Food stocks are one of the most popular investments for investors during economic downturns because they are the most essential consumer staple. No matter how much people are struggling financially, they must spend money on food. Therefore, the food industry was relatively stable during the pandemic, while other industries struggled.

One of the prominent trends in the food industry is the shift to healthier and more natural meals, snacks, and ingredients, which come with a premium price tag. Another trend to watch out for is the consumer shift from eating full meals to snacking or eating quick ready-made products. In today’s period of rising prices, this ready-made food is a way out for many people to reduce their food spending.

Stock trading advisory websites help investors make the right financial decisions. Investors always choose the best brokers that better suits his/her trading goals.

Best Food Stocks to Buy in 2023

| Sr. | Company Name | Symbol | Market Cap | Price (As of 18th November 2022) |

| 1 | General Mills | (NYSE: GIS) | $ 48 billion | $ 81.03 |

| 2 | Mondelez International | (NASDAQ: MDLZ) | $ 88.75 billion | $ 64.99 |

| 3 | Kellogg | (NYSE: K) | $ 24 billion | $ 70.6 |

| 4 | Constellation Brands | (NYSE: STZ) | $ 45.7 billion | $ 247.65 |

| 5 | Tyson Foods | (NYSE: TSN) | $ 23.6 billion | $ 65.52 |

| 6 | PepsiCo | (NASDAQ: PEP) | $ 250 billion | $ 181.33 |

| 7 | The Kroger Company | (NYSE: KR) | $ 34.5 billion | $ 48.26 |

| 8 | Campbell’s Soup | (NYSE: CPB) | $ 15.45 billion | $ 51.56 |

| 9 | McCormick | (NYSE: MKC) | $ 24.5 billion | $ 83.76 |

| 10 | Starbucks | (NASDAQ: SBUX) | $ 112.4 billion | $ 97.95 |

General Mills (NYSE: GIS)

General Mills (NYSE: GIS)

General Mills, Inc., is a leading American producer of packaged consumer foods, especially flour, breakfast cereals, snacks, prepared mixes, and similar products. It is also one of the largest food service manufacturers in the world. It is a leading global manufacturer and marketer of branded consumer foods with more than 100 brands in 100 countries across six continents. In addition to its manufacturing business, the company has 50 percent interests in two strategic joint ventures that manufacture and market food products that are sold in more than 120 countries worldwide. Green energy stock is all ready to be a part of the upcoming future.

It operates through the following segments:

- North America Retail

- International

- Pet

- North America Foodservice

The company offers a variety of human and pet food products that provide great taste, nutrition, convenience, and value for consumers around the world. Its business is focused on the following large, global categories:

- snacks, including grain, fruit, and savory snacks, nutrition bars, and frozen hot snacks

- ready-to-eat cereal

- convenient meals, including meal kits, ethnic meals, pizza, soup, side dish mixes, frozen breakfast, and frozen entrees

- wholesome natural pet food

- refrigerated and frozen dough

- baking mixes and ingredients

- yogurt

- super-premium ice cream

The below chart shows the quarterly annual reports for the current year:

| Q1 2023 | The full year 2022 | |

| Net Revenue | $ 4.7 billion | $ 19 billion |

| Net Profit | $ 820 million | $ 2.7 billion |

| Earnings per share | $ 1.37 | $ 4.46 |

General Mills has a market cap of $ 48 billion. Its shares are currently trading at $ 81.03. The stock of the company has been on a bullish run since last year. It started off the year 2021 at $ 58.8 and closed off the year at $ 67.38. Overall, the stock appreciated by 14.6 %.

Also, hydrogen stocks are worth investing in 2023.

In 2022, the stock continued its bullish trend and spiked further up. From $ 67.37, the stock last closed at $ 81.03 representing a 20 % appreciation to date.

Checkout:

- Accurate and Reliable Gold Forecast

- Reliable and Trusted Commodity Signals

Mondelez International (NASDAQ: MDLZ)

Mondelez International is a snack manufacturing company The company manufactures and markets food and beverage products for consumers in approximately 165 countries globally. With offices in 80 countries, the company operates five segments: Latin America, Asia Pacific, Eastern Europe, the Middle East, Africa, Europe, and North America. Investing in fintech stocks is a smart investment move today.

Mondelez International has many well-known brands. Cadbury, Chips Ahoy, Oreo, Philadelphia, Ritz, and Wheat Thins. With more than 53 brands of snack, foods, and refreshments, the following are among Mondelez’s power brands which drives more than 50 % of the company’s growth:

- Biscuits – Oreo, Nabisco and LU

- Chocolates – Milka, Cadbury Dairy Milk, and Cadbury

- Gum and Candy – Trident, Chiclets, Halls, and Stride

- Coffee – Jacobs

- Powdered beverages – Tang

The below chart shows the quarterly annual reports for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 7.7 billion | $ 7.3 billion | $ 7.8 billion |

| Operating Income | $ 679 million | $ 927 million | $ 1.1 billion |

| Net Profit | $ 533 million | $ 748 million | $ 861 million |

| Earnings per share | $ 0.39 | $ 0.54 | $ 0.62 |

Also learn about Best Day Trading Stocks.

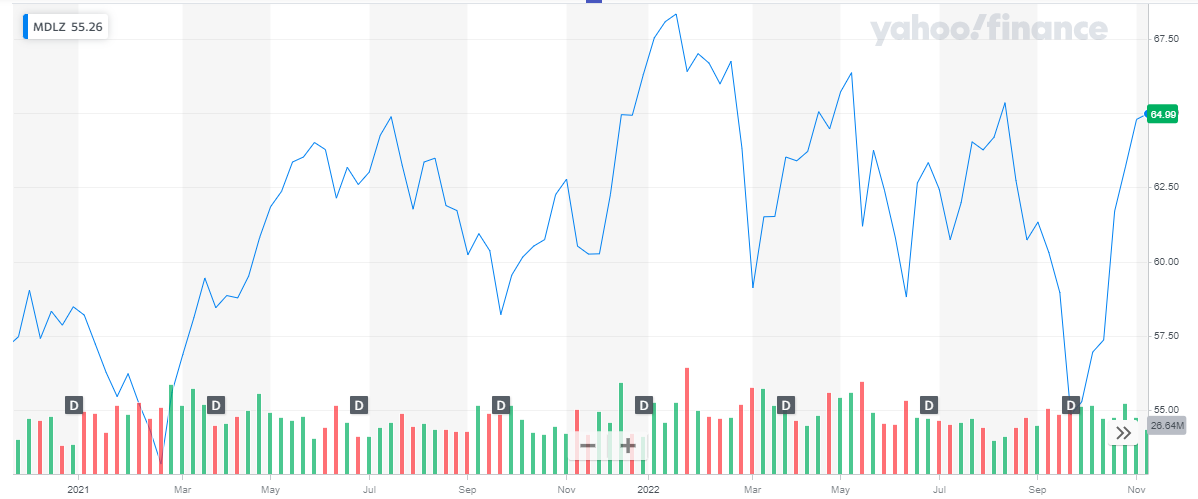

Mondelez Inc has a market cap of $ 88.75 billion. Its shares are trading at $ 64.99. The share of the company has been volatile in the past two years. It started the year 2021 at $ 58.47, went as low as $ 53.16, and closed off the year at $ 66.31. Overall, the stock appreciated by 13.4 %.

In 2022, the stock continued it’s volatile but this year the stock went on a downward journey. The stock dropped to the low of $ 54.83 before closing at $ 64.99. To date, the stock has declined by 18.5 %.

Also read:

Kellogg Company (NYSE: K)

Kellogg’s is the leading American producer of ready-to-eat cereals and other food products. Kellogg’s Corn Flakes was one of the earliest and remains one of the most popular breakfast cereals in the United States. Kellogg’s is one of the largest food manufacturing companies in the United States. They are particularly well known for their cereal brands, but they also make other popular breakfast foods and snack items.

There are many trading blogs designed for individual investors that are interested in choosing individual buzzing stocks.

Kellogg’s manufactures a large variety of food which is one of its biggest strengths. The company is not overly reliant on the sales of any one product. The company has also been trying to expand into the global market, which helps them increase its revenue streams. The year 2020 was a slow year for the company. The pandemic caused supply chain disruptions and made it difficult for the company to expand.

Some of the popular company brands are:

- Pringles

- Cheez-It

- Special K

- Kellogg’s Frosted Flakes

- Pop-Tarts

- Kellogg’s Corn Flakes

- Rice Krispies

- Eggo

- Mini-Wheats

- KashiRXBAR

- MorningStar Farms

The below chart shows the quarterly annual reports for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 3.9 billion | $ 3.86 billion | $ 3.67 billion |

| Net Profit | $ 312 million | $ 326 million | $ 424 million |

| Earnings per share | $ 0.91 | $ 0.96 | $ 1.24 |

We also have covered the best ETFs to buy in all categories.

Kellogg’s has a market cap of $ 24.1 billion. Its shares are trading at $ 70.6.

The stock of the company remained steady during 2021. The stock started off at $ 62.23 and closed off the year at $ 64.42 representing a 3.5 % increase the year. In 2022, the stock spiked high and reached a peak of $ 76.76 and last closed at $ 70.6. To date, the stock appreciated by 10 %.

Constellation Brands

Constellation Brands

Constellation Brands primarily manufactures and distributes beer, wine, and spirits, Constellation is the largest beer import firm in the United States. Also, it has the third-largest beer market among major beer providers. The company has around 40 locations and employs roughly 9,000 people. Its portfolio of brands includes more than one hundred brands which include Robert Mondavi, Ruffino, Corona, Svedka Vodka, and many more. Get to know about top Infrastructure stocks to invest.

It operates through the following segments:

- Beer – The Beer segment includes imported and craft beer brands

- Wine and Spirits – The Wine and Spirits segment sells wine brands across all categories-table wine, sparkling wine, and dessert wine and across all price points.

- Corporate Operations and Other – The Corporate Operations and Other segments comprise costs of executive management, corporate development, corporate finance, human resources, internal audit, investor relations, legal, public relations, and information technology.

- Canopy – The Canopy segment consists of canopy equity method Investments.

The below chart shows the quarterly annual reports for the current year:

| Q2 2023 | Q1 2023 | |

| Net Revenue | $ 2.7 billion | $ 2.4 billion |

| Operating Income / Loss | $ 813 million | $ 816 million |

| Net Profit / Loss | ($ 1.1) billion | $ 389.5 million |

| Earnings per share | ($ 6.3) | $ 2.09 |

Semiconductor stocks are one of the best investment opportunities.

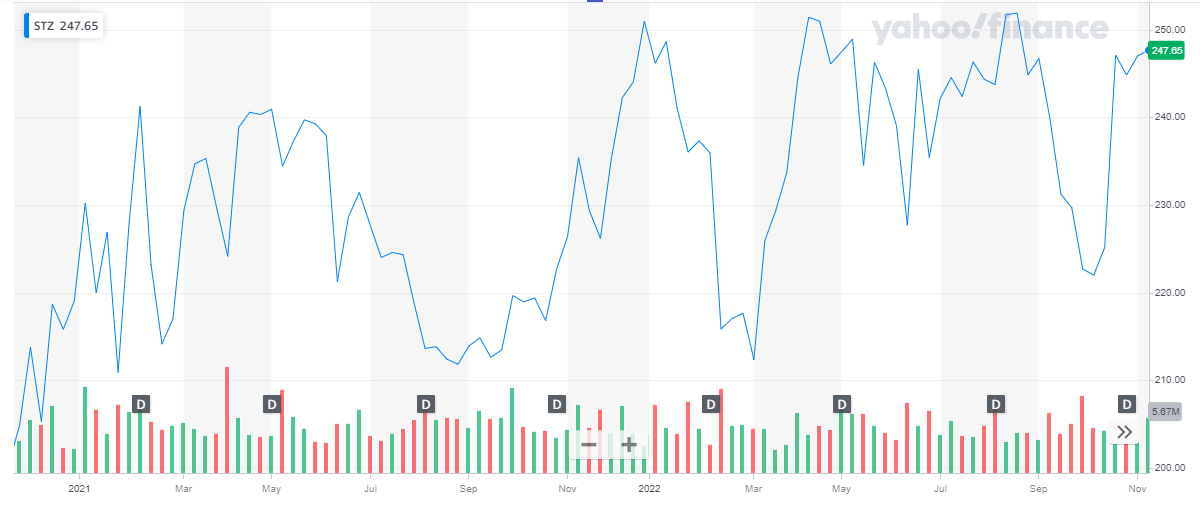

Constellation Brands has a market cap of $ 45.7 billion. Its shares are trading at $ 247.65.

The stock has been very volatile since the last year. It started off at $ 219.05 in 2021. After multiple dips and peaks, the stock closed at $ 250.97. During the year, the stock appreciated by 15 %.

In 2022, the stock continued with its volatile behavior. From $ 250.97, the stock dropped to as low as $ 212.39. During the year, the highest the stock went was $ 251.9, and last closed at $ 247.65.

Tyson Foods (NYSE: TSN)

Tyson Foods (NYSE: TSN)

Tyson Foods is a modern, multi-national, protein-focused food company producing approximately 20% of the beef, pork, and chicken in the United States. Operating out of multiple subsidiaries, the company is widely known for its prepared foods and meat products sold in grocery stores under such brands as Jimmy Dean and Hillshire Farm. Tyson Foods is the largest annual exporter of beef from the U.S., via the 123 food processing facilities it owns and operates throughout the nation.

Get to know the best tech stocks to invest in now.

It operates the popular brand names:

- Jimmy Dean

- Hillshire Farm

- BallPark

- Wright

- Aidell’s

- State Fair

Tyson Foods is also the leading protein provider to many national restaurant chains, including quick service, casual, mid-scale, and fine dining restaurants.

The below chart shows the quarterly annual reports for the current year:

| Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 13.8 billion | $ 13.5 billion | $ 13.1 billion | $ 12.93 billion |

| Operating Income | $ 766 million | $ 1.03 billion | $ 1.15 billion | $ 1.45 billion |

| Net Profit | $ 537 million | $ 750 million | $ 829 million | $ 1.12 billion |

| Earnings per share | $ 1.5 | $ 2.14 | $ 2.34 | $ 3.16 |

Also, learn about top shipping stocks in 2023.

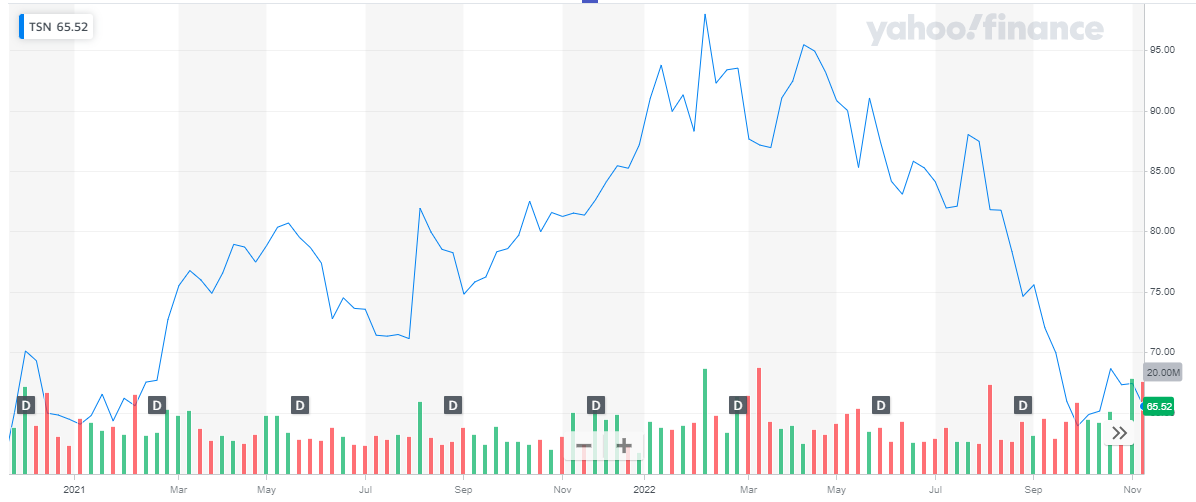

Tyson Foods has a market cap of $ 25.6 billion. Its shares are trading at $ 65.52.

The stock of the company remained bullish during 2021 and for the major part of 2022.

It started off the year 2021 at $ 64.44 and closed off the year at $ 87.16. Overall, the stock appreciated by 35.3 %.

In 2022, the stock started off with a bullish run till it peaked at $ 97.99. After that the stock started to decline and last closed at $ 65.52, representing a 25 % decline to date.

PepsiCo (NASDAQ: PEP)

PepsiCo (NASDAQ: PEP)

PepsiCo, Inc. is American food and beverage company that is one of the largest in the world, with products available in more than 200 countries. The company operates through seven segments:

- Frito-Lay North America

- Quaker Foods North America

- PepsiCo Beverages North America

- Latin America

- Europe

- Africa, the Middle East, and South Asia

- Asia Pacific, Australia, New Zealand, and China Region

It provides dips, cheese-flavored snacks, and spreads, as well as corn, potato, and tortilla chips; cereals, rice, pasta, mixes and syrups, granola bars, grits, oatmeal, rice cakes, simply granola, and side dishes; beverage concentrates, fountain syrups, and finished goods; ready-to-drink tea, coffee, and juices; dairy products; and sparkling water makers and related products. It serves wholesale and other distributors, food service customers, grocery stores, drug stores, convenience stores, discount/dollar stores, mass merchandisers, membership stores, hard discounters, e-commerce retailers and authorized independent bottlers, and others through a network of direct-store-delivery, customer warehouse, and distributor networks, as well as directly to consumers through e-commerce platforms and retailers. But it’s always wise to limit your exposure to risky investments like best altcoins.

The below chart shows the quarterly annual reports for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 21.9 billion | $ 20.2 billion | $ 16.2 billion |

| Operating Income | $ 3.35 billion | $ 2.1 billion | $ 5.3 billion |

| Net Profit | $ 2.7 billion | $ 1.43 billion | $ 4.3 billion |

| Earnings per share | $ 1.95 | $ 1.03 | $ 3.06 |

PepsiCo has a market cap of $ 250 billion. Its shares are trading at $ 181.33. The share of the company has been on a bullish streak since last year. It started the year 2021 at $ 148.3 and closed off the year at $ 173.71. Overall, the stock appreciated by 17 % during the year.

Check our updates for NASDAQ Forecast.

In 2022, the stock continued its bullish streak with partial volatile behavior. The stock last closed at $ 181.33 representing a 4.5 % appreciation to date.

Kroger (NYSE: KR)

Kroger (NYSE: KR)

Kroger is the largest grocery store chain in the US, with thousands of locations and subsidiaries throughout the country. In addition to their own brand of supermarkets, they also own popular chains like Ralph’s, Fry’s, Smith’s, Food 4 Less, and more.

The cybersecurity stocks have become a high-growth sector and are attracting a lot of investor attention.

It owns almost 2,800 stores in 35 states under two dozen banners. This makes Kroger one of the world’s largest retailers.

The below chart shows the quarterly annual reports for the current year:

| Q2 2022 | Q1 2022 | |

| Net Revenue | $ 16.2 billion | $ 44.6 billion |

| Operating Income | $ 954 million | $ 1.5 billion |

| Net Profit | $ 731 million | $ 664 million |

| Earnings per share | $ 1.01 | $ 0.91 |

Get to know the best DRIP stocks to buy now.

Kroger has a market cap of $ 34.5 billion. Its shares are trading at $ 48.26.

The stock of the company has been on a bullish streak since last year. The share started in the year 2021 at $ 31.76. It continued its bullish streak throughout the year and closed off the year at $ 46.26. Overall, the stock appreciated by 46 % during the year.

In 2022, the stock continued its bullish streak and peaked at $ 61.67. The stock last closed at $ 48.26, representing a 4 % appreciation to date.

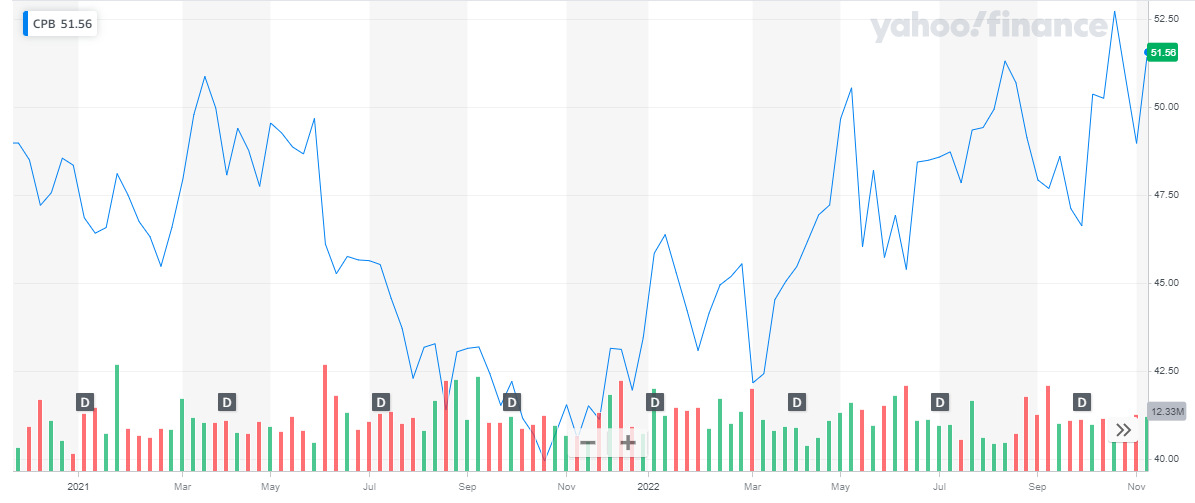

Campbell’s Soup (NYSE: CPB)

Campbell’s Soup (NYSE: CPB)

Campbell’s Soup is a very good food stock, worth investing with excellent brand recognition. In addition to its namesake soup products, the company also owns Pepperidge Farm, Prego, Swanson, and Snyder’s-Lance. Between these brands, Campbell’s has a huge portfolio of food products. These include soups, chicken broth, baked goods, beverage products, and more.

Get to know the list of crypto mining companies that are leading the industry.

The below chart shows the quarterly annual reports for the current year:

| Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 2 billion | $ 2.1 billion | $ 2.2 billion | $ 2.2 billion |

| Net Profit | $ 96 million | $ 188 million | $ 212 million | $ 261 million |

| Earnings per share | $ 0.32 | $ 0.62 | $ 0.70 | $ 0.86 |

Renewable energy stocks have been very popular in the year 2020 and their popularity continues to increase in 2022.

Campbell soup has a market cap of $ 15.45 billion. Its shares are trading at $ 51.56.

The stock of the company started off the year 2021 at $ 48.35. The stock picked up a downward trend and dropped to the low of $ 39.95 and eventually closed the year at $ 43.46. Overall, the stock declined by 10 % during the year.

In 2022, the stock changed course and started rising. The stock last closed at $ 51.56 representing an 18.7 % appreciation during the year.

McCormick

McCormick

McCormick is another prominent food stock. It is primarily a food firm that makes, distributes, and promotes flavoring goods. These include, among others, spices, seasoning mixes, and condiments. McCormick primarily sells to retail establishments, food producers, and food service organizations. In addition, its products are offered in several nations. Based on income, it is the world’s largest producer of spices and associated culinary products. Investors are now looking for the finest solar energy stocks to invest in.

The below chart shows the quarterly annual reports for the current year:

| Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 1.6 billion | $ 1.5 billion | $ 1.5 billion |

| Operating Income | $ 235.2 million | $ 157 million | $ 206.9 million |

| Net Profit | $ 222 million | $ 212 million | $ 154.9 million |

| Earnings per share | $ 0.83 | $ 0.44 | $ 0.58 |

Learn about the best defense stocks in 2023.

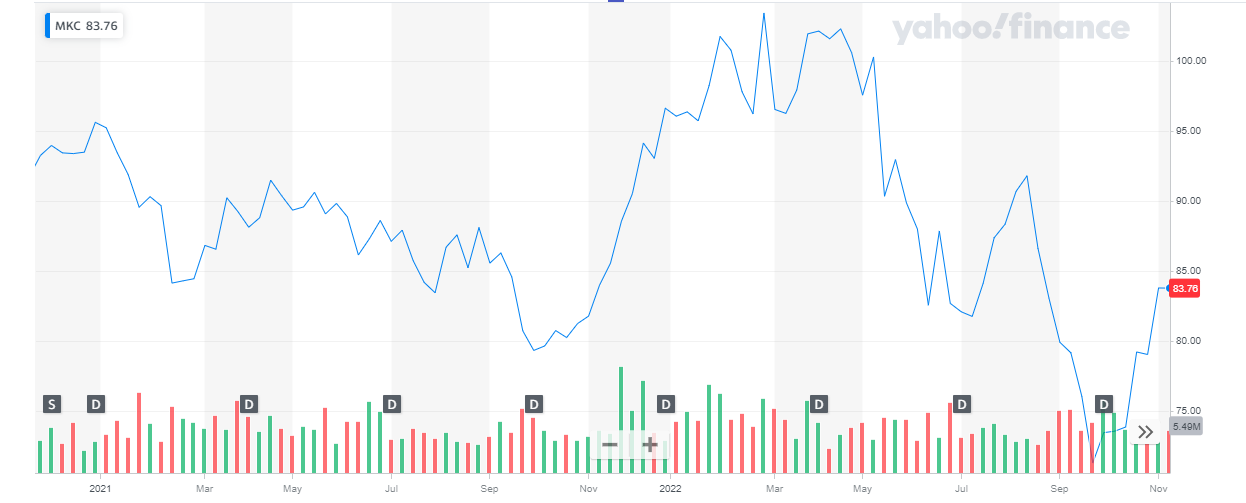

McCormick has a market cap of $ 22.45 billion. Its shares are trading at $ 83.76.

The stock of the company started off the year 2021 at $ 95.6. Initially, the stock followed a downward trend. After hitting the low of $ 79.31, the stock reversed course and eventually closed off the year at $ 96.61. Overall, the stock maintained its price during the year.

In 2022, the stock continued with its upward run. After peaking at $ 103.41, the stock reversed course and dropped to the low of $ 71.27. The stock last closed at $ 83.76 representing a 13.3 % decline to date.

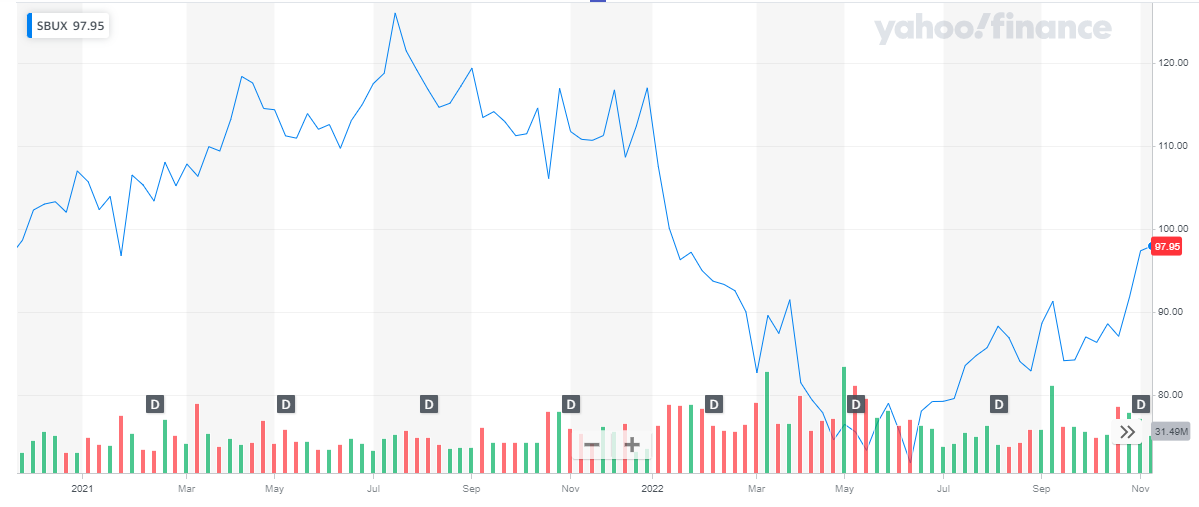

Starbucks (NASDAQ: SBUX)

Starbucks (NASDAQ: SBUX)

Starbucks is the world’s largest coffee chain. Its surprising performance during the pandemic is commendable. The company adapted to the pandemic environment very well and it has been reflected in the Starbucks share price which had a good performance last year. The company’s future includes plans to increase its global footprint. They are planning on opening over 1,000 new stores, many of which will be international.

Also check out: List of Most Volatile Stocks

What made this coffee chain stand out amongst others was its rewards program. Under this reward program, the restaurant chain has created a very loyal customer base that has made Starbucks a part of its regular routine.

The below chart shows the quarterly annual reports for the current year:

| Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | |

| Net Revenue | $ 8.4 billion | $ 8.1 billion | $ 7.6 billion | $ 8 billion |

| Operating Income | $ 1.2 billion | $ 1.3 billion | $ 949 million | $ 1.12 million |

| Net Profit | $ 878 million | $ 913 million | $ 674.5 million | $ 816 million |

| Earnings per share | $ 0.76 | $ 0.79 | $ 0.58 | $ 0.69 |

With the gas prices soaring, there are many gas stocks to benefit from.

Starbucks has a market cap of $ 112 billion. Its shares are trading at $ 97.95.

The stock of the company had an excellent year in 2021. It started off at $ 106.98 and maintained a bullish streak till it peaked at $ 125.97. The stock closed the year at $ 116.97 representing a 9.3 % appreciation during the year.

Read:

In 2022, the stock became bearish and dropped to the low of $ 71.87. The stock last closed at $ 97.95 representing a 16% decline to date

Conclusion

Conclusion

Investing in food companies can lead to investing in a wide range of different companies. Food stocks are considered a defensive investment that is immune to economic shifts. Meaning the stock price of food companies is cyclical and rises when the economy is hot.

However, for investors looking for high-risk-high-reward investments, food stocks are not a good option.

Therefore always pair up your investment with your investment goals to avoid disappointment and earn the return you expect.

You may also like reading: