-

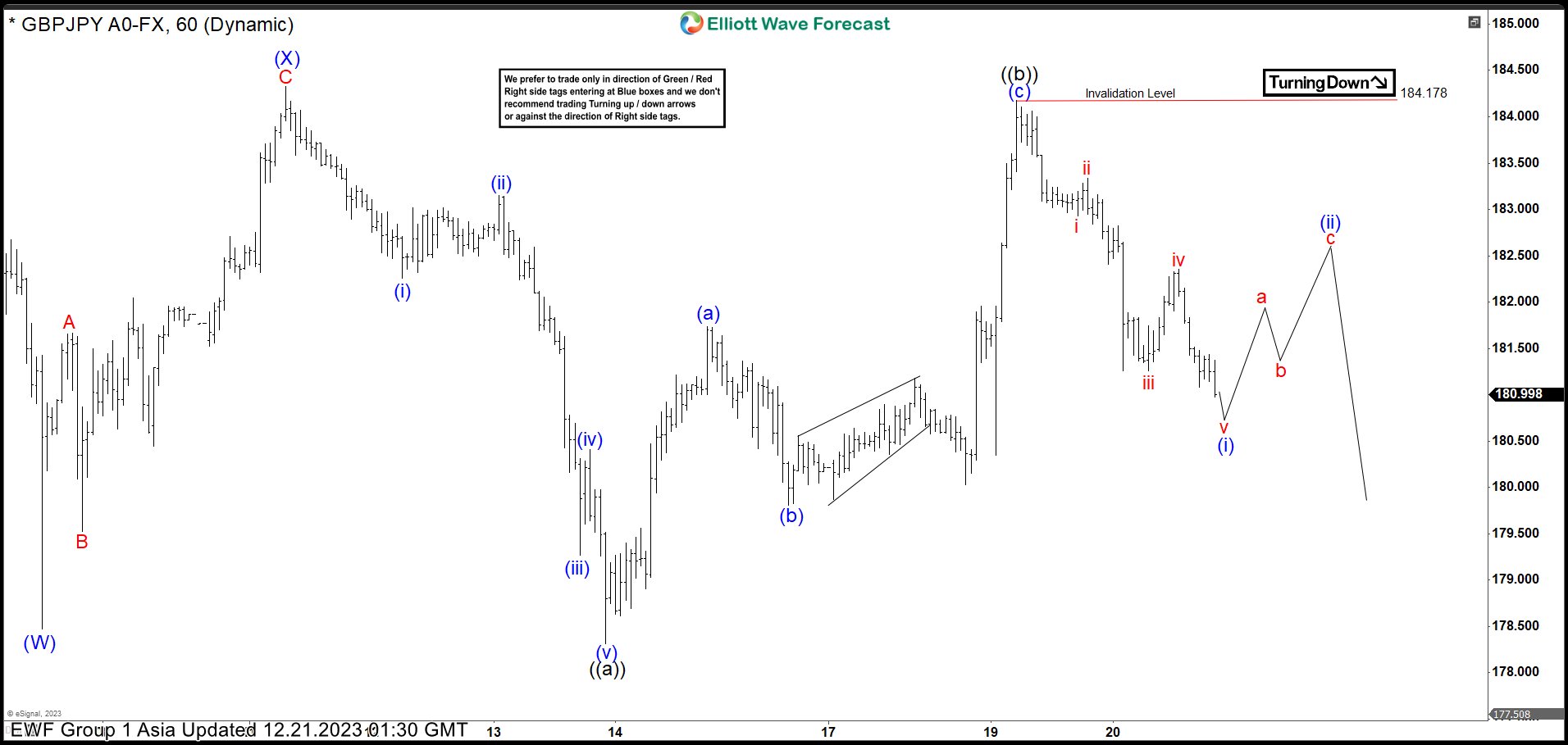

GBPJPY is Showing a Incomplete Bearish Sequence

Read MoreShort Term Elliott Wave View in GBPJPY shows that it has ended wave ((3)) at 188.66. Pullback in wave ((4)) is currently in progress as a double three Elliott Wave structure. Down from wave ((3)), wave A ended at 185.06 and wave B ended at 186.18. Wave C lower made a strong drop ended at […]

-

American Express AXP is Heading to a Potential Selling Area

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart August 2023 We believe that the […]

-

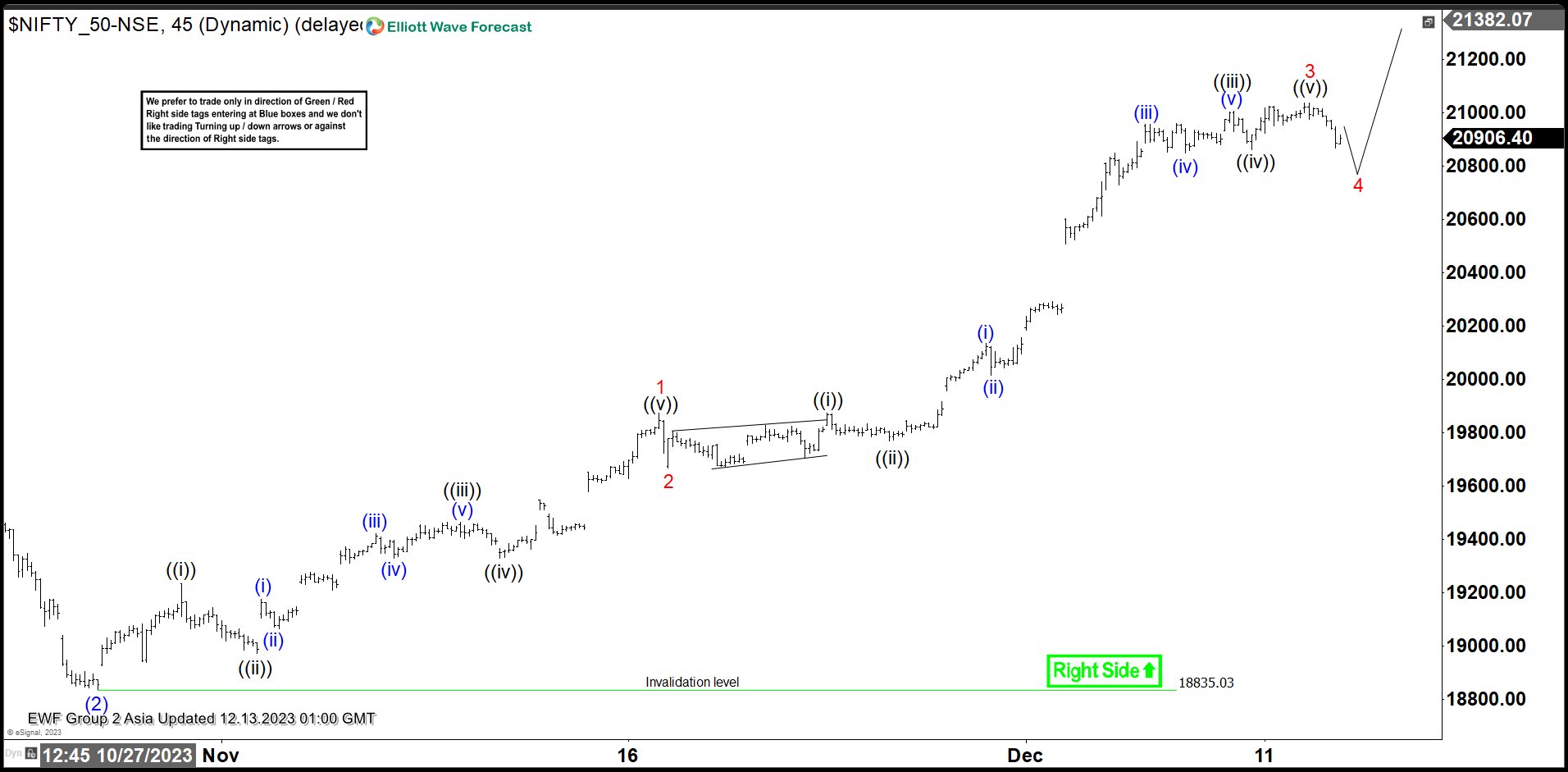

Nifty Short Term Pullback Likely Find Support in 3, 7 or 11 Swing

Read MoreNifty is looking to end impulsive rally and short term dips should find support in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

QQQ Should See Further Upside in Impulsive Rally

Read MoreQQQ is looking to complete 5 waves rally and should see more upside. This article and video look at the Elliott Wave path.

-

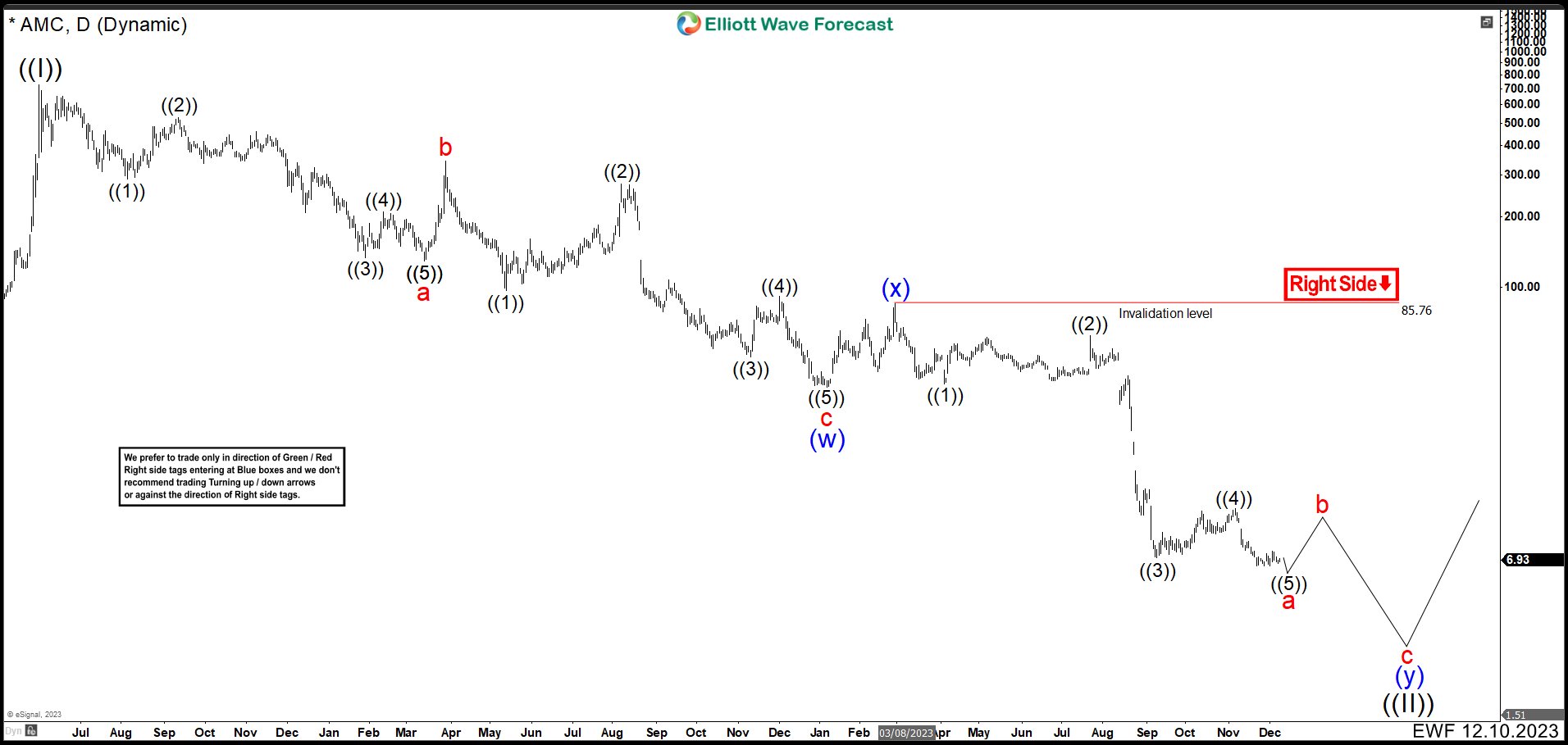

Selling Rallies Strategy is the Best Option to Trade AMC Entertainment

Read MoreAMC Entertainment Holdings, Inc. is an American movie theater chain headquartered in Leawood, Kansas, and the largest movie theater chain in the world. Founded in 1920, AMC has the largest share of the U.S. theater market ahead of Regal and Cinemark Theatres. It has 2,866 screens in 358 theatres in Europe and 7,967 screens in 620 […]

-

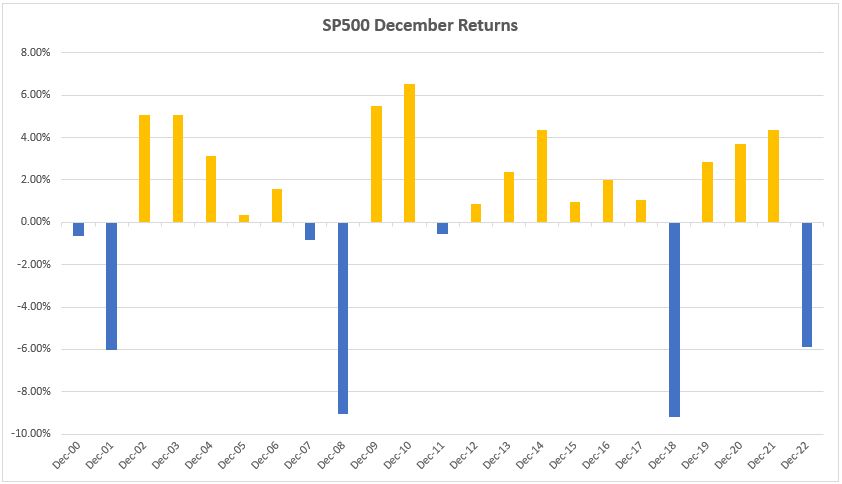

Will the Santa Rally Appear this 2023 in the Capital Market?

Read MoreThe Santa rally is a capital market phenomenon named in 1972 by Yale Hirsc. He noticed an unusual upward movement in the markets from December 28 to January 2 of the following year. This event has been recurrent for years that it has earned its own name “The Santa Rally”. According to the Stock Trader […]