-

Riding the Trend: USDCNH Shows Dollar Strength Set to Persist

Read MoreIn recent years, the renminbi paused its attempt to strengthen against the USD. In February 2014, the renminbi found support at 6.0153 as wave ((III)). From there, it formed a perfect zig-zag corrective structure, reaching equal legs at the 7.1964 high in September 2019. Following these three swings, USDCNH was expected to continue its downtrend. […]

-

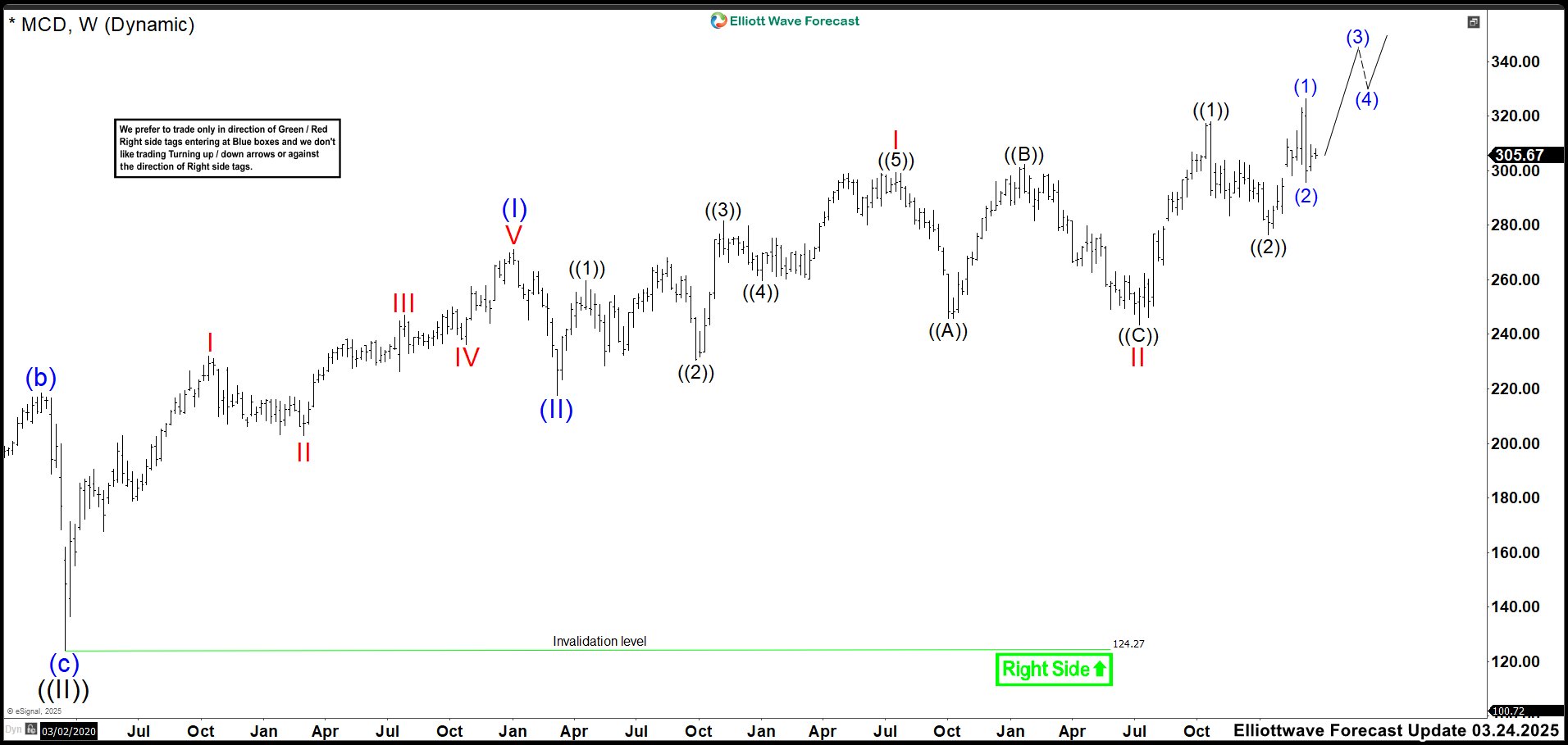

McDonald’s (MCD): Continuing the Bullish Trend with Wave ((3))

Read MoreMcDonald’s (MCD) stock is on track to deliver moderate growth throughout 2025. Analysts expect an average price target of $323.39, offering a potential upside of 5.79% from its current level. Furthermore, monthly forecasts highlight price fluctuations between $282 and $370, influenced by market conditions. Menu innovation, digital initiatives, and geographic diversification strengthen its position and […]

-

Can Micron (MU) Overcome the Market Hurdles for a Strong Rally?

Read MoreThe performance of Micron Technology Inc. (MU) stock has been a constant topic of interest in financial markets. Despite strong projections and a track record of innovation in the semiconductor industry, the ability of its stock to sustain a significant rally could be challenged by economic and sector-specific factors. In this article, we will explore […]

-

QuantumScape’s (QS) Shares: Waiting for the Spark to Ignite the Rally

Read MoreQuantumScape Corporation (QS) develops and commercializes solid-state lithium-metal batteries. These batteries power electric vehicles and other applications, delivering higher energy density and faster charging compared to traditional lithium-ion batteries. QS Weekly Technical Analysis: March 2025 Outlook QS weekly chart showing critical support break and potential final bearish phase before reversal The price action of QS […]

-

Why Johnson & Johnson’s (JNJ) Rally Might Be Short-Lived

Read MoreJohnson & Johnson (JNJ) is an American multinational corporation founded in 1886 that develops medical devices, pharmaceuticals, and consumer packaged goods. Its common stock is a component of the Dow Jones Industrial Average, and the company is ranked No. 36 on the 2021 Fortune 500 list of the largest United States corporations by total revenue. […]

-

Market Volatility Leads to Palantir (PLTR), Bullish Sentiment Continues

Read MoreAbout Palantir Technologies Palantir Technologies (PLTR), Inc. is a holding company, which engages in the development of data integration and software solutions. It operates through the Commercial and Government segments. The firm offers automotive, financial compliance, legal intelligence, mergers and acquisitions solutions. PLTR Daily Chart Analysis: February 8, 2025 PLTR daily chart showing wave V […]