longer period of time.

- Regular Dividend Payment

The payment of the dividend is consistent and steady over a period of years.

- Consistent Increase in Dividend Payouts

An important feature of companies with good financial strength is that they are not only making regular dividend payouts but also the percentage of dividends is increasing regularly.

- Not much Growth in Capital Invested

There is very low capital appreciation.

Benefits of Investing in Income stocks

Benefits of Investing in Income stocks

A few advantages of investing in these stocks are:

- Regular and Quick Return on Investments

Income stocks generate a regular stream of income. The dividend is either paid on a monthly or quarterly basis.

- Increasing Dividend Payments

These companies are usually financially stable and profitable. They regularly increase their dividends.

- Less Risk

These stocks are less risky as the companies are well established. In fact, these are the first choice for investors who want a stable return and less risk.

Disadvantages of Investing in Income stocks

A few disadvantages of investing in these stocks are:

- No Guaranteed Dividend Payments:

There is a possibility that the company’s profits might decline and they stop paying dividends to its shareholders.

- Less Return on Investments

Since the company pays all the excess profits to its investors as a dividend, there is no money left for reinvestment in the growth of the company. Hence, very few appreciations in stock value.

- Changes in Interest Rates

An increase in the interest rates leads to higher returns from bonds, and fixed income investments which in turn affect the price of income stocks and reduce the value of the investor portfolio.

- Inflation

During inflation, the return from these stocks might remain the same while the prices of each commodity grow. Therefore, during times of inflation, they are not a dependable source of income.

- Taxes

Dividend income is taxable income. This also reduces the rate of return for the investor.

Best Income Stocks 2024

Here are some of the best income stocks to consider:

| Sr. | Company Name | Symbol | Market cap | Price (As of 4th April 2023) |

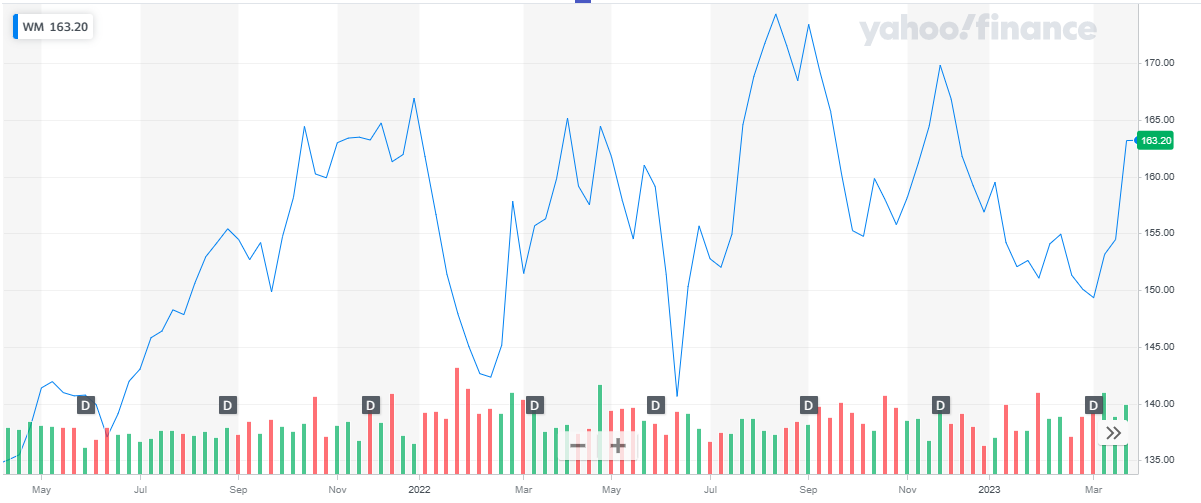

| 1 | Waste Management | WM | $ 66.5 billion | $ 163.53 |

| 2 | Verizon | VZ | $ 166.53 billion | $ 39.65 |

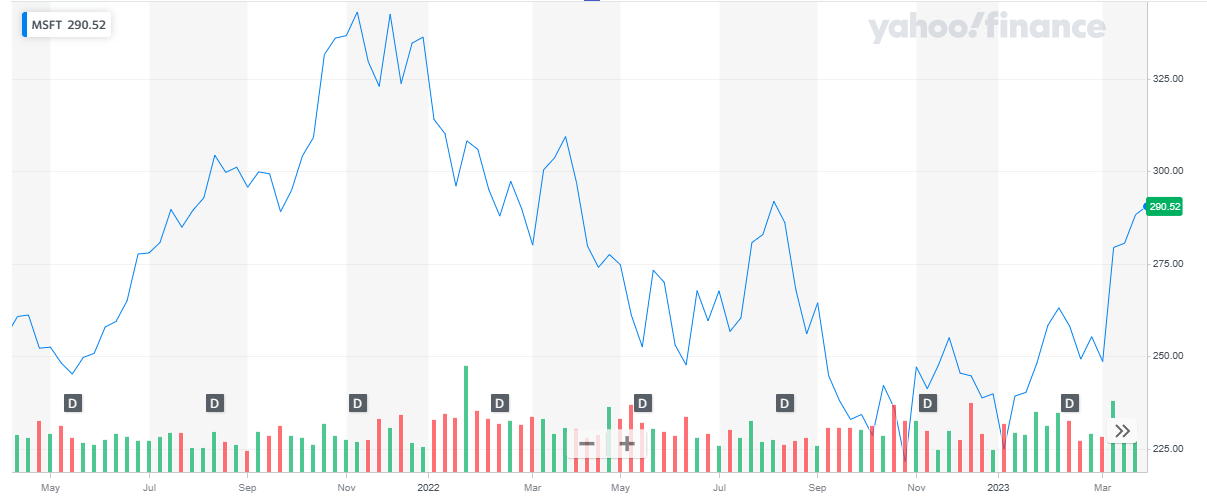

| 3 | Microsoft | MSFT | $ 2.146 trillion | $ 287.18 |

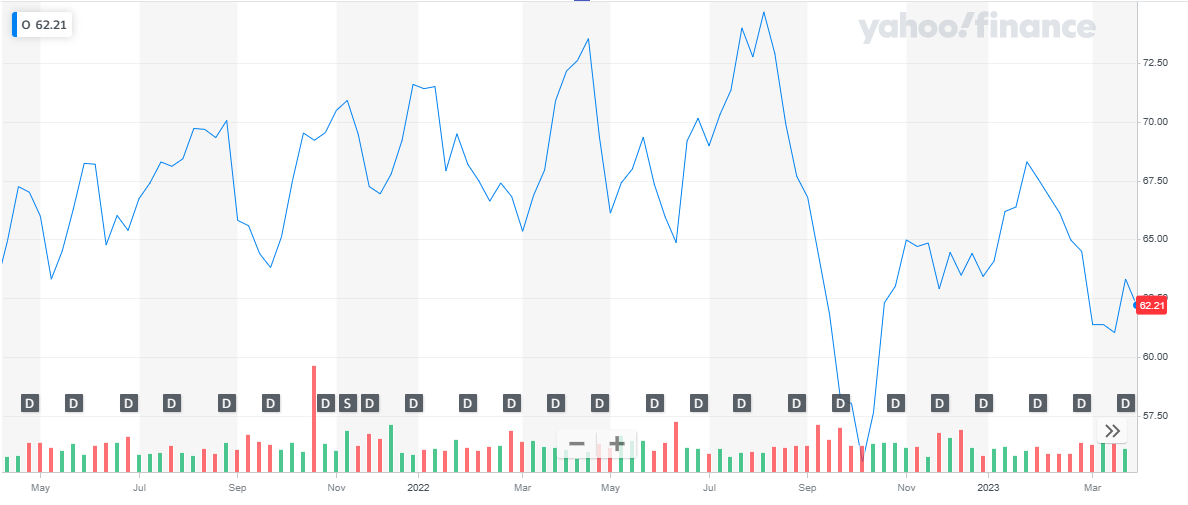

| 4 | Realty Income | O | $ 41.8 billion | $ 62.84 |

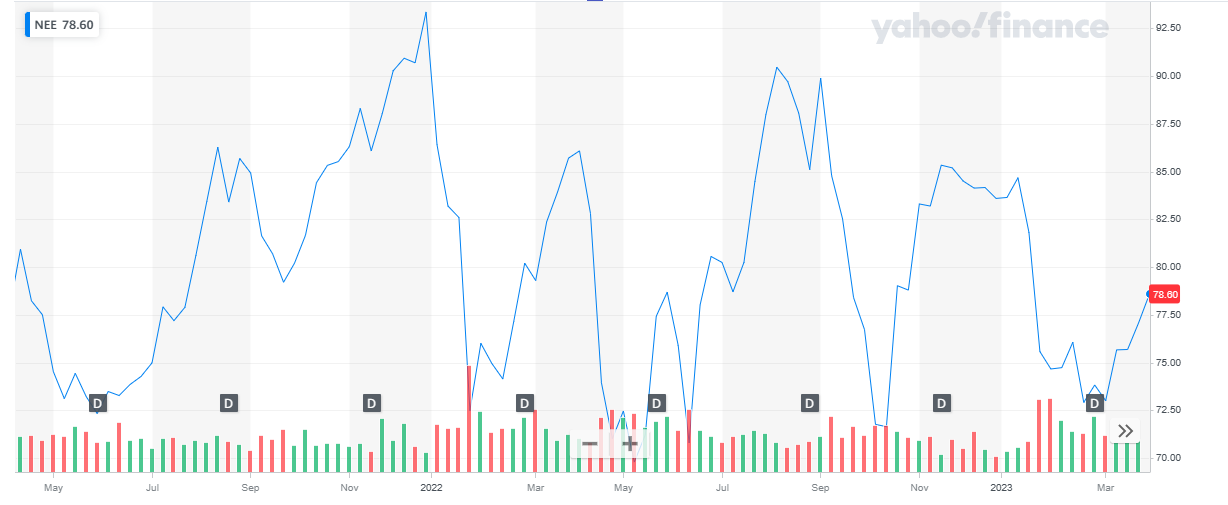

| 5 | NextEra Energy | NEE | $ 154.17 billion | $ 77.16 |

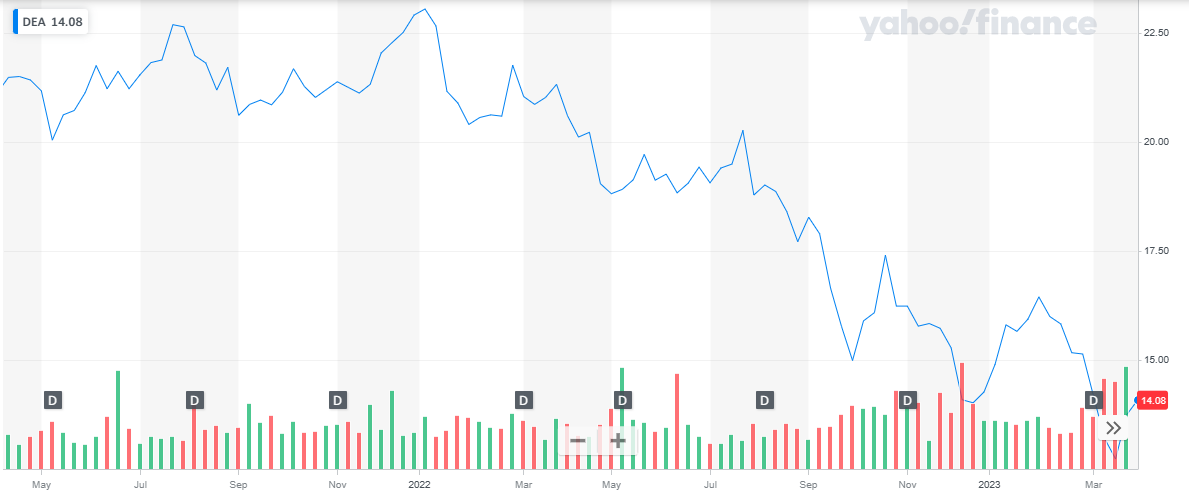

| 6 | Easterly Government Properties | DEA | $ 2.39 billion | $ 13.38 |

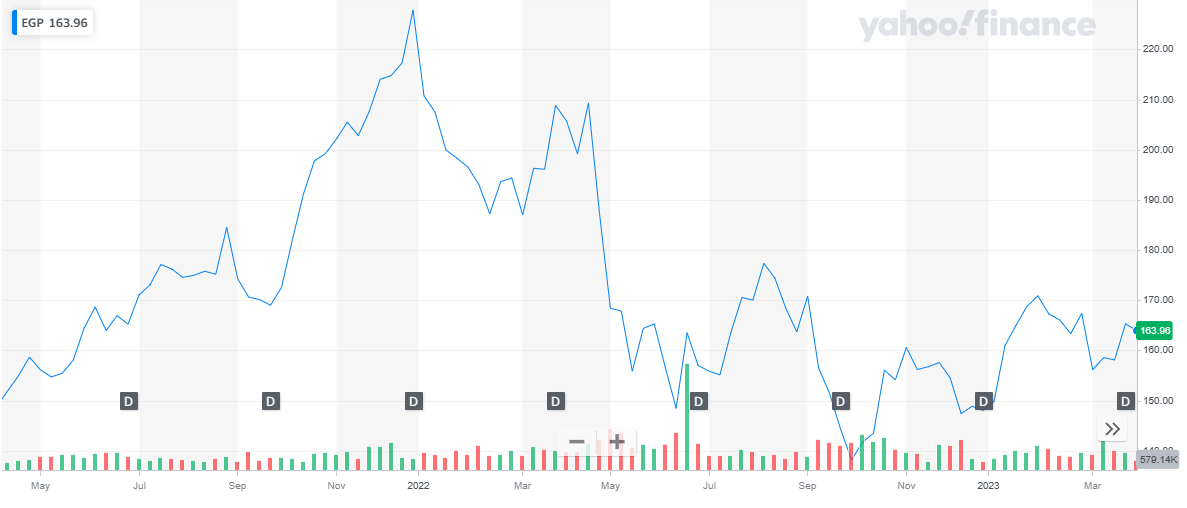

| 7 | EastGroup Properties | EGP | $ 7.17 billion | $ 164.46 |

| 8 | Vanguard Real Estate ETF | VNQ | $ 65.18 billion | $ 82.27 |

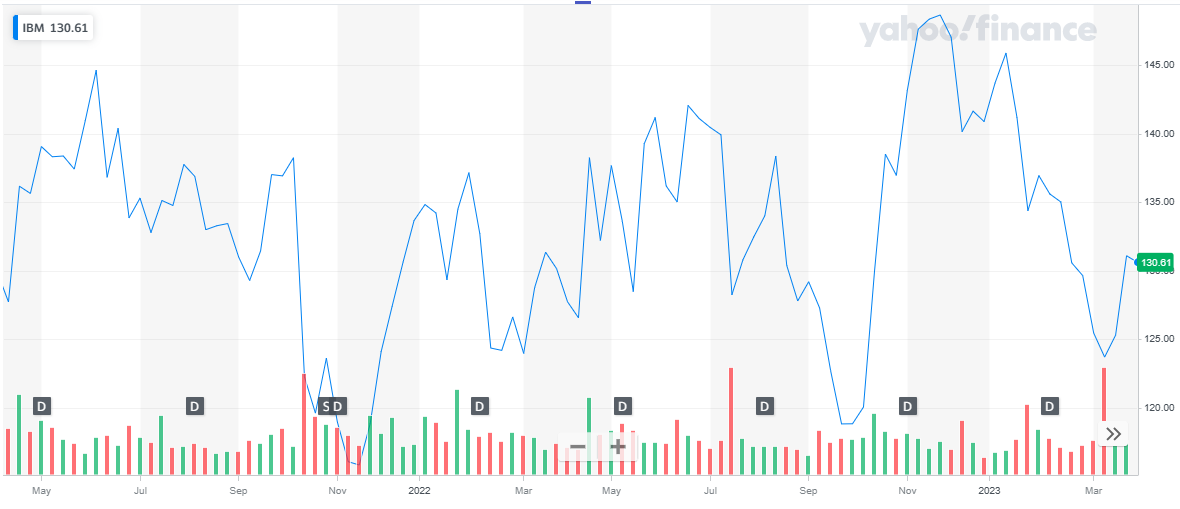

| 9 | International Business Machines Corp | IBM | $ 117.95 billion | $ 131.6 |

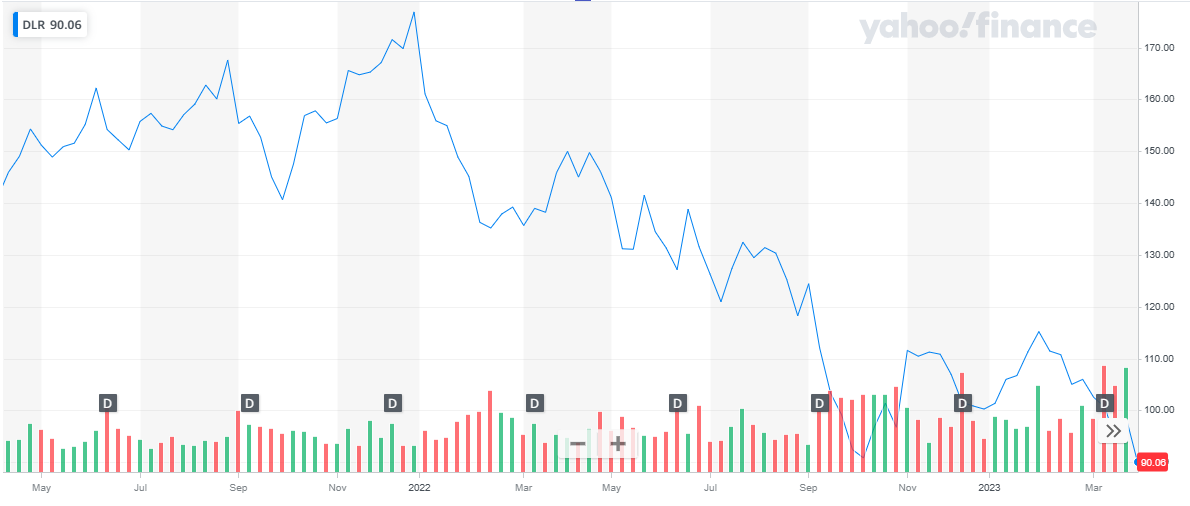

| 10 | Digital Realty Trust Inc. | DLR | $ 29.08 billion | $ 92.78 |

Waste Management

Waste Management Inc (WM) is a provider of waste management and environmental services. It has a presence in the entire waste management vertical from the collection, solid and hazardous waste landfill management, transfer, recycling, and resource recovery to disposal. Through its counseling, the company assists customers in achieving their green goals including zero waste. WM also develops, operates, and owns landfill gas-to-energy facilities; and recovers naturally occurring gas inside landfills to generate electricity. It recycles various materials including plastic, cardboard, paper, glass, and metal. The company serves municipal, commercial, residential, and industrial customers in the US and Canada. WM is headquartered in Houston, Texas, the US.

Waste Management, Inc. recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 19,698 million | $ 17,931 million | 9.85 % |

| Income from Operations | $ 3,365 million | $ 2,965 million | 13.5 % |

| Net Income | $ 2,238 million | $ 1,816 million | 23.23 % |

| EPS | $ 5.39 | $ 4.29 | 25.6 % |

For the full year 2022, $ 2.58 billion was returned to shareholders, including $ 1.5 billion of share repurchases and $1.08 billion of cash dividends. The Board of Directors has indicated its intention to increase the annual dividend by $0.20 per share to $2.80 for the next year, increasing estimated annual dividends paid to shareholders to $1.1 billion. This will be the 20th consecutive year of increases in the Company per share dividend.

Waste Management has a market cap of $ 66.7 billion. Its shares are trading at $ 163.18.

The stock of WM has been volatile since 2022. It started the year 2022 at $ 166.9. After multiple dips and peaks, the stock closed the year at $ 156.88, representing a 6 % decline during the year.

In 2023, after an initial decline in price, the stock started to rise and has appreciated a total of 4 % to date.

Also, learn:

- Top domestic stocks

- Best covered call stocks

- Best drip stocks

- Best stock signals

- Best stock forecast website

- Stocks vs Shares

Verizon

Verizon Communications Inc (Verizon) provides communications, information, and entertainment products and services. The company offers voice, data, and video services and solutions through its wireless and wireline networks. It offers value-added services such as broadband video and data, corporate networking solutions, data center and cloud services, security and managed network services, and local and long-distance voice services. Verizon’s multimedia offerings include music, video, gaming, and news content. Verizon serves small and medium, enterprises, the public sector, and wholesale businesses. The company has a business presence in the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Verizon is headquartered in New York City, New York, and the US.

Verizon recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 136,835 million | $ 133,613 million | 2.4 % |

| Income from Operations | $ 30,467 million | $ 32,448 million | -6.1 % |

| Net Income | $ 21,748 million | $ 22,618 million | -3.8 % |

| EPS | $ 5.06 | $ 5.32 | -4. % |

Verizon has been paying rising dividends for 16 consecutive years. For the year 2022, the company has paid a $ 2.61 dividend per share.

Verizon has a market cap of $ 165 billion. Its shares are trading at $ 39.46.

The stock has been on a declining trend for the past two years. It started the year 2022 at $ 51.96. During the year the stock dropped to the low of $ 35.35 and eventually closed off at $ 39.4. Overall, the stock declined by 24.2 % in 2022.

In 2023, the stock has been mildly volatile and has maintained its price level to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Microsoft

Microsoft Corp (Microsoft) develops, licenses, and supports software products, services, and devices. The company offers a comprehensive range of operating systems, cross-device productivity applications, server applications, software development tools, business solution applications, desktop and server management tools, video games, and training and certification services. It also designs, manufactures, and sells hardware products including PCs, tablets, gaming and entertainment consoles, and other intelligent devices. The company provides a broad spectrum of services including cloud-based solutions, solution support, and consulting services. Microsoft markets distribute and sell offerings through original equipment manufacturers, distributors, resellers, online marketplaces, Microsoft stores, and other partner channels. The company has a business presence across the Americas, Europe, Asia-Pacific, the Middle East, and Africa. Microsoft is headquartered in Redmond, Washington, the US.

Microsoft recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 198,270 million | $ 168,088 million | 18 % |

| Net Income | $ 72,738 million | $ 61,271 million | 18.7 % |

| EPS | $ 9.7 | $ 8.12 | 19.5 % |

Read: Top Information Technology Stocks

For the fiscal year 2022, the company has paid a $ 2.48 dividend per share, amounting to a total of $ 18,556 million.

Microsoft has a market cap of $ 2.185 trillion. Its shares are trading at $ 284.34.

The stock started the year 2022 at $ 336.32. the stock picked up a bearish run. After dropping to the low of $ 221.39, the stock closed off the year at $ 239.82 representing a 29 % decline the year.

In 2023, the stock reversed its course and started to rise. To date, the stock has appreciated by 21.2 %

Checkout:

- Best drone stocks

- Forex Signals providers

- Best NFT stocks

- Best swing trading stocks

- Technical analysis books

Realty Income

Realty Income Corp (RIC) engages in the business of real estate operations with net lease and long-term agreements. It also holds portfolio management, asset management, credit research, and real estate research activities. RIC caters to legal, finance and accounting, information technology, and capital markets. It acquires and manages freestanding commercial properties under long-term net lease agreements. The company’s industrial property portfolio includes apparel stores, automotive collision services, beverages, aerospace, consumer goods, food processing, general merchandise, and grocery stores. RIC is headquartered in San Diego, California, US.

Realty Income recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 3,343.7 million | $ 2,080.5 million | 60.7 % |

| Net Income | $ 869.4 million | $ 359.5 million | 142 % |

| EPS | $ 1.42 | $ 0.87 | 63.2 % |

In December 2022, the company announced the 101st consecutive quarterly dividend increase, which is the 118th increase in the amount of the dividend since our listing on the New York Stock Exchange (NYSE) in 1994. The annualized dividend amount as of December 31, 2022, was $ 2.982 per share. The number of monthly dividends paid per share increased by 4.7 % to $ 2.967, as compared to $ 2.833 in 2021. We distributed $ 2.967 per common share to stockholders during 2022, representing 75.7 % of our diluted AFFO per share of $ 3.92.

Realty Income has a market cap of $ 41.2 billion. Its shares are trading at $ 62.27.

The stock has been volatile for the past few years. It started the year 2022 at $ 71.59 and continued to be volatile throughout the year. In September, the stock suffered a huge blow ad dropped to the low of $ 55.54 and eventually closed the year at $ 63.43. Overall, the stock declined by 11.4 %.

In 2023, after an initial rise, the stock pulled back. To date, it has appreciated by 2 %.

Checkout:

- Best crypto signals

- Best undervalued stocks

- Best stock indicators

- Top trading blogs

- Best regional bank stocks

- Best crude oil stocks

NextEra Energy

NextEra Energy Inc (NEE) is an electric power and energy infrastructure company. It generates, transmits, and distributes electricity; and holds investments in gas infrastructure assets. NEE produces power using nuclear, coal, oil, natural gas, wind, and solar sources. The company also purchases electricity for resale and provides risk management services related to power and gas consumption. It serves residential, commercial, industrial, wholesale, and other customers in Florida; and owns, develops, constructs, manages, and operates electricity generation facilities in the US and Canada wholesale energy markets. NEE is headquartered in Juno Beach, Florida, the US.

NextEra Energy recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 17,397 million | $ 14,233 million | 22.23 % |

| Income from Operations | $ 4,081 million | $ 2,913 million | 40.1 % |

| Net Income | $ 4,147 million | $ 3,573 million | 16 % |

| EPS | $ 2.1 | $ 1.81 | 16 % |

NextEra Energy Inc. has been paying rising dividends for 30 consecutive years. For the year 2022, the company has paid a $ 0.42 dividend per share in each quarter.

NextEra Energy Inc has a market cap of $ 156.23 billion. Its shares are trading at $ 78.61.

The stock started the year 2022 at $ 93.36. The stock has been extremely volatile during the year. After multiple dips and peaks, the stock closed at $ 83.6 representing a 10.5 % decline.

In 2023, the stock continued its volatility and last closed at $ 78.54 representing a 6 % decline to date.

Easterly Government Properties

Easterly Government Properties

Easterly Government Properties focus primarily on the acquisition, development, and management of Class A commercial properties that are leased to U.S. Government agencies through the General Services Administration.

They have 86 total operating projects, 38 different tenant agencies working with them, a total of 26 properties in different states, 1 property under development, and a total of 8.7 million leased square feet.

Easterly Government Properties recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 293,606 million | $ 274,860 million | 6.8 % |

| Net Income | $ 35,562 million | $ 33,957 million | 4.72 % |

| EPS | $ 0.34 | $ 0.35 | -2.9 % |

Easterly Government Properties maintained a quarterly cash dividend of $ 0.265 per share in FY 2022.

Easterly Government Properties has a market cap of $ 2.5 billion. Its shares are trading at $ 14.09.

The stock has been on a bearish run for the past two years. It started the year 2022 at $ 22.92. After staying bearish throughout the year, the stock closed at $ 14.27 representing a 38 % decline during the year.

In 2023, after an initial rise, the stock again started to decline. To date, the stock has declined by 1.3 %.

Also read:

- Best day trading stocks

- Best stock advisor service

- Best forex indicators

- Best preferred stocks

- Best penny stocks to invest in

- Best crypto day trading strategies

EastGroup Properties

EastGroup Properties Inc (EGPI) is a real estate investment trust. The company develops, acquires, and operates industrial properties. EGPI also provides functional and business distribution spaces, and warehouse spaces to a wide range of tenants and users to operate their businesses. The company’s property focuses on multi-tenant business distribution. It also provides property management services from its offices in Florida, Arizona, California, Texas, and North Carolina. The company has offices in Orlando, Houston, Phoenix, Charlotte, Dallas, Jacksonville, Ft. Lauderdale, Tampa, and San Antonio. EGPI is headquartered in Ridgeland, Mississippi, the US.

EastGroup Properties recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 487,025 million | $ 409,475 million | 18.9 % |

| Net Income | $ 186,274 million | $ 157,638 million | 18.2 % |

| EPS | $ 4.36 | $ 3.9 | 11.8 % |

EastGroup declared a cash dividend of $ 1.25 per share in the fourth quarter of 2022. The fourth quarter dividend, which was paid on January 13, 2023, was the Company’s 172nd consecutive quarterly cash distribution to shareholders. The Company has increased or maintained its dividend for 30 consecutive years and has increased it 27 years over that period, including increases in each of the last 11 years. The annualized dividend rate of $ 5.00 per share yielded 2.9 % on the closing stock price of $ 171.62 on February 6, 2023.

EastGroup Properties has a market cap of $ 7.2 billion. Its shares are trading at $ 163.03.

The stock started the year 2022 at $ 227.85. It continued to decline throughout the year and closed off at $ 148.06. Overall, the stock declined by 35 %.

In 2023, the stock recovered a bit and has appreciated by 10.11 % to date.

Vanguard Real Estate ETF

Vanguard Real Estate ETFs cover a wide range of both domestic and foreign real estate-related equities. These equities include real estate investment trusts (REITs), property managers, land owners, brokers, and other real estate services. Emerging markets may be included in the fund’s holdings.

Vanguard Real Estate ETFs have a market cap of $ 32.47 billion. It has a dividend yield of 4.15 %. It has an expense ratio of 0.12 %.

| Year | Capital return by NAV | Income returns by NAV | Total return by NAV | Total Return by Market Price | Benchmark |

| 2022 | -27.98 % | 1.78 % | -26.20 % | -26.21 % | -26.12 % |

| 2021 | 37.79 % | 2.60 % | 40.38 % | 40.33 % | 40.56 % |

| 2020 | -6.95 % | 2.23 % | -4.72 % | -4.64 % | -4.55 % |

Read:

- Forex vs stocks

- Top infrastructure stocks

- Best 3D printing stocks

- Buzzing stocks

- Top trending stocks

- Best AI backed stocks

International Business Machines Corp

International Business Machines Corp (IBM) is a provider of information technology (IT) products and services. The company produces and sells system hardware and software, and offers infrastructure, hosting, and consulting services. IBM’s product portfolio includes analytics, artificial intelligence (AI), automation, blockchain, cloud computing, IT infrastructure, IT management, cybersecurity, and software development products. The company also offers services such as cloud, networking, security, technology consulting, application services, business resilience services, and technology support services. It serves automotive, banking, and financial markets, electronics, energy and utilities, healthcare, insurance, life sciences, manufacturing, metals and mining, retail and consumer products, and telecommunication industries. The company has operations in the Americas, Europe, the Middle East, Africa, and Asia-Pacific. IBM is headquartered in Armonk, New York, the US.

International Business Machines Corp recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 60,530 million | $ 57,350 million | 5.55 % |

| Net Income | $ 1,639 million | $ 5,743 million | -71.5 % |

| EPS | $ 1.97 | $ 5.26 | -62.5 % |

IBM’s Board of Directors considers the dividend payment quarterly. In the second quarter of 2022, the Board of Directors increased the company’s quarterly common stock dividend from $1.64 to $1.65 per share. The dividend yield for the year was at 5.3 % and the total dividends paid for the year were a total of $ 5,948 million.

International Business Machines Corp has a market cap of $ 117 billion. Its shares are trading at $ 132.14.

The stock started the year 2022 at $ 133.6. The stock has been extremely volatile throughout the year. The stock closed the year at $ 140.89 representing a 5.5 % appreciation throughout the year.

In 2023, the stock picked up a declining trend. To date, the stock has declined by 6.6 %.

Digital Realty Trust Inc.

Digital Realty Trust Inc.

Digital Realty Trust Inc (Digital Realty Trust) is a real estate investment trust (REIT) service provider. The company acquires, owns, develops, and operates data centers and provides colocation and interconnection solutions. Its data centers offer various services such as disaster recovery purposes, digital communication, transaction processing, and housing mission-critical corporate information technology (IT) applications. The company’s customers include domestic and international companies across multiple industry verticals such as cloud and information technology services, communications and social networking, financial services, healthcare, manufacturing, energy, and consumer products. It operates in North America, Asia Pacific, Latin America, Oceania, and Europe. Digital Realty Trust is headquartered in Austin, Texas, US.

Digital Realty Trust Inc recently announced its financial results for the year ended December 31, 2022:

| 2022 | 2021 | Percentage change | |

| Revenues | $ 4,692 million | $ 4,428 million | 6 % |

| Operating Income | $ 590 million | $ 694 million | 15 % |

| Net Income | $ 337 million | $ 1,681 million | -80 % |

| EPS | $ 1.18 | $ 5.95 | -80 % |

Digital Realty Trust Inc has a market cap of $ 26.65 billion. Its shares are trading at $ 90.21.

The stock started the year 2022 at $ 176.87. Throughout the year the stock remained bearish and closed at $ 100.27. Overall, the stock declined by 43.5 %.

In 2023, after an initial recovery, the stock again declined. To date, the stock has declined by 11.15 %.

Also read:

Back