-

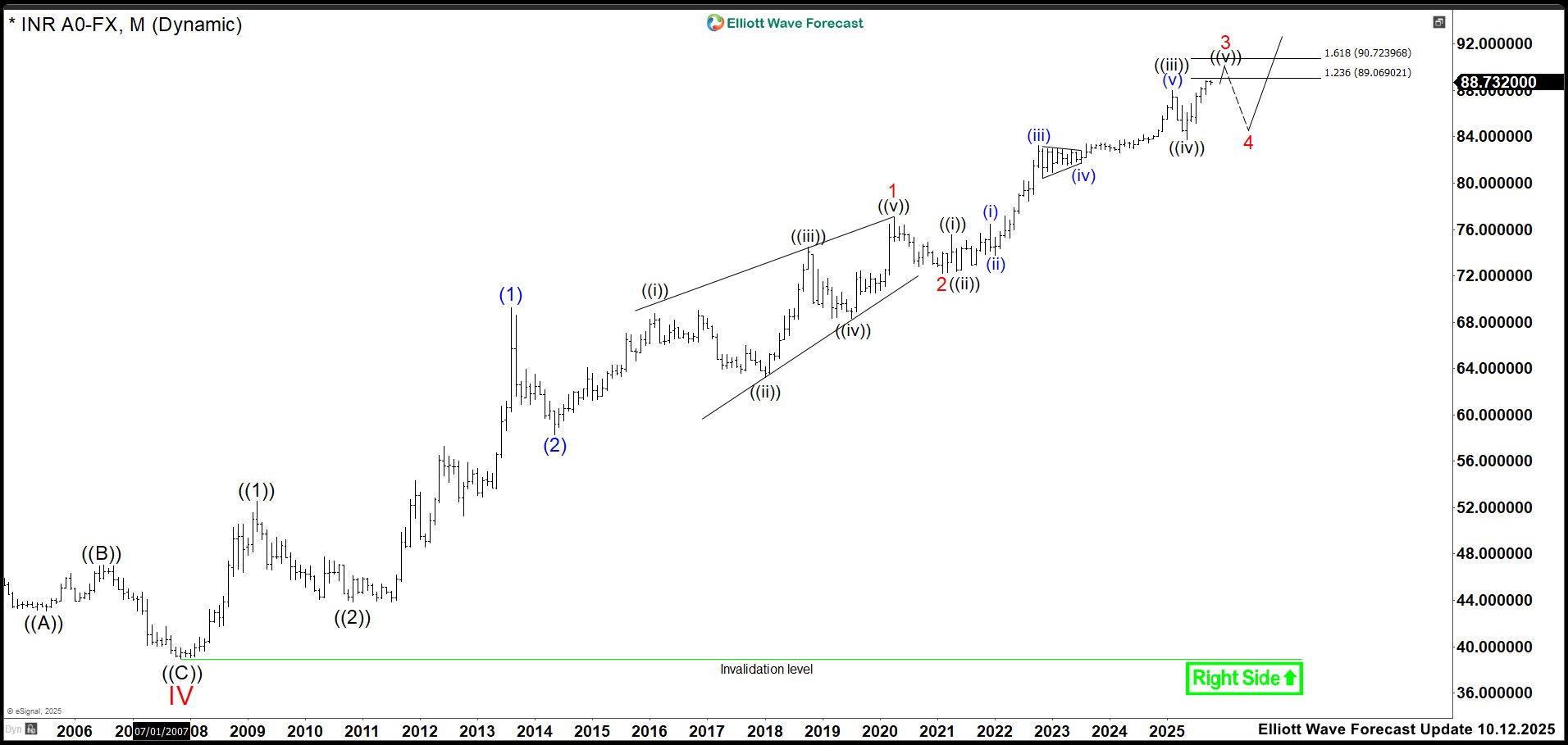

India Faces Rupee (USDINR) Pause Before Renewed Slide

Read MoreThe Indian rupee (USDINR) has faced steady pressure in 2025 due to global uncertainty and rising import costs. Higher oil prices and reduced foreign investment have made the currency weaker. The Reserve Bank of India has limited its support, allowing more market-driven movement. As a result, the rupee has dropped closer to 91 against the […]

-

AXP Approaches Exhaustion Zone: Is a Correction Looming?

Read MoreAmerican Express (AXP) delivered strong Q4 results, boosting investor confidence heading into the next quarter. Card member spending surged, net interest income rose 12%, and fee growth accelerated. As a result, management expects revenue to grow 8–10% in Q1 2026. Moreover, they increased the quarterly dividend by 17%, signaling optimism and financial strength. These moves […]

-

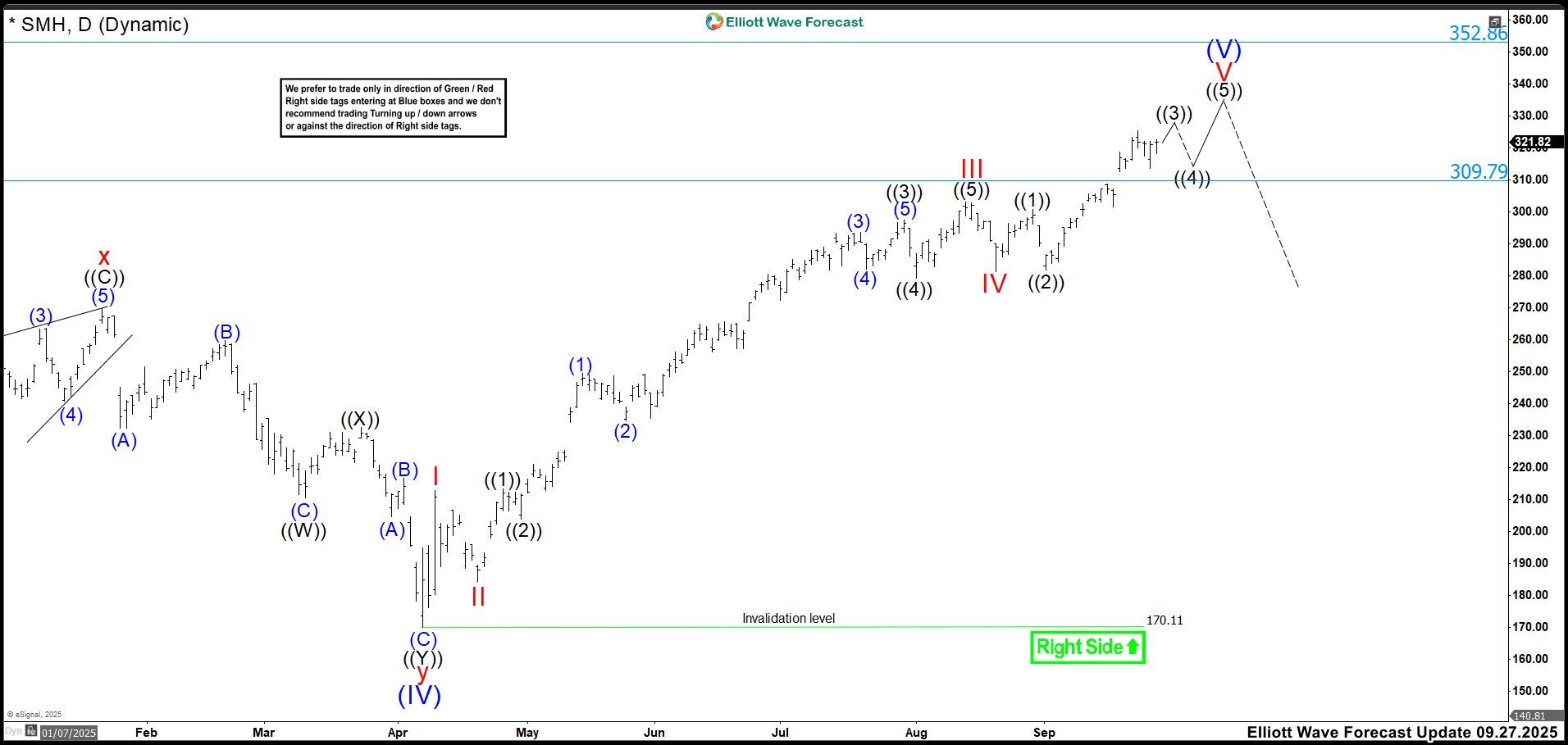

Extreme SMH Zone: Hold Tight or Take Profits?

Read MoreThe VanEck Semiconductor ETF (SMH) trades within the forecasted extreme zone of 309.83 to 353.03, showing signs of technical overheating. Analysts expect an average 12-month price target of 343.93, with bullish projections reaching up to 451.50. Strong demand for semiconductors—driven by AI, electric vehicles, and cloud infrastructure—continues to push momentum. All major moving averages, from […]

-

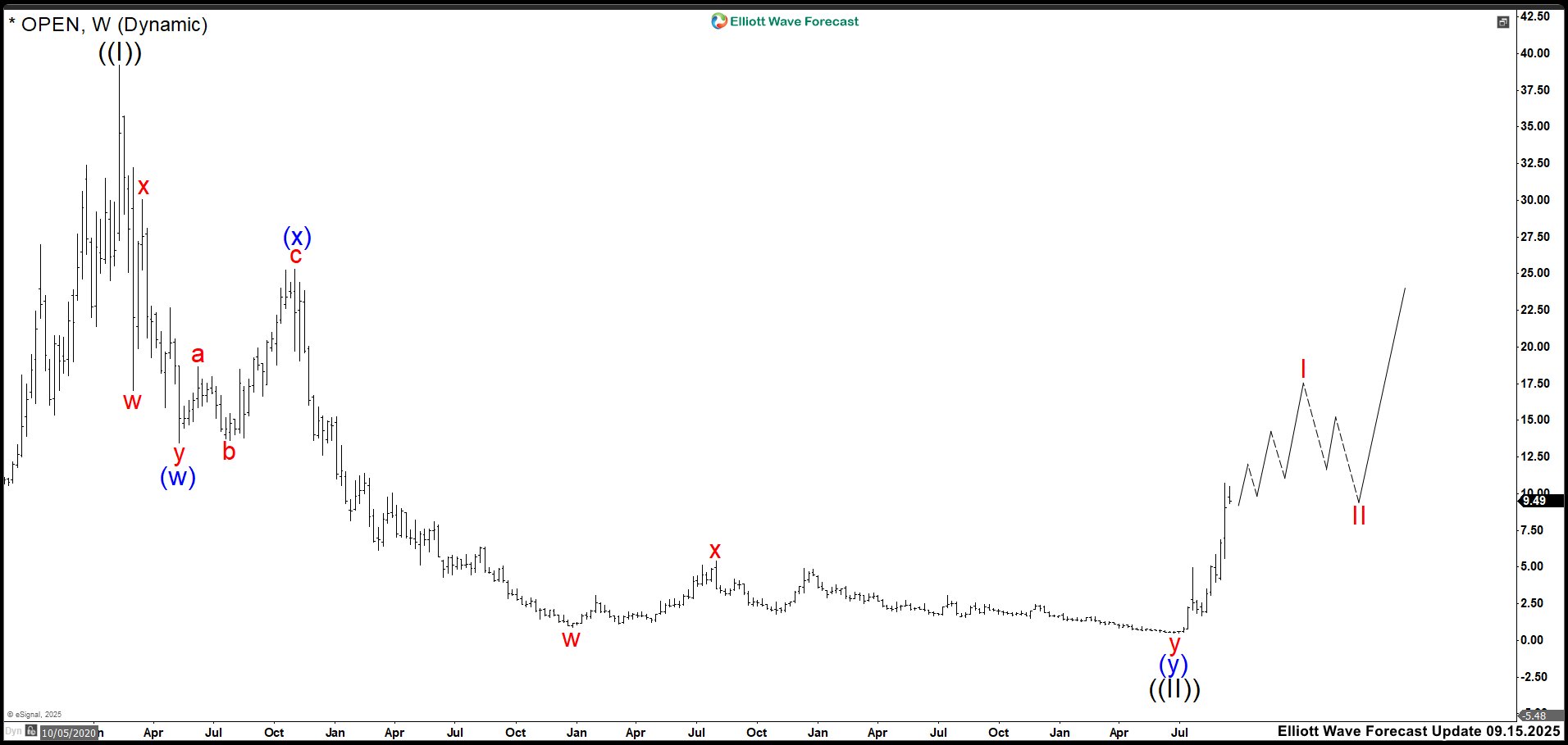

OPEN Stock: Real Value Emerging or Just a Retail Trap?

Read MoreOPEN ’s makes selling homes easier by offering fast cash offers. Then, it repairs and resells the homes through its platform. Buyers also complete their purchases online. This digital process cuts delays and avoids agent fees. As a result, customers save time and money. Recently, Opendoor added AI tools to improve pricing. Investors now see […]

-

CRWD in Final Stage: One More High Could Trigger Market Correction

Read MoreCrowdStrike (CRWD) leads AI-powered cybersecurity with strong financial results and growing market presence. By mid-2025, its market value passed $104 billion. This shows investor trust, even with ongoing net losses. The Falcon platform boosts ARR through advanced endpoint protection and threat detection. As a result, recent quarters showed steady double-digit ARR growth, raising long-term revenue […]

-

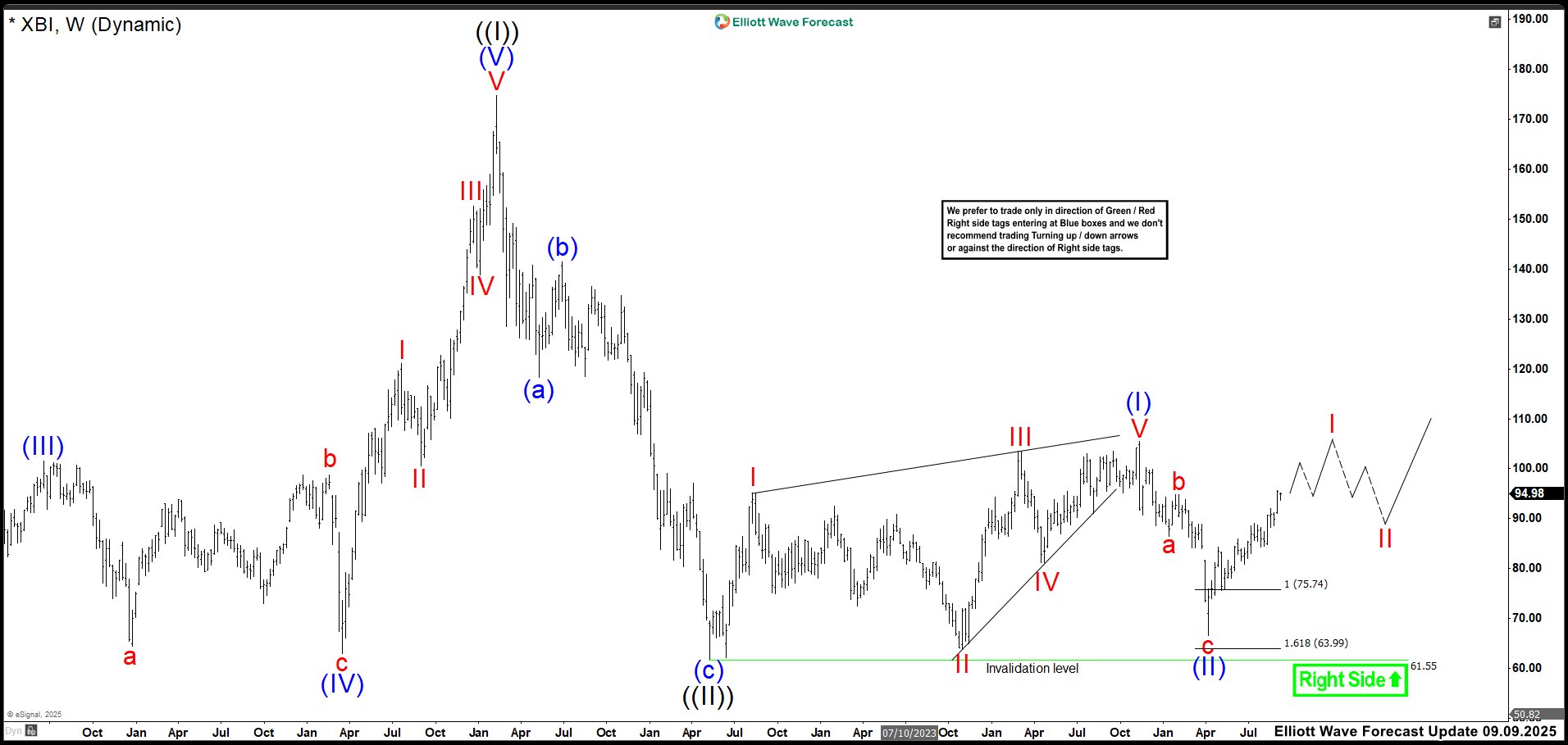

Biotech Surge: XBI Ends Correction and Rallies as Expected

Read MoreThe SPDR S&P Biotech ETF (XBI) draws investors who seek high-risk, high-reward exposure to the biotech sector. In late 2025, investor sentiment remains cautiously optimistic. This reflects both strong opportunities and ongoing uncertainty. Analysts set a 12-month price target near $141.31. That suggests a 48% upside from current levels around $95. Technical indicators support this […]