-

Micron (MU) Surges on AI Boom, Wave Count Confirms Rally

Read MoreMicron Technology (MU) leads the memory and storage industry with advanced DRAM, NAND, and emerging memory technologies. Founded in 1978, it quickly became essential to smartphones, AI, automotive systems, and data centers. Moreover, Micron focuses on performance, energy efficiency, and scalable innovation. As a result, it empowers faster, smarter, and more secure digital solutions worldwide. […]

-

ARM Surges Higher — Here’s Why We’re Updating the Charts

Read MoreARM Holdings plc, a new public player with a deep innovation track record, leads in energy-efficient, high-performance processor design. It powers billions of devices and anchors the AI and mobile computing surge. The company’s scalable licensing model ensures recurring revenue across diverse sectors. Its robust ecosystem fosters long-term client relationships, securing ARM’s future in tech. […]

-

Powering the Future: ARM Breakout Potential in a Connected World

Read MoreARM Holdings plc is a relatively new entrant to public markets, yet its technological foundation is anything but inexperienced. Renowned for pioneering energy-efficient, high-performance processor designs, ARM powers billions of devices globally. Its recent IPO signals a strategic leap, positioning the company for strong, long-term growth as demand for smart, connected technologies accelerates. ARM enjoys […]

-

AT&T (T) Approaches Final Wave High Before Correction Opportunity

Read MoreAT&T Inc. (T) is an American multinational telecommunications holding company headquartered in Dallas, Texas. It is the world’s largest telecommunications company by revenue and the third-largest provider of mobile telephone services in the U.S. AT&T stock continues to gain traction as it approaches the $29.03 resistance zone. Investors are encouraged by its strong free cash […]

-

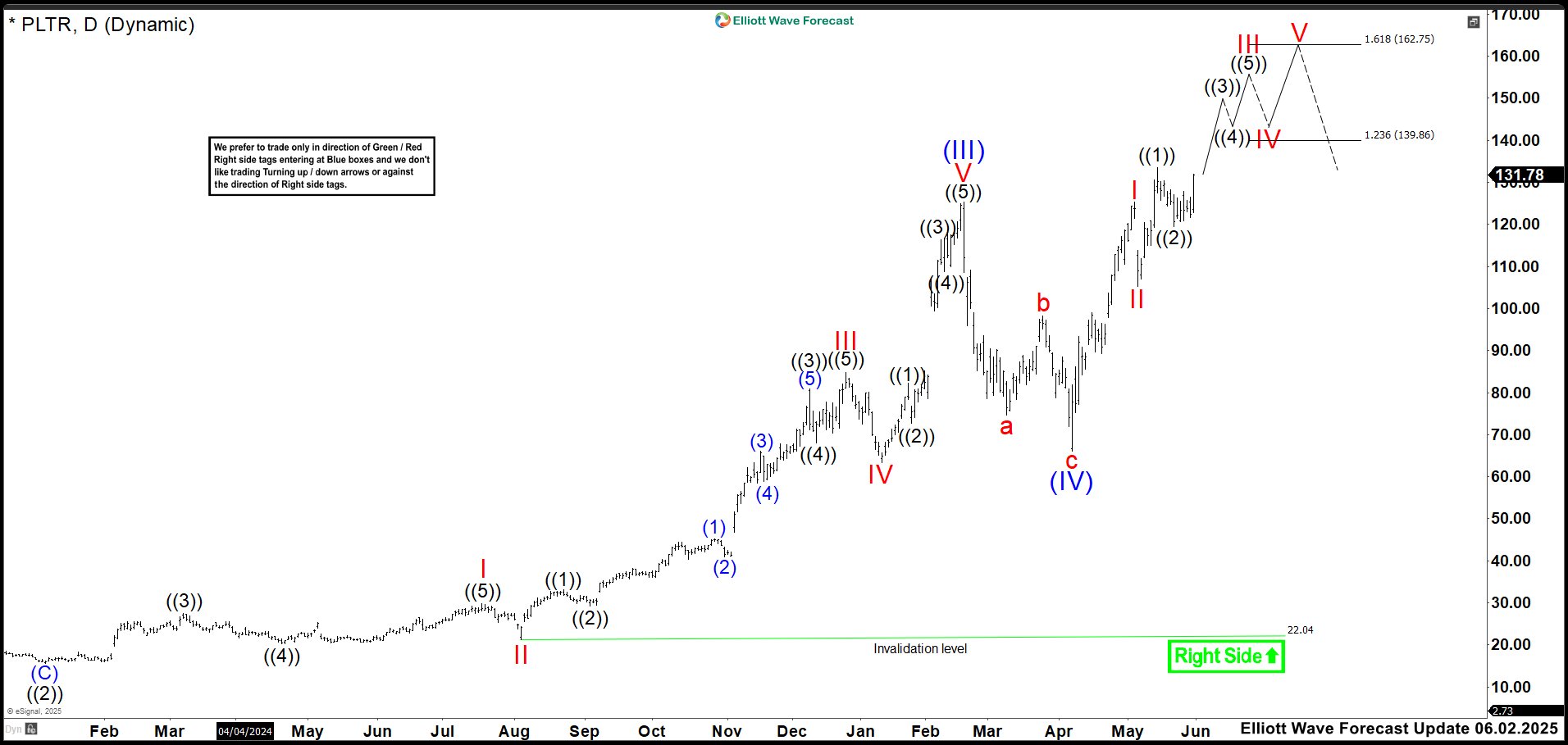

Palantir (PLTR) Surges Ahead: A New Impulse Cycle Begins After April Correction

Read MorePalantir Technologies (PLTR) thrives as demand for data analytics grows. Its stock surged over 140% after Trump’s election, reflecting investor confidence. The company holds a $309 billion market cap and $5.43 billion in cash reserves, ensuring financial stability. Moreover, partnerships with Bain & Company and Divergent Technologies strengthen its market influence. Although analysts warn of […]

-

Ford (F) Stock: A Temporary Rebound Before Further Declines?

Read MoreFord’s stock finally rebounded after months of decline. Earlier, we predicted a failed rally that would push prices lower. Instead, the stock kept falling. Now, it’s bouncing back—but will it last? According to Elliott Wave analysis, this rally seems weak. Ford’s stock will likely drop again, sinking below $8 soon. Several issues weigh on Ford. […]